[ad_1]

Up to date on March twenty fourth, 2023 by Bob Ciura

To spend money on nice companies, it’s important to discover them first. Carl Icahn is an professional at this, with an fairness funding portfolio price greater than $22 billion, as of the top of the 2022 fourth quarter.

Carl Icahn’s portfolio is stuffed with high quality shares. You’ll be able to ‘cheat’ from Carl Icahn shares to seek out picks for your portfolio. That’s as a result of institutional traders are required to periodically present their holdings in a 13F submitting.

You’ll be able to see all 15 Carl Icahn shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Notes: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

This text analyzes Carl Icahn’s 15 shares based mostly on info disclosed in his This autumn 2022 13F submitting.

Desk of Contents

You’ll be able to skip to a selected part with the desk of contents beneath. Shares are listed by share of the full portfolio, from highest to lowest.

Carl Icahn & Dividend Shares

Carl Icahn has grown his wealth by investing in and buying companies with robust aggressive benefits buying and selling at truthful or higher costs.

Most traders know Carl Icahn appears to be like for engaging shares, however few know the diploma to which he invests in dividend shares:

- 11 out of the 15 Carl Icahn shares pay dividends

- His high 5 holdings have a median dividend yield of 5.3% (and make up 91% of his portfolio)

- His funding agency, Icahn Enterprises, is structured as an MLP and pays its personal traders a double-digit yield.

Hold studying this text to see Carl Icahn’s 15 inventory choices analyzed in higher element.

#1: Icahn Enterprises L.P. (IEP)

Dividend Yield: 10.5%

P.c of Carl Icahn’s Portfolio: 71.9%

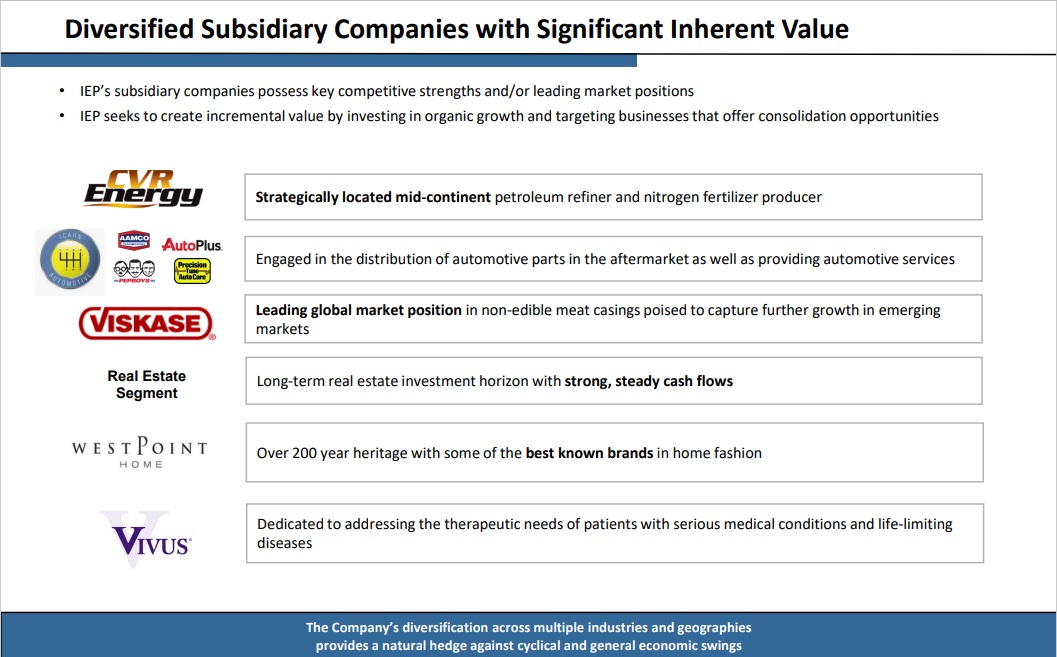

Icahn Enterprises L.P. operates in funding, power, automotive, meals packaging, metals, actual property and residential style companies in the US and Internationally. The corporate’s Funding phase focuses on discovering undervalued firms to allocate capital via its varied non-public funding funds.

Supply: Investor Presentation

Carl Icahn owns 100% of Icahn Enterprises GP, the final accomplice of Icahn Enterprises and Icahn Enterprises Holdings, and roughly 87% of Icahn Enterprises’ excellent shares.

On February twenty fourth, 2022, Icahn Enterprises reported its This autumn-2022 and full-year outcomes for the interval ending December thirty first, 2022. For the quarter, revenues got here in at $3.1 billion, 34.2% greater year-over-year, whereas the loss per unit was $0.74, versus the loss per unit of 1.72 in This autumn-2021. Improved income outcomes have been as a result of Icahn’s investments recording higher outcomes in comparison with final yr. For FY2022, the corporate posted a GAAP internet revenue per unit of $0.57.

Click on right here to obtain our most up-to-date Positive Evaluation report on IEP (preview of web page 1 of three proven beneath):

#2: CVR Vitality Inc. (CVI)

Dividend Yield: 4.9%

P.c of Carl Icahn’s Portfolio: 10.7%

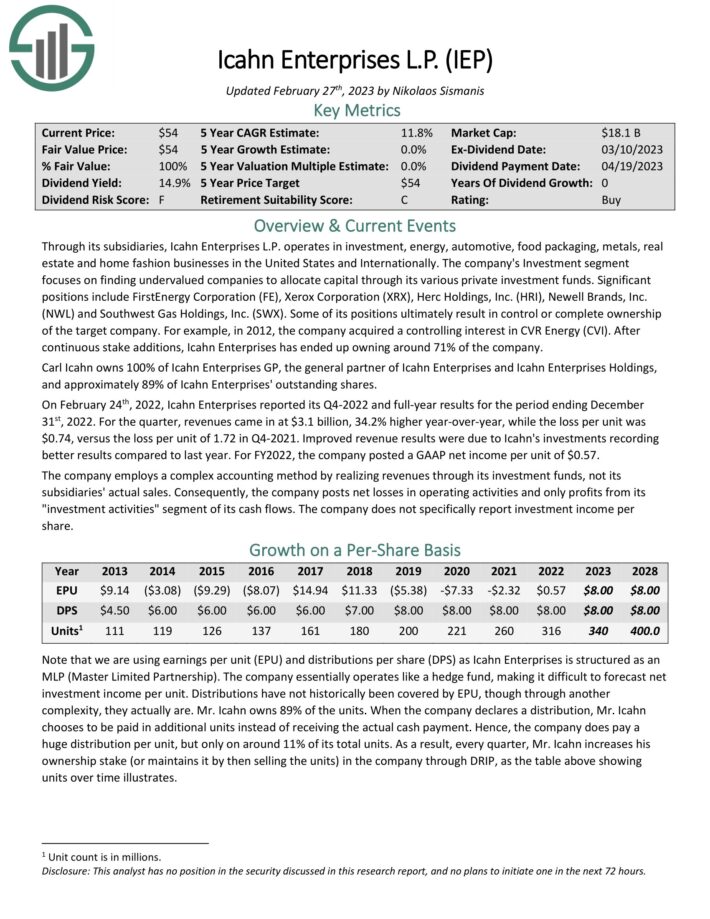

CVR Vitality is a diversified holding firm primarily engaged within the renewable fuels and petroleum refining and advertising companies, in addition to within the nitrogen fertilizer manufacturing enterprise via its curiosity in CVR Companions, LP. CVR Vitality subsidiaries function the final accomplice and personal 37% of the widespread models of CVR Companions.

Supply: Investor Presentation

For full-year 2022, the corporate reported internet revenue of $463 million, or $4.60 per diluted share, on internet gross sales of $10.9 billion, in comparison with internet revenue for full-year 2021 of $25 million, or 25 cents per diluted share, on internet gross sales of $7.2 billion. Adjusted earnings for full-year 2022 was $6.04 per diluted share in comparison with an adjusted lack of 93 cents per diluted share in full-year 2021, primarily pushed by improved crack spreads.

It additionally elevated quarterly money dividend to 50 cents for the fourth quarter 2022, bringing the cumulative money dividends declared for 2022 to $5.30 per share, together with particular dividends.

#3: Firstenergy Corp. (FE)

Dividend Yield: 3.9%

P.c of Carl Icahn’s Portfolio: 3.4%

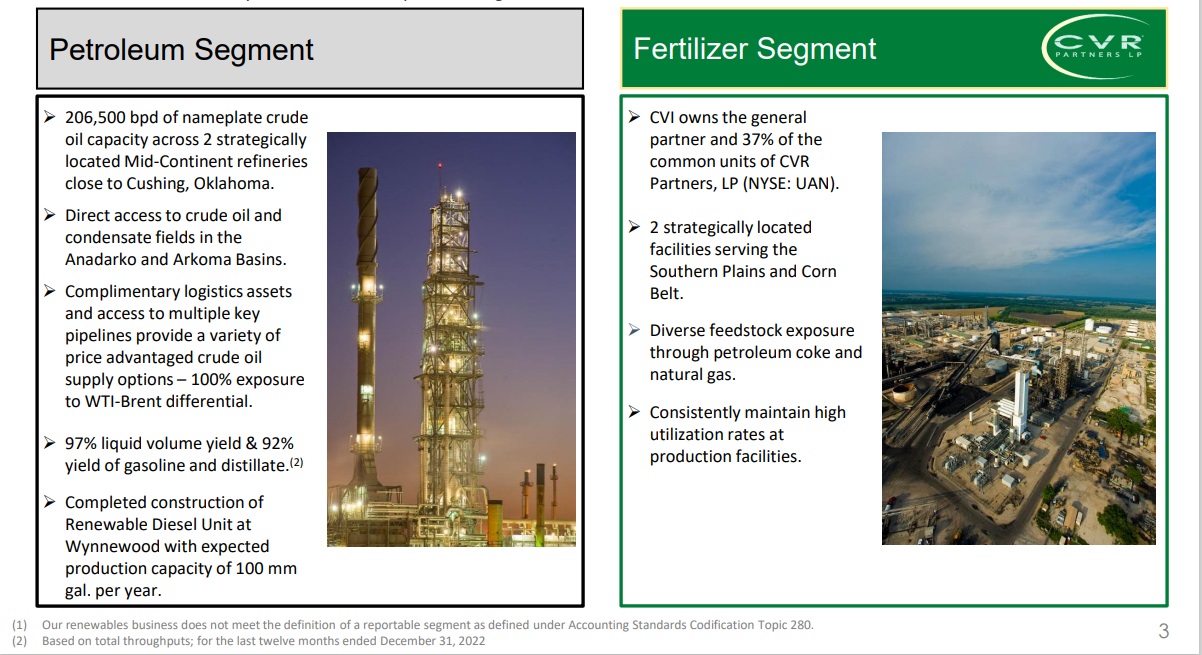

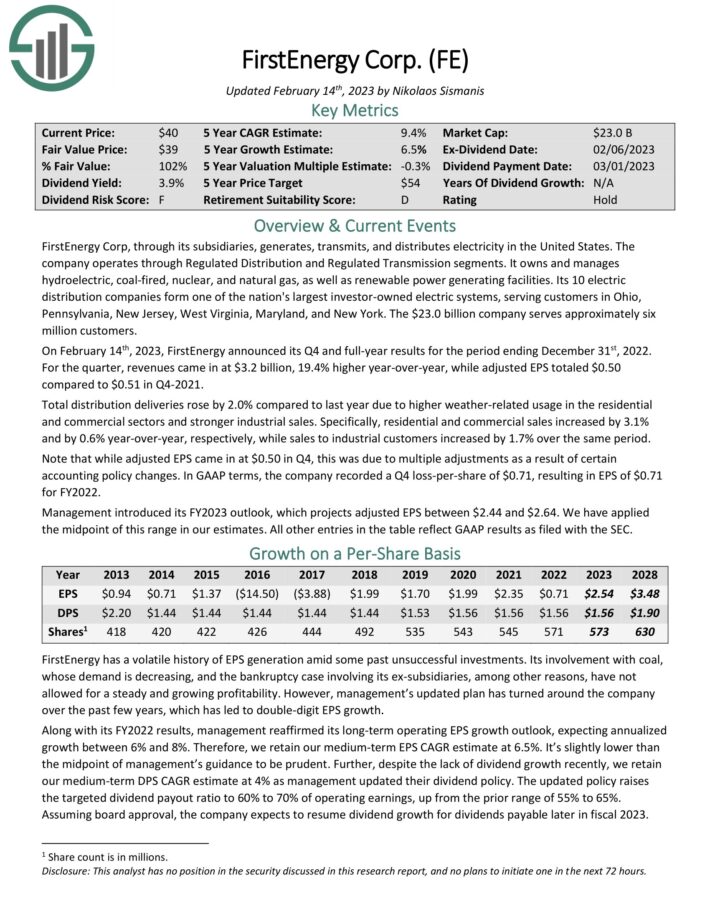

FirstEnergy Corp, via its subsidiaries, generates, transmits, and distributes electrical energy in the US. The corporate operates via Regulated Distribution and Regulated Transmission segments. It owns and manages hydroelectric, coal-fired, nuclear, and pure gasoline, in addition to renewable energy producing services.

Its 10 electrical distribution firms type one of many nation’s largest investor-owned electrical techniques, serving prospects in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. The $23.0 billion firm serves roughly six million prospects.

Supply: Investor Presentation

On February 14th, 2023, FirstEnergy introduced its This autumn and full-year outcomes for the interval ending December thirty first, 2022. For the quarter, revenues got here in at $3.2 billion, 19.4% greater year-over-year, whereas adjusted EPS totaled $0.50

in comparison with $0.51 in This autumn-2021. Whole distribution deliveries rose by 2.0% in comparison with final yr as a result of greater weather-related utilization within the residential and industrial sectors and stronger industrial gross sales.

Particularly, residential and industrial gross sales elevated by 3.1% and by 0.6% year-over-year, respectively, whereas gross sales to industrial prospects elevated by 1.7% over the identical interval. Observe that whereas adjusted EPS got here in at $0.50 in This autumn, this was as a result of a number of changes because of sure accounting coverage modifications.

In GAAP phrases, the corporate recorded a This autumn loss-per-share of $0.71, leading to EPS of $0.71 for FY 2022. Administration launched its FY2023 outlook, which tasks adjusted EPS between $2.44 and $2.64.

Click on right here to obtain our most up-to-date Positive Evaluation report on FE (preview of web page 1 of three proven beneath):

#4: Xerox Holdings (XRX)

Dividend Yield: 5.8%

P.c of Carl Icahn’s Portfolio: 2.6%

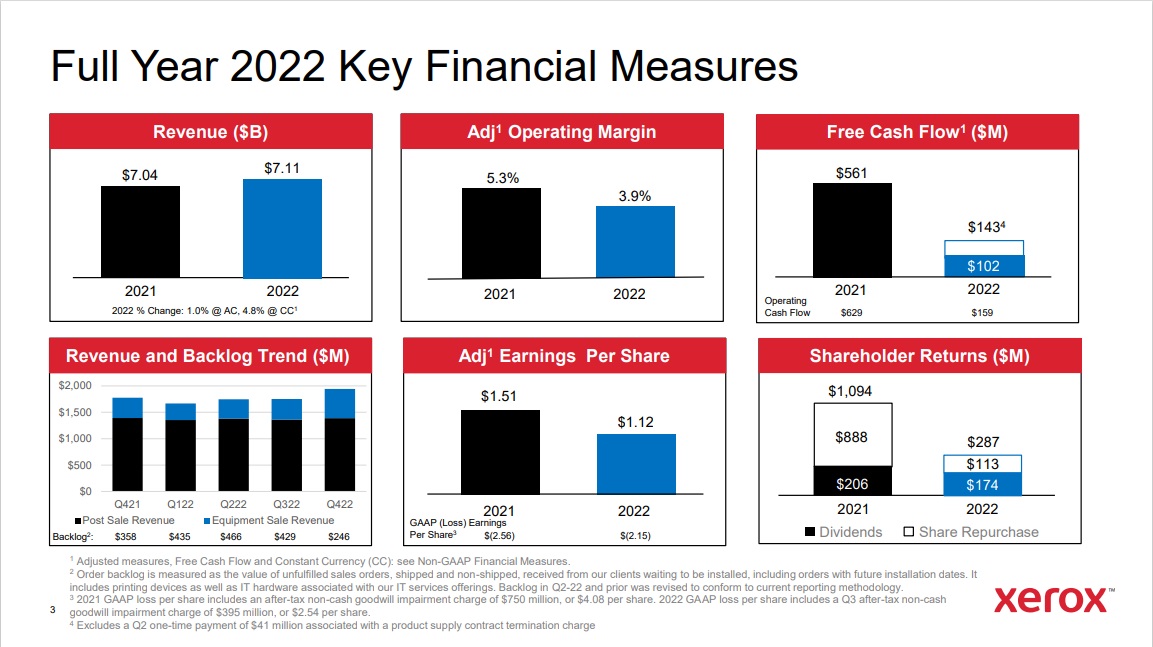

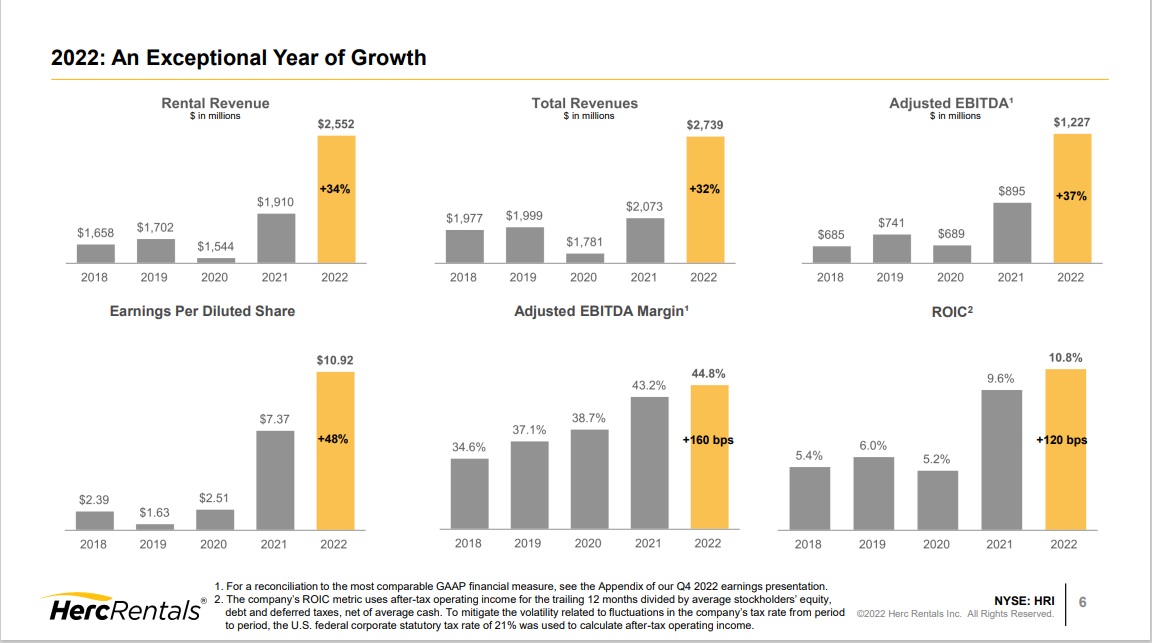

Xerox Company traces its lineage again to 1906 when The Haloid Photographic Firm started manufacturing photographic paper and gear. Via a sequence of mergers and spinoffs, the Xerox we all know in the present day was shaped.

Xerox spun off its enterprise processing unit in 2017 (now known as Conduent) and now focuses on design, growth, and gross sales of doc administration techniques. The corporate produces about $7 billion in annual income.

Xerox reported fourth quarter and full-year earnings on January twenty sixth, 2023, and outcomes have been fairly robust. Income was up 9% year-over-year to $1.94 billion. Income was up nearly 14% on a continuing forex foundation. Adjusted earnings-pershare was 89 cents. That was up from simply 34 cents a yr in the past.

Supply: Investor Presentation

Adjusted working margin was 9.2% of income, almost double what it was within the year-ago interval. Working money movement was barely weaker, declining $12 million to $186 million from final yr’s This autumn. Free money movement was $168 million, additionally down barely year-over-year.

For the yr, adjusted earnings-per-share fell from $1.51 to $1.12. Income was up 1% on a reported foundation, however up 4.8% on a continuing forex foundation. Adjusted working margin was 3.9% of income, down from 5.3% in 2022. The corporate guided for 2023 income of flat to barely decrease, and working margin of at the least 4.7%. As well as, free money movement is anticipated to be at the least $500 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on Xerox Holdings (preview of web page 1 of three proven beneath):

#5: Herc Holdings (HRI)

Dividend Yield: 1.6%

P.c of Carl Icahn’s Portfolio: 2.3%

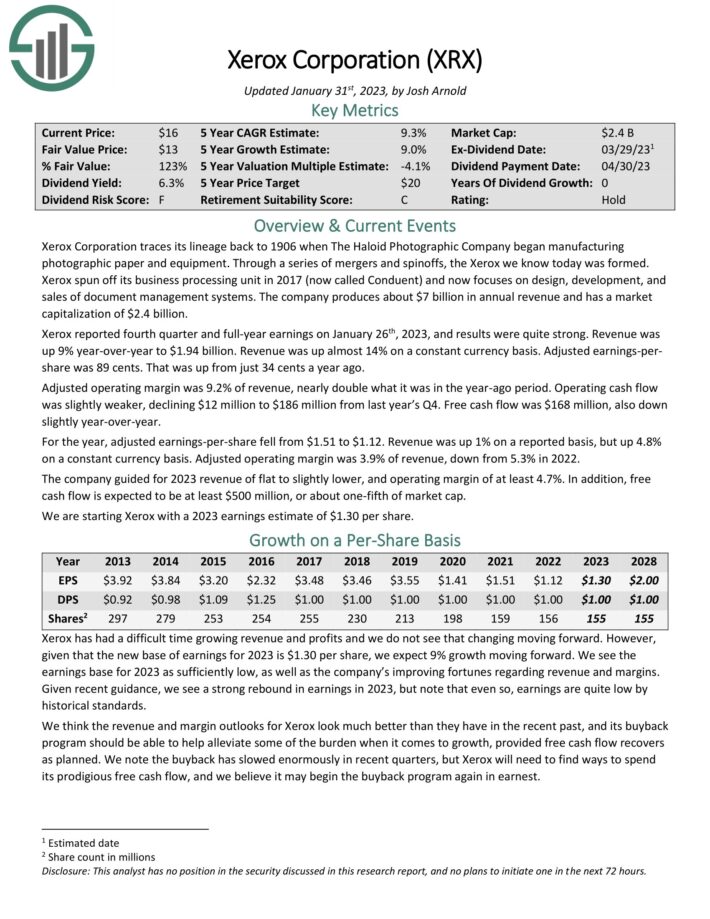

Herc Holdings is an gear rental provider in the US and internationally. It rents aerial, earth-moving, materials dealing with, vans and trailers, air compressors, compaction, and lighting gear.

You’ll be able to see an summary of the corporate’s monetary efficiency in 2022 beneath:

Supply: Investor Presentation

The corporate additionally supplies ProSolutions offering providers together with energy technology, local weather management, remediation and restoration, pump, trench shoring, and studio and manufacturing gear. It additionally presents ProContractor skilled grade instruments.

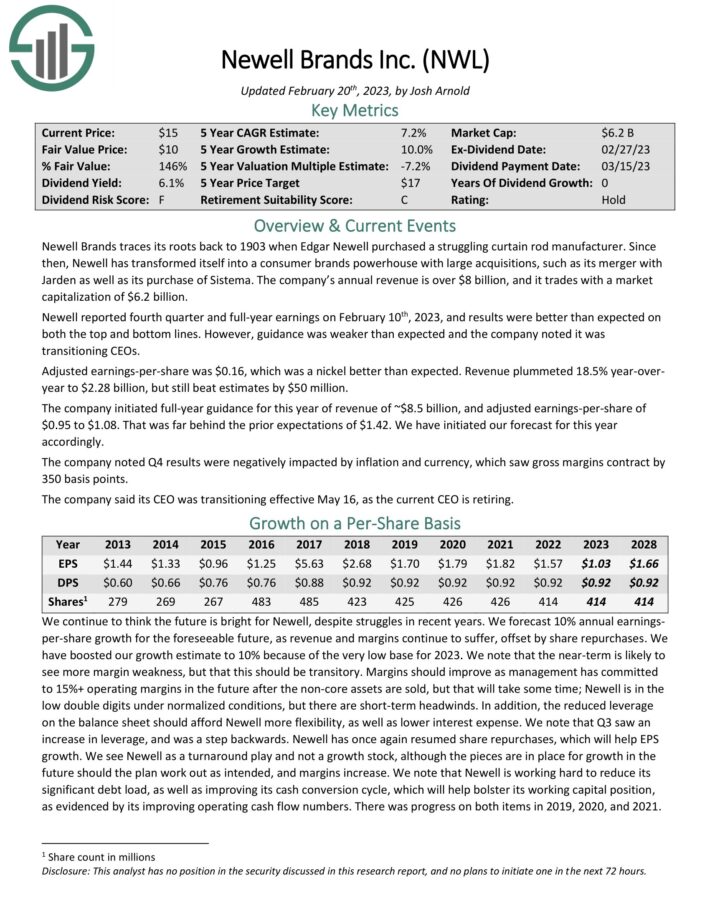

#6: Newell Manufacturers (NWL)

Dividend Yield: 6.2%

P.c of Carl Icahn’s Portfolio: 2.2%

Newell has reworked itself right into a client manufacturers powerhouse with massive acquisitions, similar to its merger with

Jarden in addition to its buy of Sistema. The corporate’s annual income is over $8 billion and it has a diversified product portfolio.

Supply: Investor Presentation

Newell reported fourth quarter and full-year earnings on February tenth, 2023, and outcomes have been higher than anticipated on each the highest and backside strains. Nonetheless, steering was weaker than anticipated and the corporate famous it was transitioning CEOs.

Adjusted earnings-per-share was $0.16, which was a nickel higher than anticipated. Income plummeted 18.5% year-over yr to $2.28 billion, however nonetheless beat estimates by $50 million.

The corporate initiated full-year steering for this yr of income of ~$8.5 billion, and adjusted earnings-per-share of $0.95 to $1.08. That was far behind the prior expectations of $1.42. The corporate famous This autumn outcomes have been negatively impacted by inflation and forex, which noticed gross margins contract by 350 foundation factors.

Click on right here to obtain our most up-to-date Positive Evaluation report on Newell (preview of web page 1 of three proven beneath):

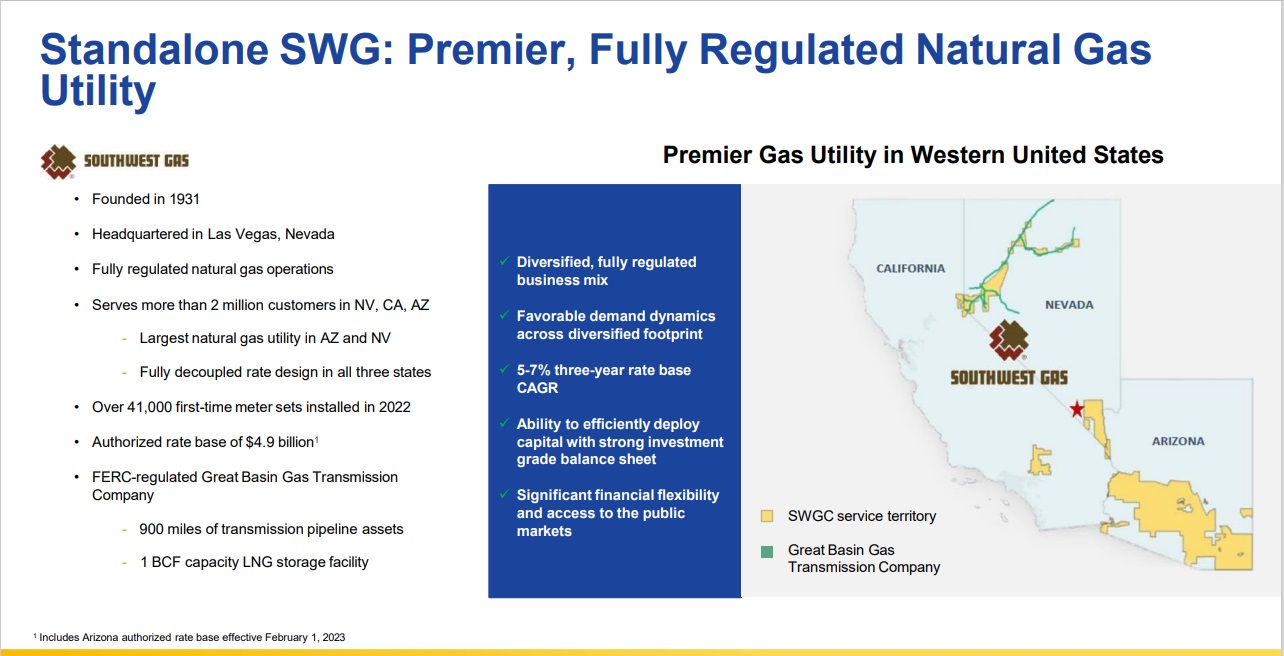

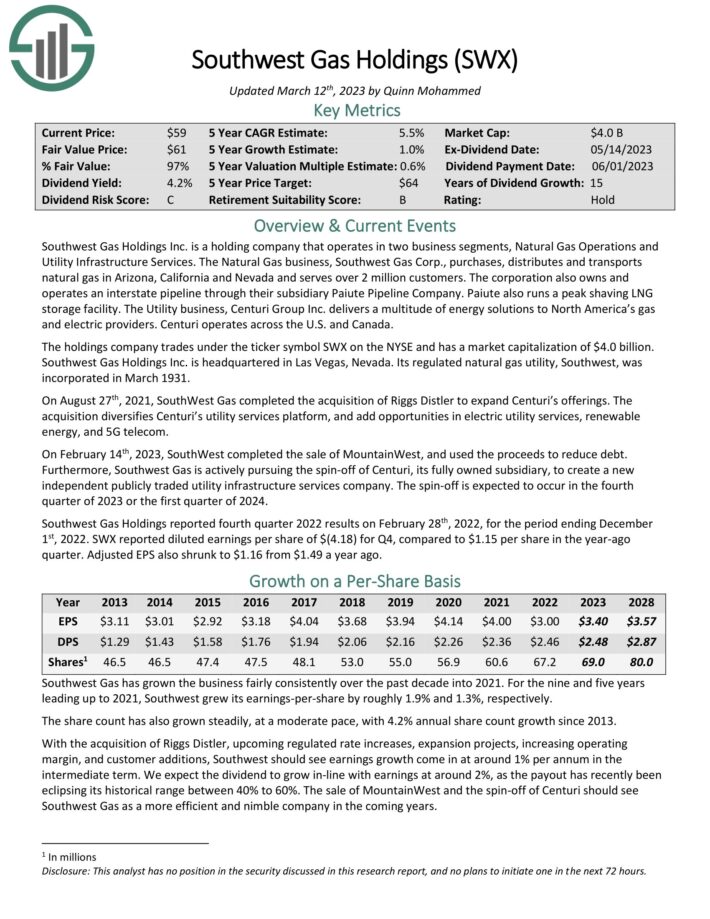

#7: Southwest Gasoline Holdings (SWX)

Dividend Yield: 4.1%

P.c of Carl Icahn’s Portfolio: 1.9%

Southwest Gasoline Holdings Inc. is a holding firm that operates in two enterprise segments, Pure Gasoline Operations and Utility Infrastructure Companies. The Pure Gasoline enterprise, Southwest Gasoline Corp., purchases, distributes and transports pure gasoline in Arizona, California and Nevada and serves over 2 million prospects.

The company additionally owns and operates an interstate pipeline via their subsidiary Paiute Pipeline Firm. Paiute additionally runs a peak shaving LNG storage facility. The Utility enterprise, Centuri Group Inc. delivers a mess of power options to North America’s gasoline and electrical suppliers. Centuri operates throughout the U.S. and Canada.

Supply: Investor Presentation

On February 14th, 2023, SouthWest accomplished the sale of MountainWest, and used the proceeds to cut back debt. Moreover, Southwest Gasoline is actively pursuing the spin-off of Centuri, its absolutely owned subsidiary, to create a brand new impartial publicly traded utility infrastructure providers firm. The spin-off is anticipated to happen within the fourth quarter of 2023 or the primary quarter of 2024.

Southwest Gasoline Holdings reported fourth quarter 2022 outcomes on February twenty eighth, 2022, for the interval ending December 1st, 2022. SWX reported diluted earnings per share of $(4.18) for This autumn, in comparison with $1.15 per share within the year-ago quarter. Adjusted EPS additionally shrunk to $1.16 from $1.49 a yr in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWX (preview of web page 1 of three proven beneath):

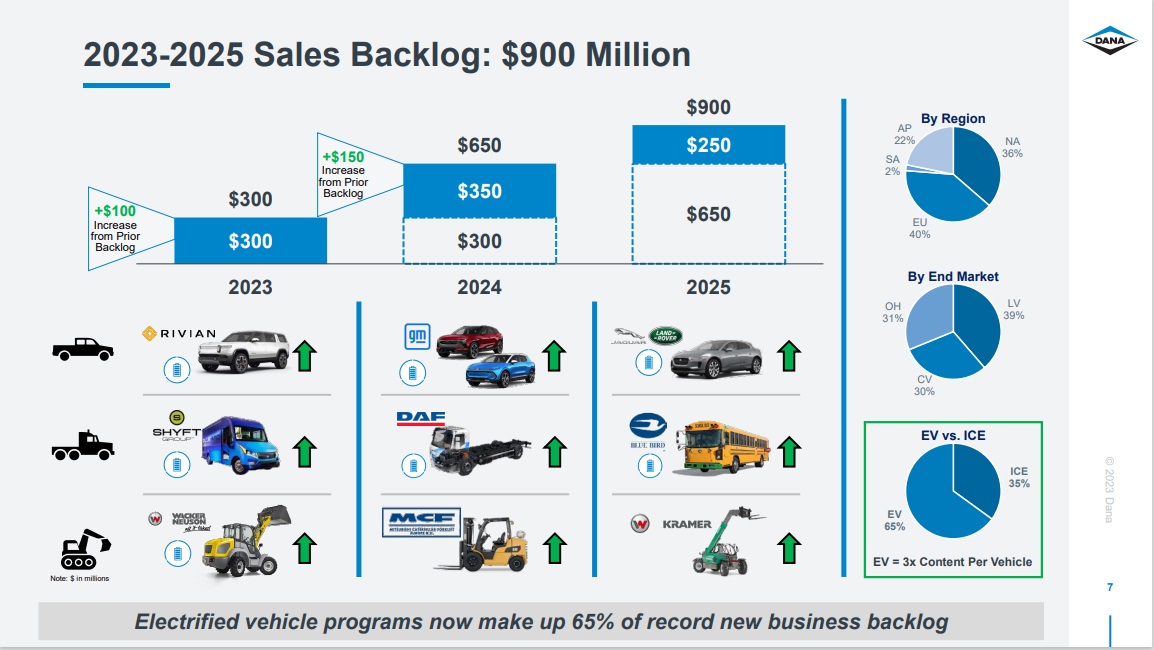

#8: Dana Inc. (DAN)

Dividend Yield: 2.4%

P.c of Carl Icahn’s Portfolio: 1.2%

Dana Integrated supplies power-conveyance and energy-management options for autos and equipment in North America, Europe, South America, and the Asia Pacific. It operates in 4 segments: Gentle Automobile Drive Methods, Industrial Automobile Drive and Movement Methods, Off-Freeway Drive and Movement Methods, and Energy Applied sciences.

Gross sales for 2022 have been $10.2 billion, in contrast with $8.9 billion in 2021. The rise of $1.2 billion resulted from improved general market demand and conversion of the gross sales backlog mixed with pricing actions, together with materials commodity worth and inflationary price recoveries.

Supply: Investor Presentation

Adjusted EBITDA for 2022 was $700 million, in contrast with $795 million in 2021. Decrease revenue was pushed primarily by non-material inflation, in addition to manufacturing inefficiencies pushed by risky buyer demand schedules, continued supply-chain challenges, greater launch prices, and accelerated spending on growth for electric-vehicle merchandise.

The online loss attributable to Dana for 2022 was $242 million or $1.69 per share, in contrast with internet revenue of $197 million or $1.35 per share in 2021. The loss resulted from a one-time non-cash goodwill impairment cost of $191 million as a result of rising rates of interest and decrease market capitalization, and from $157 million of further non-cash tax valuation allowances.

#9: Bausch Well being Firms (BHC)

Dividend Yield: N/A (Bausch Well being doesn’t at present pay a quarterly dividend)

P.c of Carl Icahn’s Portfolio: 1.2%

Bausch Well being Firms was previously referred to as Valeant Prescribed drugs and adjusted its identify to Bausch Well being Firms Inc. in July 2018. Bausch Well being manufactures and markets a variety of pharmaceutical, medical system, and over-the-counter (OTC) merchandise primarily within the therapeutic areas of eye well being, gastroenterology, and dermatology.

The corporate operates via 5 segments: Salix, Worldwide, Solta Medical, Diversified Merchandise, and Bausch + Lomb. The Salix phase supplies gastroenterology merchandise within the U.S., whereas the Worldwide phase presents Solta merchandise, branded and generic pharmaceutical merchandise, OTC merchandise, and medical system merchandise, and Bausch + Lomb merchandise in Canada, Europe, Asia, Latin America, Africa, and the Center East.

The Solta Medical phase presents medical units. The Diversified Merchandise phase presents pharmaceutical merchandise within the areas of neurology and different therapeutic courses, in addition to generic, dermatological, and dentistry merchandise in the US.

Lastly, the Bausch + Lomb phase presents merchandise with a give attention to the imaginative and prescient care, surgical, and ophthalmic prescription drugs merchandise.

#10: Conduent Inc. (CNDT)

Dividend Yield: N/A (Conduent doesn’t at present pay a quarterly dividend)

P.c of Carl Icahn’s Portfolio: 0.7%

Conduent delivers technology-led enterprise course of options for companies and governments globally. Conduent’s options and providers digitally remodel its shoppers’ operations together with delivering 43% of vitamin help funds within the U.S., enabling 1.3 billion customer support interactions yearly.

For 2022, income of $3.8 billion declined 6.8% year-over-year, primarily pushed by important, non-recurring stimulus funds quantity in its Authorities Companies enterprise within the prior yr, recessionary-related quantity reductions within the Industrial enterprise, in addition to unfavorable overseas change impression.

#11: Cheniere Vitality (LNG)

Dividend Yield: 1.0%

P.c of Carl Icahn’s Portfolio: 0.7%

Cheniere Vitality is an power firm engaged in liquefied pure gasoline associated companies. It owns and operates the Sabine Move LNG terminal in Cameron Parish, Louisiana; and the Corpus Christi LNG terminal close to Corpus Christi, Texas.

The corporate additionally owns Creole Path pipeline, a 94-mile pipeline interconnecting the Sabine Move LNG terminal with varied interstate pipelines; and operates Corpus Christi pipeline, a 21.5-mile pure gasoline provide pipeline.

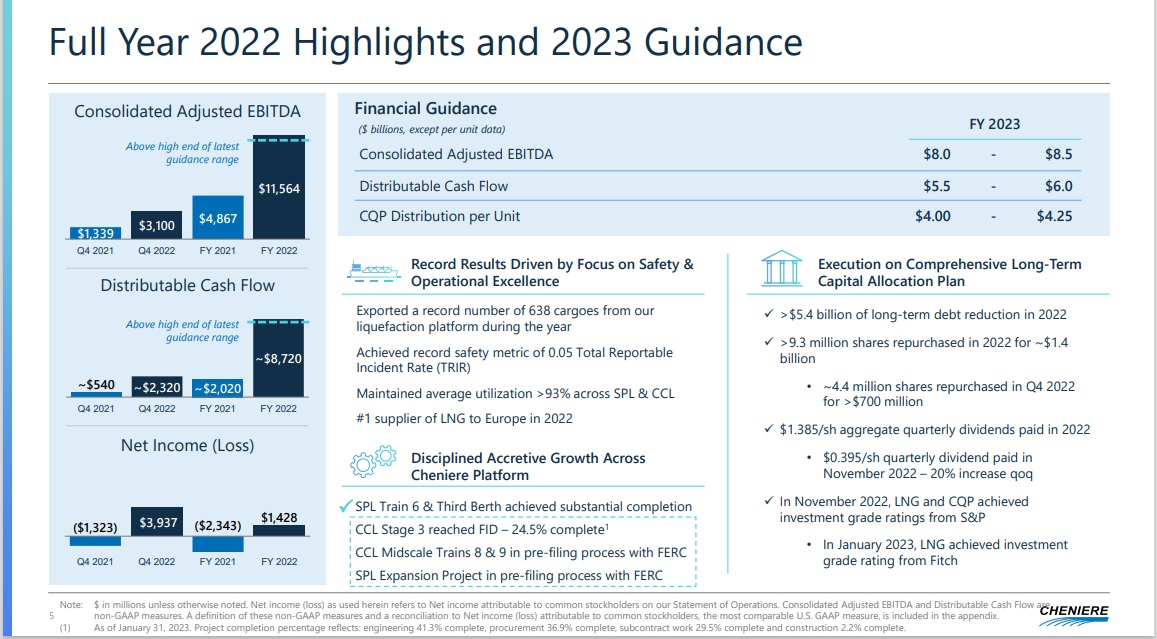

You’ll be able to see an summary of the corporate’s 2022 monetary efficiency within the picture beneath:

Supply: Investor Presentation

#12: Crown Holdings, Inc. (CCK)

Dividend Yield: 1.0%

P.c of Carl Icahn’s Portfolio: 0.4%

Crown Holdings, Inc., along with its subsidiaries, provides inflexible packaging merchandise in Pennsylvania and internationally. It operates via Americas Beverage, European Beverage, Asia Pacific, and Transit Packaging segments.

Internet gross sales within the fourth quarter have been $3,012 million in comparison with $3,054 million within the fourth quarter of 2021 reflecting greater costs and elevated beverage gross sales unit volumes, offset by decrease volumes within the Transit Packaging companies and unfavorable overseas forex translation of $92 million.

Earnings from operations was $229 million within the fourth quarter in comparison with $303 million within the fourth quarter of 2021. Section revenue within the fourth quarter of 2022 was $292 million in comparison with $357 million within the prior-year fourth quarter as a result of greater prices and better power costs.

#13: Sandridge Vitality Inc. (SD)

Dividend Yield: N/A

P.c of Carl Icahn’s Portfolio: 0.3%

SandRidge Vitality, Inc. engages within the acquisition, growth, and manufacturing of oil and pure gasoline primarily in the US Mid-Continent. As of December 31, 2022, it had an curiosity in 1,471 gross producing wells.

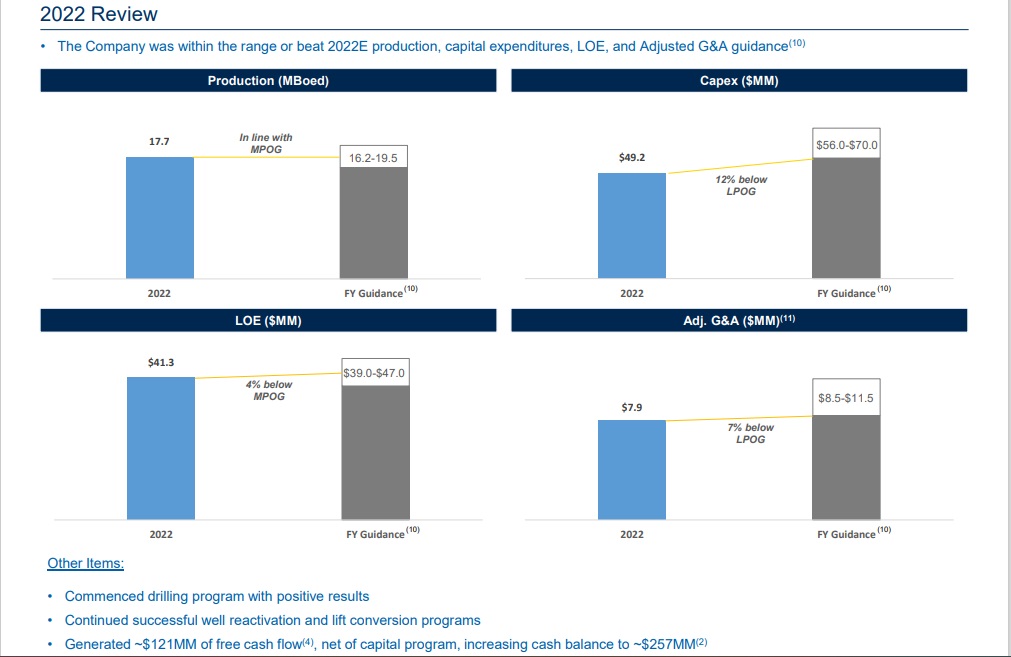

For 2022, the corporate generated internet revenue of $242.2 million, or $6.59 per fundamental share in 2022. Adjusted internet revenue was $171.5 million, or $4.67 per fundamental share. Adjusted EBITDA of $191.2 million in 2022 in comparison with $113.5 million in 2021.

Supply: Investor Presentation

Sandridge generated roughly $120.6 million of free money movement in 2022, which represents a conversion fee of roughly 63% relative to adjusted EBITDA. Manufacturing averaged 17.7 MBoed in 2022.

The corporate drilled eight and accomplished six new wells in 2022. In 2023, the corporate at present plans to drill two and full 4 new wells. It additionally returned 50 wells to manufacturing in 2022 that have been beforehand curtailed.

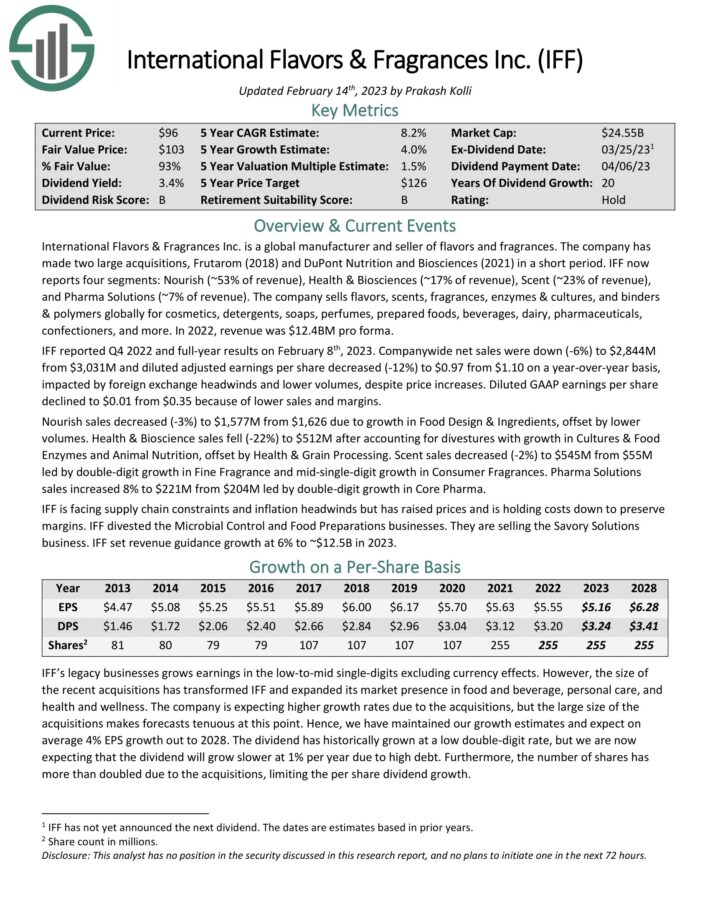

#14: Worldwide Flavors & Fragrances (IFF)

Dividend Yield: 3.4%

P.c of Carl Icahn’s Portfolio: 0.3%

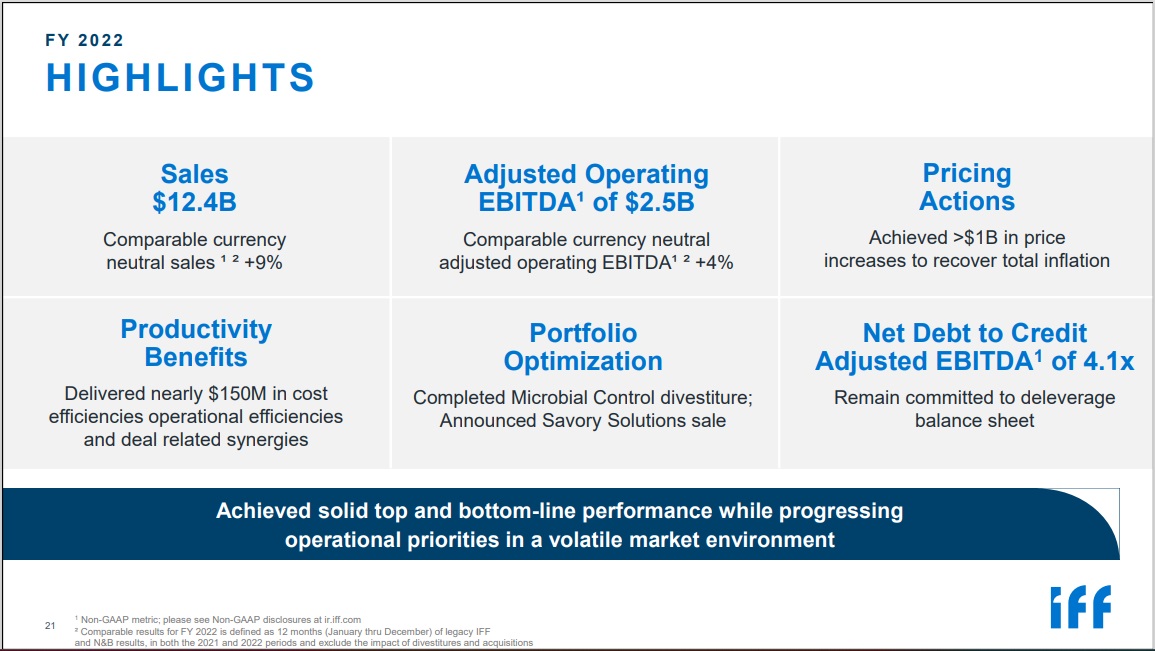

Worldwide Flavors & Fragrances Inc. is a worldwide producer and vendor of flavors and fragrances. The corporate has made two massive acquisitions, Frutarom (2018) and DuPont Vitamin and Biosciences (2021) in a brief interval. IFF now experiences 4 segments: Nourish (~53% of income), Well being & Biosciences (~17% of income), Scent (~23% of income), and Pharma Options (~7% of income).

The corporate sells flavors, scents, fragrances, enzymes & cultures, and binders & polymers globally for cosmetics, detergents, soaps, perfumes, ready meals, drinks, dairy, prescription drugs, confectioners, and extra. In 2022, income was $12.4BM professional forma.

Supply: Investor Presentation

IFF reported This autumn 2022 and full-year outcomes on February eighth, 2023. Companywide internet gross sales have been down (-6%) to $2,844M from $3,031M and diluted adjusted earnings per share decreased (-12%) to $0.97 from $1.10 on a year-over-year foundation, impacted by overseas change headwinds and decrease volumes, regardless of worth will increase. Diluted GAAP earnings per share declined to $0.01 from $0.35 due to decrease gross sales and margins.

Nourish gross sales decreased (-3%) to $1,577M from $1,626 as a result of development in Meals Design & Components, offset by decrease volumes. Well being & Bioscience gross sales fell (-22%) to $512M after accounting for divestitures with development in Cultures & Meals Enzymes and Animal Vitamin, offset by Well being & Grain Processing. Scent gross sales decreased (-2%) to $545M from $55M led by double-digit development in Wonderful Perfume and mid-single-digit development in Client Fragrances. Pharma Options gross sales elevated 8% to $221M from $204M led by double-digit development in Core Pharma..

Click on right here to obtain our most up-to-date Positive Evaluation report on IFF (preview of web page 1 of three proven beneath):

#15: Bausch & Lomb Company (BLCO)

Dividend Yield: N/A

P.c of Carl Icahn’s Portfolio: 0.3%

Bausch + Lomb Company operates as an eye fixed well being firm worldwide. It operates via three segments: Imaginative and prescient Care, Ophthalmic Prescribed drugs, and Surgical. The Imaginative and prescient Care phase supplies contact lenses and speak to lens care merchandise.

The Ophthalmic Prescribed drugs phase presents proprietary and generic pharmaceutical merchandise for post-operative therapies, in addition to for the remedy of eye situations similar to glaucoma and retinal illnesses.

The Surgical phase supplies medical system gear, consumables, and applied sciences. Bausch + Lomb Company was spun off from Bausch Well being Firms.

Ultimate Ideas

You’ll be able to see extra high-quality dividend shares within the following Positive Dividend databases:

Alternatively, one other excellent place to search for high-quality enterprise is contained in the portfolios of different extremely profitable traders.

To that finish, Positive Dividend has created the next inventory databases:

You may additionally be seeking to create a extremely personalized dividend revenue stream to pay for all times’s bills.

The next two lists present helpful info on excessive dividend shares and shares that pay month-to-month dividends:

Lastly, you possibly can see the articles beneath for evaluation on different main funding corporations/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link