Andrew Burton

Alibaba Group Holding Restricted (NYSE:BABA) has seen very risky buying and selling as of late. With the Chinese language property market showing as dicey as ever, buyers have grown cautious on Chinese language equities, with BABA buying and selling right down to beneath its IPO value.

However the inventory has seen some life not too long ago on account of serious insider shopping for from co-founder Jack Ma in addition to CEO Joe Tsai. The inventory stays terribly low cost at the very least on the floor, backed by numerous internet money and a major fairness funding portfolio.

Nevertheless, I’ve grown disillusioned by administration’s incapacity to ship on plans to separate out its enterprise items by way of spinoffs and IPOs. With the obvious catalyst now showing unlikely, I can’t keep away from turning my consideration to the Chinese language macro setting. I’m promoting my inventory and don’t intend to revisit the title till there may be tangible progress on enterprise spinoffs or a decision of the Chinese language property disaster.

BABA Inventory Value

Pessimism is excessive for Chinese language equities, however is it excessive sufficient? BABA briefly traded beneath its 2014 IPO value, however has not too long ago seen indicators of life due disclosure that each Ma and Tsai had bought a mixed $200 million of inventory within the firm. Whereas Ma’s $50 million buy was of the Hong Kong-listed securities, it’s notable that Tsai’s $150 million buy was of the American depository receipts.

I final coated BABA in October, the place I stood by my bullish ranking on account of the sturdy steadiness sheet and catalysts in movement. Whereas it might appear abrupt, I’m now pulling my bullish ranking attributable to administration being unable to execute on the deliberate spinoffs, despite having already tried to spin off each the grocery and cloud divisions.

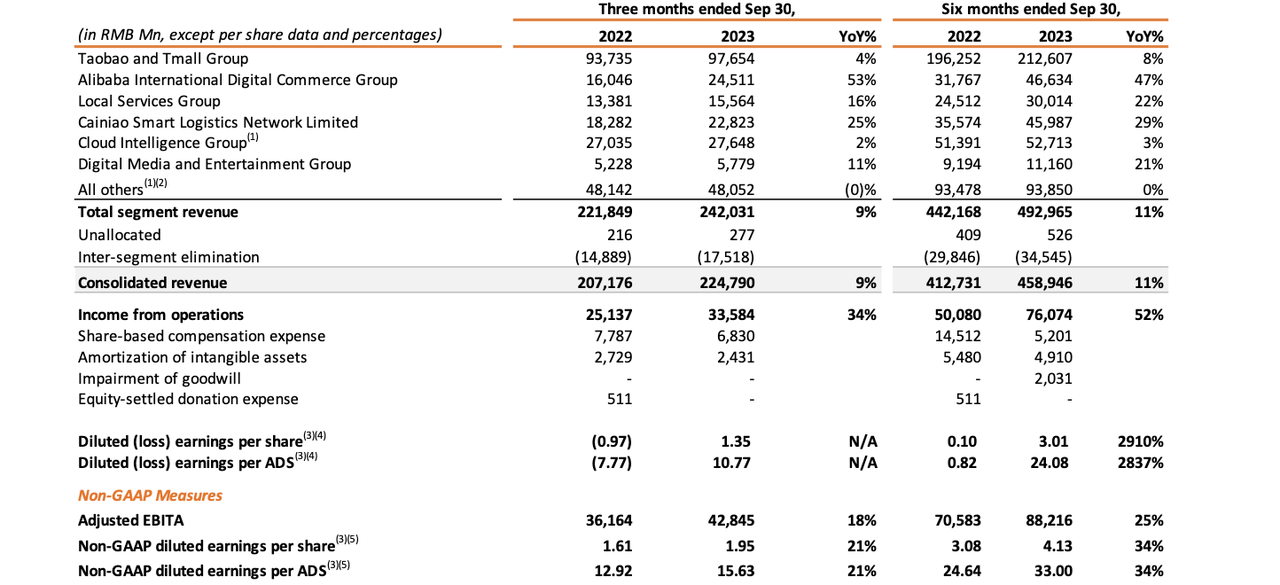

BABA Inventory Key Metrics

In its most up-to-date quarter, BABA generated 9% YoY income progress, led by 53% progress in worldwide digital commerce. It’s notable that competitor PDD Holdings (PDD), previously Pinduoduo, has been producing triple-digit top-line progress compared. Working revenue grew even quicker at 34% YoY as the corporate continues to push for operational effectivity.

2023 Q3 Presentation

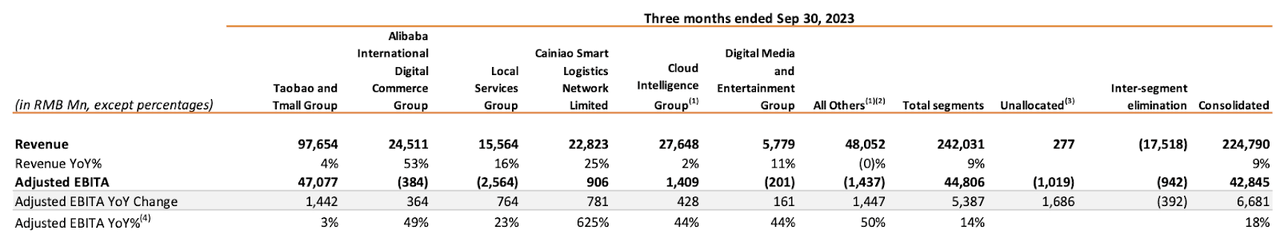

From an adjusted EBITA perspective, we are able to see beneath that the corporate delivered the best enhancements in its Cainiao logistics section.

2023 Q3 Presentation

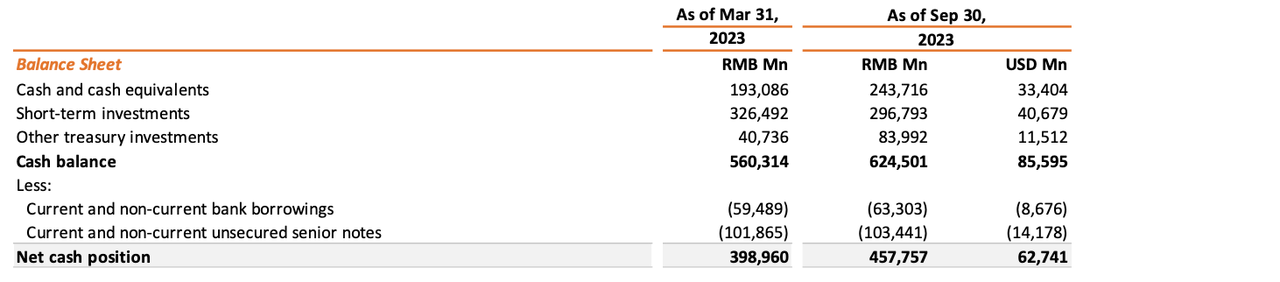

BABA ended the quarter with a sometimes sturdy steadiness sheet, highlighted by $62.7 billion in internet money and $67 billion in fairness investments. I notice that the market cap not too long ago stood at simply round $185 billion.

2023 Q3 Presentation

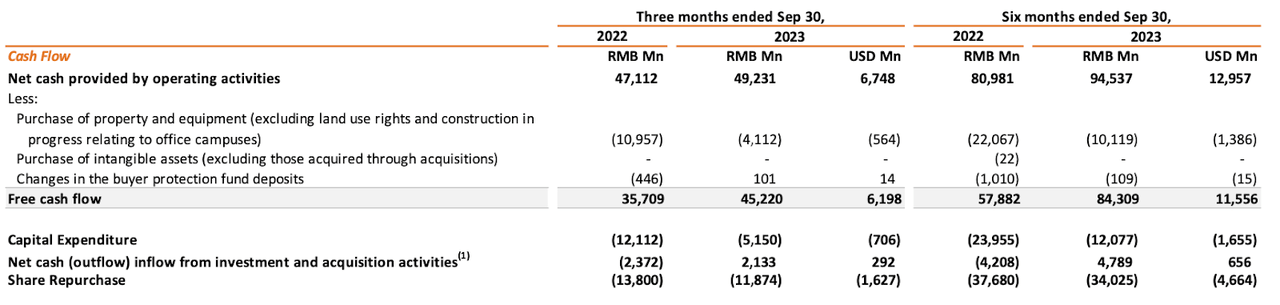

BABA generated $6.2 billion in free money circulate and repurchased $1.6 billion of inventory. Given present valuations, buyers might have been hoping for the corporate to be extra aggressive with its share repurchase program, however the firm’s latest outcomes stay much more constructive than in years previous when share repurchases had been fully off the desk. Administration has since issued a press launch stating that that they had repurchased $2.9 billion of inventory within the fourth quarter.

2023 Q3 Presentation

On the convention name, administration famous that they are going to now not pursue a spin-off of their cloud division attributable to “uncertainties created by latest U.S. export restrictions on superior computing chips.” This comes after administration paused their plans to IPO the grocery section attributable to issues about valuation. Administration acknowledged that they intend to as an alternative develop a “sustainable progress mannequin based mostly on rising AI-driven demand for networked and extremely scaled cloud computing companies.”

I view this growth as being fairly damaging to the bullish thesis, because the cloud division (and others) had been and haven’t been rewarded with premium valuations beneath the conglomerate construction. As such, I’m not of the view that driving elevated give attention to the cloud division would result in shareholder returns, that’s until administration additionally will increase the aggressiveness of their share repurchase program (of which there isn’t a indication). The corporate had beforehand filed for an IPO of their Cainiao Logistics section in August and has obtained approval from the alternate, however at this level I have to see outcomes earlier than regaining hope.

Administration emphasised their dedication to long run profitability, discussing ambitions to carry their ROIC from the single-digits to the double-digits. Administration additionally famous plans to “monetize the worth of non-core property,” particularly calling out the $67 billion in fairness investments. Such a transfer, if carried out, can be extremely bullish for buyers given the low valuation of the inventory at this time – however once more, after being disillusioned on the enterprise section spinoffs I have to see to consider.

Administration authorised a quarterly dividend however famous that they’re “not going to contemplate a one-time money dividend,” stating that “the precedence for money use is to take a position for future progress.” That seems to go towards the commentary concerning monetizing the fairness portfolio, and on the very least crushes any hopes for an aggressive share repurchase program fueled by money readily available and gross sales from the fairness portfolio.

Is BABA Inventory A Purchase, Promote, or Maintain?

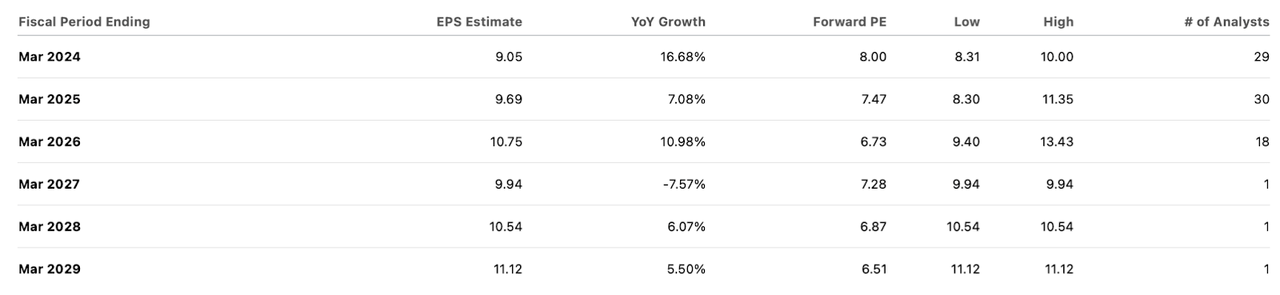

At latest costs, BABA was buying and selling at simply round 8x earnings.

Searching for Alpha

The corporate does have round 70% of its market cap represented by internet money and fairness investments, however I warning towards calculating upside based mostly on adjusting for internet money on condition that administration has made it clear that an aggressive share repurchase or dividend payout is off the desk.

My earlier bullish case was based mostly on Alibaba Group Holding Restricted creating shareholder worth by breaking apart the enterprise segments by way of IPOs and spinoffs. The thought was that many of those companies are loss-generating or not producing a lot income, that means that they don’t seem to be contributing a lot to that present P/E ratio. By separating them out, they’d obtain non-zero valuations, and that may result in substantial worth creation assuming that the core Taobao enterprise is valued at the very least the present earnings a number of. Nevertheless, as it’s wanting more and more unlikely that BABA will be capable of spin out their cloud or grocery segments, that thesis is falling aside.

Within the absence of that thesis, we’re left questioning if Alibaba Group Holding Restricted inventory is reasonable sufficient at present ranges. The Chinese language authorities threat is well-known, and I’d argue that administration is just not repurchasing sufficient inventory nor paying beneficiant sufficient dividends to offset that threat by way of shareholder return of capital. However there are different dangers which might be extra regarding.

As briefly talked about earlier, PDD and different rivals are potential causes for concern. The truth that PDD is rising so quickly relative to BABA seems to point that BABA is shedding market share to the competitors. Sure, some might level to PDD spending aggressively on promoting, however it’s notable that PDD stays extremely worthwhile on a consolidated foundation with a surprising 22% internet margin within the newest quarter. If it seems that BABA’s core companies are in slow-growth and even terminal decline, then 8x earnings now not appears so low cost. If something, one might argue that 8x earnings can be too costly, on condition that we should additionally issue within the Chinese language threat.

However for my part, the extra regarding threat is that of the macro scenario in China. It seems inevitable for an actual property disaster to emerge, and I’m not inspired by the federal government’s efforts to help the monetary markets. My naive eye sees a number of similarities between the 2008-2009 Nice Monetary Disaster and the troubles in China at this time. I’m of the view that we might probably see exceedingly engaging entry factors into Chinese language shares together with BABA within the medium-term future. It’s not clear what position, if any, BABA will play in a Chinese language restoration.

Once more, I stress that these issues all the time existed, however have develop into extra vital given the dearth of seen catalysts. I’m downgrading the inventory to “maintain” representing a impartial ranking, however might improve the inventory if administration reveals a dedicated effort to returning money to shareholders extra aggressively.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.