[ad_1]

- Airbnb loved a post-IPO surge however confronted a downturn attributable to COVID-19

- Upcoming Q3 outcomes are essential for the corporate after a current inventory decline

- Analysts have optimistic forecasts for Q3, however the inventory’s efficiency will rely upon earnings and journey business’s turnaround

Airbnb (NASDAQ:) made its debut on in December 2020 and skilled a exceptional surge in its inventory worth shortly earlier than the outbreak of COVID-19. The attract of Airbnb as a progress inventory post-IPO triggered elevated demand, propelling its share worth to just about $220 throughout the preliminary two months of 2021, representing a powerful 50% achieve from its opening worth of $146.

Nevertheless, the tide rapidly turned in March 2021 when COVID-19 was declared a pandemic, leading to a considerable downturn for Airbnb because the journey business floor to a halt. The inventory dipped under its IPO opening worth, erasing earlier positive aspects. All through 2021, it maintained a sideways trajectory amidst the continued pandemic, nevertheless it transitioned right into a downward pattern within the latter half of 2022.

Airbnb Inventory Punished Regardless of Revenue, Income Development

The restoration that kicked off in 2023 prolonged till July, bolstered by optimistic developments within the journey business. But, within the final three months, Airbnb’s inventory has been on a downward trajectory, instilling a destructive outlook as the corporate approaches the discharge of its Q3 outcomes scheduled for November 1.

Within the earlier quarter, introduced in August, Airbnb reported earnings per share of $0.98, surpassing expectations by almost 25%. The quarterly earnings additionally barely exceeded the projections set by InvestingPro, amounting to $2.48 billion.

Regardless of reaching revenue progress for 5 consecutive quarters, buyers appear to be penalizing the corporate for its slowed progress. Whereas the gross revenue margin has sustained a year-on-year enhance of 75%, the continued deceleration in gross sales, regardless of an 18% enhance, is a matter of great concern, significantly for an organization like Airbnb, which is often perceived as a progress inventory.

Supply: InvestingPro

For 2023, after the quarterly outcomes announcement, it’s evident that the inventory is buying and selling with a bearish bias, indicating that buyers are closely influenced by the corporate’s monetary efficiency.

That is exemplified by corrections following the monetary outcomes launched in Might and August. Nevertheless, after the Might pullback, the inventory surged to a excessive of $155 by the tip of July on speculations of inclusion within the , pushed by summer time exercise within the journey sector.

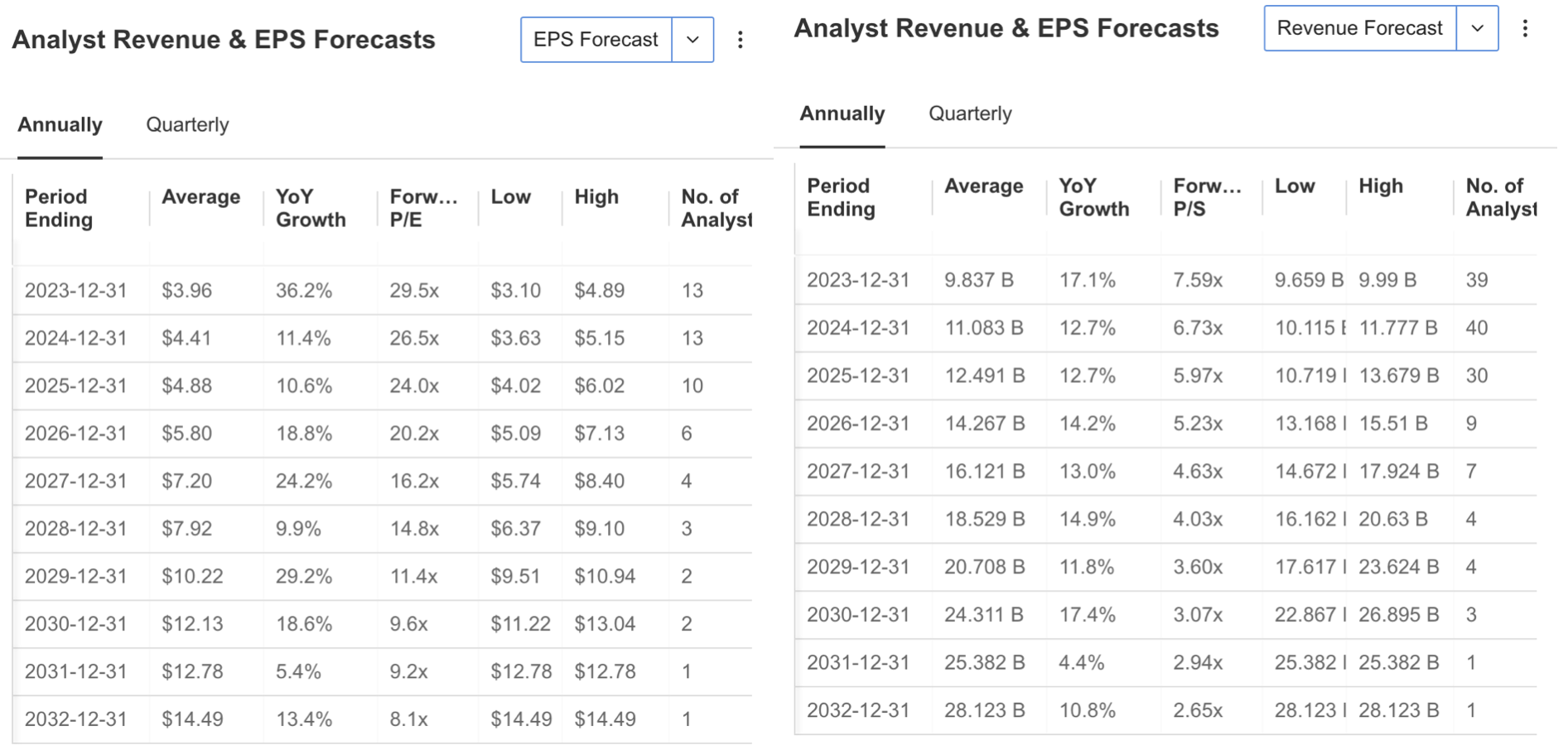

Airbnb’s Q3 earnings report might introduce volatility within the inventory worth. Analysts are comparatively optimistic in regards to the final quarter, with estimates suggesting an earnings per share of $2.15 for Q3.

The consensus view of analysts has elevated by 21%, from $1.71 to $2.15, in accordance with the most recent replace. The income forecast for the quarter is $3.36 billion, indicating a 15% year-on-year progress however highlighting the expectation of continued income progress deceleration.

Supply: InvestingPro

Whereas the slowdown in progress is anticipated to have an effect on profitability within the forecasts for the approaching durations, a decline in EPS is predicted for This autumn and the primary quarter of 2024. Nevertheless, analysts predict that profitability will get well in the direction of the summer time months.

Whereas the same decline is anticipated within the firm’s income within the subsequent 6 months, a rise is anticipated in the course of the durations when the journey business reaccelerates.

Supply: InvestingPro

Airbnb Going through Fierce Competitors

Along with its companies within the US, Airbnb, along with its subsidiaries, affords a pioneering middleman exercise that allows hosts to supply lodging to vacationers world wide. Nevertheless, as this short-term lodging mannequin has turn into standard, the variety of rivals has elevated significantly.

This may be seen as one of many elements that hindered Airbnb’s progress. A lot in order that even massive lodge chains weren’t detached to the expansion on this sector and began renting properties much like the Airbnb mannequin along with customary lodging companies.

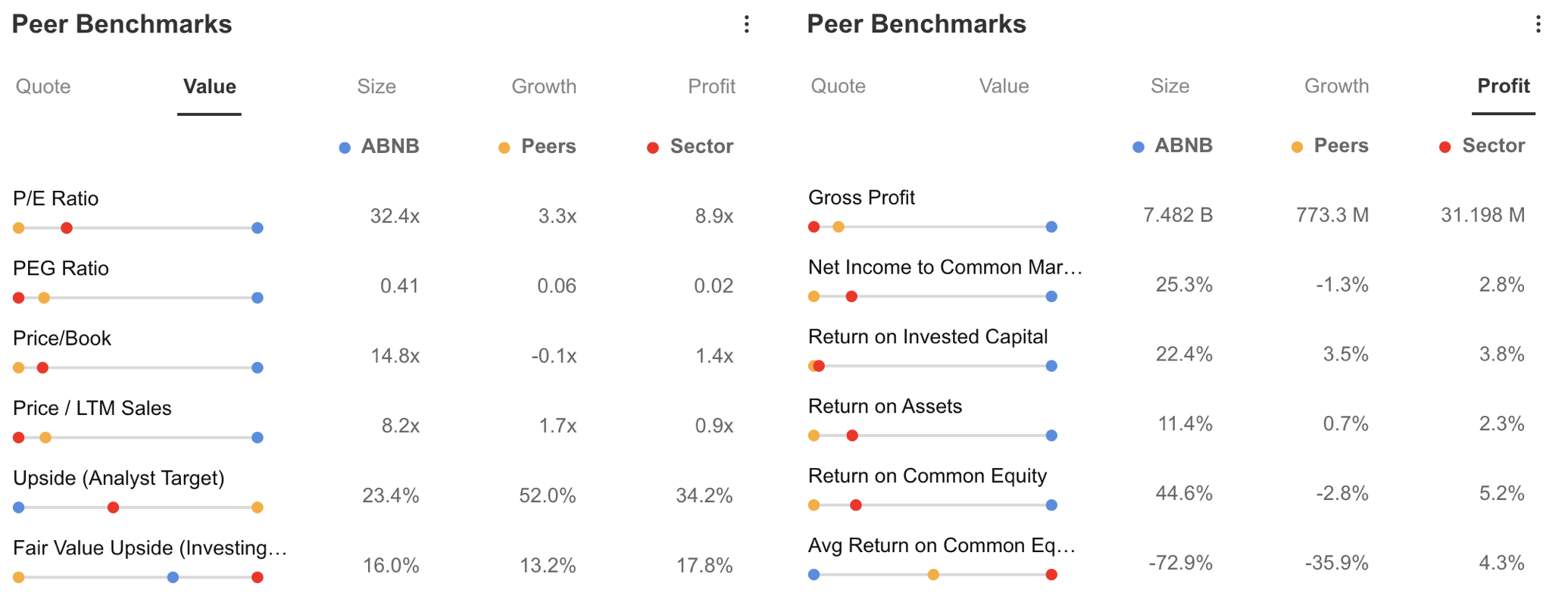

After we examine Airbnb with peer firms on InvestingPro, it may be seen that the corporate has higher efficiency in nearly all key monetary objects.

Whereas ABNB’s worth/revenue ratio is at the moment 32.4x, the truth that it stays excessive in comparison with the sector and peer firms gives the look that the inventory is overvalued, whereas the value/e-book worth of 14.8x stands as a ratio that helps this valuation.

Among the many different distinguished ratios, the return on fairness (ROE) for the final 5 years constitutes a destructive by exhibiting that the corporate can’t use its fairness effectively with out producing revenue. Nevertheless, the truth that annual profitability objects proceed to stay above peer firms retains forward-looking expectations optimistic.

Supply: InvestingPro

By way of InvestingPro, we are able to additionally attain summarized conclusions about an organization’s total outlook. Accordingly, the optimistic inferences within the InvestingPro abstract for Airbnb stand out as follows:

- The corporate’s money is above its debt

- Regular rise in earnings per share (EPS)

- Analysts revised their expectations upwards

- Excessive gross margins

- Low F/S ratio in comparison with short-term revenue progress

Alternatively, the truth that Airbnb is an organization that doesn’t pay dividends is seen as a destructive for long-term buyers, whereas the downward pattern of the inventory since September stays a query mark. Nevertheless, given the potential for the inventory to maneuver extra unstable than the market with a beta of 1.2, it additionally reveals that there’s a chance of a sooner restoration in a potential comeback.

Whereas this inference stays legitimate in a downward pattern, in accordance with the present worth motion, Airbnb may be thought-about a riskier asset within the index.

Supply: InvestingPro

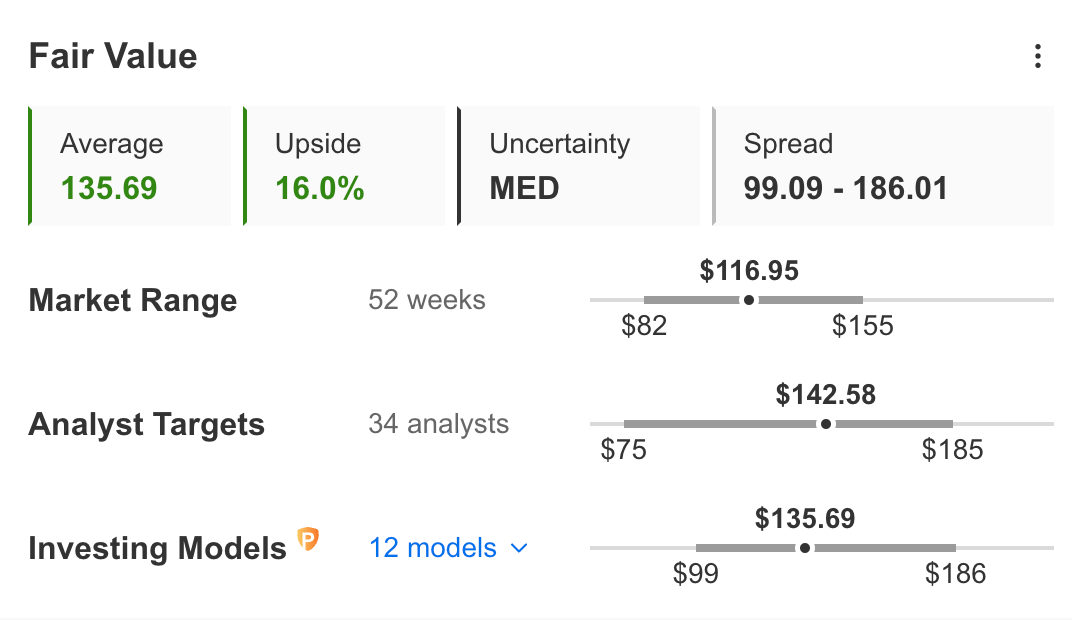

Truthful worth evaluation for ABNB inventory, which is buying and selling at $116 at this time, reveals that the opportunity of a restoration is on the desk. A lot in order that in accordance with the 12 InvestingPro mannequin, the honest worth was calculated at $ 135. This reveals that the inventory stays 16% discounted in accordance with this basic evaluation. The typical estimate of 34 analysts factors to $ 142, increased than the honest worth evaluation.

Lastly, let’s analyze Airbnb’s monetary well being in accordance with the InvestingPro abstract and attempt to establish the present help and resistance ranges of the share worth.

Supply: InvestingPro

Airbnb’s present monetary well being has a superb efficiency with a rating of three out of 5. The objects that elevate the typical are progress and profitability, whereas money circulate continues at common worth. ABNB’s worth momentum is dragging down efficiency as a result of pullback in current months, whereas relative worth can be among the many objects that should be improved.

ABNB Inventory: Technical View

Technically, it may be seen that the share of ABNB continues its pattern with the next peak and decrease backside formation sample in its fluctuating course in 2023. Based mostly on the downtrend originating in November 2021, it’s noteworthy that the 2023 pattern turned from the perfect correction pattern at 160 {dollars}.

Within the present state of affairs, if ABNB manages to keep up the typical help of $110 and might see a weekly shut above this worth stage, it might flip its route upwards within the final quarter of the 12 months as a continuation of the excessive peak – low backside sample.

On this case, we are able to see that the following native peak of the inventory may very well be within the vary of 170 – 180 {dollars}. Alternatively, if the essential help level of $ 100 under $ 110 is damaged, the present sample will turn into invalid.

Accordingly, the downward pattern is more likely to lengthen in the direction of the $80 band. Nevertheless, in accordance with the present outlook and expectations for Q3 earnings to be introduced, the inventory appears extra more likely to flip its route upwards.

***

Apple Earnings: What to Anticipate?

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link