[ad_1]

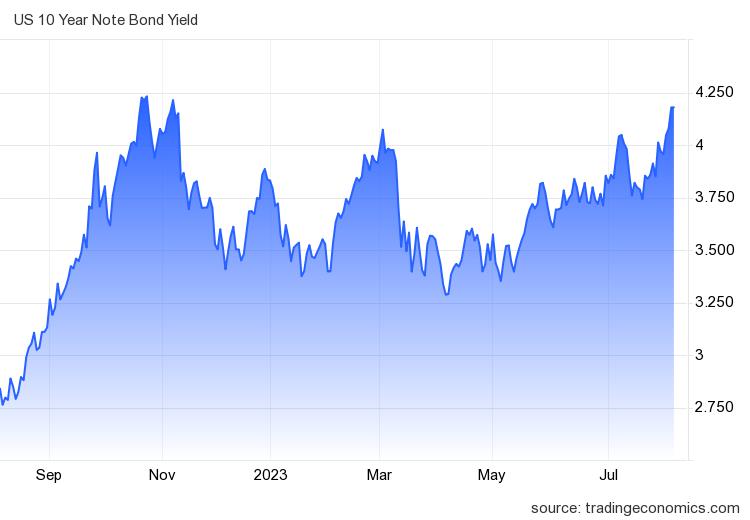

US inventory indices noticed slight losses on Thursday (03/08), after 10-year T-note yields hit an 8-month excessive. Increased bond charges have a damaging influence on shares. The ten-year T-note yield elevated additional in August, reaching 4.18%, a degree not seen since early November. Preliminary claims elevated solely barely, as anticipated, however job losses have been at their lowest degree in virtually a 12 months and each labour costs and productiveness exceeded expectations, suggesting that the labour market continues to be robust.

Shares have been additionally hit by some weaker-than-expected earnings experiences, with DXC Expertise and Expedia Group falling greater than -29% and greater than -16% respectively. In the meantime, the expertise index was unstable in the direction of the shut as a result of a number of experiences from large-cap corporations similar to Apple and Amazon.

-

Apple Inc. introduced that its earnings per share for the third quarter of the fiscal 12 months 2023 got here in at $1.26, surpassing analyst estimates. The determine marks an annual bounce of 5%. The corporate’s income fell 1% in comparison with the earlier 12 months, reaching $81.8 billion within the reported quarter. In the meantime, working revenue for the three-month interval fell to $22.9 billion from the $23.1 billion recorded final 12 months. Internet revenue rose 2% to $19.8 billion, whereas iPhone gross sales fell 2.7% to $39.6 billion. Apple shares fell 0.32% in after-hours buying and selling following the report launch.

-

Amazon.com Inc. reported that its web gross sales for the second quarter of 2023 reached $134.4 billion, exceeding estimates and growing by 11% from the identical interval a 12 months earlier. In comparison with the loss reported a 12 months earlier, web revenue elevated to $6.75 billion, and diluted earnings per share elevated to $0.65. Working revenue for the second quarter of 2023 elevated by 133% to $7.7 billion. Amazon shares jumped 6.59% in after hours buying and selling on better-than-expected outcomes.

Inventory indices recovered from their worst ranges after information on Thursday confirmed that US Q2 NonFarm productiveness rose greater than anticipated and Q2 unit labour prices fell greater than anticipated, easing inflation considerations.

Optimistic feedback from Richmond Fed President Barkin have been additionally bullish for shares, as he stated {that a} larger-than-expected easing in inflation in June is likely to be a sign the US economic system may have a smooth touchdown, returning to cost stability with out a damaging recession.

Technical Evaluation

USA100, D1 was seen hindered on the 15300 round-figure, after some hopes have been raised over tech firm experiences forward of the market shut. The each day Doji actually doesn’t point out a continued course, after the earlier 2 days of declines. It’s vaguely seen that the excessive has declined to 15828 from 15946. Continued decline will face different assist, particularly on the 15000 spherical determine along with 14933.

On the upside, bulls could also be cautious, after Fitch downgraded the US credit standing to AA+ from AAA, citing anticipated fiscal deterioration over the subsequent three years and a rising normal authorities debt burden.

The transfer to the upside is prone to proceed on a technical foundation, however some draw back can’t be dominated out from the realisation of earlier lengthy positions. So long as the index trades above 13722 assist, the bulls’ dominance will stay the winner.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link