[ad_1]

ipopba

Funding Abstract

Following our final publication on Agiliti, Inc. (NYSE:AGTI) we would advise there’s been minimal statistical change throughout the funding debate. In that report, the place we rated AGTI a maintain, there have been plenty of speaking factors for statement. To call a few:

- Compression in inventory value in first ~18months since IPO, following challenges in its Well being and Human Providers settlement (“HHS”) and diminishing Covid-19 tailwinds.

- This was estimated to have a $10–$15mm adjustment to income from final yr.

- Sizewise acquisition and integration transferring alongside fairly properly with $38mm/$0.02 per share in income for Q2 FY22.

- Shares regarded pretty priced at 18x ahead earnings, value goal on the time of $18.54 [price at publication of $17.24].

As we flip to the current day, we rigorously examined AGTI once more to doubtlessly revise our place on the inventory. Right here I am going to current the newest findings for AGTI. It is price noting that almost all of AGTI’s income and EPS upsides since itemizing ~18 months in the past has arrived as a perform of Covid-19 tailwinds and its HHS agreements. With each of those diminishing, this reduces the predictability of future money flows, and, due to this fact, AGTI’s company worth. Internet-net, we proceed to charge AGTI a maintain, observing comparable headwinds to share value appreciation down the road.

Q3 outcomes a step up, however headwinds stay

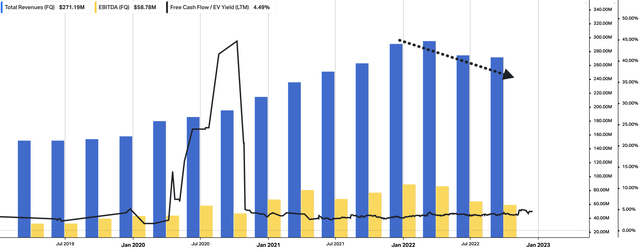

First turning to AGTI’s Q3 monetary outcomes, it pulled a income clip of $271mm, a 300bps YoY improve. It is necessary to make an apples-for-apples comparability and exclude the COVID-related increase from Q3 2021. After doing this, we word that AGTI’s YoY income progress was between 6% and seven%, on adjusted EBITDA of $66.5mm. It pulled this right down to adjusted earnings per share of $0.19, in comparison with $0.23 this time final yr. You’ll be able to see the impression of the main headwinds to AGTI’s top-line progress [HHS agreement, Covid-19 windbacks] in Exhibit 1.

Since January 2022, income progress has pulled decrease, together with core EBITDA progress and the extent of recorded free money circulate (“FCF”). Nonetheless, buyers should purchase the AGTI on a trailing FCF yield of ~400–500bps, which is price paying attention to.

Exhibit 1. Impacts from income headwinds clearly seen from January 2022. But, buyers can nonetheless purchase AGTI on a 400–500bps trailing FCF yield.

Knowledge: HBI, Refinitiv Eikon, Koyfin

In the course of the quarter, utilization for the corporate’s peak-demand rental units treaded decrease, although it appeared to have stabilized at a stage barely beneath pre-pandemic ranges. Administration expects to see a seasonal improve in utilization within the latter half of the fourth quarter and into Q1 FY23′.

As talked about, the corporate acknowledged a $0.04 per share draw back in EPS from Q3 FY21. This lower was as a result of a slight drop in adjusted internet revenue and a rise within the efficient rate of interest on our debt.

Shifting to the divisional highlights, our essential information factors are as follows:

- When it comes to medical engineering, we noticed that Q3 income was $104mm, representing a 700bps YoY decline.

- Income from the HHS settlement was decrease YoY because the work shifted again to pre-pandemic upkeep and administration actions, reasonably than being pushed by COVID deployment and in-market assist for medical units.

- We might additionally word that on-site managed providers income totaled $64mm, a 12% YoY decline for the quarter. This lower was primarily because of the revised pricing and scope of the HHS settlement talked about above, and due to this fact was anticipated.

Lastly, shifting to the stability sheet, there have been a number of extra takeouts price discussing. AGTI ended Q3 with internet debt of $1.04 billion, comprising $1.07 billion in debt and $32mm in money readily available. The corporate’s CFFO for the YTD to September 2022 amounted to $162mm.

These actions of money circulate introduced the corporate’s leverage to ratio of three.3x for Q3. It is also price noting that by the top of Q3 FY22 AGTI had retired over $120mm in debt obligations utilizing money on the stability sheet. On account of these capital budgeting initiatives, the curiosity fee diminished by ~$3mm yearly.

Steerage revision factors to extra progress challenges

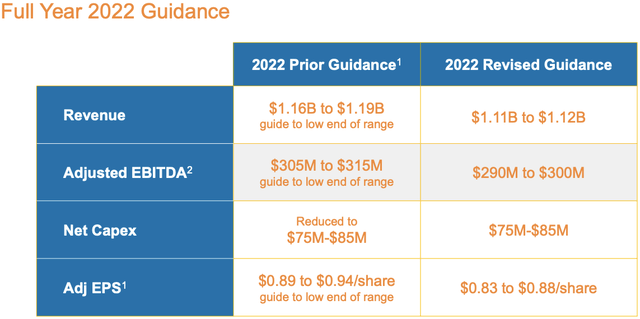

Administration additionally downgraded steering from earlier estimates on the Q3 earnings name [Exhibit 2, taken from AGTI’s Q3 presentation].

It now initiatives full yr income within the vary of $1.11 billion–$1.12 billion in adjusted EBITDA between $290mm–$300mm. It expects to gather adjusted earnings per share within the vary of $0.83 to $0.88 for the yr.

Every of those down-steps in FY22 steering represents a significant discount in prime–backside line progress. This presents as a draw back threat within the funding debate by estimation.

Exhibit 2. AGTI’s revised FY22 earnings steering [revised down]

Knowledge: AGTI Q3 FY22 investor presentation

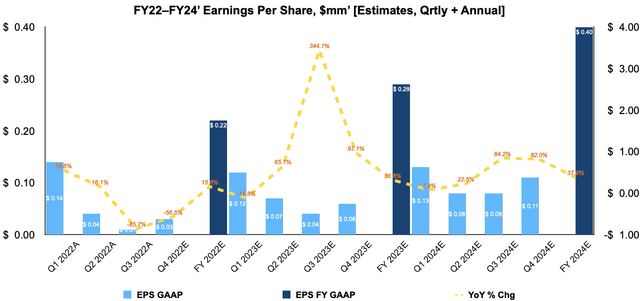

These are affordable progress assumptions and we’re aligned with the corporate in its diminished steering. With respect to GAAP estimates, you may see our ahead EPS assumptions for the corporate within the chart beneath.

Exhibit 3. AGITI FY22–FY24′ EPS progress assumptions [internal estimates, quarterly and annual]

Knowledge: HBI Estimates

Valuation and conclusion

We have been market and basic information to information value visibility within the broad healthcare area in FY22.

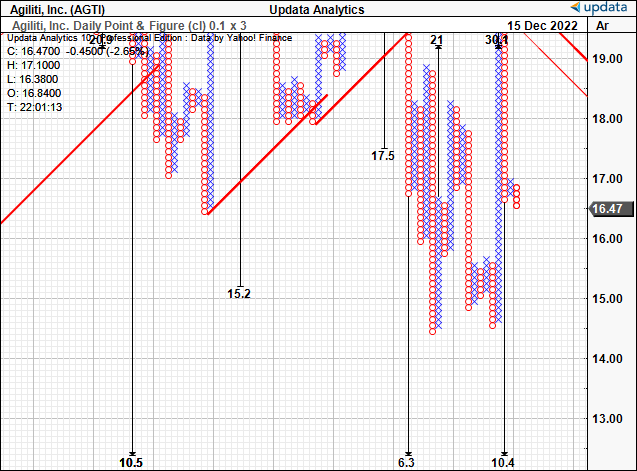

Trying on the level and determine evaluation beneath, you may see we’ve a number of draw back targets but to be activated, the newest being $10.40. Nevertheless, there’s additionally targets as little as $6.30. With an absence of tangible upside, this confirms our impartial thesis.

Exhibit 4. Draw back targets to $10.40, $6.30

Knowledge: Updata

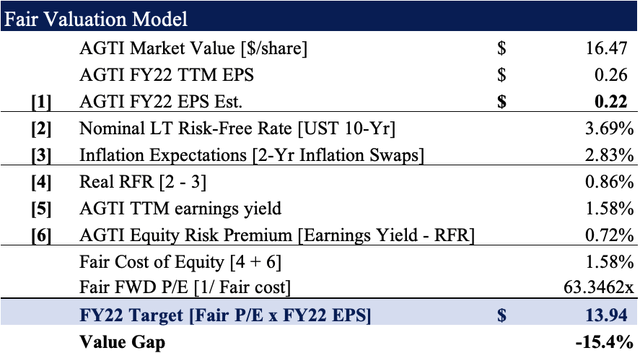

As well as, rolling our FY22 EPS estimates ahead, we see the inventory priced pretty at a lofty ~63x ahead earnings. Nevertheless, the EPS draw back forecasted for FY22 is a draw back issue that may’t be ignored. Even at this excessive a number of, it could seem the inventory is greater than pretty valued at its present market value on a valuation of $13.95 [63.34 x $0.22].

Exhibit 5. FY22 value goal estimate = $13.95.

Word: Honest ahead price-earnings a number of calculated as 1/honest value of fairness. This is named the ‘regular state’ P/E. For extra and literature see: [M. Mauboussin, D. Callahan, (2014): What Does a Price-Earnings Multiple Mean?; An Analytical Bridge between P/Es and Solid Economics, Credit Suisse Global Financial Strategies, January 29 2014]. (Knowledge: HBI Estimates)

Internet-net, we proceed to see overhang for AGTI in unison with findings from our final publication. In different phrases, the market appears to be like but to have priced these in, they usually stay a compressor to the AGTI share value wanting forward. We additionally see draw back targets and consider there are extra selective alternatives elsewhere at this cut-off date. Price maintain.

[ad_2]

Source link