Vladimir Vladimirov/E+ by way of Getty Pictures

ADMA Biologics (NASDAQ:ADMA) is my private largest biopharma holding, so it’s an organization I observe significantly intently. The corporate is now in a important transition interval as ADMA’s vertically built-in enterprise mannequin seemingly begins to bear some fruit. ADMA simply reported full-year 2021 earnings and offered steerage for 2022, so I’m penning this as an replace on how I view the corporate’s general funding thesis.

ADMA’s Full-12 months 2021 Numbers Delivered on Promised Progress

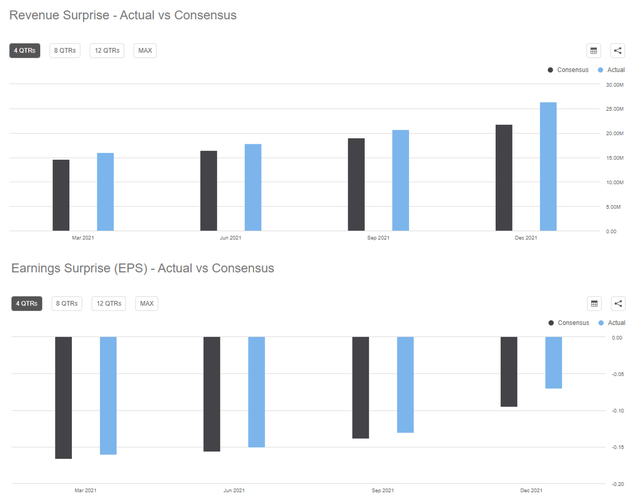

To me, ADMA’s funding thesis is all about administration execution and the way we’ve seen continued regular progress in direction of clearly said targets for a number of years now. That was evident once more within the strong income and earnings beats simply introduced for ADMA’s second full 12 months of selling its plasma merchandise.

ADMA introduced that it had recorded $80.9 million in income for the full-year 2021 versus $42.2 million in 2020. This beat expectations by $4.61 million, and earnings additionally beat expectations by $0.01. The corporate has now crushed analyst estimates of each income and earnings every quarter for the final 12 months.

Quarterly Income and Earnings Shock (Searching for Alpha)

The 2021 full-year income quantity represented 92% development over 2020, largely resulting from rising adoption of ASCENIV and the provision chain and effectivity enhancements ADMA has applied. ADMA has really offered particular steerage for full-year 2022 income for the primary time, saying it can exceed $125 million in income which might be in extra of fifty% year-over-year development.

ADMA’s gross margin was optimistic on a full-year foundation for the primary time as effectively. Gross margin went from destructive in each prior 12 months to 1.4% for the full-year 2021 and 13.3% in This fall. On high of that, the CEO mentioned on their convention name that he expects gross margin to proceed to enhance all through 2022, and in later solutions to questions, administration mentioned they anticipated to see gross margin of 40% to 50% by the tip of 2023.

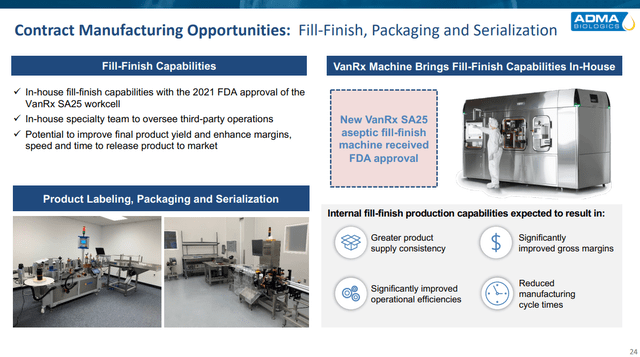

Loads of that is as a result of rising efficiencies the corporate is beginning to see with its vertically built-in enterprise mannequin. One nice instance of that is the VanRx machine that the CEO mentioned often on analyst calls in 2021. This machine permits ADMA to do the fill-finish course of (final step in producing a completed product) itself, which saves the corporate money and time over contracting it out to a 3rd celebration.

VanRx Machine Description (ADMA’s Company Presentation)

The corporate additionally makes use of a proprietary plasma assortment system from Haemonetics at its assortment services that’s specifically designed to spice up assortment yields. Such an emphasis on elevated effectivity by means of all sides of its enterprise appears to be more and more paying off for ADMA.

Haemonetics’ Persona System (Haemonetics’ Web site)

One other a part of the bettering gross margin can also be resulting from an rising proportion of ASCENIV gross sales vs BIVIGAM in ADMA’s complete gross sales combine. That is noteworthy as a result of ASCENIV has a better value and margin for ADMA resulting from its hyperimmune nature ($900/gram ASCENIV vs $133/gram BIVIGAM). Administration mentioned on their year-end name that they count on this pattern to proceed and have even began to extend the relative quantity of ASCENIV they’re producing.

ADMA can also be nonetheless on observe with its buildout of a plasma assortment community. Administration is now reporting that 9 services are already within the works, together with six in Tennessee, South Carolina, and Georgia which can be already operational and gathering plasma. Two of those facilities have really acquired FDA approval throughout Q1 2022, and at 30,000 liters to 50,000 liters in anticipated collections per facility per 12 months, ADMA ought to comparatively quickly be gathering the vast majority of its personal plasma itself. The truth is, ADMA’s administration has guided that that is prone to happen by year-end 2023.

This vertical integration of provide does come at a value although with bills associated to this build-out rising by $2.5 million in This fall and about $8 million for the full-year 2022. On condition that ADMA now has about half of its services in operation, I’m personally anticipating to see the present $12.5 million annual expense degree finally double. Along with the extra safety of producing its personal plasma provide, ADMA additionally expects that its price per liter of plasma ought to begin declining as ADMA’s assortment volumes enhance and its reliance on third-party offers decreases.

One other a part of that vertical integration is ADMA’s Boca Raton, Florida processing facility which the corporate now says is probably going price $400 million by itself. That plant’s 600,000-liter capability ought to simply be sufficient to assist administration’s targets of a $250+ million annualized run price by the tip of 2024 and $300+ million in yearly income by 2025 on condition that ADMA’s plasma yield is ~3.5-4 grams/liter (interprets to income of roughly $600-$800/liter given ADMA’s pricing).

ADMA’s Steadiness Sheet Is Enhancing However Extra Money Is Wanted

ADMA had two main points from a stability sheet perspective, and it has now taken steps to handle one among them. That one is the debt overhang it had from its cope with Perceptive Advisors. ADMA simply introduced a $175 million debt refinancing with Hayfin Capital Administration. The primary $150 million of that went to totally repay Perceptive, and the final $25 million can probably be drawn down this 12 months to fund operations. Most vital to me is that maturity was pushed out from 2024 to 2027. This could permit ADMA time to build up some money movement to assist pay down that debt quite than having to boost dilutive money for the whole thing.

ADMA’s different massive stability sheet situation is that it’s going to nonetheless want at the very least yet one more sizable money infusion previous to reaching profitability. The corporate solely had $51.1 million in money and equivalents on the finish of 2021. Though ADMA’s web loss decreased in 2021 to $72 million from $76 million the 12 months prior as revenues almost doubled, it’s clear that present money ranges aren’t even ample for the rest of 2022, to not point out 2023. Bills have elevated considerably with SG&A bills rising about $8 million in 2022, and plasma heart working bills additionally rising about $8 million.

Administration has promised profitability by the primary quarter of 2024 on the newest, however I nonetheless count on losses of at the very least round $50 million in 2022 and $20 million in 2023 simply estimating based mostly off of projected income, gross margin, and expense development. To me, that implies the corporate may nonetheless want round one other $100 million. $25 million of that might probably come from the present Hayfin debt deal, however $75 million must come from elsewhere. If that’s a further dilutive elevate, it could clearly damage present shareholders.

Administration is conscious of that danger although and continues to be participating in a evaluation of strategic alternate options along with Morgan Stanley (MS). Whereas I hope one thing helpful comes out of that, I personally am factoring within the further dilution and at present imagine that I’ll nonetheless become profitable as a long-term shareholder regardless.

ADMA’s Dangers

ADMA has two main dangers to me. One is administration execution, and the opposite is the excessive diploma of capital funding required in constructing a vertically built-in enterprise mannequin and the ensuing danger of significant dilution of present shareholders. As I’ve already mentioned, I view administration’s latest execution as the most important cause I personal the inventory. They’ve been very clear in regards to the recreation plan and have constantly met or exceeded expectations. This offers me a excessive diploma of confidence that the corporate will proceed to progress in direction of its targets, nevertheless it’s actually price being conscious of how reliant the corporate is on continued execution.

If execution falters, it may imply ADMA persevering with to lose cash for much longer than simply the subsequent two years as is at present projected as a result of there’s no apparent approach for the corporate to chop prices because it continues to construct out its infrastructure. On condition that ADMA misplaced an amount of cash equal to a couple of fourth of its present market cap in 2021 and has debt round half of its market cap, it wouldn’t take many extra years of losses to supply enormous dilution. I’ve personally factored some further dilution into my valuation of the inventory, however I’m comfy that I’ll nonetheless make a robust return regardless of it if issues go the way in which they at present appear to be headed. That mentioned, that is actually not a inventory with out danger, and anybody contemplating investing in it must do their very own diligence on this situation and ensure they’re comfy with the extent of particularly potential dilution danger they’re taking.

ADMA Is A Sturdy Lengthy-Time period Story

Whereas I may very well be pleasantly shocked with a near-term rally, I actually count on to have to carry on to my ADMA shares for a number of extra years to get full worth out of them. I’m comfy doing that although as a result of administration has been clear and environment friendly in its execution and since ADMA has a number of broader market developments in its favor.

First, the plasma market isn’t a simple one for brand spanking new rivals to enter. As ADMA itself has proven, an enormous diploma of capital funding is required and the pay-off time is lengthy. The manufacturing cycle is seven to 12 months earlier than income may even start to be acknowledged, and it’s laborious for plasma corporations to get consumers to contemplate their merchandise earlier than a pretty big quantity of stock has been constructed up. ADMA additionally has strong IP safety on its course of for screening hyperimmune donors for ASCENIV by means of 2035, greater than a decade after the corporate will possible obtain profitability. This might additionally permit time for a possible enlargement of ASCENIV use into sufferers at excessive danger for an RSV an infection.

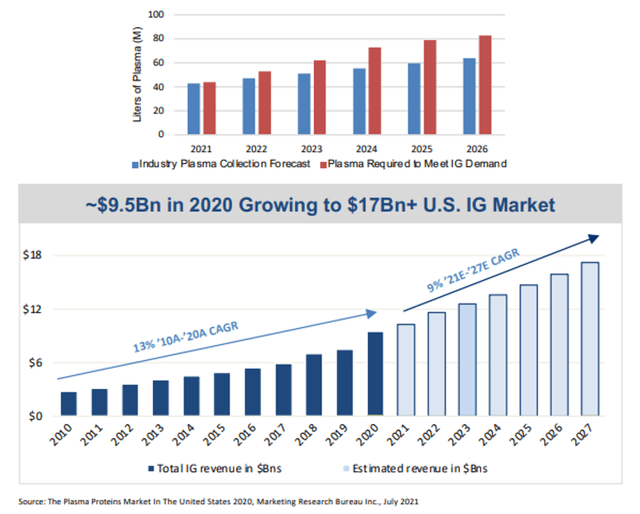

Second, the immune globulin market is a extremely undersupplied market which ought to result in sturdy development over the approaching years. ADMA is one among solely six producers within the US market, and provide development shouldn’t be at present anticipated to maintain up with demand.

Plasma Trade Progress Development (ADMA’s Company Presentation)

ADMA will possible be well-positioned to show that demand into massive income development and finally free money movement for shareholders.

That is personally my largest holding, and I’ve a value foundation of about $1.90. I’ll possible think about including on any main pullbacks from right here, however largely I’m simply planning to carry my present place for the subsequent few years as ADMA’s enterprise makes the transition to a cash-flow optimistic firm. I ultimately count on that ADMA’s market cap will possible revert to at the very least two to 3 instances its annual gross sales, if not greater. Given that might indicate a market worth of almost two to 3 instances above the place ADMA presently trades, I really feel pretty assured that I’ll nonetheless make an excellent return even when ADMA is unable to keep away from additional dilution from right here as long as the present degree of administration execution persists.