[ad_1]

winhorse

It isn’t really easy within the present market to seek out shares to put money into. We’re in a bear market and face a excessive danger of the U.S. financial system coming into a recession subsequent 12 months. It additionally appears possible that the inventory market will decline additional and in such a market surroundings many shares will decline hand-in-hand with the key indices – even when such declines will not be justified.

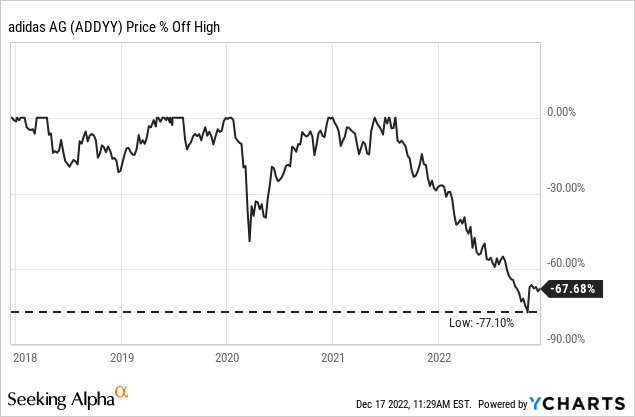

Only some shares are capable of battle that development – and one instance is likely to be the German sportswear producer adidas AG (OTCQX:ADDYY). The inventory declined as steep as 77% because the earlier highs in 2021 and appears to be buying and selling under its intrinsic worth.

Enterprise Description

adidas is designing, creating, distributing, and advertising and marketing athletic and sports activities life-style merchandise. Amongst different merchandise it principally affords footwear, attire, and equipment. The corporate was initially based in 1924 in Herzogenaurach in Germany (the place it’s nonetheless headquartered), however the adidas AG we all know as we speak was based in 1949 (after the Dassler brothers cut up up and based the 2 corporations adidas and PUMA SE (OTCPK:PMMAF)). In 1995, the corporate had its IPO and as we speak adidas is producing about €21 billion in annual gross sales and has barely above 61,000 staff everywhere in the world.

adidas Annual Report 2021

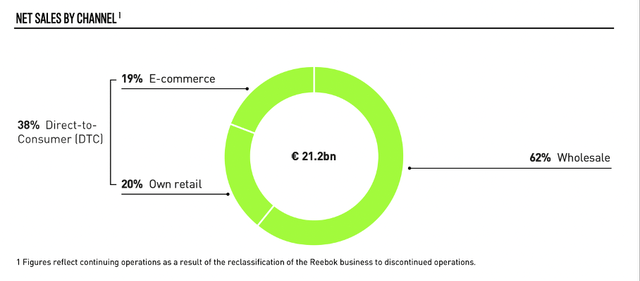

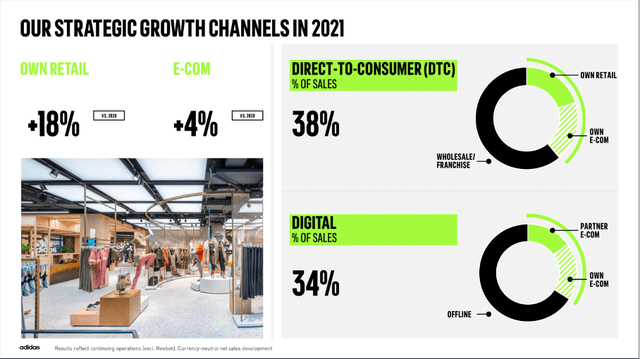

The corporate has three main distribution channels. The most important a part of income remains to be generated by wholesale (62% of complete income in fiscal 2021). However like many different corporations, adidas can also be attempting to extend its direct-to-consumer channels. On the finish of the third quarter of fiscal 2022, adidas had 2,089 shops (a small decline from 2,168 shops one 12 months earlier) and in fiscal 2021 about 20% of complete income stemmed from retail shops. And about 19% of complete income stemmed from e-commerce in fiscal 2021. E-commerce might develop income 8% in Q3/22 and particularly in EMEA, North America, and Latin America e-commerce gross sales grew within the double digits.

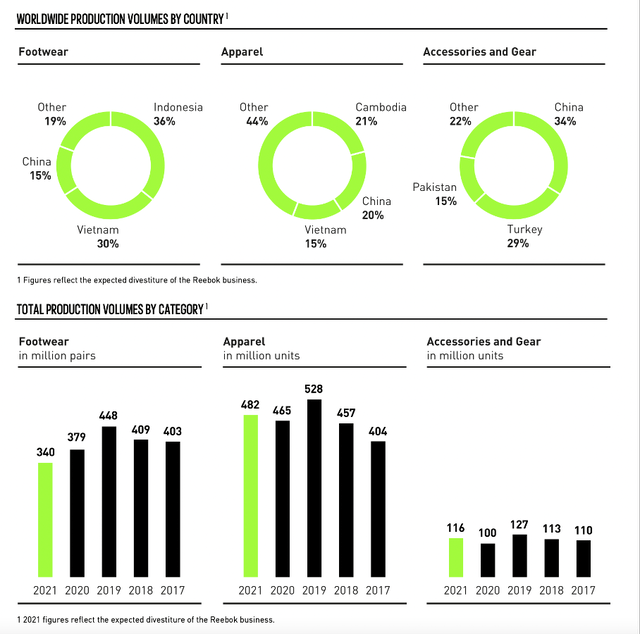

adidas is promoting its merchandise in three main classes – footwear, attire in addition to equipment and equipment. In 2021, the corporate offered 340 million pairs of footwear and 482 million items of attire. And equipment and equipment offered 116 million items.

adidas Annual Report 2021

Blended Outcomes

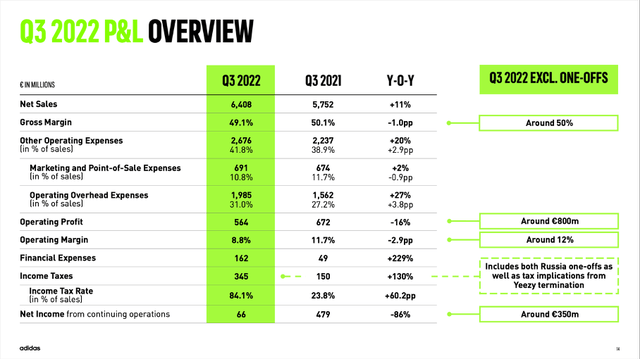

When trying on the final outcomes, adidas is struggling a bit. Nevertheless, it’s nonetheless reporting strong outcomes and within the third quarter of fiscal 2022, the corporate might enhance internet gross sales from €5,752 million in the identical quarter final 12 months to €6,408 million this quarter – leading to 11.4% year-over-year development. We must also point out that adidas profited from forex fluctuations and currency-neutral gross sales elevated about 4% YoY. Whereas the highest line might nonetheless enhance, working revenue declined 16.1% year-over-year from €672 million in Q3/21 to €564 million in Q3/22. And eventually, diluted earnings per share from persevering with operations declined from €2.34 in the identical quarter final 12 months to solely €0.34 this quarter.

adidas Q3/22 Presentation

And when trying on the outcomes for the primary 9 months, we see adidas struggling. Nevertheless, I don’t know if the inventory value decline was justified as income nonetheless elevated 7.5% year-over-year from €16,096 million within the first 9 months of 2021 to €17,306 million within the first 9 months of 2022. Working revenue declined from €1,920 million to €1,393 million leading to 27.4% YoY decline. And diluted earnings per share from persevering with operations additionally declined from €6.87 within the first 9 months of 2021 to €3.83 within the first 9 months of 2022 – a decline of 44.3% YoY.

Drawback: Better China

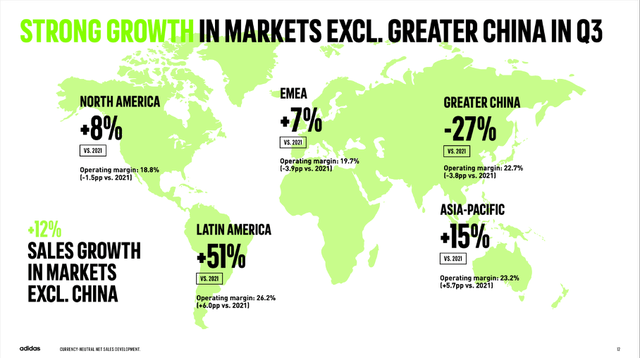

When trying on the development charges within the completely different areas world wide, we see one of many main issues adidas has proper now. Whereas the EMEA area (7% development) and North America (8% development) report strong outcomes, the Asia-Pacific area grew 15% YoY and Latin America grew even 51% YoY. However the issue youngster proper now could be Better China, which needed to report 27% decline year-over-year.

adidas Q3/22 Presentation

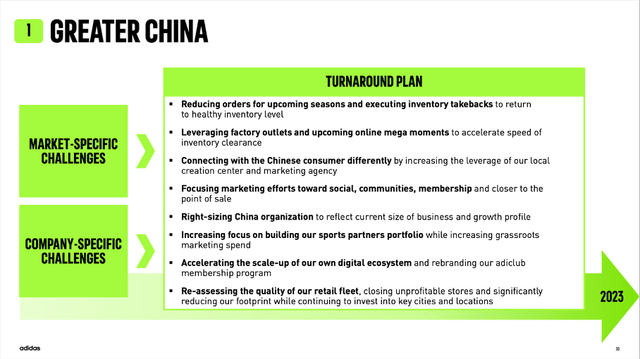

Through the earnings name, administration talked about two of the challenges adidas is dealing with in Better China:

Beginning with Better China. We proceed to see a number of market particular challenges which might be affecting our complete trade. The strict zero COVID-19 coverage with nationwide restrictions stays in place amid greater than 2000 day by day new COVID-19 instances in November. As a consequence, offline site visitors is subdued as a result of imminent danger of recent lockdowns.

As well as, native life-style influencers are nonetheless hesitant to collaborate with Western manufacturers. Whereas these challenges are trade extensive in nature, you additionally should admit that we face further firm particular challenges, which is a slower than anticipated restoration from the market particular challenges simply talked about, our stock ranges, which had been greater at the beginning of the sluggish market and growth stay considerably elevated and can maintain us busy for some extra months.

However adidas additionally has a turnaround plan for Better China and it’ll scale back orders for upcoming seasons to return to wholesome stock ranges. Moreover, adidas may also right-size the China group and adidas may also attempt to join with the Chinese language shopper otherwise.

adidas Q3/22 Presentation

Yeezy Contract Termination

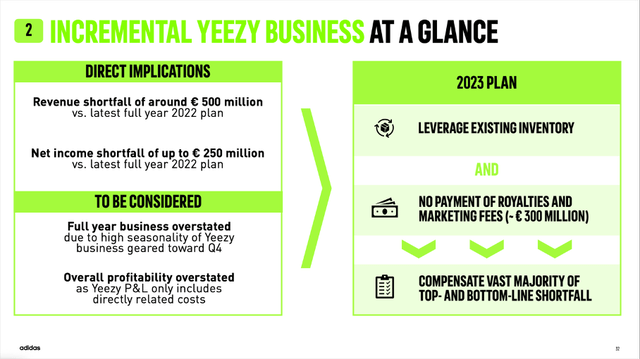

A second detrimental influence on adidas’ enterprise stemmed from the termination of the adidas Yeezy partnership. Adidas is ending manufacturing of all Yeezy merchandise and stopped any funds. The termination of this contract can have a detrimental influence of €250 million on fiscal 2022 internet revenue. For the 2022 outlook, the detrimental influence is already mirrored.

adidas Q3/22 Presentation

Through the Q3/22 earnings name, CFO Hurt Ohlmeyer gave extra particulars on monetary expectations for This autumn/22 and underlined that adidas owns all design rights:

I can verify that adidas is the only real proprietor of all design rights, able to present product in addition to earlier and new colorways below the partnership, and we intend to make use of those rights as early as 2023. Let’s have a extra detailed look on the incremental Yeezy enterprise. Given the excessive seasonality of the Yeezy enterprise, the place we’re sometimes producing round 1/3 of the full annual revenues and virtually 40% of the annual revenue contribution in This autumn, we anticipate the income shortfall associated to the fast termination of the partnership of round €500 million Euro.

As talked about, the anticipated internet revenue shortfall is forecasted to achieve as much as €250 million in This autumn. On this context, let me emphasize that the implied profitability of the Yeezy enterprise is overstated as a result of truth. Its price solely consists of these bills which might be instantly associated to the product and the enterprise. In different phrases, it doesn’t embody any additional central prices or location for sourcing digital, retail, or some other providers that this a part of our enterprise has been benefiting from and that we’re important for achievement.

We may be assured that adidas will be capable to compensate the loss within the coming quarters, however we should always not ignore that adidas generated about 7% of its complete income from the Yeezy partnership and we additionally ought to anticipate a small detrimental influence on fiscal 2023 outcomes. However over the long run, the detrimental influence shouldn’t be measurable.

Recession

Except for the struggling Chinese language enterprise and the Yeezy contract termination, a 3rd danger for adidas is the looming recession. And when trying on the efficiency of adidas since 1991, the corporate was normally affected by recessions however might most often recuperate fairly properly within the quarters following a recession. In 2003 in addition to 2009, annual income declined about 4% in comparison with the earlier 12 months. In 2020, income declined quite steep – 16.1% decline from €23.64 billion in 2019 to €19.84 billion in 2020. Nevertheless, on this case it was not a lot the recession, however quite COVID-19 and the ensuing lockdowns.

When trying on the backside line, adidas needed to report a loss in 1992 in addition to in 1998 and in 2009, earnings per share declined quite steep from €3.25 within the earlier 12 months to €1.25 in 2009 – leading to a decline of 62%. In 2020, adidas noticed an analogous steep decline from €10.00 in 2019 to €2.21 in 2020 – leading to 78% backside line decline.

And we should anticipate that one other potential recession in 2023 will have an effect on adidas’ enterprise as soon as once more. We will already see detrimental results however should assume 2023 shall be one other difficult 12 months for adidas.

Lengthy-term Development

Whereas adidas is dealing with a number of short-to-mid-term challenges – just like the three talked about above – the long-term outlook for adidas remains to be brilliant. First, adidas can also be specializing in direct-to-consumer channels – like lots of its friends. And whereas adidas had its shops for a very long time, e-commerce gross sales had been a driver of development and between 2015 and 2020 elevated with a CAGR of 48%. And in 2021, 34% of complete gross sales had been already digital (mixture of personal e-commerce in addition to accomplice e-commerce).

adidas Normal Assembly 2022 Presentation

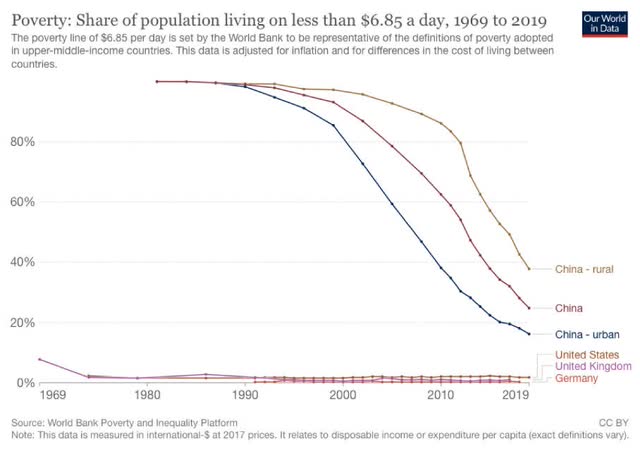

One other driver of development – no less than previously – was Better China. Between 2015 and 2020, income elevated with a CAGR of 15%. And though the market is struggling proper now (see above), we may be pretty assured for adidas to return on the trail of development in China once more. The nation will proceed to develop at a excessive tempo and outperform most different nations. Moreover, increasingly more individuals will transfer in direction of the center class and can change into potential clients for adidas’ merchandise.

Our world in knowledge

And lots of research expect strong development for the worldwide sportwear market – and never only for China. Within the years to return, we are able to assume mid-single digit development charges for the sportswear market. Fortune Enterprise Insights expects a CAGR of 6.6% for the years till 2028 and is particularly pointing in direction of the rising demand for sensible sportswear in addition to the rising well being consciousness among the many inhabitants which ought to gasoline development. Information Bridge Market Analysis is a bit more conservative and anticipating the market to develop with a CAGR of 5.53% till fiscal 2029 and Analysis Dive is anticipating a CAGR of 4.8% between 2021 and 2028.

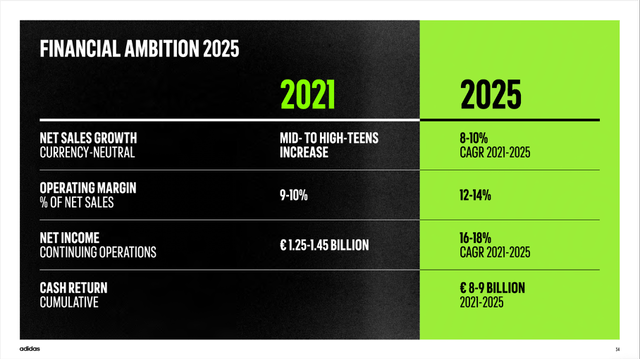

adidas Investor & Media Day 2021

And adidas itself has bold monetary targets for the years till 2025. In response to its “Personal the sport” technique, adidas is anticipating internet gross sales to develop between 8% and 10% till fiscal 2025 and internet revenue is predicted to develop with a CAGR between 16% and 18% within the years 2021 until 2025.

Nice Enterprise

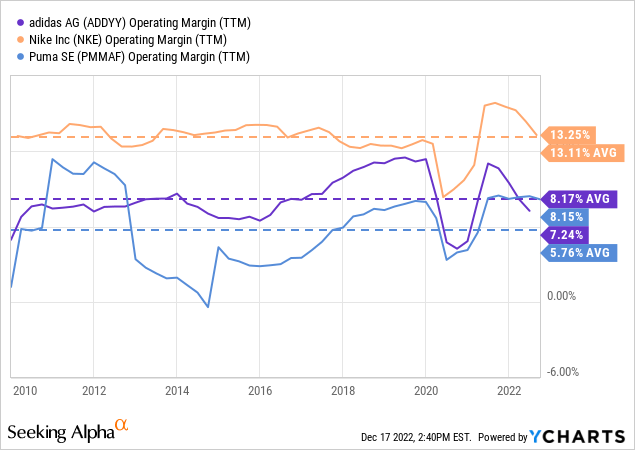

adidas is commonly seen because the weaker competitor of NIKE (NKE). As I’ve written in a earlier article about Nike, the U.S. sports activities firm is superior to its friends in most classes. Particularly when trying on the working margin, Nike might report a lot better numbers. Whereas adidas had a mean margin of 8.17% over the last decade, Nike reported a mean margin of 13.25%.

However Nike and adidas each have an financial moat across the enterprise – based mostly on the model identify in addition to price benefits. Whereas Nike takes the tenth spot on the record of most useful manufacturers (in response to Interbrand), adidas is just 42nd. However we should always not neglect that we’re speaking about essentially the most helpful manufacturers on the planet. As I’ve talked about in my article about Nike, the model identify by itself just isn’t creating an financial moat – the model identify has both to extend the willingness to pay a better value or the model identify should scale back search prices. And each are true in case of adidas (like they’re true for Nike). Prospects are clearly prepared to pay a better value for adidas sportswear (particularly for sneakers, clients typically pay absurd costs). Moreover, the model can also be decreasing search prices as many purchasers will simply decide a shoe from adidas (particularly in Europe) with out even taking a look at different manufacturers.

And adidas can also be making the most of price benefits. Though adidas just isn’t market chief (it’s second after Nike), the corporate remains to be promoting lots of of tens of millions of footwears and attire and is clearly forward of all the opposite opponents – like Puma or Beneath Armour, Inc. (UAA) (UA). With a considerable amount of footwear and attire offered, for instance growth prices will decline and advertising and marketing prices are decrease per offered merchandise, which is producing price benefits for adidas.

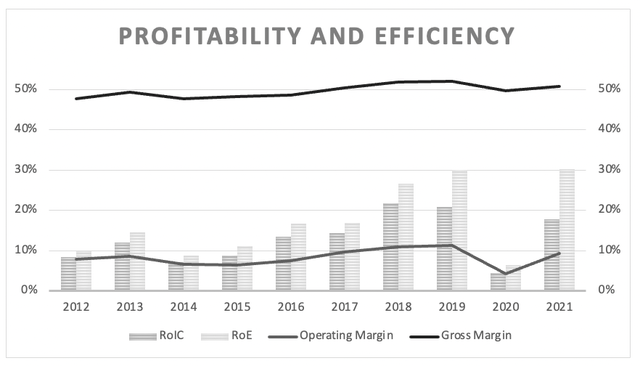

adidas: Gross Margin, working margin and RoIC (Creator’s work)

The financial moat of adidas can also be seen by taking a look at some metrics. Not solely has adidas a really steady gross margin, however it might additionally enhance its working margin since 2015 (other than 2020), which is an efficient signal. And within the final decade the corporate might report a mean return on invested capital of 12.95% – indicating an financial moat across the enterprise. When trying on the final 5 years, RoIC was even greater and round 16%.

Stable Stability Sheet

Except for the financial moat, adidas additionally has a strong steadiness sheet. On September 30, 2022, short-term borrowings had been €1,036 million and long-term borrowings had been €1,958 million. When evaluating the full debt to the full fairness of €6,520 million, we get a D/E ratio of 0.46. And when evaluating the full debt to the working revenue of fiscal 2021 (which was €1,986 million), it will take about 1.5 years to repay the excellent debt. Each metrics are not any cause for concern. Moreover, the corporate has €806 million in money and cash-equivalents on its steadiness sheet (and solely €1,318 million in goodwill).

The one main downside proper now could be the excessive stock ranges, which elevated from €3,664 million on September 30, 2021, to €6,315 million on September 30, 2022. Nevertheless, adidas is anticipating stock ranges to normalize once more throughout 2023 as the corporate is aggressively clearing extra stock and is tactically repurposing present stock. However total, adidas has a strong steadiness sheet.

Dividend

adidas can also be attention-grabbing for its dividend. The corporate is paying a dividend since its IPO in 1995. And so far as I can inform, the corporate needed to reduce its dividend solely as soon as since then – through the Nice Monetary Disaster – and suspended the dividend for fiscal 2019 – as a consequence of COVID-19. Like many different European corporations, adidas didn’t increase the dividend each single 12 months, however it will probably nonetheless be seen as a steady dividend payer.

For fiscal 2021, adidas paid an annual dividend of €3.30 (a rise of 10% in comparison with the earlier 12 months), which is leading to a dividend yield of two.7%. When utilizing earnings per share for fiscal 2021 (€7.47), we get a payout ratio of 44% and I see no cause for the dividend not being sustainable. That is additionally throughout the goal vary of 30% to 50% of internet revenue in response to the corporate’s dividend coverage.

adidas can also be utilizing share buybacks, which is quite untypical for German (or European) corporations. And particularly in the previous few quarters, adidas decreased the variety of excellent shares fairly aggressively, which appears a very good transfer contemplating the low share value. In December 2021, the Govt Board determined to launch a multi-year share buyback program and to date, the corporate is utilizing it fairly successfully. Between Q3/21 and Q3/22, adidas decreased the variety of excellent shares from 193.2 million to 179.2 million – leading to a lower of seven.2%.

Intrinsic Worth Calculation

Utilizing aggressive share buybacks proper now (it additionally looks as if adidas used money and money equivalents it had on its steadiness sheet) looks as if a terrific strategic transfer because the inventory is undervalued. However when taking a look at easy valuation metrics, adidas does truly not look like so low-cost. When taking TTM earnings per share, adidas is buying and selling for 27 instances earnings proper now – which doesn’t appear to be a discount. Nevertheless, trailing twelve months earnings per share will not be consultant for adidas’ true earnings energy.

As a substitute, we use a reduction money move calculation because it allows us to make extra exact assumptions for the years to return. And for fiscal 2023 and monetary 2024, we stay cautious and assume a free money move round €1,000 million. However for fiscal 2025 we assume that adidas will be capable to generate €2 billion in free money move once more (an quantity it already generated previously and nonetheless a quite cautious assumption for my part). And let’s be cautious and assume solely 8% development for the years to return until the tip of the subsequent decade, adopted by 6% development until perpetuity. When calculating with 179.2 million in excellent shares and 10% low cost price, we get an intrinsic worth of €268.07 for adidas and the share is clearly undervalued and a discount.

Let’s put these numbers a bit in perspective. First, 8% development is clearly under the expansion charges adidas might report in previous a long time. It’s also clearly under adidas’ targets until 2025 – in response to its “Personal the Recreation” technique.

|

CAGR |

Since 1991 (for EPS since 1994 as extraordinarily low 1991 numbers would disturb the image |

Since 2001 |

Since 2011 |

|

Income |

8.76% |

6.43% |

4.76% |

|

Earnings per share |

13.58% |

11.95% |

13.04% |

Moreover, I feel we’re cautious sufficient for the subsequent two years and are reflecting the chance of a recession. And the idea of €2 billion in FCF in 2025 can also be not too optimistic.

Conclusion

Regardless of the upper working margin of Nike, adidas appears to be the higher decide proper now. Nike can also be buying and selling about 40% under its earlier all-time excessive, however nonetheless for 30 instances earnings and Nike appears to be distant from being a discount – it’s most likely pretty valued at finest. Adidas however appears to be buying and selling under its intrinsic worth and we’re nonetheless speaking about a terrific enterprise. And the inventory looks as if a decide and candidate that may outperform in a almost certainly difficult 12 months 2023.

Editor’s Observe: This text was submitted as a part of In search of Alpha’s Prime 2023 Decide competitors, which runs by means of December 25. This competitors is open to all customers and contributors; click on right here to seek out out extra and submit your article as we speak!

[ad_2]

Source link