Will 2023 be the 12 months that gold hits $3,000 an oz?

Ole Hansen, revered commodity strategist at Denmark’s Saxo Financial institution, says it’s doable as soon as markets understand that international inflation will stay sizzling regardless of financial tightening. I consider, as I’ve mentioned earlier than, that gold might climb as excessive as $4,000.

Hansen notes three different components that would assist push the steel to new document highs subsequent 12 months. One, an growing “battle financial system mentality” might discourage central banks from holding international trade reserves within the title of self-reliance, which might favor gold. Two, governments will proceed to drive up deficit spending on formidable initiatives such because the power transition. And three, a possible international recession in 2023 would immediate central banks to open the liquidity spouts.

The analyst has already mentioned that his feedback are much less of a forecast and extra of a thought experiment, however I don’t suppose buyers ought to brush him apart so simply. I consider it’s very doable that we might see $3,000 gold—or greater—within the subsequent 12 to 18 months, for all the explanations he talked about.

Central Banks on a Gold Shopping for Spree

Hansen is appropriate in citing central banks’ growing urge for food for gold as a reserve asset. Central bankers and finance ministers could also be all about fiat foreign money, however behind the scenes, they’re gobbling up the yellow steel on the quickest charges in residing reminiscence. Within the third quarter, official internet gold purchases had been roughly 400 tonnes, round $20 billion, probably the most in over a half-century.

Turkey was the largest gold purchaser within the third quarter, adopted by Uzbekistan and India.

This week, China’s central financial institution disclosed it bought gold for the primary time since 2019. The Asian nation mentioned it just lately added 32 tonnes, or $1.8 billion, bringing its whole to 1,980 tonnes.

Regardless of being the sixth largest holder of gold, not counting the Worldwide Financial Fund (IMF), China nonetheless has a protracted method to go if it needs to diversify away from the U.S. greenback in a significant manner. The steel represents solely 3.2% of its whole reserves, in response to World Gold Council (WGC) information. Evaluate that to 65.9% of reserves within the U.S., the world’s largest holder with greater than 8,133 tonnes.

That is very bullish, and I predict we’ll be seeing much more shopping for from China within the coming months.

Overtightening Threat and Recession Watch

With inflation trying to persist into subsequent 12 months, a small to average recession seems increasingly possible. There’s the chance that the Federal Reserve will overtighten, and this has sturdy macroeconomic implications for gold.

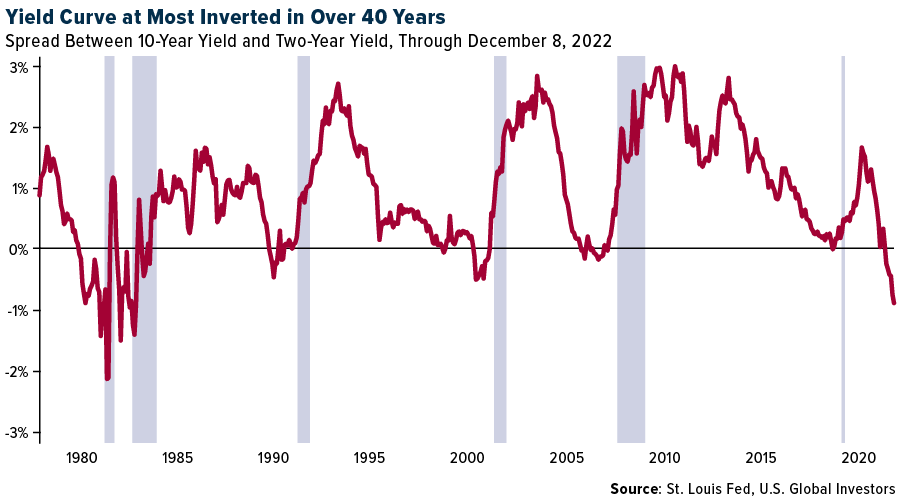

An indicator we preserve our eyes on is the unfold between the 10-year Treasury yield and two-year Treasury yield. Over the previous 40 years (at the very least), each recession has been preceded by a yield curve inversion. As of right this moment, the yield curve is at its most inverted in over 40 years, suggesting a recession is all however assured. The query shouldn’t be if, however when.

In latest days, most banks and scores businesses have slashed their international development estimates for 2023 on expectations of persistently excessive shopper costs and speedy financial tightening. Shopping for gold now might show itself to be a sensible funding alternative. In 5 out of the final seven recessions, gold delivered constructive returns, in response to the WGC, offering some safety to buyers.

Gold Setting Up for a Rally?

Technically, gold is beginning to look engaging proper now, the steel having damaged above its 50-day and 200-day transferring averages. After breaching the important thing $1,800-an-ounce stage final week, gold is once more testing the psychologically essential value level.

If 2022 ended right this moment, this might mark the second straight 12 months that gold has declined. And but, at unfavourable 1.75%, the yellow steel has remained among the finest property to carry this 12 months.

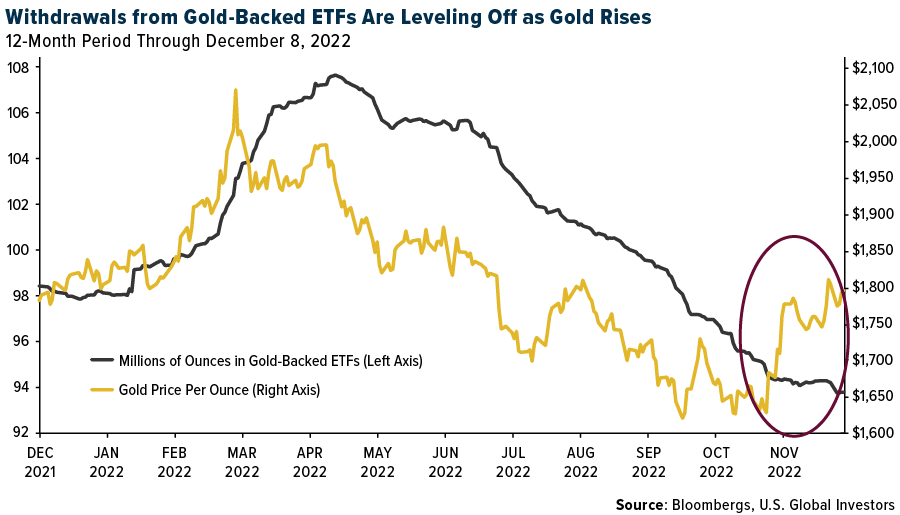

It hasn’t at all times been straightforward. Holdings in all identified gold-backed gold ETFs have declined for seven months straight as of November 2022. Nevertheless, we’re beginning to see these declines stage off as gold begins to push greater.

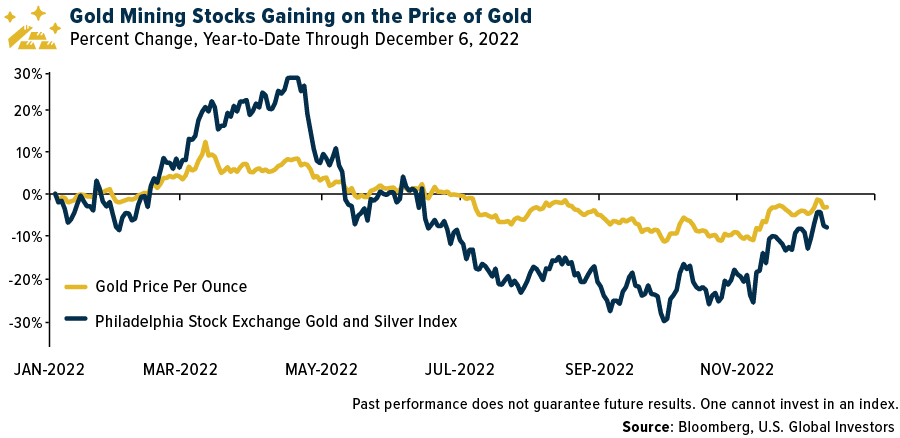

A gold rally—presumably to $3,000, as Ole Hansen forecasts—would even be extremely constructive for gold mining shares. These firms are rather more unstable than the value of the underlying steel. As you may see under, when gold has jumped, gold mining shares have traditionally jumped greater. (The reverse has additionally been true.)

May Gold Be Poised for a Comeback in 2023?

I’ll be co-hosting a webcast this coming Monday, December 12, at 2:00pm Jap. We’ll be protecting the gold market and sharing our outlook for the steel in 2023. In case you’d like to affix us, please electronic mail me at [email protected] with the topic line “Gold Webcast.”

Index Abstract

- The main market indices completed down this week. The Dow Jones Industrial Common misplaced 2.77%. The S&P 500 Inventory Index fell 3.37%, whereas the Nasdaq Composite fell 3.99%. The Russell 2000 small capitalization index misplaced 5.06% this week.

- The Hold Seng Composite rose 7.14% this week; whereas Taiwan was down 1.77% and the KOSPI fell 1.86%.

- The ten-year Treasury bond yield rose 10 foundation factors to three.593%.

Airways and Transport

Strengths

- One of the best performing airline inventory for the week was China Jap, up 20.2%. IATA information reveals that the worldwide air journey restoration continued in October, with stable worldwide visitors up 102.2% year-over-year with softer home tendencies resulting from China restrictions. Relative to 2019 ranges, worldwide visitors improved to -27.9% in October versus -30.1% in September. IATA famous that ahead bookings proceed to color a constructive outlook regardless of macroeconomic headwinds.

- Feedback from Asian liners together with COSCO, Yang Ming and a few Asian intra-region gamers present some optimism, as all of them don’t anticipate normalized freight charges to go under working break-even ranges, even when near-term the charges overshoot on the draw back, (with such a view echoed by Mitsui O.S.Ok.). Two key highlights: 1) busier-than-expected intra-Asia peak season suggests exercise is stabilizing; 2) oversupply issues in 2023/2024 are prone to be partly mitigated by supply slippages and “overdue” scrapping as IMO 2023 rules are anticipated to have phased-in capability discount results.

- European airline bookings as a proportion of 2019 ranges improved considerably by 18 factors to -2% within the week, primarily pushed by greater worldwide volumes in addition to a decrease base. Whole internet gross sales had been up 14% this week. Intra-Europe internet gross sales improved by 12 factors to -15% versus 2019 and had been up 4% this week.

Weaknesses

- The worst performing airline inventory for the week was Allegiant, down 11.7%. Delta Air Traces and its pilots’ union management reached an AIP. It consists of an at the very least 18% wage improve or at the very least a 34% increase over 4 years. Fleet banding simplification leads to wages for choose plane varieties growing the bottom 18%. The improve compares to 21% in ALK’s ratified contract, albeit the brand new Delta wages are 11% greater. The AIP features a “me too” clause that ensures Delta pilot pay exceeds United/American Airways charges by at the very least 1%.

- Transport charges decreased 6.2% week-over-week (WoW) and 59.5% year-over-year (YoY) on North American routes to the west coast, and seven.0% WoW and 36.3% YoY to the east coast. Charges on European routes had been right down to northern European areas, and right down to these across the Mediterranean.

- Airbus mentioned it wouldn’t make its 2022 goal of 700 plane deliveries however that it maintained its 2022 EBITA and free money circulate steering. The corporate additionally mentioned it was adjusting the pace of its deliberate manufacturing ramp up within the subsequent two to a few years.

Alternatives

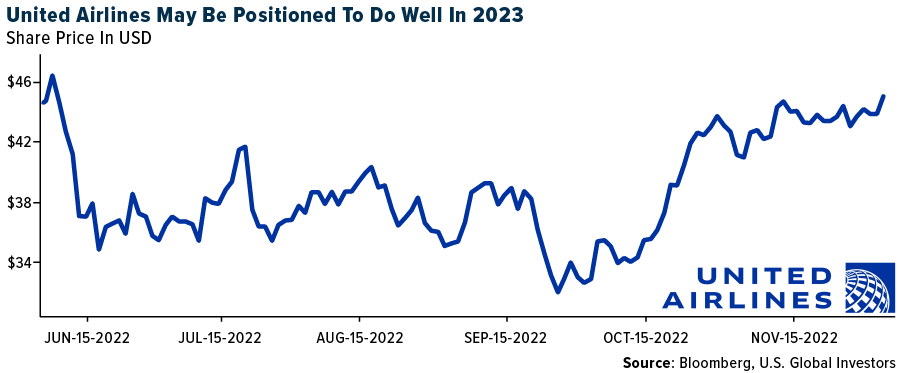

- Based on Cowen, United Airways has the best publicity to the continuing restoration in higher-margin worldwide journey amongst U.S. airways. The provider has extra lie-flat seats than all different U.S. airways mixed and its hubs place it properly to seize spending by high-net-worth shoppers. United is tackling structural challenges via its United Subsequent plan that ought to enhance each unit revenues and unit prices, improve buyer loyalty, and reduce publicity to lower-yielding income.

- U.S. airways’ trailing seven-day web site visits are up 10% year-over-year for the week. The entire U.S. airways noticed visitation enhance this week versus final week on a year-over-year foundation besides Hawaiian, which noticed web site visitors decelerate to -18% year-over-year. Out of the “huge 4,” Southwest Airways has the best visitation on an absolute foundation and American is the one one which has visitation down on a year-over-year foundation.

- Morgan Stanley stays bullish on the air journey outlook for the third 12 months in a row however its order of desire modifications barely. Legacies transfer to the highest of the group’s desire checklist – Delta is the brand new high decide. 2023 might be a “Goldilocks” 12 months for the U.S. airways when market situations are “excellent.” The final three years have seen excessive situations – 2020 and 2021 had been “too chilly” because of the lingering pandemic and 2022 was “too sizzling” with pent up demand and inflation. Equally, whereas leisure demand and pricing are arguably “too sizzling”, company/worldwide are nonetheless operating chilly.

Threats

- China’s home air visitors nonetheless bounced alongside the underside at 25% of 2019 ranges within the second half of November, down from 28% within the first half of November. Unsurprisingly, home visitors at each Beijing and Guangzhou was most disrupted at 5-10% of 2019 ranges within the second half of final month, whereas Shanghai and Hainan carried out largely according to the business at 30-35% of 2019 ranges.

- Goldman expects container delivery to enter a downcycle with oversupply resulting from softened demand from the U.S. and Europe, relieved port congestion and new ship supply. Consequently, the financial institution forecasts fuel-adjusted delivery charges to peak in 2022 and decline by 46%/26%/21percentin 2022-2025. Whereas delivery charges have began to appropriate, Goldman sees additional draw back to charges because the market is but to acknowledge the high-capacity addition with 6%/4% in 2023/24E.

- In China, the “10 New Covid Measures” solely deal with home Covid coverage loosening; a key query might be whether or not there can be any modifications to the quarantine requirement for inbound passengers within the close to time period, because the quarantine necessities for shut contacts of Covid circumstances and inbound passengers was once comparable earlier than the modifications.

Rising Markets

Strengths

- One of the best performing nation in rising Europe for the week was Romania, gaining 2.8%. One of the best performing nation in Asia this week was Hong Kong, gaining 7.2%.

- The Czech koruna was the perfect performing foreign money in rising Europe this week, gaining 0.3%. The Chinese language yuan was the perfect performing foreign money in Asia this week, gaining 1.4%.

- Hong Kong equites proceed to outperform as the federal government is contemplating easing lots of its Covid restrictions together with these protecting abroad entries and quarantine guidelines. After a pointy spike in Covid circumstances, authorities in Hong Kong reported a four-fold improve within the variety of Hong Kong residents who’ve taken the fourth Covid vaccination shot prior to now week (with probably the most taking the BioNTech shot designed to guard towards omicron variant), FactSet reported.

Weaknesses

- The worst performing nation in rising Europe for the week was Hungary, dropping 3.5%. The worst performing nation in Asia this week was Indonesia, dropping 4.3%.

- The Hungarian forint was the worst performing foreign money in rising Europe this week, dropping 2.0%. The Indian rupee was the worst performing foreign money in Asia this week, dropping 1.4%.

- China recorded smaller income from commerce. Within the month of November, the commerce stability surplus declined to $69.84 billion from $85.15 billion in October. Exports declined 8.7% year-over-year and imports dropped by 7.1%.

Alternatives

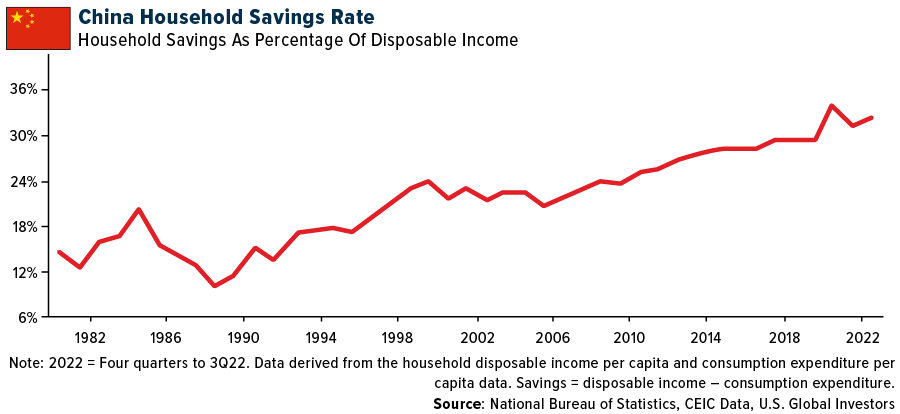

- Christopher Wooden in his Greed & Worry publication from December 1, titled “Closet Easing and Face” said that China’s family financial savings price has risen 29.9% in 2019 to 32.3% within the fourth quarter of 2022. Excessive cash-on-hand might result in sturdy consumption, simply as has been seen in lots of different markets when lockdowns had been ended, and borders had been re-opened.

- The ultimate inflation studying for the Eurozone, which can come out subsequent week, might verify a small correction within the shopper value index (CPI). The preliminary CPI was reported at 10%, under the anticipated 10.4%, and October’s CPI of 10.6%. The Central Financial institution of Europe would love inflation to step by step fall again to 2%.

- For now, it appears that evidently Russia will preserve exporting oil regardless of G-7 nations agreeing to set a value cap on Russian oil exports at $60 {dollars} per barrel. Some members wished the oil cap value to be a lot decrease (at $30-$40 stage) so as to not fund Putin’s battle in Europe, but it surely was set at $60, and at a giant low cost to worldwide benchmark, which slid to $80 this week. The oil cap at $60 is excessive sufficient for Moscow to maintain promoting oil as Russia is promoting oil at a reduction, at round $45 per barrel (and manner under the cap imposed by G-7 members at $60).

Threats

- China’s latest steps to reopen its financial system had been properly taken by buyers, with equites transferring greater after years of strict zero-Covid coverage depressed the financial system and shopper sentiment. Whereas the reopening ought to result in normalization of financial situations, many predict that when the Covid restrictions are relaxed, the medical system might overheat and as many as 2 million folks might die in China.

- This week, Russia claimed that Ukraine attacked Russia’s airbases deep contained in the nation, killing three navy personnel. The blasts at websites lots of of miles from the border between the 2 nations had been the results of a Ukrainian drone assault, Russia’s protection ministry mentioned. Ukraine didn’t take accountability for the assault. If the acquisition by Russia is correct that Ukraine was behind the assaults on Russia territory, it is a severe escalation of the battle.

- Division amongst Eurozone members relating to help for Ukraine is rising. Hungary has blocked an €18bn bundle of EU monetary help for Ukraine, which wants near $40 billion from companions subsequent 12 months to take care of public companies.

Vitality and Pure Sources

Strengths

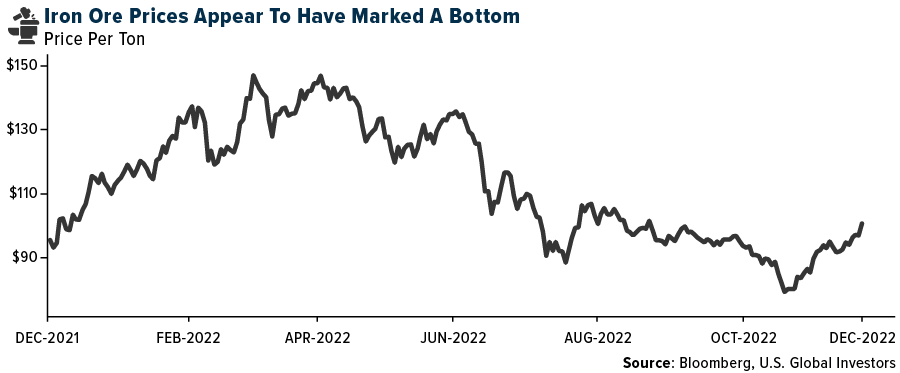

- One of the best performing commodity for the week was zinc, rising 5.96%, partly on the China reopening commerce. Nevertheless, Nyrstar introduced that its zinc smelter in France will stay closed indefinitely. It had been shut since October for upkeep. Iron ore costs continued to rise this week as constructive Chinese language coverage selections boosted sentiment and metal costs, whereas met coal costs have stabilized. The newest bout of Chinese language insurance policies was the central financial institution slicing the reserve requirement ratio by 25 foundation factors for banks and the reiteration of easing Covid restrictions.

- Qatar Vitality and ConocoPhillips signed 15-year LNG agreements with Germany for the provision of as much as 2 million tons per 12 months from Qatar’s ongoing North Discipline East and North Discipline South growth initiatives, the place ConocoPhillips is a key companion. The announcement marks the first-ever sizeable LNG provide deal between Qatar and Germany.

- China boosted power purchases final month as winter approached, whereas copper imports continued to defy a slowing financial system by reaching their highest stage this 12 months. Commodities imports broadly are nonetheless lagging the tempo set in 2021 as strict virus curbs and the disaster within the property market solid a cloud over consumption.

Weaknesses

- The worst performing commodity for the week was WTI crude oil, falling 10.65%, on anticipation of weaker demand going ahead. President Xi Jinping, whereas visiting Riyadh, expressed nearer ties to the area for future power purchases, the sharing of nuclear know-how, huge information, and aerospace. As well as, the Chinese language foreign money can be used for all oil and fuel commerce settlements. U.S. pure fuel consumption was down 5% year-over-year this previous week on the again of decrease residential and business demand, energy burn, and industrial demand. Whole demand was down 11.1 Bcf per day week-over-week.

- Along with oil weak spot, Powder River Foundation steam coal fell greater than 7% and the Sprott Bodily Uranium Belief pulled again about 3%. Pure fuel rose lower than 1% for the week.

- Mosaic Co. has curtailed potash manufacturing at its mine in Saskatchewan as weaker demand despatched fertilizer costs on a downturn. Fertilizer costs spiked with the Russian invasion of Ukraine however have since slumped with patrons on strike. Nevertheless, the U.S. remains to be importing fertilizer from Russia and that has taken a few of the stress off costs just lately as imports have surged.

Alternatives

- Based on JPMorgan, the super-cycle is within the early innings, with upside threat to $150 per barrel in 2023-2024 led by tighter spare capability and potential provide outages; LT $80 per barrel is properly underpinned. The group sees restricted threat premium in present pricing owing to; 1) the ‘all-in’ breakeven for the worldwide oil producers (together with variable shareholder distributions, de-leveraging and now windfall levies) sits at $75 per barrel; this represents the marginal oil value wanted to drive incremental funding in provide development and helps LT $80 per barrel outlook; 2) low OECD inventories; and three) restricted OPEC spare capability.

- Mass Timber, a brand new pattern in additional cost-efficient development and sustainability, grew regardless of the latest interval of document lumber pricing – (buyers are very bullish on the prospects for mass timber with North America seeing the same adoption/demand curve to that skilled in Europe). Constructing codes altering are accommodating the pattern for mass timber, with 12-story buildings allowed in Canada and 18-story buildings within the U.S.

- Based on JPMorgan, commodities are on tempo to ship a second consecutive 12 months of double-digit returns. As international development slows in 2023 however commodity provide stays constrained and critically low inventories persist, commodity costs might keep elevated regardless of a decline in financial exercise. As in 2022, JPMorgan is most constructive on power, however not like 2021, returns can be pushed by oil—particularly if oil raises roll yields and generates a rebound in investor positioning—whereas U.S. pure fuel costs are forecasted to say no 40% by year-end 2023.

Threats

- CIBC revised its commodity value assumptions with notable updates together with reducing its 2023E copper value to $3.50 per pound from $3.95/lb., which is under consensus of roughly $3.70/lb. Included in its forecast is $3.35/lb. on common in H1/23E, bettering to $3.65/lb. Within the second half of subsequent 12 months, because the group expects rising inflation and charges, in addition to elevated recession threat to be ongoing components in early 2023, and that price hike easing, a stabilizing financial system can present help for industrial metals in late 2023 and into 2024. CIBC continues to forecast a copper provide surplus in 2023/2024 and expects that within the medium-term (2025/2026) provide demand fundamentals revert to a market deficit and are supportive of upper copper costs.

- Colombian President Gustavo Petro proposed over the weekend a reform to Colombia’s mining code, which was initially issued in 2001. “It should be reformed; it’s of no use to us (…) The State ought to now not prioritize huge mining multinational firms. The State should prioritize the small, conventional miner, small-scale conventional mining and, above all, help the mining effort that’s undoubtedly wanted, as a result of this isn’t a battle towards mining however towards the methods through which mining is presently carried out in Colombia,” he mentioned.

- Based on Bloomberg, the U.S. and the EU are contemplating new tariffs aimed toward Chinese language metal and aluminum imports to scale back international overcapacity and to assist their local weather agenda. The concept is reported to be nonetheless in its infancy levels and has not been formally proposed. Right now, it’s unclear what authorized provisions the Biden administration would possibly use to implement new tariffs and whether or not such a proposal can be WTO compliant.

Luxurious Items

Strengths

- Toll Brothers reported better-than-expected fourth quarter outcomes, supported by sturdy pricing for the posh dwelling builder. Lennar shares gained this week as properly on expectations that the corporate might also report good quarterly outcomes subsequent week regardless of rising mortgage charges.

- China continues to ease Covid restrictions. Beijing eased guidelines associated to mass testing and lockdowns and scrapped necessary hospitalization and mass quarantines. Native media reported that residents can be now not be required to point out a unfavourable PCR take a look at to enter supermarkets, procuring facilities, airports, and different public facilities.

- MGM China Holdings, a Macau on line casino and lodge operator, was the perfect performing S&P World Luxurious inventory for the week, gaining 41.1%. Macau shares surged after China and Hong Kong began to take away Covid-related restrictions.

Weaknesses

- Tesla’s shares proceed to say no. Weak demand for Tesla autos in China pushed the corporate to chop manufacturing shifts at its Shanghai manufacturing unit and delay the on-boarding of some new hires.

- Retail gross sales within the Eurozone declined 2.7% year-over-year in November from -0.6% within the prior month and under the anticipated decline of two.6%. Month-over-month gross sales weakened as properly. Europe is a vital space for the posh sector, producing about 27% of income in 2021.

- Farfetch, a web based retailer promoting luxurious merchandise worldwide, was the worst performing S&P World Luxurious inventory for the week, dropping 24.9%. Shares proceed to dump this week after final week’s drop of 35% in a single day on December 1, after the corporate supplied a disappointing outlook.

Alternatives

- Based on Altiant’s survey of 1,200 high-net-worth people and vacationers in 14 nations spanning elements of Asia, Europe, and the Americas in the course of the second half of 2022, vacationers are eyeing extra worldwide journeys subsequent 12 months. The report additionally discovered {that a} majority of the rich vacationers proceed to favor spending on experiences over tangible items. Nearly 60% plan to spend extra on journey in 2023, in contrast with 10% who say they might reduce. Wellness will stay a key diver in trip planning for 61% of respondents.

- Marriott Worldwide introduced plans on the Worldwide Luxurious Journey Market (ILTM) Cannes to introduce greater than 35 luxurious accommodations in 2023. The corporate has practically 500 luxurious accommodations and resorts in 68 nations and territories right this moment and is poised to additional its place as the worldwide chief in luxurious hospitality with greater than 200 luxurious properties within the improvement pipeline.

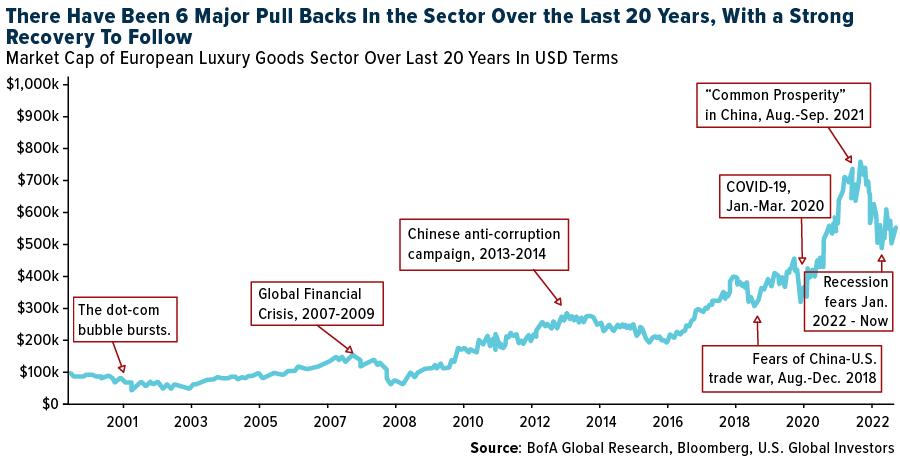

- Financial institution of America’s World Analysis Crew believes that the posh sector presents a gorgeous shopping for alternative. Within the chart under, the group reveals six prior-major pullbacks within the luxurious sector over the previous 20 years. Probably the most present pullback has already resulted in a 24% share value decline for the sector for the reason that starting of the 12 months and greater than 35% for the reason that November peak. Robust pullbacks often result in a bounce.

Threats

- In November, Apple briefly shut down its manufacturing plant in Zhengzhou, China probably resulting in a scarcity of 6 million iPhone 14 Professional and Professional Max items. The corporate is planning to develop manufacturing into India and Vietnam, however it is going to take money and time to diversify provide chains. Bloomberg reported that 35% of factories supplying Apple are presently situated in China. Ives and Wedbush estimated it will take till 2025 or 2026 for 50% of Apple’s iPhone manufacturing to maneuver to India and Vietnam if Apple moved “aggressively.”

- Larger items and companies costs this vacation season in comparison with final 12 months might put a dent in customers’ spending habits. This 12 months, extra customers could also be keen to search for offers relatively than blindly shopping for costly presents for family and friends members. The Nationwide Retail Federation predicts that vacation gross sales in November and December will improve 6% to eight% from final 12 months. The annual price of inflation in October was 7.7%.

- Bank card spending is softening amongst customers who’ve greater incomes, in response to Barclay’s analysis staff. After a few years the place shopper spending development on luxurious items has been stronger than spending on fundamentals or low cost objects, the group now sees spending by luxurious shoppers clearly lagging.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the perfect performer for the week was Axie Infinity, rising 16.39%.

- Goldman Sachs Group plans to take a position tens of hundreds of thousands of {dollars} in crypto corporations, citing an interview with Mathew McDermott, international head of digital property on the firm. The financial institution plans to purchase or spend money on crypto corporations after the collapse of FTX damage buyers’ curiosity and valuations, writes Bloomberg.

- Crypto trade Binance Holdings on Wednesday launched its first proof of reserves, based mostly on a snapshot evaluate by accounting. The report reveals the trade having enough crypto property to stability its whole platform liabilities, writes Bloomberg. It captures a glimpse of Binance’s Bitcoin holdings at a particular second in time to reassure prospects that its property and liabilities match.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was 1inch Community, down 11.82%.

- Circle Web Monetary, the issuer of the cryptocurrency USDC stablecoin, mentioned its deliberate merger with particular objective acquisition firm Harmony Acquisition Corp. has been terminated. Beneath the phrases of Harmony’s amended and restated certificates of incorporation, Harmony has till December 10 to consummate a enterprise mixture, writes Bloomberg.

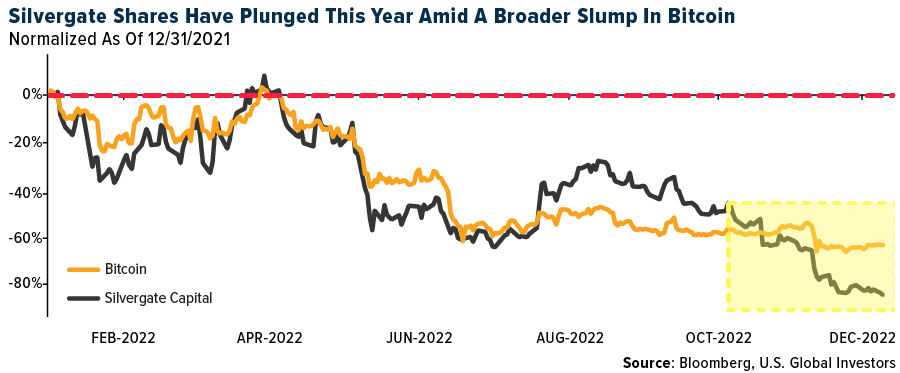

- Crypto financial institution Silvergate Capital Corp was requested by three U.S. Senators to launch all data associated to switch of funds for the collapsed FTX empire of Sam Bankman-Fried. Shares of La Jolla, a California-based financial institution, fell as a lot as 8%. The slide extends Silvergate’s losses for the 12 months to greater than 84% and has it buying and selling at a recent 52-week low, writes Bloomberg.

Alternatives

- Coinbase World Inc. waived charges for changing Tether Holdings stablecoin USDT for the token Coinbase backs, reviews Bloomberg, as competitors heats up among the many three largest issuers of such digital property. In a weblog publish on Friday, Coinbase sought to painting stablecoin USDC as a safer asset amid the turmoil unleashed by the collapse of crypto trade FTX as month in the past.

- The European Union proposed new guidelines on Thursday to fight tax fraud and evasion within the crypto sector by requiring all digital asset service suppliers to report transactions involving prospects residing within the bloc. The initiative by the EU’s government arm, a part of a bundle to extend the transparency within the tax system, goals to make sure that the bloc’s residents pay taxes on features from buying and selling or investing in crypto property, writes Bloomberg.

- FTX’s new CEO and chapter attorneys met with Manhattan federal prosecutors investigating the cryptocurrency trade’s collapse and allegations that it misused billions of {dollars} in buyer funds. John J. Ray met this week with the U.S. lawyer’s workplace for the Southern District of New York, writes Bloomberg.

Threats

- Digital property are already a 12 months into one of many business’s worst slumps, however judging from latest bulletins of steep headcount discount, crypto executives appear to be bracing for extra ache. Crypto exchanges Bybit and Swyftx over the previous two days mentioned they’re shedding 30% and 35% of their workers, respectively. The bulletins got here lower than every week after larger rival Kraken unveiled the same workforce scrapping, writes Bloomberg.

- Orthogonal Buying and selling mentioned in a tweet on Tuesday that it had been “severely impacted by the collapse of FTX and related buying and selling actions” making it unable to repay on a $10 million crypto mortgage, reviews Bloomberg. That prompted the entity that runs the lending pool on DeFi protocol Maple to problem a discover of default for all of the fund’s energetic borrowings.

- Amber Group, one in all Asia’s main crypto platforms, has continued to put off workers and put a funding spherical on maintain amid turmoil within the digital-asset sector following the chapter of the FTX trade. The job cuts on the Singapore-based firm, whose backer consists of Temasek Holdings and Sequoi China, in response to an article printed by Bloomberg.

Gold Market

This week gold futures closed at $1.806.90, down $2.70 per ounce, or 0.15%. Gold shares, as measured by the NYSE Arca Gold Miners Index, ended the week decrease by 2.14%. The S&P/TSX Enterprise Index got here in off 3.60%. The U.S. Commerce-Weighted Greenback rose 0.38%.

| Date | Occasion | Survey | Precise– | Prior |

|---|---|---|---|---|

| Dec-5 | Sturdy Items Orders | 1.0% | 1.1% | 1.0% |

| Dec-8 | Preliminary Jobless Claims | 230k | 230k | 226k |

| Dec-9 | PPI Remaining Demand YoY | 7.2% | 7.4% | 8.1% |

| Dec-13 | Germany CPI YoY | 10.0% | — | 10.0% |

| Dec-13 | Germany ZEW Survey Expectations | -26.4 | — | -36.7 |

| Dec-13 | Germany ZEW Survey Present Scenario | -57.0 | — | -64.5 |

| Dec-13 | CPI YoY | 7.3% | — | 7.7% |

| Dec-14 | FOMC Charge Resolution (Higher Sure) | 4.50% | — | 4.0% |

| Dec-14 | China Retail Gross sales YoY | -3.9% | — | -0.5% |

| Dec-15 | ECB Most important Refinancing Charge | 2.500% | — | 2.000% |

| Dec-15 | Preliminary Jobless Claims | 234k | — | 230k |

| Dec-16 | Eurozone CPI Core YoY | 5.0% | — | 5.0% |

Strengths

- One of the best performing valuable steel for the week was palladium, up 3.12%. Anglo American Plc warned this week that manufacturing throughout its operations can be decrease than anticipated over the subsequent couple of years. Platinum group metals had been hit particularly onerous as whole output might fall as a lot as 12.5% by 2025. Earlier within the week, Glencore lowered its forecast for 2023 on most of its commodities.

- Gold steadied after touching the best stage since July as merchants weighed extra U.S. financial information and China’s leisure of its strict zero-Covid insurance policies. Bullion had been damage by the Fed’s aggressive price hikes this 12 months, however latest indications that the central financial institution is changing into much less hawkish have boosted the steel, pushing it previous $1,800 an oz final week.

- The world’s largest gold trade traded fund (ETF) is to retailer a few of its stock exterior London for the primary time, in a transfer aimed toward facilitating additional growth. The $52.5 billion SPDR Gold Belief (GLD) has held all of its bullion in HSBC’s London vaults since its inception as the primary bodily backed gold ETF in 2004. Nevertheless, it’s now including a second custodian, JPMorgan, using the U.S. financial institution’s vaults in Zurich and New York, in addition to in London. It’s believed to be the primary time a gold ETF has had a number of custodians.

Weaknesses

- The worst performing valuable steel for the week was gold, off 0.15%. After final week’s near-2.43% acquire in gold, bearish buyers tried to ship a message of weak spot with the Monday open. Traders offered off 0.47% of whole identified gold ETF holdings, which is a major amount relative to regular day by day flows. The selloff message didn’t resonate nonetheless, with gold climbing in value every subsequent day of the week.

- Gold’s rebound above $1,800 an oz has been met with promoting by a few of the largest gamers available in the market, elevating questions in regards to the sustainability of the rally. Bullion-backed ETFs lower their holdings by 13.7 tons, in response to an preliminary tally by Bloomberg. The most important day by day drop in 20 months pushed down gold by probably the most since September.

- The Perth Mint reported gross sales of gold cash and minted bars again to 114,304 ounces in November from 183,102 ounces in October. Silver cash and bars fell concurrently. The Mint famous, regardless of the autumn again, gross sales had been nonetheless at their second highest stage this monetary 12 months.

Alternatives

- China reported a rise in its gold reserves for the primary time in additional than three years, reviews Bloomberg, shedding some mild on the identification of the thriller patrons within the bullion market. The Individuals’s Financial institution of China raised its holdings by 32 tons in November from the month earlier than, in response to information on its web site on Wednesday. That introduced its whole to 1,980 tons, the sixth-biggest central financial institution bullion hoard on this planet, the article continues.

- M&A will proceed into 2023, with quite a few senior firms having publicly commented on taking a look at M&A as a part of their development technique. Transactions that present diversification and fewer threat focus would garner shareholder help. There could also be additional consolidations within the streaming house (between the smaller gamers).

- India’s commerce ministry is discussing a discount in import taxes on gold to rein in unlawful shipments, in response to folks accustomed to the matter. The world’s second-largest shopper of the valuable steel, virtually all of which is bought from overseas, has requested the Finance Ministry to think about lowering the tariff to about 10% from 12.5%, two of the folks mentioned, asking to not be recognized because the deliberations are personal.

Threats

- Gold Discipline’s key rationale for its Yamana provide was an rising “hole” of manufacturing decline to 2.0 million ounces by 2030, which was reiterated on November 28 as a motive to proceed to take a look at M&A. The hole shouldn’t be an pressing strategic weak spot for Gold Fields; the corporate might have a manufacturing decline to 2.3 million ounces in 2029, however with $8 billion free money circulate 2023-2030E and a debt-free stability sheet to reinvest over the long run, it is going to be capable of finding new avenues of manufacturing.

- Google searches for “diamonds” within the U.S. seem to have decoupled from their historic pattern of sharply rising into the vacation season. This might be indicative of weakening shopper urge for food for these stones, as evidenced by the softening for polished costs throughout the dimensions spectrum in addition to the weaker-than-expected DeBeers’ web site gross sales.

- Extortion is how mining executives in South Africa are describing “Mafia” like teams organizing to disrupt mining operations with a threatening letter, a derailed practice, blocked roads, burned autos, and staff locked up, reviews Bloomberg. In November, a practice derailed on the primary export route for coal miners. Transnet SOC Ltd, mentioned the incident occurred “towards a backdrop of risk and disruptions to the corporate’s operations by disgruntled groupings in search of enterprise mixtures.” South Africa is now ranked 75 out of 84 jurisdictions, in comparison with 40in 2019, by the Frazier Institute’s Annual Survey of Mining Corporations.

This commentary shouldn’t be thought of a solicitation or providing of any funding product. Sure supplies on this commentary might comprise dated info. The knowledge supplied was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. World Traders doesn’t endorse all info equipped by these web sites and isn’t liable for their content material. All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions is probably not acceptable to each investor.

Holdings might change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Traders as of (09/30/22):

ConocoPhilips

Wesdome Gold Mines

Mandalay Sources

Yamana

COSCO Transport Holdings

Yang Ming Marine Transport

Mitsui OSK

Delta Air Traces

American Airways

United Airways

Airbus SE

Southwest Airways

Hawaiian Holdings

Marriott Worldwide

Anglo American Plc

*The above-mentioned indices will not be whole returns. These returns replicate easy appreciation solely and don’t replicate dividend reinvestment.

The Dow Jones Industrial Common is a price-weighted common of 30 blue chip shares which might be typically leaders of their business. The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. firms. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq Nationwide Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest firms within the Russell 3000®, a widely known small-cap index.

The Hold Seng Composite Index is a market capitalization-weighted index that contains the highest 200 firms listed on Inventory Trade of Hong Kong, based mostly on common market cap for the 12 months. The Taiwan Inventory Trade Index is a capitalization-weighted index of all listed widespread shares traded on the Taiwan Inventory Trade. The Korea Inventory Value Index is a capitalization-weighted index of all widespread shares and most popular shares on the Korean Inventory Exchanges.

The Philadelphia Inventory Trade Gold and Silver Index (XAU) is a capitalization-weighted index that features the main firms concerned within the mining of gold and silver. The U.S. Commerce Weighted Greenback Index offers a basic indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 p.c and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded firms concerned primarily within the mining for gold and silver. The S&P/TSX Enterprise Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 firms. A quarterly revision course of is used to take away firms that comprise lower than 0.05% of the burden of the index, and add firms whose weight, when included, can be better than 0.05% of the index.

The S&P 500 Vitality Index is a capitalization-weighted index that tracks the businesses within the power sector as a subset of the S&P 500. The S&P 500 Supplies Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base stage of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Shopper Discretionary Index is a capitalization-weighted index that tracks the businesses within the shopper discretionary sector as a subset of the S&P 500. The S&P 500 Data Know-how Index is a capitalization-weighted index that tracks the businesses within the info know-how sector as a subset of the S&P 500. The S&P 500 Shopper Staples Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the shopper staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Shopper Value Index (CPI) is likely one of the most widely known value measures for monitoring the value of a market basket of products and companies bought by people. The weights of elements are based mostly on shopper spending patterns. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index relies on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment setting. Gross home product (GDP) is the financial worth of all of the completed items and companies produced inside a rustic’s borders in a particular time interval, although GDP is often calculated on an annual foundation. It consists of all personal and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P World Luxurious Index is comprised of 80 of the biggest publicly traded firms engaged within the manufacturing or distribution of luxurious items or the availability of luxurious companies that meet particular investibility necessities.

Free money circulate (FCF) is the money an organization generates after taking into account money outflows that help its operations and keep its capital property.

The Philadelphia Inventory Trade Gold and Silver Index is a capitalization-weighted index which incorporates the main firms concerned within the mining of gold and silver.