[ad_1]

- Volatility has been the constant in the 2022 bear market.

- Wherever we go in the next 12-18 months, bargains are starting to emerge.

- Here are five stocks I think are positioned well for the years ahead and offer an attractive entry point.

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Taking Advantage of Uncertainty

I did very little buying in March 2020, and not much more in April or May. More than I sold, fortunately. But I didn’t know where the economy (or the world) was heading, let alone the markets, so I was cautious.

One stock I picked up in that period was Honeywell (NASDAQ:). Honeywell was one of the first companies I ever bought, on a recommendation from my first investing mentor. I had sold it in 2017 for personal reasons, and then it was always expensive. I had no special thesis about Honeywell in 2020; I just thought it was a well-run company that was finally available for a good price, and it was surely not going to go bankrupt, so the risk-reward was attractive.

Honeywell is one of my smallest positions, but it has been a solid outperformer vs. the and the since I picked it up.

I feel better about the market and the world than I did in spring 2020. Yes, we are in a bear market, and . There are macro, geopolitical, and micro headwinds that could slow the market down further. The quick rebound from the 2020 crash seems unlikely to be replicated given the economic uncertainty out there. And yet, it’s this period more uncertain than the pre-vaccine, edging out of lockdown, “can the economy restart” climate of that time.

I think it’s a good time to go shopping, or at least have a shopping list ready for any further legs down. I am not predicting that markets will go up this month, next quarter, or even in the next year. It’s just that there are good companies out there that will continue to grow in the decade ahead and that are now available for eminently reasonable prices for investors to benefit from that growth.

Here are a few names that I have on my list for consideration. To find them, I used a few screeners on InvestingPro+ to try to get companies that are growing sustainably (Revenue CAGR of 10-50% in the last 3 years), that are returning capital (share buyback yield is above 5%), that are profitable (EBITDA Margins above 20%), and that have low debt (total debt/total capital).

This forces me to eliminate names like Visa (NYSE:) or Moody’s Corporation (NYSE:) that have strong fundamentals but are still expensive. I also sought to avoid industry leaders like Target (NYSE:) or Netflix (NASDAQ:) that I like and have thought about a decent bit, but which have great uncertainty for at least the coming months, as betrayed by their recent earnings reports. I also brought a couple names that I had been watching previously to this list.

Here are five names that check off at least several of those boxes and are worth a closer look:

(Prices/valuations are as of June 23rd close, all in USD)

The Bear Market Shopping List

1. NVR Inc

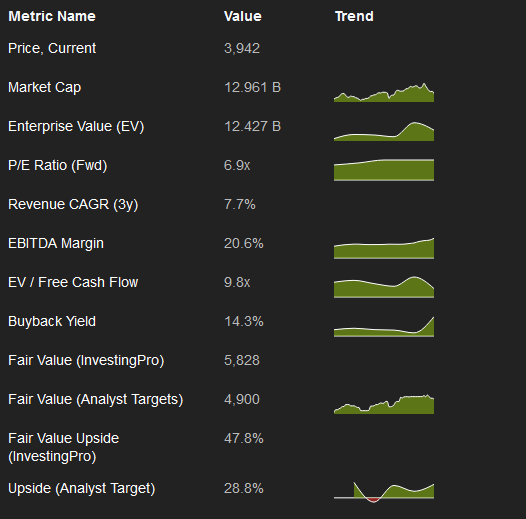

NVR Data from InvestingPro+

NVR Inc (NYSE:) is a homebuilder. Housing is feared to be on the verge of a bear market, as the spike in mortgage rates dries up demand and forces both housing prices down and home sales lower. Housing data suggests a slowdown is setting in: missed expectations, sentiment is dipping, and is tailing off as well.

While fears of a full-out bear market seem overdone, NVR has a few points in its favor even in the worst-case scenario. Its balance sheet is stronger than peers – NVR is in a net cash position, while PulteGroup Inc (NYSE:) and DR Horton Inc (NYSE:) have low debt loads (14% and 18% of market cap, respectively), and Toll Brothers Inc (NYSE:) and KB Home (NYSE:) have significantly higher debt loads (58% and 75%, of market cap, respectively). NVR’s strategy is to buy options on land rather than own it directly on the balance sheet, which lessens their risk and allows them to remain profitable even in downturns, like the housing-centered bear market of the Great Financial Crisis.

NVR Chart from Investing.com

I don’t fully understand the dynamics of the homebuilder space, and don’t have the strongest view on whether we do or don’t hit a bear market in the sector. NVR just promoted a new CEO, adding an extra variable. At less than 9x trailing free cash flow and a net cash position to continue buying back shares (the count has dropped 10.5% in the last five years), there’s a decent chance that won’t matter much to current investors, especially those who are on the sector.

2. Pfizer Inc

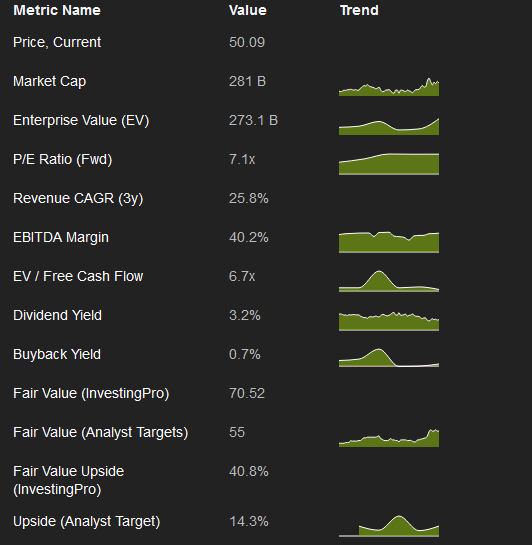

PFE Data from InvestingPro+

Pfizer (NYSE:) is a giant company and a pharmaceutical staple company. It’s boring, I mean to say, and unlikely to produce the sorts of volatile returns that a cyclical stock like NVR might. It is also over-earning – revenue nearly doubled last year, owing almost entirely to Comirnaty and Paxlovid, i.e. their Covid-19 vaccines and treatment pills, which we can hope will diminish in need or at least profitability in the years ahead.

PFE Chart from Investing.com

Pfizer does have a very solid balance sheet and a growing dividend (3.2% yield at the current price), and it offers a decent amount of surety. Every investment comes with risk, but Pfizer’s chances of blowing up seem a lot lower than others. The company’s target is 6% CAGR not counting the Covid-19 related products, and their statements suggest they expect to still make money from Comirnaty and Paxlovid in the years ahead. While they could be more aggressive in buying back shares (only a 4.6% reduction of share count in the last five years), they are at least worth revisiting nearly 20% below 52-week highs.

3. Bank of New York Mellon

BK Data from InvestingPro+

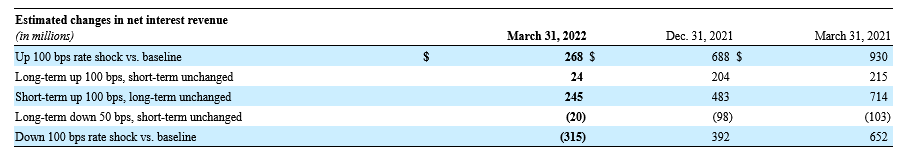

Financials are normally considered beneficiaries from higher rates. It’s not quite automatic, but the presumption is that banks will be able to raise interest rates on their customer loans faster than they are forced to on customer deposits.

Bank of New York Mellon (NYSE:), best known for their custodial services, breaks out the potential impact of interest rates outstripping expectations in either direction in their 10-Q:

They don’t have the exact scenario of long-term rates up, but short-term rates are up even more, but from a layman’s perspective, it looks like BK has pared back their extreme outcomes and is positioned well for rates to go up. Throw in the 3.2% dividend yield (and they are due for a dividend increase), the share buyback program, and an eminently reasonable valuation, and this could do ok in the months ahead.

4. Atkore

ATKR Data from InvestingPro+

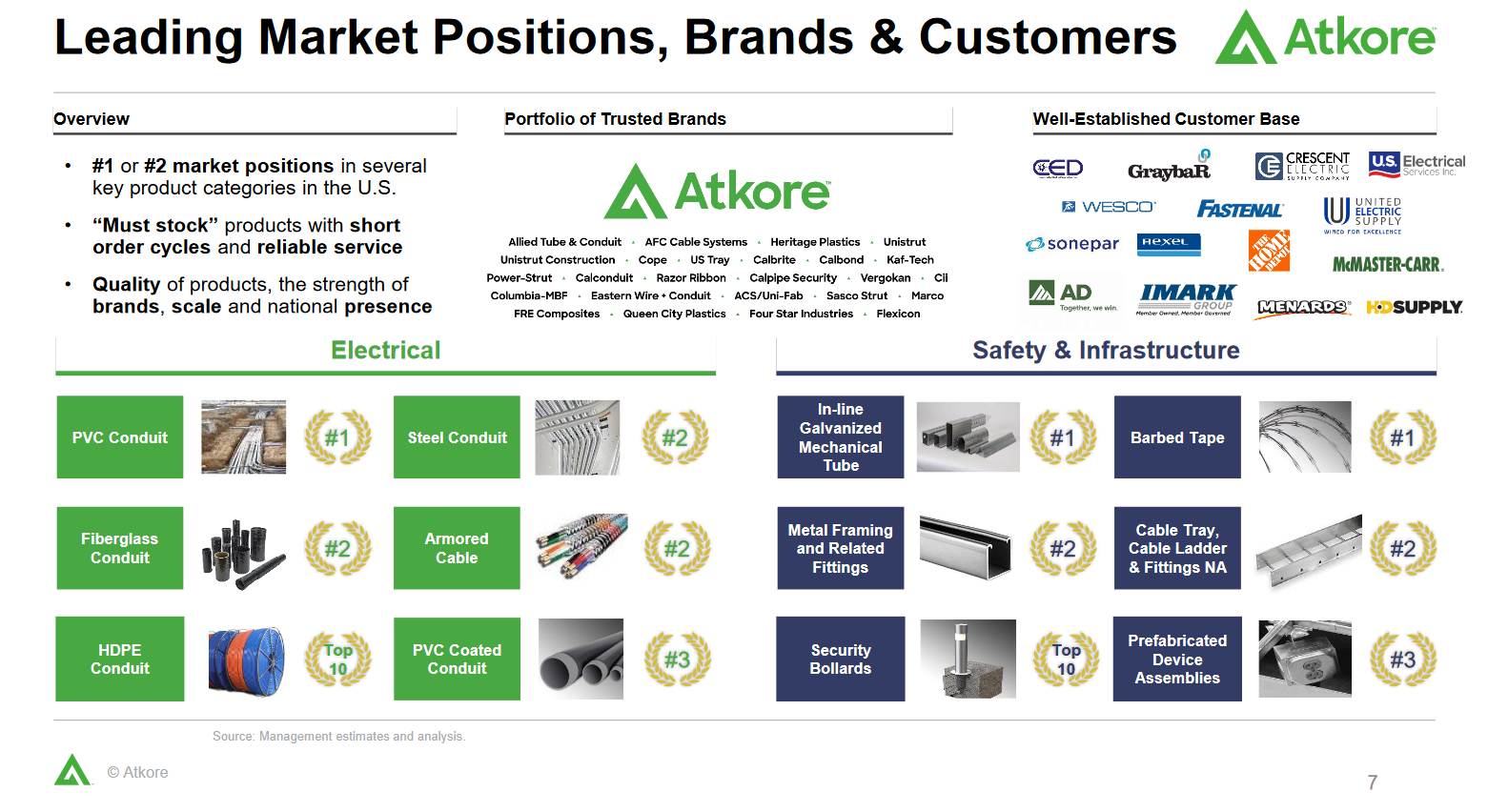

Atkore International Group Inc (NYSE:) is the smallest company on this list, but it fits our criteria. The company, once a unit at Tyco International, makes electrical piping, conduits, and cables that go into residential and non-residential building and infrastructure projects. They have leadership position in those spaces compared to competitors like Eaton (NYSE:), ABB Ltd (NYSE:), Nucor Corp (NYSE:), and Encore Wire (NASDAQ:).

Source: Atkore

Atkore’s exposed to construction and real estate, and has been able to pass on increased materials costs to their clients, which means they are making an inordinate amount of money. They raised guidance for the second time in their current fiscal year (which ends in November) to $20.1 in adjusted EPS at the midpoint, and $1.25-$1.3B in adjusted EBITDA, and their adjustments are relatively small. That’s where the crazy low multiple comes from above.

Atkore has been bracing for this boom time to end, targeting $600M in adjusted EBITDA as their post-boom baseline. It’s probable the market a) is selling off everything and b) is worried that the housing focused slowdown will hit Atkore harder and they might fall below that post-boom baseline, and sooner than expected.

That’s certainly possible, but the company has grown profits steadily in its public career since 2016, its leadership in the current climate says good things, and it is buying shares back aggressively, meaning that even when profits revert, they will be spread out over a smaller share base.

5. Williams Sonoma

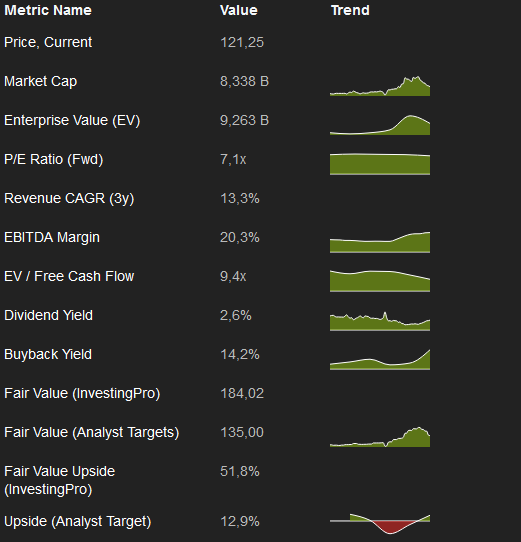

WSM Data from InvestingPro+

Source: InvestingPro+

I wanted to avoid retail and tech for this list because they’ve been such hot sectors and because behavior is changing so rapidly (as Target or DocuSign (NASDAQ:) can attest to), but Williams-Sonoma (NYSE:) may be an exception.

The home products retailer has been in the center of the people buying for their home trend of the pandemic for the last two years, and so far has avoided a guidance cut or other self-inflicted tumble. I wouldn’t expect the company to continue to earn $15/share forever, but at the same time, the company’s guidance is to reach $10B in sales by fiscal year 2024 and maintain 2021 operating margins, which gets them to nearly $20/share in earnings at the current share count. They just spent $500M reducing said share count in the last quarter, with $1.1B left outstanding, and no debt on the balance sheet (not counting operating leases).

WSM Chart from Investing.com

The market has humbled many a management team, forcing them to shift their sails (and sales) and cut guidance, and that could still happen to WSM, so there’s certainly headline risk. And like a few of the names on this list, sentiment may weigh against the company as the market doubts it can keep up its success, until proven otherwise.

But if the guidance and the share buyback wasn’t enough, what is intriguing about WSM is that it is trading at less than 19x EV / FY 2019 cash flow. So if you assume they get no lasting benefit from this 40% bump in revenue (from FY 2019 to FY 2021) and 216% bump in earnings, they are still not exactly expensive.

Buying In Turbulent Times

It’s not easy to buy a stock and then see it go down right away, and I suspect that is what’s in store for many investors in the weeks ahead. There are no ‘easy’ gimmes, and market sentiment has flung from extreme to extreme.

My underlying conviction is that the current climate will pass, and that companies with good balance sheets, strong business positions, and reasonable valuations will make it through this period and reward investors in the years ahead. These are five names that I’m looking at. They all come with risks – especially whether they are at peak cycle – but they’re starting points. What’s on your list?

Disclaimer: I am long Honeywell and Atkore. Atkore has dropped quite a bit since I bought it on Tuesday. As always, nothing in this article is investment advice.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »

[ad_2]

Source link