Market Recap

Final Friday introduced one other downbeat session in Wall Avenue, with the S&P 500 including to current losses to shut 1.4% decrease for the week however however, the index continues to be up 4% for the month. On the financial calendar, areas of weaknesses within the world financial system proceed to be offered with a sequence of lower-than-expected flash Buying Managers’ Index (PMI) readings from main economies. Notably within the US, flash manufacturing PMI stays in contractionary territory (46.3 versus earlier 48.4) whereas the companies sector noticed a moderation in development (54.1 versus earlier 54.9) for the primary time in six months.

Forward, market contributors could also be maintaining a tally of any additional developments across the mercenaries’ rebellion in Russia however having chosen to face down, the mercenaries have already given up their preliminary benefit of the shock component in a rebel, which reduces the probabilities of additional escalation. The potential dangers to observe could also be on any renewed opposition from the Russian public to Putin’s management, particularly with the Ukraine battle being the agenda for the motion which has not been well-received by the general public beforehand.

The week forward will convey focus to China’s PMI readings as properly, with market contributors hoping to hunt for any pockets of resilience within the China’s restoration story. The US core PCE worth index may even be in focus. Three months of no-progress could clarify the +0.3% upward revision within the Fed’s 2023 core PCE projections (3.9% versus 3.6% in March) on the newest FOMC assembly, subsequently a softer inflation learn can be appeared upon to offer room for the Fed to ship a protracted pause in July.

The US greenback has been making an attempt to remain above its Ichimoku cloud on the day by day chart however a transfer again above the 103.12 stage could also be warranted to offer higher conviction for the bulls. For now, its Relative Power Index (RSI) nonetheless hangs beneath the 50 stage whereas a flat-lining MACD factors to a near-term consolidation. The current CFTC information revealed that the greenback’s combination positioning towards G10 currencies has seen a renewed build-up in net-short positioning final week, following 4 weeks of unwinding. On the draw back, the 100.50 stage, which marks a number of bottoms year-to-date, could also be on watch.

Supply: IG charts

Asia Open

Asian shares look set for a combined open, with Nikkei -0.16%, ASX -0.37% and KOSPI +0.19% on the time of writing. Chinese language equities stay beneath strain these days, with the Grasp Seng Index unwinding all of its previous two weeks’ positive aspects upon a retest of the higher fringe of an Ichimoku cloud resistance on the weekly chart, which can reveal its significance as a key stage for sellers.

The financial calendar is comparatively quiet within the area, with Thailand’s commerce information and Singapore’s industrial manufacturing. Having seen an eighth straight month of contraction in Singapore’s exports, manufacturing could monitor the general weak point with expectations for a deeper year-on-year contraction to -7.4% from earlier -6.9%.

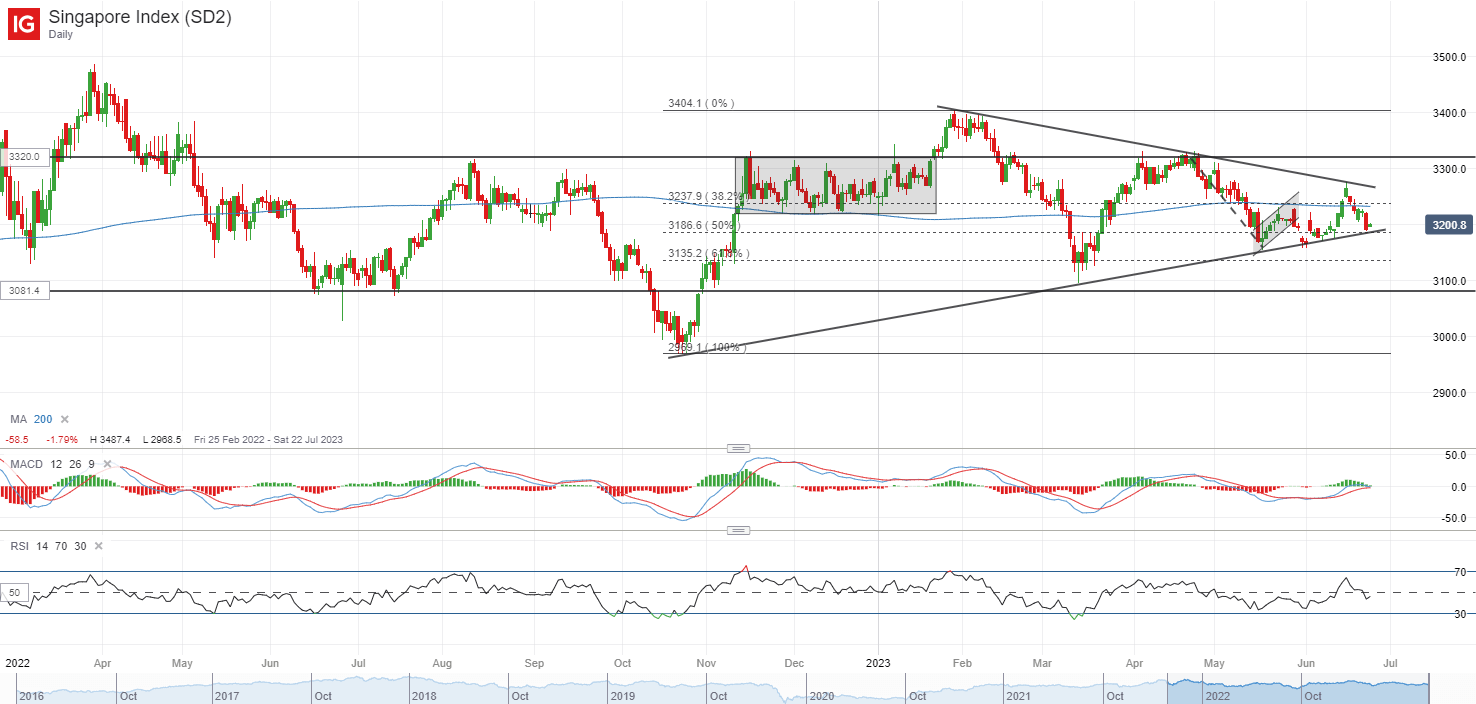

The Straits Instances Index continues to commerce inside a symmetrical triangle sample, with the index heading again to retest the decrease trendline for the fourth event for the reason that begin of the 12 months. Any breakdown of the decrease triangle trendline may go away the March 2023 backside on watch on the 3,100 stage.

Supply: IG charts

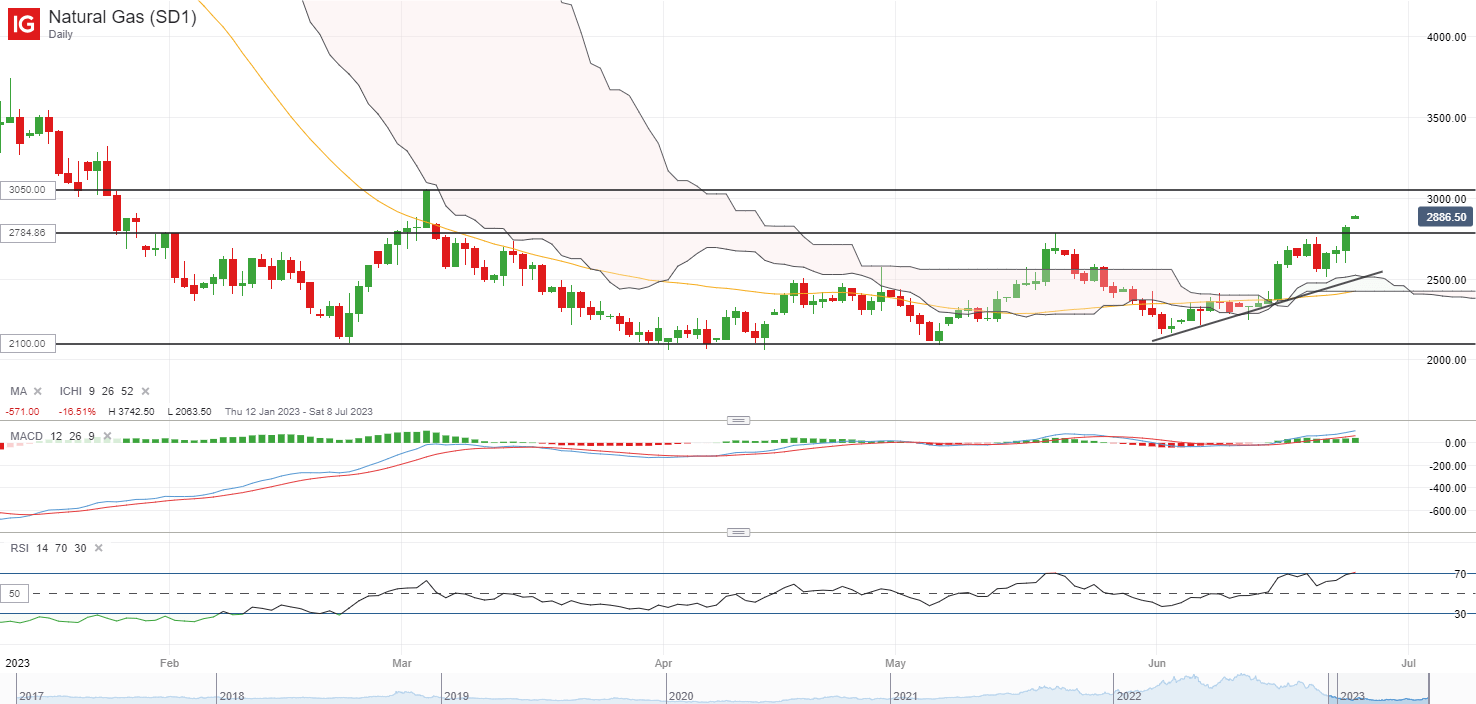

On the watchlist: Extra indicators of life in pure fuel costs with push to three-month excessive

After plunging as a lot as 78% since August 2022, pure fuel costs have been largely forming a base over the previous months, which means that promoting strain could also be exhausted for now. Hotter-than-usual world temperatures rising electrical use and lower-than-planned provide in Norway’s fuel output have been on the radar, with pure fuel costs heading to its three-month excessive to finish final week.

On the technical entrance, the RSI maintains above its key 50 stage, with the current formation of upper highs and better lows supporting a near-term upward bias. The three.05 stage could also be on watch subsequent, with any transfer above this stage suggesting a break of its ranging sample and offers additional validation of consumers taking management after a months-long interval of indecision. On the draw back, a sequence of assist traces can be on watch, which incorporates its Ichimoku cloud assist and its 50-day MA.

Supply: IG charts

Friday: DJIA -0.65%; S&P 500 -0.77%; Nasdaq -1.01%, DAX -0.99%, FTSE -0.54%.