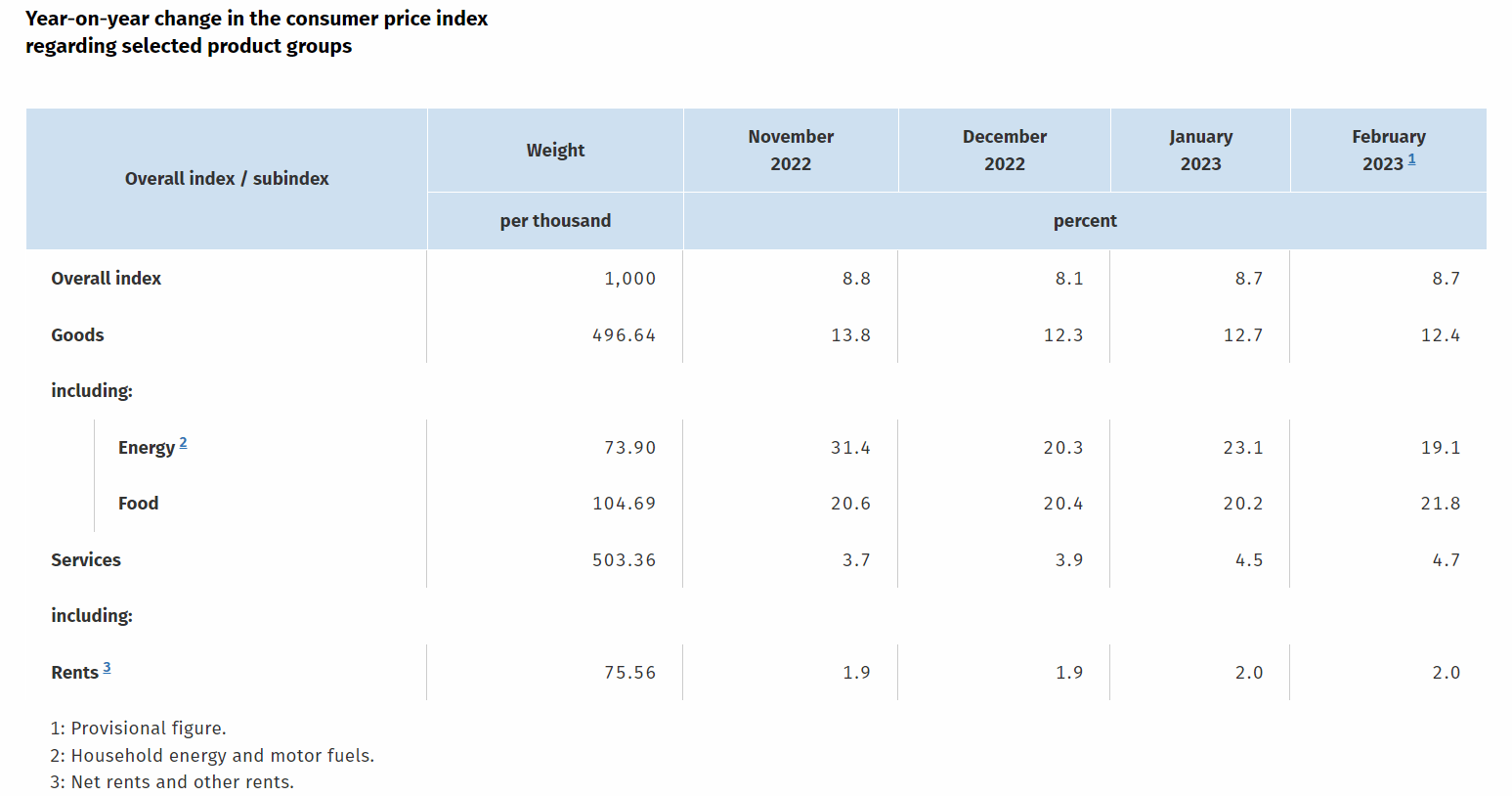

German CPI Overview:

- German CPI Preliminary (Feb) unchanged at 8.7%, lacking expectations of 8.5%

- Harmonized inflation (incl meals and vitality) rises to 1% (MoM) as meals prices stay elevated.

- EUR/USD rises with hawkish expectations for the ECB

German inflation unchanged as CPI exhibits no signal of easing

German CPI information for February has been launched, with the figures beating expectations on each an annual and month-on-month foundation. Because the YoY inflation fee stays unchanged at 8.7%, harmonized inflation (together with meals and vitality) fee has risen to 9.3%.

DailyFX Financial Calendar

The information that measures the change within the costs of products and companies over a predetermined interval means that worth pressures might stay elevated for longer.

Supply: German Federal Statistics

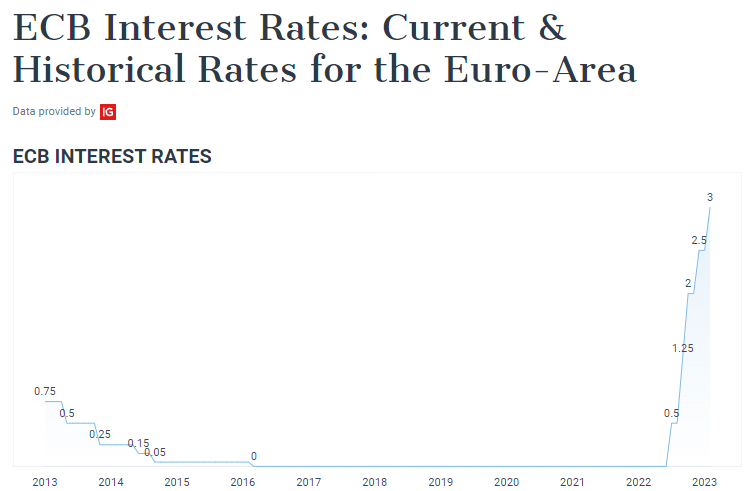

Whereas the ECB (European Central Financial institution) deliberate to lift charges by a further 50 basis-points later this month (16 March), the current readings from Spain, France and Germany poses a further menace to the European progress outlook.

DailyFX ECB Curiosity Charges

Below ‘regular’ circumstances, larger rates of interest cut back client spending, driving inflation decrease. Nevertheless, within the aftermath of the Coronavirus pandemic, ballooned balanced sheets and the battle in Ukraine has pressured policymakers to take a extra aggressive method. For the central financial institution financial coverage stays targeted on reaching ‘full employment’ whereas sustaining worth stability.

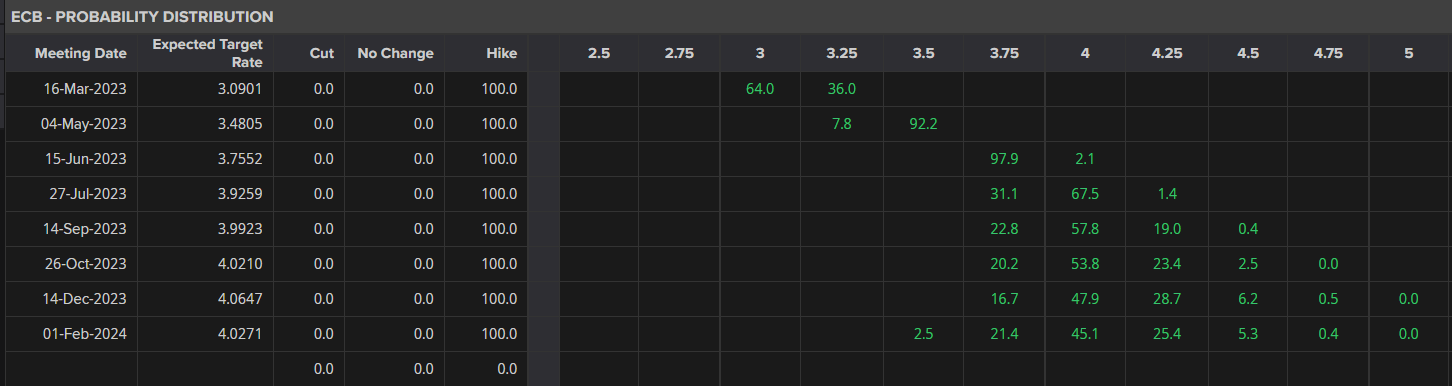

With ECB president Christine Lagarde stressing the dedication to tame inflation via extra fee hikes, market contributors at the moment are anticipating terminal charges to achieve 4% by July (at present at 2.75%).

Supply: Refinitiv

With Eurozone inflation on deck (launched 2 March at 10:00 GMT), the repricing of data has supported German yields, pushing the two-yields to their highest ranges since 2008.

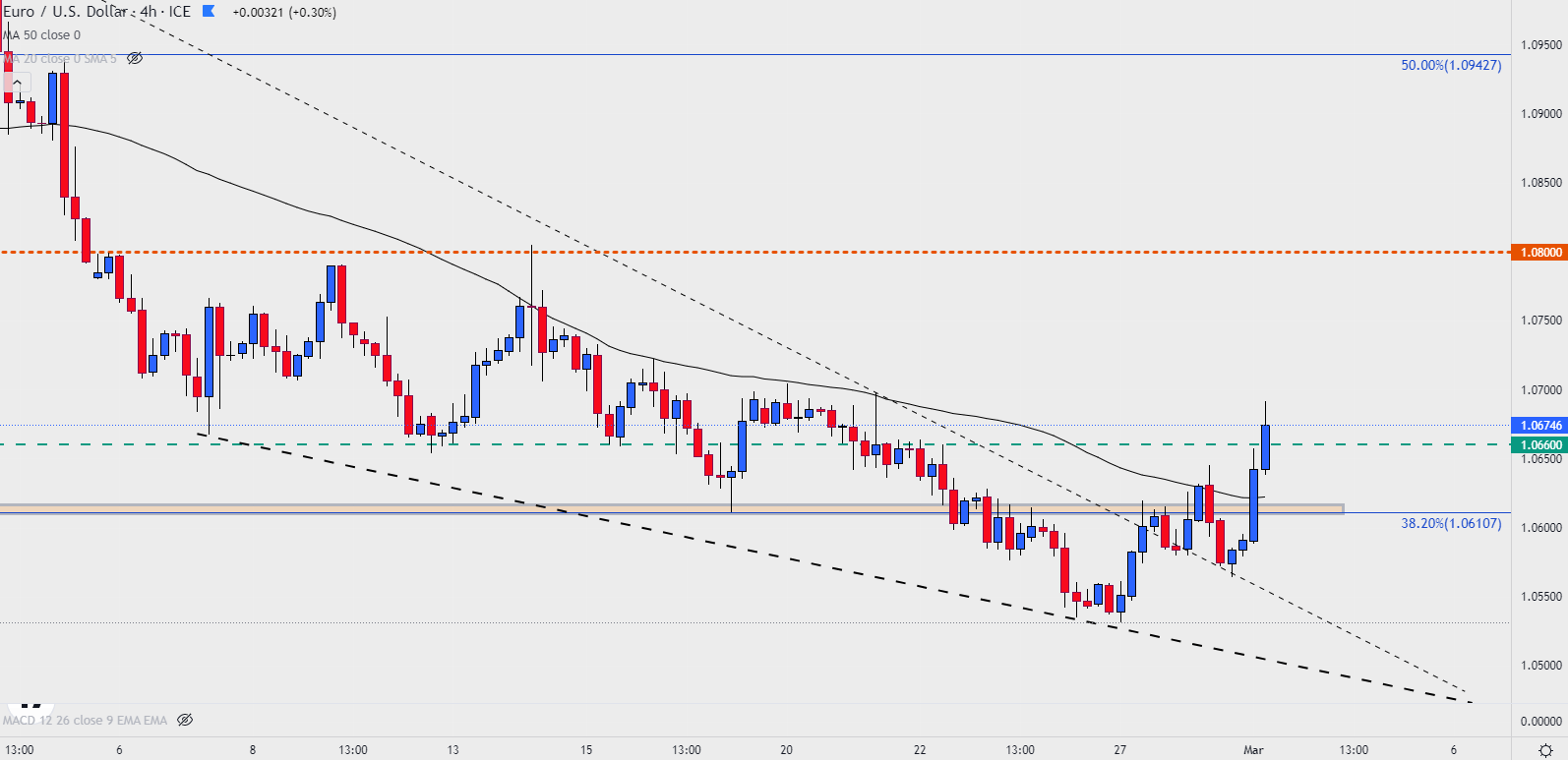

In response to the newest forecasts, EUR/USD has risen, with traders now anticipating that the ECB will stay extra hawkish for longer than its Federal Reserve counterpart.

EUR/USD Value Chart

Chart ready by Tammy Da Costa utilizing TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707