MichaelRLopez

In my final article on PBF Power (NYSE:PBF), I argued that the present low valuation created an uneven threat/reward setup, and with just a few extra good quarters of money stream, they’d be capable of repurchase a big quantity of their float, sending share costs larger.

Properly, excellent news got here early with the sale of fifty% of the soon-to-be working renewable diesel facility at their Chalmette refinery to Eni (E) for $835-885 million. This growth each materially derisks the venture, as Eni can be bringing experience, and offers a money windfall for PBF, which materially derisks the inventory.

PBF Partnership with Eni

In my unique article, I discounted the projected money stream for the Renewable Diesel, or RD venture by 50%, as a result of PBF has no monitor file in operating a RD facility. The partnership with Eni is a gamechanger in my view, each from a money inflow standpoint, and from a threat discount standpoint.

The money cost of $835-885 million for 50% of the venture, which ought to hit PBF’s checking account within the subsequent 90 days, represents over 15% of their market worth as of at present.

Moreover, I imagine the experience Eni brings materially derisks the venture, each from an operational and advertising and marketing standpoint.

Give credit score on account of PBF Administration. They stated they may do that on their very own, however CEO Tom Nimbley stated they have been in search of a companion that:

can enhance the worth of the partnership the place there’s an additive side the place somebody is bringing some attributes that we do not at the moment have.”

It seems to be like they discovered that companion.

PBF Valuation

The partnership with Eni places a concrete valuation on the Renewable Diesel (“RD”) venture, particularly since they’re being paid half in money up entrance. My private view is that the market wasn’t giving this venture a lot credit score even with administration estimating it could produce $400 million a 12 months in EBITDA at present RIN costs.

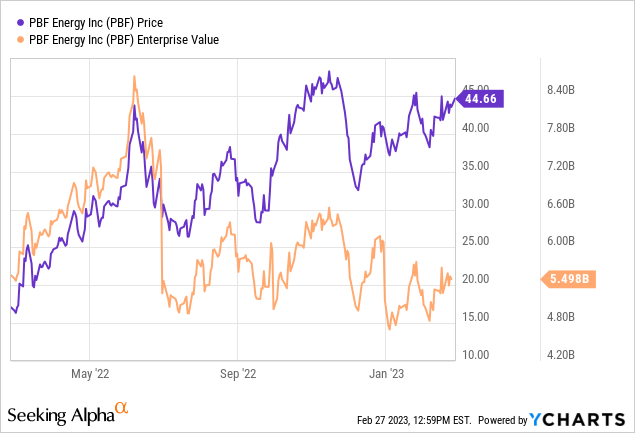

With the inventory at $44, and 129 million shares excellent, PBF has a market capitalization of $5.7 billion.

From the $5.7 billion valuation, if we subtract $1.7 billion for the RD venture, and subtract one other $1 billion for logistics arm PBFX (I am utilizing the valuation previous to PBF buying the remaining models, to be conservative) it places PBF’s refining property at a $3 billion greenback valuation.

That is a extremely undemanding valuation for over 1.02 MMbpd of refining capability, particularly with crack spreads nonetheless elevated.

For comparability, Marathon (MPC) has 3 MMbpd of refining capability and an enterprise worth of $72 billion. Phillips 66 (PSX) has 2.2 MMbpd refining capability an enterprise worth of $60 billion. Valero (VLO) has 3.2 MMbpd of refining capability enterprise worth of $47 billion.

This isn’t a apples-to-apples comparability, so do not conclude PBF is 5x underpriced. These firms all have their very own RD initiatives, and I’m not backing out the logistics arms from their valuation like I did with PBF. Plus, the bigger refiners do have some scale benefits over PBF as effectively. However with this necessary caveat, it nonetheless exhibits the dramatic valuation hole between the opposite main US refiners and PBF.

Taking a look at PBF’s refining property from a substitute value standpoint exhibits an identical large low cost. Cenovus (CVE) simply spent $1.2 billion to rebuild its Superior, Wisconsin refinery, which solely has 49mbpd of capability. Going again to 2019, PBF acquired a deal on the Martinez refinery for “simply” $1 billion; its substitute value can be far larger at present than it was then.

Share Repurchases

PBF Administration actually embraced share repurchases shortly.

On the Q3 Convention name in late October, then CFO Erik Younger answered an analyst query if “a buyback is within the thought course of down the highway.” He answered:

In the end, share buyback is yet one more instrument that may be employed. We have seen it amongst our peer group and amongst other people which can be on the market. And so it completely might be one thing that we might put in place in some unspecified time in the future sooner or later.

Lower than 6 weeks later, on December twelfth, after a decline into the low $30’s attributable to each declining crack spreads and former PBFX holders promoting shares, PBF introduced a $500 million inventory buyback program. Shares jumped 7% to $35 on the information. Assuming they began repurchasing the following day, there have been solely 13 buying and selling days remaining in 2022. In these 13 days, they repurchased $156.4 million in shares. Together with 2023, they’ve repurchased over 5 million shares, roughly 4% of the excellent, for $189 million.

Future Share Repurchases

In just a few months, PBF ought to be able to repurchase a considerable quantity of the excellent shares. There have been just a few attention-grabbing exchanges on the This autumn Convention Name that hinted at PBF’s future plans. The primary was CFO Karen Davis saying:

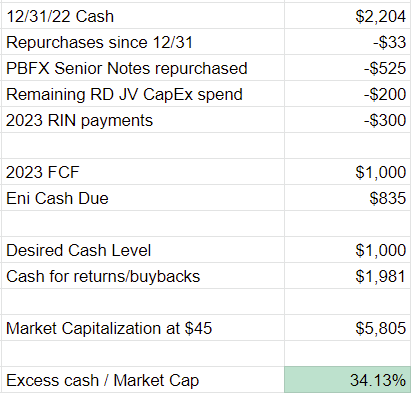

we anticipate that over time, our money ought to return to extra normalized ranges within the $750 million to $1 billion vary. Our gross debt is now beneath pre-pandemic ranges and at a stage that we imagine is at the moment acceptable and sustainable for our enterprise.

On the excessive finish of that vary, it implies a money return of $1.2 billion from the present money stability of $2.2 billion. This once more is earlier than the Eni cost.

Then there was the next entertaining trade with BofA’s Doug Leggate:

Doug Leggate

Karen, congrats on the everlasting seat. Now it’s a must to cope with all of us. Forgive me for beating on Neil’s query however let me perhaps simply ask it in a different way. Why ought to we not take into consideration the proceeds from the three way partnership translating on to share buybacks? As a result of your working money stream takes care of all the opposite belongings you talked about. So are we a 15% buyback with the money influx from the JV?

Karen Davis

Properly, to start with, I would say we’re simply delighted to be partnering with Eni and for the time being, simply targeted on closing the deal.

Doug Leggate

You are not discouraging me from considering that means?

Matt Lucey

We’d by no means discourage you to suppose any means you need. It is a futile — any try can be futile. However look, we have been very, very targeted on getting the transaction to the purpose the place we’re at present. The transaction hasn’t closed but and I realized a protracted, very long time in the past not to determine methods to spend cash that you do not have in your pocket but. Clearly, the corporate will put ahead insurance policies which can be acceptable on the acceptable time however we’ve got nothing else so as to add for the time being.

They’re properly not spending the cash earlier than they’ve it, however as soon as they do, my serviette math exhibits the next doable outlook for PBF repurchases.

PBF Money Movement for repurchases (PBF 10-Ok, Writer’s calculations)

Even with the extra debt payoff of PBFX notes, this leaves round $2 billion accessible for share repurchases and particular dividends – sufficient to buy nearly 1/third of the excellent shares at these ranges.

Final Man Standing in PADD1 and PADD5 – perhaps this is not a unfavourable?

The next is usually my free considering – I haven’t got lots of numbers to again this up, so take it with a grain of salt.

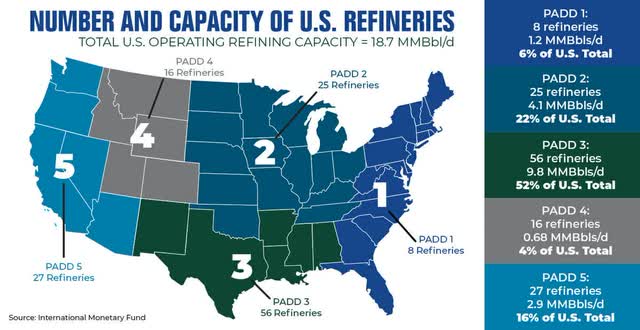

Essentially the most frequent motive I learn for PBF’s low cost versus the opposite main refiners, past scale, is that 2/3rds of PBF’s refineries are in PADD1 (Delaware Metropolis, DE and Paulsboro, NJ) or PADD5, particularly California (Torrance and Martinez.)

PADD1 is deprived from primarily being served by water and rail, not pipeline, and since PADD1 is the same old vacation spot for abroad refined product.

PADD5 is deprived primarily due to the political local weather in California that’s overtly hostile to power firms. Not too long ago, the elevated worth of CA pure fuel has additionally been a unfavourable.

US PADD Districts and Refineries (IMF)

As I’ve tried as an example, I imagine the low cost for that is definitely within the inventory worth. However what if the “typical knowledge” is fallacious?

With PADD1, perhaps the Russian refined product embargo mixed with much less Chinese language exports, will trigger decrease refined product imports on the East Coast. This mixed with jet demand returning to pre-COVID ranges, together with extra driving, and 2023 might be the 12 months we see “regular” East Coast demand, however with out the 335mbpd Philadelphia Power Options refinery (closed on account of hearth in 2019) and the 130mbpd Come By Likelihood refinery (closed in 2020.)

With PADD5, California has additionally misplaced refining capability since 2020 with the 161 Mbpd Marathon Martinez refinery changing to RD this 12 months and the 120Mbpd Phillips 66 Rodeo California changing to RD (opening in 2024.) Maybe the return to workplace driving and elevated jet gas demand will maintain crack costs excessive in 2023 and past. With jet gas, PBF Martinez particularly has a excessive jet gas output (roughly 23% of their output.) On the political entrance, California governor Newsom’s efforts for a windfall revenue tax additionally appear to be stalling as effectively.

We all know the traditional reasoning that favors gulf coast refiners and refiners with entry to shale oil. However maybe the profit is overstated, and the economics of working in PADD1 and PADD5 are higher than most suppose.

Conclusion

In my latest interview with In search of Alpha, I talked about in search of catalysts that drive a rerating in deep worth names, and that producing lots of money to both repurchase shares or debt is usually a good way to do this.

PBF spent most of final 12 months repurchasing debt, and it definitely re-rated in consequence. Contemplating they’re web debt free as of final quarter, even earlier than the Eni cost, I imagine they will spend this 12 months repurchasing shares, and we might see an additional re-rating larger.

So what’s holding PBF again? Truthfully, I simply suppose it is a scary chart for brand new traders. Taking a look at simply the inventory worth, it seems to be like we have “missed the transfer” because it ran from $18 to $45. However wanting as a substitute at Enterprise Worth, it is truly down from this time final 12 months, as PBF has paid off $3 billion in debt whereas shopping for out PBFX and repurchasing shares. If we issue within the incoming cost from Eni, EV can be down considerably.

I feel we’re one other good quarter and the closing of the Eni deal away from this being a $60 inventory.