Fundamental Forecast for the Swiss Franc: Neutral

- The Swiss Franc may be the most appealing safe haven currency after the Swiss National Bank’s first rate hike in 15 years.

- Fears of a resuscitated Eurozone debt crisis may continue to bolster flows into the Swiss Franc via EUR/CHF rates.

- According to the IG Client Sentiment Index, the Swiss Franc has a bullish bias.

Swiss Franc Week in Review

The Swiss Franc was the best performing major currency last week, gaining ground against each of its major counterparts after the Swiss National Bank shocked market participants with their first rate hike in 15 years. The rate hike, from -0.75% to -0.25%, marked the first move in the SNB’s main rate since 2015.

With risk appetite eroding once again amid rising global recession concerns, the Swiss Franc posted its strongest performance against the commodity currencies: AUD/CHF rates dropped by -3.22%; CAD/CHF rates plunged alongside oil prices, down -3.61%; and NZD/CHF rates fell by -2.42%. CHF/JPY rates performed well too, as the divergence between the SNB and the Bank of Japan grew wider: the pair added +2.23%. Rounding out the majors, EUR/CHF rates sank by -2.01%, GBP/CHF rates lost -2.57%, and USD/CHF rates eased back -1.80%, despite the Federal Reserve hiking rates by 75-bps for the first time since 1994.

A Lighter Swiss Economic Calendar

After the surprise rate hike by the SNB, the economic calendar lightens up significantly in the days ahead for the Swiss Franc. In fact, there are only two events on the Swiss economic calendar in the coming week, leaving the Swiss Franc at the whims of broader risk trends as well as news flow around concerns around a resurgent Eurozone debt crisis.

- On Tuesday, May Swiss trade balance figures are due at 6 GMT.

- On Thursday, 1Q’22 Swiss current account data will be released at 7 GMT.

For full Swiss economic data forecasts, view the DailyFX economic calendar.

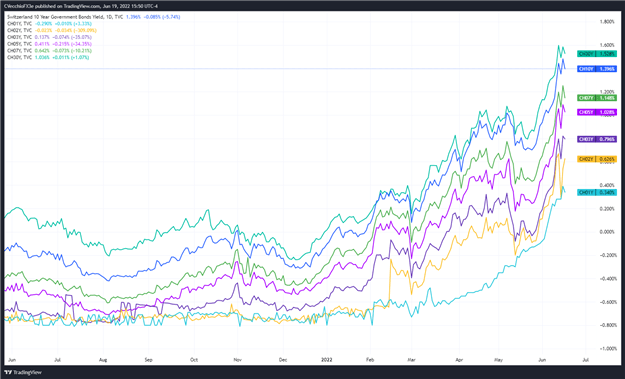

Swiss Government Bond Yield Curve (1-year to 30-years) (June 2020 to June 2022) (Chart 1)

The sharp uptick in Swiss inflationary pressures in recent months – now at +2.9% y/y in May, well-above the SNB’s objective of 0 to +2% – has provided a tailwind to Swiss government bond yields. With the SNB reacting in turn, Swiss government bond yields are now at their highest levels since 2014.

While still comparatively low compared to other major economies, the elevation in Swiss yields should increase the relative appeal of the Swiss Franc compared to other safe haven currencies like the Japanese Yen moving forward. Moreover, the rise in Swiss yields may help bolster the Franc as echoes of the Eurozone debt crisis grow louder – so loud that the European Central Bank was forced to hold an emergency meeting last Wednesday, less than a week after their June policy meeting.

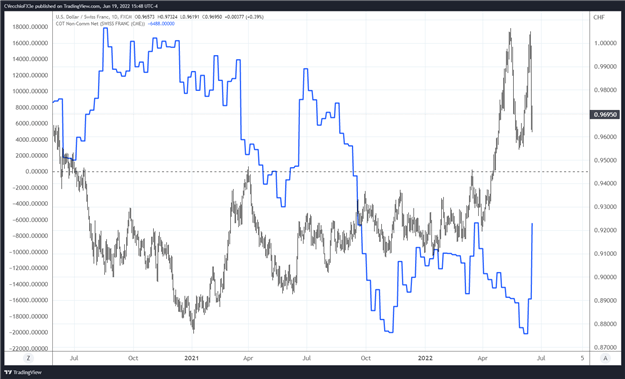

CFTC COT Swiss Franc Futures Positioning (June 2020 to June 2022) (Chart 2)

Finally, looking at positioning, according to the CFTC’s COT for the week ended May 24, speculators decreased their net-short Swiss Franc positions to 6,488 contracts from 15,850 contracts. It’s worth noting that the positioning reporting period ended two days prior to the SNB rate decision; a further decline in net-shorts is anticipated moving forward.

— Written by Christopher Vecchio, CFA, Senior Strategist