[ad_1]

Up to date on April twenty sixth, 2023 by Bob Ciura

Traders trying to generate increased revenue ranges from their funding portfolios ought to have a look at Actual Property Funding Trusts or REITs. These are corporations that personal actual property properties and lease them to tenants or spend money on actual property backed loans, each of which generate a gentle stream of revenue.

The majority of their revenue is then handed on to shareholders by means of dividends. You may see all 200+ REITs right here.

You may obtain our full record of REITs, together with essential metrics reminiscent of dividend yields and market capitalizations, by clicking on the hyperlink under:

The fantastic thing about REITs for revenue buyers is that they’re required to distribute 90% of their taxable revenue to shareholders yearly within the type of dividends. In return, REITs usually don’t pay company taxes.

In consequence, most of the 200+ REITs we observe supply excessive dividend yields.

However not all high-yielding shares are automated buys. Traders ought to rigorously assess the basics to make sure that excessive yields are sustainable. Many (however not all) high-yield securities have a major threat of a dividend discount and/or deteriorating enterprise outcomes.

With that in thoughts, we created an inventory of protected REITs which have premier enterprise fashions and powerful property portfolios. In flip, their dividends needs to be thought of extra sustainable than the overwhelming majority of REITs.

Particularly, the next 9 protected REITs have at the least 10 years of annual dividend will increase, Dividend Danger Scores of ‘C’ or higher, dividend yields above 3% utilizing knowledge from the Positive Evaluation Analysis Database.

The shares are ranked by dividend yield, from lowest to highest. The desk of contents under permits for straightforward navigation.

Desk of Contents

You may immediately bounce to any particular part of the article through the use of the hyperlinks under:

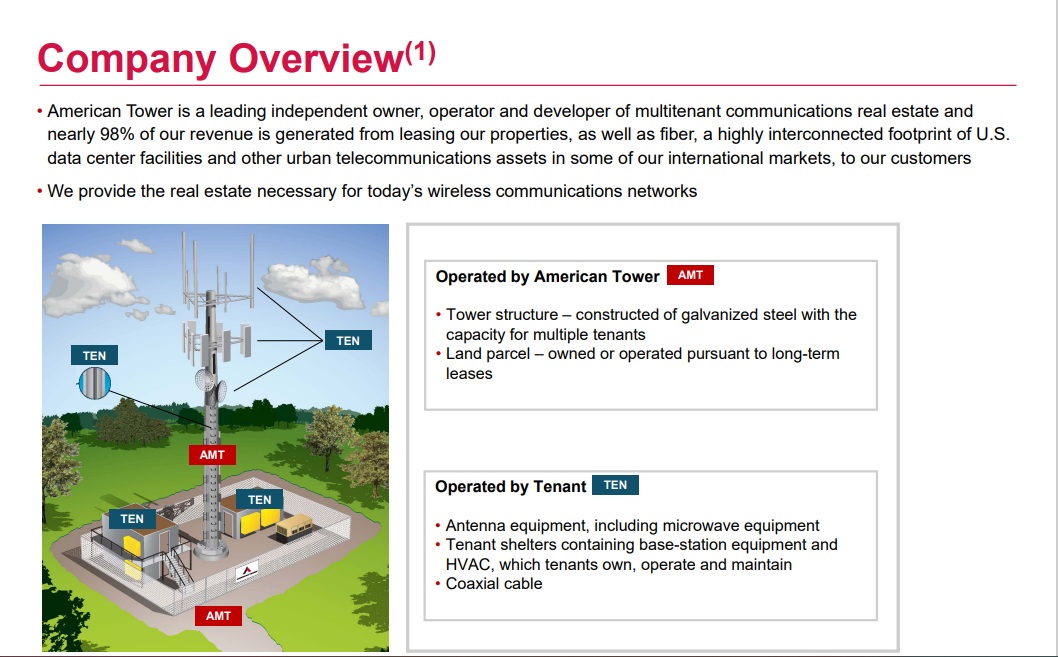

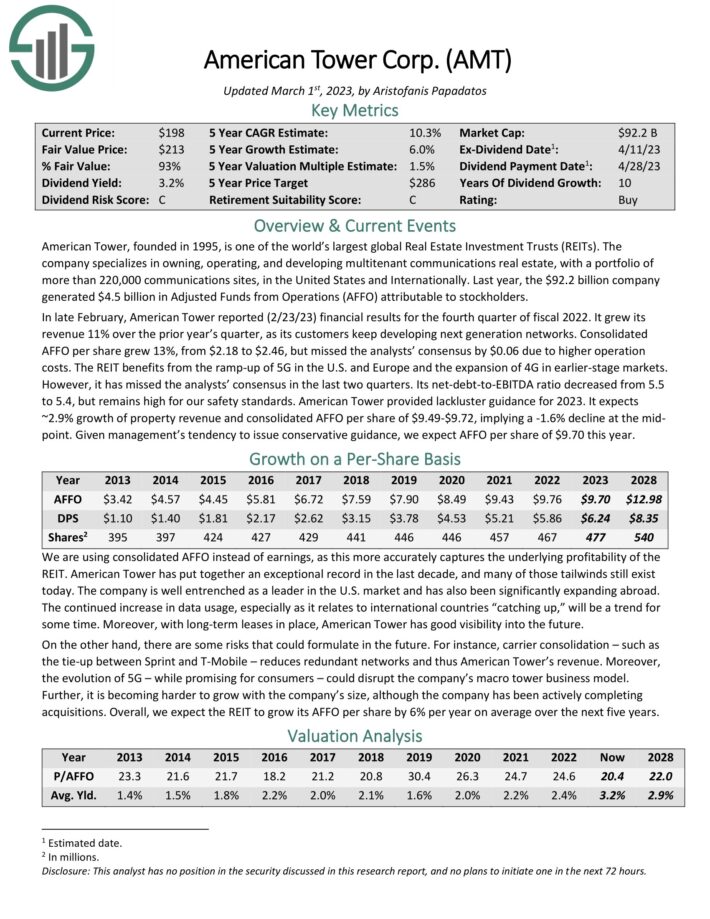

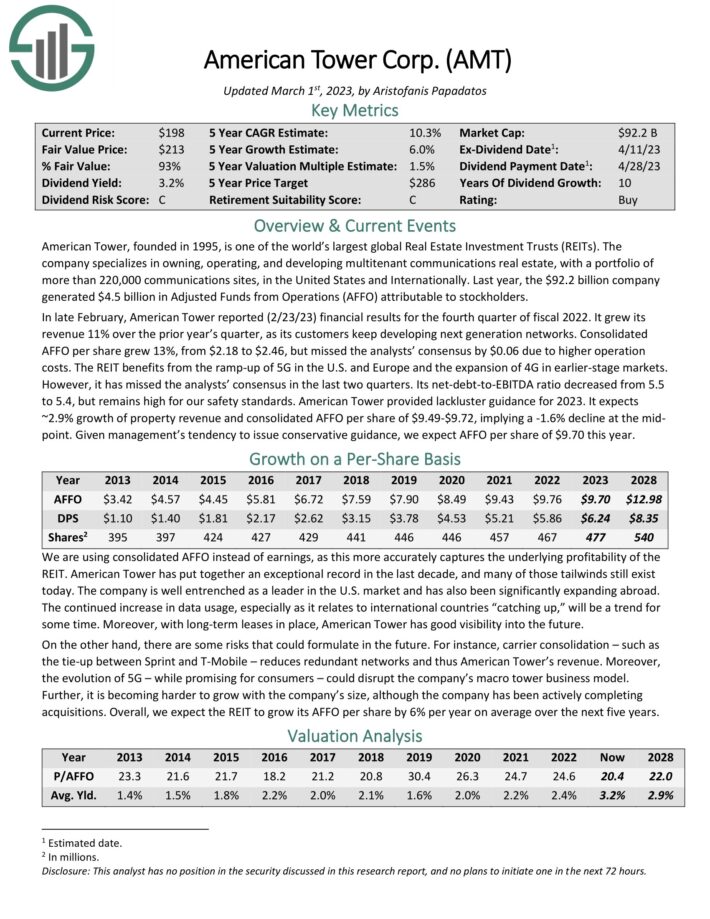

Protected REIT No. 9: American Tower Corp. (AMT)

American Tower focuses on proudly owning, working, and growing multi-tenant communications actual property, with a portfolio of greater than 220,000 communications websites, in the US and Internationally. Final 12 months, the $92.2 billion firm generated $4.5 billion in Adjusted Funds from Operations (AFFO) attributable to stockholders.

Supply: Investor Presentation

In late February, American Tower reported (2/23/23) monetary outcomes for the fourth quarter of fiscal 2022. It grew its income 11% over the prior 12 months’s quarter, as its prospects maintain growing subsequent era networks. Consolidated AFFO per share grew 13%, from $2.18 to $2.46, however missed the analysts’ consensus by $0.06 on account of increased operation prices.

The REIT advantages from the ramp-up of 5G within the U.S. and Europe and the growth of 4G in earlier-stage markets. Its net-debt-to-EBITDA ratio decreased from 5.5 to five.4.

American Tower offered steerage for 2023. It expects ~2.9% development of property income and consolidated AFFO per share of $9.49-$9.72, implying a -1.6% decline on the midpoint.

Click on right here to obtain our most up-to-date Positive Evaluation report on American Tower (preview of web page 1 of three proven under):

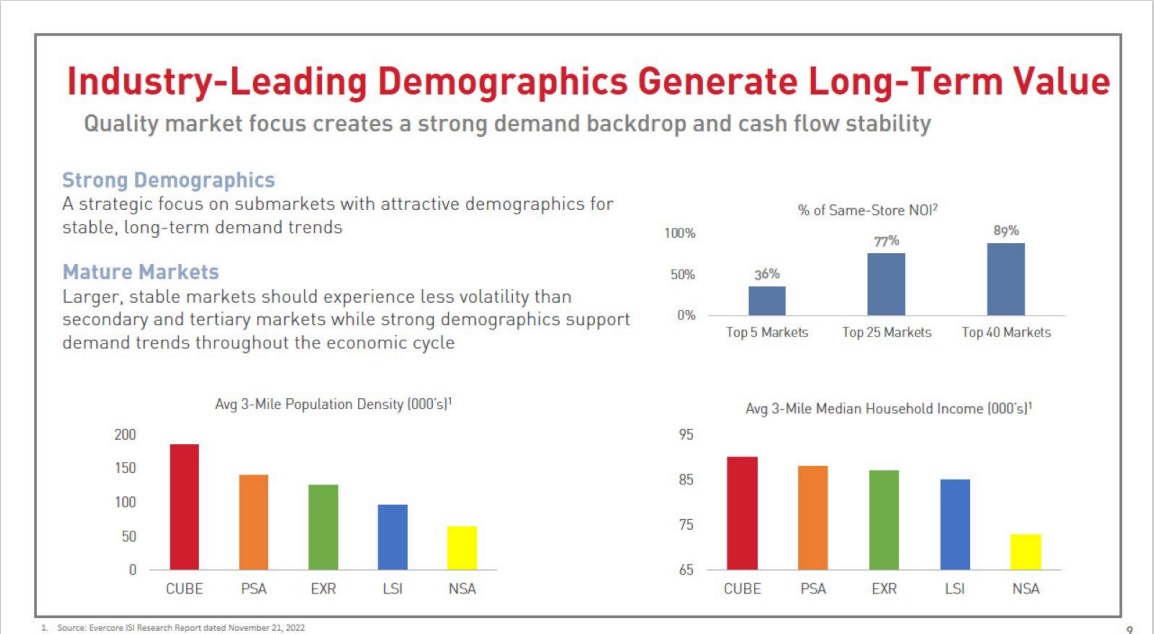

Excessive-Yield REIT No. 8: CubeSmart (CUBE)

CubeSmart is a self-managed REIT targeted totally on the possession, operation, administration, acquisition, and improvement of self-storage properties in the US. The corporate owns 611 self-storage properties, totaling roughly 44.1 million rentable sq. toes within the District of Columbia and 24 different states.

As well as, the corporate manages 663 shops for third events bringing the overall variety of shops that it owns and/or manages to 1,279. CubeSmart has over 340,000 prospects and generated round $1 billion in revenues final 12 months.

Supply: Investor Presentation

On December seventh, 2022, CubeSmart raised its dividend by 14% to a quarterly fee of $0.49. On February twenty third, 2023, CubeSmart reported its This autumn-2022 and full-year outcomes for the interval ending December thirty first, 2022. For the quarter, revenues grew by 9.5% to $200.7 million year-over-year.

Larger revenues have been primarily attributable to elevated rental charges on our same-store portfolio in addition to revenues generated from property acquisitions and lately opened improvement properties.

Particularly, same-store NOI rose 12.1% year-over-year, pushed by 9.5% same-store income development towards only a 2.3% same-store enhance in property working bills. Accordingly, FFO grew by a considerable 72.2% to $152.6 million. Nonetheless, on account of an elevated variety of shares excellent as a useful resource of funds for the corporate’s acquisitions, FFO/share grew by 68% to $0.67. Similar-store occupancy on the finish of This autumn was 92.1%, barely decrease from final 12 months’s 93.3%.

For the 12 months, FFO/share jumped by 19.9% to $2.53. Administration launched its fiscal 2023 steerage, anticipating to attain FFO/share between $2.64 and $2.71. Now we have utilized the midpoint of this vary in our estimates, which suggests year-over-year development of about 6%.

Click on right here to obtain our most up-to-date Positive Evaluation report on CubeSmart (preview of web page 1 of three proven under):

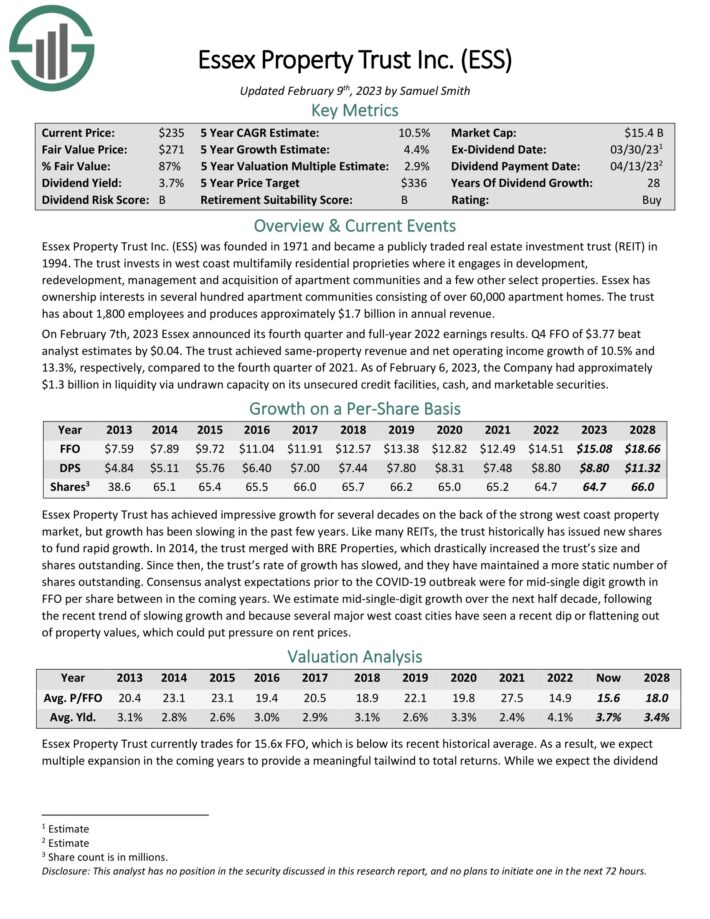

Excessive-Yield REIT No. 7: Essex Property Belief (ESS)

Essex Property Belief was based in 1971. The belief invests in west coast multifamily residential proprieties the place it engages in improvement, redevelopment, administration and acquisition of condo communities and some different choose properties.

Essex has possession pursuits in a number of hundred condo communities consisting of over 60,000 condo houses. The belief has about 1,800 workers and produces roughly $1.6 billion in annual income.

Supply: Investor Presentation

On February seventh, 2023 Essex introduced its fourth quarter and full-year 2022 earnings outcomes. This autumn FFO of $3.77 beat analyst estimates by $0.04. The belief achieved same-property income and web working revenue development of 10.5% and 13.3%, respectively, in comparison with the fourth quarter of 2021.

As of February 6, 2023, the corporate had roughly $1.3 billion in liquidity by way of undrawn capability on its unsecured credit score services, money, and marketable securities.

Click on right here to obtain our most up-to-date Positive Evaluation report on ESS (preview of web page 1 of three proven under):

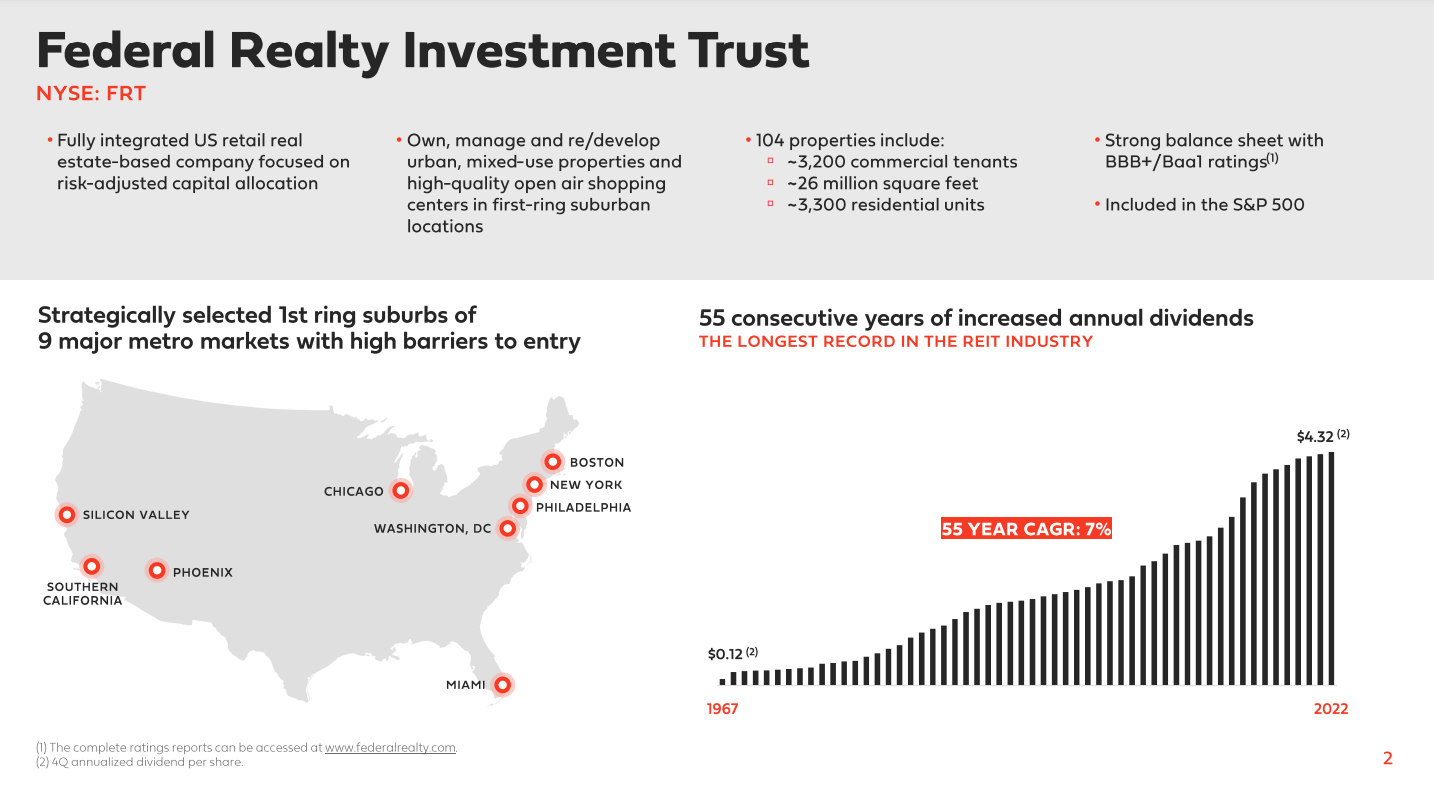

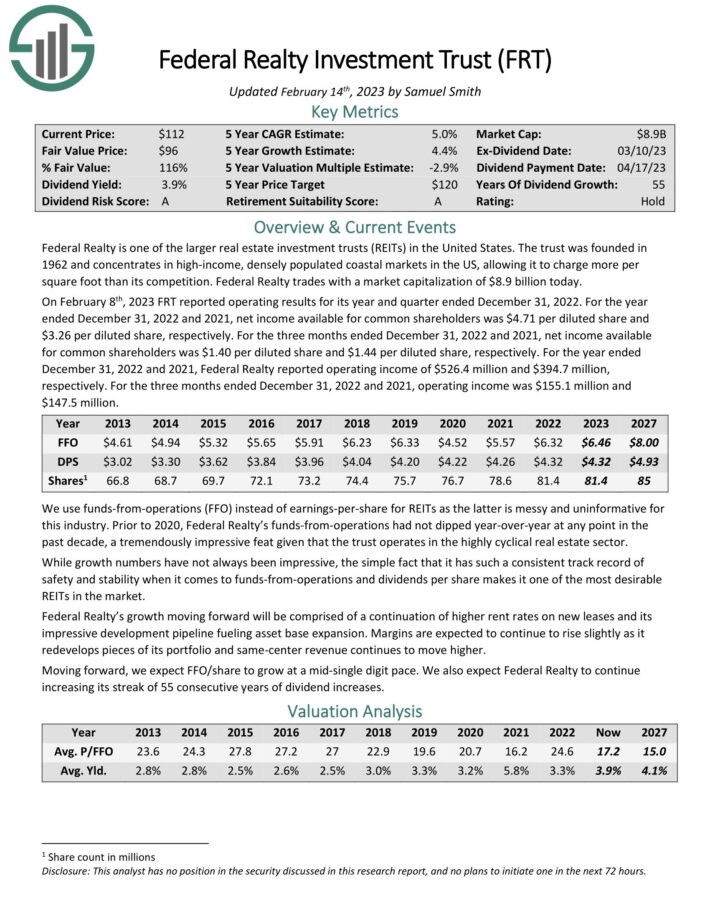

Excessive-Yield REIT No. 6: Federal Realty Funding Belief (FRT)

Federal Realty primarily owns purchasing facilities. Nonetheless, it additionally operates in redevelopment of multi-purpose properties together with retail, flats, and condominiums. The portfolio is extremely diversified by way of tenant base.

Supply: Investor Presentation

On February eighth, 2023 FRT reported working outcomes for its 12 months and quarter ended December 31, 2022. For the 12 months ended December 31, 2022 and 2021, web revenue obtainable for frequent shareholders was $4.71 per diluted share and $3.26 per diluted share, respectively. For the three months ended December 31, 2022 and 2021, web revenue obtainable for frequent shareholders was $1.40 per diluted share and $1.44 per diluted share, respectively.

For the 12 months ended December 31, 2022 and 2021, Federal Realty reported working revenue of $526.4 million and $394.7 million, respectively. For the three months ended December 31, 2022 and 2021, working revenue was $155.1 million and $147.5 million.

FRT has elevated its dividend for over 50 years, making it a Dividend King. It’s the solely Dividend King on the record of protected REITs.

Click on right here to obtain our most up-to-date Positive Evaluation report on Federal Realty (preview of web page 1 of three proven under):

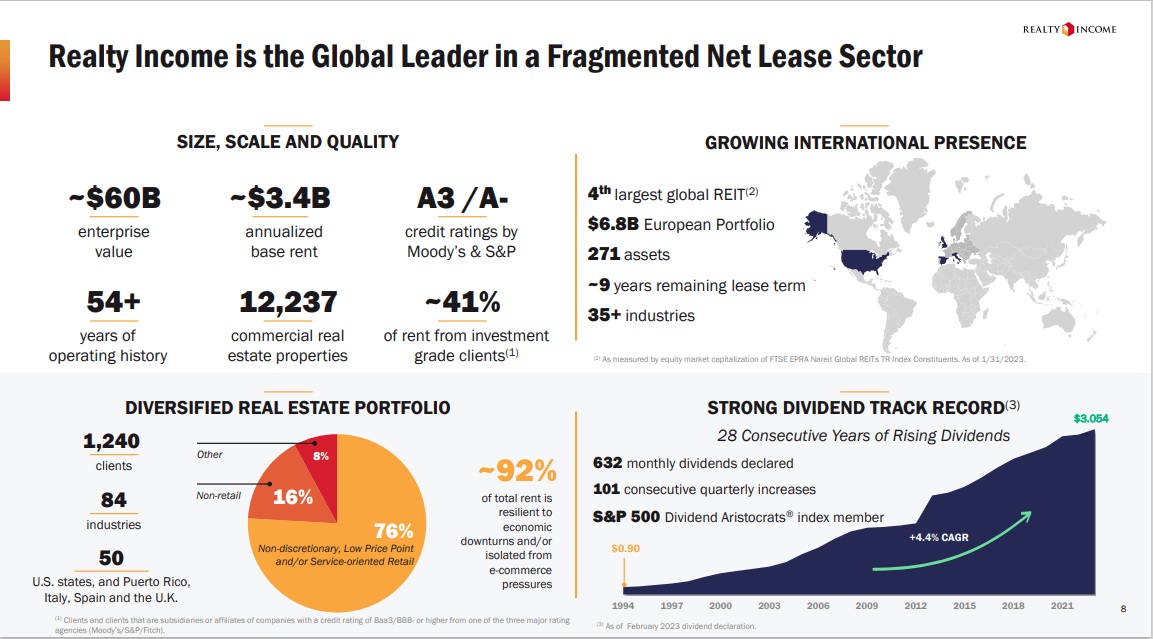

Excessive-Yield REIT No. 5: Realty Revenue (O)

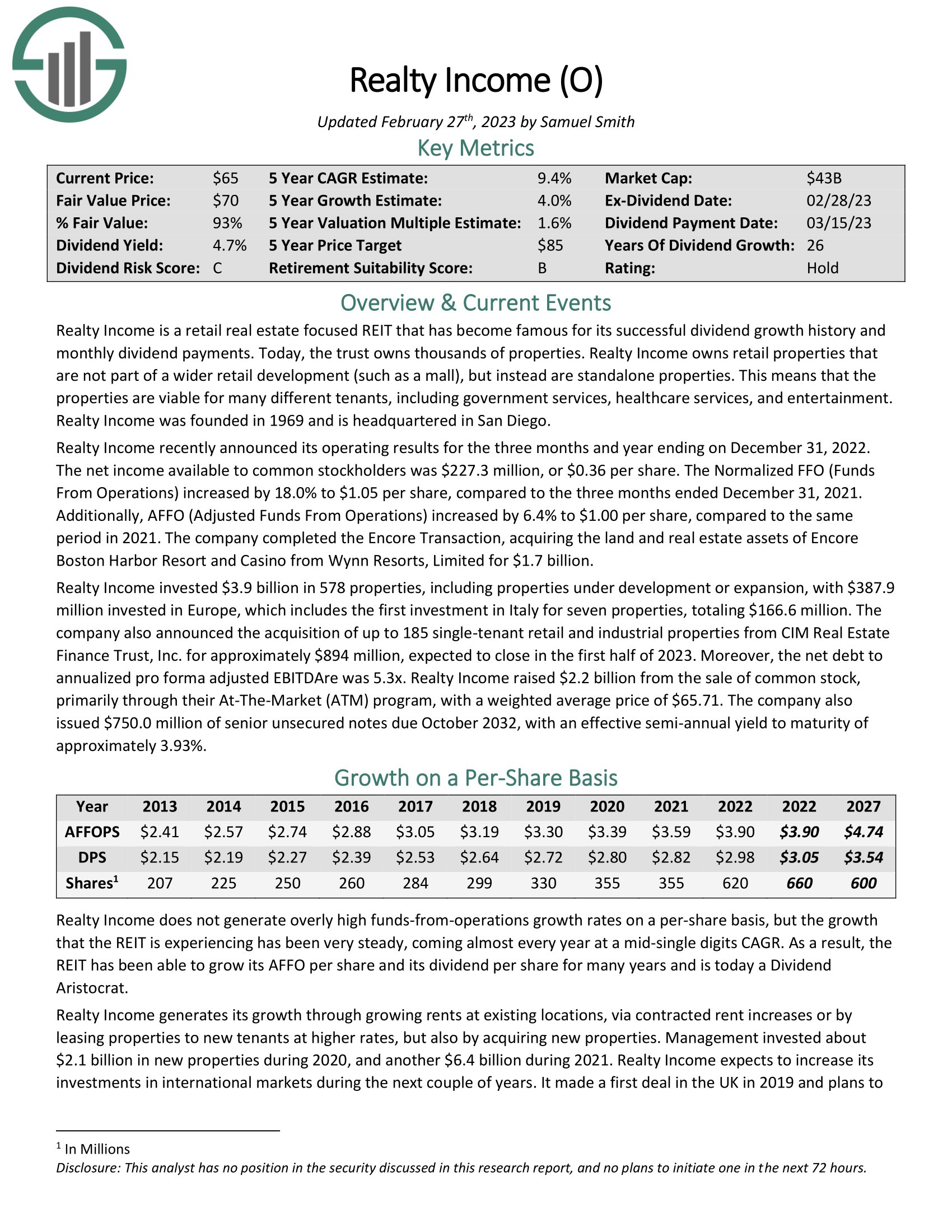

Realty Revenue owns greater than 11,000 properties and has a market capitalization in extra of $40 billion. Realty Revenue focuses on standalone properties reasonably than ones linked to a mall, as an example. That will increase the pliability of the tenant base and helps the belief diversify its buyer base.

The belief has earned a sterling fame for its dividend development historical past. A part of its attraction definitely just isn’t solely in its precise payout historical past however the truth that these payouts are made month-to-month as a substitute of quarterly. Certainly, Realty Revenue has declared 633 consecutive month-to-month dividends, a observe file that’s unprecedented amongst protected REITs.

Impressively, the corporate has elevated its dividend greater than 120 instances since its preliminary public providing in 1994. Consequently, Realty Revenue is a member of the Dividend Aristocrats.

Supply: Investor Presentation

Realty Revenue lately introduced its working outcomes for the three months and 12 months ending on December 31, 2022. The web revenue obtainable to frequent stockholders was $227.3 million, or $0.36 per share. The Normalized FFO (Funds From Operations) elevated by 18.0% to $1.05 per share, in comparison with the three months ended December 31, 2021.

Moreover, AFFO (Adjusted Funds From Operations) elevated by 6.4% to $1.00 per share, in comparison with the identical interval in 2021. The corporate accomplished the Encore Transaction, buying the land and actual property belongings of Encore Boston Harbor Resort and On line casino from Wynn Resorts, Restricted for $1.7 billion.

Realty Revenue invested $3.9 billion in 578 properties, together with properties below improvement or growth, with $387.9 million invested in Europe, which incorporates the primary funding in Italy for seven properties, totaling $166.6 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on O (preview of web page 1 of three proven under):

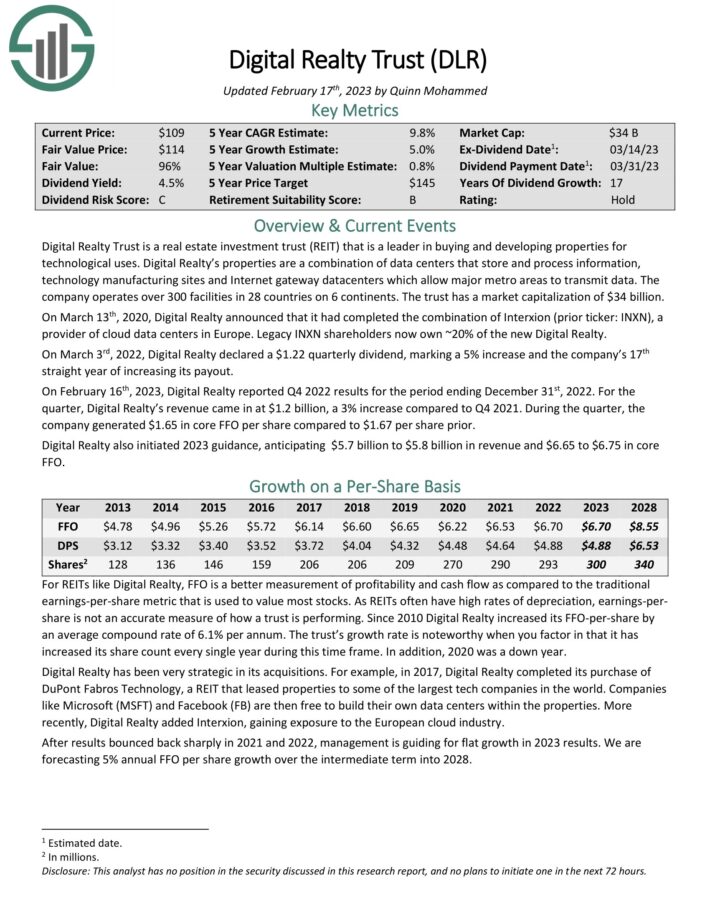

Excessive-Yield REIT No. 4: Digital Realty Belief (DLR)

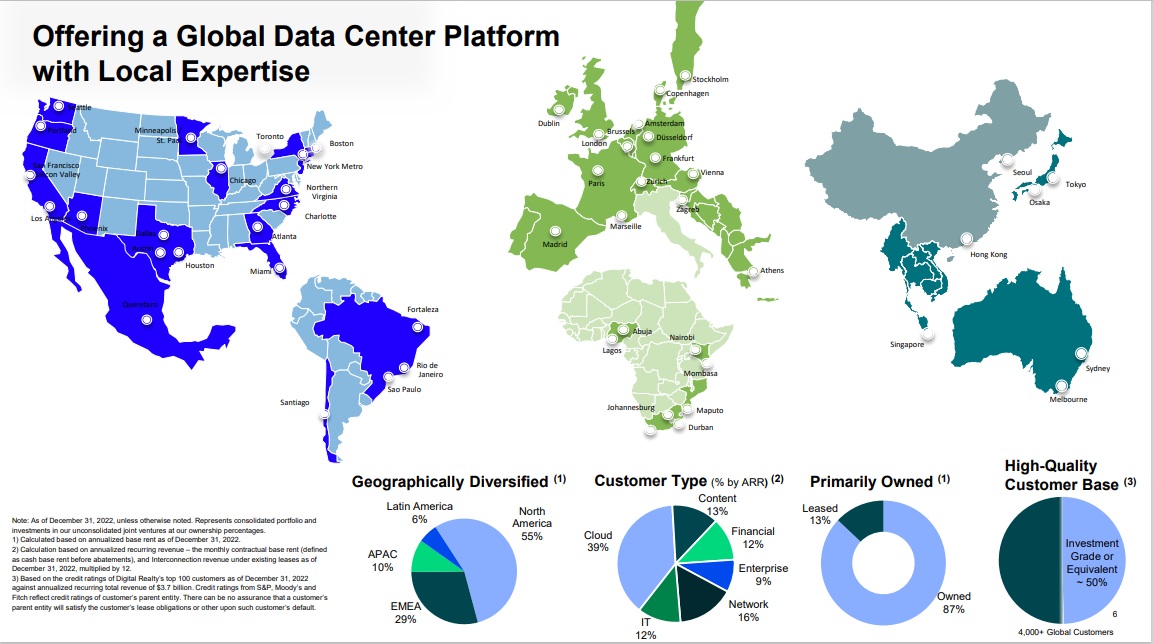

Digital Realty Belief is a REIT that may be a chief in shopping for and growing properties for technological makes use of. Digital Realty’s properties are a mix of knowledge facilities that retailer and course of info, expertise manufacturing websites and Web gateway knowledge facilities which permit main metro areas to transmit knowledge. The corporate operates over 300 services in 28 nations on 6 continents.

Supply: Investor Presentation

On March third, 2022, Digital Realty declared a $1.22 quarterly dividend, marking a 5% enhance and the corporate’s seventeenth straight 12 months of accelerating its payout. On February sixteenth, 2023, Digital Realty reported This autumn 2022 outcomes for the interval ending December thirty first, 2022.

For the quarter, Digital Realty’s income got here in at $1.2 billion, a 3% enhance in comparison with This autumn 2021. In the course of the quarter, the corporate generated $1.65 in core FFO per share in comparison with $1.67 per share prior. Digital Realty additionally initiated 2023 steerage, anticipating $5.7 billion to $5.8 billion in income and $6.65 to $6.75 in core FFO.

Digital Realty is exclusive amongst protected REITs in that it gives publicity to the expertise sector.

Click on right here to obtain our most up-to-date Positive Evaluation report on Digital Realty (preview of web page 1 of three proven under):

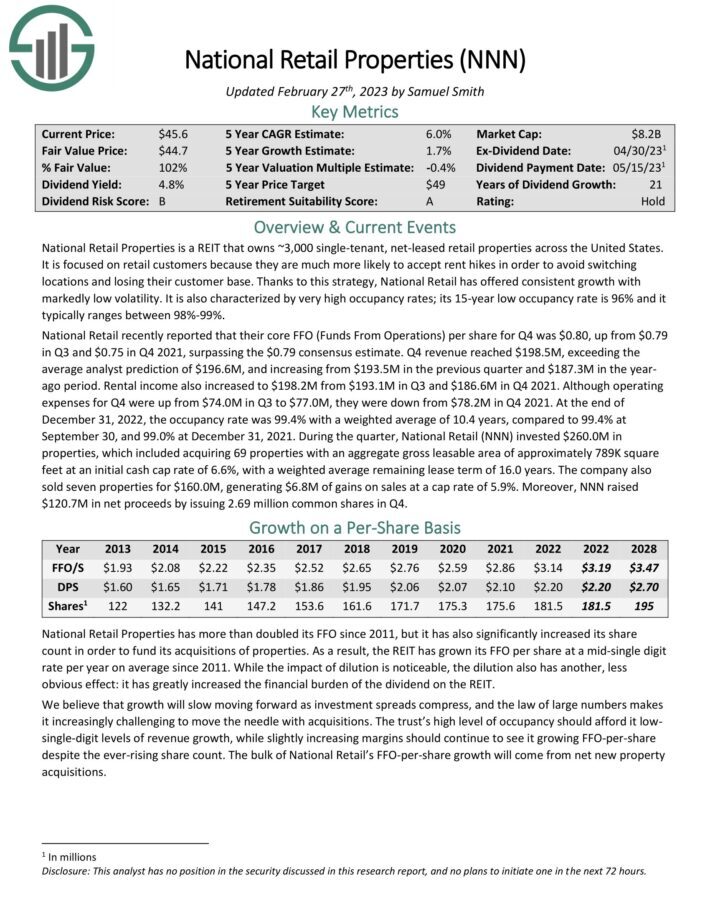

Excessive-Yield REIT No. 3: Nationwide Retail Properties (NNN)

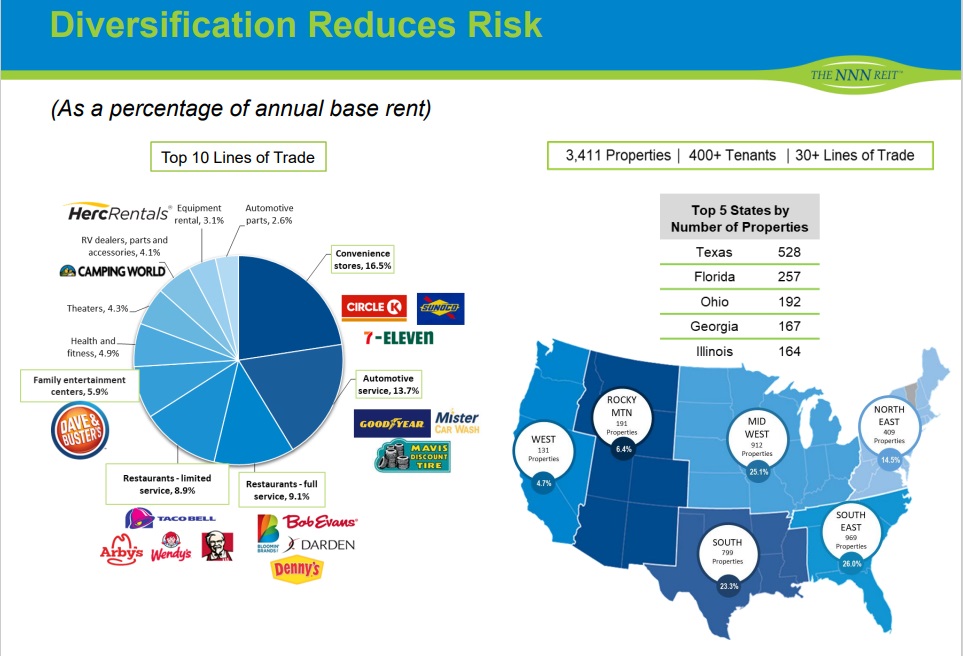

Nationwide Retail Properties is on the record of protected REITs because it owns ~3,000 single-tenant, net-leased retail properties throughout the US. It’s targeted on retail prospects as a result of they’re much extra more likely to settle for hire hikes to be able to keep away from switching places and shedding their buyer base.

Because of this technique, Nationwide Retail has provided constant development with markedly low volatility. It is usually characterised by very excessive occupancy charges; its 15-year low occupancy fee is 96% and it usually ranges between 98%-99%. This is likely one of the strongest occupancy charges among the many protected REITs.

Supply: Investor Presentation

Nationwide Retail lately reported that their core FFO (Funds From Operations) per share for This autumn was $0.80, up from $0.79 in Q3 and $0.75 in This autumn 2021, surpassing the $0.79 consensus estimate. This autumn income reached $198.5M, exceeding the common analyst prediction of $196.6M, and growing from $193.5M within the earlier quarter and $187.3M within the yearago interval.

Rental revenue additionally elevated to $198.2M from $193.1M in Q3 and $186.6M in This autumn 2021. Though working bills for This autumn have been up from $74.0M in Q3 to $77.0M, they have been down from $78.2M in This autumn 2021.

On the finish of December 31, 2022, the occupancy fee was 99.4% with a weighted common of 10.4 years, in comparison with 99.4% at September 30, and 99.0% at December 31, 2021. In the course of the quarter, Nationwide Retail (NNN) invested $260.0M in properties, which included buying 69 properties with an combination gross leasable space of roughly 789K sq. toes at an preliminary money cap fee of 6.6%, with a weighted common remaining lease time period of 16.0 years. The corporate additionally bought seven properties for $160.0M, producing $6.8M of positive aspects on gross sales at a cap fee of 5.9%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NNN (preview of web page 1 of three proven under):

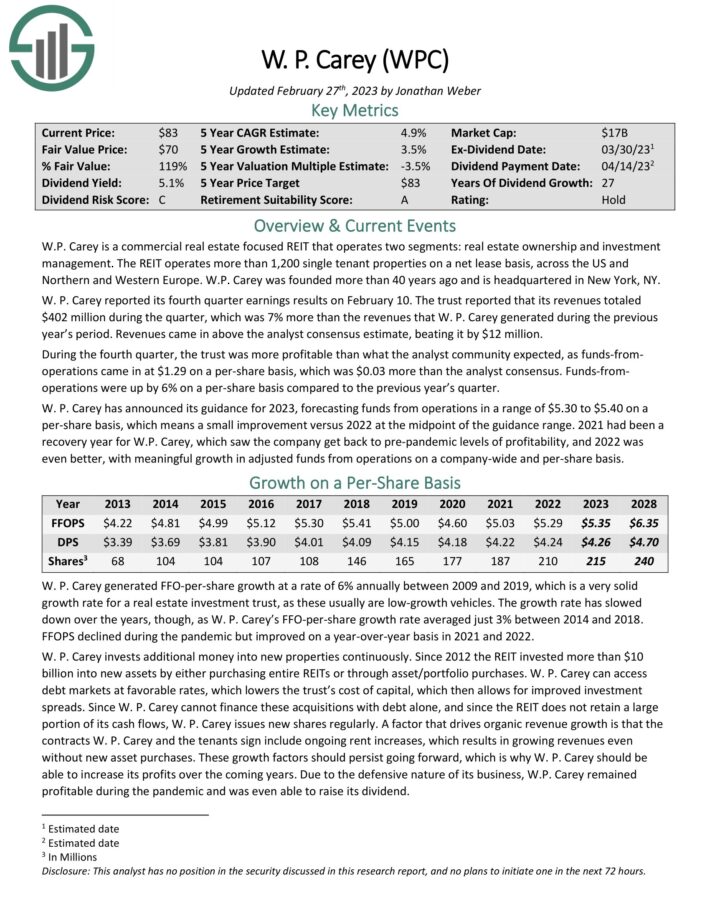

Excessive-Yield REIT No. 2: W.P. Carey (WPC)

W.P. Carey is a Actual Property Funding Belief (or REIT) with two segments: actual property possession and funding administration. The previous is the a lot bigger of the enterprise, with greater than 1,200 single-tenant properties throughout the U.S. and Northern and Western Europe.

W. P. Carey reported its fourth quarter earnings outcomes on February 10. The belief reported that its revenues totaled $402 million throughout the quarter, which was 7% greater than the revenues that W. P. Carey generated throughout the earlier 12 months’s interval. Revenues got here in above the analyst consensus estimate by $12 million.

In the course of the fourth quarter, funds-from operations got here in at $1.29 on a per-share foundation, which was $0.03 greater than the analyst consensus. Funds-from operations have been up by 6% on a per-share foundation in comparison with the earlier 12 months’s quarter.

W. P. Carey has introduced its steerage for 2023, forecasting funds from operations in a spread of $5.30 to $5.40 on a per-share foundation, which implies a small enchancment versus 2022 on the midpoint of the steerage vary.

The belief has spent greater than $10 billion over the past decade buying properties to develop its portfolio. A lot of this acquisition spree has been by means of using share issuance, because the share depend has almost tripled since 2012. That being the case, development has been very regular for W.P. Carey even because the float has gotten bigger.

W.P. Carey raises its dividend barely each quarter, although the five-year CAGR is below 1%. Even so, the inventory has a dividend development streak of 28 years, one of many longest streaks among the many protected REITs.

Click on right here to obtain our most up-to-date Positive Evaluation report on W. P. Carey (WPC) (preview of web page 1 of three proven under):

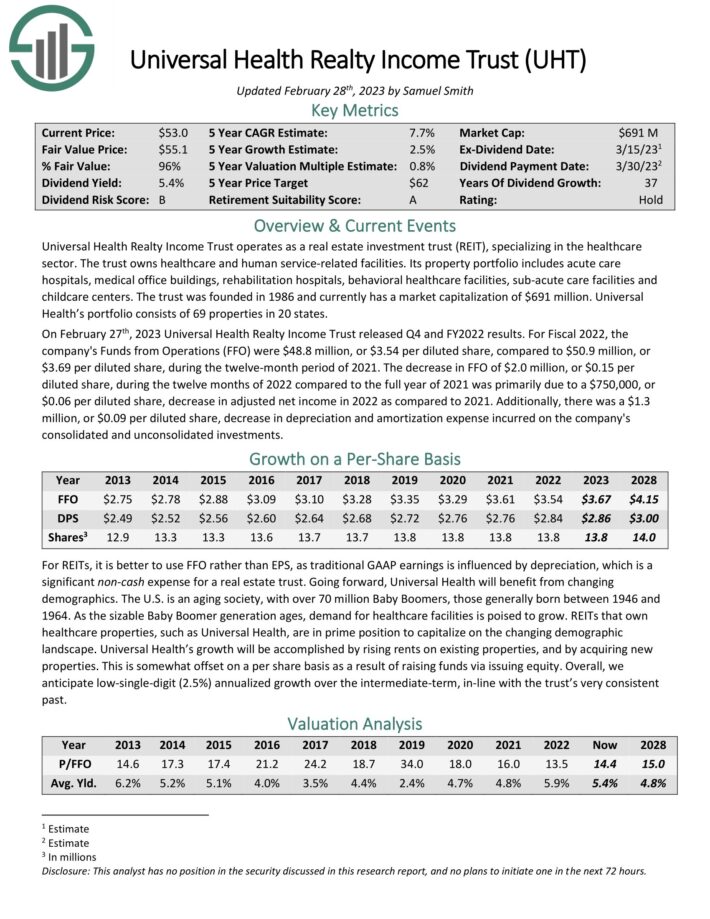

Excessive-Yield REIT No. 1: Common Well being Realty Revenue Belief (UHT)

Common Well being Realty Revenue Belief specializes within the healthcare sector. The belief owns healthcare and human service-related services. Its property portfolio consists of acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare services, sub-acute care services and childcare facilities. Common Well being’s portfolio consists of 69 properties in 20 states.

On February twenty seventh, 2023 Common Well being Realty Revenue Belief launched This autumn and FY2022 outcomes. For Fiscal 2022, the corporate’s Funds from Operations (FFO) have been $48.8 million, or $3.54 per diluted share, in comparison with $50.9 million, or $3.69 per diluted share, throughout the twelve-month interval of 2021.

Going ahead, Common Well being will profit from altering demographics. The U.S. is an growing old society, with over 70 million Child Boomers, these usually born between 1946 and 1964. Because the sizable Child Boomer era ages, demand for healthcare services is poised to develop.

Protected REITs that personal healthcare properties, reminiscent of Common Well being, are in prime place to capitalize on the altering demographic panorama. Common Well being’s development might be achieved by rising rents on current properties, and by buying new properties.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven under):

Remaining Ideas

REITs are enticing for revenue buyers as they usually have excessive dividend yields. Nonetheless, revenue buyers must also choose protected REITs which have the flexibility to pay their dividends, even when a recession happens over the subsequent 12 months. These 9 protected REITs have manageable debt ranges, ample money circulation to pay their dividends, and have excessive yields.

If you’re fascinated by discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link