[ad_1]

Revealed on January tenth, 2023 by Aristofanis Papadatos

Oil and gasoline royalty trusts got here below excessive strain in 2020 because of the coronavirus disaster and the resultant collapse of the costs of oil and gasoline. All of them diminished their distributions sharply and a few of them suspended their distributions for a number of months.

Nevertheless, because the power market recovered from the pandemic in 2021, these trusts started to get better. Even higher for them, the invasion of Russia in Ukraine and the resultant sanctions of western international locations on Russia triggered a steep rally within the costs of oil and gasoline in 2022.

Consequently, oil and gasoline trusts at the moment are providing exceptionally excessive distributions to their unitholders, leading to a lot larger yields than the 1.6% dividend yield of the S&P 500.

We’ve got created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You may obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we’ll talk about the prospects of the 8 highest-yielding royalty trusts.

Desk of Contents

You may immediately soar to any particular part of the article by utilizing the hyperlinks beneath:

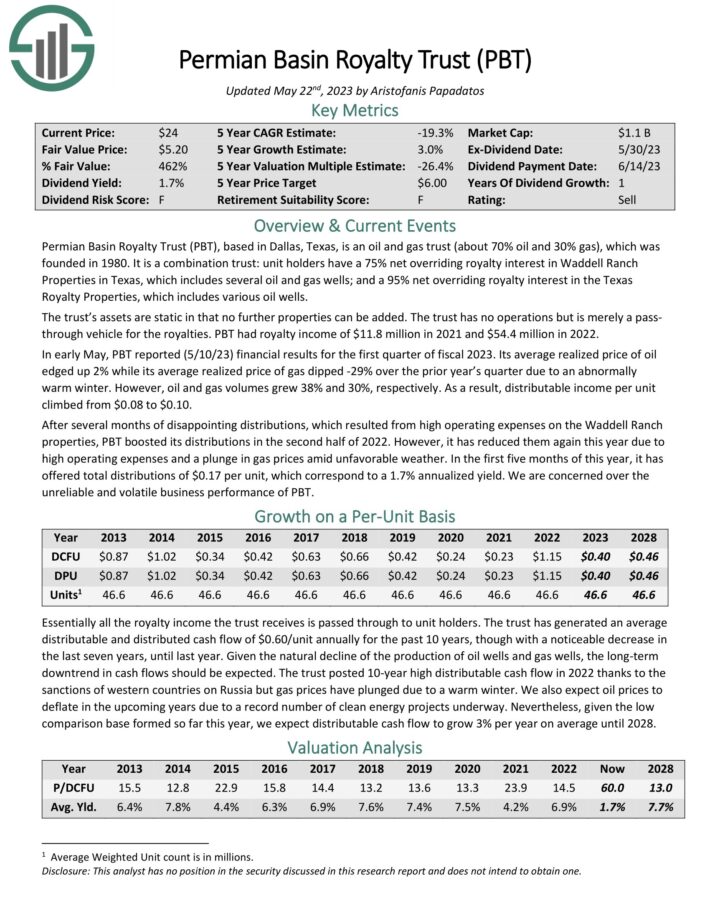

Excessive-Yield Royalty Belief No. 8: Permian Basin Royalty Belief (PBT)

Based in 1980, Permian Basin Royalty Belief is predicated in Dallas, Texas, and is an oil and gasoline belief (about 70% oil and 30% gasoline). Its unitholders have a 75% internet overriding royalty curiosity in Waddell Ranch Properties in Texas, which incorporates 332 internet productive oil wells, 106 internet productive gasoline wells and 120 internet injection wells; and a 95% internet overriding royalty curiosity within the Texas Royalty Properties, which incorporates numerous oil wells.

The belief is severely harm by the pure decline of its manufacturing. Over the past six years, the manufacturing of oil and gasoline of the belief has declined at a mean annual price of -6% and -2%, respectively.

Click on right here to obtain our most up-to-date Certain Evaluation report on Permian Basin Royalty Belief (PBT) (preview of web page 1 of three proven beneath):

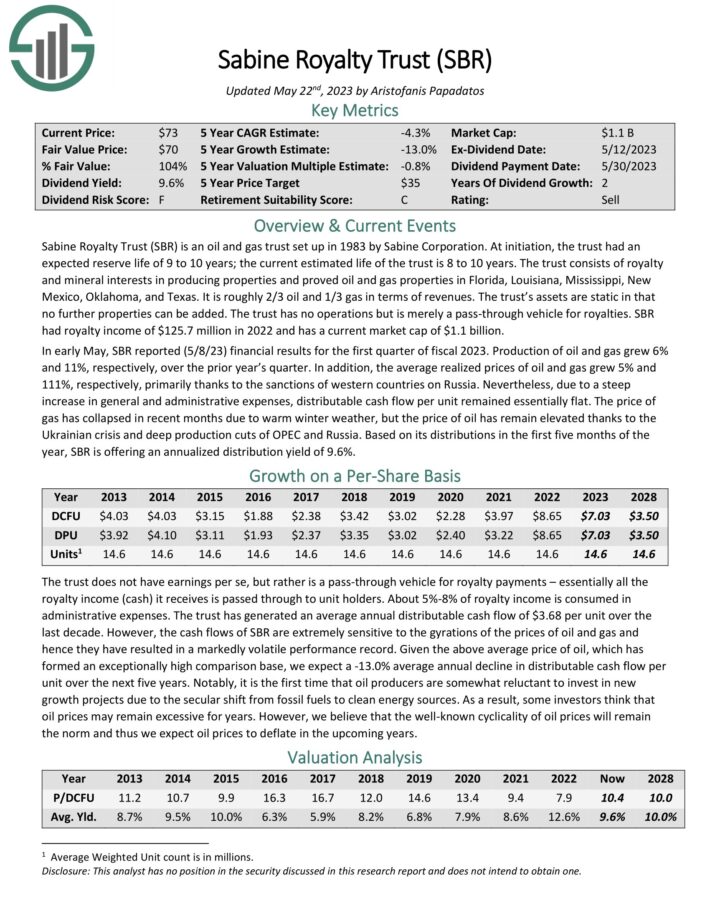

Excessive-Yield Royalty Belief No. 7: Sabine Royalty Belief (SBR)

Sabine Royalty Belief is an oil and gasoline belief that was fashioned in 1983 by Sabine Company. It consists of royalty and mineral pursuits in producing properties and proved oil and gasoline properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It generates roughly two-thirds of its revenues from oil and one-third of its revenues from gasoline. The belief has static belongings, i.e., it can’t add new properties to its asset portfolio. Sabine Royalty Belief has no operations however is merely a pass-through automobile for royalties.

All of the oil and gasoline trusts face a powerful secular headwind, particularly the pure decline of their producing wells. As a result of this decline, their manufacturing is predicted to lower in the long term. Sabine Royalty Belief has proved superior on this side. When it was arrange, 40 years in the past, it was anticipated to have a lifetime of 8-10 years. Nevertheless, it’s nonetheless producing significant volumes and is predicted to stay in life for greater than a decade.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sabine Royalty Belief (SBR) (preview of web page 1 of three proven beneath):

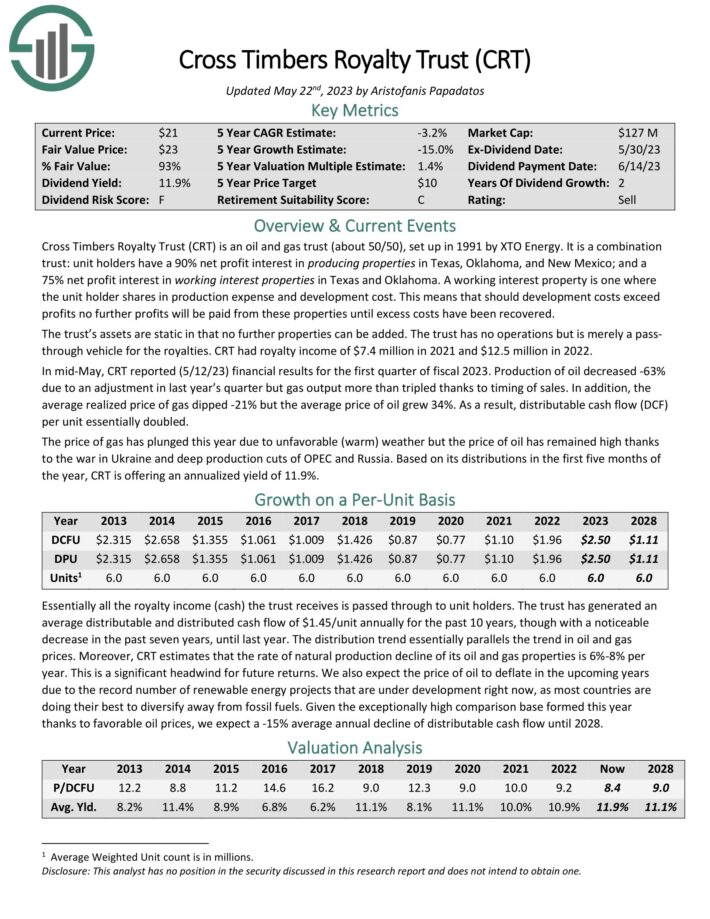

Excessive-Yield Royalty Belief No. 6: Cross Timbers Royalty Belief (CRT)

Cross Timbers Royalty Belief is an oil and gasoline belief (about 50/50), arrange in 1991 by XTO Power. Its unitholders have a 90% internet revenue curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% internet revenue curiosity in working curiosity properties in Texas and Oklahoma. A working curiosity property is one the place the unitholder shares in manufacturing expense and growth value. Which means the belief doesn’t provide any distributions to its unitholders when its growth prices exceed its revenues.

Cross Timbers Royalty Belief estimates that the speed of pure manufacturing decline of its oil and gasoline properties is 6%-8% per 12 months. It is a vital headwind for future returns.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cross Timbers Royalty Belief (CRT) (preview of web page 1 of three proven beneath):

Excessive-Yield Royalty Belief No. 5: MV Oil Belief (MVO)

MV Oil Belief acquires and holds internet income pursuits within the oil and pure gasoline properties of MV Companions, LLC. Its properties embody about 860 producing oil and gasoline wells situated within the Mid-Continent area within the states of Kansas and Colorado. The belief was fashioned in 2006 and is predicated in Houston, Texas.

MV Oil Belief has related traits to BP Prudhoe Bay Royalty Belief. In distinction to the opposite trusts, MV Oil Belief pays its distributions each quarter, not each month. As well as, it has proved extremely weak to the pure decline of its producing wells. Regardless of the exceptionally favorable commodity costs final 12 months, the belief supplied whole distributions of $2.21, which had been 38% decrease than the distributions of $3.55 supplied in 2012. Primarily based on its newest distribution, the inventory is presently providing a ahead distribution yield of 11.1% however it’s more likely to slash its distributions within the upcoming quarters because of the correction of commodity costs.

On the brilliant aspect, this efficiency of MV Oil Belief is a lot better than the aforementioned efficiency of BP Prudhoe Bay Royalty Belief. It’s also price noting that MV Oil Belief suspended its distributions for just one quarter in 2020 because of the pandemic. General, MV Oil Belief has exhibited respectable enterprise efficiency during the last decade however it’s undoubtedly weak to the key headwinds dealing with the oil and gasoline trusts, particularly the downturns in oil and gasoline costs and the pure decline of manufacturing.

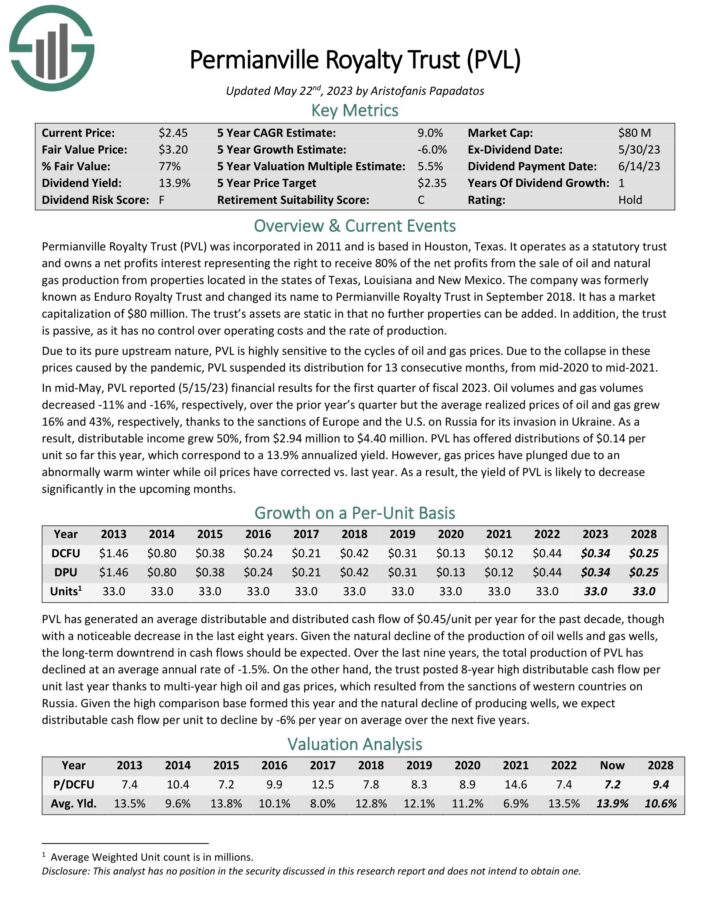

Excessive-Yield Royalty Belief No. 4: Permianville Royalty Belief (PVL)

Permianville Royalty Belief was included in 2011 and is predicated in Houston, Texas. It operates as a statutory belief and owns a internet income curiosity representing the best to obtain 80% of the web income from the sale of oil and pure gasoline manufacturing from properties situated within the states of Texas, Louisiana and New Mexico. The corporate was previously generally known as Enduro Royalty Belief and altered its title to Permianville Royalty Belief in September 2018.

Permianville Royalty Belief has proved extra weak than most royalty trusts to the downturns of the power market. Because of the collapse within the costs of oil and gasoline attributable to the pandemic, Permianville Royalty Belief suspended its distributions for 13 consecutive months, from mid-2020 to mid-2021. Given additionally the 86% plunge of the inventory of Permianville Royalty Belief in 2020 because of the pandemic, it’s evident that the belief is extremely unstable and weak to the cycles of oil and gasoline costs.

Regardless of the 13-year excessive oil and gasoline costs that prevailed final 12 months, the entire distributions of $0.44 of Permianville Royalty Belief had been far decrease than the annual distributions of the belief in 2012-2014. The belief suffers from the pure decline of its producing wells. Over the past eight years, the entire manufacturing of Permianville Royalty Belief has declined at a mean annual price of 6%. Such a decline price weighs closely on future development prospects. General, Permianville Royalty Belief is extremely dangerous and therefore traders ought to contemplate buying it solely throughout extreme downturns.

Click on right here to obtain our most up-to-date Certain Evaluation report on Permianville Royalty Belief (PVL) (preview of web page 1 of three proven beneath):

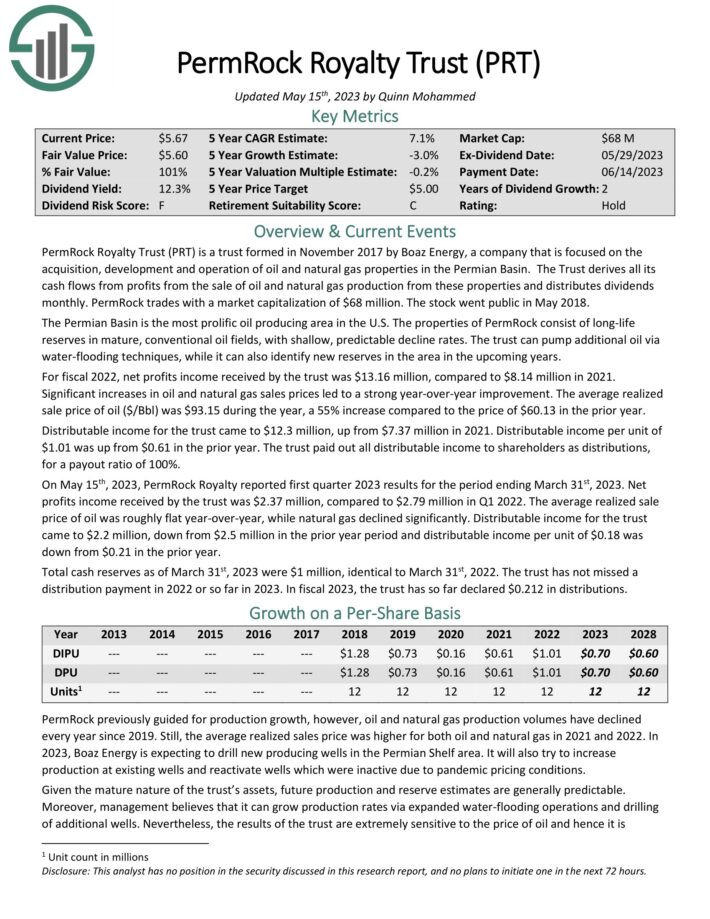

Excessive-Yield Royalty Belief No. 3: PermRock Royalty Belief (PRT)

PermRock Royalty Belief is a belief fashioned in late 2017 by Boaz Power, an organization that’s targeted on the acquisition, growth and operation of oil and pure gasoline properties within the Permian Basin. The Belief advantages from the distinctive traits of the Permian Basin, which is probably the most prolific oil producing space within the U.S. The properties of PermRock encompass long-life reserves in mature, standard oil fields, with shallow, predictable decline charges.

PermRock expects to drill new producing wells within the Permian Shelf space. It’ll additionally attempt to develop its manufacturing at current wells and reactivate wells which had been inactivated because of the hunch of commodity costs throughout the pandemic. Nonetheless, it is very important notice that the manufacturing of PermRock has declined in every of the final three years.

Click on right here to obtain our most up-to-date Certain Evaluation report on PermRock Royalty Belief (PRT) (preview of web page 1 of three proven beneath):

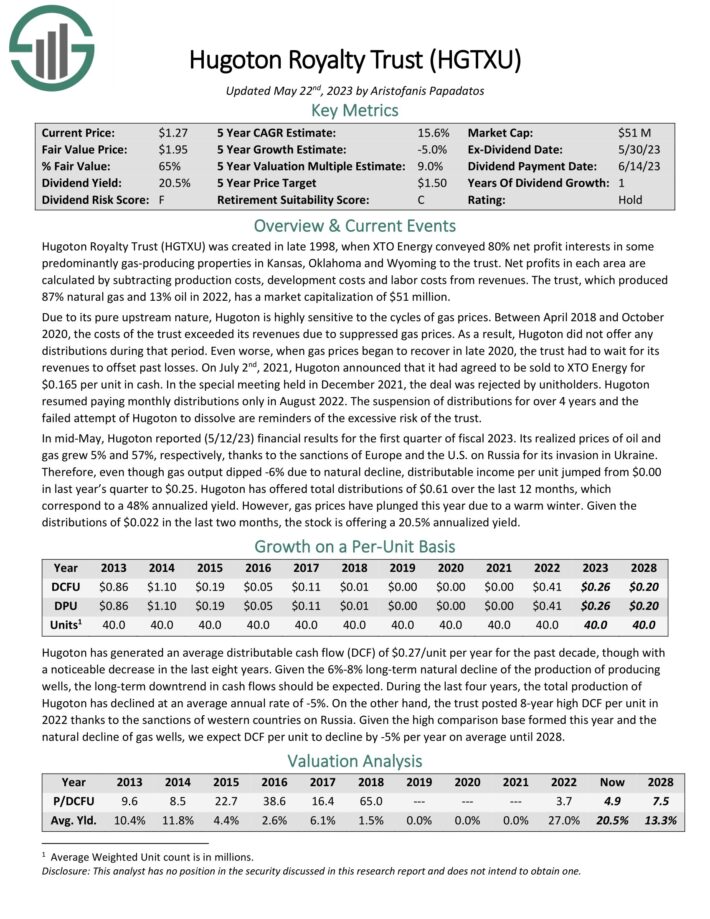

Excessive-Yield Royalty Belief No. 2: Hugoton Royalty Belief (HGTXU)

Hugoton Royalty Belief was created in late 1998, when XTO Power conveyed 80% internet revenue pursuits in some predominantly gas-producing properties in Kansas, Oklahoma and Wyoming to the belief. Web income in every space are calculated by subtracting manufacturing prices, growth prices and labor prices from revenues. The belief produced 88% pure gasoline and 12% oil in 2021.

Because of the exceptionally favorable circumstances within the U.S. pure gasoline market, Hugoton is providing a really yield of 25.2%. Nonetheless, as talked about above, gasoline costs have deflated currently. Given additionally the confirmed vulnerability of Hugoton to downturns, it’s pure that the market has punished the inventory with a ~50% plunge off its peak, in August, which has resulted within the abnormally excessive distribution yield of the belief. It’s prudent for traders to count on a lot decrease distributions going ahead.

Click on right here to obtain our most up-to-date Certain Evaluation report on Hugoton Royalty Belief (HGTXU) (preview of web page 1 of three proven beneath):

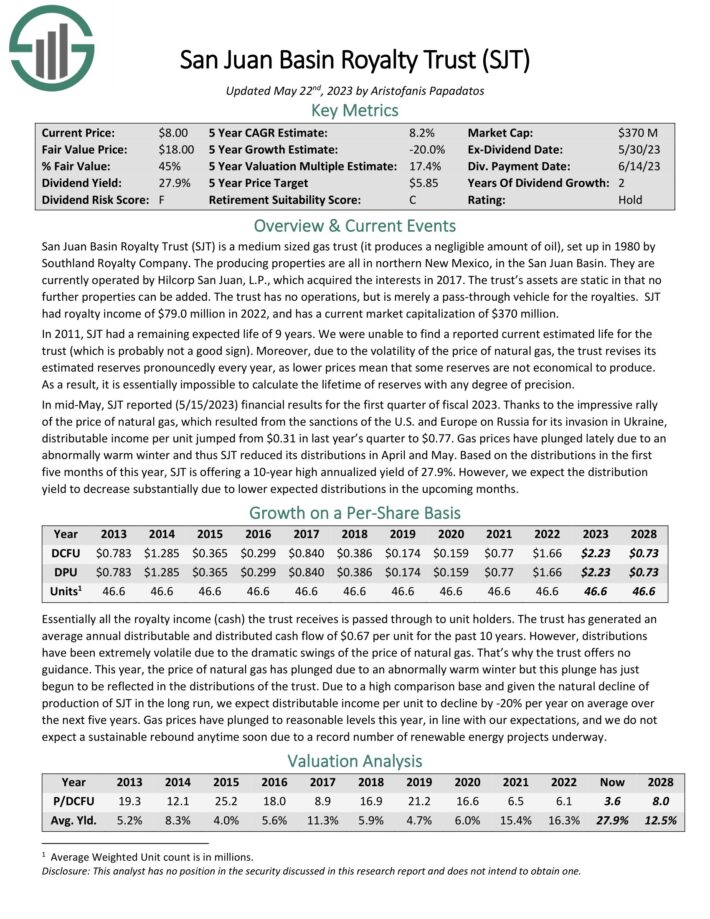

Excessive-Yield Royalty Belief No. 1: San Juan Basin Royalty Belief (SJT)

San Juan Basin Royalty Belief is a medium sized gasoline belief, which was arrange 40 years in the past by Southland Royalty Firm. The manufacturing properties are all in northern New Mexico, within the San Juan Basin.

San Juan Basin Royalty Belief has a key distinction from the opposite royalty trusts. It produces a negligible quantity of oil and thus its outcomes are affected solely by the cycles of the value of pure gasoline. Because of favorable gasoline costs, San Juan Basin Royalty Belief greater than doubled its annual distribution, from $0.77 in 2021 to a 10-year excessive of $1.71 in 2022. The present yield is 26.5%.

Nevertheless, it is very important notice that U.S. gasoline costs have slumped beneath pre-war ranges currently, as the worldwide gasoline market appears to have lastly absorbed the impact of the Ukrainian disaster. Due to this fact, San Juan Basin Royalty Belief is more likely to slash its distributions sharply within the upcoming months.

Click on right here to obtain our most up-to-date Certain Evaluation report on San Juan Basin Royalty Belief (SJT) (preview of web page 1 of three proven beneath):

Closing Ideas

All of the oil and gasoline trusts thrived in 2022 because of the exceptionally excessive costs of oil and gasoline, which resulted from the sanctions of western international locations on Russia. All of the trusts supplied multi-year excessive distributions to their unitholders and thus their 12-month trailing distribution yields are exceptionally excessive.

Nevertheless, oil and gasoline costs are notorious for his or her dramatic swings and have already returned beneath their stage simply earlier than the onset of the Ukrainian disaster. Due to this fact, traders must be ready for a lot decrease distributions from royalty trusts going ahead. They need to additionally pay attention to the extreme threat of all these trusts close to the height of their cycle. The best time to purchase these trusts is throughout a extreme downturn of the power sector, when these shares plunge and thus develop into deeply undervalued from a long-term perspective.

As talked about above, all of the oil and gasoline trusts are extremely dangerous because of the pure decline of their manufacturing and their sensitivity to the costs of oil and gasoline. Sabine Royalty Belief is the belief which has proved probably the most resilient to those threat components all through its historical past.

If you’re interested by discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link