[ad_1]

Printed by Nathan Parsh on November eleventh, 2022

Rate of interest hikes have dominated monetary dialog because the Federal Open Market Committee (FOMC) started elevating the fed funds goal fee in March of this 12 months. The Federal Reserve has a twin mandate set by Congress to maintain costs secure and maximize employment.

The Shopper Value Index (CPI) has reached ranges not seen because the Eighties. There have been quite a lot of elements that led the yearly inflation fee to hit a excessive of 9.1% in June, together with ongoing provide constraints associated to COVID-19 and the sanctions on Russian following that nation’s invasion of Ukraine. Rising wages within the U.S. as companies have scrambled to fill what has been, at instances, multiple million open jobs have additionally performed a task within the improve in primary wants starting from power to meals to housing.

To be able to tame inflation, the Federal Reserve has the federal funds fee six instances already in 2022. The final 4 have been of the 75-basis level selection. The goal federal funds fee is now 3.75% to 4.00%.

A fast historic evaluation of fee hikes. The quantity and dimension of the will increase in 2022 could not appear important, but it surely ought to be famous that charges have been stored at or close to 0% from December 2008 to November 2015 because the economic system handled the aftermath of the Nice Recession.

Previous to 2022, the final time that fee hikes occurred on a month-to-month foundation was in June of 2006, which was the eve of what’s presumably the worst recession because the Nice Melancholy. The dimensions of the final 4 will increase can be larger than any since at the least 1990. Merely put, the Fed’s tempo and dimension of rate of interest hikes have been unprecedented over the previous three a long time.

These hikes intention to shortly get inflation down from its present degree of 8.2% as of September to the Fed’s goal fee of two.0%. Inflation eats into buying energy, which might finally result in a recession as shoppers can purchase fewer items and companies per unit of foreign money.

The rising rate of interest might additionally trigger a recession because the Fed overreaches and chokes off development fully. Firms have largely been borrowing capital at traditionally low charges for a lot of the final 15 years, serving to them to increase their companies and rent extra staff.

With the next federal funds fee comes larger borrowing prices. This might make companies which are closely indebted, must refinance expiring debt, or usually use debt issuance to fund development probably expertise some ache, which might result in a recession.

There are, nevertheless, sectors of the economic system the place rising rates of interest could possibly be a tailwind. The monetary sector, notably the banking trade, ought to be a main beneficiary of fee hikes as this immediately impacts their internet curiosity earnings. If an organization is incomes extra on its loans whereas paying its depositors the identical or perhaps a barely larger fee for financial savings accounts, checking accounts, and CDs, then internet curiosity earnings goes to rise.

This text will study eight firms which are seeing a fabric profit from rate of interest hikes, all of which pay dividends to shareholders and have a purchase ranking from Positive Dividend.

With that in thoughts, we’ve compiled a listing of greater than 200 monetary shares, together with necessary investing metrics. The database is accessible for obtain beneath:

Dividend Inventory for Rising Curiosity Charges #1: JPMorgan & Chase Co. (JPM)

Our first inventory is JPMorgan, which was based in 1799 as the primary industrial financial institution within the U.S. Since then, the corporate has grown into a worldwide banking behemoth with a market capitalization of $386 billion that has annual gross sales of practically $130 billion. JPMorgan competes in each main phase of economic companies, together with shopper banking, industrial banking, house lending, bank cards, asset administration, and funding banking.

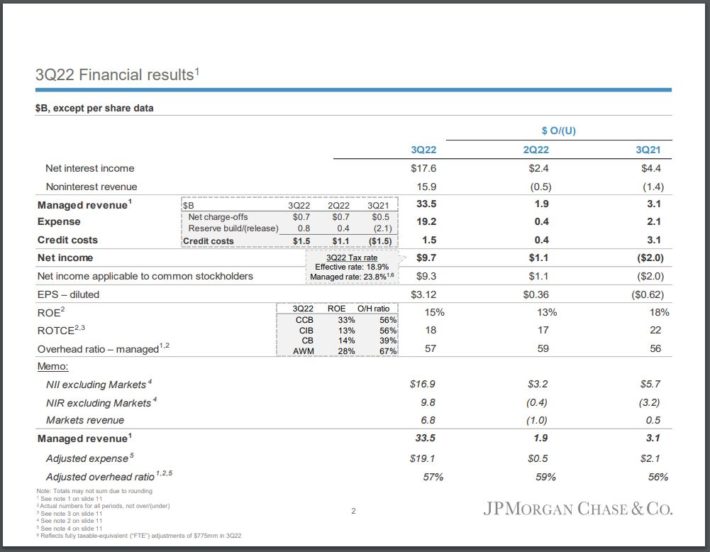

Supply: Investor Presentation

JPMorgan reported third-quarter earnings outcomes on October 14th, 2022. Income grew 10% to $32.7 billion, whereas earnings-per-share of $3.12 was decrease than the prior 12 months however above analysts’ estimates.

Web curiosity earnings of $17.5 billion in contrast favorably to $15.1 billion within the second quarter of 2022 and $13.1 billion within the third quarter of 2021. Loans of $1.11 trillion have been flat on a sequential foundation. The corporate expects internet curiosity earnings of $19 billion for the fourth quarter and near $66 billion for the 12 months. If achieved, JPMorgan’s internet curiosity earnings for 2022 could be a 25% enchancment from the prior 12 months.

Following the outcomes, we reiterate our 6% earnings development forecast for JPMorgan by means of 2027.

JPMorgan at present yields 3.0%, has raised its dividend for 11 consecutive years, and has a projected payout ratio of 35% for the 12 months. The inventory’s yield is nearly twice that of the typical yield of 1.7% for the S&P 500.

At 11.3 instances our anticipated earnings-per-share of $11.60, shares of the corporate are buying and selling near our projected price-to-earnings ratio of 12.0. A number of expansions might add 1.1% to annual returns over the subsequent 5 years.

JPMorgan is projected to return 9.7% per 12 months by means of 2027 from 6% earnings development, 3% beginning yield, and a small contribution from a number of expansions.

Click on right here to obtain our most up-to-date Positive Evaluation report on JPMorgan & Chase Co. (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #2: Synchrony Monetary (SYF)

Subsequent is Synchrony Monetary, a shopper monetary companies firm that operates three enterprise segments, together with Cost Options, Retail Credit score, and CareCredit. The corporate affords a spread of companies to its prospects, together with, however not restricted to, personal label bank cards, small-size enterprise credit score merchandise, promotional financing for higher-priced shopper items, and promotional financing for healthcare merchandise. The corporate had its IPO in 2014. Synchrony Monetary is valued at $16 billion and has annual income of greater than $10 billion.

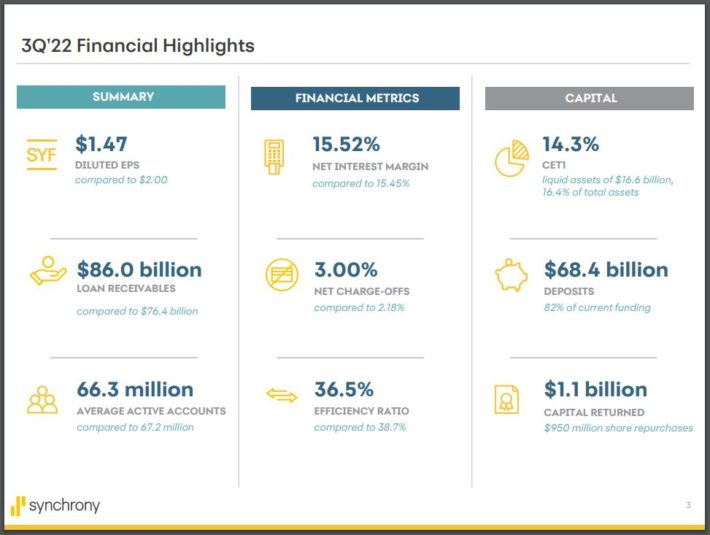

Synchrony Monetary reported third-quarter outcomes on October twenty fifth, 2022.

Supply: Investor Presentation

Income grew 22% to $2.9 billion. Earnings-per-share of $1.47 in contrast unfavorably to $2.00 within the prior 12 months, however the third quarter of 2021 noticed a large reserve launch that added $0.33 to outcomes. Earnings-per-share for the newest quarter was larger than anticipated.

Web curiosity earnings grew 7% year-over-year to $3.9 billion whereas internet curiosity margin improved 7 foundation factors to fifteen.52%. Buy volumes improved by 6% to $44.6 billion, whereas mortgage receivables have been up 13% to $86 billion. New accounts grew 6% to only underneath 6 million. Provisions for credit score losses elevated barely from $904 million to $929 million.

Synchrony Monetary is projected to develop earnings-per-share by 3% yearly by means of 2027.

Shares of the corporate yield 2.5%, and the projected payout ratio for the 12 months could be very low at 16%. Synchrony Monetary has a dividend development streak of only one 12 months after the corporate paused its dividend development in 2021.

Synchrony Monetary has a price-to-earnings ratio of 5.1 primarily based on our expectations of $7.00 of earnings per share for the 12 months. With a good worth a number of of 8 instances earnings, valuation could possibly be a 5% annual tailwind to outcomes.

Synchrony Monetary is projected to return 10.2% by means of 2027, pushed by an anticipated earnings development fee of three%, a beginning yield of two.5%, and a mid-single-digit contribution from a number of expansions.

Click on right here to obtain our most up-to-date Positive Evaluation report on Synchrony Monetary (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #3: KeyCorp (KEY)

The third inventory is KeyCorp, which has been in enterprise for 190 years and has remodeled into a number one regional financial institution with $190 billion in property. The corporate’s has operations in 15 states, offering prospects with 1,300 ATMs and 1,000 full-service branches. KeyCorp affords private, small enterprise, industrial, and company banking along with wealth administration. The $17 billion firm produced income of $7.3 billion final 12 months.

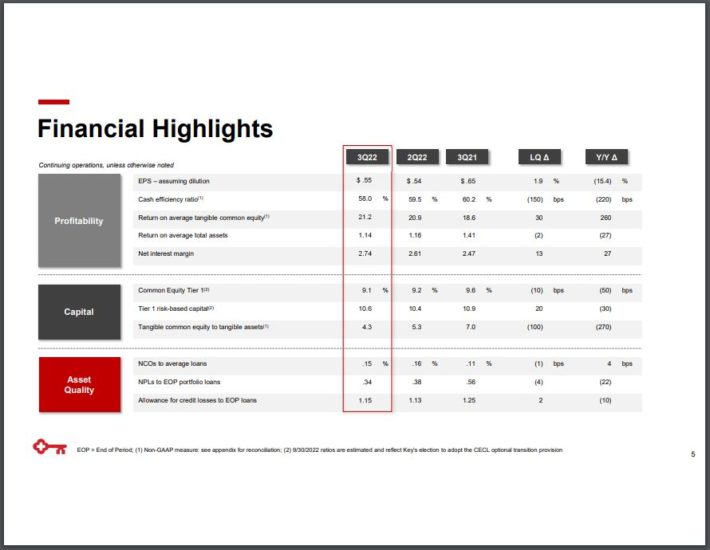

The corporate launched earnings outcomes on October twentieth, 2022.

Supply: Investor Presentation

Income grew 3.5% to $1.89 billion whereas earnings-per-share of $0.55 in comparison with $0.65 within the prior 12 months. Final 12 months’s end result benefited from reserve releases.

KeyCorp noticed development in market share in its shopper and industrial divisions, with whole loans rising 14%. Curiosity earnings grew 17.4% to $1.2 billion. Web curiosity margin of two.74% in contrast favorably to 2.61% within the second quarter and a pair of.47% within the third quarter of 2021.

The dividend yield for the inventory is 4.3%. With an anticipated payout ratio of 35% for the 12 months, it’s probably that KeyCorp’s dividend development streak of 11 years will proceed.

We anticipate the corporate to earn $2.40 this 12 months, giving KeyCorp a price-to-earnings ratio of seven.6. We consider the inventory ought to be valued at 11 instances earnings, resulting in a possible tailwind from a valuation of 8.1% over the subsequent half-decade.

Given the excessive base for earnings per share that’s projected for the corporate, we anticipate earnings development to be 0% over the medium time period. Due to this fact, the beginning yield of 4.3% and the excessive single-digit contribution from an increasing a number of ought to drive whole annual returns of 12.4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on KeyCorp (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #4: Toronto-Dominion Financial institution (TD)

The subsequent identify for consideration is Toronto-Dominion, one of many largest Canadian banks with practically $2 trillion in property. The corporate’s main segments embody Canadian Retail, U.S. Retail, and Wholesale Banking. Whereas primarily based in Canada, Toronto-Dominion generates practically 1 / 4 of its annual income from the U.S. The corporate is valued at $118 billion and produced income of $33 billion over the previous 4 quarters.

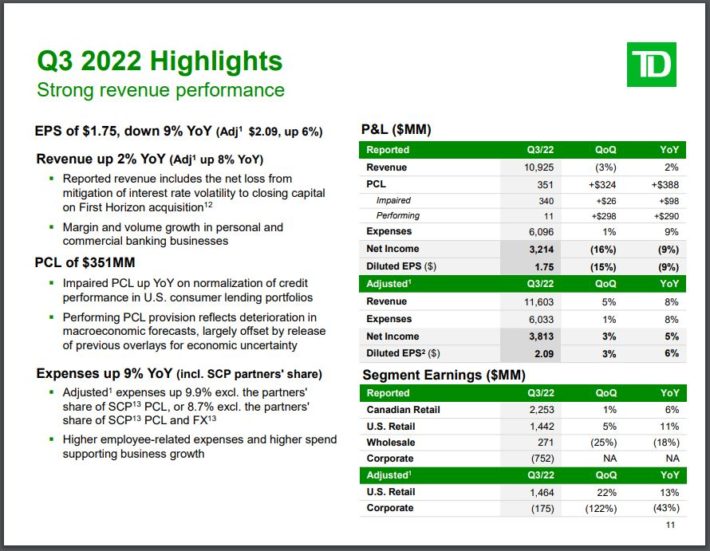

Toronto-Dominion reported third-quarter outcomes on August twenty fifth, 2022.

Supply: Investor Presentation

Canada has additionally gone by means of its personal fee mountaineering cycle, with the Financial institution of Canada elevating charges six consecutive months since March. The dimensions of the newest improve was 50-basis factors, so not but on the degree of the Fed. In consequence, internet curiosity earnings reached C$7.044 billion for the interval, up 17.3% from the prior 12 months and 10.5% from the earlier quarter.

Elsewhere, outcomes have been robust as income improved by 8.3% to C$11.6 billion whereas adjusted earnings-per-share was larger by nearly 7% to C$2.09. Complete loans elevated 10% to C$791 billion, and whole deposits grew 7.4% to C$1.2 trillion. We’ve pegged earnings development at 5.5% per 12 months for the subsequent half-decade.

Not like its American friends, the Canadian banks didn’t minimize their dividends through the Nice Recession however as an alternative paused development. Toronto-Dominion has raised its dividend every year for the final decade. Shares yield 4.2%. The payout ratio is forecasted to be 42% year-over-year.

Toronto-Dominion is buying and selling at 10.2 instances its earnings-per-share forecast of $6.48 for 2022. That is beneath our goal of 12 instances earnings, which might result in 3.4% being added to returns over the subsequent 5 years.

Added up, we consider Toronto-Dominion can return 12.4% every year by means of 2027 attributable to 5.5% earnings development, a beginning yield of 4.2%, and a low single-digit tailwind from a number of expansions.

Click on right here to obtain our most up-to-date Positive Evaluation report on Toronto-Dominion Financial institution (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #5: The Financial institution of New York Mellow Corp (BK)

Financial institution of New York Mellon was based after the American Revolution in 1784 and was the primary financial institution ever to make a mortgage to the U.S. authorities. Since that point, the corporate has grown to be valued at practically $35 billion and now generates annual income of $16 billion. The corporate affords international funding companies with a said objective of serving to shoppers handle property all through their funding lifecycle.

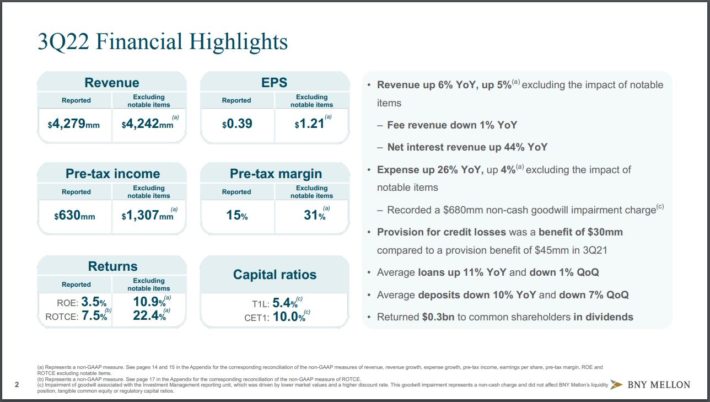

Financial institution of New York Mellon reported earnings outcomes on October seventeenth, 2022.

Supply: Investor Presentation

Income for the interval was $4.28 billion, which was 5.9% larger than the prior 12 months. Adjusted earnings-per-share of $1.21 topped the prior 12 months’s results of $1.09. Each top-and-bottom-line outcomes have been larger than anticipated.

Web curiosity income surged 44% to $926 million in comparison with the identical interval a 12 months in the past. Sequentially, internet curiosity income was up 12%. Payment income was down barely to $3.24 billion, whereas noninterest expense rose 26% to $3.68 billion. Property underneath administration have been down 8% to $1.78 trillion, primarily attributable to market deprecation.

Financial institution of New York Mellon is predicted to develop earnings-per-share by 6% per 12 months by means of 2027.

The corporate has a dividend development streak of 12 years and affords a yield of three.5% immediately. The payout ratio is predicted to be 35% for the 12 months.

We forecast earnings-per-share of $4.25 for 2022, giving Financial institution of New York Mellon a price-to-earnings ratio of 10. With a goal price-to-earnings ratio of 12, we consider that the returns might be aided by a 3.6% annual tailwind from a number of expansions.

Altogether, we mission annual returns of 12.5% within the medium time period attributable to a 6% earnings development, a beginning yield of three.5%, and a low single-digit addition from an increasing a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on The Financial institution of New York Mellow Corp (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #6: Royal Financial institution of Canada (RY)

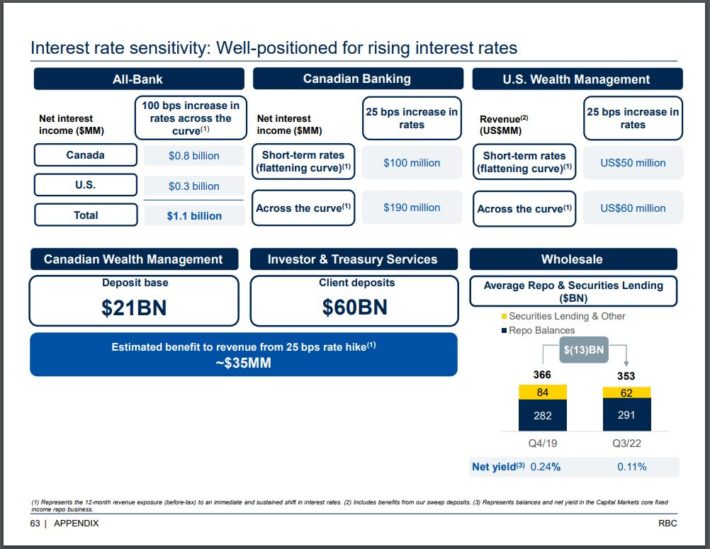

Subsequent is Royal Financial institution of Canada, or RBC, is the biggest financial institution in Canada by market capitalization and affords banking and monetary companies to prospects in Canada and the U.S. the corporate has 5 segments, together with Private & Industrial Banking, Wealth Administration, Insurance coverage, Investor & Treasury Companies, and Capital Markets. Practically 1 / 4 of income comes from the U.S. RBC is valued at $132 billion, and the corporate’s income during the last 12 months has totaled practically $25 billion.

RBC reported third-quarter outcomes on August twenty fourth, 2022. Earnings-per-share fell 17% in the newest quarter attributable to larger provisions for credit score losses, whereas income was decrease by 7%. Web curiosity earnings was constructive for RBC within the quarter. For instance, in Private & Industrial Banking, larger charges added 14% to internet curiosity earnings.

Administration said that larger charges would profit the corporate’s enterprise as a 100-basis level improve in charges would add greater than $1 billion to internet curiosity earnings.

Supply: Investor Presentation

Given its management place in its area, we consider that RBC will develop earnings-per-share by 6.5% within the medium time period.

RBC yields 4.2% and has an anticipated payout ratio of 45% for this 12 months. The corporate has elevated its dividend for ten consecutive years.

Shares of RBC have a price-to-earnings ratio of 10.8, utilizing our earnings estimate of $8.85 for this 12 months. Our forecasted price-to-earnings ratio is 12.3, which matches the typical a number of for the final decade. Reaching this goal by 2027 would add 2.6% to annual returns.

Due to this fact, RBC has a complete annual return of 12.6% within the medium time period, which stems from 6.5% earnings development, the 4.2% beginning yield, and a small contribution from a number of expansions.

Click on right here to obtain our most up-to-date Positive Evaluation report on Royal Financial institution of Canada (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #7: State Road Corp. (STT)

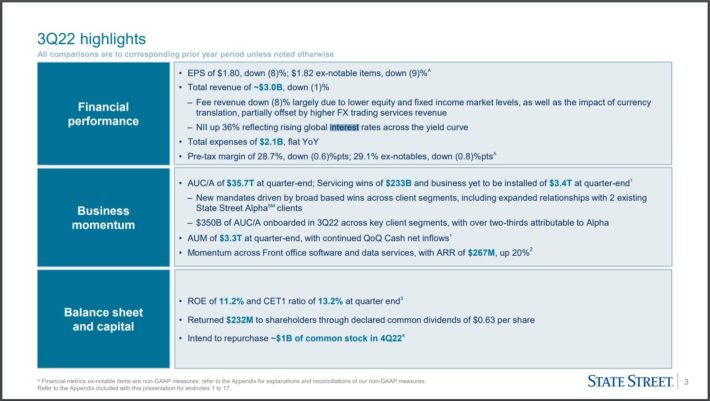

The subsequent inventory is State Road, one other monetary companies firm that may hint its roots again to the nation’s early days, having been based in 1792. The corporate is likely one of the largest property administration corporations on the earth, with greater than $3 trillion of property underneath administration and $36 trillion of property underneath custody and administration. The $28 billion firm has annual income of $12 billion.

State Road launched third-quarter earnings outcomes on October 18th, 2022.

Supply: Investor Presentation

Income fell 1% to $2.96 billion, principally attributable to an 8% lower in payment revenues that resulted from decrease inventory market ranges and a stronger greenback. On the plus aspect, rising rates of interest helped gasoline a 36% improve in internet curiosity earnings for the 12 months. The corporate did hold bills in step with the prior 12 months, which meant that earnings-per-share declined simply 7% to $1.82. Backside-line outcomes have been forward of what the analyst group had anticipated. We forecast earnings development of seven% per 12 months for the subsequent 5 years.

Shares of State Road yield 3.3%, and the corporate has a dividend development streak of 13 years, which is the longest of the names mentioned on this article. That streak ought to proceed, because the projected payout ratio for 2022 is 34%.

State Road ought to earn $7.50 per share in 2022, giving the inventory a price-to-earnings ratio of 10.2 at the moment. With a good worth goal of 12.5 instances earnings, shareholders might see a lift of 4.3% to annual returns from a number of expansions.

State Road is predicted to return 14.1% yearly by means of 2027, which stems from 7% earnings development, a beginning yield of three.3%, and a low single-digit annualized valuation tailwind.

Click on right here to obtain our most up-to-date Positive Evaluation report on State Road Corp. (preview of web page 1 of three proven beneath):

Dividend Inventory for Rising Curiosity Charges #8: Ally Monetary Inc. (ALLY)

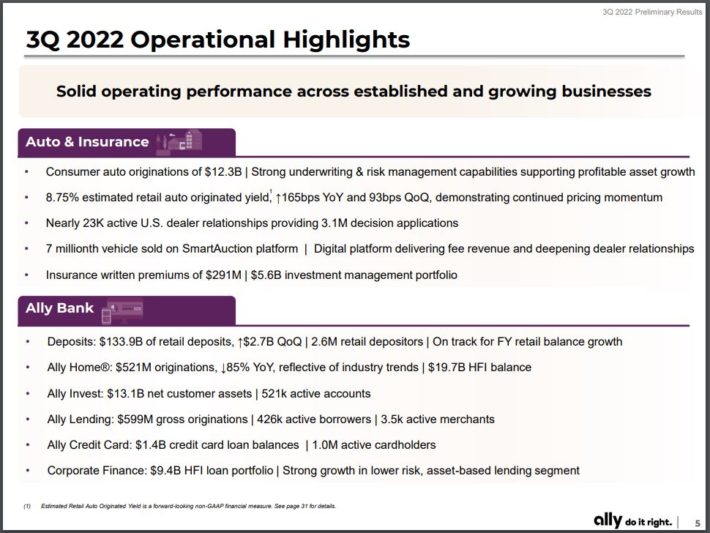

The ultimate inventory on our checklist is Ally Monetary, which supplies monetary companies to shoppers, companies, automotive sellers, and company shoppers. The corporate’s segments embody Automotive Finance Operations, Insurance coverage Operations, Mortgage Finance Operations, and Company Finance Operations. Ally Monetary affords monetary merchandise comparable to time period loans, industrial insurance coverage, traces of credit score, and car financing. The corporate is valued at $7.5 billion and has had income of $8.2 billion in 2021.

Ally Monetary reported third-quarter outcomes on October nineteenth, 2022.

Supply: Investor Presentation

Income grew 2% to $2.0 billion whereas earnings-per-share of $1.12 fell from $2.16. A lot of the decline in earnings-per-share was associated to decrease reserves and since provisions for credit score losses elevated to $438 million from $76 million within the prior 12 months for the quarter.

Ally Monetary originated $12 billion in new shopper auto loans through the interval, whereas deposits grew 2.5% to $143 billion. Increased rates of interest helped drive a 15-basis level enchancment in internet curiosity margin to three.81% for the quarter.

We consider that the corporate can obtain earnings development of 1% by means of 2027 off of a really excessive base case for the present 12 months.

Ally Monetary yields 4.7%, practically triple the typical yield of the S&P 500 Index. Buyers have acquired a dividend improve for six consecutive years. With a projected payout ratio of 20% for the 12 months, that development streak ought to proceed.

Shares have a really low price-to-earnings ratio of 4.3, utilizing estimates of $6.00 of earnings-per-share for 2022. We consider that honest worth is nearer to 7 instances earnings, implying a sizeable tailwind from a number of expansions. Reaching our goal a number of by 2027 would add 10.2% to annual returns by means of 2027.

Ally Monetary is anticipated to return 14.7% yearly over the subsequent 5 years. This stems from a 1% earnings development fee, an almost 5% dividend yield, and a double-digit contribution from a valuation.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ally Monetary Inc. (preview of web page 1 of three proven beneath):

Remaining Ideas

Rates of interest have elevated at a quicker tempo than the market has seen in fairly a while. The dimensions of the hikes is basically unprecedented, however the Federal Reserve has tried to chill inflation not seen in a long time.

Whereas rising charges can negatively affect some areas of the economic system, the monetary sector stands to learn immensely. Above, we recognized eight shares from the sector which have already seen a profit from larger charges. And with charges more likely to proceed to go up so long as inflation is excessive, these names ought to proceed to see robust development in internet curiosity earnings. All eight shares have yields of at the least 3% and have a purchase ranking from Positive Dividend attributable to projected returns.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link