[ad_1]

Printed on November twentieth, 2022, by Samuel Smith

Actual Property Funding Trusts (i.e., “REITs”) are tax-advantaged earnings automobiles which have change into more and more well-liked with buyers and establishments lately. It’s because they don’t have to pay any earnings tax on the company degree however as an alternative function pass-through entities. In alternate for this profit, they need to meet particular pointers, together with paying out no less than 90% of taxable earnings to shareholders by way of dividends. Consequently, high-yield and dividend-growth buyers typically love REITs and dedicate a substantial portion of their portfolios to them.

Nonetheless, whereas REITs should not have to pay company earnings tax, shareholders usually should pay tax on the dividend earnings they obtain from them. This earnings is usually taxed in considered one of 3 ways:

- Capital Features – this portion of the dividend consists of beneficial properties generated from asset gross sales and are taxed as capital beneficial properties.

- Return of Capital – this portion of the dividend just isn’t taxable, because it entails a discount within the investor’s price foundation. This money movement usually both comes from the rental earnings that’s written off by way of depreciation accounting guidelines for the underlying actual property or just isn’t lined by money movement in any respect and as an alternative is being funded with money reserves and/or debt. Ultimately, capital beneficial properties taxes will probably be paid on this portion of the earnings if/when the shareholder decides to promote his shares.

- Strange earnings – is the portion of the dividend earnings that continues to be after the capital beneficial properties and return of capital parts are deducted. It’s taxed on the shareholder’s prime earnings tax bracket, although it’s exempted from FICA taxes. That is in distinction to the “certified dividends” that many firms pay, that are taxed at long-term capital beneficial properties charges, that are typically equal to or lower than the highest earnings tax bracket of the person shareholder.

Out of those classifications of REIT dividends, return of capital is probably the most fascinating because it defers all taxation on the dividends till the REIT shares are bought. Capital beneficial properties are the following most fascinating, provided that the capital beneficial properties tax price is usually decrease than the earnings tax price, making the unusual earnings classification the least fascinating of REIT dividend classifications. One other important tax consideration to remember when holding REITs in a taxable account is that they profit from the 20% pass-thru earnings deduction. Provided that REITs are labeled as pass-thru entities, 20% of their dividends are exempted from taxation, additional limiting the tax legal responsibility for shareholders holding REITs in a taxable account.

What this implies is that in the event you maintain a REIT with a meaningfully excessive share of its dividends being labeled as a return of capital for the long run, when mixed with the 20% pass-thru earnings deduction, the tax burden could wind up being fairly cheap in a taxable account. On this article, we are going to talk about seven REITs that paid out a significant share of their dividends as a return of capital in 2021 as a place to begin for buyers who need to spend money on tax-efficient REITs in a taxable account. Word that this breakdown typically adjustments from 12 months to 12 months. The breakdown for the earlier 12 months’s dividends is usually introduced in January, so it’s not possible to foretell future taxation classifications with certainty.

You’ll be able to obtain our full listing of REITs, together with vital metrics corresponding to dividend yields and market capitalizations, by clicking on the hyperlink beneath:

#1. Nationwide Retail Properties (NNN)

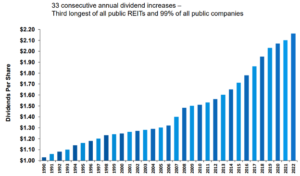

NNN is a triple web lease REIT that primarily owns single-tenant free-standing retail actual property. The enterprise mannequin is a low danger provided that the tenant bears all duty for working bills, insurance coverage, and property upkeep, the leases are prolonged in phrases and have seniority on the steadiness sheet, and NNN’s administration fastidiously does the underwriting. Its great observe report of producing steady and often rising money movement from its actual property portfolio has enabled the REIT to extend its dividend for 33 consecutive years, making it a Dividend Aristocrat. On prime of that, the dividend yield is fairly enticing at 4.9% as of this writing.

Supply: Investor Presentation

In 2021, its dividend breakdown was as follows: 76.9406% was labeled as unusual earnings, and 23.0594% was labeled as return of capital. When mixed with the 20% pass-thru earnings deduction, NNN qualifies as a fairly tax-efficient supply of reliable earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on Nationwide Retail Properties (preview of web page 1 of three proven beneath):

#2. Macerich (MAC)

MAC primarily owns class-A malls in main markets throughout the USA. Whereas it has struggled lately resulting from a surge in tenant bankruptcies as a result of rise of e-commerce and the COVID-19 lockdowns, its properties in the present day are thriving, and MAC’s board of administrators simply hiked its dividend. Whereas its dividend observe report is poor and the steadiness sheet might use additional deleveraging within the present surroundings, its properties are among the many greatest positioned to thrive long-term within the mall sector. On prime of that, its dividend yield is presently at 5.1%.

In 2021, its dividend breakdown was as follows: 6% was labeled as unusual earnings, 24.667% was labeled as capital beneficial properties, and 69.333% was labeled as return of capital. When mixed with the 20% pass-thru earnings deduction, MAC qualifies as a really tax-efficient supply of earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on Macerich (preview of web page 1 of three proven beneath):

#3. Realty Earnings (O)

O just isn’t labeled “The Month-to-month Dividend Firm” for nothing: it has an incredible observe report of paying month-to-month dividends that develop year-over-year. Its dividend progress streak makes it a Dividend Aristocrat. On prime of that, administration has applied its conservative triple web lease enterprise mannequin to close perfection, delivering market-crushing complete returns all through its publicly traded existence for the reason that Nineteen Nineties and constructing probably the most in depth portfolio of triple web lease actual property on this planet. The steadiness sheet can be stellar, with one of many highest credit score scores within the REIT sector, giving it a value of capital benefit over friends and implying that it is among the lowest-risk actual property investments obtainable. With a 4.6% present dividend yield, it’s also a wholesome supply of present earnings.

In 2021, its dividend breakdown was as follows: 30.958% was labeled as unusual earnings, 1.747% was labeled as capital beneficial properties, and 67.295% was labeled as return of capital. When mixed with the 20% pass-thru earnings deduction, O qualifies as a really tax-efficient supply of reliable earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on Realty Earnings (preview of web page 1 of three proven beneath):

#4. VICI Properties (VICI)

VICI owns an intensive portfolio of casinos – together with the well-known Caesars Palace – in addition to tons of of eating places, bars, and nightclubs. It implements a triple web lease enterprise mannequin, resulting in steady and constantly rising rental earnings from its actual property portfolio. Consequently, it has been in a position to generate rising dividends per share annually since going public again in 2017 and is predicted to proceed doing so for years to come back. On prime of that, its 4.9% present dividend yield makes it a great decide for income-focused buyers.

In 2021, its dividend breakdown was as follows: 52.652% was labeled as unusual earnings, and 47.348% was labeled as return of capital. When mixed with the 20% pass-thru earnings deduction, VICI qualifies as a really tax-efficient supply of reliable earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on VICI Properties (preview of web page 1 of three proven beneath):

#5. UMH Properties (UMH)

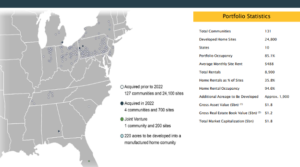

UMH owns manufactured housing communities throughout the USA and presently owns tens of hundreds of properties in over 100 communities within the Midwest and Northeast.

Supply: Investor Presentation

For a few years UMH struggled to develop its dividend and FFO per share. Nonetheless, since 2020 the corporate’s progress engine has lastly kicked into excessive gear. FFO per share elevated from $0.63 in 2019 to $0.87 in 2021, and the dividend per share lastly started to develop together with it. In 2021, UMH paid out $0.76 per share in dividends and is presently paying out a $0.80 annualized dividend. At this time, its dividend yields 4.6%, making it a strong decide for income-oriented buyers.

In 2021, its dividend breakdown was as follows: 3.241683% was labeled as unusual earnings, 0.264344% was labeled as capital beneficial properties, and 96.493973% was labeled as return of capital. When mixed with the 20% pass-thru earnings deduction, UMH clearly qualifies as a extremely tax-efficient supply of reliable earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on UMH Properties (preview of web page 1 of three proven beneath):

#6. Clipper Realty Inc. (CLPR)

CLPR primarily owns multifamily and workplace actual property in New York Metropolis and is owned roughly two-thirds by the founders of the REIT. It was a merger between 4 pre-existing actual property companies and went public in 2017. It has paid out a flat $0.38 annualized dividend annually since going public, though the COVID-19 headwinds of 2020 and 2021 hit NY city particularly laborious. It presently affords buyers a dividend yield of 5.1%, making it a sexy decide for buyers searching for predictable present earnings alongside publicity to high quality actual property in one of many world’s best cities.

In 2021, its dividend breakdown was as follows: 50% was labeled as unusual earnings, and 50% was labeled as return of capital. When mixed with the 20% pass-thru earnings deduction, CLPR qualifies as a really tax-efficient supply of reliable earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on Clipper Realty Inc. (preview of web page 1 of three proven beneath):

#7. International Medical REIT (GMRE)

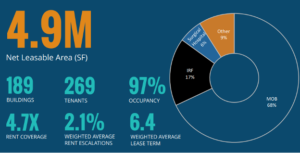

GMRE is a net-lease medical workplace REIT that owns and leases out specialised healthcare amenities, together with medical workplace buildings, inpatient rehab amenities, surgical amenities, and different specialised amenities. Since going public in 2015, GMRE has seen its adjusted funds from operations per share improve steadily. Consequently, the dividend has confirmed to be comparatively steady as properly, rising from $0.74 per share in 2016 to $0.82 in 2021. The present annualized dividend payout is $0.84, and the present yield is a whopping 9%. The dividend payout is predicted to extend barely shifting ahead, making it an attractive selection for buyers searching for present earnings and no less than some progress.

Supply: Investor Presentation

In 2021, its dividend breakdown was as follows: 66.43% was labeled as unusual earnings, 2.35% as long-term capital beneficial properties, and 31.22% because the return of capital. When mixed with the 20% pass-thru earnings deduction, GMRE qualifies as a comparatively first rate tax-efficient supply of reliable earnings, although not fairly as environment friendly as a number of the different choices offered right here.

Click on right here to obtain our most up-to-date Positive Evaluation report on International Medical REIT (preview of web page 1 of three proven beneath):

Conclusion

REITs are identified for being very tax-efficient on the company degree, usually solely having to fret about paying property taxes and being fully exempted from the expensive company earnings tax. Moreover, pass-through entities get a 20% earnings tax exemption on their dividend payouts to shareholders, making them much more enticing as tax-advantaged investments.

On prime of that, the actual property depth of the enterprise mannequin typically implies that they get to put in writing off a good portion of their rental earnings because the depreciation of their property. Whereas many REITs should not have a lot depreciation to put in writing off, some get to categorise a surprisingly massive share of their dividends as depreciation, making them remarkably tax-efficient even in a taxable account.

The draw back is that REITs solely reveal the tax classification of their dividends after they’ve been paid out, so it may be tough for buyers to know which REITs are greatest to carry in a taxable account versus a tax-advantaged account like an IRA or 401k. Consequently, some could merely play it secure and maintain all REITs – particularly the highest-yielding ones – in a tax-advantaged account. That stated, in the event you discover {that a} particular REIT has developed a current sample of paying out a excessive share of its dividends as a return of capital, there’s a good likelihood that it’ll stay that manner for the foreseeable future as this may increasingly merely be resulting from its distinctive enterprise mannequin.

Finally, REITs are most valued for his or her earnings, and buyers will usually be greatest served by focusing totally on the dividend yield, valuation, administration, steadiness sheet power, and underlying actual property high quality over the tax intricacies of the dividends. Nonetheless, it’s worthwhile for buyers in high-income tax brackets who personal a considerable REIT portfolio to attempt to maintain extra tax-efficient REITs in taxable accounts. Word that this isn’t tax recommendation, and readers are strongly inspired to do their due diligence earlier than investing.

You might also be searching for interesting shares from a sure inventory market sector to make sure applicable diversification inside your portfolio. If that’s the case, you will see that the next sources helpful:

You might also want to contemplate different investments throughout the main market indices. Our downloadable listing of small-cap U.S. shares will be accessed beneath:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link