[ad_1]

Printed on December nineteenth, 2023 by Bob Ciura

At Positive Dividend, we advocate buyers give attention to high quality dividend shares over the long term. Along with dividends, buyers also needs to be centered on whole returns.

Briefly, the entire anticipated return of a inventory is the sum of its future earnings-per-share progress, dividends, in addition to any web change within the valuation a number of. In the end, whole returns matter most for buyers.

With this in thoughts, we’ve compiled an inventory of the 50 finest dividend shares primarily based on 5-year anticipated returns (together with essential investing metrics like price-to-earnings ratios and dividend yields) which you’ll be able to obtain under:

This text lists the 7 finest dividend shares now within the Positive Evaluation Analysis Database. The highest 7 shares are listed under by 5-year anticipated annual returns, from lowest to highest.

Desk Of Contents

The seven finest dividend shares are listed under so as of whole anticipated returns over the subsequent 5 years, from lowest to highest. You may immediately bounce to any particular person inventory evaluation by clicking on the hyperlinks under:

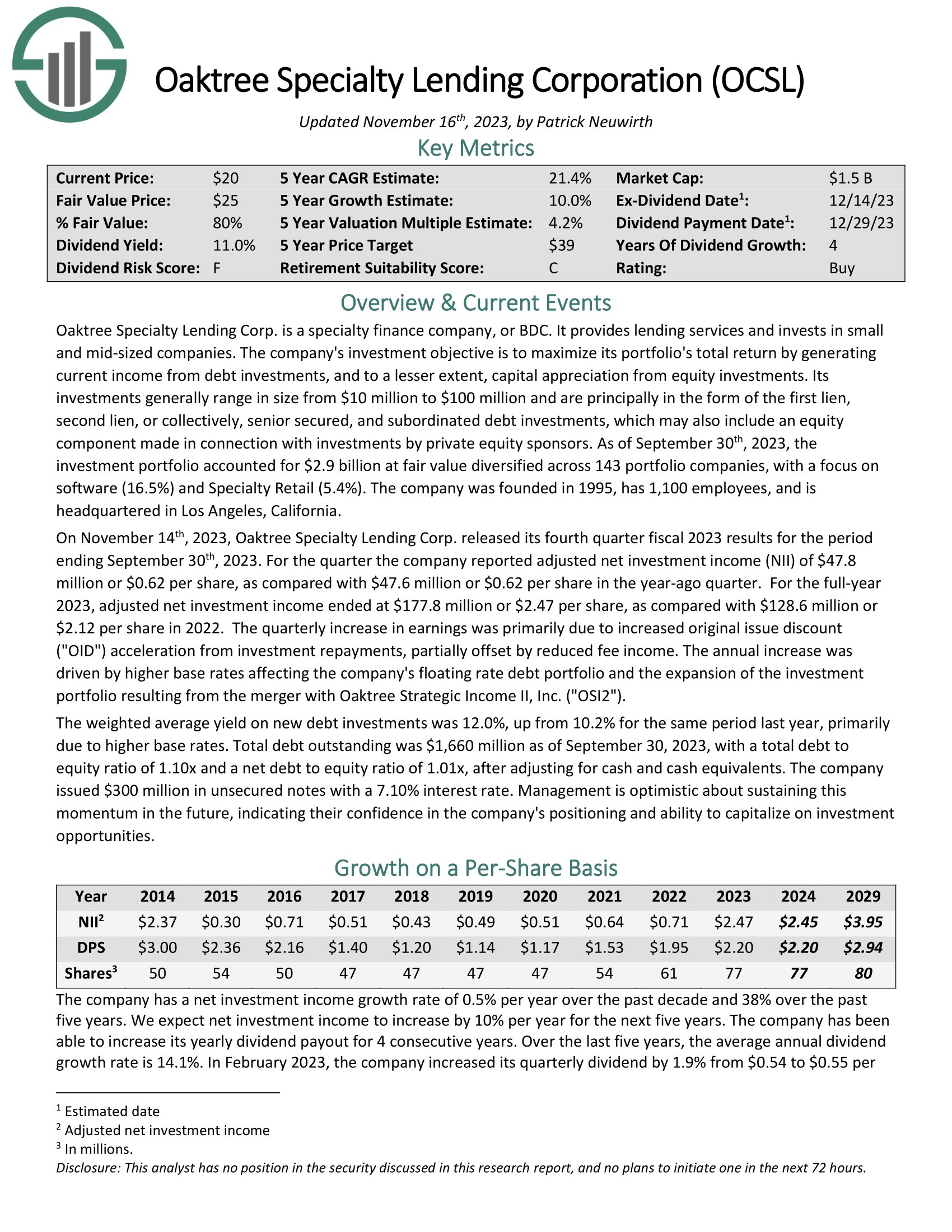

Greatest Dividend Inventory #7: Oaktree Specialty Lending (OCSL)

- 5-year anticipated annual returns: 21.3%

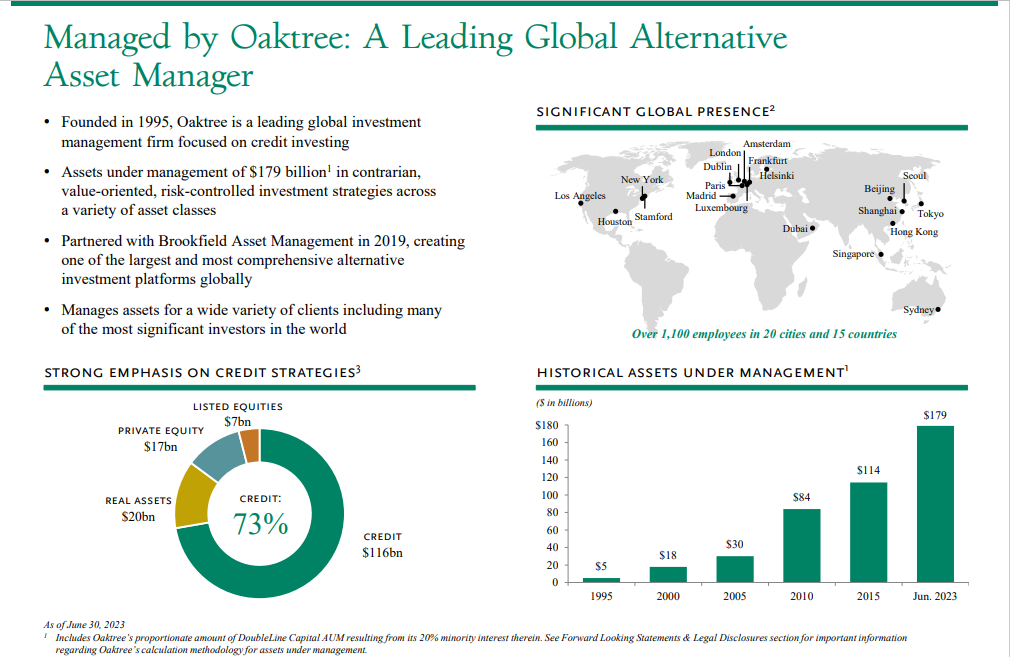

Oaktree Specialty Lending Corp. is a enterprise growth firm, or BDC. It offers lending providers and invests in small and mid-sized firms.

As of September thirtieth, 2023, the funding portfolio accounted for $2.9 billion at truthful worth diversified throughout 143 portfolio firms, with a give attention to software program (16.5%) and Specialty Retail (5.4%).

Supply: Investor Presentation

On November 14th, 2023, Oaktree Specialty Lending Corp. launched its fourth quarter fiscal 2023. For the quarter the corporate reported adjusted web funding earnings (NII) of $47.8 million or $0.62 per share, as in contrast with $47.6 million or $0.62 per share within the year-ago quarter.

For the full-year 2023, adjusted web funding earnings ended at $177.8 million or $2.47 per share, as in contrast with $128.6 million or $2.12 per share in 2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on OCSL (preview of web page 1 of three proven under):

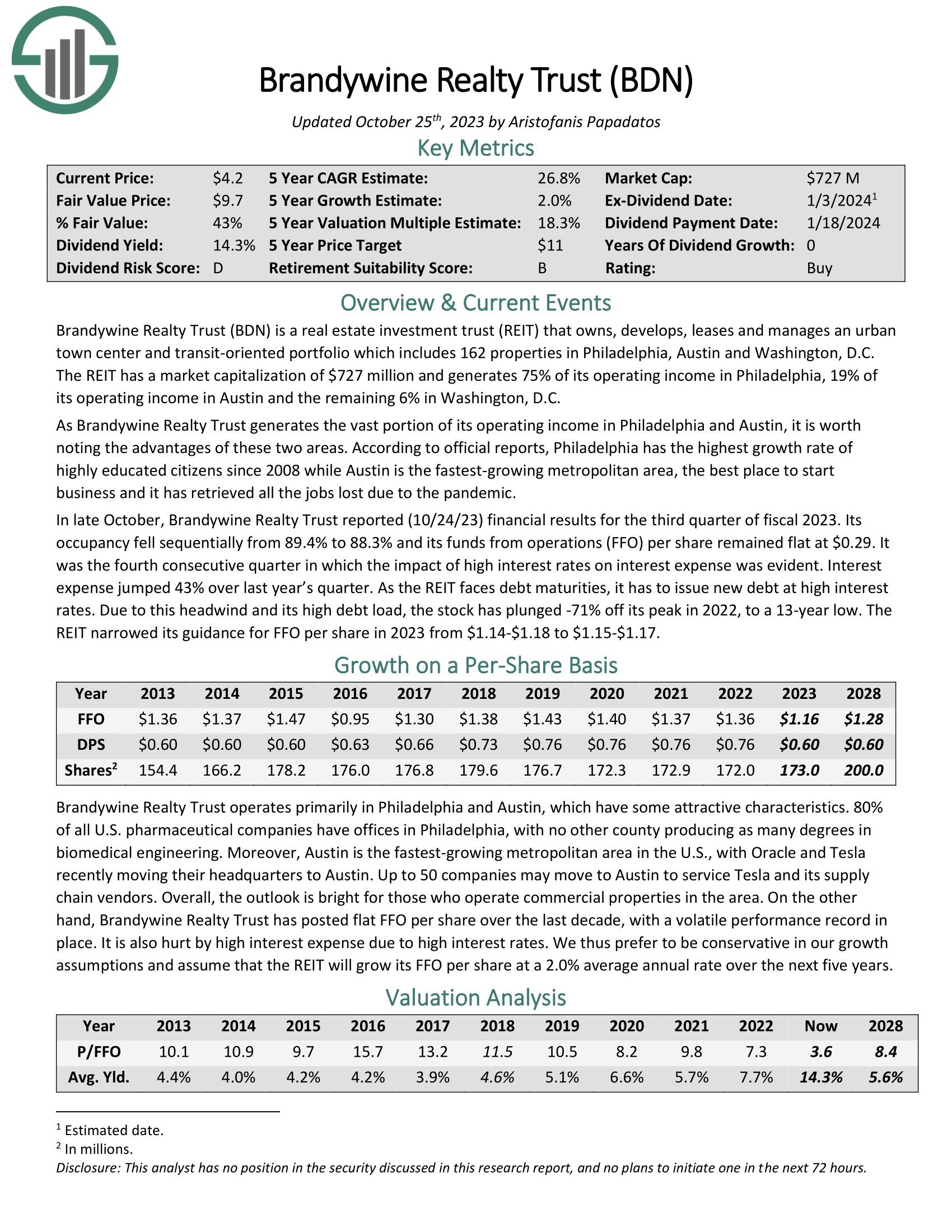

Greatest Dividend Inventory #6: Brandywine Realty Belief (BDN)

- 5-year anticipated annual returns: 21.3%

Brandywine Realty owns, develops, leases and manages an city city middle and transit-oriented portfolio which incorporates 163 properties in Philadelphia, Austin and Washington, D.C. The REIT has a market capitalization of $1.1 billion and generates 74% of its working earnings in Philadelphia, 22% of its working earnings in Austin and the remaining 4% in Washington, D.C.

In late October, Brandywine Realty Belief reported (10/24/23) monetary outcomes for the third quarter of fiscal 2023. Its occupancy fell sequentially from 89.4% to 88.3% and its funds from operations (FFO) per share remained flat at $0.29. It was the fourth consecutive quarter through which the affect of excessive rates of interest on curiosity expense was evident.

Curiosity expense jumped 43% over final yr’s quarter. Because the REIT faces debt maturities, it has to problem new debt at excessive rates of interest. On account of this headwind and its excessive debt load, the inventory has plunged -71% off its peak in 2022, to a 13-year low. The REIT narrowed its steerage for FFO per share in 2023 from $1.14-$1.18 to $1.15-$1.17.

Click on right here to obtain our most up-to-date Positive Evaluation report on BDN (preview of web page 1 of three proven under):

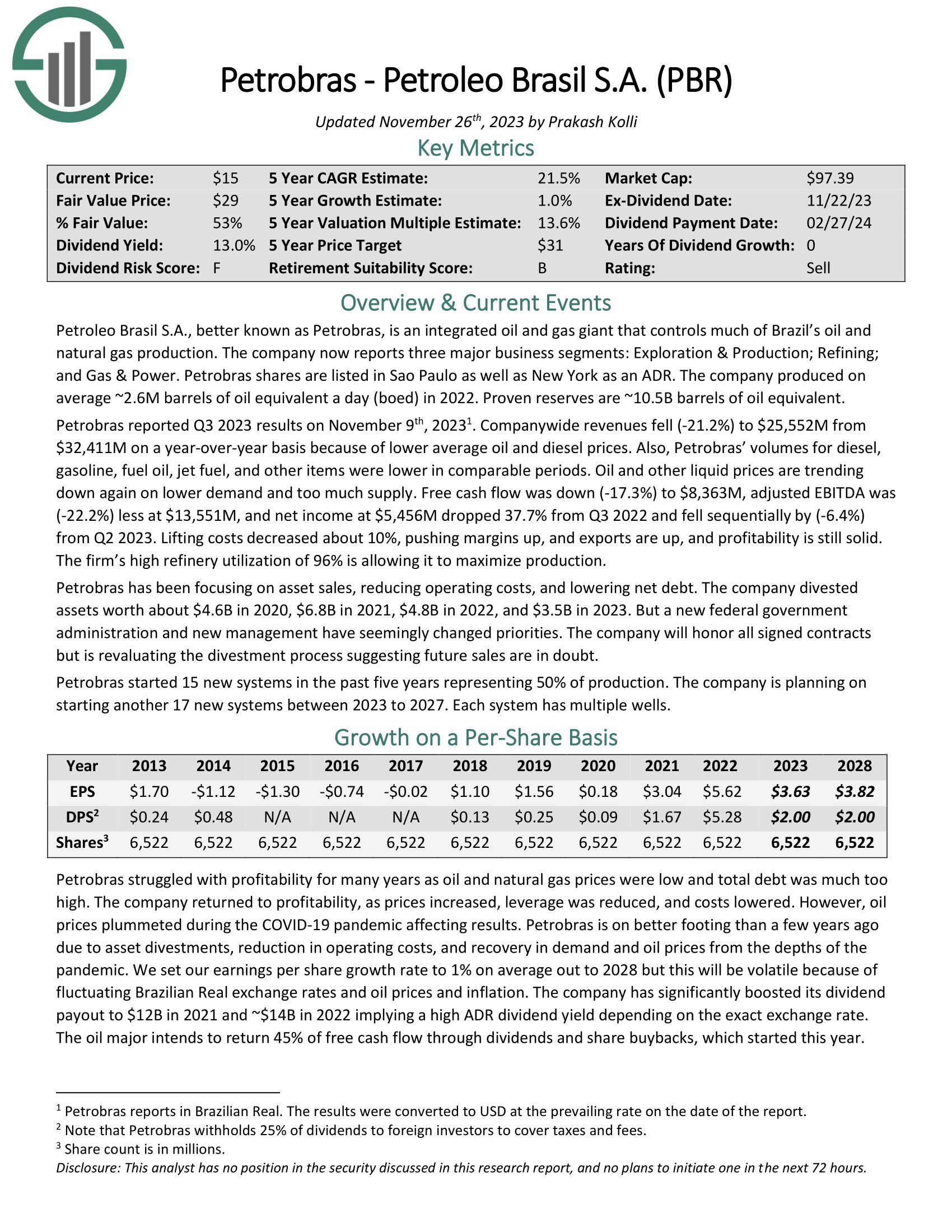

Greatest Dividend Inventory #5: Petroleo Brasileiro S.A. (PBR)

- 5-year anticipated annual returns: 21.4%

Petroleo Brasil S.A., higher often called Petrobras, is an built-in oil and gasoline large that controls a lot of Brazil’s oil and pure gasoline manufacturing. The corporate now experiences three main enterprise segments: Exploration & Manufacturing; Refining; and Fuel & Energy. The corporate produced on common ~2.6M barrels of oil equal a day (boed) in 2022. Confirmed reserves are ~10.5B barrels of oil equal.

Petrobras reported Q3 2023 outcomes on November ninth, 2023. Firm-wide revenues fell (-21.2%) to $25,552M from $32,411M on a year-over-year foundation due to decrease common oil and diesel costs. Additionally, Petrobras’ volumes for diesel, gasoline, gasoline oil, jet gasoline, and different gadgets had been decrease in comparable intervals. Oil and different liquid costs are trending down once more on decrease demand and an excessive amount of provide.

Click on right here to obtain our most up-to-date Positive Evaluation report on PBR (preview of web page 1 of three proven under):

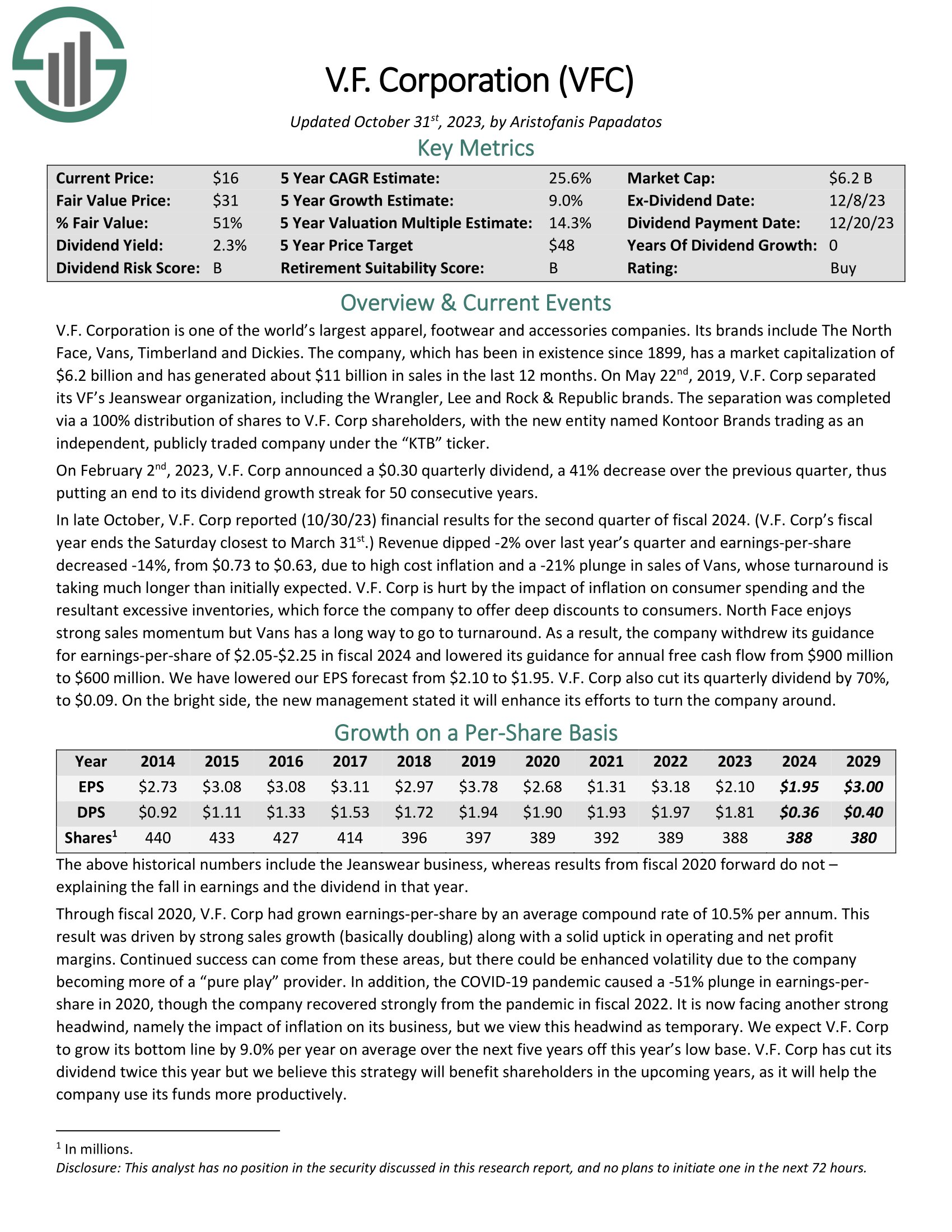

Greatest Dividend Inventory #4: V.F. Corp. (VFC)

- 5-year anticipated annual returns: 22.0%

V.F. Company is without doubt one of the world’s largest attire, footwear and equipment firms. Its manufacturers embrace The North Face, Vans, Timberland and Dickies.

In late October, V.F. Corp reported (10/30/23) monetary outcomes for the second quarter of fiscal 2024. (V.F. Corp’s fiscal yr ends the Saturday closest to March thirty first.) Income dipped -2% over final yr’s quarter and earnings-per-share decreased -14%, from $0.73 to $0.63, resulting from excessive price inflation and a -21% plunge in gross sales of Vans, whose turnaround is taking for much longer than initially anticipated.

Click on right here to obtain our most up-to-date Positive Evaluation report on VFC (preview of web page 1 of three proven under):

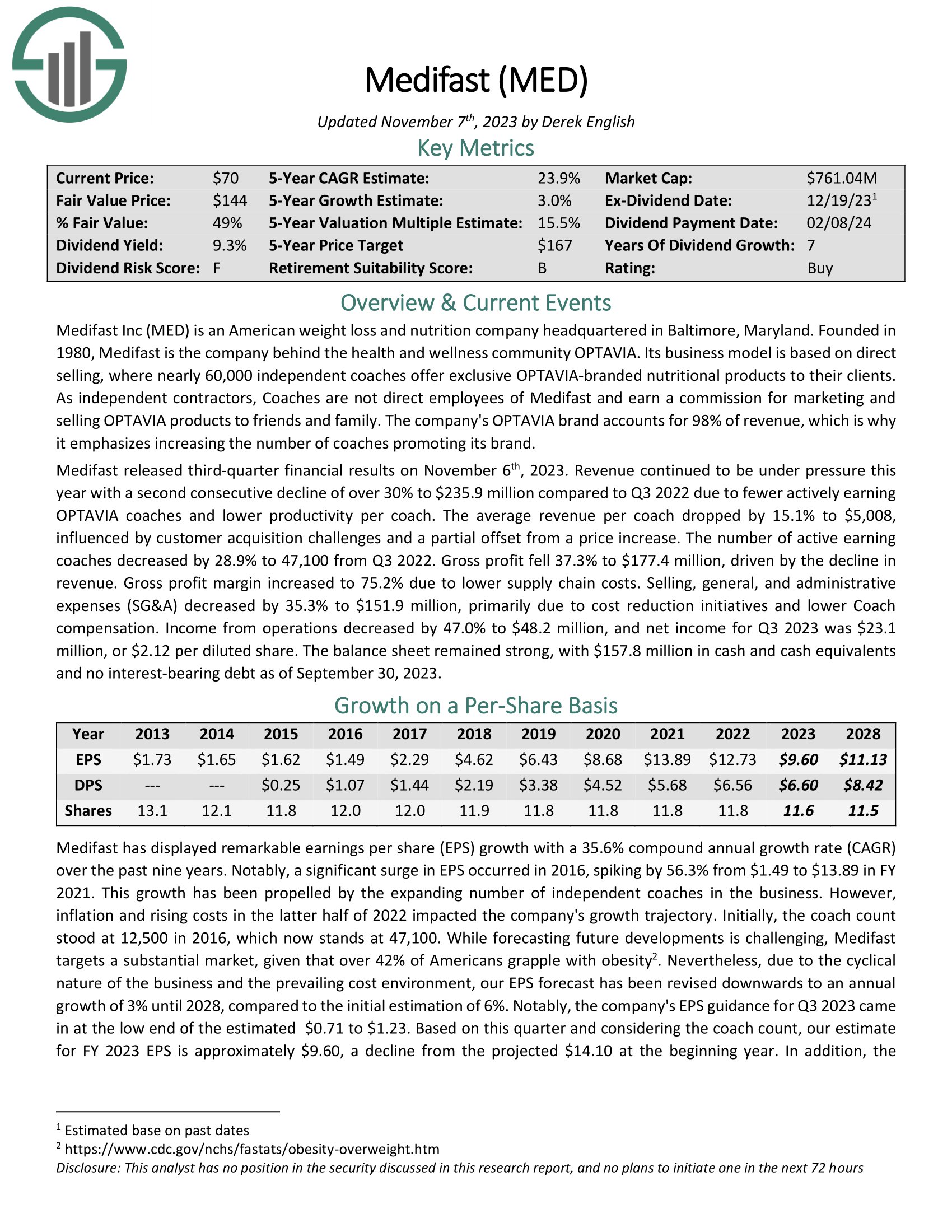

Greatest Dividend Inventory #3: Medifast Inc. (MED)

- 5-year anticipated annual returns: 25.5%

Medifast Inc is an American weight reduction and diet firm behind the well being and wellness group OPTAVIA. Its enterprise mannequin relies on direct promoting, the place practically 60,000 unbiased coaches supply unique OPTAVIA-branded dietary merchandise to their purchasers. As unbiased contractors, Coaches will not be direct staff of Medifast and earn a fee for advertising and promoting OPTAVIA merchandise to family and friends.

The corporate’s OPTAVIA model accounts for 98% of income, which is why it emphasizes rising the variety of coaches selling its model.

Medifast launched third-quarter monetary outcomes on November sixth, 2023. Income continued to be below strain this yr with a second consecutive decline of over 30% to $235.9 million in comparison with Q3 2022 resulting from fewer actively incomes OPTAVIA coaches and decrease productiveness per coach. The common income per coach dropped by 15.1% to $5,008, influenced by buyer acquisition challenges and a partial offset from a worth improve.

Click on right here to obtain our most up-to-date Positive Evaluation report on MED (preview of web page 1 of three proven under):

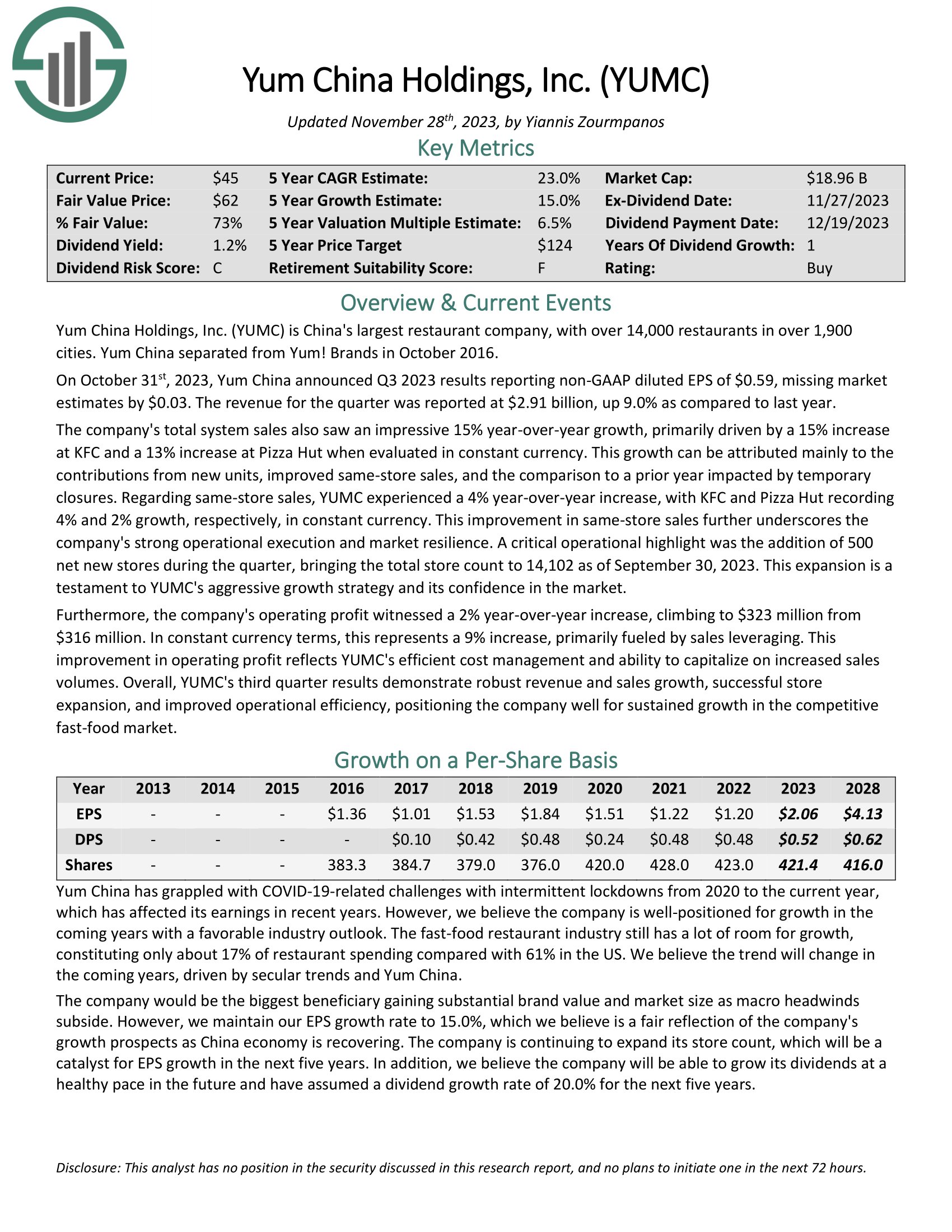

Greatest Dividend Inventory #2: Yum China (YUMC)

- 5-year anticipated annual returns: 26.1%

Yum China Holdings is China’s largest restaurant firm, with over 14,000 eating places in over 1,900 cities. Yum China separated from Yum! Manufacturers in October 2016.

On October thirty first, 2023, Yum China introduced Q3 2023 outcomes reporting non-GAAP diluted EPS of $0.59, lacking estimates by $0.03. The income for the quarter was reported at $2.91 billion, up 9.0% as in comparison with final yr. The corporate’s whole system gross sales additionally noticed a formidable 15% year-over-year progress, primarily pushed by a 15% improve at KFC and a 13% improve at Pizza Hut when evaluated in fixed foreign money.

Relating to same-store gross sales, YUMC skilled a 4% year-over-year improve, with KFC and Pizza Hut recording 4% and a pair of% progress, respectively, in fixed foreign money. This enchancment in same-store gross sales additional underscores the corporate’s sturdy operational execution and market resilience.

Click on right here to obtain our most up-to-date Positive Evaluation report on YUMC (preview of web page 1 of three proven under):

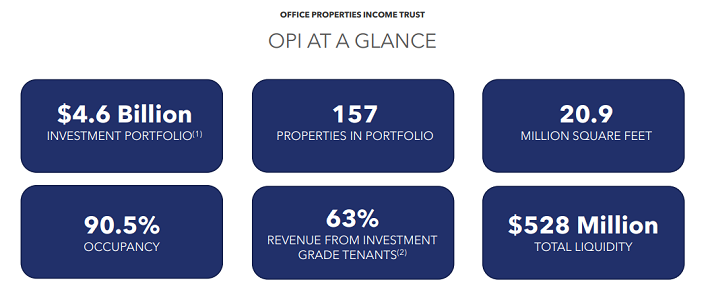

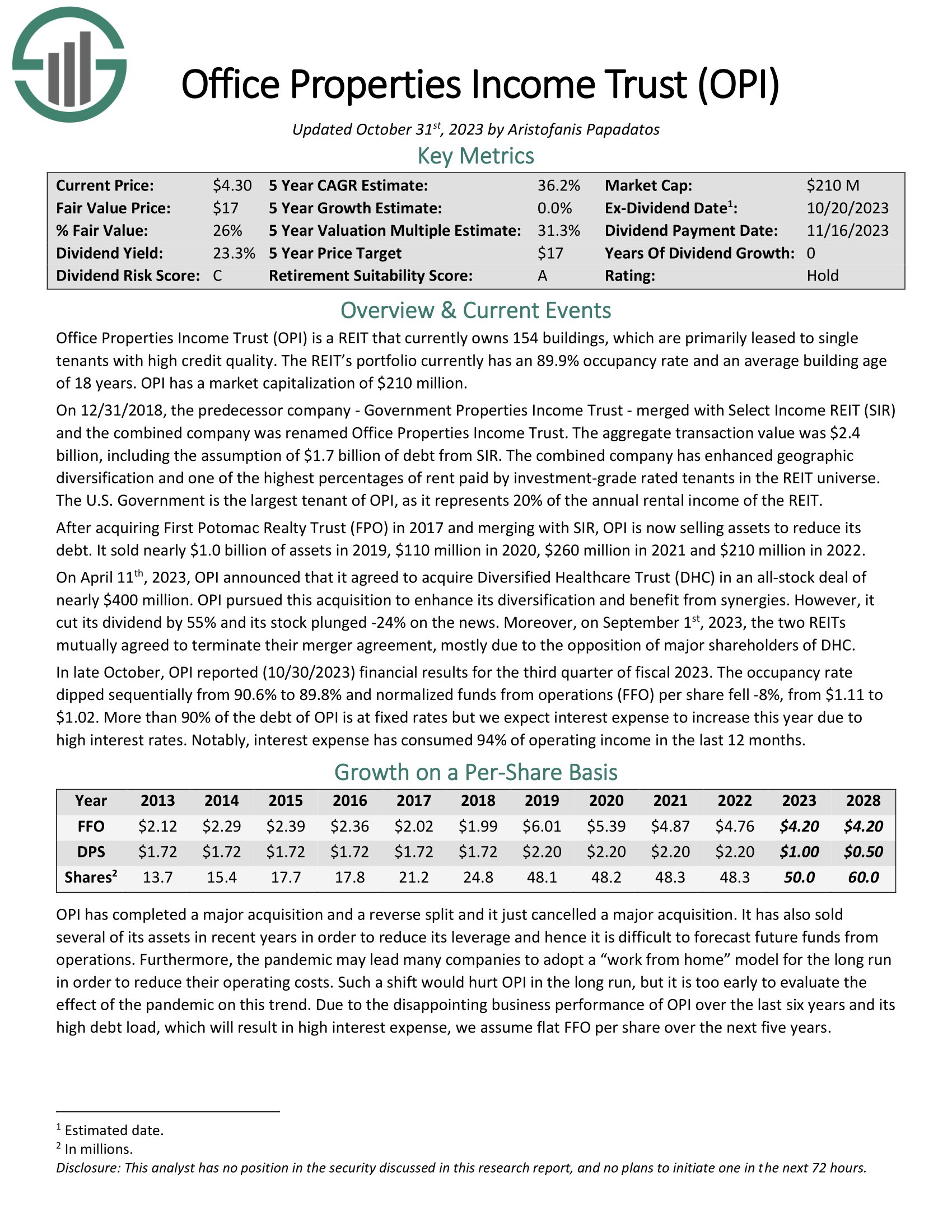

Greatest Dividend Inventory #1: Workplace Properties Earnings Belief (OPI)

- 5-year anticipated annual returns: 26.4%

Workplace Properties Earnings Belief is a REIT that presently owns 157 buildings, that are primarily leased to single tenants with excessive credit score high quality. The REIT’s portfolio presently has a 90.5% occupancy charge.

In late October, OPI reported (10/30/2023) monetary outcomes for the third quarter of fiscal 2023. The occupancy charge dipped sequentially from 90.6% to 89.8% and normalized funds from operations (FFO) per share fell -8%, from $1.11 to $1.02.

Greater than 90% of the debt of OPI is at fastened charges however we count on curiosity expense to extend this yr resulting from excessive rates of interest. Notably, curiosity expense has consumed 94% of working earnings within the final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on OPI (preview of web page 1 of three proven under):

Extra Studying

Traders searching for further dividend inventory concepts can discover further studying under:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link