- Retailers would be the final group to ship monetary ends in the Q1 reporting season.

- The retail sector has underperformed the broader market by a large margin in 2023.

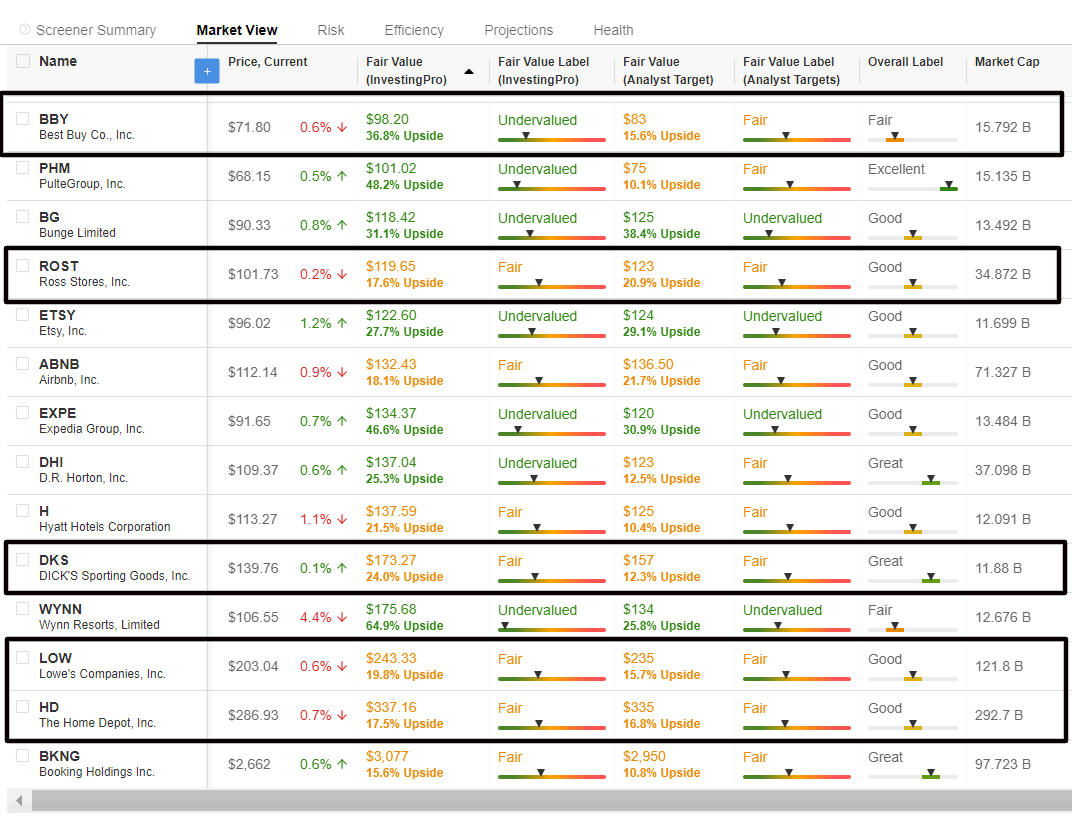

- Regardless of the gloomy macroeconomic outlook, I used the InvestingPro inventory screener to shortlist 5 bullish retail shares.

- Searching for extra top-rated inventory concepts to guard your portfolio amid the more and more unsure financial local weather? Members of InvestingPro get unique entry to our analysis instruments and information. Study Extra »

Upcoming earnings outcomes from the most important U.S. retailers would be the subsequent main take a look at for the inventory market as buyers await additional perception into the well being of client spending towards a backdrop of persistently excessive and worries over a looming recession.

Topping the prolonged checklist of outlets scheduled to report first-quarter ends in the approaching week are Walmart (NYSE:), Residence Depot (NYSE:), Goal (NYSE:), TJX Corporations (NYSE:), Ross Shops (NASDAQ:), and Foot Locker (NYSE:).

Different high-profile firms, equivalent to Lowe’s (NYSE:), Kohl’s (NYSE:), Greatest Purchase (NYSE:), Ulta Magnificence (NASDAQ:), and Costco (NASDAQ:), are as a result of report March quarter ends in the next week.

Most retailers – that are maybe essentially the most delicate to shifting financial situations and client spending – have struggled this 12 months amid a depressing macroeconomic outlook of elevated inflation and slowing financial development.

The retail business’s principal ETF – the SPDR® S&P Retail ETF (NYSE:) – is up simply 1.1% because the begin of 2023, lagging the ‘s close to 8% achieve over the identical interval.

Underscoring a number of near-term headwinds plaguing the sector, shares of Residence Depot, which is the highest U.S. house enchancment chain, are down roughly 9% year-to-date as Individuals reduce spending on discretionary gadgets because of the unsure financial local weather.

There are some exceptions, in fact. Take Walmart, for instance, whose shares are up 8% to date this 12 months because it advantages from modifications in client conduct as a result of lingering inflationary pressures which are inflicting disposable earnings to shrink.

As such, subsequent week’s earnings updates from the retail heavyweights shall be a crucial subject for buyers amid rising fears the Federal Reserve’s aggressive will tip the economic system into recession.

With that in thoughts, I used the InvestingPro inventory screener to shortlist 5 retail shares that Wall Avenue analysts are nonetheless bullish on heading into earnings.

Every identify boasts a ‘Sturdy Purchase’ ranking advice and provides vital upside potential primarily based on their InvestingPro ‘Honest Worth’ value targets.

- Greatest Purchase (Honest Worth Upside: +36.8%)

- DICK’S Sporting Items (Honest Worth Upside: +24.0%)

- Lowe’s (Honest Worth Upside: +19.8%)

- Ross Shops (Honest Worth Upside: +17.6%)

- Residence Depot (Honest Worth Upside: +17.5%)

Supply: InvestingPro

Searching for extra actionable commerce concepts to navigate the present market volatility? The InvestingPro instrument helps you simply determine successful shares at any given time.

Begin your 7-day free trial to unlock must-have insights and information!

Right here is the hyperlink for these of you who wish to subscribe to InvestingPro and begin analyzing shares your self.

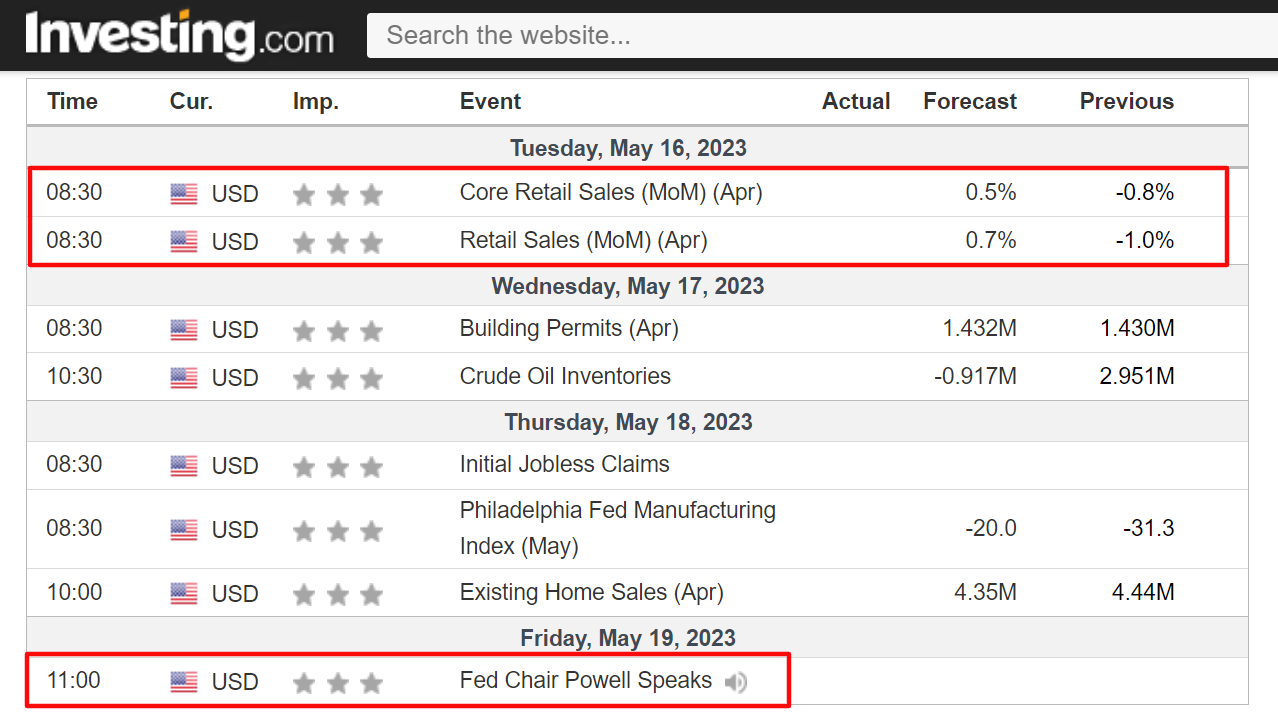

*Subsequent Week: Retail Gross sales, Powell, Financial institution Turmoil & Debt Ceiling Disaster

Along with the retailer earnings, the U.S. Commerce Division will publish its month-to-month report for April on Tuesday at 8:30 AM ET, with economists estimating a headline improve of +0.7% after spending fell -1.0% throughout the prior month.

Different financial studies on the agenda embody the Might on Monday, in addition to the Might index and April figures, that are each set for launch on Thursday, together with the newest replace.

The info shall be accompanied by a heavy slate of Federal Reserve audio system. A lot of the focus shall be on Fed Chair Jay Powell, who’s scheduled to take part in a panel dialogue titled “Views on Financial Coverage” on the Thomas Laubach Analysis Convention in Washington D.C. on Friday, at 11:00 AM ET.

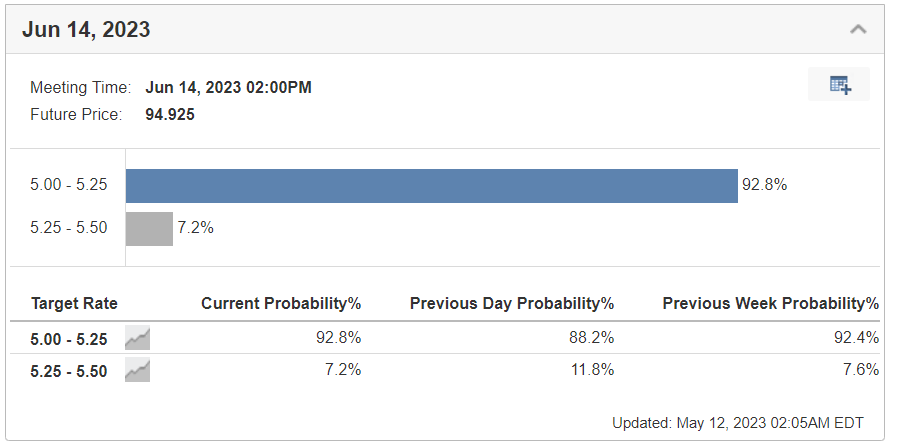

As of this morning, monetary markets overwhelmingly count on the Fed to pause its rate of interest mountaineering cycle at its subsequent assembly in June, with odds for no motion standing at 92.8%, in keeping with Investing.com’s .

Elsewhere, financial institution disaster developments will proceed to be in focus amid ongoing concern over the well being of the regional banking system.

Los Angeles-based PacWest Bancorp (NASDAQ:) plunged 22% on Thursday after it reported a pointy drop in deposits final week, sparking one other rout in shares of regional lenders.

Invesco KBW Regional Banking (NASDAQ:) is down 32% this 12 months and has suffered a sequence of risky classes since March because of the banking disaster, which has led to the collapse of three regional lenders up to now two months.

In the meantime, any updates on elevating the USA’ $31.4 trillion debt ceiling can even be watched by buyers because the nation races to avert an unprecedented default.

The U.S. Treasury Division might run out of the way to pay its debt obligations in a matter of weeks if Congress fails to move a invoice to boost the debt restrict. Lawmakers have no idea exactly how a lot time they’ve left to behave, however the “x-date” might come as quickly as June 1.

Treasury Secretary Janet Yellen urged Congress to boost the federal debt restrict and warned {that a} default might have extreme repercussions on the worldwide economic system and dangers undermining U.S. world financial management.

Discover All of the Information you Want on InvestingPro!

Disclosure: On the time of writing, I’m brief on the S&P 500 and Nasdaq 100 through the ProShares Quick S&P 500 ETF (SH) and ProShares Quick QQQ ETF (PSQ). I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic surroundings and firms’ financials. The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.