Shares saved rising as a result of and information had been higher than anticipated. That is the second week in a row that shares have jumped after a superb jobless claims report.

I’m undecided if that’s a superb factor as a result of jobless claims information is unpredictable and comes out each week. In some unspecified time in the future, it may be worse than anticipated. If that occurs, will shares take a success? Simply one thing to consider.

The and have now surged for six straight days, fueling the continued comeback rally. As we wrap up the week, it is essential to watch key market indicators for any indicators of exhaustion on this rally.

Listed below are 4 indicators to keep watch over.

1. Volatility Index

It’s laborious to say how a lot of the current market rise is because of choices expiring at this time. The , which measures market volatility, has dropped so much, which means that many buyers closed places, their bets in opposition to the market.

This compelled market makers to undo their bearish positions, so a part of the market’s rise may be due to this “volatility crush.”

2. USD/JPY’s Latest Value Motion

One more reason behind the rally could possibly be that the has stabilized just lately. It even went up yesterday and returned to its 20-day shifting common.

3. USD/CAD’s Uptrend

One other factor to look at is the , which has gone up over the previous couple of days. We regularly see that when the USD/CAD hits a low, the tends to peak, and the other is true, too. So, it’s important to keep watch over whether or not the USD/CAD retains rising.

The crucial stage it hasn’t been in a position to break by is round 1.385, apart from one time in December. If the USD/CAD retains climbing, one would assume the S&P 500 will flip decrease.

4. USD/MXN

We’ve additionally observed that the (the trade price between the US greenback and the Mexican peso) has dropped again right down to its assist stage and the 20-day shifting common after an enormous soar up.

A transfer up within the USD/MXN is a risk-off gauge; if the USD/MXN continues to fall, it’s a risk-on indication.

Backside Line

The worth motion in the previous couple of days has been fairly attention-grabbing. Buying and selling quantity has been actually low, and the distinction between bid and provide costs has been fairly huge.

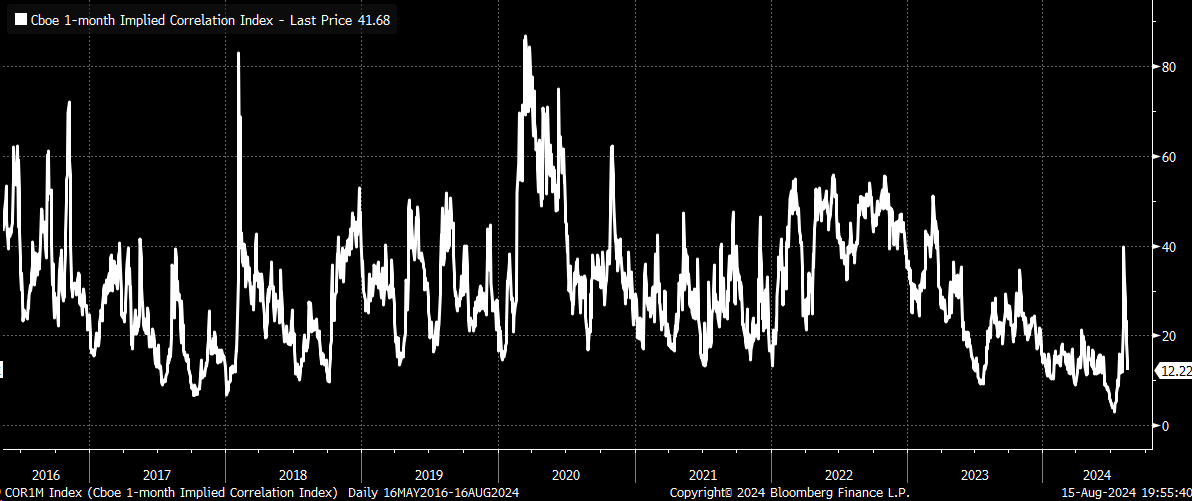

The 1-month implied correlation index is again right down to 12, which is on the decrease finish of its traditional vary. The intense ranges we noticed in July had been simply that—extremes.

Previously, like in 2017 and 2018, the lows had been round 8 or 9, and in 2023, it was round 10.

This looks as if a harmful market that, if a few of the dependable indicators and options are right, could possibly be almost burning itself out already.

Unique Put up