-

3M’s current spin-off of its healthcare subsidiary, Solventum Company, alerts a strategic shift geared toward streamlining its operations and unlocking potential worth for shareholders.

-

Regardless of preliminary market enthusiasm, issues persist relating to 3M’s monetary well being and profitability outlook for 2024.

-

Analysts stay divided on 3M’s prospects, with some highlighting its restoration potential based mostly on current monetary knowledge, whereas others categorical warning amid conservative forecasts for the upcoming quarters.

- Make investments like the massive funds for lower than $9 a month with our AI-powered ProPicks inventory choice software. Be taught extra right here>>

3M Firm (NYSE:) efficiently spun off its healthcare subsidiary, Solventum Company, which started buying and selling on the New York Inventory Change beneath the ticker SOLV.

As a part of the spinoff, 3M shareholders obtained 1 share of SOLV for each 4 shares of MMM they owned. 3M retains a 19.9% stake in Solventum, which will probably be purchased again inside 5 years after the spin-off.

The choice to spin off its healthcare enterprise was introduced by 3M two years in the past. After finishing the mandatory preparations, Solventum Corp. debuted on the NYSE this week. Following the spinoff, Solventum changed V.F. Corp. (NYSE:) within the S&P 500.

On the identical day Solventum started buying and selling, 3M reached a brand new settlement in a consuming water lawsuit. The corporate obtained last approval from the US District Courtroom for its settlement settlement with public water suppliers within the US.

This settlement follows accusations in opposition to 3M for water contamination with dangerous chemical compounds. The settlement entails a fee of $10.3 billion unfold over 13 years, with the primary installment anticipated within the third quarter of this yr, pending any objections.

Buyers React Positively

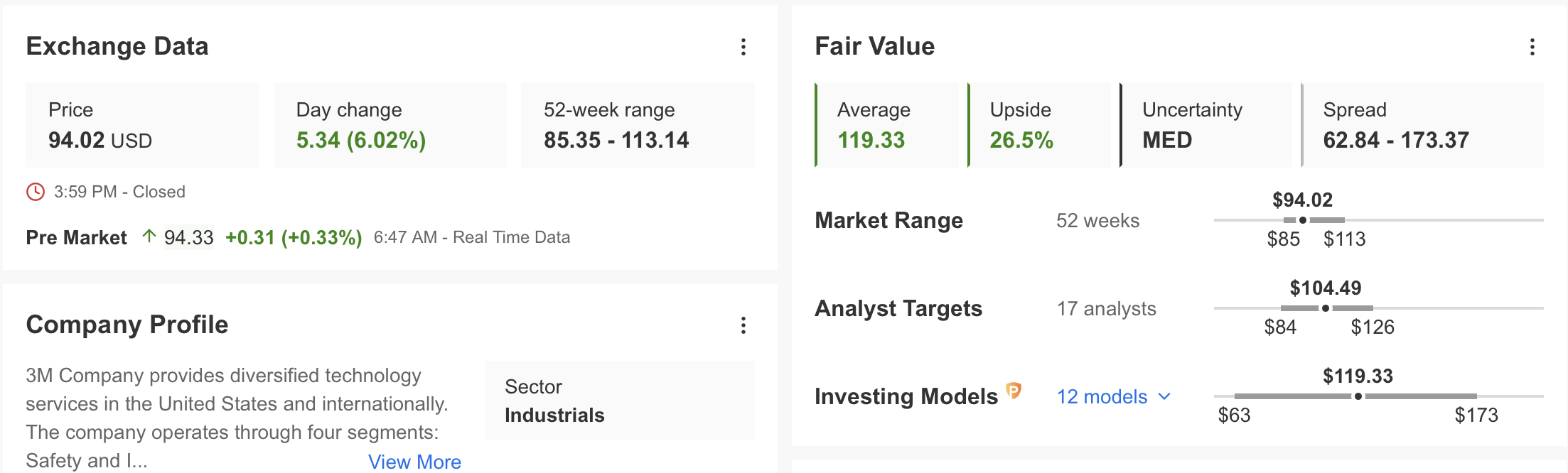

The spinoff garnered a optimistic reception from the road, resulting in a 6% improve in 3M’s inventory worth, closing at $94 from a gap of $90.85 after the spin-off announcement.

Nevertheless, preliminary buying and selling for SOLV noticed a worth drop from $80 to $68.4, a 14% lower, prompting some buyers to attend for stabilization earlier than buying.

3M’s healthcare gross sales had been declining earlier than the spinoff, with 2023 gross sales totaling $8.2 billion, down 2.8% from the earlier yr.

In its newest SEC submitting, 3M projected secure monetary efficiency for Solventum, with estimated natural gross sales development starting from -1.5% to 1.5% for the approaching yr.

The spin-off of Solventum is a part of 3M’s technique to streamline its healthcare operations, following the sale of its drug distribution enterprise for $650 million to a personal fairness agency in 2020.

Whereas we wait to see how this spinoff would fare for 3M in the long term, let’s check out the corporate’s present monetary state and the way this spinoff would possibly change issues.

3M Firm: Key Monetary Metrics

3M financials present that the corporate’s monetary well being stays beneath common. The InvestingPro Monetary Well being report reveals that 3M’s greatest downside is in development objects.

Supply: InvestingPro

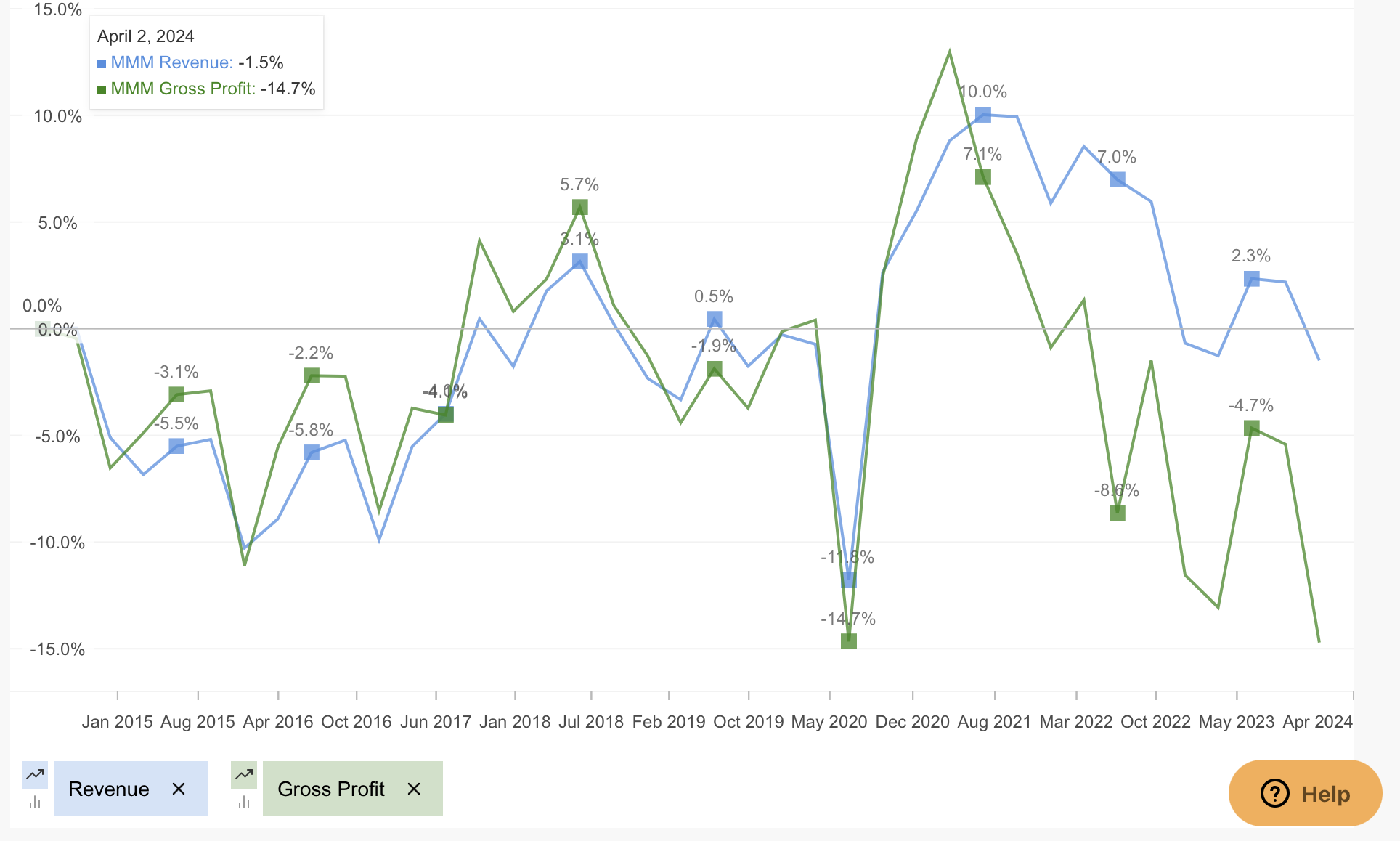

The corporate’s profitability and money stream are common. Once we visualize income and gross revenue in InvestingPro, it’s seen that 3M has had issues in income development, particularly since 2021, whereas this development has seen some restoration by 2023.

Supply: InvestingPro

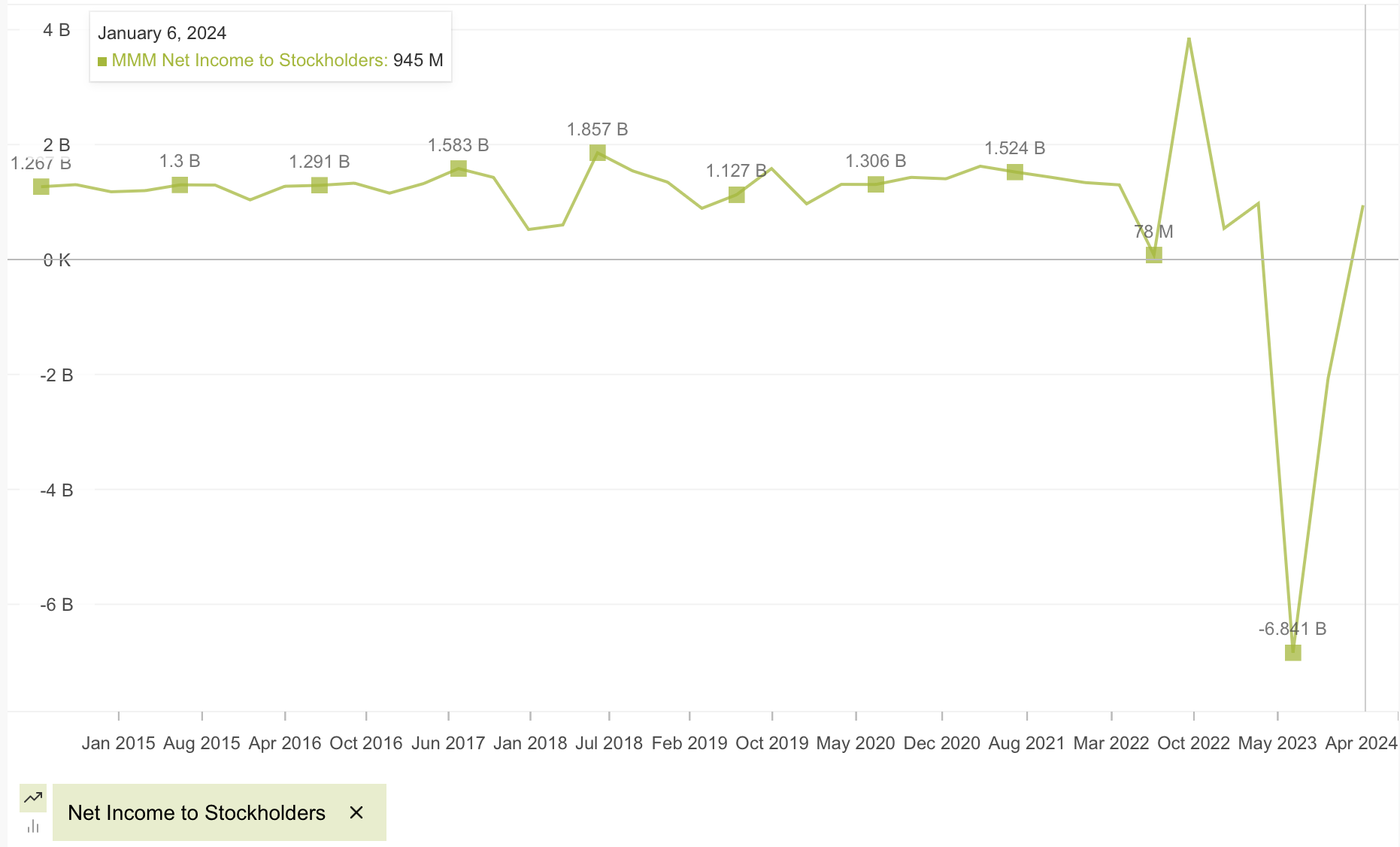

Whereas the weak spot in gross sales additionally affected revenue margins, the corporate managed to realize profitability within the final quarter of 2023 after posting losses within the 2nd and third quarters, when its operational prices elevated.

Supply: InvestingPro

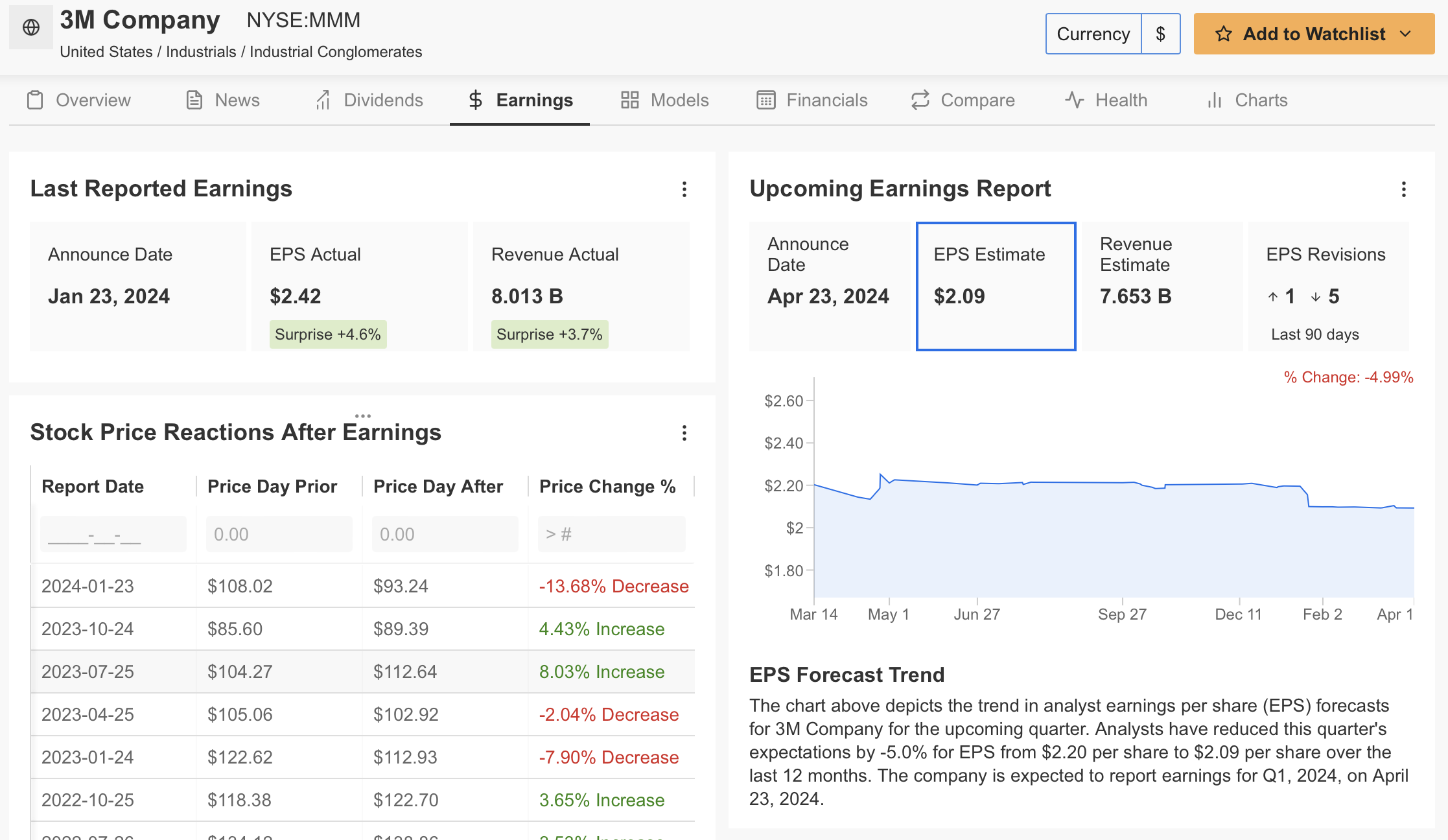

Nevertheless, the corporate, which introduced its This autumn outcomes on January 23, revealed sturdy financials and gave hope to its buyers by saying higher-than-expected income and earnings per share.

Regardless of this, the share worth fell by almost 14% after the outcomes had been introduced and fell from $108 to $93 at the moment. This was the most important damaging response after the earnings report within the final 5 years.

Regardless of the financials that gave a restoration message within the final quarter, the corporate’s low-profit outlook for 2024 was seen as the most important issue that prompted the selloff.

Furthermore, the weak revenue expectations through the interval when the spin-off that befell this week got here to the agenda made buyers uneasy.

Supply: InvestingPro

Though 3M’s 2024 projection is seen as conservative by the market, some analysts suppose that the forecasts are constant and replicate the present situations in 2024.

Accordingly, we will see that the share worth will probably be positively affected by the truth that 3M presents figures exceeding expectations in its quarterly experiences.

Nevertheless, if we check out the forecasts within the final 3-month interval, 5 analysts revised their opinion downwards.

Analysts’ consensus is that 3M will announce revenues of $ 7.65 billion with a revenue per share of $ 2.09, down 5%, within the first quarter outcomes of 2024, which will probably be introduced on April 23.

Supply: InvestingPro

Some of the vital options of 3M is that it has a big long-term investor base with 53 years of uninterrupted dividend funds.

Excluding 2024 expectations, the obtainable knowledge displays the restoration within the firm’s monetary construction, and we will verify this with InvestingPro’s truthful worth evaluation.

Primarily based on 12 monetary fashions, MMM’s truthful worth worth is at present 119 {dollars}. This DA will be interpreted as a 26% low cost to MMM’s present worth of 94 {dollars}. As well as, 17 analysts imagine that 3M inventory may transfer in the direction of $105 inside the yr.

Technical View

Since 2021, MMM, which has been transferring in a long-term falling channel, attracted consideration with its tendency to interrupt the pre-split channel upwards.

In case the inventory reaches the pre-split worth, the motion to violate the channel at $ 105 will comply with. A weekly shut above $115 on common can verify that the long-term decline has been damaged.

The uptrend that will happen in a attainable upside breakout could carry the MMM worth as much as the $160 area. Alternatively, so long as the share worth stays inside the channel on the weekly chart, it can proceed its downward development.

***

Take your investing sport to the following degree in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already nicely forward of the sport relating to AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,745% over the past decade, buyers have the very best number of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to speculate as such it’s not supposed to incentivize the acquisition of belongings in any means. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding choice and the related threat stays with the investor.