MicroStockHub

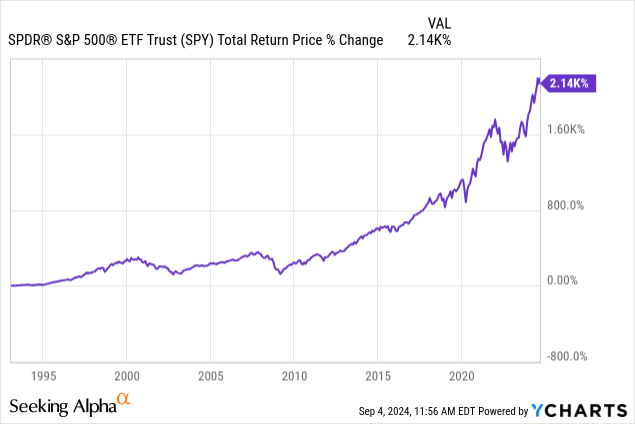

The SPDR S&P 500 ETF Belief (SPY) is a highly regarded long-term wealth compounder for passive traders because it carefully tracks its underlying index (SP500), has a low expense ratio, and has an outstanding long-term monitor report:

Nonetheless, there are three explanation why I believe that the Vanguard Dividend Appreciation Index Fund ETF Shares (NYSEARCA:VIG) is a greater funding proper now. This text will element these:

Motive 1: Decrease Expense Ratio

Warren Buffett as soon as said that:

Efficiency comes, efficiency goes. Charges by no means falter.

What Mr. Buffett means by this assertion is that, whereas numerous sectors and fund managers can every have a sizzling streak, finally market traits will change, resulting in intervals of underperformance for even the most effective traders and most promising sectors of the market (Mr. Buffett himself has even skilled these). Nonetheless, what sometimes doesn’t change over that time frame is the payment that the fund supervisor costs to traders. In consequence, one of many surest ways in which an investor can stack the percentages in his favor over the long run is to chop administration charges to as low a degree as attainable.

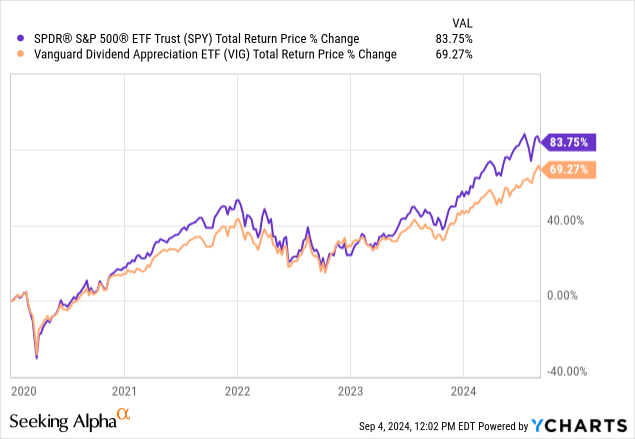

This precept is clearly displayed in a comparability of SPY and VIG. SPY has outperformed VIG because the starting of 2020:

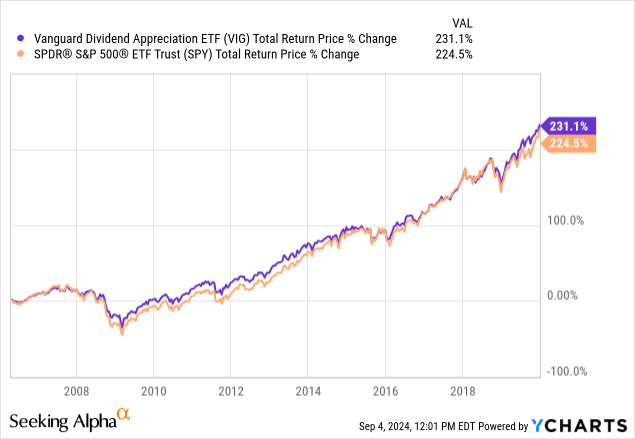

Nonetheless, this has not all the time been the case, as earlier than the start of 2020, VIG had truly outperformed SPY:

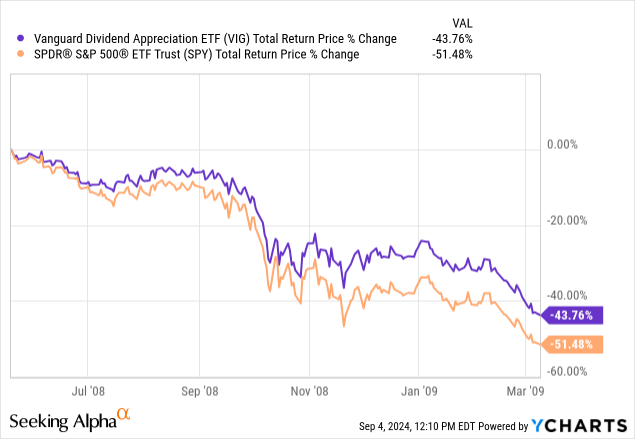

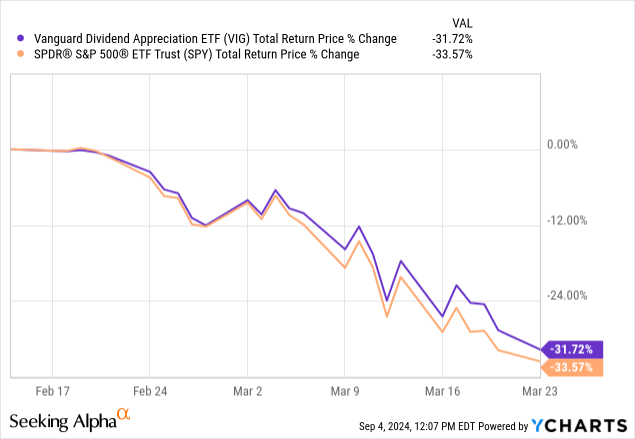

Moreover, VIG held up higher than SPY did throughout each the 2008-2009 and 2020 market crashes:

In the meantime, VIG costs a decrease expense ratio than SPY does – 0.06% vs. 0.09%. Which means that all else being equal, VIG will seemingly outperform SPY barely over time. Furthermore, SPY’s latest outperformance of VIG will not be reflective of the complete historical past of those funds as there have been intervals the place VIG has outperformed SPY and VIG appears to be extra defensive throughout occasions of turmoil and uncertainty than SPY is.

Given the surging geopolitical issues dealing with the world at present in Jap Europe, the Center East, and the Far East, the rising fears of a recession, and the nosebleed valuations within the markets at present, erring on the aspect of defensiveness with decrease charges looks as if a extra prudent wager than making an attempt to trip the wave of latest momentum that SPY has loved.

Motive 2: Superior Dividend Yield and Development

Another excuse to desire VIG to SPY is that it provides each a superior present dividend yield and stronger dividend development. Its ahead dividend yield is 1.73% in comparison with SPY’s 1.24% dividend yield. Furthermore, VIG’s five-year dividend CAGR is 10.26%, its three-year dividend CAGR is 11.65%, and its trailing twelve-month dividend CAGR is 8.01%. Compared, SPY’s five-year dividend CAGR is 4.76%, its three-year dividend CAGR is 7.06%, and its trailing twelve-month dividend CAGR is 4.92%. In consequence, VIG is a a lot stronger passive revenue machine.

Whereas each funds have comparatively low dividend yields and due to this fact lean closely on development to drive whole returns, VIG’s clear benefit when it comes to dividends and dividend development provides it additional attraction. There are a number of causes for this:

- Firstly, rising dividends are proof of true underlying earnings energy development as money being delivered to shareholders in rising quantities over a time frame will not be one thing that may be manipulated by inventive accounting.

- Greater-yielding shares are much less speculative in nature than shares that rely on bigger quantities of future development to generate whole returns and likewise have a tendency to carry up higher throughout financial downturns. It is because decrease development/larger yield shares are inclined to have decrease valuations and are due to this fact much less depending on the longer term understanding effectively than development firms are. Moreover, firms which can be extra defensive in nature can sometimes pay out additional cash in dividends since they’re extra assured of their potential to maintain that payout by way of all types of financial cycles.

- Lastly, dividends make up an underrated share of whole returns even within the S&P 500. Primarily based on analysis by Guinness Atkinson Asset Administration, between the interval Dec. 31, 1940, to Dec. 31, 2011, dividends accounted for 27% of whole returns over a mean holding interval of 1 yr, 38% of whole returns over a mean holding interval of three years, 42% of whole returns over a mean holding interval of 5 years, 42% of whole returns over a mean holding interval of 10 years, and a whopping 60% of whole returns over a mean holding interval of 20 years. Provided that VIG pays out a meaningfully larger yield than SPY does at present and can be rising its payout a lot quicker than SPY is, VIG seems more likely to outperform SPY over the long run except SPY can reverse this pattern and pace up its personal dividend development.

Motive 3: Higher Threat-Adjusted Sector Allocations

A closing purpose why we favor VIG over SPY proper now’s that its sector allocations seem extra favorable to us proper now. Whereas the S&P 500 is usually seen as an excellent proxy for the broader inventory market, the latest mega-cap tech and AI inventory booms have led to an unlimited focus of SPY into the know-how sector, with it now making up practically one-third of SPY’s whole portfolio and its top-6 holdings consisting of Apple Inc. (AAPL), Microsoft Company (MSFT), NVIDIA Company (NVDA), Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), and Alphabet Inc. (GOOG)(GOOGL).

In distinction, whereas VIG nonetheless has vital publicity to know-how (it is the biggest sector in its portfolio and its three high holdings are Apple Inc. (AAPL), Broadcom Inc. (AVGO), and Microsoft Company (MSFT)), its publicity is extra modest at 23.77% of its whole portfolio, which supplies it better publicity to different sectors like financials, healthcare, industrials, shopper defensive, and fundamental supplies. In the meantime, VIG has meaningfully much less publicity to shopper cyclical shares and communication sector shares, which each make sense since each of these sectors are usually poor for producing constant dividend development.

Given VIG’s better stability in its portfolio diversification in addition to its better publicity to defensive sectors like financials, healthcare, and shopper defensive shares in comparison with high-flying, richly valued tech shares and recession-sensitive shopper defensive shares, we consider that its sector allocations at the moment present it with higher risk-reward than SPY’s sector allocations present.

Investor Takeaway

Whereas SPY is a superb place to take a position for long-term wealth compounding, we consider that proper now VIG is an excellent higher possibility attributable to its decrease expense ratio, higher defensiveness throughout market crashes, a lot better dividend yield and dividend development, and its better-diversified portfolio. Whereas we predict that selecting particular person shares to construct a dividend portfolio is an excellent higher method, for traders who’re advantageous with a low dividend yield and desire a broadly diversified, one-stop-shop for long-term wealth compounding, VIG is difficult to beat.