[ad_1]

- Amid upcoming central financial institution conferences and essential macroeconomic information releases, market sentiment is poised for potential shifts.

- Whereas broader market indexes might proceed to consolidate sideways, particular shares have proven exceptional positive factors and sturdy bullish momentum in latest periods.

- This evaluation, powered by InvestingPro insights, seeks to find out the honest valuation of those shares and assess the bullish momentum’s sustainability.

- In 2024, make investments like the massive funds from the consolation of your private home with our AI-powered ProPicks inventory choice device. Study extra right here>>

Key central financial institution conferences, together with the , and essential macro information are on the agenda amid a busy week for the monetary markets.

Whereas indexes might consolidate sideways, sure shares have lately skilled vital positive factors and exhibit robust bullish momentum.

This evaluation goals to evaluate whether or not these shares are priced pretty and if they’re prone to preserve going up.

To entry these shares, we’ll use insights from InvestingPro. The three shares we’ll take a look at are:

1. 3M Firm

3M Firm (NYSE:) has up to date its earnings projections for the primary quarter, elevating its estimate per share to a excessive of $2.20 from the beforehand acknowledged vary of $2.00 to $2.15.

The rise in earnings estimates is because of the results of the separation of 3M’s healthcare enterprise as of April 1 and the introduced quarterly dividend of $1.51 per share, or $6.04 if annualized.

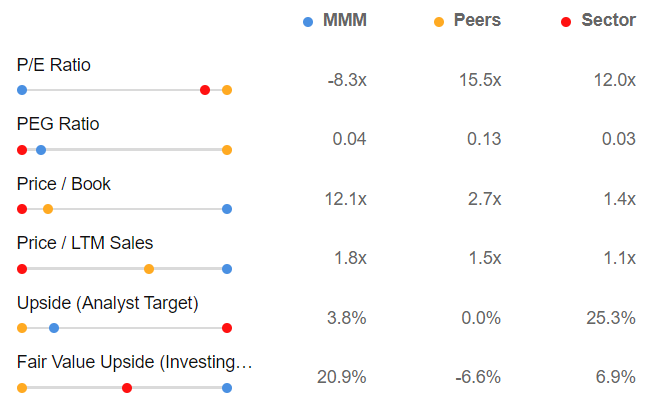

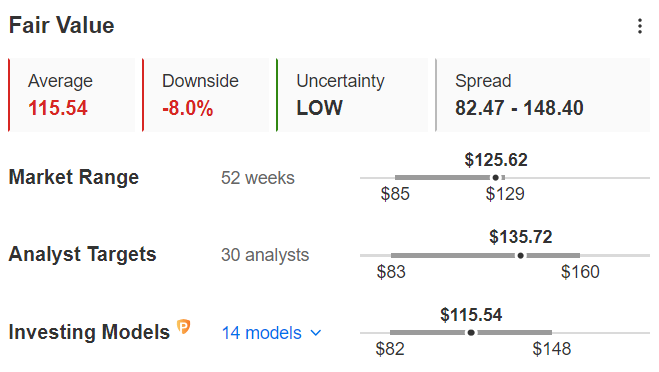

Supply: InvestingPro

For 3M, the Honest Worth from InvestingPro, which summarizes 15 funding fashions, stands at $127.02, or +20.9% above the present value.

Once more InvestingPro subscribers had been capable of observe the event of the forecasts of the analysts interviewed, as for the goal value they’re bullish on the inventory, at $108.17.

Whereas analysts and Honest Worth agree on the potential for an increase, the danger profile is much less reassuring; it has a good degree of monetary well being, with a rating of two out of 5.

Evaluating the inventory with opponents, we’ve the affirmation we anticipated, the inventory at the moment has a doubtlessly undervalued valuation.

Supply: InvestingPro

3M is now price 1.8x instances its income in comparison with 1.1x within the business, and the Value/Earnings ratio at which the inventory is buying and selling is -8.3X towards an business common of 12x, once more pointing to a slight undervaluation relative to the business.

2. Oracle

Oracle (NYSE:) was influenced by latest progress in cRPO (present remaining efficiency obligations), a robust indicator of renewed momentum within the cloud enterprise after a interval of disappointing ends in the earlier two quarters.

That is supported by the corporate’s strong working margins, that are anticipated to stay above 40%.

The corporate’s optimism is bolstered by steady progress in Infrastructure as a Service (IaaS), which recorded a 49% improve, intently aligned with the 50% progress noticed within the earlier quarter.

It lately reported a 16% improve in non-GAAP earnings per share and seven% income progress for the fiscal interval, forecasting acceleration by way of fiscal 12 months 2025.

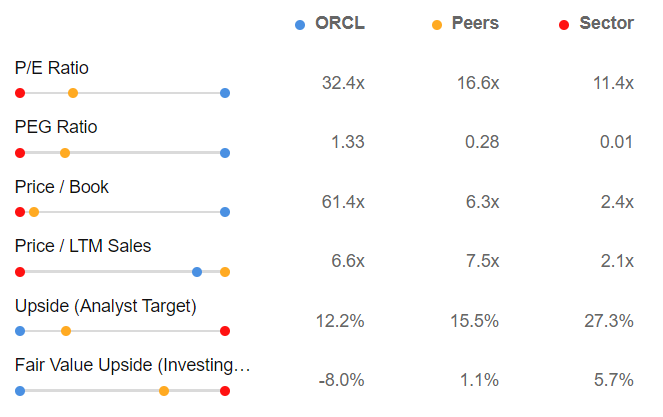

Supply: InvestingPro

For Oracle, InvestingPro’s Honest Worth, which summarizes 14 funding fashions, stands at $115.54, which is -8 % lower than the present value.

Because of InvestingPro it’s doable to observe the event of the forecasts of the analysts interviewed, as for the goal value they’re bullish on the inventory, at $135.72 and consequently removed from the common Honest Worth.

Whereas analysts and Honest Worth in the meanwhile agree on the draw back potentialities, the low-risk profile is optimistic it has an excellent monetary well being ranking of three out of 5.

Delving deeper into the inventory in comparison with its opponents, we’ve the affirmation we anticipated, the inventory is at the moment extremely overvalued

Supply: InvestingPro

Oracle is now price greater than six instances its income in comparison with greater than two instances within the business, and the Value/Earnings ratio at which the inventory is buying and selling is 32.4x in comparison with an business common of 11.4x, which stands to substantiate right here its present overvaluation even relative to the business.

3. PayPal

PayPal (NASDAQ:) strategic shift and product enhancements have been key, however the speedy influence on outcomes could also be restricted, as evidenced by the latest decline in energetic buyer accounts and cautious forecasts for 2024.

Nevertheless, the transition below Chriss’s management and the appointment of Aaron J. Webster as the corporate’s new govt vp means an elevated deal with innovation and operational effectivity because of the optimistic business outlook.

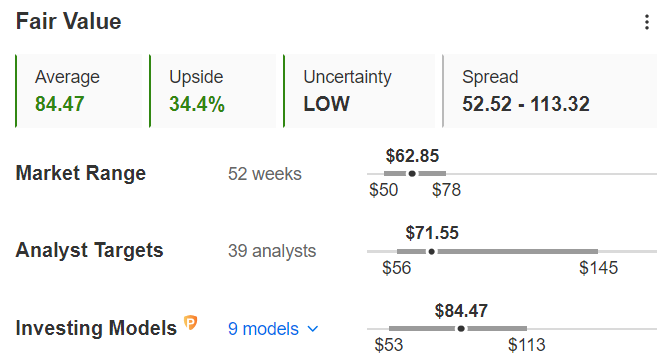

Supply: InvestingPro

For PayPal, InvestingPro’s Honest Worth, which summarizes 9 funding fashions, stands at $84.47, or 34.4% increased than the present value.

InvestingPro subscribers had been capable of observe the analysts’ forecasts simply, as they’re bullish on the inventory with the goal value at $71.55.

Presently, analysts and Honest Worth each agree on the chance of an increase. That is additional supported by the corporate’s robust monetary well being, rated at 3 out of 5 for its low-risk profile.

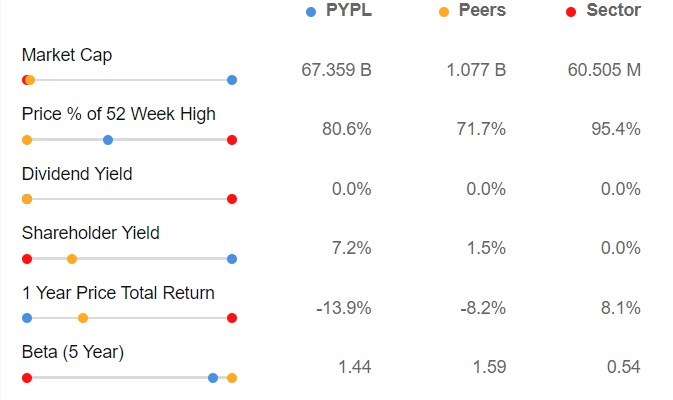

Nevertheless, upon nearer examination, evaluating it with opponents reveals a possible overvaluation, which contradicts the anticipated upside.

Supply: InvestingPro

PayPal is now price greater than two instances its revenues in comparison with two and a half instances within the business, and the Value/Earnings ratio at which the inventory is buying and selling is 15.9X towards an business common of 8.3x, which stands to substantiate its overvaluation relative to the business.

***

Take your investing sport to the following degree in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already effectively forward of the sport in the case of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and reduce losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking device: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty margin over the past decade, buyers have the very best choice of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe At present!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to speculate as such it isn’t meant to incentivize the acquisition of property in any manner. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link