Lengthy-term investing requires endurance, a stable plan, and the humility to just accept that predicting geopolitical occasions is sort of inconceivable. Whereas I all the time concentrate on the larger image, the present tempo of change calls for consideration. Speedy shifts can deliver each dangers and alternatives, and navigating them requires greater than a black-and-white perspective—nuance is crucial.

A number of threat elements are gaining prominence, together with financial uncertainty, market instability, systemic weaknesses, foreign money fluctuations, and geopolitical tensions. The U.S.’s function as a worldwide energy additionally faces new challenges. One threat particularly stands out: the growing chance of a coverage misstep. This growth deserves shut monitoring.

Let’s look at three key considerations that, whereas nonetheless contained, are prone to intensify over the following 12 months:

1. Recession Dangers Are Rising—However Don’t Count on an Rapid Downturn

For years, recession calls have been untimely, and the market has acknowledged the economic system’s resilience. Nonetheless, indicators of moderation are rising.

have softened, and aren’t displaying robust momentum. Whereas a contraction isn’t imminent, the economic system’s vulnerability is turning into extra evident as per the —a threat that traders can’t ignore.

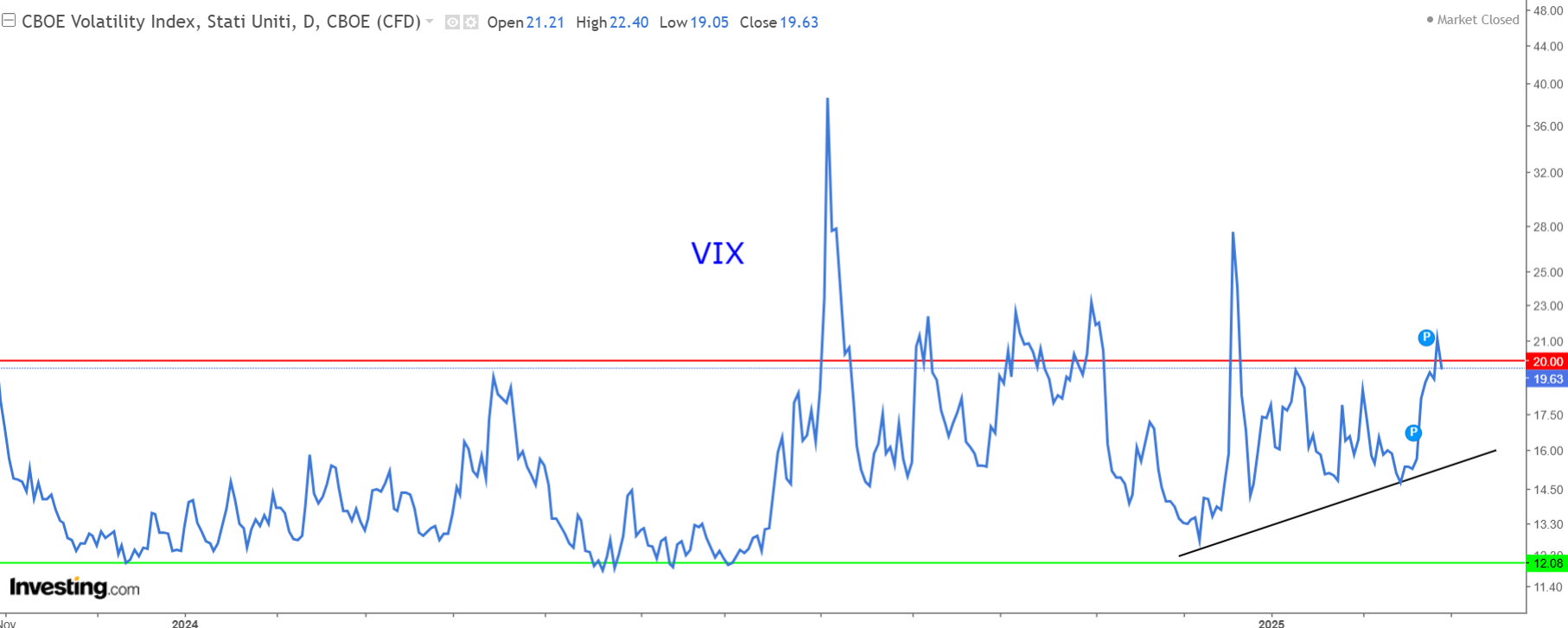

2. Volatility Is Creeping Greater

Regardless of equities repeatedly hitting all-time highs, market volatility has began to climb. If file highs outline a bullish market, then failing to interrupt earlier peaks might sign a shift towards greater volatility.

The , which hovered at traditionally low ranges post-pandemic, is now trending upward, edging previous 20. Whereas this isn’t alarming but, it hints at potential turbulence forward.

3. The Geopolitical Wild Card

Not like financial and market dangers, geopolitical uncertainty is tougher to quantify. Historic developments can information expectations for recessions and volatility, however geopolitical shifts are unpredictable. The continued tensions involving Ukraine, Russia, China, Europe, and even commerce routes just like the Panama Canal introduce an extra layer of uncertainty.

To navigate this, traders should resist the lure of emotional bias and put together for a spread of eventualities. That mentioned, if I had to decide on between worry and optimism, I’d nonetheless guess on the latter.

Rising dangers don’t simply deliver challenges—they create alternatives for traders who can keep forward of market shifts.

Subscribing to InvestingPro to capitalize on potential corrections. A subscription will even assist you to entry the newest ProPicks month-to-month rebalancing replace for March, utilizing this hyperlink.

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to take a position as such it’s not supposed to incentivize the acquisition of property in any means. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding resolution and the related threat stays with the investor.