smrm1977

Foreword

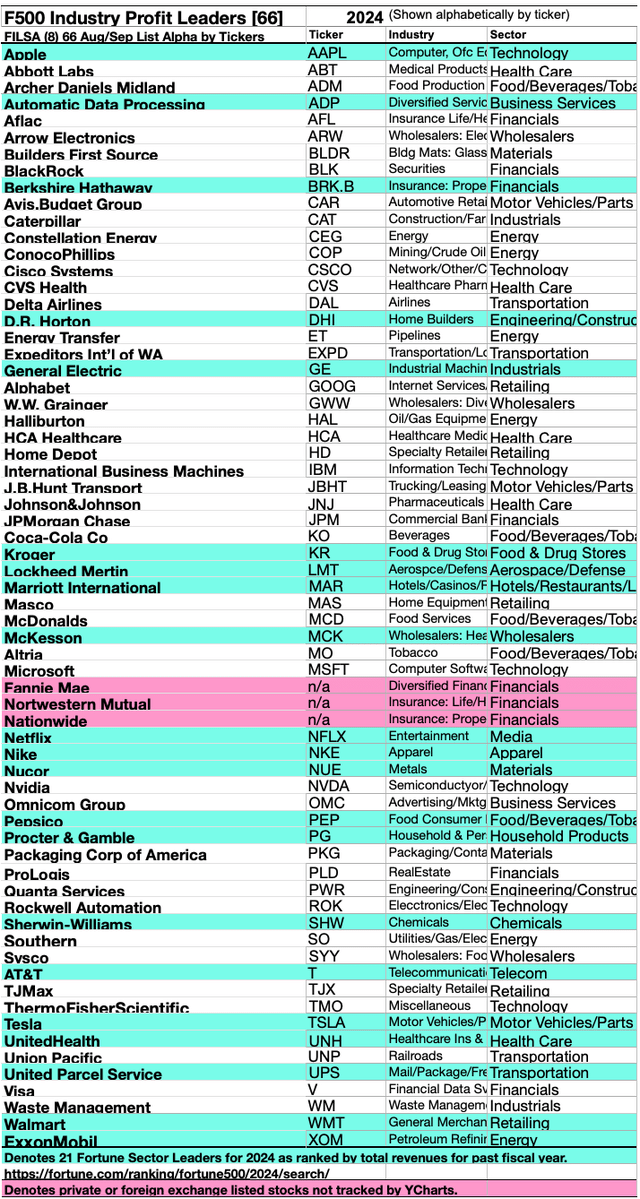

This text is predicated on Fortune journal’s 2024 survey of 500 Largest U.S. Firms (F500-IL)

“The Fortune 500, in its seventieth yr, ranked the most important U.S. corporations by income. In complete, Fortune 500 corporations represented two-thirds of the U.S. GDP with $18.8 trillion in revenues, $1.7 trillion in earnings, and $43 trillion in market worth (as of March 28, 2024), they usually employed 31 million folks worldwide.” This text covers the highest profit-generating corporations in 66-industries.

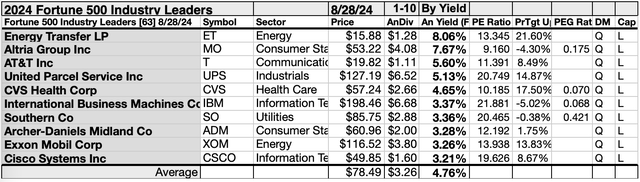

Any assortment of shares is more-clearly understood when subjected to yield-based (canine catcher) evaluation, this assortment of F500-IL for 2024 is ideal for the dogcatcher course of. Beneath are the August 28 information for the 57 dividend shares populating these F500IL as parsed-by YCharts.

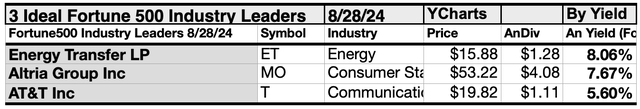

The costs of three of the 57 dividend picks made the opportunity of proudly owning productive dividend-shares from this assortment a actuality for first-time buyers.

The three Dogcatcher supreme best-to-buy August 2024 shares have been: Power Switch (ET); Altria Group (MO); AT&T (T).

These three stay up-to the best of getting their annual dividends from a $1K funding exceed their single-share costs. Many buyers see this situation as “look-closer to maybe-buy” alternative.

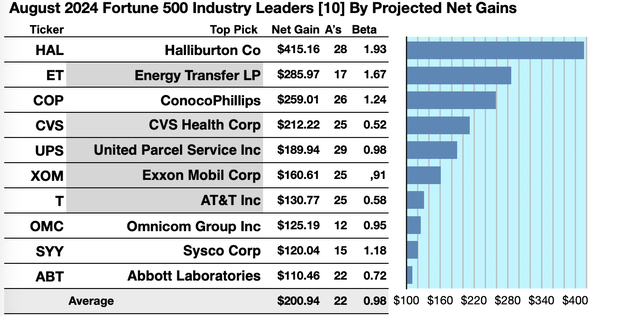

Actionable Conclusions (1-10): Analysts Estimated 11.05% To 41.52% Internet Beneficial properties From Ten F500-IL Dividend Shares Into August 2025

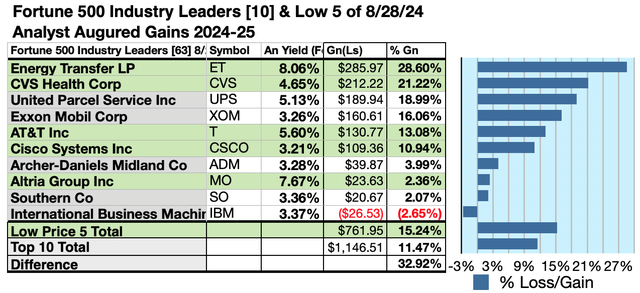

5 of ten high F500-IL dividend shares by yield have been additionally among the many high ten gainers for the approaching yr based mostly on analyst 1-year goal costs. (They’re tinted grey within the chart under). Thus, the yield-based forecast for these August favorites was graded by Wall St. Wizards as 50% correct.

Supply: YCharts.com

Estimated dividends from $1000 invested in every of the very best yielding F500-IL shares, added to the median of combination one-year goal costs from analysts (as reported by YCharts), generated the next listing. (Notice: one-year target-prices by lone-analysts weren’t included.) Thus, ten possible profit-generating trades, projected to August, 2025 have been:

Halliburton Co (HAL) was projected to internet $415.16 based-on the median of goal estimates from 28 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 93% larger than the market as an entire.

Power Switch LP was projected to internet $285.97, based mostly on the median of goal worth estimates from 17 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 67% larger than the market as an entire.

ConocoPhillips (COP) was projected to internet $259.01 based mostly on dividends, plus the median of goal worth estimates from 26 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 24% larger than the market as an entire.

CVS Well being Corp (CVS) was projected to internet $212.22, based mostly on dividends, plus the median of goal worth estimates from 25 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 48% underneath the market as an entire.

United Parcel Service (UPS) was projected to internet $189.94 based mostly on the median of goal worth estimates from 29 analysts, plus annual dividend, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 2% lower than the market as an entire.

Exxon Mobil Corp (XOM) was projected to internet $160.61, based mostly on the median of estimates from 25 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 9% lower than the market as an entire.

AT&T Inc was projected to internet $130.77 based mostly on dividends, plus the median of goal estimates from 25 brokers, much less transaction charges. The Beta quantity confirmed this estimate topic to danger/volatility 42% lower than the market as an entire.

Omnicom Group Inc (OMC) was projected to internet $125.19, based mostly on dividends, plus the median of goal worth estimates from 12 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 5% lower than the market as an entire.

Sysco Corp (SYY) was projected to internet $120.04, based mostly on dividends, plus median goal worth estimates from15 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 18% larger than the market as an entire.

Abbott Laboratories (ABT) was projected to internet $110.46, based mostly on dividends, plus the median of goal worth estimates from 22 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 28% lower than the market as an entire.

The common internet achieve in dividend and worth was estimated at 20.09% on $10k invested as $1k in every of those ten shares. These achieve estimates have been topic to common danger/volatility 7% larger than the market as an entire.

Supply: Open supply canine artwork from dividenddogcatcher.com

The Dividend Canines Rule

Shares earned the “canine” moniker by exhibiting three traits: (1) paying dependable, repeating dividends, (2) their costs fell to the place (3) yield (dividend/worth) grew greater than their friends. Thus, the very best yielding shares in any assortment grew to become referred to as “canines.” Extra exactly, these are, in reality, finest referred to as, “underdogs”.

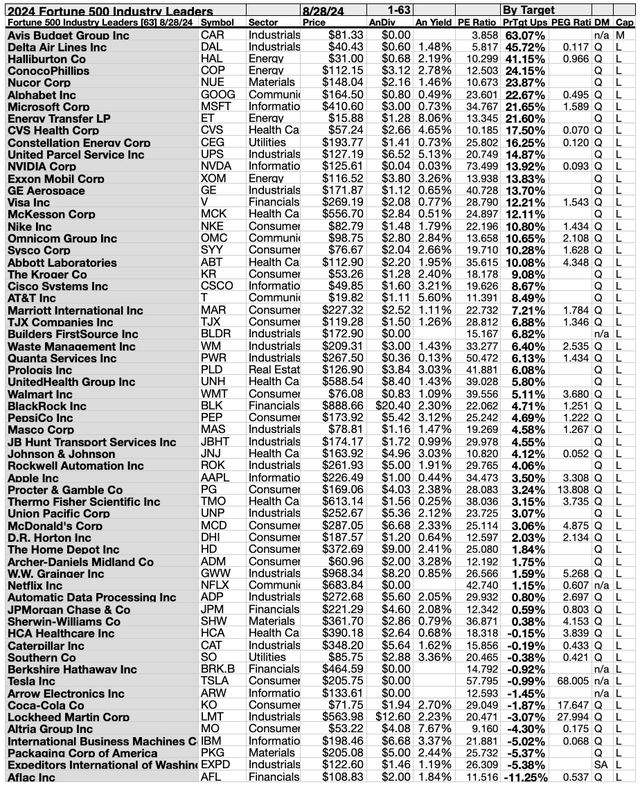

63 F500-IL In August Per Analyst Goal Knowledge

Supply: YCharts.com

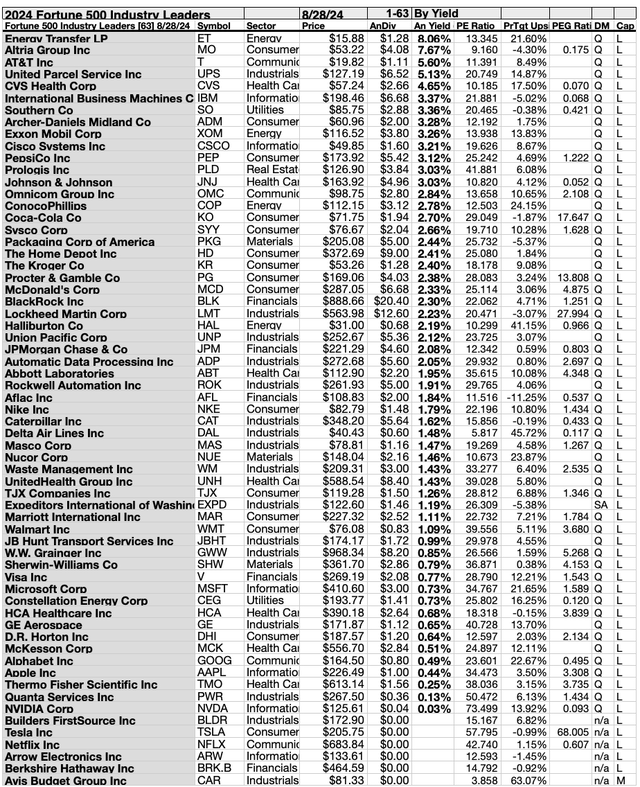

63 F500-IL August Yields

Supply: YCharts.com

Actionable Conclusions (11-20): Ten High F500-IL By Yield

High ten F500-IL by yield in August represented seven of 11 Morningstar sectors. First place was held by the primary of two vitality members, Power Switch LP [1], the opposite positioned ninth, Exxon Mobil [9].

The primary of two client staples representatives positioned second, Altria Group [2]; the opposite positioned eighth, Archer-Daniels Midland (ADM) [8].

Then, third place went to communication providers, particularly, AT&T [3]. Thereafter, a lone industrials member positioned fourth, United Parcel Service [4].

A lone healthcare consultant positioned fifth, CVS Well being [5]. The primary of two expertise representatives claimed sixth place, Worldwide Enterprise Machines (IBM) [7]; the opposite positioned tenth, Cisco Techniques (CSCO) [10].

Lastly, utilities took the seventh place, Southern (SO) [7], to finish the 2024 high ten F500-IL dividend pack in August.

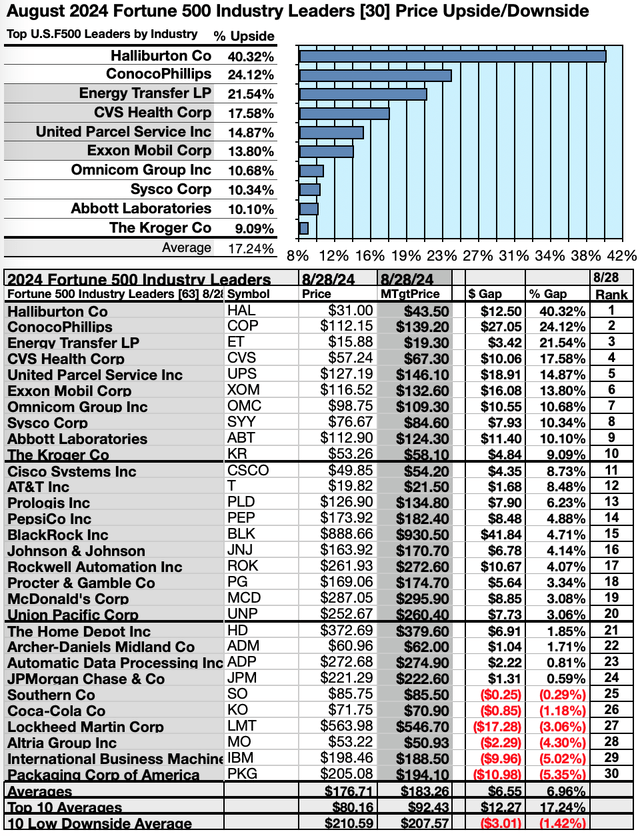

Actionable Conclusions: (21-30) Ten High F500-IL as-of August 28 Confirmed 9.09% to 40.32% Upsides, and (31) Seven -0.29% to -6.61% Down-siders

Supply: YCharts.com

To quantify high canine rankings, analyst median worth goal estimates offered a “market sentiment” gauge of upside potential. Added to the straightforward high-yield metrics, median analyst goal worth estimates grew to become one other device to dig out bargains.

Analysts Forecast A 32.92% Benefit For five Highest Yield, Lowest Priced, of 10 F500-IL Dividend Shares From August

Ten high Fortune F500-IL yield (dividend / worth) outcomes, offered by YCharts, produced the next rating.

Supply: YCharts.com

As famous above high ten F500-IL shares screened 8/28/24, displaying the very best dividend yields, represented seven of 11 within the Morningstar sector scheme.

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The High Ten Highest-Yield F500-IL (32) Delivering 1524% Vs. (33) 11.47% Internet Beneficial properties by All Ten Come August, 2025

Supply: YCharts.com

$5000 invested as $1k in every of the 5 lowest-priced shares within the high ten F500-IL by yield have been predicted by analyst 1-year targets to ship 32.93% extra achieve than $5,000 invested as $0.5k in all ten. The very lowest-priced choice, Power Switch was projected to ship the most effective internet achieve of 28.6%.

Supply: YCharts.com

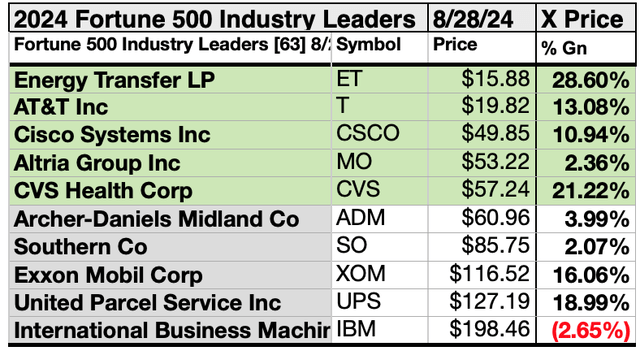

The 5 lowest-priced top-yield F500-IL for 2024 Dividend Canines as of August 28 have been: Power Switch LP; AT&T; Cisco Techniques; Altria Group; CVS Well being, with costs starting from $15.88 to $57.24.

5 higher-priced F500-IL Dividend Canines as of August 28 have been: Archer-Daniels Midland; Southern Co; Exxon Mobil; United Parcel Service; Worldwide Enterprise Machines, whose costs ranged from $60.96 to $198.46.

The excellence between 5 low-priced dividend canines and the overall area of ten mirrored Michael B. O’Higgins’ “primary technique” for beating the Dow. The dimensions of projected positive factors based mostly on analyst targets added a singular factor of “market sentiment” gauging upside potential. It offered a here-and-now equal of ready a yr to seek out out what may occur out there. Warning is suggested, since analysts are traditionally solely 15% to 85% correct on the course of change and simply 0% to fifteen% correct on the diploma of change.

The web achieve/loss estimates above didn’t think about any international or home tax issues ensuing from distributions. Seek the advice of your tax advisor relating to the supply and penalties of “dividends” from any funding.

Afterword

This text options Fortune 500 Trade Leaders and focuses on the highest 30 for August. Subsequently, close to half the unique listing of 57 dividend paying corporations is uncared for. To treatment this situation, the next is offered

A Full Checklist of 66 Fortune 500 Trade Leaders for 2024

Sources: Fortune.com, YCharts.com

(Shares are grouped alphabetically by ticker, in ascending order.) The bluish-greenish tinted shares are Sector Leaders. The three wine-tinted listings are privately owned or international alternate listed shares not included within the YCharts listings.

If someway you missed the suggestion of which shares are ripe for selecting at first of this text, here’s a reprise of the listing on the finish:

Supply: YCharts.com

The costs of three of those 66 F500-IL for June made the opportunity of proudly owning productive dividend shares from this assortment extra viable for first-time buyers.

These three stay as much as the best of getting their annual dividends from a $1K funding equal or exceed their single share costs. Many buyers see this situation as “look-closer to maybe-buy” alternative.

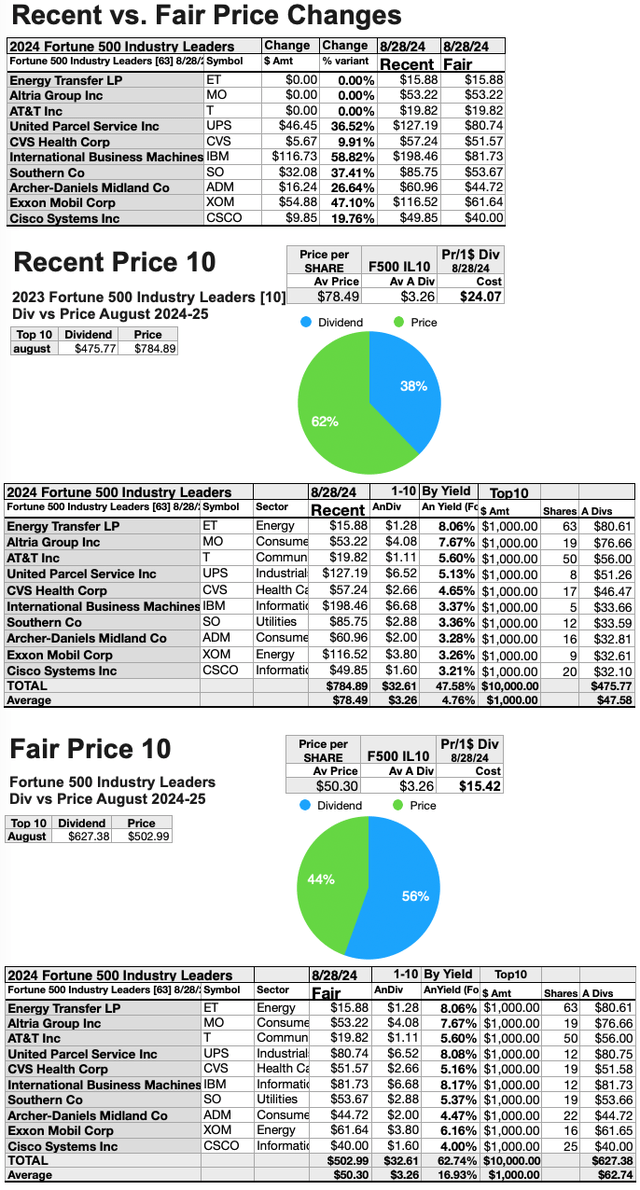

How All Ten High F500-IL Shares May Turn into Superb Truthful Priced Canines

Supply: YCharts.com

Three of the highest ten F500-IL shares in August 2024 have been priced lower than the annual dividends paid out from a $1K funding. The greenback and proportion variations between current and truthful costs are detailed within the high chart. Three supreme fair-priced shares plus the seven at present costs are proven within the center chart. Lastly, the truthful pricing of all ten high canines conforming to that supreme are the topic of the underside chart.

With renewed draw back market stress to 60%, it’s potential for all ten highest-yield F500-IL shares, to change into fair-priced with their annual yield (from $1K invested) assembly or exceeding their single share costs. This pack received a pleasant head-start with three of ten already truthful priced.

Shares listed above have been steered solely as potential reference factors to your buy or sale analysis course of. These weren’t suggestions.

Disclaimer: This text is for informational and academic functions solely and shouldn’t be construed to represent funding recommendation. Nothing contained herein shall represent a solicitation, advice or endorsement to purchase or promote any safety. Costs and returns on equities on this article besides as famous are listed with out consideration of charges, commissions, taxes, penalties, or curiosity payable attributable to buying, holding, or promoting identical.

Graphs and charts have been compiled by Rydlun & Co., LLC from information derived from www.indexarb.com; YCharts.com; Yahoo Finance – Inventory Market Stay, Quotes, Enterprise & Finance Information; analyst imply goal worth by YCharts. Canine picture: Open supply canine artwork from dividenddogcatcher.com.