[ad_1]

Updated on April 12th, 2022 by Bob Ciura

Income investors are always on the hunt for high-quality dividend stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of all 147 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 66 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

While their length of dividend increases is the same, leading to some overlap, there are also some important differences between the Dividend Aristocrats and Dividend Champions. As a result, the Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

This article will discuss large cap stocks, and an analysis of our top 7 Dividend Champions, ranked according to expected total returns in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Overview of Dividend Champions

The requirement to become a Dividend Champion is simple: 25+ years of consecutive annual dividend increases. The Dividend Aristocrats have the same requirement when it comes to number of years, but with a few additional requirements.

To be a Dividend Aristocrat, a company must also be included in the S&P 500 Index, must have a float-adjusted market cap of at least $3 billion, and must have an average daily value traded of at least $5 million. These added requirements preclude many companies that possess a sufficient track record of annual dividend increases, but do not qualify based on market cap or liquidity reasons.

As a result, while there is some overlap between the Dividend Aristocrats and the Dividend Champions, there are also many Dividend Champions that are not Dividend Aristocrats. Income investors might want to consider these stocks due to their impressive histories of annual dividend increases, so we have compiled them in the downloadable spreadsheet above.

In addition, we have ranked the top 7 Dividend Champions according to total expected annual returns over the next five years. Our top 7 Dividend Champions right now are ranked below.

The Top 7 Dividend Champions To Buy Right Now

The following 7 stocks represent Dividend Champions with at least 25 consecutive years of dividend increases, but they also have durable competitive advantages, long-term growth potential, and high expected total returns.

Stocks have been ranked by expected total annual return over the next five years, from lowest to highest.

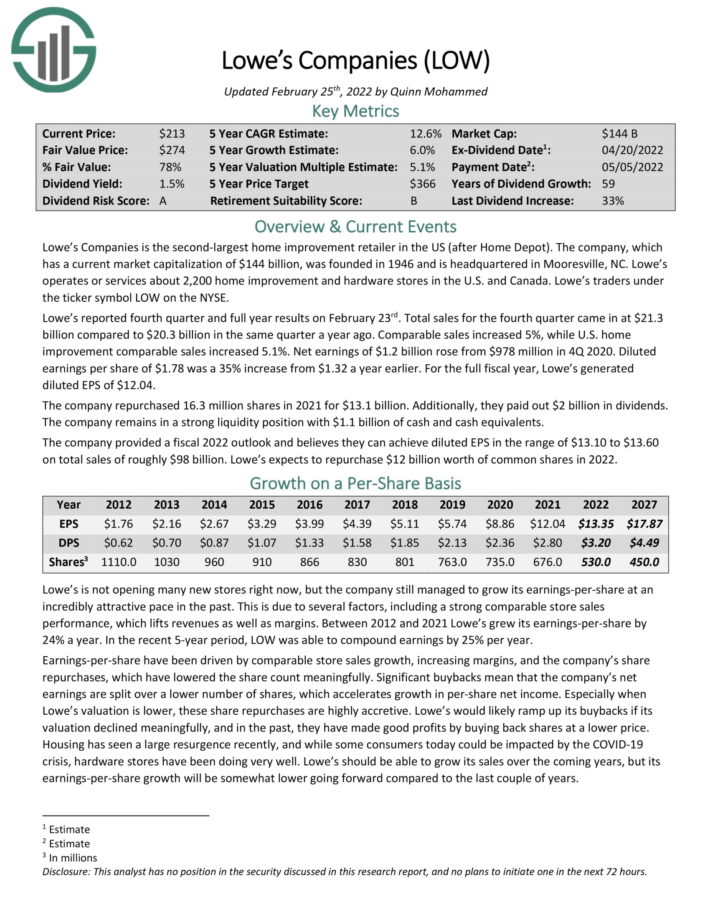

Top Dividend Champion #7: Lowe’s Companies (LOW)

- 5-year expected returns: 13.6%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 2,200 home improvement and hardware stores in the U.S. and Canada.

The company has generated strong growth in the past few years, fueled by the strong U.S. economy and housing market.

Source: Investor Presentation

Lowe’s reported fourth quarter and full year results on February 23rd . Total sales for the fourth quarter came in at $21.3 billion compared to $20.3 billion in the same quarter a year ago. Comparable sales increased 5%, while U.S. home improvement comparable sales increased 5.1%. Net earnings of $1.2 billion rose from $978 million in 4Q 2020. Diluted earnings per share of $1.78 was a 35% increase from $1.32 a year earlier.

For the full fiscal year, Lowe’s generated diluted EPS of $12.04. The company repurchased 16.3 million shares in 2021 for $13.1 billion. Additionally, they paid out $2 billion in dividends. The company remains in a strong liquidity position with $1.1 billion of cash and cash equivalents.

The company provided a fiscal 2022 outlook and believes they can achieve diluted EPS in the range of $13.10 to $13.60 on total sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion worth of common shares in 2022.

The combination of multiple expansion, 6% expected EPS growth and the 1.5% dividend yield lead to total expected returns of 13.6% per year.

Click here to download our most recent Sure Analysis report on Lowe’s (preview of page 1 of 3 shown below):

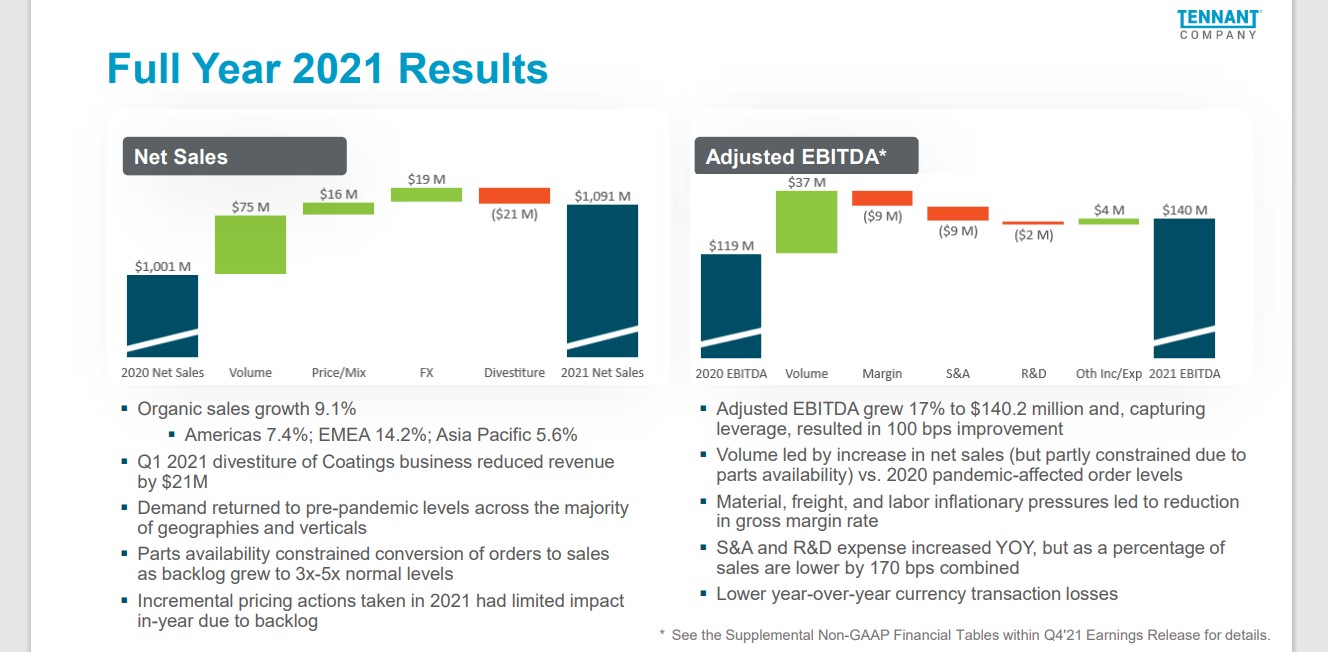

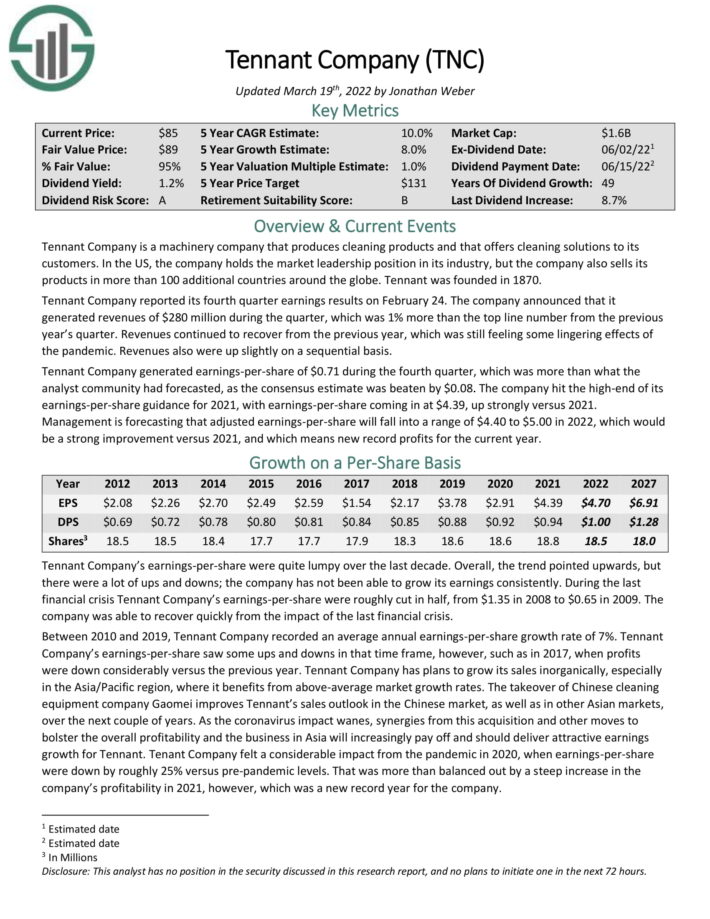

Top Dividend Champion #6: Tennant Co. (TNC)

- 5-year expected returns: 13.9%

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its

customers. In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe. Tennant was founded in 1870.

Tennant Company reported its fourth quarter earnings results on February 24. The company announced that it generated revenues of $280 million during the quarter, which was 1% more than the top line number from the previous year’s quarter. Revenues continued to recover from the previous year, which was still feeling some lingering effects of the pandemic. Revenues also were up slightly on a sequential basis.

Source: Investor Presentation

Tennant Company generated earnings-per-share of $0.71 during the fourth quarter, which was more than what the analyst community had forecasted, as the consensus estimate was beaten by $0.08. The company hit the high-end of its earnings-per-share guidance for 2021, with earnings-per-share coming in at $4.39, up strongly versus 2021.

Management is forecasting that adjusted earnings-per-share will fall into a range of $4.40 to $5.00 in 2022, which would be a strong improvement versus 2021, and which means new record profits for the current year

Assuming a flat valuation multiple, 4% expected growth and dividends, we expect total returns of 13.9% per year over the next five years.

Click here to download our most recent Sure Analysis report on Tennant (preview of page 1 of 3 shown below):

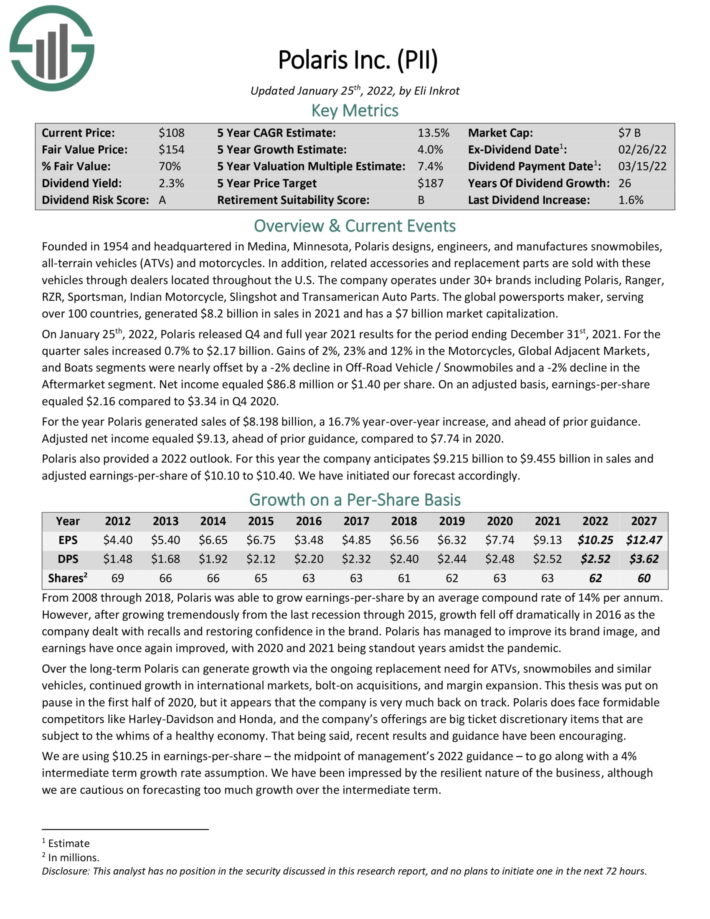

Top Dividend Champion #5: Polaris Industries Inc. (PII)

- 5-year expected returns: 14.0%

Polaris designs, engineers, and manufactures snowmobiles, all–terrain vehicles (ATVs) and motorcycles. In addition, related accessories and replacement parts are sold with these vehicles through dealers located throughout the U.S.

The company operates under 30+ brands including Polaris, Ranger, RZR, Sportsman, Indian Motorcycle, Slingshot and Transamerican Auto Parts.

Source: Investor Presentation

On January 25th, 2022, Polaris released Q4 and full year 2021 results for the period ending December 31st, 2021. For the quarter sales increased 0.7% to $2.17 billion. Gains of 2%, 23% and 12% in the Motorcycles, Global Adjacent Markets, and Boats segments were nearly offset by a -2% decline in Off-Road Vehicle / Snowmobiles and a -2% decline in the Aftermarket segment. Net income equaled $86.8 million or $1.40 per share.

On an adjusted basis, earnings-per-share equaled $2.16 compared to $3.34 in Q4 2020. For the year Polaris generated sales of $8.198 billion, a 16.7% year-over-year increase, and ahead of prior guidance. Adjusted net income equaled $9.13, ahead of prior guidance, compared to $7.74 in 2020. Polaris also provided a 2022 outlook. For this year the company anticipates $9.215 billion to $9.455 billion in sales and adjusted earnings-per-share of $10.10 to $10.40.

The stock has a 2.4% dividend yield. We also expect 4% annual EPS growth, and a 7.6% boost from an expanding P/E multiple. Total returns are expected to reach 14% per year.

Click here to download our most recent Sure Analysis report on Polaris (preview of page 1 of 3 shown below):

Top Dividend Champion #4: Pentair plc (PNR)

- 5-year expected returns: 14.2%

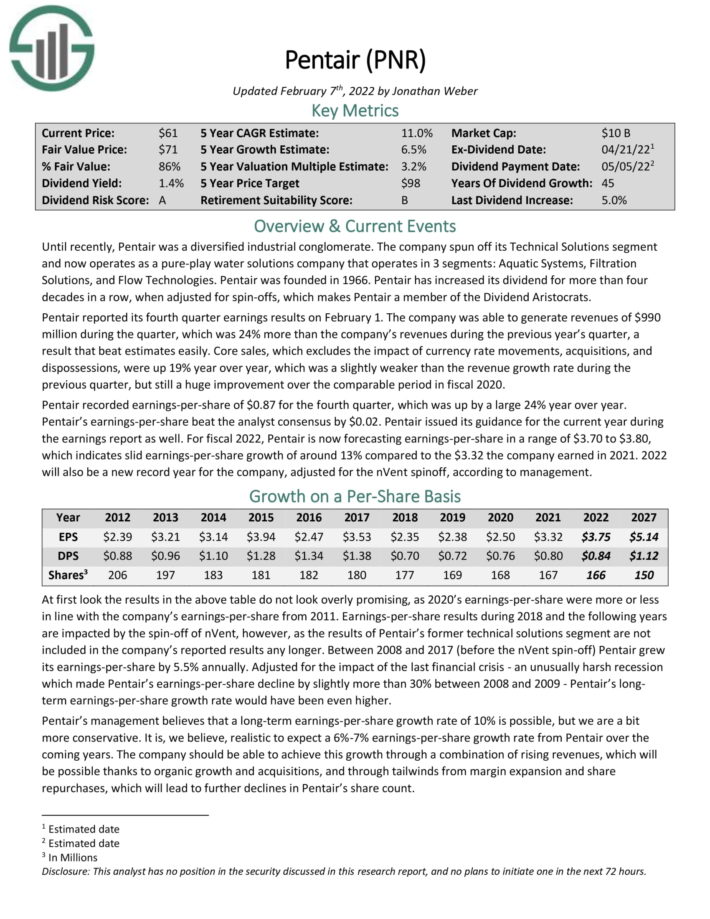

Pentair operates as a pure–play water solutions company with 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies. Pentair was founded in 1966. Pentair has increased its dividend for more than four decades in a row, when adjusted for spin–offs.

Pentair reported its fourth quarter earnings results on February 1. Revenue of $990 million increased 24% year-over-year. Core sales, which excludes the impact of currency rate movements, acquisitions, and dispossessions, were up 19% year over year. Pentair recorded earnings–per–share of $0.87 for the fourth quarter, which was up by 24% year over year.

Pentair issued its guidance for the current year during the earnings report as well. For fiscal 2022, Pentair is now forecasting earnings–per–share in a range of $3.70 to $3.80, which indicates earnings–per–share growth of around 13%.

Total returns are expected to reach 14.2% over the next five years.

Click here to download our most recent Sure Analysis report on Pentair (preview of page 1 of 3 shown below):

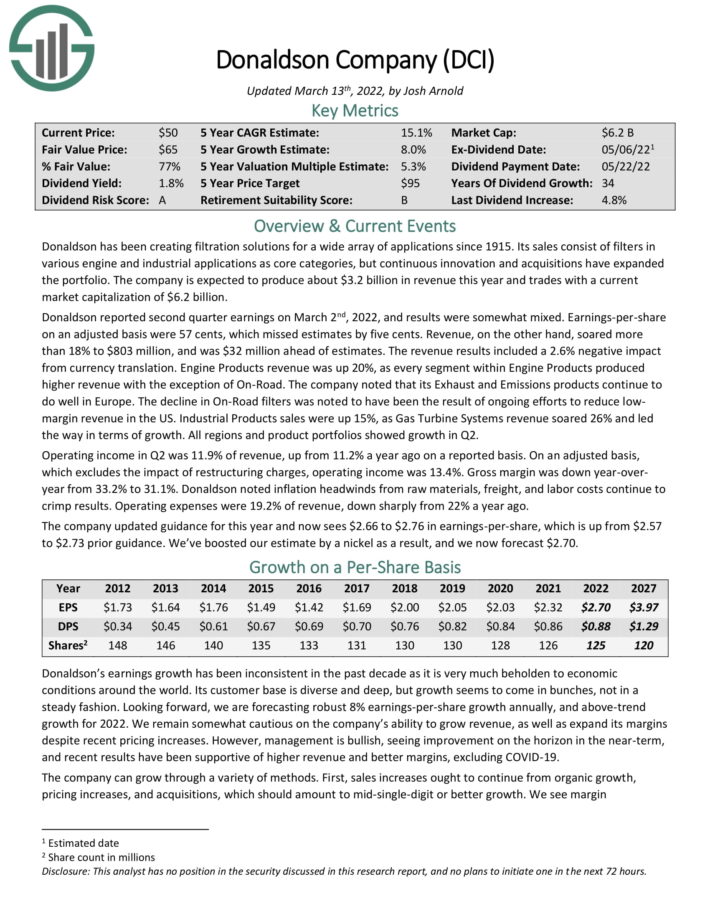

Top Dividend Champion #3: Donaldson Company (DCI)

- 5-year expected returns: 14.6%

Donaldson has been creating filtration solutions for a wide array of applications since 1915. Its sales consist of filters in various engine and industrial applications as core categories, but continuous innovation and acquisitions have expanded the portfolio. The company is expected to produce about $3.1 billion in revenue this year.

Donaldson reported first quarter earnings on December 1st, 2021, and results were better than expected for both revenue and profits. Total sales were up 19.5% to $761 million, up from $637 million in the same period a year ago.

Gross margin declined to 33.8% of revenue from 35.0%. This weakness reflected higher costs for raw materials, labor and freight, partially offset by higher sales and pricing.

We expect 8% annual EPS growth for Donaldson going forward, while the stock also has a 1.7% dividend yield. With a boost from P/E multiple expansion, we expect 14.6% annual returns over the next five years for Donaldson stock.

Click here to download our most recent Sure Analysis report on Donaldson (preview of page 1 of 3 shown below):

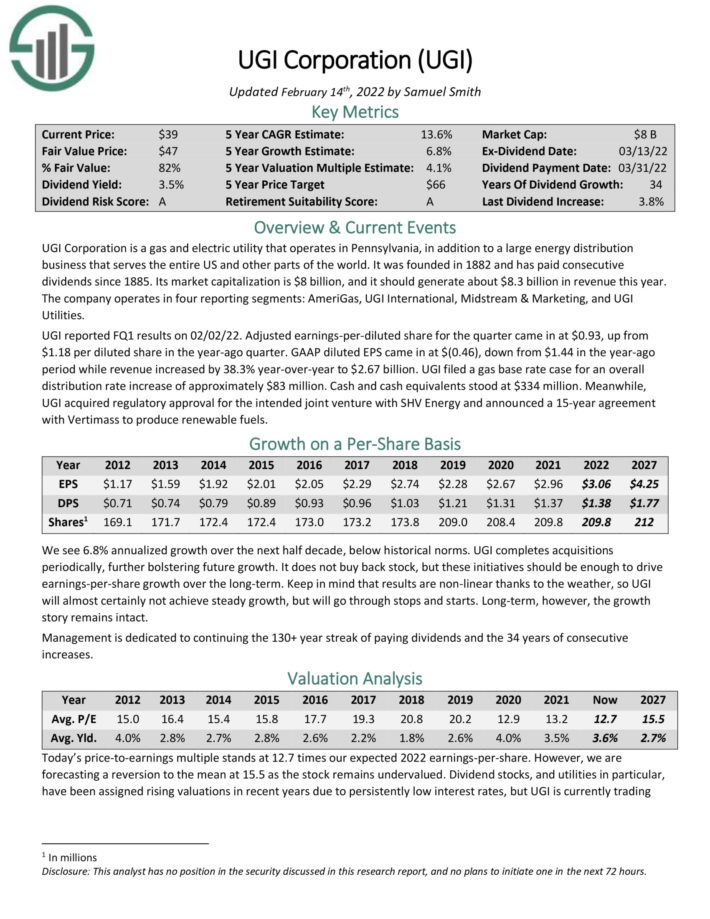

Top Dividend Champion #2: UGI Corp. (UGI)

- 5-year expected returns: 15.3%

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885. The company should generate about $8.3 billion in revenue this year.

Source: Investor Presentation

The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI reported FQ1 results on 02/02/22. Adjusted EPS for the quarter came in at $0.93, up from $1.18 per diluted share in the year ago quarter. Revenue increased by 38.3% to $2.67 billion. UGI filed a gas base rate case for an overall distribution rate increase of approximately $83 million.

We expect 15.3% annual returns over the next five years, due to 6.8% EPS growth, the 3.8% dividend yield, and a ~4.7% annual boost from a rising P/E multiple.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

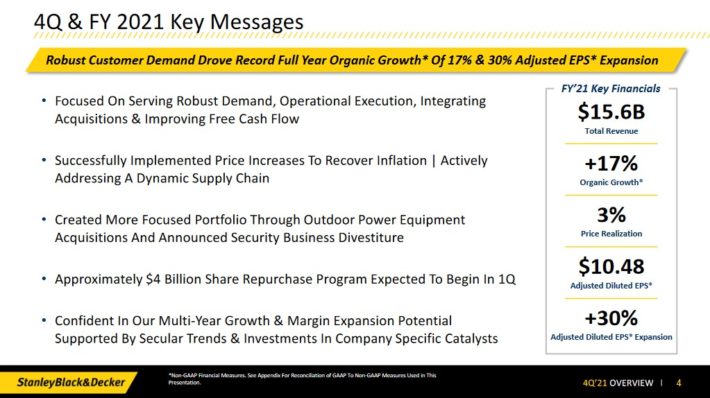

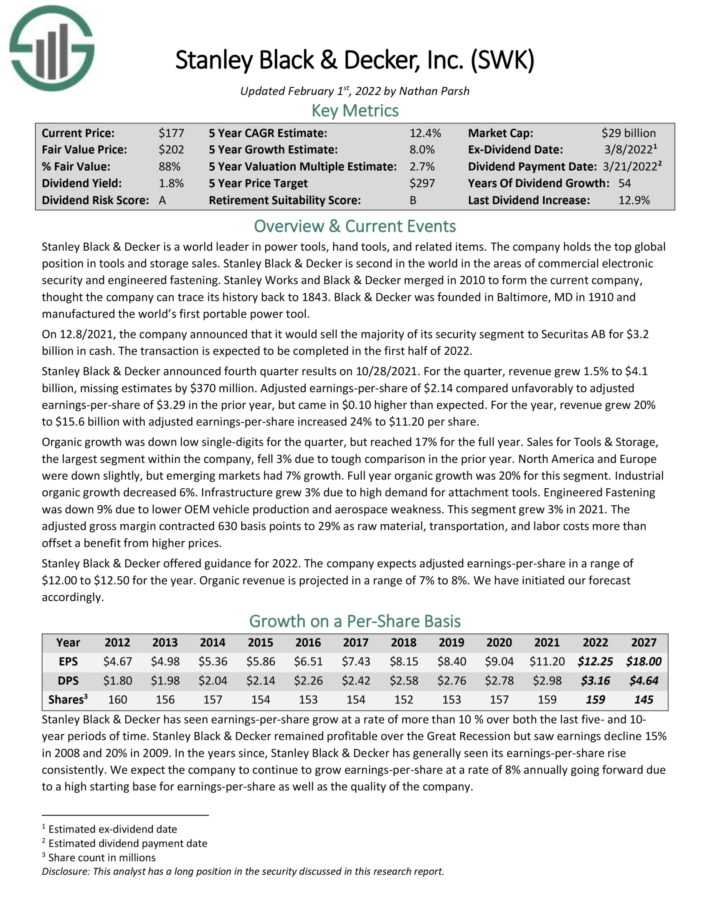

Top Dividend Champion #1: Stanley Black & Decker (SWK)

- 5-year expected returns: 17.6%

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales. Stanley Black & Decker is second in the world in the areas of commercial electronic security and engineered fastening.

You can see an overview of the company’s 2021 fourth-quarter performance in the image below:

Source: Investor Presentation

Revenue grew 17% on an organic basis. Adjusted earnings-per-share increased 30% year-over-year.

The stock has a 2.2% dividend yield, and we expect 8% annual EPS growth. With a ~7.4% boost from an expanding P/E multiple, total returns are expected to reach 17.6% per year.

Click here to download our most recent Sure Analysis report on SWK (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks.

In order for a company to raise its dividend for at least 25 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries.

They also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 7 Dividend Champions presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link