[ad_1]

Data updated daily

Constituents updated annually

The consumer staples sector is home to some of the most well-known dividend growth stocks in the world.

There is also a wide body of evidence that suggests that the consumer staples sector outperforms over long periods of time.

With that in mind, we’ve compiled a database of all consumer staples stocks, which you can access below:

The list of stocks was derived from a few major consumer staples ETFs:

- Consumer Staples Select Sector SPDR ETF (XLP)

- Invesco Dynamic Food & Beverage ETF (PBJ)

- Invesco S&P Small Cap Consumer Staples ETF (PSCC)

Keep reading this article to learn more about the merits of investing in consumer staples stocks.

Table of Contents

This article provides our full list of all consumer staples stocks, a tutorial on how to use the spreadsheets to create screens of consumer staples stocks, and the top 7 consumer staples stocks now.

The top 7 list was derived from the expected returns of each stock. We calculate expected returns based on a projection of earnings-per-share growth, dividend yields, and changes in the valuation multiple. The 7 consumer staples stocks are ranked by 5-year expected returns, from lowest to highest.

The table of contents below allows for easy navigation:

How To Use The Consumer Staples Stocks List To Find Investment Ideas

Having an Excel document containing each dividend-paying consumer staples stocks is very useful.

This tool becomes even more potent when combined with a solid, fundamental knowledge of how to manipulate data with Microsoft Excel. Quantitative investing screeners allow investors to remove many of the cognitive biases that impair long-term investing returns.

With that in mind, this section will provide a step-by-step explanation of how to use the dividend-paying consumer staples stocks list to find the best consumer staples investment ideas by using simple screening techniques.

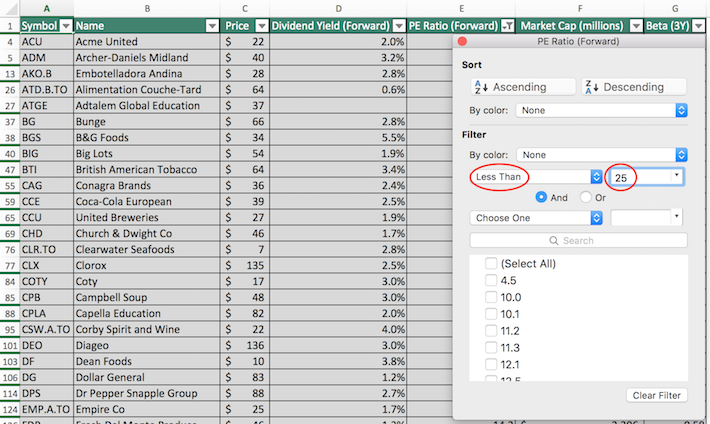

The first screen that we will implement is for stocks with price-to-earnings ratios below 25,

Screen 1: Avoiding Overvalued Stocks

Step 1: Download your free spreadsheet of all 71 consumer staples stocks here.

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter setting to “Less Than” and input 25 into the field beside it, as shown below.

The remaining stocks in the spreadsheet are consumer staples with price-to-earnings ratio less than 25.

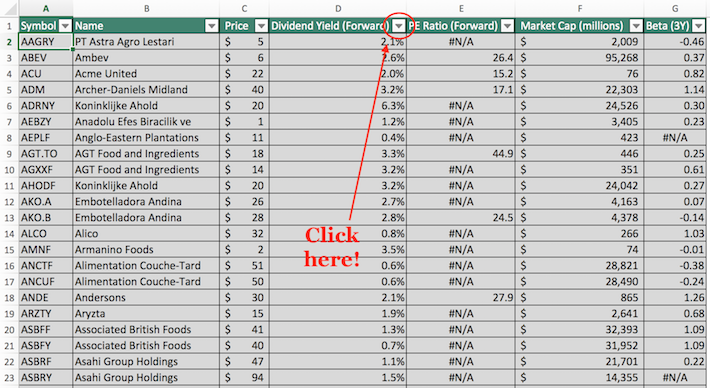

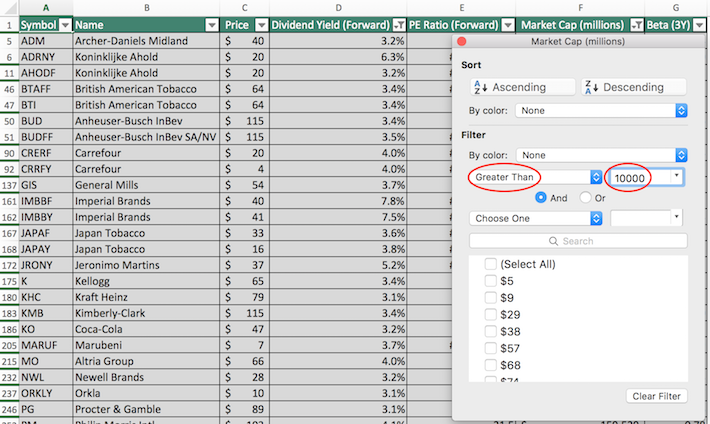

The next screen that we’ll implement is for ‘blue chip stocks’ – those with dividend yields above 3% and market capitalizations above $10 billion.

Screen 2: Blue Chip Stocks

Step 1:Download your free spreadsheet of all 71 consumer staples stocks here.

Step 2: We’ll first filter by dividend yield and then by market capitalization. Importantly, order doesn’t matter – you could also filter by market capitalization and then dividend yield and the screen would output the same results.

To filter by dividend yield, click the filter icon at the top of the dividend yield icon, as shown above.

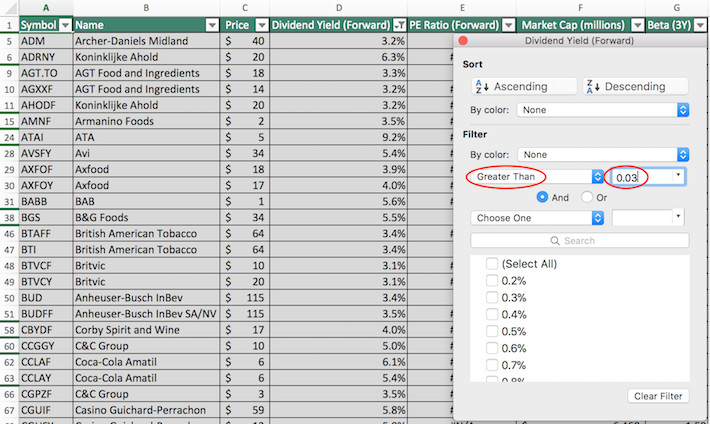

Step 3: To filter for dividend yields greater than 3%, change the filter setting to ‘Greater Than’, and input 0.03 into the field beside it.

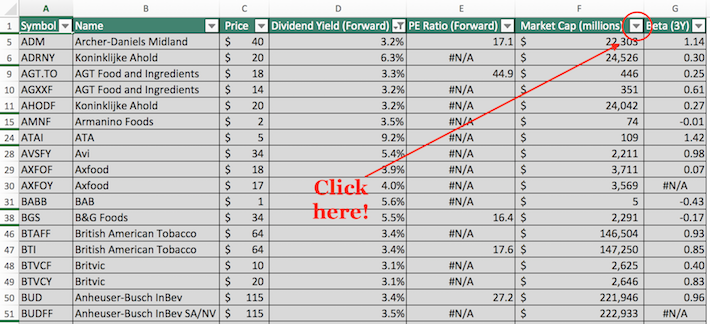

Step 4: Next we’ll execute the screen for market capitalization. Close of out of the previous window (by clicking exit, not by clicking ‘clear filter’ at the bottom of the filter window). Then, click the filter icon at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to ‘Greater Than’ and input 10000 into the field beside it. Notice that since market capitalization is measured in millions of dollars in this spreadsheet, then filtering for stocks with market capitalizations above ‘$10,000 million’ is equivalent for screening for securities with market capitalizations above $10 billion.

The remaining stocks in this spreadsheet are those with dividend yields above 3% and market capitalizations above $10 billion.

You now have a solid understanding of how to use the dividend-paying consumer staples stocks spreadsheet to find compelling investment ideas. The next section will provide a summary of why the consumer staples sector merits an allocation in your investment portfolio.

Why Invest In Consumer Staples Stocks?

Consumer staples stocks are an appealing investment category for a number of reasons.

First of all, consumer staples stocks are very recession-resistant by definition. Consumer staples companies make products or deliver services that are considered to be ‘staples’ – in other words, consumers can’t do without them.

Food stocks within the consumer staples sector are an excellent example of this. Consumers are likely to buy more food products during recessions as they cut back on dining out to conserve funds during difficult economic times.

Alcohol stocks are another example. People tend to drink at least the same amount (if not more) when times get tough.

This means that consumer staples stocks tend to hold up very well during periods of economic turmoil. This can be seen by studying the sector’s performance during the 2007-2009 financial crisis.

During 2008, for example, the consumer staples sector returned -15%. While this seems bad on the surface, it is actually very good on a relative basis. Here’s the performance of some other sectors during the same calendar year:

- Financials: -55%

- Materials: -44%

- Technology: -41%

Clearly, the performance of the consumer staples sector beat these other industries by a wide margin despite being negative itself. In fact, consumer staples was the single best performing sector during calendar year 2008.

The consumer staples sector stands up well during times of recessions, implying that the sector presents less risk than many of its counterparts.

Amazingly, the sector’s long-term performance has also been one of the best. The sector has demonstrated a remarkable ability to generate consistently high returns on invested capital, avoiding the mean reversion experienced by many other highly profitable industries.

While traditional academic theory tells us that investors must assume extra risk to generate incremental returns, the outperformance of the recession-resistant consumer staples sector tells us that this isn’t true in practice. The sector’s combination of high returns and low risk make it a uniquely appealing sector for conservative total return investors.

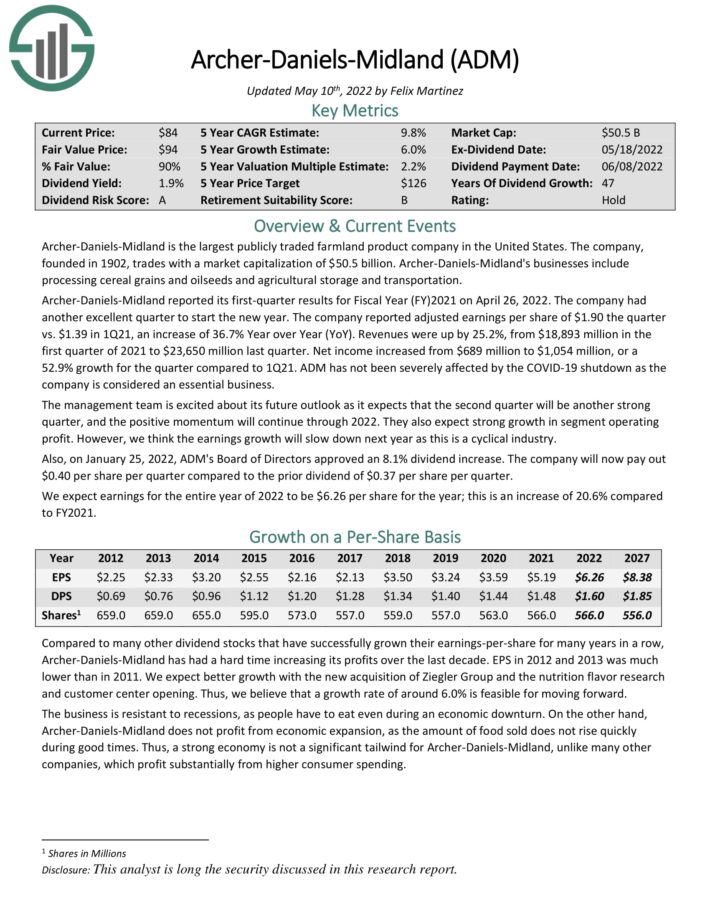

Consumer Staples Stock #7: Archer Daniels Midland (ADM)

- Expected Annual Returns: 8.1%

Archer-Daniels-Midland is the largest publicly traded agriculture stocks in the United States. Its businesses include processing cereal grains and oilseeds and agricultural storage and transportation.

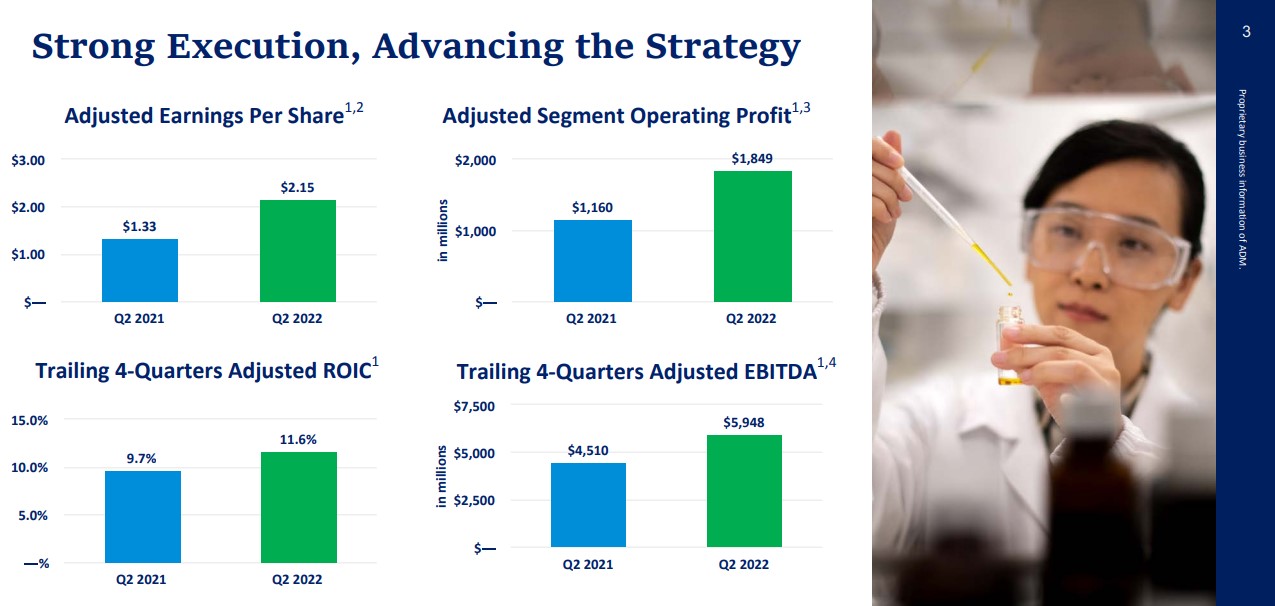

Archer-Daniels-Midland reported its second-quarter results for Fiscal Year (FY)2022 on July 26, 2022. The company had another excellent quarter starting the year’s first half. The company reported adjusted earnings per share of $2.15 the quarter vs. $1.33 in 2Q21, an increase of 61.6% Year over Year (YoY). Revenues were up by 19%, from $22,926 million in the second quarter of 2021 to $27,284 million.

Source: Investor Presentation

Net income increased from $712 million to $1,236 million, or a 73.6% growth for the quarter compared to 2Q21. For the first six months of the year, revenues are up 21.8% compared to the first six months of 2021. Net income is also up for the first six months year-over-year, by 63.5%. Overall, earnings per share are up 62.5% for the first six months.

We expect annual returns of 8.1% per year, due to 6% expected EPS growth, the 1.8% dividend yield, and a 0.3% annual boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

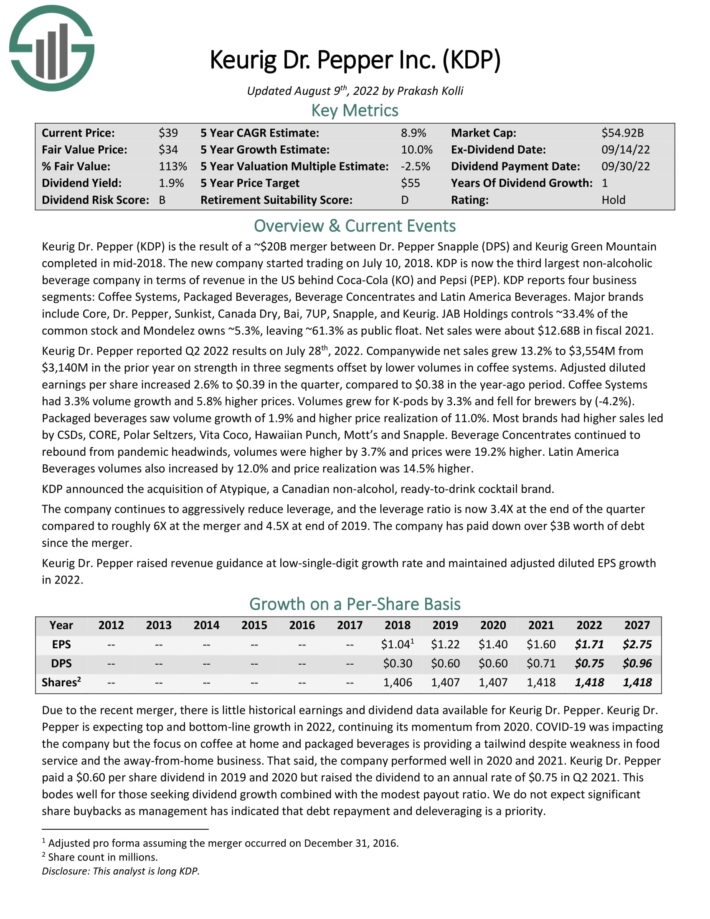

Consumer Staples Stock #6: Keurig Dr. Pepper (KDP)

- Expected Annual Returns: 8.1%

Keurig Dr. Pepper is the result of a ~$20B merger between Dr. Pepper Snapple (DPS) and Keurig Green Mountain completed in mid-2018. The new company started trading on July 10, 2018. KDP is now the third largest non-alcoholic beverage company in terms of revenue in the US behind Coca-Cola (KO) and Pepsi (PEP).

KDP reports four business segments: Coffee Systems, Packaged Beverages, Beverage Concentrates and Latin America Beverages. Major brands include Core, Dr. Pepper, Sunkist, Canada Dry, Bai, 7UP, Snapple, and Keurig.

Keurig Dr. Pepper reported Q2 2022 results on July 28th, 2022. Companywide net sales grew 13.2% to $3,554M from $3,140M in the prior year on strength in three segments offset by lower volumes in coffee systems. Adjusted diluted earnings per share increased 2.6% to $0.39 in the quarter, compared to $0.38 in the year-ago period. Coffee Systems had 3.3% volume growth and 5.8% higher prices. Volumes grew for K-pods by 3.3% and fell for brewers by (-4.2%).

KDP announced the acquisition of Atypique, a Canadian non-alcohol, ready-to-drink cocktail brand. The company continues to aggressively reduce leverage, and the leverage ratio is now 3.4X at the end of the quarter compared to roughly 6X at the merger and 4.5X at end of 2019. The company has paid down over $3B worth of debt since the merger.

We expect annual returns just above 8% per year, due mostly to 10% expected EPS growth and the 1.9% dividend yield. We view the stock as overvalued, with a ~3.9% expected negative annual return from a declining P/E multiple.

Click here to download our most recent Sure Analysis report on Keurig Dr. Pepper (preview of page 1 of 3 shown below):

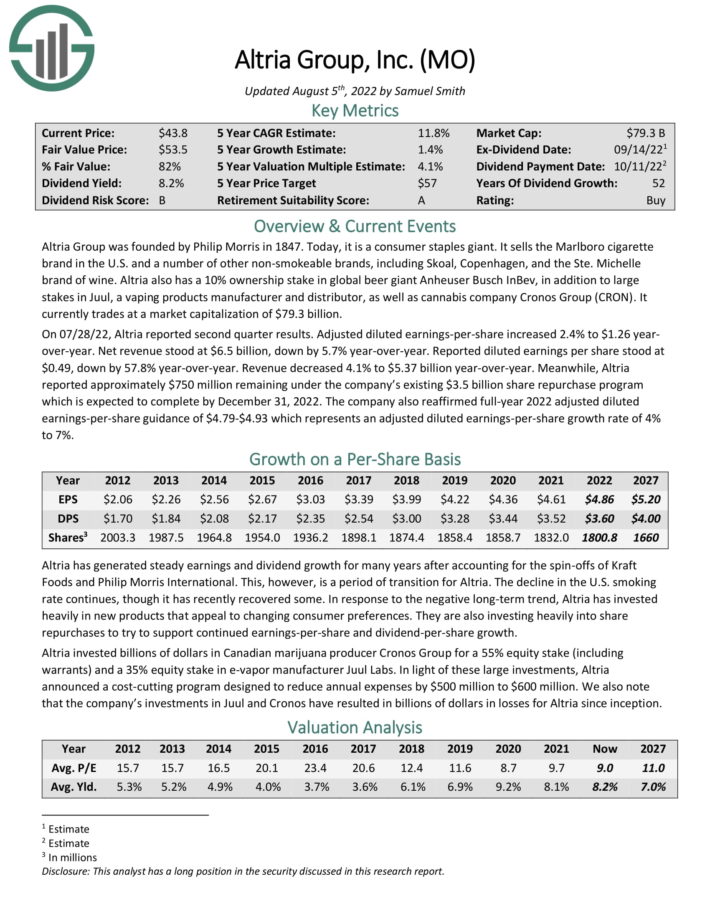

Consumer Staples Stock #5: Altria Group (MO)

- Expected Annual Returns: 11.0%

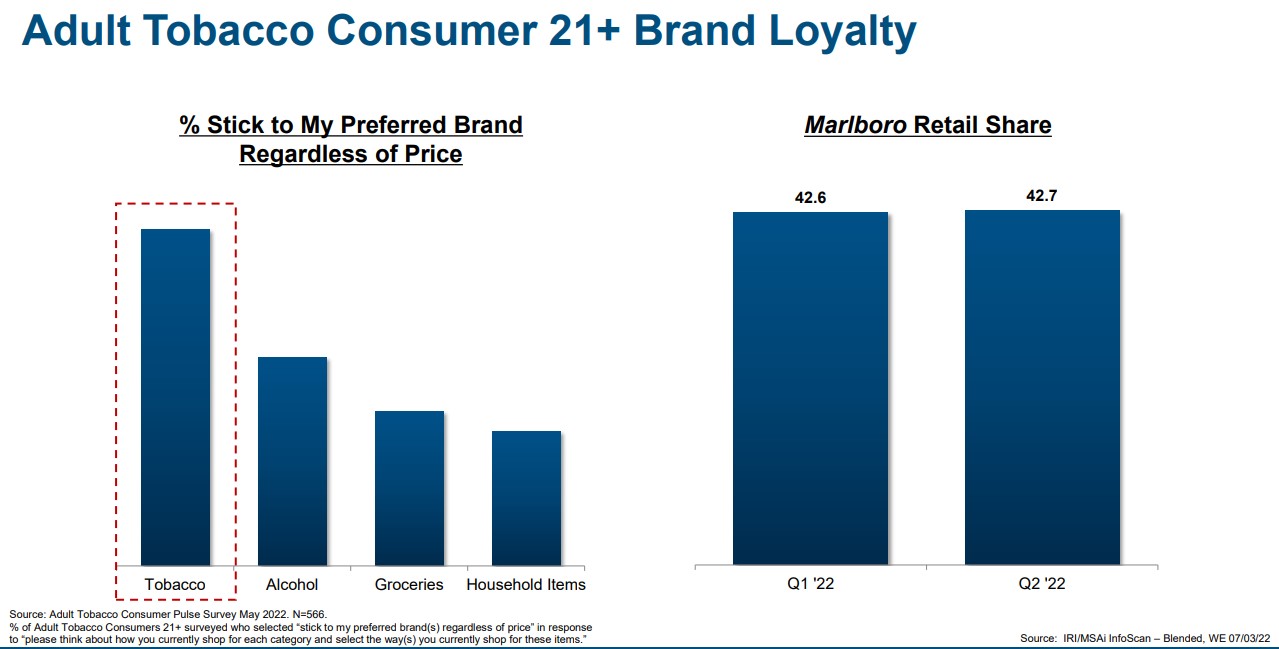

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

The flagship brand continues to be Marlboro, which holds over 40% retail market share in the U.S.

Source: Investor Presentation

Altria also has a 10% ownership stake in global beer giant Anheuser-Busch InBev, in addition to large stakes in Juul, a vaping products manufacturer and distributor, as well as cannabis company Cronos Group (CRON).

On 07/28/22, Altria reported second quarter results. Adjusted diluted earnings-per-share increased 2.4% to $1.26 yearover-year. Net revenue stood at $6.5 billion, down by 5.7% year-over-year. Reported diluted earnings per share stood at $0.49, down by 57.8% year-over-year. Revenue decreased 4.1% to $5.37 billion year-over-year.

Meanwhile, Altria reported approximately $750 million remaining under the company’s existing $3.5 billion share repurchase program which is expected to complete by December 31, 2022. The company also reaffirmed full-year 2022 adjusted diluted earnings-per-share guidance of $4.79-$4.93 which represents an adjusted diluted earnings-per-share growth rate of 4% to 7%.

Click here to download our most recent Sure Analysis report on Altria Group (preview of page 1 of 3 shown below):

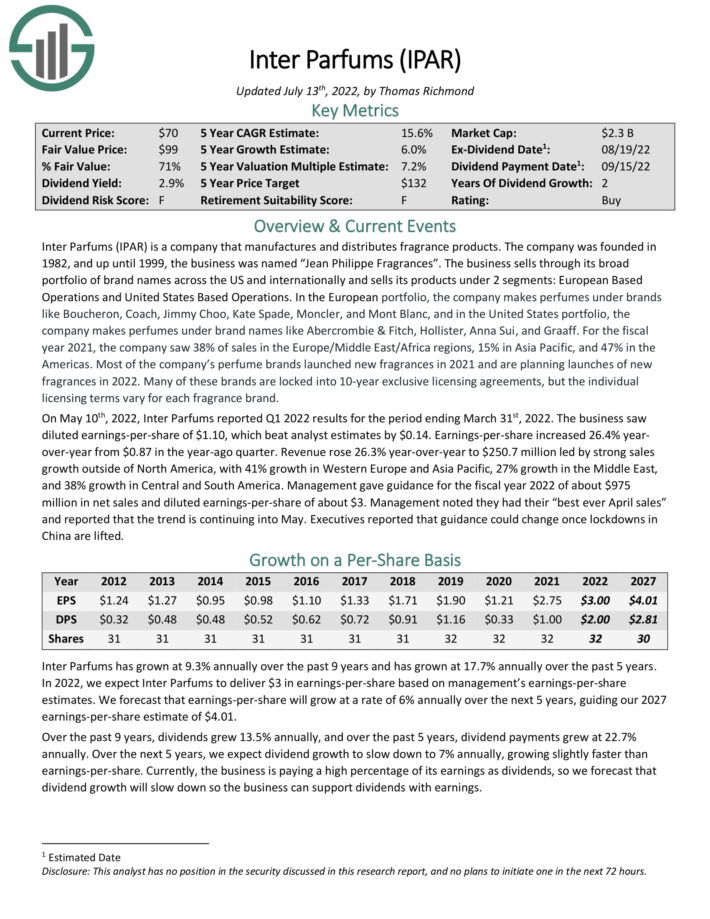

Consumer Staples Stock #4: Inter Parfums (IPAR)

- Expected Annual Returns: 11.6%

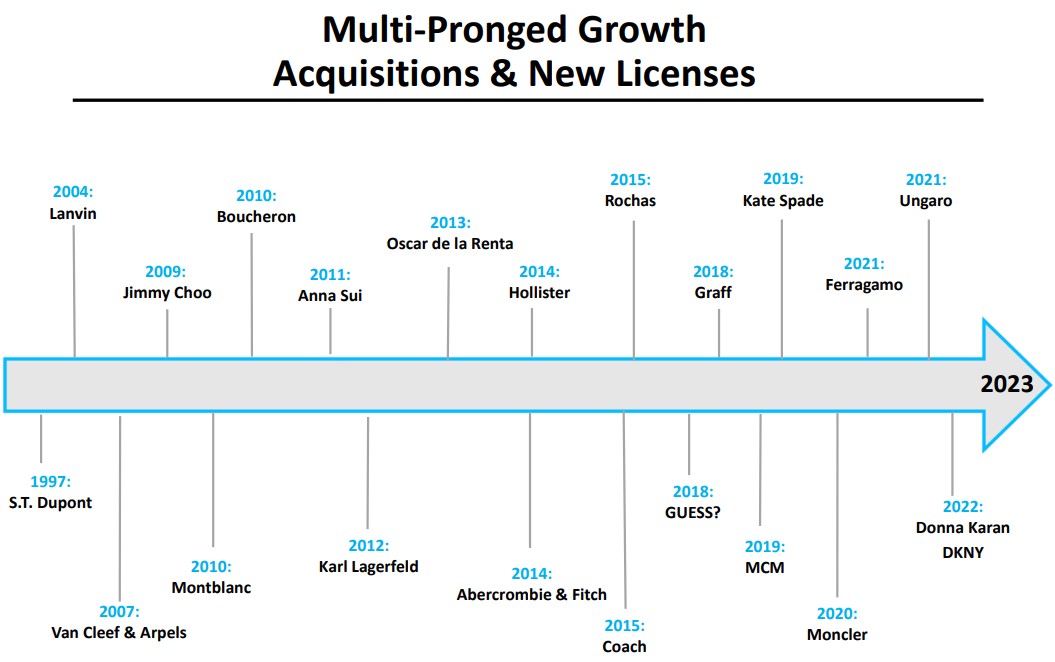

Inter Parfums manufactures and distributes fragrance products. The business sells through its broad portfolio of brand names across the US and internationally and sells its products under 2 segments: European Based Operations and United States Based Operations. In the European portfolio, the company makes perfumes under brands like Boucheron, Coach, Jimmy Choo, Kate Spade, Moncler, and Mont Blanc, and in the United States portfolio, the company makes perfumes under brand names like Abercrombie & Fitch, Hollister, Anna Sui, and Graaff.

Growth has been generated in large part by acquisitions and licensing.

Source: Investor Presentation

For the fiscal year 2021, the company saw 38% of sales in the Europe/Middle East/Africa regions, 15% in Asia Pacific, and 47% in the Americas. Most of the company’s perfume brands launched new fragrances in 2021 and are planning launches of new fragrances in 2022. Many of these brands are locked into 10-year exclusive licensing agreements, but the individual licensing terms vary for each fragrance brand.

On May 10th, 2022, Inter Parfums reported Q1 2022 results for the period ending March 31st, 2022. The business saw diluted earnings-per-share of $1.10, which beat analyst estimates by $0.14. Earnings-per-share increased 26.4% yearover-year from $0.87 in the year-ago quarter. Revenue rose 26.3% year-over-year to $250.7 million led by strong sales growth outside of North America, with 41% growth in Western Europe and Asia Pacific, 27% growth in the Middle East, and 38% growth in Central and South America. Management gave guidance for the fiscal year 2022 of about $975 million in net sales and diluted earnings-per-share of about $3.

Total expected returns are estimated at 11.6% per year.

Click here to download our most recent Sure Analysis report on IPAR (preview of page 1 of 3 shown below):

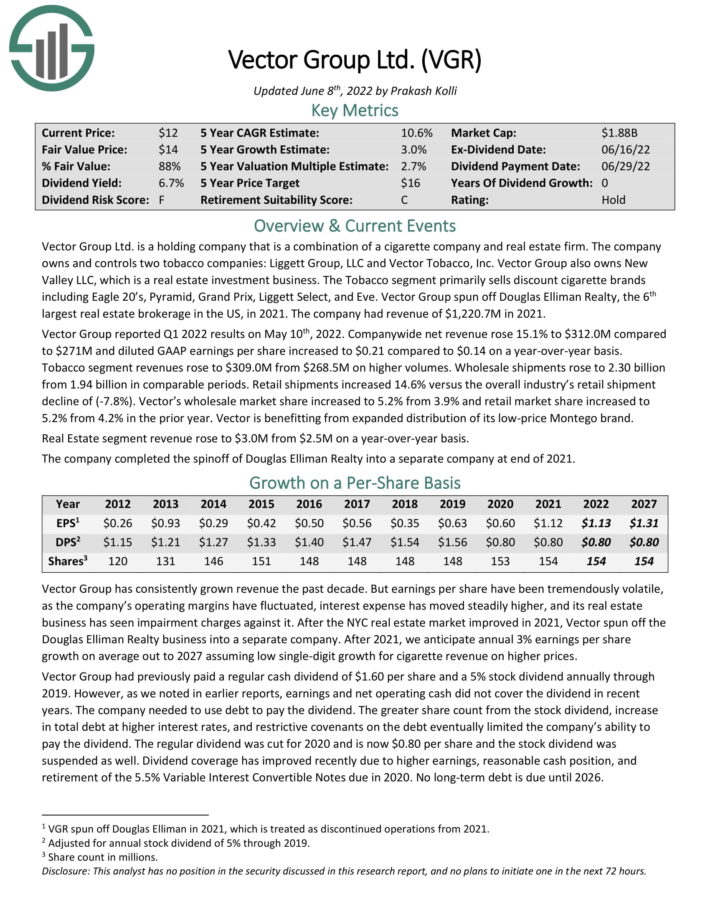

Consumer Staples Stock #3: Vector Group (VGR)

- Expected Annual Returns: 13.9%

Vector Group Ltd. is a holding company that is a combination of a cigarette company and real estate firm. The company owns and controls two tobacco companies: Liggett Group, LLC and Vector Tobacco, Inc. Vector Group also owns New Valley LLC, which is a real estate investment business. The Tobacco segment primarily sells discount cigarette brands including Eagle 20’s, Pyramid, Grand Prix, Liggett Select, and Eve. Vector Group spun off Douglas Elliman Realty, the 6th largest real estate brokerage in the US, in 2021. The company had revenue of $1,220.7M in 2021.

Vector Group reported Q1 2022 results on May 10th, 2022. Company-wide net revenue rose 15.1% to $312.0M compared to $271M and diluted GAAP earnings per share increased to $0.21 compared to $0.14 on a year-over-year basis. Tobacco segment revenues rose to $309.0M from $268.5M on higher volumes.

Wholesale shipments rose to 2.30 billion from 1.94 billion in comparable periods. Retail shipments increased 14.6% versus the overall industry’s retail shipment decline of (-7.8%). Vector’s wholesale market share increased to 5.2% from 3.9% and retail market share increased to 5.2% from 4.2% in the prior year. Vector is benefiting from expanded distribution of its low-price Montego brand. Real Estate segment revenue rose to $3.0M from $2.5M on a year-over-year basis.

Click here to download our most recent Sure Analysis report on VGR (preview of page 1 of 3 shown below):

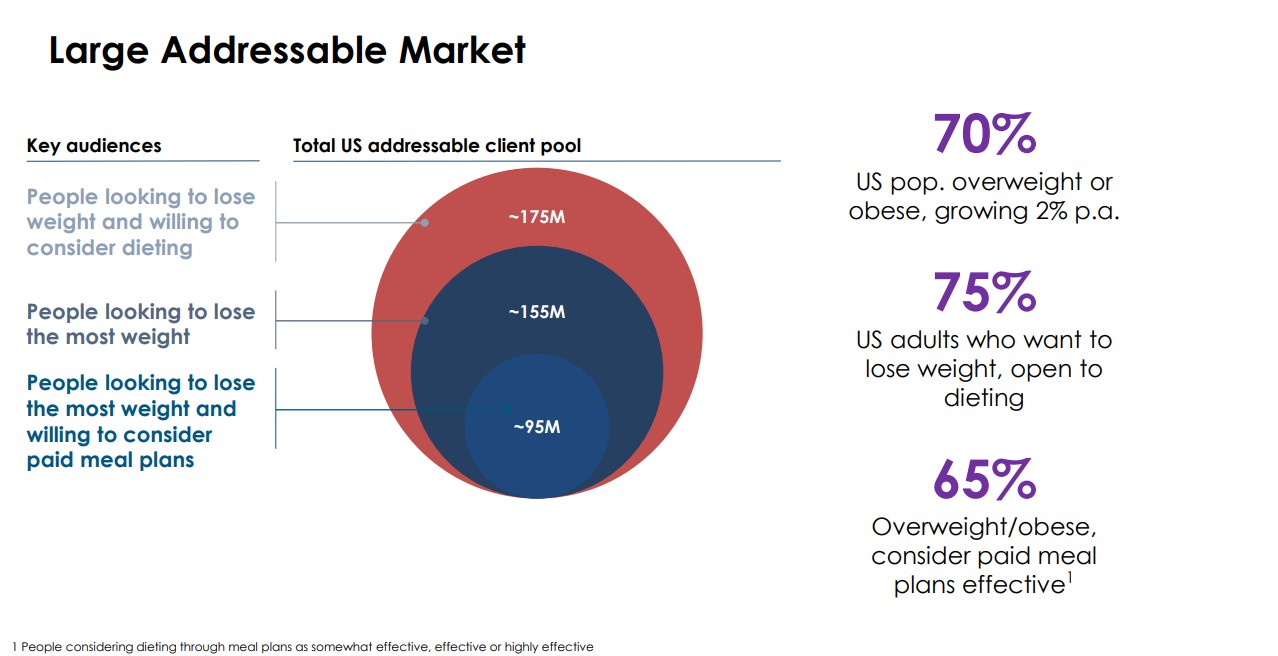

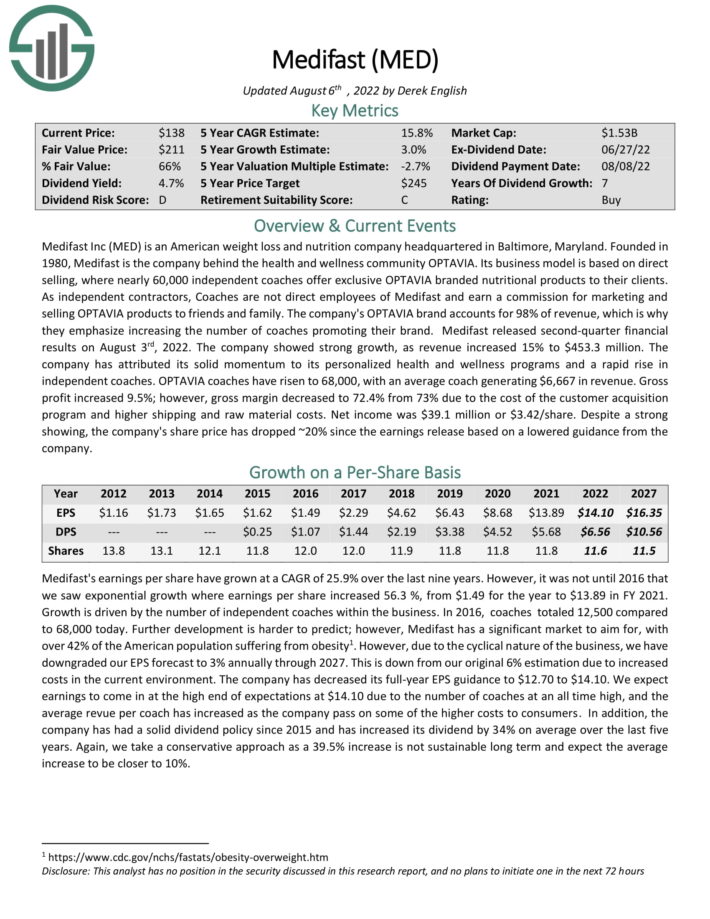

Consumer Staples Stock #2: Medifast (MED)

- Expected Annual Returns: 17.4%

Medifast Inc. is an American weight loss and nutrition company headquartered in Baltimore, Maryland. Founded in 1980, Medifast is the company behind the health and wellness community OPTAVIA. Its business model is based on direct selling, where nearly 60,000 independent coaches offer exclusive OPTAVIA branded nutritional products to their clients.As independent contractors, Coaches are not direct employees of Medifast and earn a commission for marketing and selling OPTAVIA products to friends and family.

The company has a large addressable market:

Source: Investor Presentation

The company’s OPTAVIA brand accounts for 98% of revenue, which is why they emphasize increasing the number of coaches promoting their brand. Medifast released second-quarter financial results on August 3rd, 2022. The company showed strong growth, as revenue increased 15% to $453.3 million. The company has attributed its solid momentum to its personalized health and wellness programs and a rapid rise in independent coaches. OPTAVIA coaches have risen to 68,000, with an average coach generating $6,667 in revenue.

Gross profit increased 9.5%; however, gross margin decreased to 72.4% from 73% due to the cost of the customer acquisition program and higher shipping and raw material costs. Net income was $39.1 million or $3.42/share.

Total returns are expected to reach 17.4% per year over the next five years, due to 3% expected EPS growth, the 4.5% dividend yield, and a 9.9% annual boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on MED (preview of page 1 of 3 shown below):

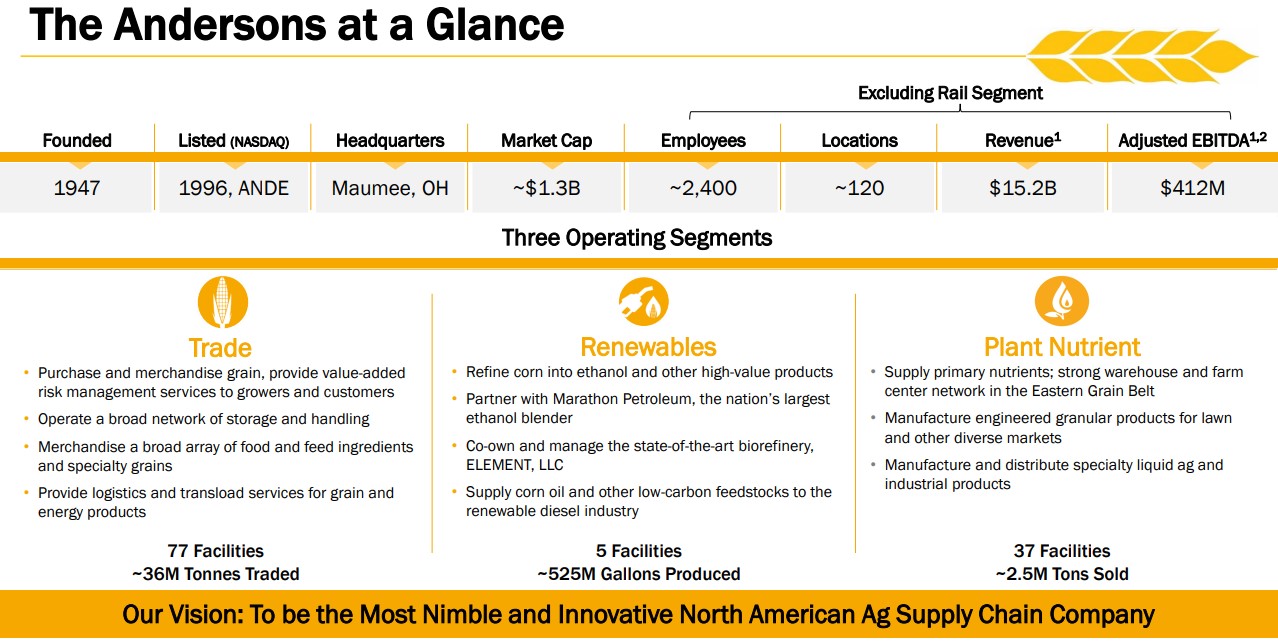

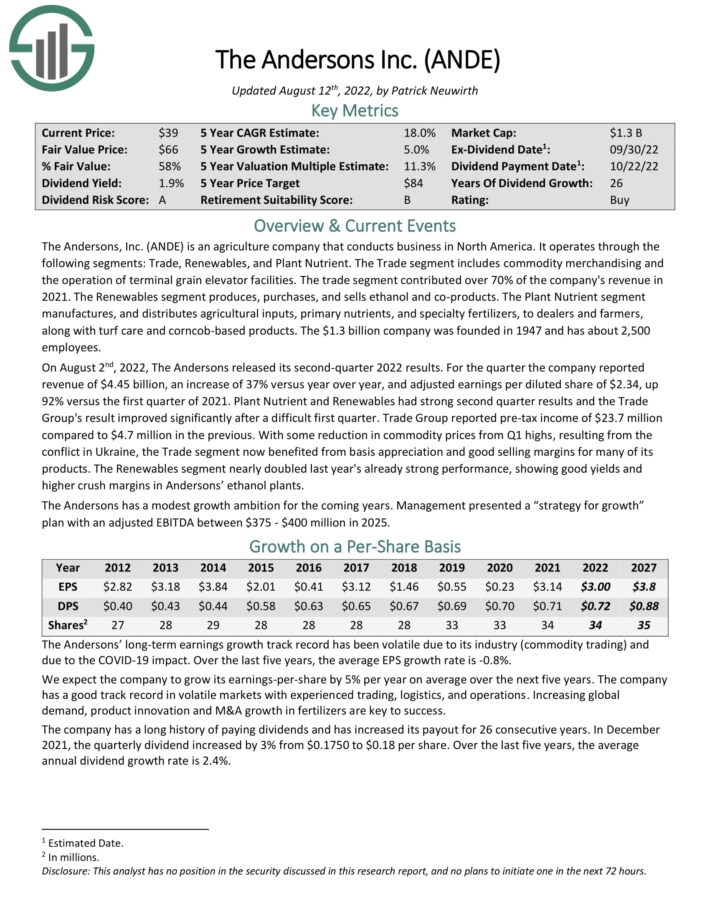

Consumer Staples Stock #1: The Andersons (ANDE)

- Expected Annual Returns: 17.9%

The Andersons, Inc. is an agriculture company that conducts business in North America. It operates through the following segments: Trade, Renewables, and Plant Nutrient. The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The trade segment contributed over 70% of the company’s revenue in 2021.

Source: Investor Presentation

On August 2nd, 2022, The Andersons released its second-quarter 2022 results. For the quarter the company reported revenue of $4.45 billion, an increase of 37% versus year over year, and adjusted earnings per diluted share of $2.34, up 92% versus the first quarter of 2021. Plant Nutrient and Renewables had strong second quarter results and the Trade Group’s result improved significantly after a difficult first quarter. Trade Group reported pre-tax income of $23.7 million compared to $4.7 million in the previous.

With some reduction in commodity prices from Q1 highs, resulting from the conflict in Ukraine, the Trade segment now benefited from basis appreciation and good selling margins for many of its products. The Renewables segment nearly doubled last year’s already strong performance, showing good yields and higher crush margins in Andersons’ ethanol plants.

The Andersons has a modest growth ambition for the coming years. Management presented a “strategy for growth” plan with an adjusted EBITDA between $375 – $400 million in 2025.

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. Shares currently yield 1.8%. Total returns are estimated at 17.9% per year.

Click here to download our most recent Sure Analysis report on ANDE (preview of page 1 of 3 shown below):

Final Thoughts

The consumer staples sector is an intriguing place to looks for high-quality dividend investment ideas.

If you’re willing to look outside of this sector while hunting for investment opportunities, the following stock databases are highly useful:

Investing is a unique craft because we have the ability to ‘cheat’ off the moves of the world’s greatest investors.

Large, institutional investment managers with more than $100 million in assets under management are required to disclose their portfolio holdings on a quarterly basis through a regulatory filing called a 13F.

With this in mind, there is no better investor than Berkshire Hathaway’s Warren Buffett. We provide a detailed quarterly analysis on Warren Buffett’s stock portfolio, which you can access below:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link