[ad_1]

da-kuk

As we spherical out the primary quarter of 2024, I’ve 20 new dividend will increase to share with you. They common an 8.5% improve, with a median of 8%. Learn on for the whole lists!

As an investor using a dividend-growth technique, I all the time sit up for receiving dividends, particularly will increase. I’ve noticed that firms that frequently elevate their dividend payouts carry out considerably higher than these that don’t. I continuously monitor these firms and am blissful to share my insights on upcoming dividend will increase. I’ve compiled a listing of prime shares anticipated to lift dividends within the upcoming week. You may confidently use this evaluation to assemble your portfolio and make well timed purchases.

How I Created The Lists

The data offered here’s a results of merging two sources of knowledge – the “U.S. Dividend Champions” spreadsheet from this web site and upcoming dividend information from NASDAQ. The method combines information on firms with a constant dividend progress historical past with future dividend funds. It is vital to know that every one firms included on this record have constantly grown in dividends for a minimum of 5 years.

Firms should have increased whole yearly dividends to be included on this record. Therefore, an organization could not improve its dividend each calendar yr, however the whole annual dividend can nonetheless develop.

What Is The Ex-Dividend Date?

The ex-dividend date is when you will need to buy shares to be eligible for the upcoming dividend or distribution. To qualify, you will need to have purchased the shares by the top of the previous enterprise day. As an example, if the ex-dividend date is Tuesday, you will need to have acquired the shares by the market shut on Monday. If the ex-dividend date is a Monday (or a Tuesday following a vacation on Monday), you will need to have purchased the shares by the earlier Friday.

Dividend Streak Classes

Listed here are the definitions of the streak classes, as I will use them all through the piece.

- King: 50+ years.

- Champion/Aristocrat: 25+ years.

- Contender: 10-24 years.

- Challenger: 5+ years.

| Class | Depend |

| King | 0 |

| Champion | 3 |

| Contender | 9 |

| Challenger | 8 |

The Dividend Will increase Record

Information was sorted by the ex-dividend date (ascending) after which by the streak (descending):

| Identify | Ticker | Streak | Ahead Yield | Ex-Div Date | Enhance P.c | Streak Class |

| Financial institution First Company | (BFC) | 10 | 1.68 | 26-Mar-24 | 16.67% | Contender |

| Essex Property Belief, Inc. | (ESS) | 30 | 4.07 | 27-Mar-24 | 6.06% | Champion |

| W. P. Carey Inc. REIT | (WPC) | 26 | 6.14 | 27-Mar-24 | 0.58% | Champion |

| Fairness Way of life Properties, Inc. | (ELS) | 20 | 2.73 | 27-Mar-24 | 6.71% | Contender |

| Camden Property Belief | (CPT) | 15 | 4.19 | 27-Mar-24 | 3.00% | Contender |

| DENTSPLY SIRONA Inc. | (XRAY) | 13 | 1.92 | 27-Mar-24 | 14.29% | Contender |

| Metal Dynamics, Inc. | (STLD) | 13 | 1.29 | 27-Mar-24 | 8.24% | Contender |

| First Industrial Realty Belief, Inc. | (FR) | 12 | 2.85 | 27-Mar-24 | 15.63% | Contender |

| Rexford Industrial Realty, Inc. | (REXR) | 11 | 3.3 | 27-Mar-24 | 10.00% | Contender |

| Amdocs Restricted – Abnormal Shares | (DOX) | 11 | 1.93 | 27-Mar-24 | 10.11% | Contender |

| Danaher Company | (DHR) | 10 | 0.43 | 27-Mar-24 | 12.50% | Contender |

| FirstService Company – Widespread Shares | (FSV) | 9 | 0.53 | 27-Mar-24 | 11.11% | Challenger |

| Dick’s Sporting Items Inc | (DKS) | 9 | 2 | 27-Mar-24 | 10.00% | Challenger |

| CareTrust REIT, Inc. | (CTRE) | 9 | 4.8 | 27-Mar-24 | 3.57% | Challenger |

| Solar Communities, Inc. | (SUI) | 8 | 2.87 | 27-Mar-24 | 1.08% | Challenger |

| Stantec Inc | (STN) | 8 | 0.97 | 27-Mar-24 | 7.70% | Challenger |

| Willis Towers Watson Public Restricted Firm – Ordin… | (WTW) | 8 | 1.28 | 27-Mar-24 | 4.76% | Challenger |

| Nutrien Ltd. Widespread Shares | (NTR) | 7 | 4.03 | 27-Mar-24 | 1.89% | Challenger |

| Monolithic Energy Methods, Inc. | (MPWR) | 7 | 0.75 | 27-Mar-24 | 25.00% | Challenger |

| Air Merchandise and Chemical substances, Inc. | (APD) | 42 | 2.96 | 28-Mar-24 | 1.14% | Champion |

Area Definitions

Streak: Years of dividend progress historical past are sourced from the U.S. Dividend Champions spreadsheet.

Ahead Yield: The brand new payout charge is split by the present share worth.

Ex-Dividend Date: That is the date you must personal the inventory.

Enhance P.c: The % improve.

Streak Class: That is the corporate’s general dividend historical past classification.

Present Me The Cash

Here is a desk mapping the brand new charges versus the outdated charges. It additionally reiterates the share improve. This desk is sorted equally to the primary (ex-dividend day ascending, dividend streak descending).

| Ticker | Previous Charge | New Charge | Enhance P.c |

| BFC | 0.3 | 0.35 | 16.67% |

| ESS | 2.31 | 2.45 | 6.06% |

| WPC | 0.86 | 0.865 | 0.58% |

| ELS | 0.447 | 0.477 | 6.71% |

| CPT | 1 | 1.03 | 3.00% |

| STLD | 0.425 | 0.46 | 8.24% |

| XRAY | 0.14 | 0.16 | 14.29% |

| FR | 0.32 | 0.37 | 15.63% |

| REXR | 0.38 | 0.418 | 10.00% |

| DOX | 0.435 | 0.479 | 10.11% |

| DHR | 0.24 | 0.27 | 12.50% |

| FSV | 0.225 | 0.25 | 11.11% |

| DKS | 1 | 1.1 | 10.00% |

| CTRE | 0.28 | 0.29 | 3.57% |

| WTW | 0.84 | 0.88 | 4.76% |

| SUI | 0.93 | 0.94 | 1.08% |

| STN | .195 CAD | .21 CAD | 7.70% |

| NTR | 0.53 | 0.54 | 1.89% |

| MPWR | 1 | 1.25 | 25.00% |

| APD | 1.75 | 1.77 | 1.14% |

Further Metrics

Some completely different metrics associated to those firms embody yearly pricing motion and the P/E ratio. The desk is sorted the identical means because the desk above.

| Ticker | Present Value | 52 Week Low | 52 Week Excessive | PE Ratio | % Off Low | % Off Excessive |

| BFC | 83.12 | 63.56 | 91.87 | 14.62 | 31% Off Low | 10% Off Excessive |

| ESS | 240.63 | 187.07 | 251.77 | 27.73 | 29% Off Low | 4% Off Excessive |

| WPC | 56.36 | 49.91 | 73.19 | 26.9 | 13% Off Low | 23% Off Excessive |

| ELS | 65.57 | 60.09 | 73.58 | 50.25 | 9% Off Low | 11% Off Excessive |

| CPT | 98.35 | 81.97 | 111.69 | 53.06 | 20% Off Low | 12% Off Excessive |

| STLD | 142.71 | 88.84 | 143.43 | 16.95 | 61% Off Low | 1% Off Excessive |

| XRAY | 33.28 | 26.06 | 42.25 | 0 | 28% Off Low | 21% Off Excessive |

| FR | 51.99 | 40.2 | 55.15 | 25.51 | 29% Off Low | 6% Off Excessive |

| DOX | 92.42 | 77.6 | 97.76 | 18 | 19% Off Low | 5% Off Excessive |

| REXR | 50.65 | 41.28 | 58.76 | 87.14 | 23% Off Low | 14% Off Excessive |

| DHR | 251.55 | 181.9 | 269 | 52.25 | 38% Off Low | 6% Off Excessive |

| DKS | 219.48 | 100.27 | 222.92 | 13.7 | 119% Off Low | 2% Off Excessive |

| FSV | 169.66 | 130.55 | 171.94 | 83.32 | 30% Off Low | 1% Off Excessive |

| CTRE | 24.19 | 16.9 | 24.29 | 24.66 | 43% Off Low | 0% Off Excessive |

| SUI | 131.23 | 102.03 | 140.86 | 93.01 | 29% Off Low | 7% Off Excessive |

| WTW | 274.59 | 192.38 | 278.86 | 43% Off Low | 2% Off Excessive | |

| STN | 86.49 | 54.41 | 87.53 | 22.93 | 59% Off Low | 1% Off Excessive |

| MPWR | 666.98 | 378.81 | 778.15 | 92.02 | 76% Off Low | 14% Off Excessive |

| NTR | 53.64 | 47.9 | 73.53 | 261.72 | 12% Off Low | 27% Off Excessive |

| APD | 238.95 | 212.24 | 303.88 | 31.48 | 13% Off Low | 21% Off Excessive |

Tickers By Yield And Development Charges

I’ve organized the desk in descending order, so traders can prioritize the present yield. As a bonus, the desk additionally options some historic dividend progress charges. Furthermore, I’ve integrated the “Chowder Rule,” which is the sum of the present yield and the five-year dividend progress charge.

| Ticker | Yield | 1 Yr DG | 3 Yr DG | 5 Yr DG | 10 Yr DG | Chowder Rule |

| WPC | 6.14 | -4.1 | -0.9 | -0.1 | 1.8 | 6.1 |

| CTRE | 4.8 | 1.8 | 3.9 | 6.4 | 11.2 | |

| CPT | 4.19 | 6.4 | 6.4 | 5.4 | 4.7 | 9.6 |

| ESS | 4.07 | 5 | 3.6 | 4.4 | 6.7 | 8.6 |

| NTR | 4.03 | 10.4 | 5.6 | 5.4 | 6 | 9.5 |

| REXR | 3.3 | 20.6 | 20.9 | 18.9 | 21.9 | 22.2 |

| APD | 2.96 | 8 | 9.3 | 9.7 | 9.5 | 12.6 |

| SUI | 2.87 | 5.7 | 5.6 | 5.6 | 4 | 8.5 |

| FR | 2.85 | 8.5 | 8.6 | 8 | 14.2 | 10.9 |

| ELS | 2.73 | 9.2 | 9.3 | 10.2 | 13.6 | 12.9 |

| DKS | 2 | 105.1 | 47.4 | 34.8 | 23.1 | 36.9 |

| DOX | 1.93 | -11.9 | 9.9 | 11.7 | 12.8 | 13.6 |

| XRAY | 1.92 | 12 | 11.9 | 9.9 | 8.4 | 11.8 |

| BFC | 1.68 | 86.2 | 29.3 | 20.8 | 23.1 | 22.5 |

| STLD | 1.29 | 0 | 19.4 | 17.8 | 14.5 | 19.1 |

| WTW | 1.28 | 2.4 | 6.9 | 7 | 1.3 | 8.3 |

| STN | 0.97 | 6.3 | 8.2 | 7 | 6.3 | 8 |

| MPWR | 0.75 | 33.3 | 26 | 27.2 | 28 | |

| FSV | 0.53 | 11.1 | 10.9 | 10.8 | 11.3 | |

| DHR | 0.43 | 5 | 13.4 | 10.4 | 26.5 | 10.8 |

Historic Returns

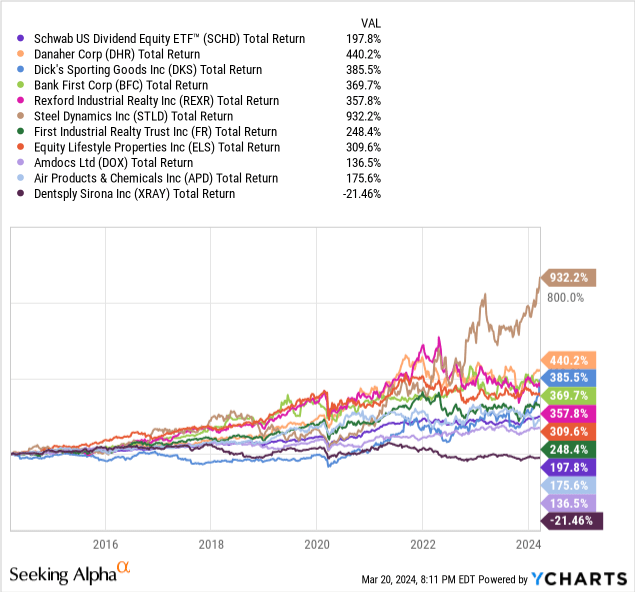

My funding technique entails discovering shares combining rising dividends and constantly outperforming the market. I take advantage of the Schwab U.S. Dividend Fairness ETF (SCHD) as my dividend progress benchmark. This ETF has a exceptional monitor file of outstanding efficiency, a better yield than the S&P 500, and a confirmed file of rising dividends. I want to spend money on the ETF if a inventory can not beat the benchmark. I’ve added firms to my private funding portfolio based mostly on this evaluation. I additionally routinely use this evaluation to decide on well timed extra purchases.

I am evaluating SCHD to the top-10 firms with the very best 10-year dividend progress charge. That is one of many components used within the methodology behind SCHD. This can be a proxy for fulfillment, though it isn’t an ideal predictor. Share costs are inclined to comply with sturdy dividend progress over lengthy durations of time. Under are the outcomes.

To begin the evaluation, SCHD had a complete return of 198%. XRAY has been a little bit of a shocker with a destructive 21% whole return over the previous decade.

On the flip aspect, Metal Dynamics has knocked the quilt off the ball with a 932% whole return, although arguably a lot of it has come prior to now two years. It is intriguing, and I wish to take a look at it nearer.

One other section has extremely sturdy efficiency. DHR, DKS, BFC, REXR, and ELS all had an amazing efficiency, starting from 440% for DHR to 310% for ELS, with the remaining in between.

FR additionally bested SCHD by just a few factors per yr. Lastly, APD and DOX, which carried out effectively however lagged behind SCHD, rounded out the dialogue.

Please do your due diligence earlier than making any funding choice.

[ad_2]

Source link