[ad_1]

Visitor Contribution by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

Predicting the longer term is a dicey enterprise. Most didn’t anticipate the economic system to stay so resilient, or inflation to fall so quick, or the massive affect of synthetic intelligence (AI) in 2023. However right here we’re. Now it’s time to take a stab at 2024. What can we anticipate from the present vantage level?

Issues look good. The primary cause for optimism is that inflation has fallen far, and rates of interest have possible peaked. Inflation and rising rates of interest have hindered the marketplace for the previous two years. The elimination of that destructive catalyst must be very constructive going ahead. The economic system stays sturdy. It seems to be like we would get by means of this Fed fee mountaineering cycle with out a lot financial ache.

On the similar time, many shares are nonetheless low-cost. For that reason, Positive Dividend recommends buyers concentrate on prime quality dividend shares which have elevated their payouts for at the least 10 years.

Blue-chip shares are established, financially sturdy, and persistently worthwhile publicly traded corporations.

Their energy makes them interesting investments for comparatively protected, dependable dividends and capital appreciation versus much less established shares.

This analysis report has the next assets that will help you spend money on blue chip shares:

Know-how drove the market indexes increased in 2023, whereas most different inventory sectors continued to languish. Defensive sectors together with utilities and REITs had been pushed decrease by rising rates of interest and several other of the most effective shares in these sectors hit multi-year lows. These shares come into 2024 with dirt-cheap valuations, not rising rates of interest, and a probable slowing economic system, which is a time of relative market outperformance.

Know-how shares had a blowout 2023 with that sector up over 50% for the 12 months. However a lot of the transfer is a rebound from an terrible 2022. And AI offers one other sturdy catalyst for development going ahead. Know-how isn’t carried out and the rally ought to broaden out in 2024.

After all, you by no means know. Inflation may reignite and charges may proceed to rise in spite of everything. The geopolitical state of affairs may flip ugly and trump every little thing else. It’s additionally an enormous election 12 months. The recession that by no means occurred may very well be just a bit additional down the highway. The buyer has proven distinct indicators of rolling over, and consumption accounts for 70% of GDP. Most pundits are predicting a slowing economic system and attainable delicate recession. But it surely may very well be worse.

Something is feasible in 2024. However the dangers appear extra towards a slowing economic system and recession slightly than still-rising inflation and rates of interest. That units up nicely for the beleaguered defensive shares. On the similar time, AI isn’t going anyplace. Corporations will proceed to spend massive on the know-how whatever the economic system, the Fed, or who’s President.

Waiting for 2024, I like a battered defensive inventory that has current momentum off a multi-year low in addition to a know-how inventory that has not but benefited from the AI craze however ought to within the subsequent 12 months.

Qualcomm Included (QCOM)

Qualcomm (QCOM) is the world’s largest provider of chips for cellular units. It additionally holds the patents for the important thing know-how programs which might be the spine of all 3G and 4G networks. Chips account for roughly 75% of revenues whereas licensing from patents accounts for 25%, though the smaller space is extra worthwhile and higher insulated from competitors.

Qualcomm is the undisputed king of smartphone chips and Analysts estimate that the 5G chipset market will develop from $2.1 billion in 2020 to over $23 billion by 2026. And one other big development catalyst is rising, synthetic intelligence (AI). It’s a technological game-changer that corporations can’t afford to overlook.

The AI market within the U.S. is anticipated to develop from $86.9 billion in 2022 to $407 billion by 2030. International estimates for the trade have it round $500 billion in 2022 rising to over $2 trillion by 2030. One other examine estimates that the AI trade’s worth will develop by 13 instances over the following seven years. Qualcomm describes itself because the “on-device AI chief,” referring to cellular units.

However this hasn’t been an excellent 12 months for QCOM regardless of the AI increase and tech sector dominance this 12 months. QCOM is up about 30% YTD after the current rally within the sector, however the general know-how sector is up 50% this 12 months. QCOM has been a laggard. The inventory at present trades greater than 25% beneath the all-time excessive made at the start of 2022.

The problem is that system gross sales are cyclical and this 12 months smartphone gross sales have been down in a slower world economic system. Qualcomm’s revenues are down greater than 20% from final 12 months. Semiconductors are a cyclical trade subsector as nicely. Know-how market analysis outfit Gartner estimates that trade semiconductor revenues will fall about 11% in 2023.

However issues seem to have bottomed out. Qualcomm soundly beat expectations within the final earnings quarter and revised ahead steerage increased because it sees enterprise choosing up in 2024. Smartphone gross sales are accelerating. Gartner estimates semiconductor revenues will develop by about 17% in 2024. In the meantime, Qualcomm is introducing new AI-enabled chips for smartphones and private computer systems (PCs) as nicely, a brand new marketplace for the corporate.

The most important beneficiaries of the preliminary AI increase had been the businesses that profit from the know-how extra instantly. However as AI continues to proliferate it’ll definitely discover its solution to cellular units, and Qualcomm will likely be a main beneficiary.

NextEra Vitality, Inc. (NEE)

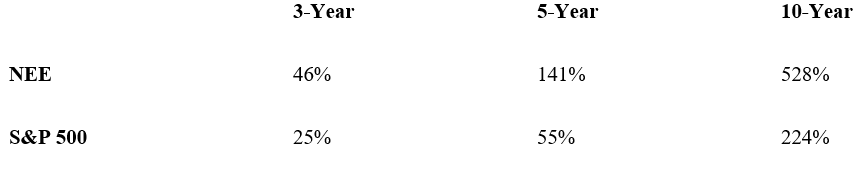

NEE isn’t just a few boring, stodgy utility inventory with the attainable profit of fine timing. It has a protracted observe report of not solely vastly outperforming the utility sector, however the general market as nicely. Previous to this 12 months, right here’s how NEE’s whole returns in comparison with these of the S&P 500:

How may a utility inventory greater than double the returns of the market over five- and ten-year intervals? It’s not an extraordinary utility.

NextEra Vitality offers all some great benefits of a defensive utility plus publicity to the fast-growing and extremely sought-after various vitality market. It’s the world’s largest utility. It’s a monster with about $21 billion in annual income and a $125 billion market capitalization. Earnings development and inventory returns have nicely exceeded what is often anticipated of a utility.

NEE is 2 corporations in a single. It owns Florida Energy and Gentle Firm, which is among the absolute best regulated utilities within the nation, accounting for about 55% of revenues. It additionally owns NextEra Vitality Sources, the world’s largest generator of renewable vitality from wind and photo voltaic and a world chief in battery storage.

There may be additionally an enormous runway for development tasks. NextEra has deployed $50 to $55 billion in the previous couple of years on development expansions and acquisitions. It additionally has a big challenge backlog.

However NEE is down 27% YTD and lately traded close to the bottom value in three years. But, every little thing that propelled the inventory increased previously continues to be firmly in place. In reality, issues is likely to be higher sooner or later than they had been previously.

Additional Studying

If you’re focused on discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets will likely be helpful:

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link