[ad_1]

Revealed on December twenty fifth, 2022 by Nikolaos Sismanis

The inventory market had a tough time in 2022, with the extremely tremulous macroeconomic setting spooking traders and inducing a stormy bear market. At Positive Dividend, we’re extremely targeted on shares with robust dividend development prospects.

Because of uncertainty remaining fairly elevated and the opportunity of a looming recession in 2023 being moderately noteworthy, we’ve recognized a number of recession-proof shares whose dividend prospects ought to stay rock-solid if the present bear market persists.

As a reminder, recession-proof shares are shares which can be thought of to be much less weak to financial downturns and recessionary market environments and, subsequently, could also be much less affected by elevated volatility within the capital markets. In fact, there isn’t any such factor as a very recession-proof inventory, as all sorts of securities are topic to some extent of market danger.

However, some shares could also be much less delicate to harsh financial situations and, subsequently, could also be much less prone to expertise as a lot of an impression of their monetary efficiency throughout a recession. Consequently, dividend-paying, recession-poof shares ought to get pleasure from higher longevity qualities with regards to their payouts.

Some examples of the sorts of firms that match this description are discovered among the many Dividend Aristocrats.

The Dividend Aristocrats are a choose group of 65 shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

You’ll be able to obtain an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter equivalent to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

On this article, we’re inspecting 12 dividend shares lined in our Positive Evaluation Analysis Database, whose recession-proof traits ought to allow them to continue to grow their dividends in a bear market and past.

The truth is, all 12 shares featured right here have been assigned an A ranking of their Dividend Threat Rating. In addition they characteristic a observe file of at the least 15 years of consecutive annual dividend will increase, which means they’ve already confirmed their potential to face up to harsh financial environments, together with the Nice Monetary Crises and, most lately, the COVID-19 pandemic.

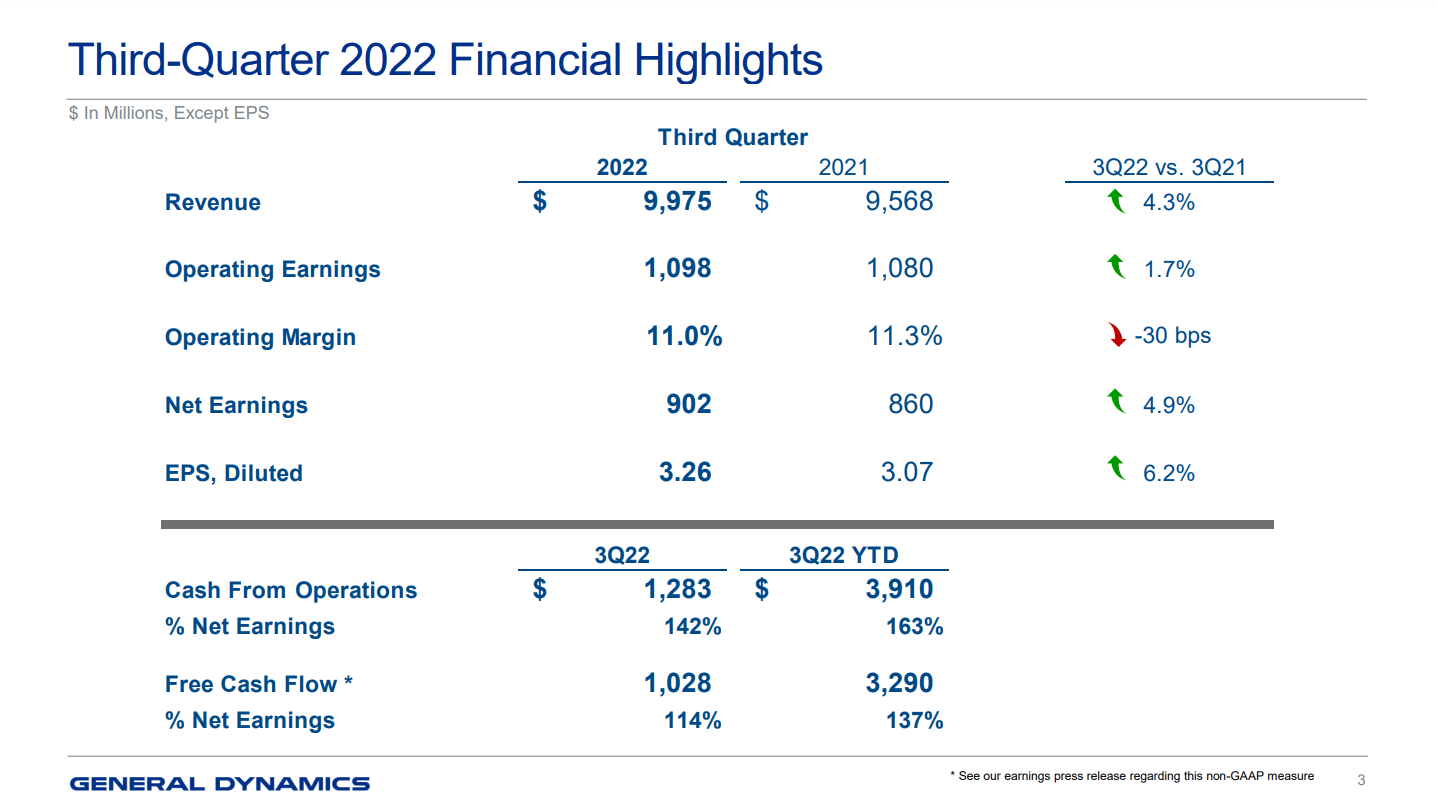

Recession-Proof Inventory #12: Normal Dynamics Company (GD)

- Dividend Yield: 2.0%

- Years of Dividend Progress: 31

Normal Dynamics is a US aerospace & protection firm that now operates in 4 enterprise segments: Aerospace (21% of gross sales), Fight Methods (19%), Marine Methods (26%), and Applied sciences (34%).

Normal Dynamics Aerospace phase is targeted on enterprise jets and providers, whereas the rest of the corporate is on protection. The corporate makes the well-known merchandise such because the M1 Abrams tank, Stryker automobile, Virginia-class submarine, Columbia-class submarine, and Gulfstream enterprise jets. Primarily based on income, Normal Dynamics is the fourth largest protection firm.

The corporate recorded revenues of roughly $38.5 billion in 2021, and each the highest and backside traces have grown persistently over time as a result of rising US protection spending, worldwide gross sales, and enterprise jet gross sales. Accordingly, the corporate has managed to persistently enhance its dividend, now boasting a powerful observe file of 31 consecutive annual dividend will increase. This makes Normal Dynamics a Dividend Aristocrat.

Supply: Investor Presentation

We consider the corporate will proceed performing properly as its established naval and floor platforms place it properly to maintain profitable future assist upkeep and modernization contracts in addition to future prime contracts. Most lately, the corporate was awarded a $5.13 billion modification to a beforehand awarded contract by the U.S. Navy. The continuing, unlucky conflict in Ukraine must also be a powerful driver towards future order influx.

Because of its robust company-wide backlog of $88.1 billion, its low payout ratio of 41%, and the truth that the protection trade experiences a number of tailwinds nowadays, we consider that Normal Dynamics’ dividend development prospects ought to stay rock-solid throughout a possible recession.

Click on right here to obtain our most up-to-date Positive Evaluation report on Normal Dynamics (preview of web page 1 of three proven beneath):

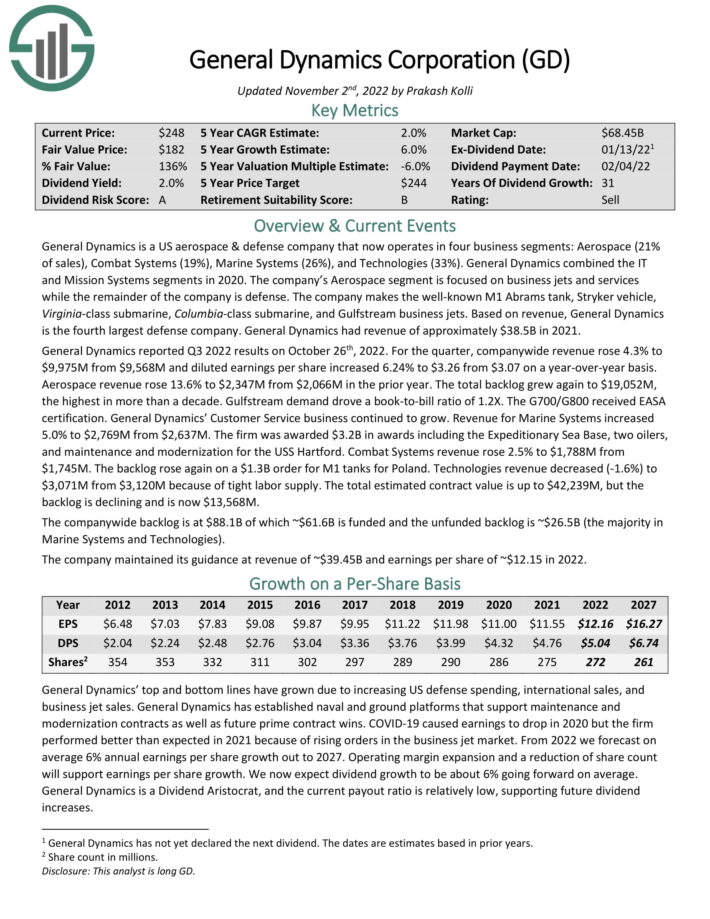

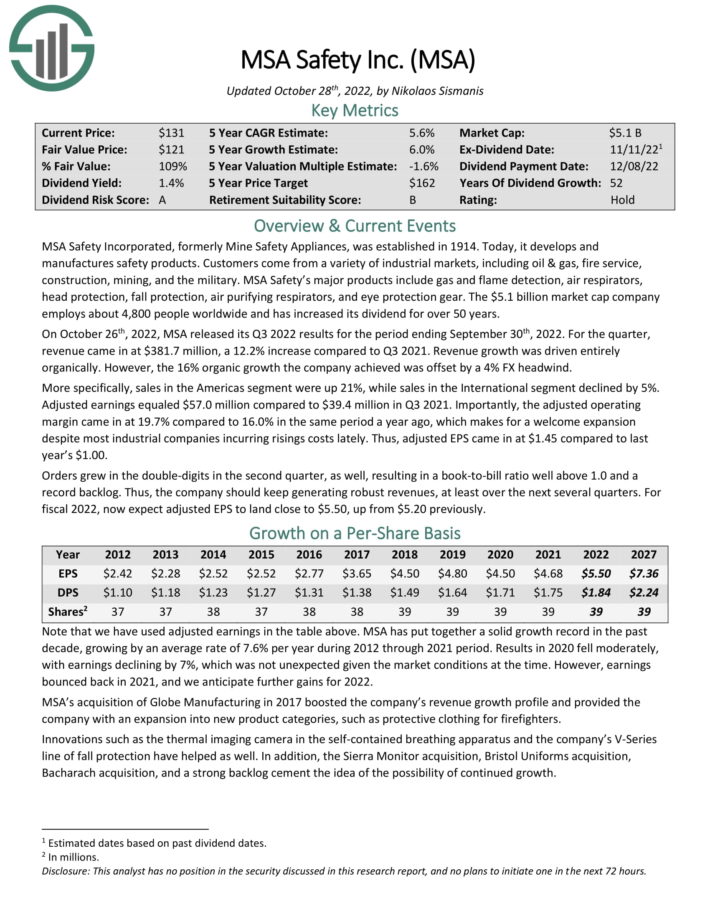

Recession-Proof Inventory #11: MSA Security Included (MSA)

- Dividend Yield: 1.3%

- Years of Dividend Progress: 52

MSA Security Included, previously Mine Security Home equipment, was established in 1914. At present, it develops and manufactures security merchandise. Prospects come from a wide range of industrial markets, together with oil & fuel, hearth service, building, mining, and the navy.

MSA Security’s main merchandise embody fuel and flame detection, air respirators, head safety, fall safety, air-purifying respirators, and eye safety gear. The $5.5 billion market cap firm has elevated its dividend for 52 years, which qualifies it as a Dividend King.

Supply: Investor Presentation

On October twenty sixth, 2022, MSA launched its Q3 2022 outcomes for the interval ending September thirtieth, 2022. For the quarter, income got here in at $381.7 million, a 12.2% enhance in comparison with Q3 2021. Income development was pushed completely organically. Nevertheless, the 16% natural development the corporate achieved was offset by a 4% FX headwind.

Orders grew within the double digits within the second quarter, as properly, leading to a book-to-bill ratio properly above 1.0 and a file backlog. Thus, the corporate ought to hold producing strong revenues, at the least over the following a number of quarters.

The corporate has a worldwide attain that rivals can not match, with roughly a 3rd of annual gross sales from exterior the Americas, and it may put money into development initiatives to retain its trade management. With its payout ratio standing at simply 33%, a strong order backlog, and administration’s express dedication to rising the dividend yearly, we consider MSA traders ought to sleep properly at night time with regard to its dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSA Security Included (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #10: Medtronic plc (MDT)

- Dividend Yield: 3.6%

- Years of Dividend Progress: 45

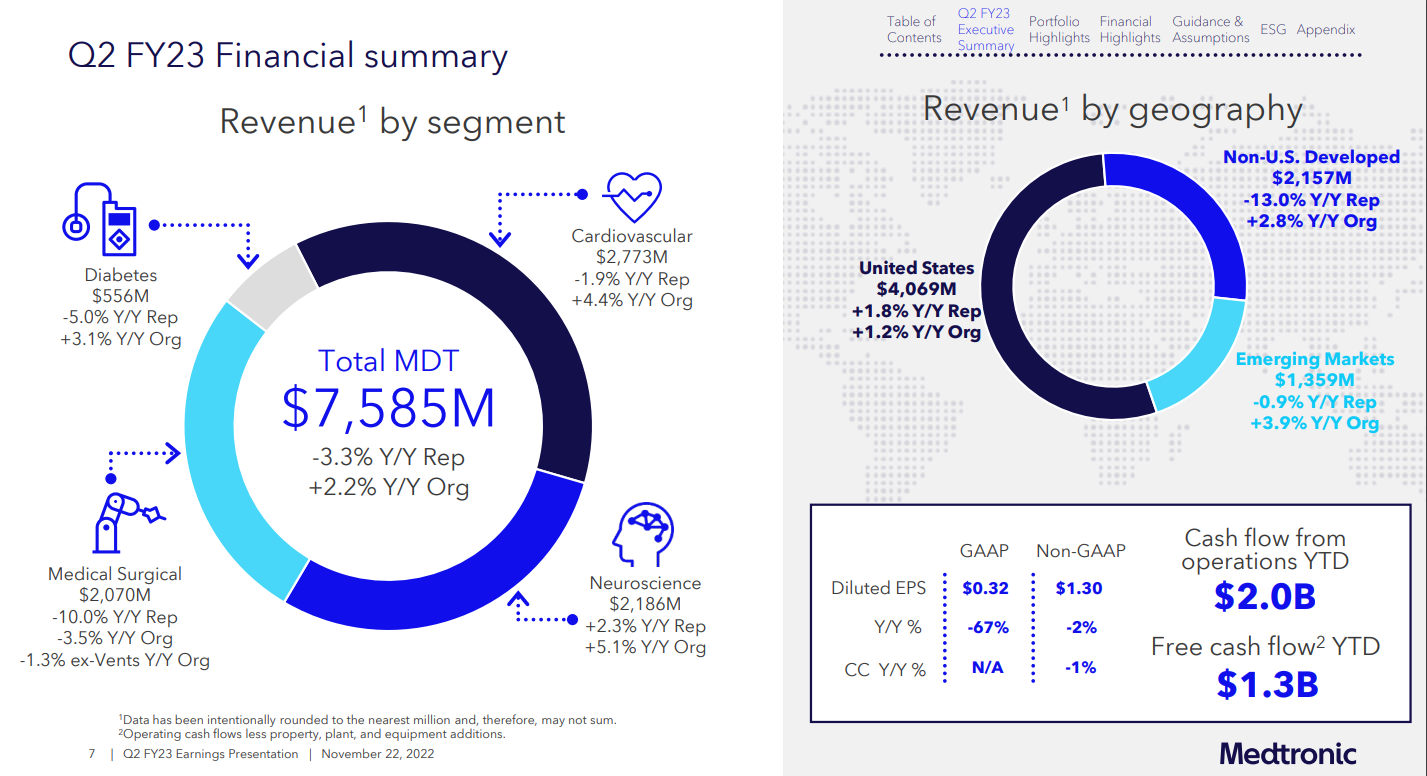

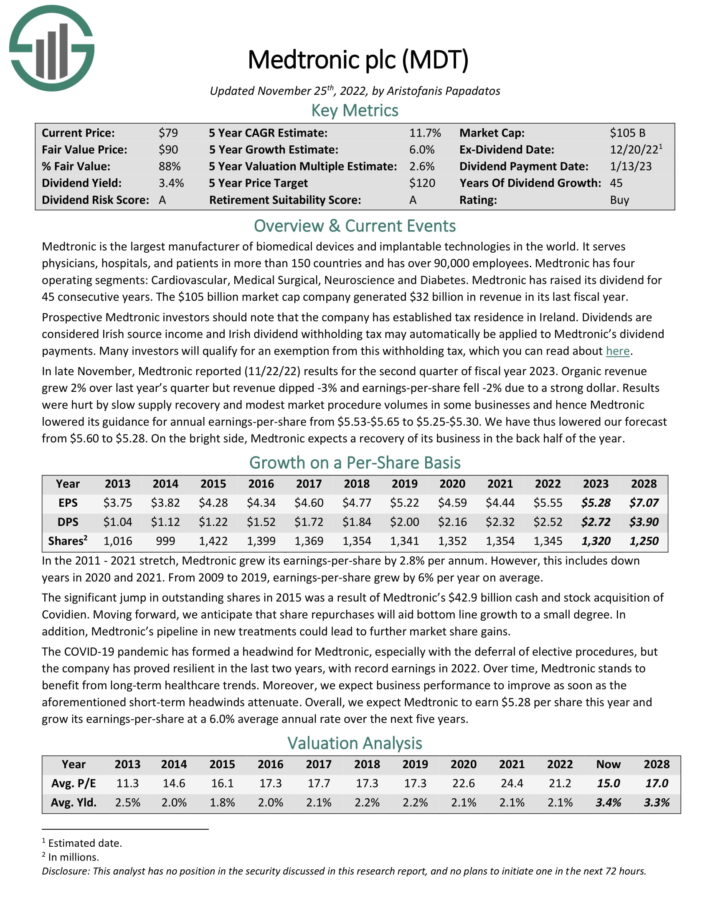

Medtronic is the biggest producer of biomedical gadgets and implantable applied sciences on the planet. It serves physicians, hospitals, and sufferers in additional than 150 international locations and has over 90,000 staff. Medtronic has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience, and Diabetes. Medtronic has raised its dividend for 45 consecutive years. The $103 billion market cap firm generated $32 billion in income in its final fiscal 12 months.

In late November, Medtronic reported (11/22/22) outcomes for the second quarter of the fiscal 12 months 2023. Natural income grew 2% over final 12 months’s quarter, however income dipped by 3%, and earnings-per-share fell -by 2% as a result of a powerful greenback. Outcomes have been damage by sluggish provide restoration and modest market process volumes in some companies, and therefore Medtronic lowered its steering for annual earnings-per-share from $5.53 to $5.65, all the way down to $5.25 to $5.30.

Supply: Investor Presentation

Medtronic’s most compelling aggressive benefit is its mental management in a sophisticated trade throughout the healthcare sector. Medtronic additionally has a powerful product pipeline that ought to drive its development for the foreseeable future, most certainly to lead to additional dividend hikes. The payout ratio stands at a wholesome 51%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Medtronic (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #9: S&P International Inc. (SPGI)

- Dividend Yield: 1.0%

- Years of Dividend Progress: 49

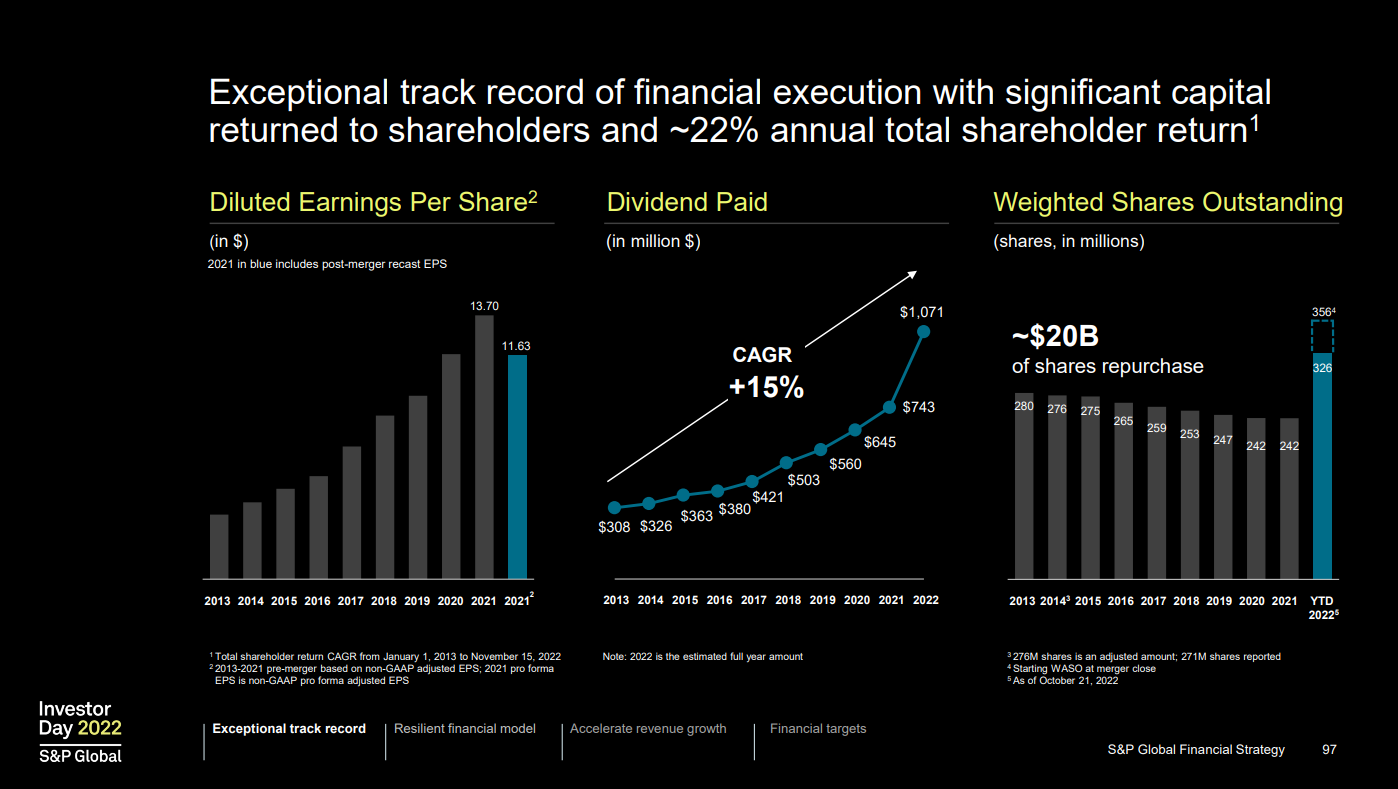

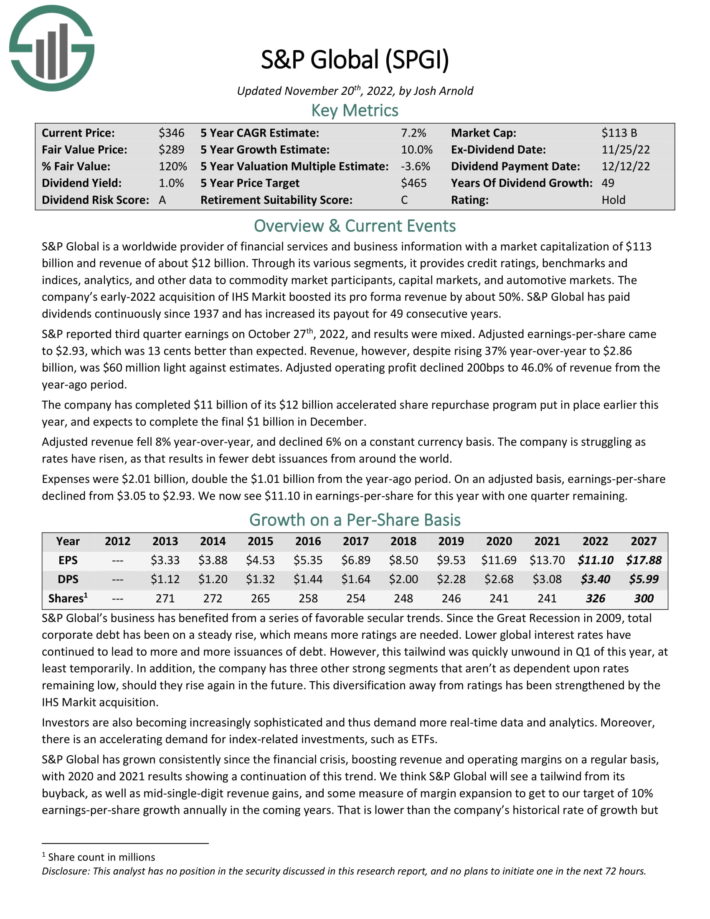

S&P International is a worldwide supplier of economic providers and enterprise info with a market capitalization of $108.2 billion and has annual income of about $12 billion. By means of its varied segments, it gives credit score rankings, benchmarks and indices, analytics, and different information to commodity market contributors, capital markets, and automotive markets.

The corporate’s early 2022 acquisition of IHS Markit boosted its professional forma income by about 50%. S&P International has paid dividends constantly since 1937 and has elevated its payout for 49 consecutive years.

Supply: Investor Presentation

S&P reported third-quarter earnings on October twenty seventh, 2022, and outcomes have been combined. Adjusted earnings-per-share got here to $2.93, which was 13 cents higher than anticipated. Income rose 37% year-over-year to $2.86 billion, butwas $60 million mild in opposition to estimates. Adjusted working revenue declined 200bps to 46.0% of income from the year-ago interval.

Then again, S&P International is weak to recessions, as firms, international locations, and people turn into way more conservative throughout such intervals, and thus their curiosity in monetary providers and debt issuance tremendously decreases. This was evident within the Nice Recession when S&P International’s earnings-per-share fell -21%.

Nevertheless, provided that it was a monetary disaster and most firms noticed their earnings collapse, the efficiency of S&P International was stable total. To its credit score, S&P International’s earnings thrived in 2020 regardless of the capital markets quickly crumpling.

Click on right here to obtain our most up-to-date Positive Evaluation report on S&P International (preview of web page 1 of three proven beneath):

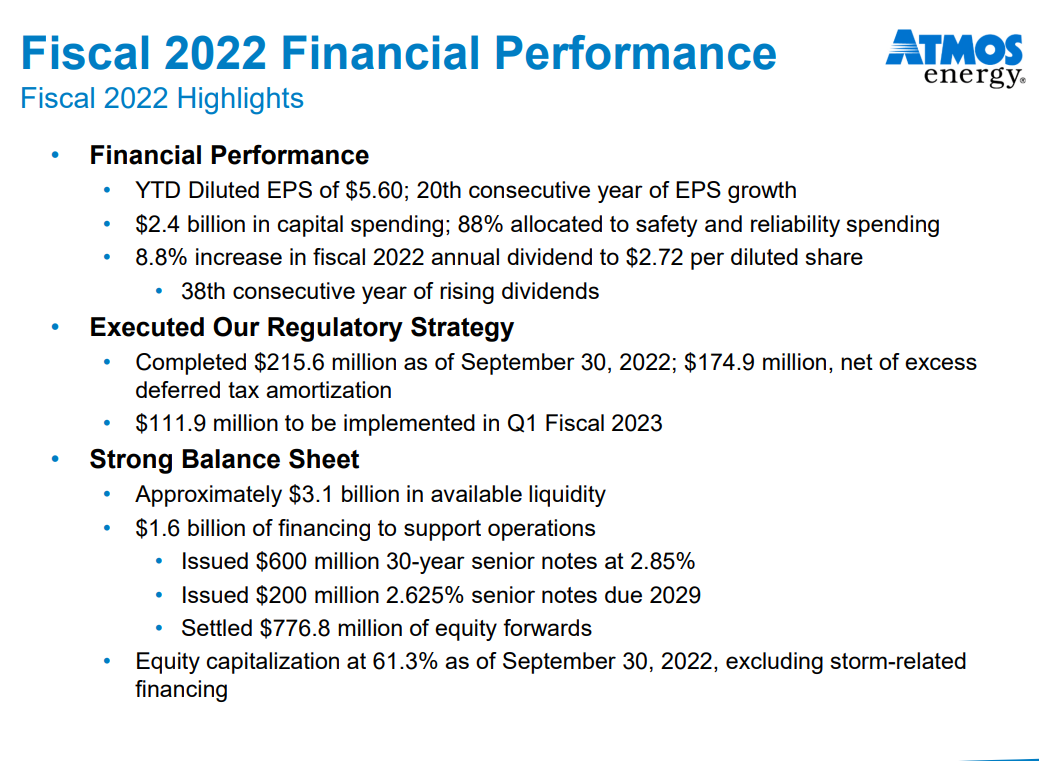

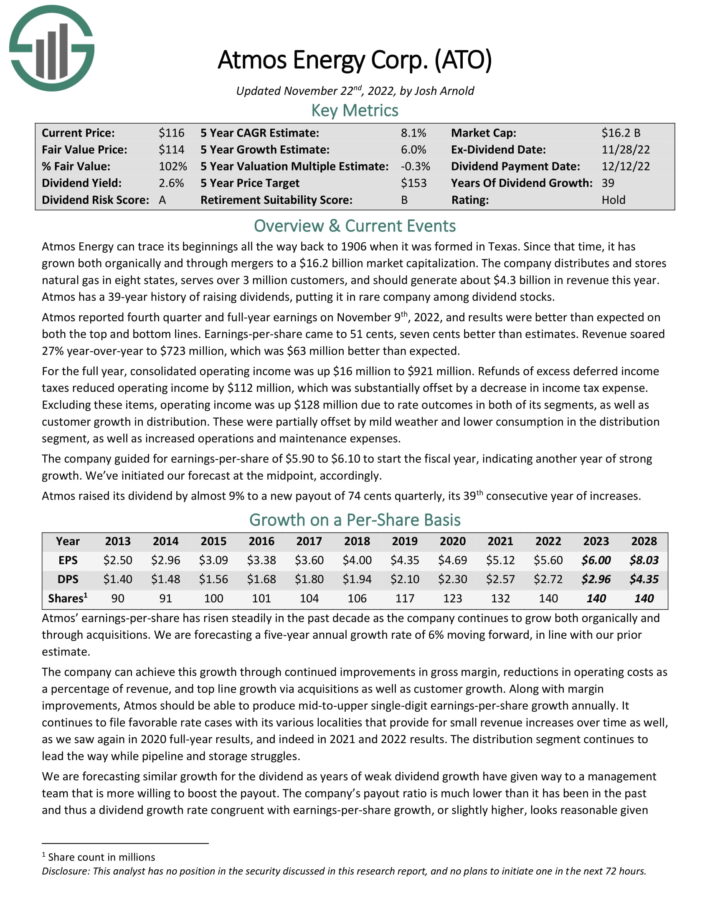

Recession-Proof Inventory #8: Atmos Power Company (ATO)

- Dividend Yield: 2.6%

- Years of Dividend Progress: 39

Atmos Power can hint its beginnings all the way in which again to 1906, when it was fashioned in Texas. Since that point, it has grown, each organically and thru mergers, to a $16.2 billion market capitalization.

The corporate distributes and shops pure fuel in eight states, serves over 3 million prospects, and may generate about $4.3 billion in income this 12 months. Atmos has a 39-year historical past of elevating dividends, putting amongst the elite group of Dividend Aristocrats.

Atmos reported fourth-quarter and full-year earnings on November ninth, 2022, and outcomes have been higher than anticipated on each the highest and backside traces. Earnings-per-share got here to 51 cents, seven cents higher than estimates. Income soared 27% year-over-year to $723 million, which was $63 million higher than anticipated.

Supply: Investor Presentation

The corporate’s aggressive benefit is in its vast distribution space and lack of direct competitors in its service areas for residential and industrial prospects. As well as, discretionary use of pure fuel is low as individuals usually use what they want, no matter financial situations, which means Atmos’ recession efficiency is prone to be resilient, as seen in 2020.

Click on right here to obtain our most up-to-date Positive Evaluation report on Atmos Power Company (preview of web page 1 of three proven beneath):

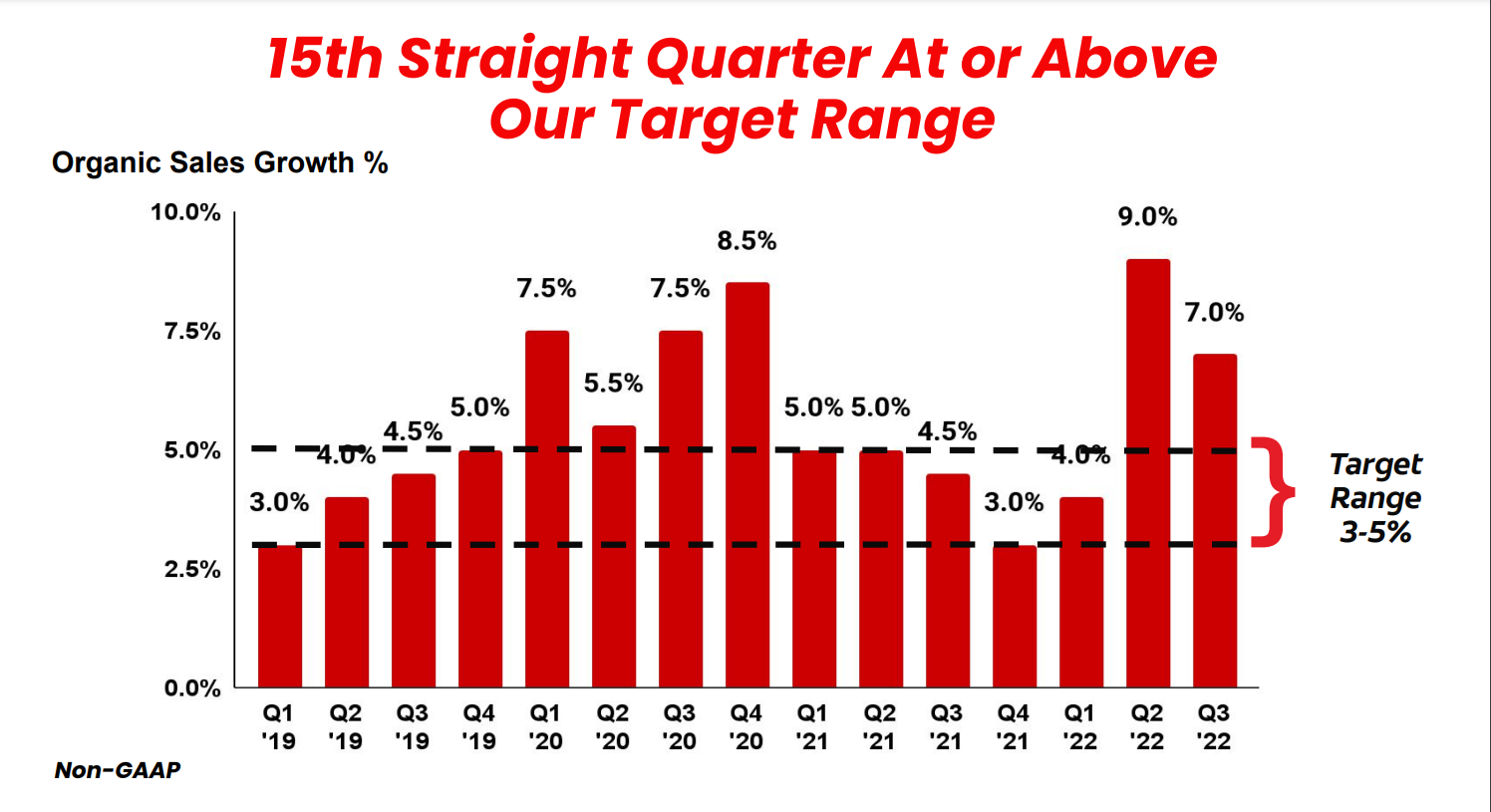

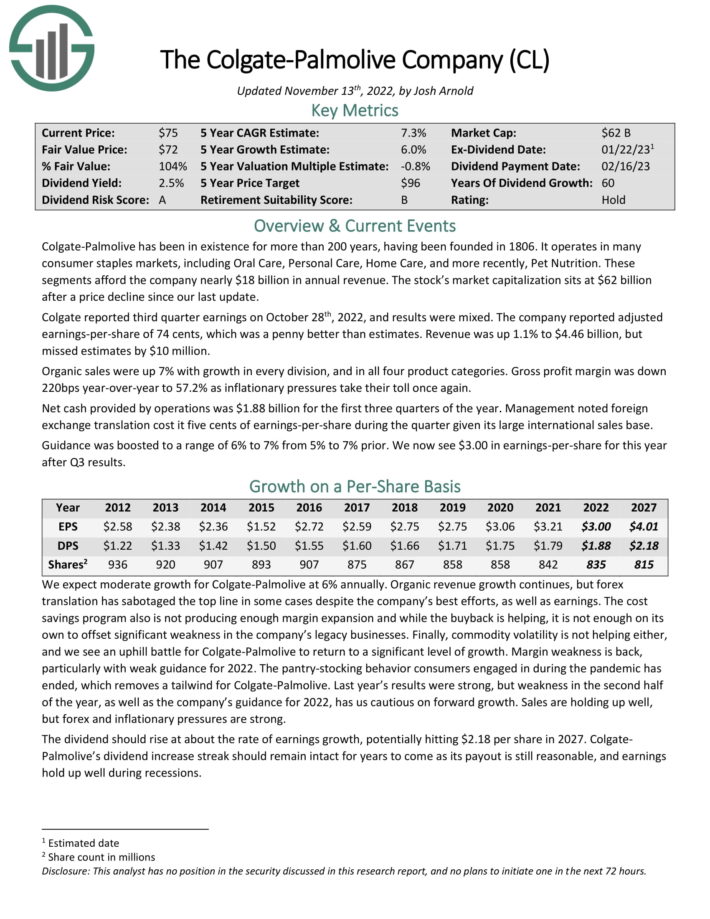

Recession-Proof Inventory #8: Colgate-Palmolive Firm (CL)

- Dividend Yield: 2.6%

- Years of Dividend Progress: 39

Colgate-Palmolive has been in existence for greater than 200 years, having been based in 1806. It operates in lots of shopper staples markets, together with Oral Care, Private Care, Residence Care, and, extra lately, Pet Vitamin. These segments generate practically $18 billion in annual income for the corporate. The inventory’s market capitalization sits at $66 billion.

Colgate reported third-quarter earnings on October twenty eighth, 2022, and outcomes have been combined. The corporate reported adjusted earnings-per-share of 74 cents, which was a penny higher than estimates. Income was up 1.1% to $4.46 billion, however missed estimates by $10 million. Natural gross sales have been up 7%, with development in each division and in all 4 product classes. The gross revenue margin was down 220 foundation factors year-over-year to 57.2% as inflationary pressures took their toll as soon as once more.

Supply: Investor Presentation

The corporate’s payout ratio is 63% of earnings, considerably increased than lately. However, see the dividend as protected, and we consider Colgate-Palmolive will produce many extra years of dividend will increase. Colgate is a recession-resistant inventory, given the staple nature of the merchandise it sells, and its aggressive benefit is discovered within the dominant manufacturers it owns. That is confirmed within the firm’s 60-year-long dividend development observe file.

Click on right here to obtain our most up-to-date Positive Evaluation report on Colgate- Palmolive Company (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #7: California Water Service Group (CWT)

- Dividend Yield: 1.7%

- Years of Dividend Progress: 54

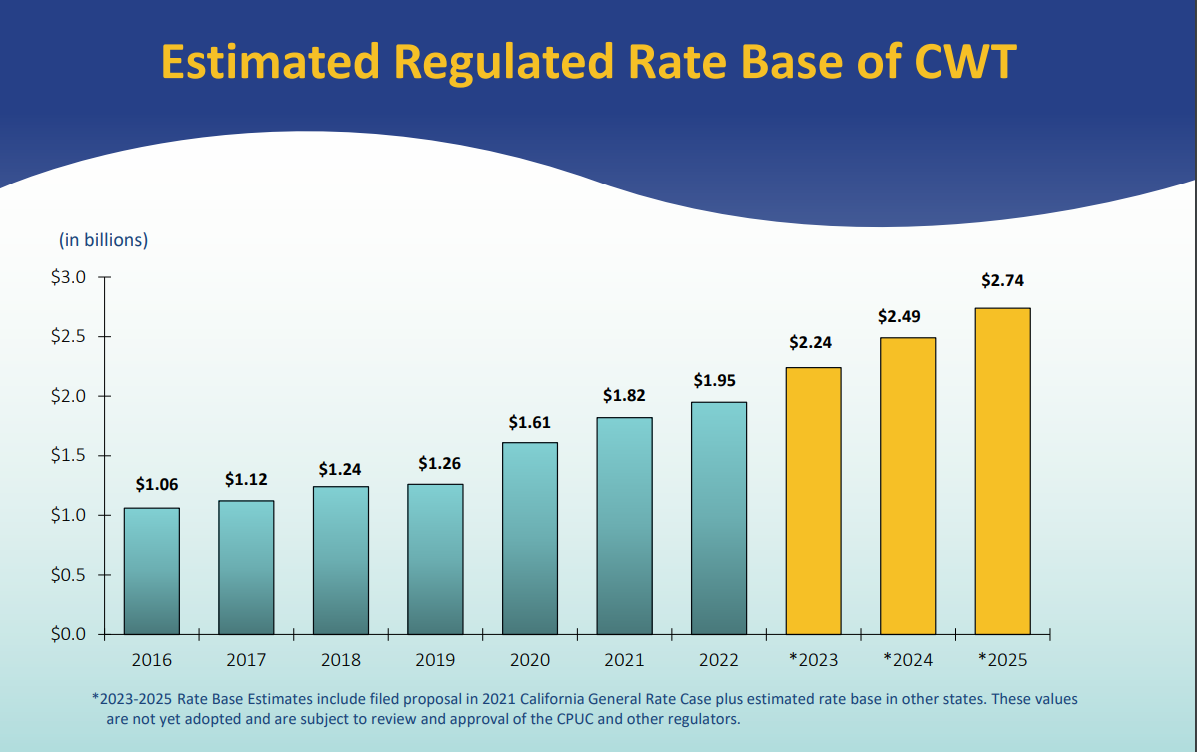

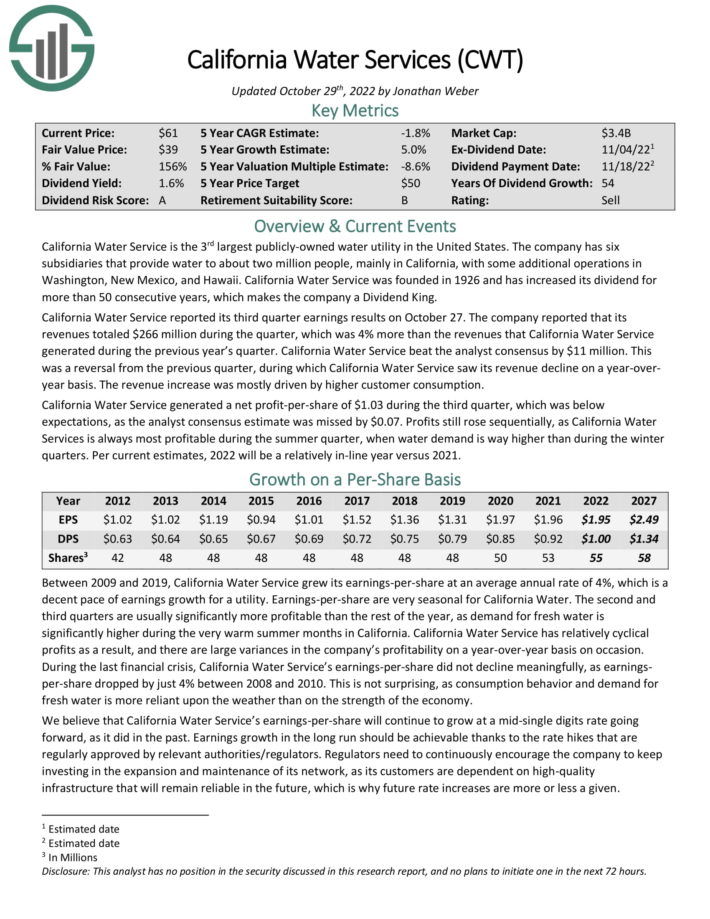

California Water Service is the third largest publicly-owned water utility in the USA. The corporate has six subsidiaries that present water to about two million individuals, primarily in California, with some further operations in Washington, New Mexico, and Hawaii.

California Water Service was based in 1926 and has elevated its dividend yearly for greater than half a century, which makes the corporate a Dividend King.

California Water Service reported its third-quarter earnings outcomes on October 27. The corporate reported that its revenues totaled $266 million through the quarter, which was 4% greater than the revenues that California Water Service generated through the earlier 12 months’s quarter. The income enhance was principally pushed by increased buyer consumption.

California Water Service generated a internet profit-per-share of $1.03 through the third quarter, which was beneath expectations, because the analyst consensus estimate was missed by $0.07. Income nonetheless rose sequentially, as California Water Providers is at all times most worthwhile through the summer time quarter when water demand is means increased than through the winter quarters.

Supply: Investor Presentation

The predictable nature of the corporate’s earnings, mixed with a payout ratio that’s not overly excessive, implies that the dividend seems very protected. Additional, California Water Service is a regulated utility, and as such, it doesn’t have to fret about competitors an excessive amount of.

Click on right here to obtain our most up-to-date Positive Evaluation report on California Water Service (preview of web page 1 of three proven beneath):

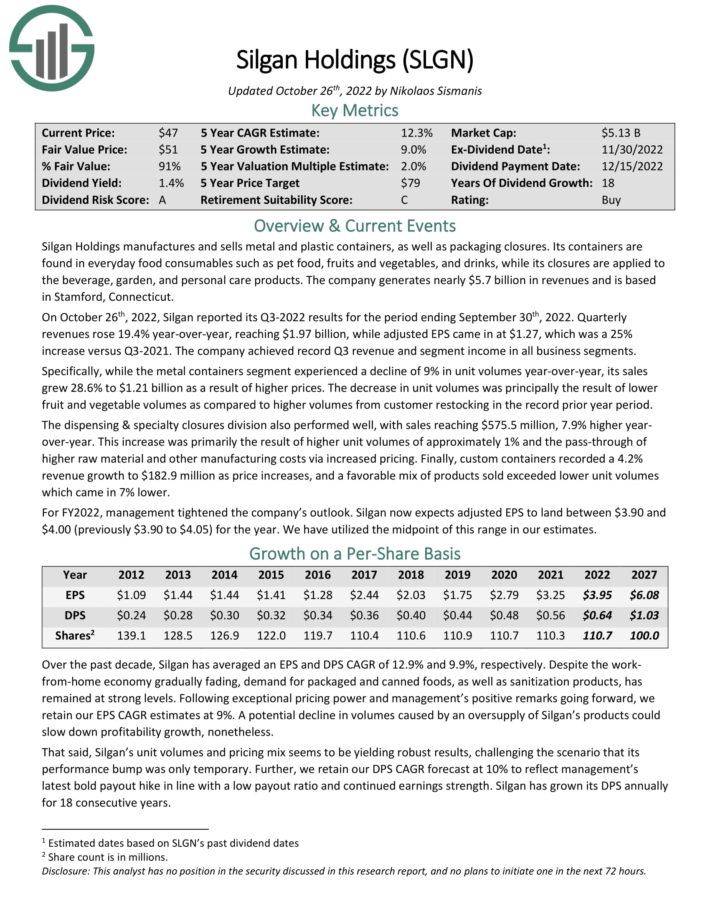

Recession-Proof Inventory #6: Silgan Holdings Inc. (SLGN)

- Dividend Yield: 1.2%

- Years of Dividend Progress: 18

Silgan Holdings manufactures and sells metallic and plastic containers, in addition to packaging closures. Its containers are present in on a regular basis meals consumables equivalent to pet meals, vegetables and fruit, and drinks, whereas its closures are utilized to beverage, backyard, and private care merchandise. The corporate generates practically $5.7 billion in revenues and is predicated in Stamford, Connecticut.

On October twenty sixth, 2022, Silgan reported its third-quarter outcomes for the interval ending September thirtieth, 2022. Quarterly revenues rose 19.4% year-over-year, reaching $1.97 billion, whereas adjusted EPS got here in at $1.27, which was a 25% enhance versus Q3-2021. The corporate achieved file Q3 income and phase earnings in all enterprise segments.

Over the previous decade, Silgan has averaged an EPS and DPS CAGR of 12.9% and 9.9%, respectively. Regardless of the work-from-home financial system steadily fading, demand for packaged and canned meals, in addition to sanitization merchandise, has remained at robust ranges.

Supply: Investor Presentation

Traders can depend on Silgan’s dividends for the reason that firm’s payout ratio has principally remained extremely low. It presently stands at 16%. Because the firm’s IPO in 1996, Silgan has by no means reported a money-losing quarter. Its merchandise are very important for varied shopper staples. Therefore, its operations are fairly secure, displayed in its 18-year dividend development file.

Click on right here to obtain our most up-to-date Positive Evaluation report on Silgan Holdings (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #5: Walgreens Boots Alliance, Inc. (WBA)

- Dividend Yield: 5.0%

- Years of Dividend Progress: 47

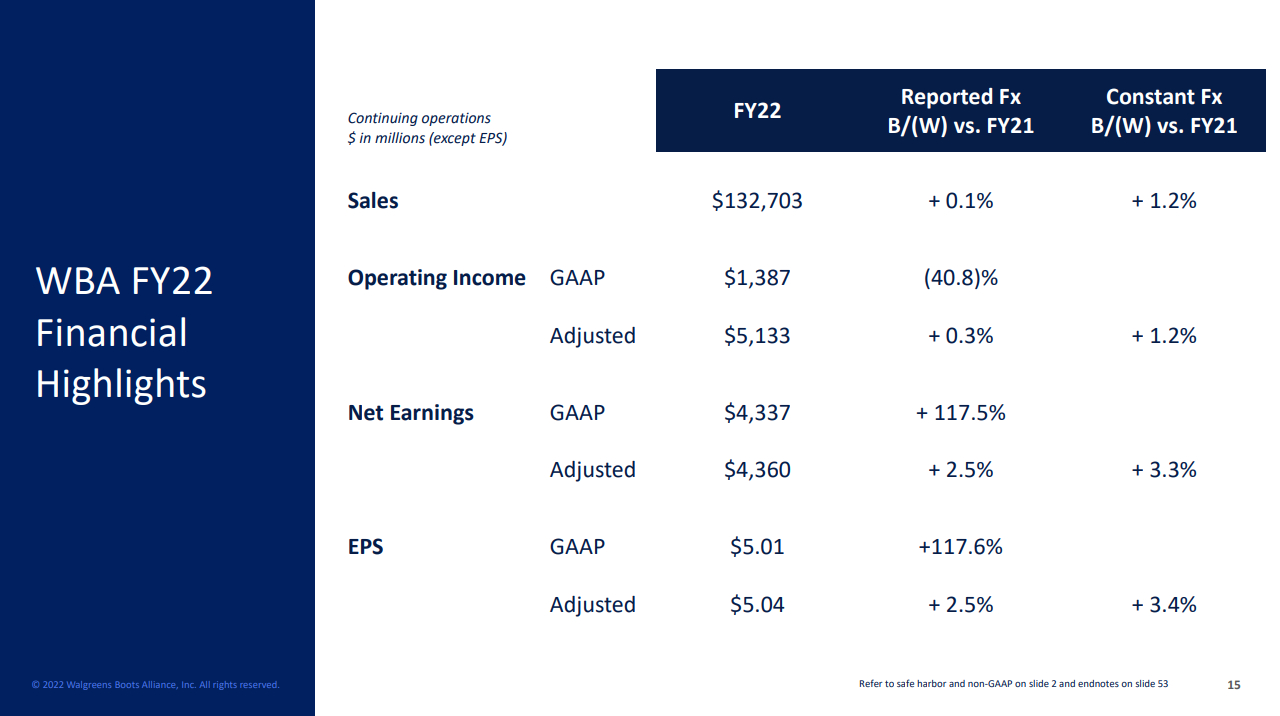

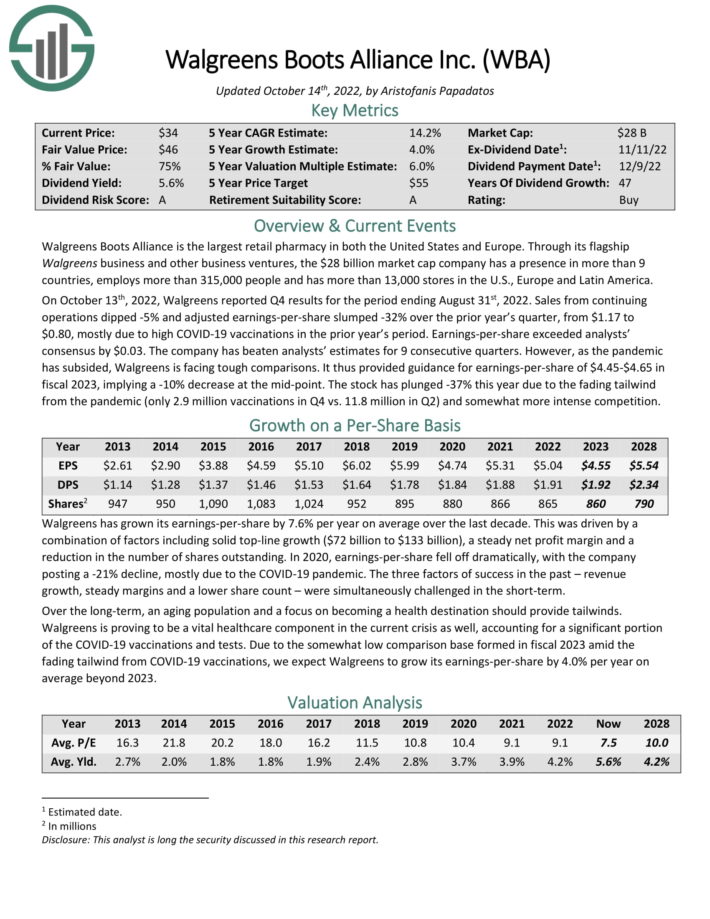

Walgreens Boots Alliance is the biggest retail pharmacy in each the USA and Europe. By means of its flagship Walgreens enterprise and different enterprise ventures, the $28 billion market cap firm has a presence in additional than 9 international locations, employs greater than 315,000 individuals, and has greater than 13,000 shops within the U.S., Europe, and Latin America.

On October 13 th, 2022, Walgreens reported This autumn outcomes for the interval ending August thirty first, 2022. Gross sales from persevering with operations dipped -5%, and adjusted earnings-per-share slumped -32% over the prior 12 months’s quarter, from $1.17 to $0.80, principally as a result of excessive COVID-19 vaccinations within the prior 12 months’s interval.

Supply: Investor Presentation

Walgreens’ aggressive benefit lies in its huge scale and community in an necessary and rising trade. The payout ratio stays affordable, at 42%, and may proceed so as to add an earnings ballast for dividend-growth traders. Moreover, regardless of the diminished earnings in 2020, it ought to be famous that Walgreens has put collectively a really robust file in good occasions and dangerous.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens Boots Alliance (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #4: Federal Realty Funding Belief (FRT)

- Dividend Yield: 4.3%

- Years of Dividend Progress: 55

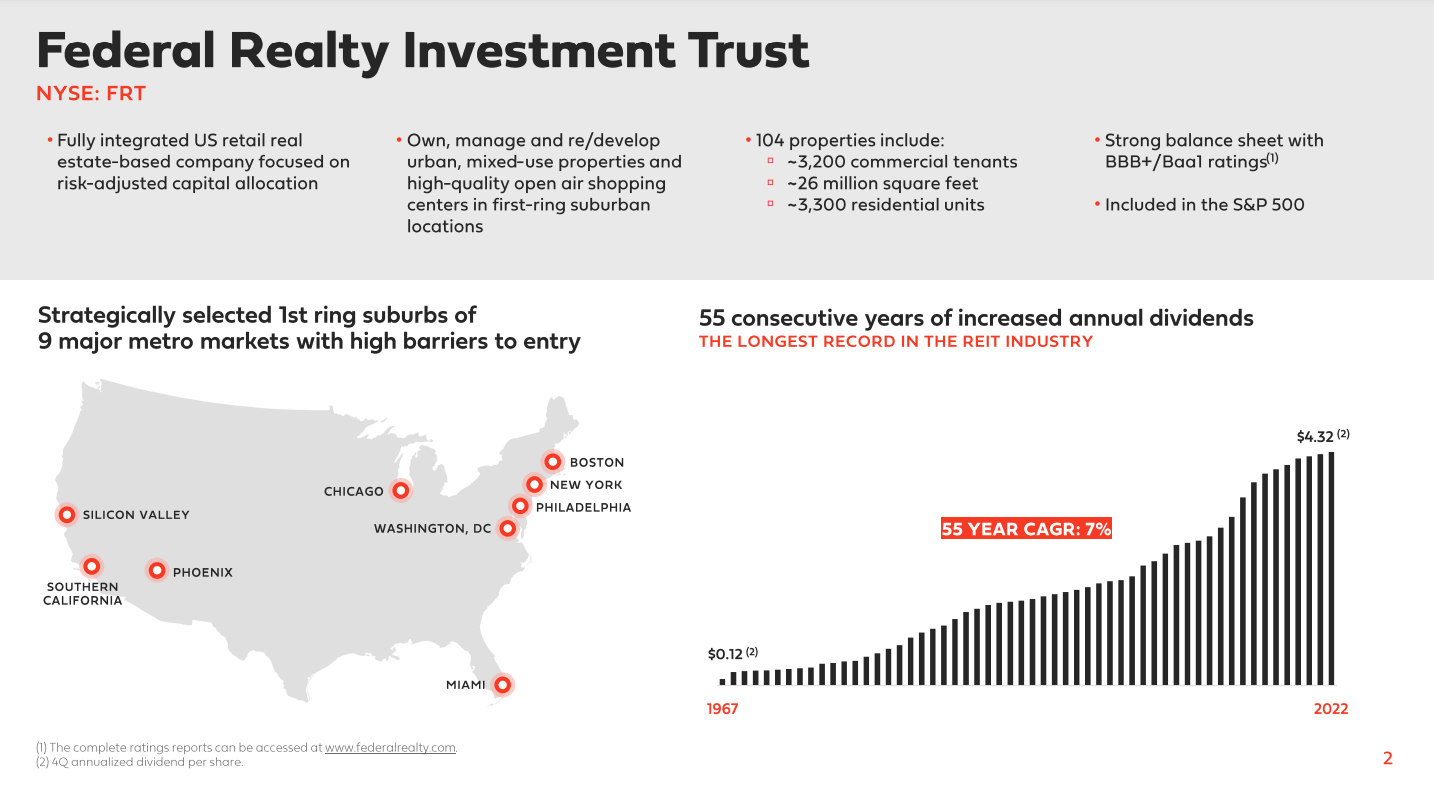

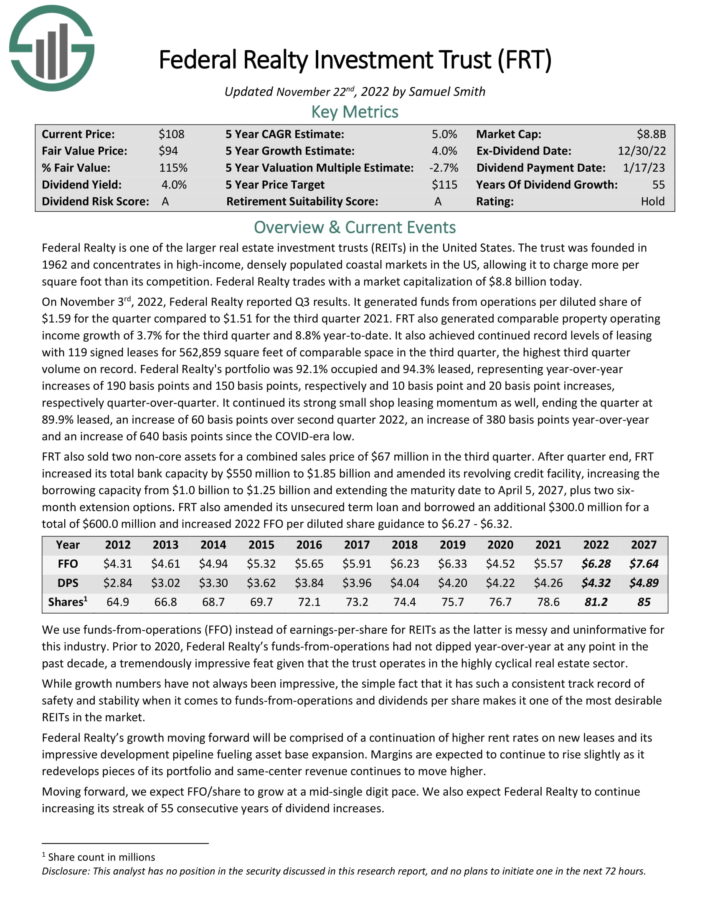

Federal Realty is among the bigger actual property funding trusts (REITs) in the USA. The belief was based in 1962 and concentrates on high-income, densely populated coastal markets within the US, permitting it to cost extra per sq. foot than its competitors. Federal Realty trades with a market capitalization of $8.3 billion at present.

Supply: Investor Presentation

On November third, 2022, Federal Realty reported third-quarter outcomes. It generated FFO/share of $1.59 for the quarter in comparison with $1.51 within the prior-year interval. FRT additionally generated comparable property working earnings development of three.7% for the interval and eight.8% year-to-date.

The belief additionally achieved continued file ranges of leasing with 119 signed leases for 562,859 sq. toes of comparable area within the quarter, the very best third-quarter quantity on file. Federal Realty’s portfolio was 92.1% occupied and 94.3% leased, representing year-over-year will increase of 190 foundation factors and 150 foundation factors, respectively, and 10 foundation level and 20 foundation level will increase, respectively, quarter-over-quarter.

FRT options the longest dividend development streak amongst REITs, boasting 55 years of successive annual dividend will increase.

Click on right here to obtain our most up-to-date Positive Evaluation report on Federal Realty Funding Belief (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #3: Abbott Laboratories (ABT)

- Dividend Yield: 1.9%

- Years of Dividend Progress: 51

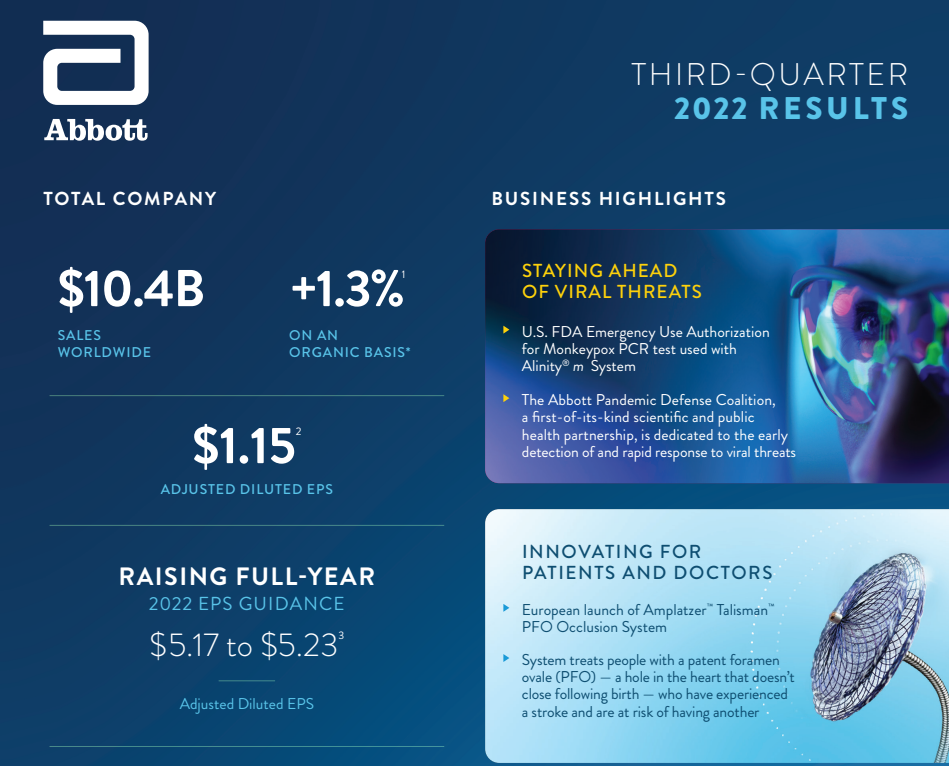

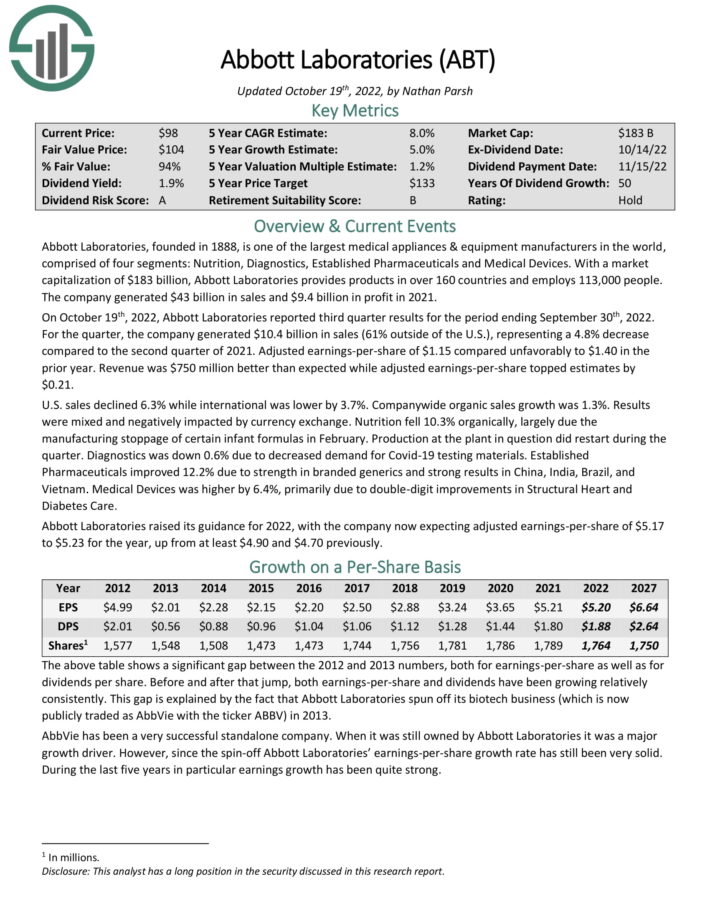

Abbott Laboratories, based in 1888, is among the largest medical home equipment & gear producers on the planet, comprised of 4 segments: Vitamin, Diagnostics, Established Prescribed drugs, and Medical Units. With a market capitalization of $183 billion, Abbott Laboratories gives merchandise in over 160 international locations and employs 113,000 individuals. The corporate generated $43 billion in gross sales and $9.4 billion in revenue in 2021.

On October nineteenth, 2022, Abbott Laboratories reported third-quarter outcomes for the interval ending September thirtieth, 2022. For the quarter, the corporate generated $10.4 billion in gross sales (61% exterior of the U.S.), representing a 4.8% lower in comparison with the second quarter of 2021.

Adjusted earnings-per-share of $1.15 in contrast unfavorably to $1.40 within the prior 12 months. Income was $750 million higher than anticipated, whereas adjusted earnings-per-share topped estimates by $0.21.

Supply: Investor Infographic

Abbott Laboratories’ dividend payout ratio has by no means been above 50% all through the final decade. It presently stands at a really wholesome 36%. Coupled with the truth that the corporate’s earnings-per-share has proven constant development even through the harshest financial environments, Abbott Laboratories’ dividend seems very protected.

Click on right here to obtain our most up-to-date Positive Evaluation report on Abbott Laboratories (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #2: Canadian Nationwide Railway Firm (CNI)

- Dividend Yield: 1.8%

- Years of Dividend Progress: 27

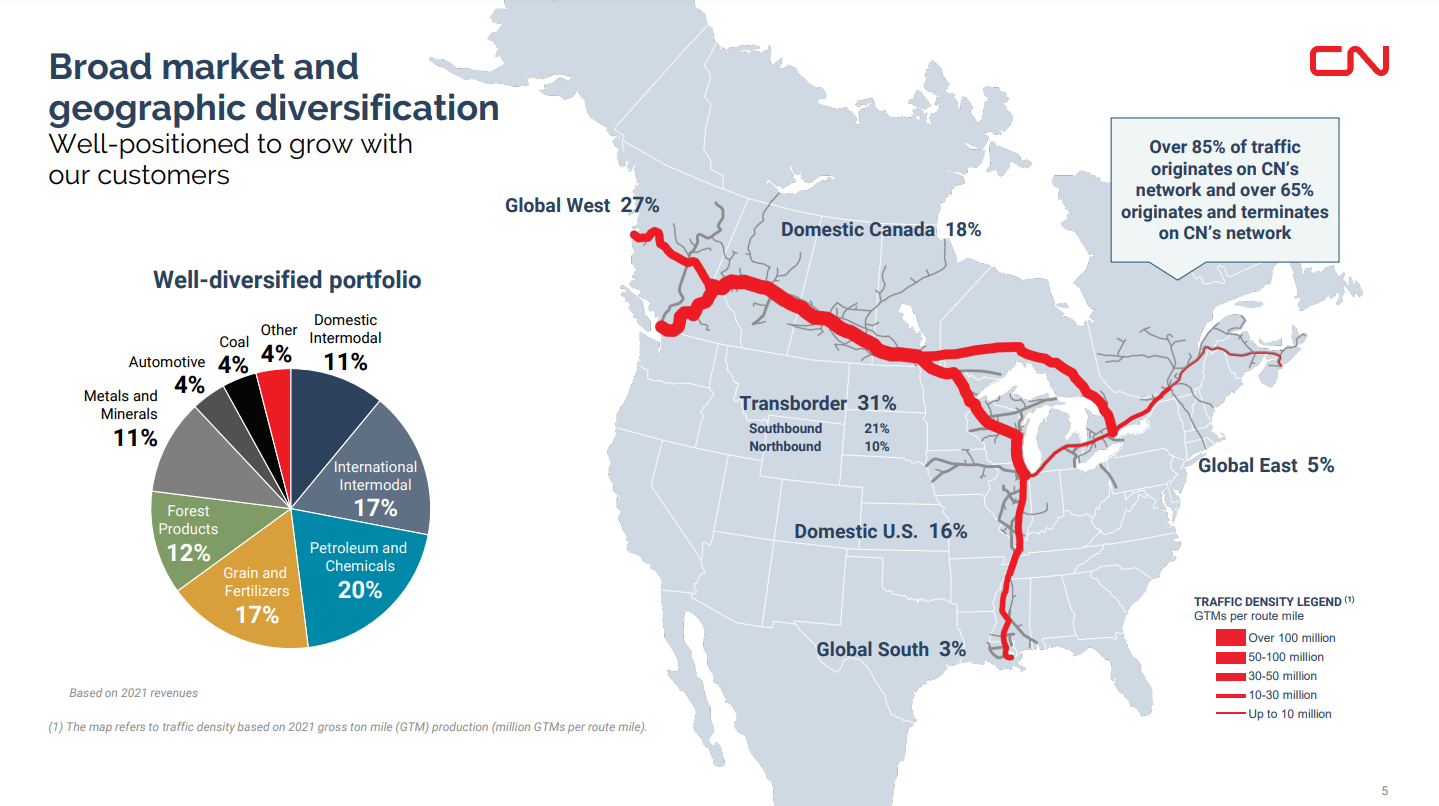

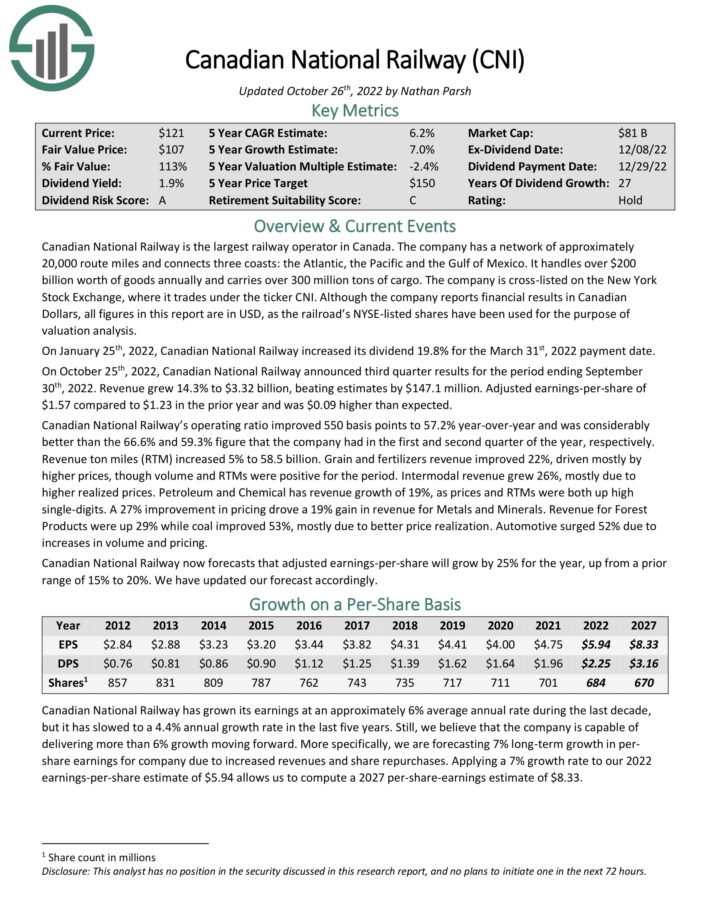

Canadian Nationwide Railway is the biggest railway operator in Canada. The corporate has a community of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific, and the Gulf of Mexico. It handles over $200 billion value of products yearly and carries over 300 million tons of cargo.

Supply: Investor Presentation

On October twenty fifth, 2022, Canadian Nationwide Railway introduced third-quarter outcomes for the interval ending September thirtieth, 2022. Income grew 14.3% to $3.32 billion, beating estimates by $147.1 million.

Adjusted earnings-per-share of $1.57 in comparison with $1.23 within the prior 12 months and was $0.09 increased than anticipated. Canadian Nationwide Railway’s working ratio improved 550 foundation factors to 57.2% year-over-year and was significantly higher than the 66.6% and 59.3% figures that the corporate had within the first- and second-quarters of the 12 months, respectively.

Canadian Nationwide Railway advantages from working within the railway trade, one of many sectors with the very best obstacles to entry. The capital and experience required to construct new railways are large. Furthermore, the railway trade is saturated and is structured as an oligopoly, which leads to nearly no new entrants and minimal competitors.

Click on right here to obtain our most up-to-date Positive Evaluation report on Canadian Nationwide Railway (preview of web page 1 of three proven beneath):

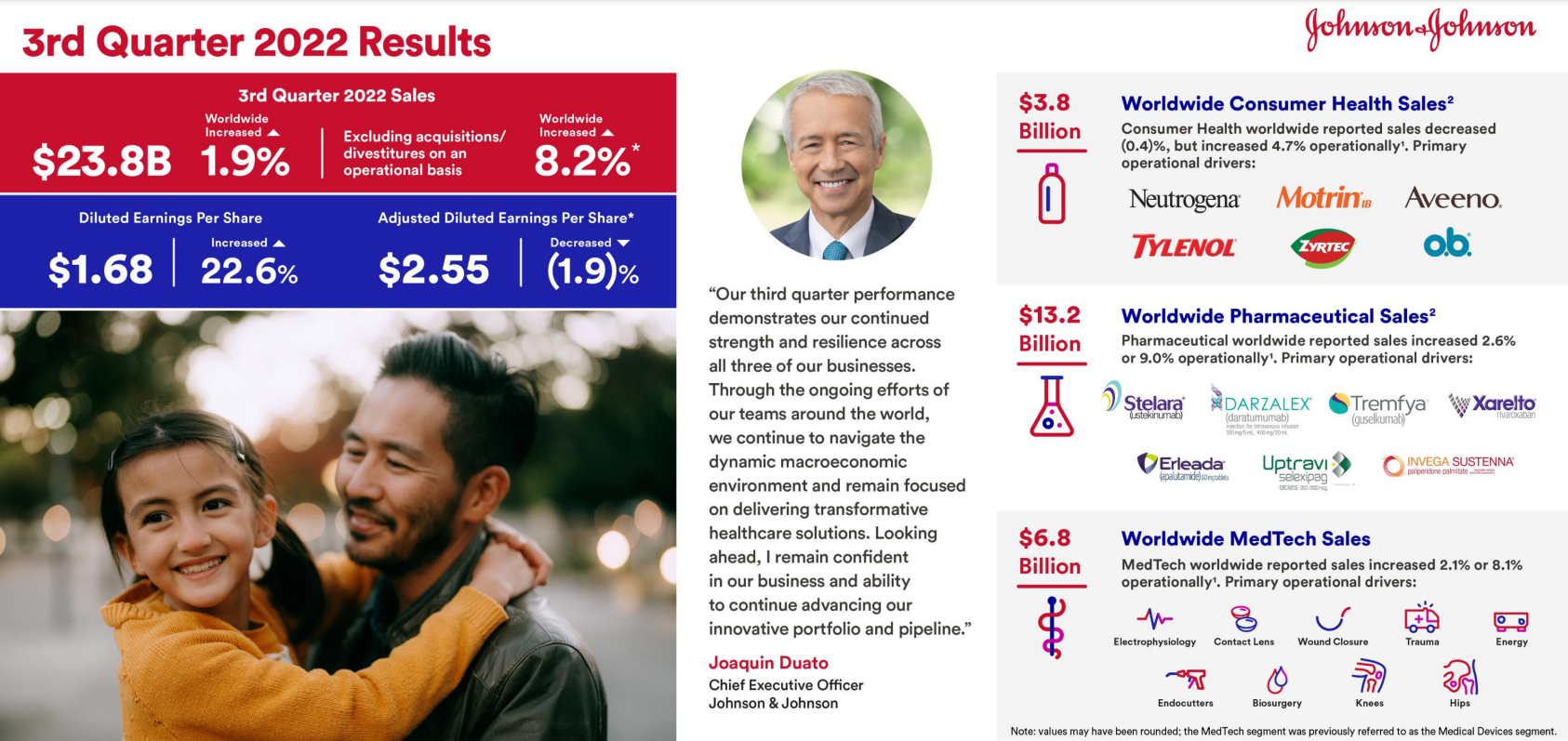

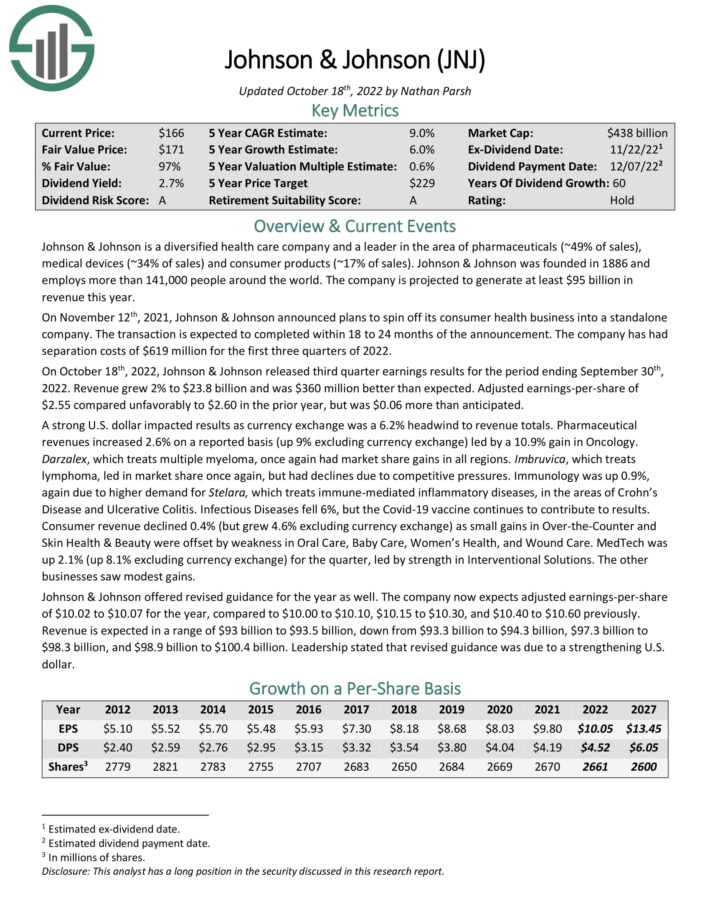

Recession-Proof Inventory #1: Johnson & Johnson (JNJ)

- Dividend Yield: 2.5%

- Years of Dividend Progress: 60

Johnson & Johnson is a diversified healthcare firm and a frontrunner within the space of prescription drugs (~49% of gross sales), medical gadgets (~34% of gross sales), and shopper merchandise (~17% of gross sales). Johnson & Johnson was based in 1886 and is projected to generate at the least $95 billion in income this 12 months.

On October 18th, 2022, Johnson & Johnson launched third-quarter earnings outcomes for the interval ending September thirtieth, 2022. Income grew 2% to $23.8 billion and was $360 million higher than anticipated. Adjusted earnings-per-share of $2.55 in contrast unfavorably to $2.60 within the prior 12 months however was $0.06 greater than anticipated.

Supply: Investor Presentation

Johnson & Johnson has a fairly low dividend payout ratio. This provides the corporate ample room to boost its dividend, even in a chronic recession. One among Johnson & Johnson’s key aggressive benefits is the scale and scale of its enterprise. It’s a worldwide chief in a variety of healthcare classes. Satisfactory diversification amongst its companies, subsequently, permits it to proceed to develop even when one of many segments is underperforming.

The corporate’s qualities and talent to proceed performing properly beneath varied financial situations are mirrored in its 60-year-long dividend development observe file. The payout ratio stays at a wholesome 45%, which ought to enable for steady dividend will increase shifting ahead.

Click on right here to obtain our most up-to-date Positive Evaluation report on Johnson & Johnson (preview of web page 1 of three proven beneath):

Ultimate Ideas

Whereas no inventory is finally recession-proof, there are particular sectors and industries that are typically extra resilient throughout financial downturns. Normally, nevertheless, important items and providers, equivalent to healthcare, utilities, and shopper staples, have a greater historical past when it comes to producing stable outcomes and persevering with to develop their dividends throughout robust financial situations.

The shares we’ve chosen for this text have already confirmed they’ll stand tall throughout recessionary environments fairly sufficiently, as confirmed by their prolonged dividend development observe information. Their distinctive qualities, aggressive benefits in every trade, high quality revenues, and considerate capital allocation methods ought to enable them to proceed rising their dividends each throughout a possible upcoming recession and past.

Searching for extra top quality names? These different Positive Dividend databases might be very helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link