[ad_1]

Revealed on December twenty ninth, 2022 by Nikolaos Sismanis

Are you on the lookout for long-term funding alternatives that may present a dependable stream of passive revenue for you and your loved ones? If that’s the case, “eternally” shares could also be price contemplating. These are shares which have confirmed dependable and sturdy over lengthy durations whereas retaining the potential to proceed offering passive revenue for generations to return.

This text will spotlight 12 “eternally” shares coming from numerous industries, together with expertise, healthcare, and client items, with stable observe data of development and stability. Their distinctive qualities, market-leading positions, and dedication to rising their dividends are fairly prone to preserve serving you and your loved ones with rising passive revenue for the long-term future.

The downloadable Dividend Kings Spreadsheet Listing under incorporates the next for every inventory within the index amongst different vital investing metrics:

- Payout ratio

- Dividend yield

- Value-to-earnings ratio

You may see the total downloadable spreadsheet of all 48 Dividend Kings (together with vital monetary metrics similar to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

What makes a inventory a “eternally” inventory?

To extra particularly outline what makes a inventory a “eternally” inventory in our e-book, listed below are just a few attributes we thought-about when figuring out which shares to incorporate in our checklist:

Sturdy financials:

Our “eternally” inventory checklist contains firms with wholesome stability sheets and the flexibility to submit constant income throughout numerous financial environments. These firms are extra seemingly to have the ability to proceed paying and rising their dividends in good occasions and dangerous.

Dividend historical past:

The shares now we have chosen have a longtime historical past of constantly paying dividends and rising them over time. This can be a good indicator that their administration groups worth their shareholders and are dedicated to returning worth to them. Extended dividend development observe data additionally reinforce the earlier level that these firms have already managed to develop their payouts in good and dangerous occasions. Our chosen shares function at the least 20 years of consecutive dividend hikes.

Dividend yield / Payout ratio:

Whereas an organization’s dividend yield is bigoted when figuring out whether or not a inventory is a generational holding, now we have made positive that the shares featured right here pay out a significant yield that can be well-covered. Whereas a excessive yield will be tempting, it’s vital to think about the dividend’s sustainability. We’ve chosen firms that yield at the least 2.5% and whose payouts comprise lower than 80% of their underlying earnings.

Development potential:

A longtime observe file of stable financials and dividend development alone could be inadequate for a “eternally” inventory except its future development prospects additionally stay strong. We’ve chosen shares with a number of development catalysts and a transparent plan for future development. That is important to make sure these firms can proceed to develop their dividends and assist your wealth compound over time somewhat comfortably.

Aggressive benefits/moat:

A robust aggressive benefit will help an organization keep its profitability and development over the long run, making it extra prone to proceed paying dividends and rising them over time. This is among the essential standards that may make a inventory a “eternally” inventory – an organization that has a stable aggressive benefit and may keep its market place and profitability is extra seemingly to have the ability to proceed offering passive revenue for generations to return.

Without end Inventory #12: Enbridge Inc. (ENB)

- Dividend yield: 6.6%

- Years of dividend development: 27

Enbridge is an oil & fuel firm that operates the next segments: Liquids Pipelines, Gasoline Distributions, Power Companies, Gasoline Transmission & Midstream, and Inexperienced Energy & Transmission. Enbridge purchased Spectra Power for $28 billion in 2016 and has grow to be one of many largest midstream firms in North America.

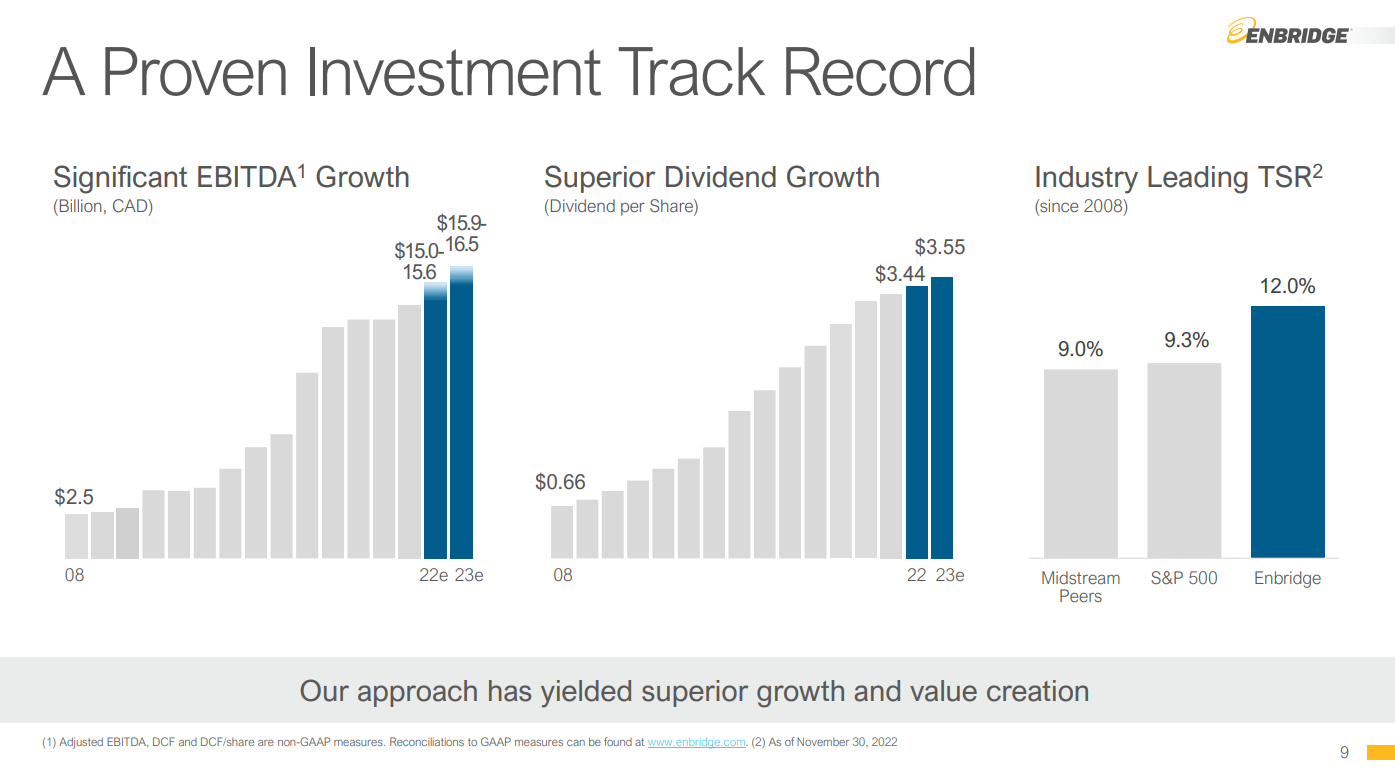

Enbridge reported its third-quarter earnings outcomes on November 4th. The corporate generated increased revenues through the quarter, however since commodity costs are primarily a pass-through value for the corporate, increased revenues don’t essentially translate into increased income. Throughout the quarter, Enbridge nonetheless managed to develop its adjusted EBITDA by 15% 12 months over 12 months, to CAD$3.8 billion, up from CAD$3.3 billion through the earlier 12 months’s quarter. This was potential because of stronger contributions from the liquids pipelines phase primarily.

Boasting 27 years of consecutive dividend will increase, Enbridge has undoubtedly established its operational resilience capabilities. As essential vitality infrastructure property have grow to be extra important than ever in immediately’s economic system, Enbridge’s efficiency will seemingly stay strong within the coming years and in the long run.

Supply: Investor Presentation

With its payout ratio standing at a wholesome 68% and its huge asset footprint serving as an incredible aggressive benefit, we imagine Enbridge ought to proceed serving income-oriented traders adequately for many years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Enbridge Inc. (preview of web page 1 of three proven under):

Without end Inventory #11: PepsiCo, Inc. (PEP)

- Dividend yield: 2.5%

- Years of dividend development: 50

PepsiCo is a world meals and beverage firm that generates about $80 billion annual gross sales. The corporate has a number of aggressive benefits, together with its robust manufacturers and a world scale. Particularly, PepsiCo has 23 particular person manufacturers that every generates at the least $1 billion in annual gross sales. In addition to its robust manufacturers tending to yield constant gross sales as they’re broadly trusted amongst shoppers, they safe optimum shelf house at retailers and supply PepsiCo with distinctive pricing energy.

PepsiCo’s newest outcomes as soon as in opposition to demonstrated the corporate’s capacity to attain strong outcomes throughout a somewhat difficult buying and selling surroundings. Specifically, Q3 revenues grew 8.8% to $21.97 billion, beating analysts’ estimates by $1.15 billion. The adjusted earnings-per-share of $1.97 in comparison with $1.79 within the prior 12 months was $0.12 higher than anticipated. Regardless of these spectacular outcomes, the stronger U.S. greenback imposed a 3% headwind to each income and earnings-per-share.

Earlier in 2022, PepsiCo elevated its annualized dividend by 7% to $4.60, its fiftieth consecutive annual dividend improve. This formally tagged the corporate as a Dividend King. The corporate additionally introduced a share repurchase authorization of as much as $10 billion, solidifying its dedication to creating worth for shareholders.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Certain Evaluation report on PepsiCo, Inc. (preview of web page 1 of three proven under):

Without end Inventory #10: AbbVie Inc. (ABBV)

- Dividend yield: 3.6%

- Years of dividend development: 51

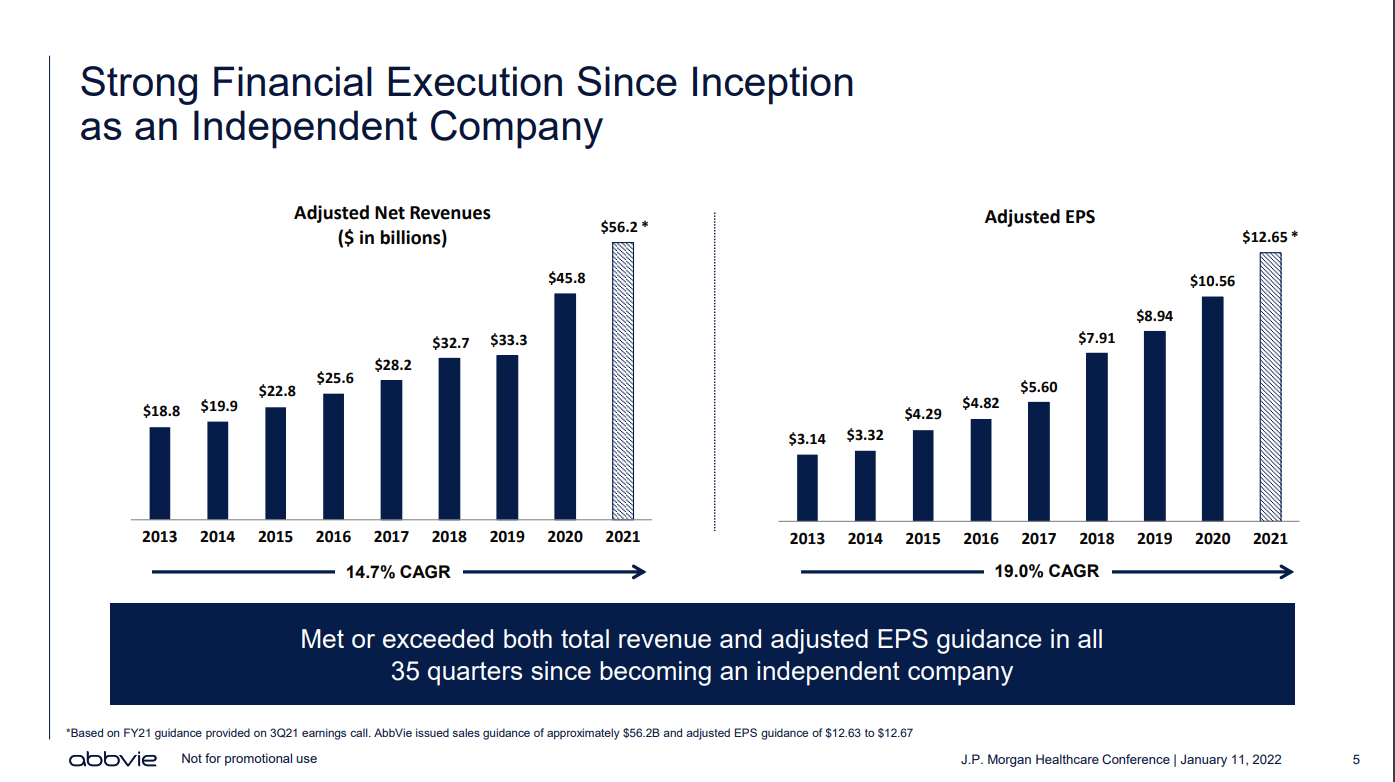

AbbVie is a biotechnology firm targeted on growing and commercializing medicine for immunology, oncology, and virology. AbbVie was spun off by Abbott Laboratories in 2013. The corporate has a somewhat quick stand-alone historical past. Nonetheless, AbbVie has grow to be one of many largest gamers within the biotechnology trade, particularly following the closing of its acquisition of previously impartial pharma firm Allergan.

AbbVie reported its third-quarter earnings outcomes on October 28. The corporate generated revenues of $14.8 billion through the quarter, which was 3% greater than AbbVie’s revenues through the earlier 12 months’s quarter. AbbVie’s revenues have been positively impacted by compelling development from a few of its newer medicine, together with Skyrizi and Rinvoq, whereas Humira remained AbbVie’s most vital drug by way of total income contribution.

Following strong profitability, AbbVie’s steering for 2022’s targets adjusted earnings-per-share between $13.76 and $13.96. This could characterize a sizeable improve versus 2021, which was additionally a file 12 months.

Supply: Investor Presentation

Whereas the upcoming expiry of AbbVie’s Humira patent has added some dangers recently, the corporate’s diversified portfolio, together with the current acquisition of Allergan, ought to proceed to generate tons of money. With the payout ratio standing at slightly below 43% and AbbVie’s newest 51st consecutive dividend hike by 5% cementing administration’s confidence in future efficiency, we imagine the inventory makes for an incredible generational revenue holding.

Click on right here to obtain our most up-to-date Certain Evaluation report on AbbVie Inc. (preview of web page 1 of three proven under):

Without end Inventory #9: Cincinnati Monetary Corp. (CINF)

- Dividend yield: 2.6%

- Years of dividend development: 62

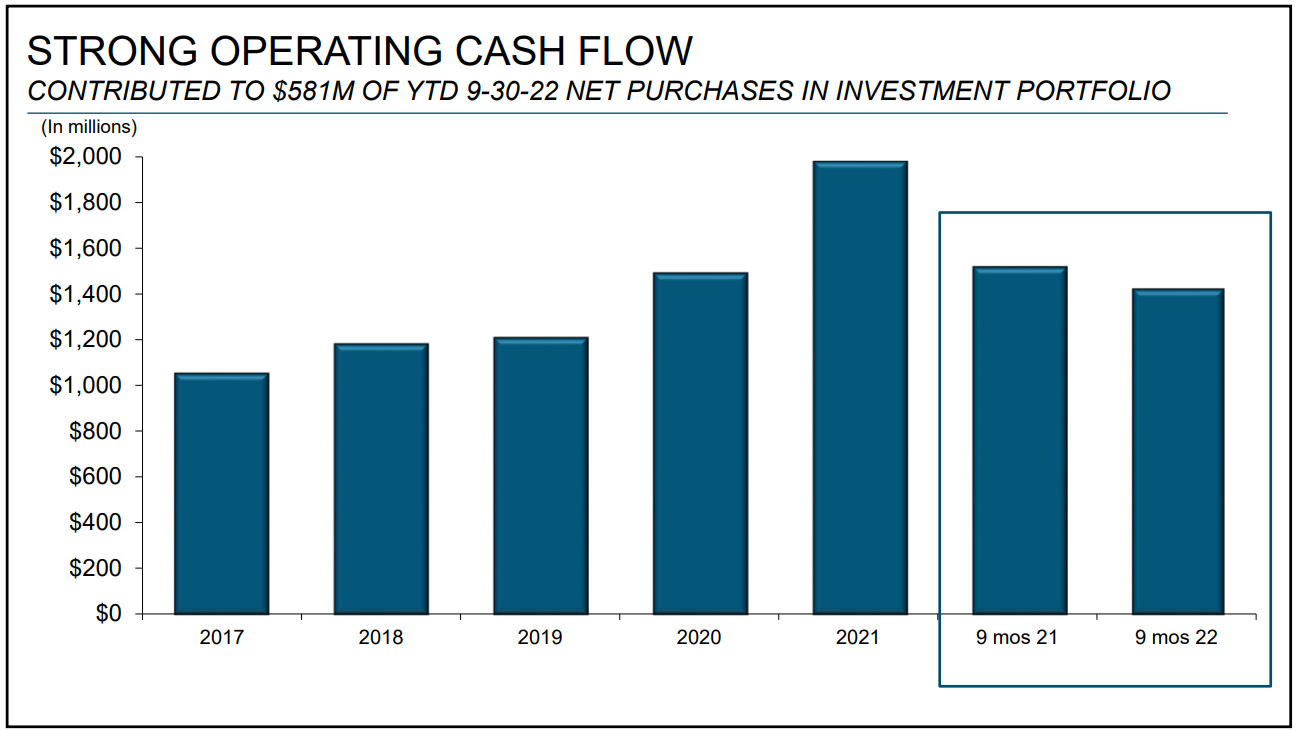

Cincinnati Monetary Corp. is an insurance coverage firm based in 1950. It provides enterprise, residence, auto insurance coverage, and monetary merchandise, together with life insurance coverage, annuities, property, and casualty insurance coverage. Cincinnati Monetary is headquartered in Fairfield, Ohio, buying and selling with a $16.4 billion market capitalization.

As an insurance coverage firm, Cincinnati Monetary makes cash in two methods. It earns revenue from premiums on insurance policies written and by investing its float, or the massive sum of cash consisting of the time worth between the premium revenue and insurance coverage claims.

On October thirty first, 2022, Cincinnati Monetary reported its Q3 outcomes for Fiscal 12 months (FY)2022. Whole revenues have been $1.4 billion, down 21% year-over-year. Nonetheless, earned premiums grew 13% to $1.88 billion in comparison with final 12 months.

The corporate posted a internet lack of $(418) million, or $(2.64) per share, in comparison with a revenue of $153 million, or $0.94 per share, in Q3 of 2021. That mentioned, the loss was attributable to realizing $674 million in funding losses through the quarter amid the tough market scenario within the capital market throughout this era.

Supply: Investor Handout

Whereas the insurance coverage trade is extremely aggressive, Cincinnati Monetary’s model, large-scale, and shut relationship with its prospects ought to proceed to distinguish amongst its friends. These qualities have helped the corporate to extend its dividend for 62 years in a row.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cincinnati Monetary Corp. (preview of web page 1 of three proven under):

Without end Inventory #8: Matthews Worldwide Company (MATW)

- Dividend yield: 3.0%

- Years of dividend development: 29

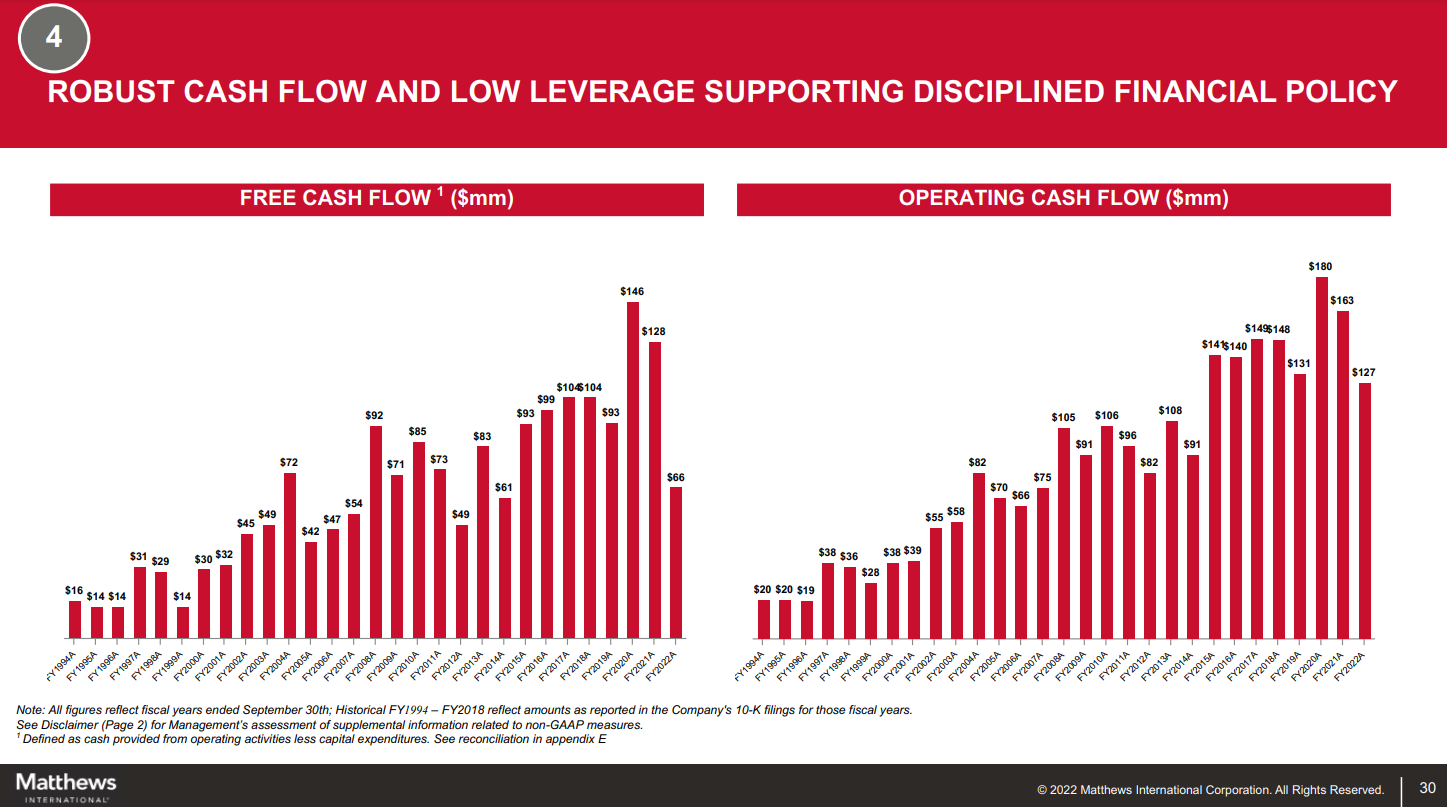

Matthews Worldwide Company gives model options, memorialization merchandise, and industrial applied sciences on a world scale. The corporate’s three enterprise segments present diversifed money flows which might be sourced wherever from model improvement providers and printing tools, to memorialization merchandise, caskets, and cremation tools, to industrial automation applied sciences and options.

Matthews Worldwide reported fourth-quarter outcomes on November seventeenth. The corporate achieved gross sales of $457 million, a 4.2% improve in comparison with the identical prior 12 months interval. The rise was attributable to gross sales development within the Industrial Applied sciences and Memorialization segments, in addition to current acquisitions of OLBRICH GmbH and R+S Automotive GmbH.

The corporate is looking for complementary acquisition alternatives which may lengthen its capabilities in present companies or broaden the company even additional geographically. Matthews is concentrating on to attain a long-term annual return on invested capital of at the least 12% on these acquisitions. Some such examples are current acquisitions OLBRICH GmbH, and R+S Automotive GmbH made in August 2022, which expanded the corporate’s world presence and its place within the industrial and automotive elements enterprise.

Supply: Investor Presentation

With Matthews Worldwide’s payout ratio standing under one-third of earnings and the corporate’s current acquisition prone to ignite additional development, we imagine its prolonged dividend development observe file is about to proceed for many years to return.

Click on right here to obtain our most up-to-date Certain Evaluation report on Matthews Worldwide Company (preview of web page 1 of three proven under):

Without end Inventory #7: QUALCOMM Integrated (QCOM)

- Dividend yield: 2.7%

- Years of dividend development: 20

Qualcomm, as it’s recognized immediately, develops and sells built-in circuits to be used in voice and knowledge communications. The chip maker receives royalty funds for its patents utilized in gadgets which might be on 3G, 4G, and 5G networks. Qualcomm has a present market capitalization of $123 billion and generates annual gross sales of ~$44 billion.

Whereas the semiconductor trade is cyclical, Qualcomm’s chips are important for telephone producers to energy their gadgets. Qualcomm’s applied sciences are essential for powering the telecommunications trade typically, and the corporate has loved nice traction recently as a result of ongoing growth of the 5G community.

On November 8 th, 2022, Qualcomm introduced outcomes for the fourth quarter of fiscal 12 months 2022 for the interval ending September 25 th, 2022. For the quarter, income grew 22.2% to $11.4 billion, $20 million above estimates. Adjusted earnings-per-share of $3.13 in contrast favorably to $2.55 within the earlier 12 months and was in-line with expectations. For the fiscal 12 months, income improved 32% to $44.2 billion, whereas adjusted earnings-per-share of $12.54 was a 47% improve from the prior 12 months.

Supply: Investor Presentation

Qualcomm has grown its dividend for 20% consecutive years and primarily based on its projected earnings for the 12 months, its dividend payout ratio stands near 29%.

Click on right here to obtain our most up-to-date Certain Evaluation report on QUALCOMM Integrated (preview of web page 1 of three proven under):

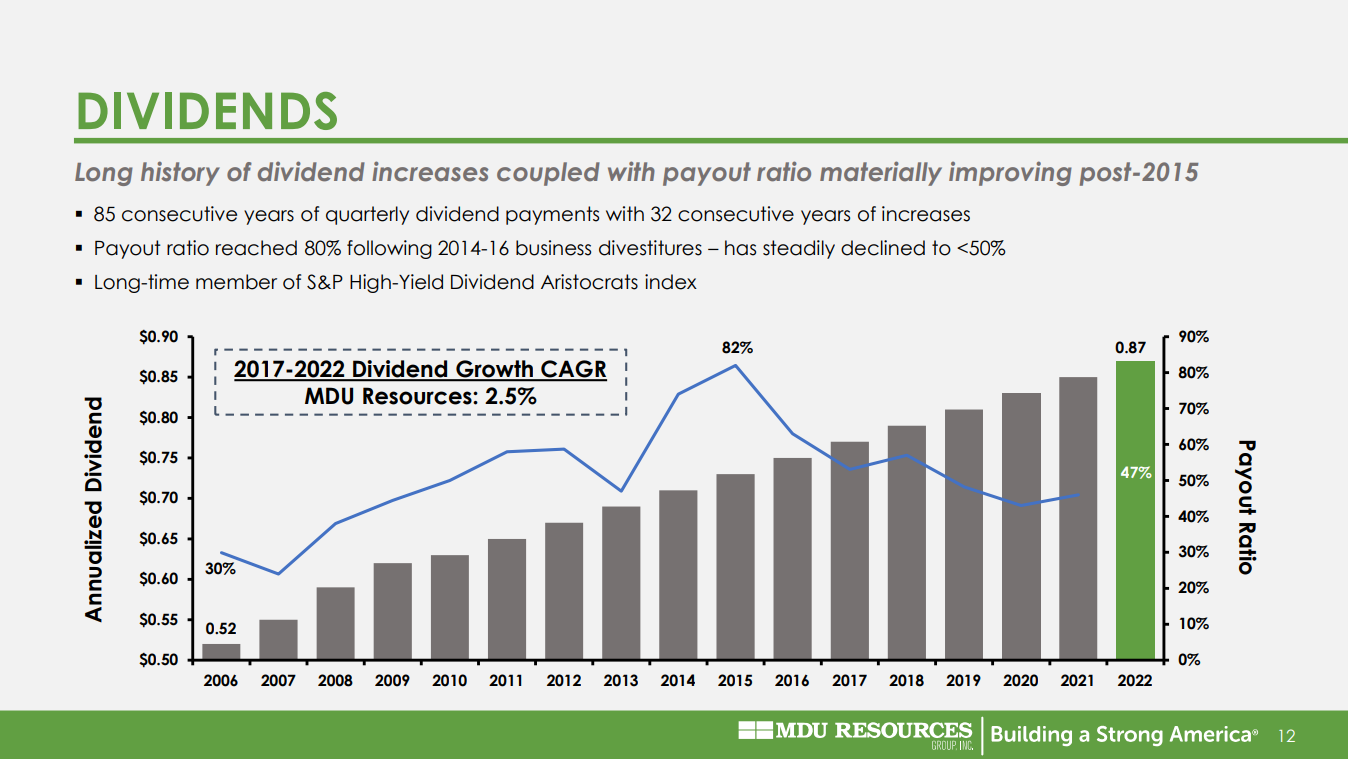

Without end Inventory #6: MDU Assets (MDU)

- Dividend yield: 2.9%

- Years of dividend development: 32

MDU Assets is a regulated vitality supply, transportation, and development supplies and providers enterprise. The corporate was based in 1924, and since then, it has grown from a small electrical utility in North Dakota to a market capitalization of $6.2 billion.

MDU has paid 85 consecutive years of dividends and operates electrical and fuel utilities, pipelines, and development companies. It ought to generate $6.6 billion in gross sales this 12 months, and about 75% of that may come from the corporate’s development companies; utility companies make up the remaining ~25%.

Supply: Investor Presentation

MDU posted third-quarter earnings on November third, 2022, and outcomes have been worse than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 75 cents, which was two cents gentle in opposition to expectations. Income was up 25% year-over-year to $1.98 billion however missed estimates by $20 million. Administration mentioned adjusted earnings-per-share needs to be within the vary of $1.75 to $1.90 this 12 months, implying a comparatively secure efficiency in comparison with fiscal 2021.

The corporate can obtain this growth through gross sales development, each organically and thru acquisitions. With a file backlog and strong outcomes from the development enterprise, we predict MDU’s future is shiny. Its capacity to carry out nicely and develop shareholder returns through the years is mirrored in its 32-year dividend development observe file.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDU Assets (preview of web page 1 of three proven under):

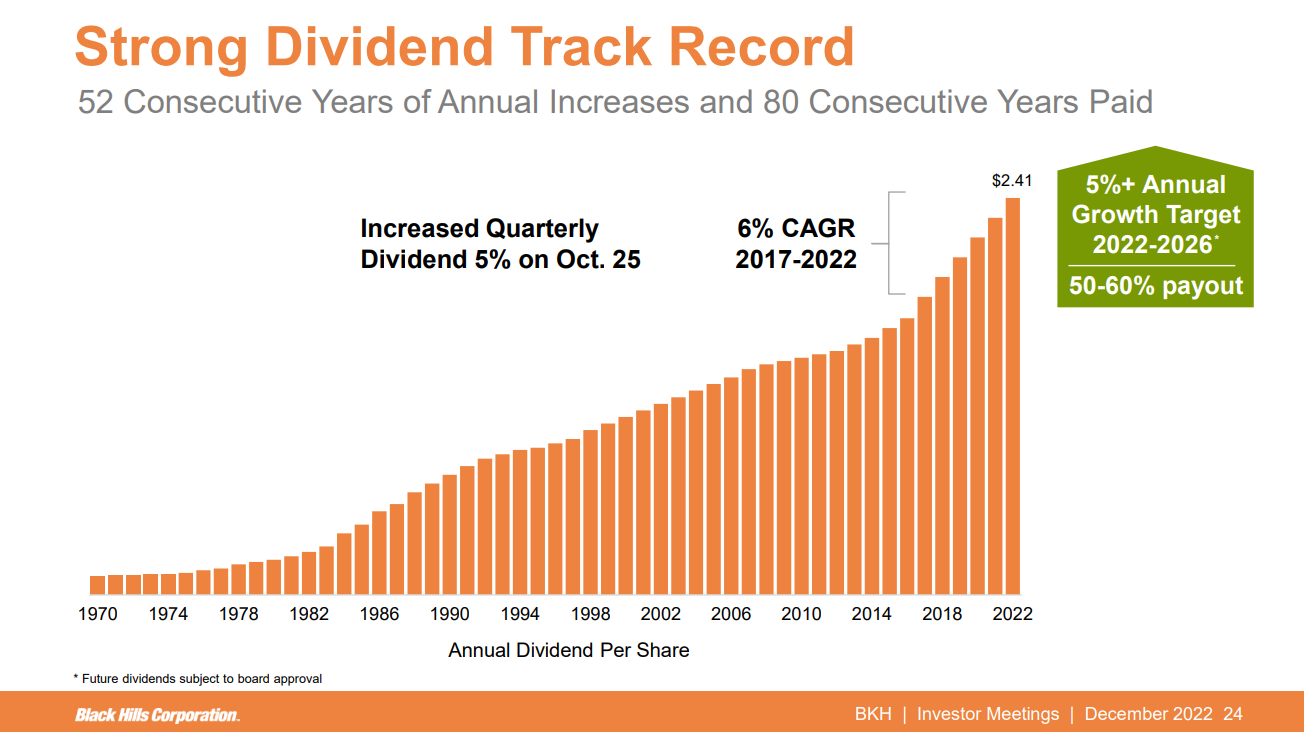

Without end Inventory #5: Black Hills Company (BKH)

- Dividend yield: 3.6%

- Years of dividend development: 52

Black Hills Company is an electrical utility that gives electrical energy and pure fuel to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was based in 1941 and is headquartered in Speedy Metropolis, South Dakota. Black Hills Company has elevated its dividend for over 50 years, making it a Dividend King thanks to 5 many years of dividend raises.

Black Hills Company reported its third-quarter earnings outcomes on November 2nd. The corporate generated revenues of $460 million through the quarter, which was 22% greater than the revenues that Black Hills Company was in a position to generate through the earlier 12 months’s quarter. Black Hills Company’s revenues have been increased than the analyst group anticipated, beating the consensus estimate by a hefty $70 million.

Resulting from a modest dividend development fee, Black Hills Company’s dividend payout ratio declined over the previous decade. Immediately, the corporate pays out roughly 60% of its internet income by way of dividends.

Supply: Investor Presentation

Demand for electrical energy and fuel shouldn’t be very cyclical, though it depends upon climate situations to some extent. Thus, Black Hills ought to stay worthwhile below most circumstances. Clients have a tendency to stay with their supplier as a result of Black Hills operates a comparatively secure enterprise mannequin. The corporate also needs to be capable to climate future recessions nicely, which makes it an excellent generational inventory for rising revenue.

Click on right here to obtain our most up-to-date Certain Evaluation report on Black Hills Company (preview of web page 1 of three proven under):

Without end Inventory #4: Realty Earnings Company (O)

- Dividend yield: 4.6%

- Years of dividend development: 27

Realty Earnings is a REIT that has grow to be well-known for its profitable dividend development historical past and month-to-month dividend funds. Immediately, the belief owns greater than 4,000 properties that aren’t a part of a wider retail improvement (similar to a mall) however as an alternative are stand-alone properties. Which means its areas are viable for a lot of totally different tenants, together with authorities providers, healthcare providers, and leisure.

Realty Earnings introduced its third-quarter earnings outcomes on November 3. The belief reported that it generated revenues of $840 million through the quarter, up 71% in comparison with the prior-year interval. Realty Earnings additionally managed to generate a sturdy adjusted AFFO-per-share of $0.98 through the quarter.

Realty Earnings has trademarked itself as “The Month-to-month Dividend Firm”, boasting 628 month-to-month dividends declared and 100 consecutive quarterly will increase.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Earnings Company (preview of web page 1 of three proven under):

Without end Inventory #3: Goal Company (TGT)

- Dividend yield: 3.0%

- Years of dividend development: 54

Goal was based in 1902 and, after a failed bid to broaden into Canada, has operations solely within the U.S. market. Its enterprise consists of about 2,000 huge field shops that provide basic merchandise and meals and function distribution factors for the corporate’s burgeoning e-commerce enterprise. Goal’s market capitalization of $67.6 billion ought to produce about $110 billion in complete income this 12 months.

Goal reported third-quarter earnings on November sixteenth, 2022, and outcomes have been weaker than anticipated, together with considerably weak steering for the 12 months’s ultimate quarter. Adjusted earnings-per-share was $1.54 per share, which missed estimates by 64 cents. Income was higher, rising 3.4% to $26.52 billion, which was $120 million higher than estimates.

Supply: Investor Infographic

We see continued comparable gross sales development as driving outcomes, together with sizable margin growth from low ranges in 2022 and a tailwind from buybacks. Goal’s digital efforts are additionally working exceptionally properly. The corporate’s small-format shops are performing very nicely, opening a brand new avenue of development for the corporate within the coming years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Goal Company (preview of web page 1 of three proven under):

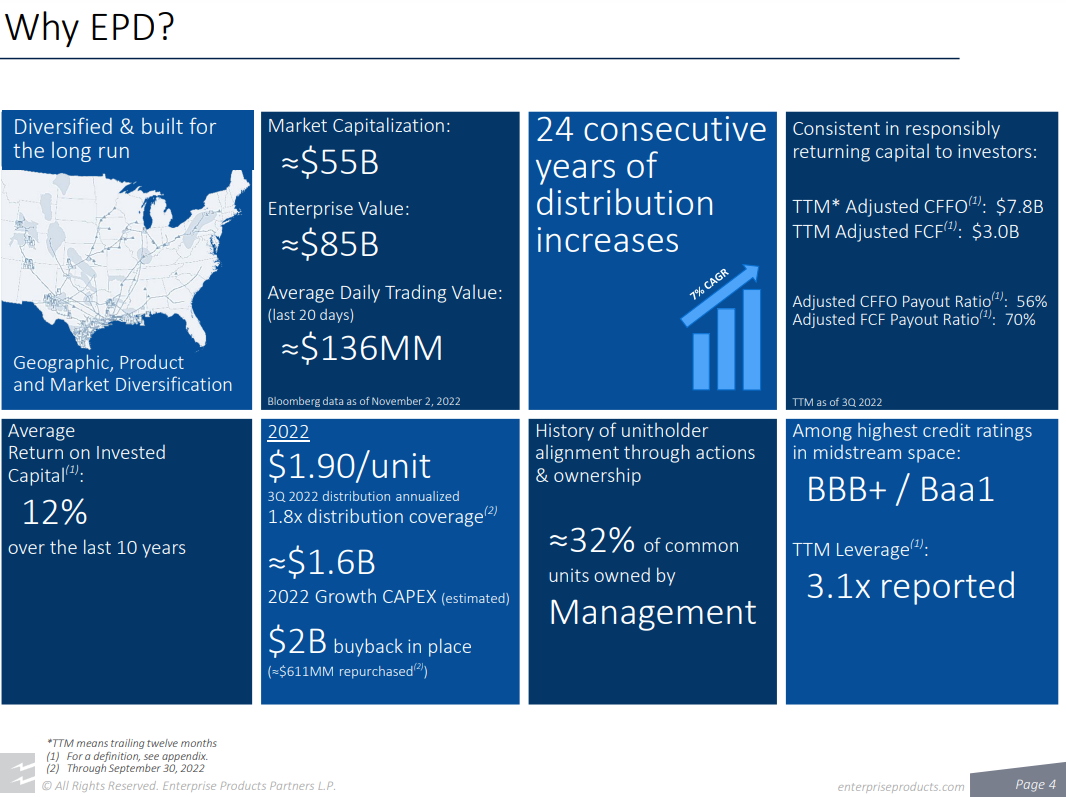

Without end Inventory #2: Enterprise Merchandise Companions L.P. (EPD)

- Dividend yield: 7.9%

- Years of dividend development: 24

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and fuel storage and transportation firm. Enterprise Merchandise has an incredible asset base which consists of practically 50,000 miles of pure fuel, pure fuel liquids, crude oil, and refined merchandise pipelines. It additionally has a storage capability of greater than 250 million barrels. These property gather charges primarily based on supplies transported and saved.

On 11/01/22, Enterprise Merchandise reported third-quarter outcomes. Q3 GAAP EPS of $0.62 beat analyst estimates by $0.01. Income of $15.46B (+42.8% Y/Y) beat analyst estimates by $1.64B. Distributable Money Stream (DCF), excluding proceeds from asset gross sales, elevated 16% to $1.9B for the third quarter of 2022 in comparison with $1.6B for the third quarter of 2021. DCF supplied 1.8 occasions protection of the distribution declared with respect to the third quarter of 2022.

By way of security, Enterprise Merchandise Companions is among the strongest midstream MLPs. It has credit score scores of BBB+ from Commonplace & Poor’s and Baa1 from Moody’s, that are increased scores than most MLPs. It additionally has a distribution protection ratio of over 1.6x, leaving room for distribution will increase and unit repurchases. Enterprise Merchandise’ high-quality property generate robust money stream, even in recessions.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Certain Evaluation report on Enterprise Merchandise Companions L.P. (preview of web page 1 of three proven under):

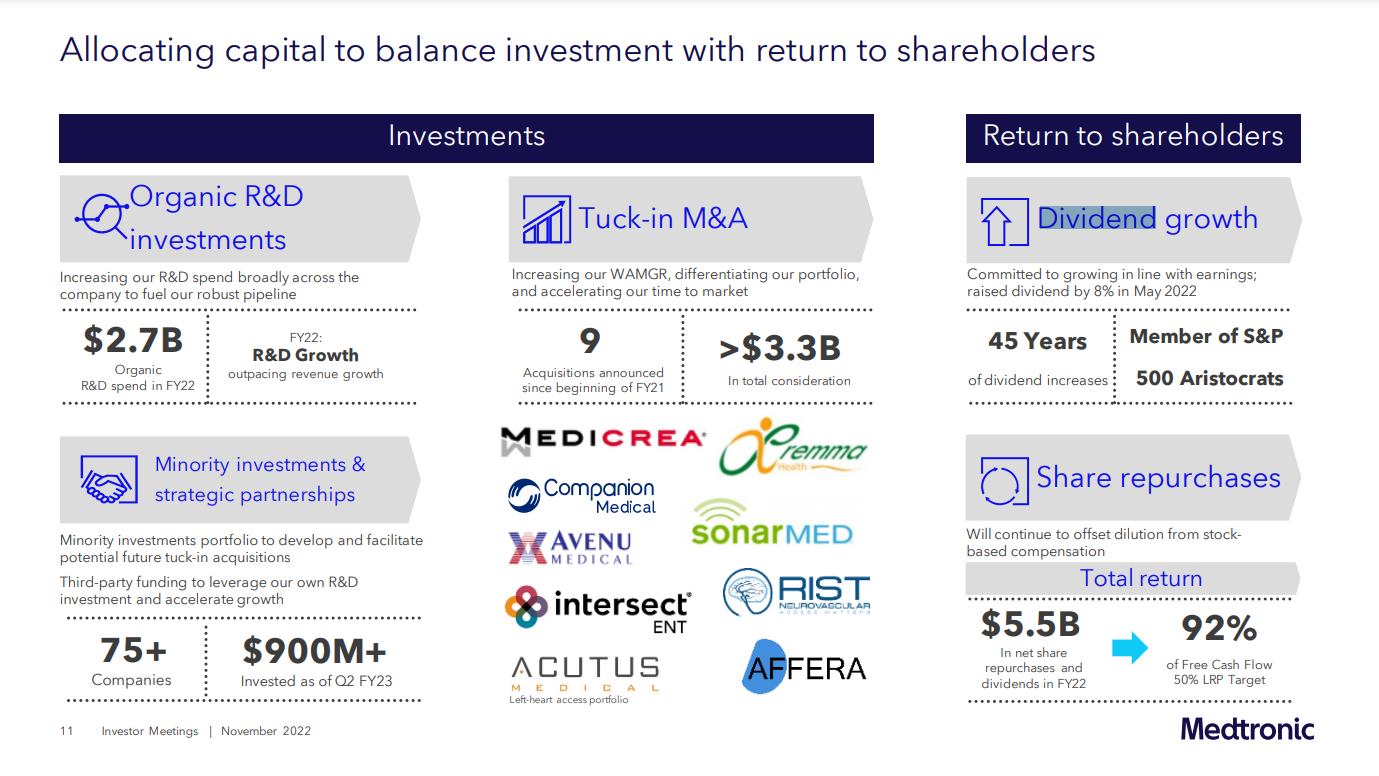

Without end Inventory #1: Medtronic plc (MDT)

- Dividend yield: 3.5%

- Years of dividend development: 45

Medtronic is the biggest producer of biomedical gadgets and implantable applied sciences on the planet. It serves physicians, hospitals, and sufferers in additional than 150 international locations and has over 90,000 staff. Medtronic has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience, and Diabetes. The $104 billion market cap firm generated $32 billion in income in its final fiscal 12 months.

In late November, Medtronic reported (11/22/22) outcomes for the second quarter of fiscal 12 months 2023. Natural income grew 2% over final 12 months’s quarter, however income dipped -3%, and earnings-per-share fell -2% attributable to a robust greenback.

Outcomes have been harm by sluggish provide restoration and modest market process volumes in some companies, and therefore Medtronic lowered its steering for annual earnings-per-share from $5.53-$5.65 to $5.25-$5.30. Nonetheless, we imagine that these modest impacts are largely transitory amid the continued macroeconomic panorama.

Medtronic’s most compelling aggressive benefit is its mental management in a sophisticated trade inside the healthcare sector. Medtronic additionally has a robust product pipeline that ought to drive its development for the foreseeable future.

Supply: Investor Presentation

Its rising financials, moat, and constant deal with invocation have allowed the corporate to develop its dividend for 45 consecutive years. The dividend has grown by 16% per 12 months on common during the last 45 years and by 8% per 12 months on common during the last 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Medtronic plc (preview of web page 1 of three proven under):

Remaining Ideas

In conclusion, “eternally” shares, such because the 12 names we featured on this article, will be an effective way to generate passive revenue and steadily develop your wealth over time. Without end shares have confirmed to be reliable and enduring over lengthy durations, and their development catalysts ought to proceed offering rising revenue for generations to return.

When deciding on “eternally” shares in your portfolio, it’s important to think about quite a lot of components, together with stable financials, a historical past of constantly paying and rising dividends, development potential, and a stable aggressive benefit or “moat.” We hope that our checklist has supplied some worthwhile concepts for long-term funding alternatives.

Additional Studying

In case you are occupied with discovering high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link