For those who learn the headline of this text, you in all probability have the identical thought as everybody else:

“No CHANCE”

Which means, there isn’t a method this headline is true. I imply, what number of traders are you aware with a portfolio that’s 60% shares and 40% gold? (Okay possibly a couple of loopy Canadians or Australians?)

Probably the most iconic institutional benchmark is the 60/40 portfolio of US shares and bonds. It appears loopy to suppose that there’s nothing particular about this allocation. So let’s run a loopy thought experiment and swap out one of many belongings, bonds, with one other completely unrelated asset, gold, and see what occurs. Absolutely it should crush returns…..proper?

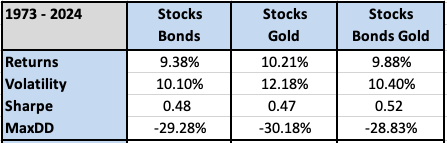

The entire threat and return statistics are nearly the identical. Some readers will in fact reply that the time interval is cherry picked, however it holds for the final 100 years too.

Traders like to suppose it binary phrases “Ought to I personal bonds OR gold?!” Nevertheless, traditionally the extra uncorrelated belongings included within the portfolio, the higher. So as a substitute of asking “Ought to I personal bonds OR gold?!”, maybe the query needs to be “Ought to I personal bonds AND gold?!”

Traditionally, the reply has been…”BOTH”.

Are gold and bonds simply interchangeable?

Not a gold bug however I lived with a Canadian as soon as.