Revealed on November seventeenth, 2022, by Quinn Mohammed

Prefer it protected castles from plunderers in olden instances, a moat protects an organization from rivals within the enterprise world. An organization’s moat will be considered its aggressive benefits, particularly its benefits over rivals.

This moat will be slim or it may be extensive. A slim moat is a smaller aggressive benefit over friends, whereas a large moat can imply the corporate has a big benefit over friends, which seemingly protects its outcomes via a number of financial cycles.

Slender and extensive moats have minimal life expectations of 10+ and 20+ years, respectively, which they’re anticipated to learn the corporate.

We regularly see that firms with extensive moats are higher in a position to proceed rising earnings and because of this, develop their dividends for a few years. These firms additionally normally have robust margins in relation to their friends, as their moats shield their income and market share.

Firms with extensive moats can supply traders extra peace of thoughts as they’re usually extra steady blue-chip shares.

Under are ten extensive moat dividend shares that may be discovered within the VanEck Morningstar Large Moat ETF (MOAT), which have respectable anticipated annual returns over the following 5 years.

We created a full record of all 45 Dividend Kings. You possibly can obtain the complete record, together with vital monetary metrics corresponding to dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Desk of Contents

Large Moat Inventory #10: Blackrock (BLK)

- Anticipated annual returns: 6.5%

BlackRock, based in 1988, is a big funding and asset administration agency. Right now the agency boasts over $8 trillion of belongings beneath administration (“AUM”). BlackRock gives funding administration, danger administration, and advisory providers worldwide for institutional and retail purchasers.

Its merchandise embrace single and multi-asset class portfolios, equities, fastened revenue, different investments, and cash market devices. About 79% of BlackRock’s income is obtained from funding advisory, administration charges, and securities lending, with the rest coming from efficiency charges, distribution charges, and know-how providers income.

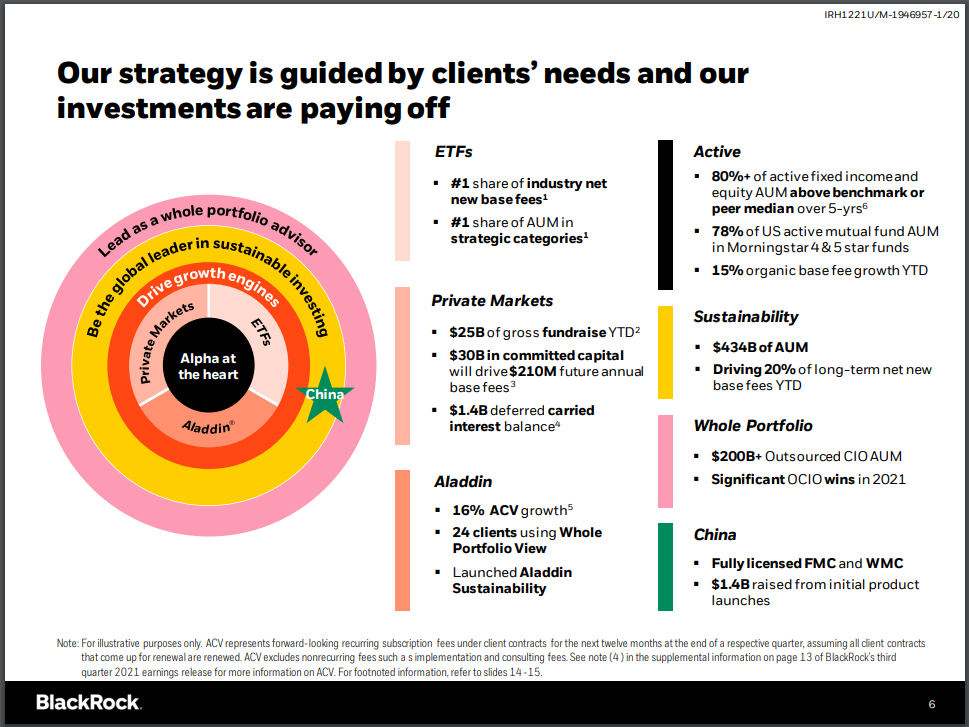

Supply: Investor Presentation

Income decreased by 15% within the third quarter of 2022 to $4.31 billion, primarily because of the influence of decrease markets and greenback appreciation on common AUM and decrease efficiency charges. Working revenue fell 21% to $1.53 billion, internet revenue decreased by 16% to $1.41 billion, and adjusted EPS fell 16% to $9.55.

The principle aggressive benefit for BlackRock is its dimension, which is highly effective when mixed with a number one model within the funding administration business. A lot of its merchandise, such because the iShares line of ETFs, are highly regarded for his or her low charges.

Click on right here to obtain our most up-to-date Positive Evaluation report on Blackrock (preview of web page 1 of three proven under):

Large Moat Inventory #9: Utilized Supplies (AMAT)

- Anticipated annual returns: 9.8%

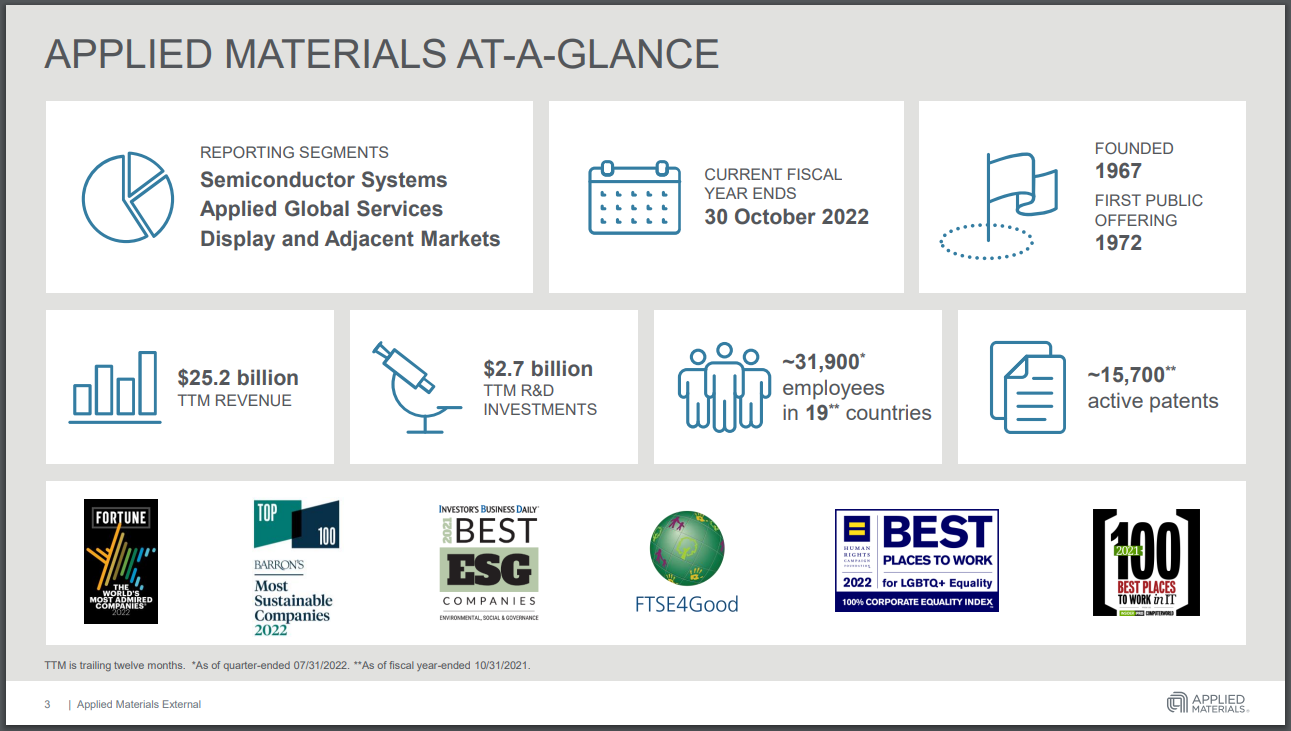

Utilized Supplies started in a small workplace unit in 1967; since then, it has undergone some main, transformative modifications. These modifications have afforded it some spectacular development charges; in the present day, it has a market capitalization of $85 billion and greater than $25 billion in annual income. Utilized Supplies has grow to be a significant participant within the semiconductor market, making up most of its income.

Supply: Investor Presentation

Utilized Supplies reported third-quarter earnings on August 18th, 2022, and outcomes beat analysts’ expectations on each the highest and backside traces. Adjusted earnings-per-share equaled $1.94, which was 15 cents forward of estimates. Income grew 5.2% to $6.52 billion and beat expectations by $250 million.

Utilized Supplies’ lengthy historical past of fixing advanced engineering issues and its entrenched prospects is a profit to the corporate. The corporate has created excessive buyer switching prices with its glorious merchandise, which we expect is a long-term aggressive benefit in a really aggressive area. Additionally it is seeing excessive charges of development in its subscription enterprise, which is nicely over half of its income now.

Click on right here to obtain our most up-to-date Positive Evaluation report on Utilized Supplies (preview of web page 1 of three proven under):

Large Moat Inventory #8: MarketAxess Holdings Inc. (MKTX)

- Anticipated annual returns: 10.6%

MarketAxess Holdings is a fintech firm working an digital buying and selling platform for fastened revenue, corresponding to company bonds, utilizing patented buying and selling know-how. Over 1,900 institutional members make the most of the corporate’s service. These members are broker-dealer purchasers, funding advisers, mutual funds, insurance coverage firms, pension funds, banks, and hedge funds.

The merchandise traded on the platform are U.S. high-grade company bonds, rising market bonds, U.S. crossover, and high-yield bonds, Eurobonds, U.S. company bonds, municipal bonds, and others.

MarketAxess reported third-quarter outcomes on October 19th, 2022, and noticed income enhance 6% year-over-year to $172 million. Working revenue additionally rose however was lighter, at 3.1% increased. Diluted EPS of $1.58 was six cents, or 4% increased than the identical prior yr interval.

The corporate’s estimated U.S. high-grade market share got here to 21.1% for the quarter, down 30 foundation factors from the prior yr’s market share estimates. Nonetheless, the corporate’s estimated high-yield market share grew 400 foundation factors from 15.3% within the third quarter of 2021 to 19.3% within the third quarter of 2022.

MKTX’s aggressive benefit is its place because the main digital buying and selling community for the institutional market in U.S. credit score merchandise. It includes practically two thousand energetic institutional traders and supplier corporations.

Click on right here to obtain our most up-to-date Positive Evaluation report on MarketAxess Holdings Inc. (preview of web page 1 of three proven under):

Large Moat Inventory #7: Microsoft (MSFT)

- Anticipated annual returns: 10.8%

Microsoft Company, based in 1975, develops, manufactures, and sells software program and {hardware} to companies and customers. Its merchandise embrace working programs, enterprise software program, software program growth instruments, video video games and gaming {hardware}, and cloud providers. Microsoft is likely one of the largest firms on the earth, with a market capitalization is $1.7 trillion.

Microsoft has a pending acquisition of Activision Blizzard (ATVI), a online game growth and content material chief, for $68.7 billion. The deal was introduced on January 18th, 2022, and is predicted to shut within the fiscal yr 2023 and is topic to evaluate.

In late October, Microsoft reported monetary outcomes for the primary quarter of fiscal 2023. The corporate grew its income by 11% year-over-year. Gross sales of Azure, Microsoft’s high-growth cloud platform, grew 35%. Nonetheless, adjusted earnings-per-share decreased by -13%, from $2.71 to $2.35, largely as a result of a robust greenback, which diminished earnings from worldwide markets, in addition to manufacturing shutdowns in China and weak tendencies within the PC market.

Microsoft has a large moat within the working system & Workplace enterprise items and a robust market place in cloud computing. It’s unlikely that the corporate will lose market share with its older, established merchandise, whereas cloud computing is such a high-growth business that there’s sufficient room for development for a number of firms. Microsoft has a famend model and a world presence, which gives aggressive benefits.

Click on right here to obtain our most up-to-date Positive Evaluation report on Microsoft (preview of web page 1 of three proven under):

Large Moat Inventory #6: KLA Corp. (KLAC)

- Anticipated annual returns: 11.4%

KLA Company is a provider to the semiconductor business. The corporate provides course of management and yield administration programs for semiconductor producers corresponding to TSMC, Samsung and Micron. KLA was created in 1997 via a merger between KLA Devices and Tencor Devices and has grown via a spread of acquisitions since then.

KLA Company reported first-quarter earnings outcomes on October 26th, and revenues of $2.72 billion was a 31% year-over-year enhance. This beat analyst expectations by $120 million. KLA’s strong income efficiency will be defined by the truth that many semiconductor firms have elevated their investments into manufacturing capability due to ongoing wholesome chip demand.

KLA is a key provider to the biggest semiconductor firms and, due to this fact, a related a part of this massive business that’s extraordinarily vital to our fashionable lifestyle. KLA is the market chief within the course of management sector. Its scale and dimension give it benefits over rivals with regards to receiving large contracts, and thru higher economies of scale, KLA additionally has the power to attain increased margins than smaller friends.

Click on right here to obtain our most up-to-date Positive Evaluation report on KLA Corp. (preview of web page 1 of three proven under):

Large Moat Inventory #5: Polaris (PII)

- Anticipated annual returns: 12.6%

Polaris designs, engineers, and manufactures snowmobiles, all-terrain autos (ATVs), and bikes. As well as, associated equipment and alternative elements are offered with these autos via sellers positioned all through the U.S.

The corporate operates beneath 30+ manufacturers, together with Polaris, Ranger, RZR, Sportsman, Indian Bike, Slingshot, and Transamerican Auto Elements.

On October 25th, 2022, Polaris launched Q3 outcomes. Income elevated 19.4% to $2.34 billion, beating estimates by $140 million. Adjusted earnings-per-share of $3.25 in contrast favorably to $2.85 within the prior yr and was $0.47 above expectations.

Polaris enjoys a aggressive benefit via its model names, low-cost manufacturing, and lengthy historical past in its varied industries, permitting the corporate to be the chief in ATVs and quantity two in snowmobiles and home bikes.

Click on right here to obtain our most up-to-date Positive Evaluation report on Polaris (preview of web page 1 of three proven under):

Large Moat Inventory #4: Intercontinental Alternate Inc (ICE)

- Anticipated annual returns: 12.9%

Intercontinental Alternate, Inc. is an operator of economic exchanges and mortgage know-how. The corporate owns the New York Inventory Alternate, a derivatives alternate, an digital market for futures and over-the-counter power contracts, and the main tender commodity alternate.

ICE provides pricing, market information, danger administration, and buying and selling help. The corporate acquired Ellie Mae in 2020 for $11B, increasing into mortgage know-how providers.

Intercontinental reported second-quarter outcomes on August 4th, and internet income elevated 8% to $1.8 billion from $1.7 billion, and adjusted diluted earnings per share rose by 14% to $1.32 from $1.16 on a year-over-year foundation. The corporate benefitted from increased income pushed by extra buying and selling on exchanges and fixed-income providers, offset by a lot weaker mortgage origination. ICE can be buying Black Knight, a mortgage know-how firm, for $13B in money and inventory. The acquisition is predicted to shut within the first half of 2023.

ICE’s aggressive benefit is its scale in buying and selling, the NYSE model, proprietary alternate merchandise, information in commodity futures and fixed-income information, and mortgage know-how. The corporate can present distinctive datasets from its exchanges that rivals can not entry.

Click on right here to obtain our most up-to-date Positive Evaluation report on Intercontinental Alternate Inc. (preview of web page 1 of three proven under):

Large Moat Inventory #3: State Road Corp (STT)

- Anticipated annual returns: 13.3%

State Road Company is a Boston-based monetary providers firm that traces its roots again to 1792. It is likely one of the largest asset administration corporations on the earth, with $3.3 trillion of belongings beneath administration and $36 trillion of belongings beneath custody and administration. The corporate has elevated its dividend for 12 consecutive years.

In September of 2021, State Road introduced the acquisition of Brown Brothers Harriman Investor Providers for $3.5 billion, which might make State Road the primary asset servicing agency globally. Asset servicing gives back-end operations for most of the world’s hottest funds and ETFs. State Road’s foremost rivals embrace BlackRock, Financial institution of New York Mellon, and Vanguard.

On October 18th, State Road reported outcomes for the third quarter, and charge revenues decreased -8% year-over-year as a result of headwinds from decrease inventory market ranges and a stronger greenback. Alternatively, internet curiosity revenue elevated by 36% on account of increased rates of interest, and the financial institution generated excessive foreign currency trading earnings and saved its whole bills basically flat. Earnings-per-share fell solely -7%, from $1.96 to $1.82.

State Road is a market chief in its asset administration and asset servicing business. It additionally advantages from its economies of scale, which pose a formidable barrier to new entrants.

Click on right here to obtain our most up-to-date Positive Evaluation report on State Road Corp. (preview of web page 1 of three proven under):

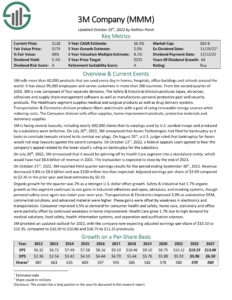

Large Moat Inventory #2: 3M Firm (MMM)

- Anticipated annual returns: 14.1%

3M is an industrial producer that sells greater than 60,000 merchandise used every day in houses, hospitals, workplace buildings, and colleges worldwide. It has about 95,000 workers and serves prospects in additional than 200 nations.

On July 26th, 2022, 3M introduced that it could be spinning off its Well being Care section right into a standalone entity, which might have had $8.6 billion of income in 2021. The transaction is predicted to shut by the tip of 2023.

The brand new 3M will include the segments which generated $26.8 billion in gross sales in 2021, whereas the healthcare spin-off will retain the product portfolio, which generated $8.6 billion in gross sales in 2021.

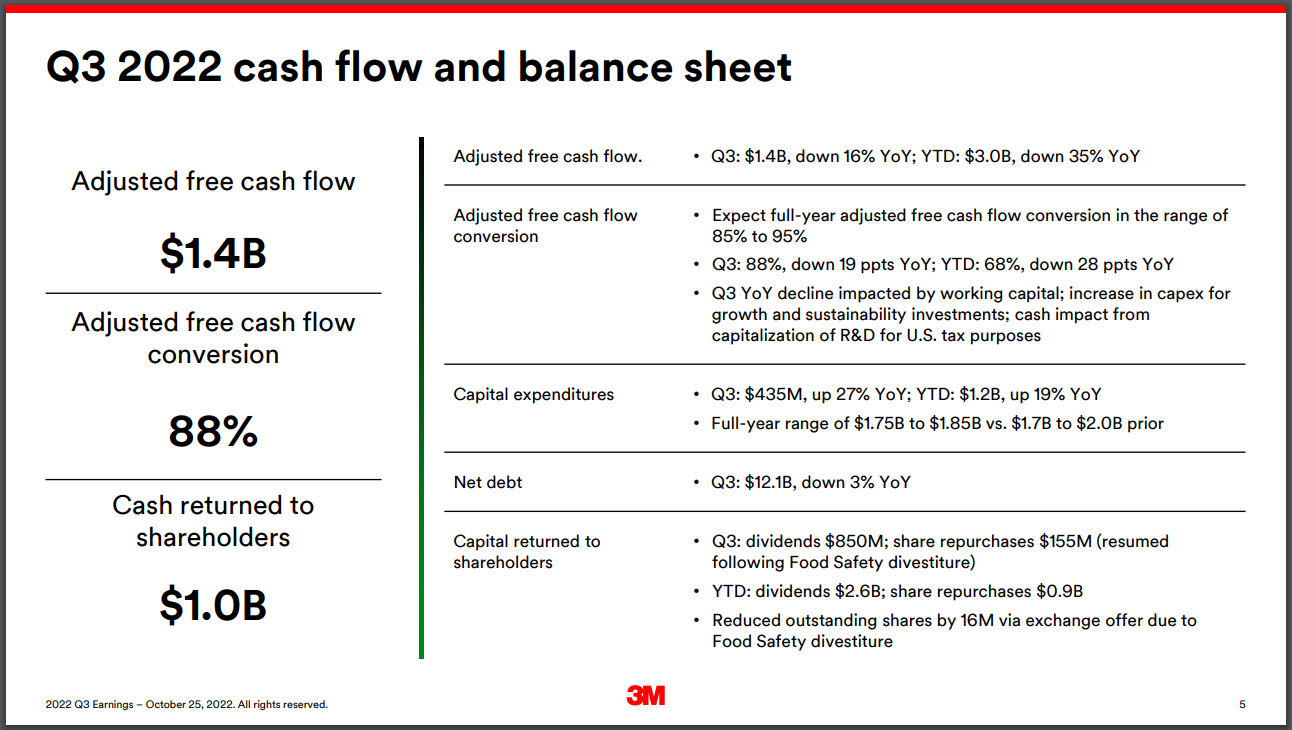

Supply: Investor Presentation

On October 25th, 2022, 3M reported third-quarter earnings outcomes. Income decreased by 3.8% to $8.6 billion and was $100 million lower than analyst expectations. Adjusted earnings-per-share of $2.69 in comparison with $2.45 within the prior yr and beat estimates by $0.10.

3M’s innovation is likely one of the firm’s biggest aggressive benefits. The corporate targets R&D spending equal to six% of gross sales (or roughly $2 billion yearly) with the intention to create new merchandise to satisfy client demand. This spending has confirmed to be very useful to the corporate as 30% of gross sales over the past fiscal yr had been from merchandise that didn’t exist 5 years in the past. 3M’s dedication to creating modern merchandise has led to a portfolio of greater than 100,000 patents.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M Firm (preview of web page 1 of three proven under):

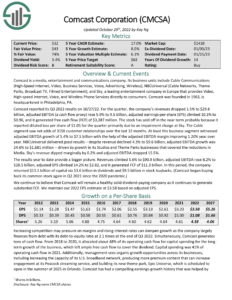

Large Moat Inventory #1: Comcast Corp. (CMCSA)

- Anticipated annual returns: 15.5%

Comcast is a media, leisure, and communications firm. Its enterprise items embrace Cable Communications (Excessive-Pace Web, Video, Enterprise Providers, Voice, Promoting, Wi-fi), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Leisure), and Sky, a number one leisure firm in Europe that gives Video, Excessive-speed web, Voice, and Wi-fi Cellphone Providers on to customers.

Comcast reported third-quarter 2022 outcomes on October 27th, and income of $29.85 billion declined 1.5% year-over-year however surpassed estimates by $120 million. Adjusted earnings-per-share of $0.96 beat estimates by $0.06.

Comcast is likely one of the largest gamers within the leisure business. New market entrants must spend many billions of {dollars} to ascertain themselves as key cable gamers or leisure networks. This strong place has enabled the corporate to extend its dividend for 14 consecutive years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Comcast Corp. (preview of web page 1 of three proven under):

Last Ideas

Large moat shares have nice aggressive benefits with endurance. These benefits usually enable the corporate to flourish via a number of financial cycles with rising earnings. Consequently, these firms regularly sport robust dividend enhance data.

Moreover, the next Positive Dividend databases include essentially the most dependable dividend growers in our funding universe:

In the event you’re on the lookout for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].