Updated on April 18th, 2022 by Bob Ciura

Investors looking to generate higher levels of income from their investment portfolios should take a look at Real Estate Investment Trusts, or REITs. These are companies that own real estate properties and lease them to tenants or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders, through dividends. You can see all 208 REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs, for income investors, is that they are required to distribute 90% of their taxable income to shareholders annually, in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

Bonus: Listen to our interview with Brad Thomas on The Sure Investing Podcast about intelligent REIT investing in the below video.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure the high yields are sustainable. This article will discuss 10 of the highest-yielding REITs around with market capitalizations above $1 billion.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are all very important factors as well.

We urge investors to use the below analysis as informative, but to do significant due diligence before buying into any security – and especially high yield securities. Many (but not all) high yield securities have significant risk of a dividend reduction and/or deteriorating business results.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

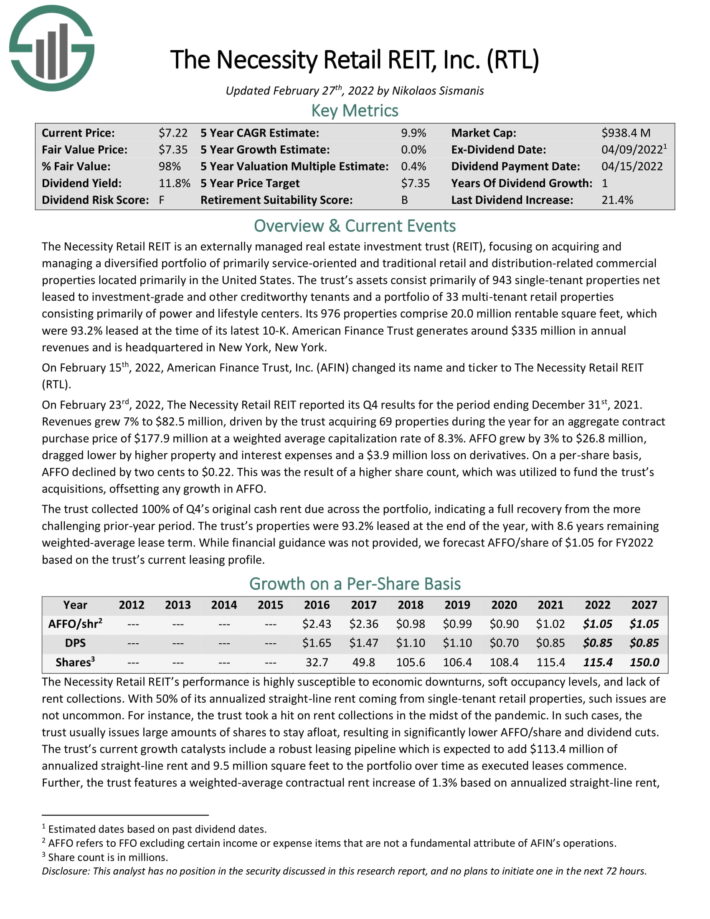

High-Yield REIT No. 10: The Necessity Retail REIT (RTL)

The Necessity Retail REIT (formerly known as American Finance Trust) is an externally managed real estate investment trust (REIT), focusing on acquiring and managing a diversified portfolio of primarily service-oriented and traditional retail and distribution-related commercial properties located primarily in the United States.

Source: Investor Presentation

The trust’s assets consist primarily of 943 single-tenant properties net leased to investment-grade and other creditworthy tenants and a portfolio of 33 multi-tenant retail properties consisting primarily of power and lifestyle centers. Its 976 properties comprise 20.0 million rentable square feet, which were 93.2% leased at the time of its latest 10-K.

Click here to download our most recent Sure Analysis report on RTL (preview of page 1 of 3 shown below):

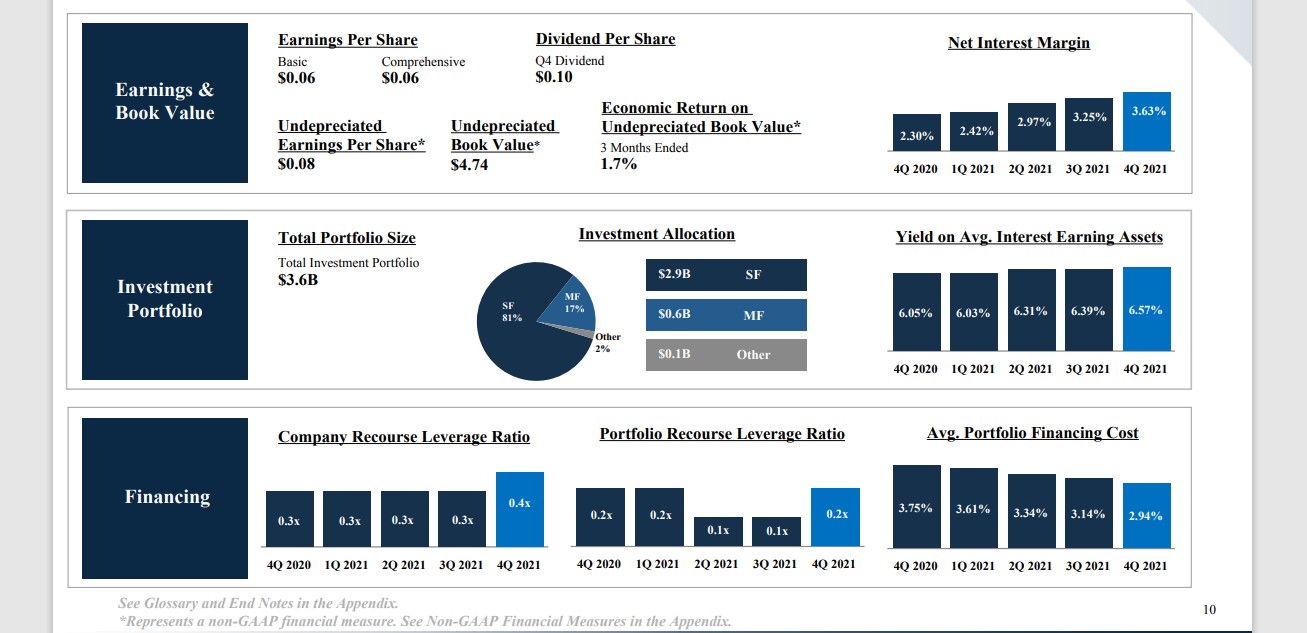

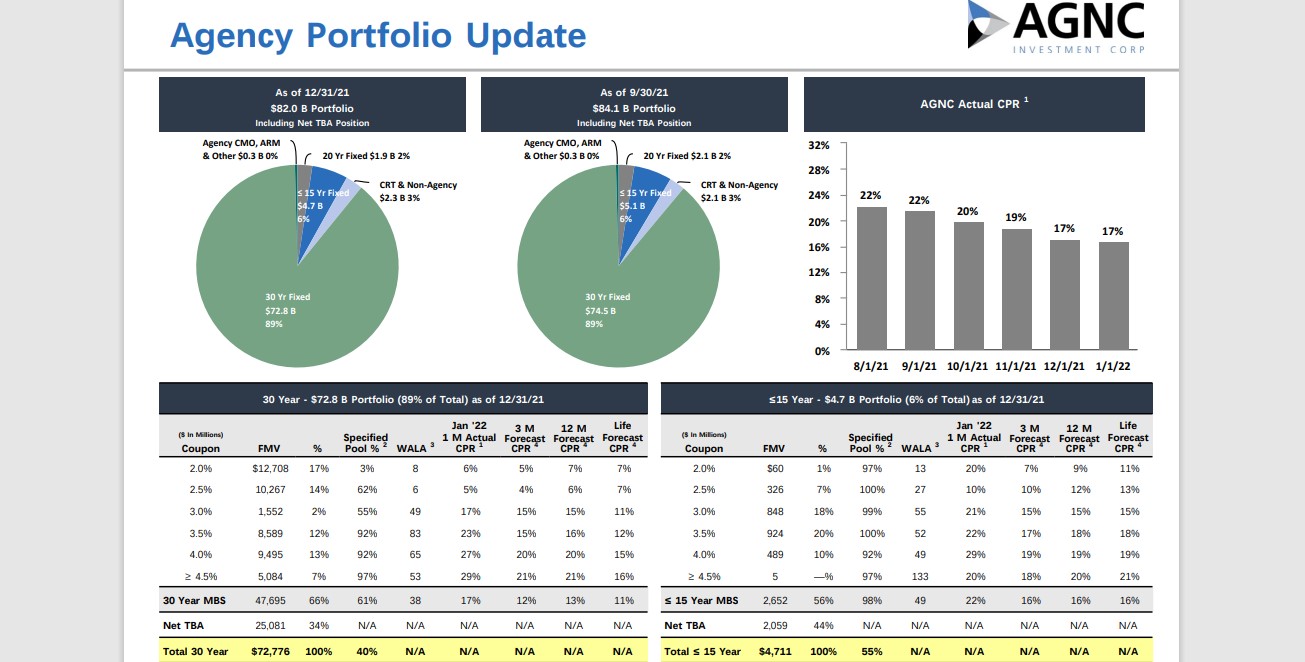

High-Yield REIT No. 9: New York Mortgage Trust (NYMT)

New York Mortgage Trust is a real estate investment trust, or REIT, that acquires, invests in, finances, and manages mortgage-related assets and other financial assets. The trust doesn’t own physical real estate, but rather seeks to manage a portfolio of investments that are real estate related. New York Mortgage Trust derives revenue from net interest income and net realized capital gains from its investment portfolio.

Source: Investor Presentation

The trust primarily seeks to generate interest income from mortgage-related assets, but it also owns some distressed financial assets where it seeks to capture capital gains. The trust invests in residential mortgage loans, multi-family CMBS, preferred equity, and joint venture equity.

Click here to download our most recent Sure Analysis report on NYMT (preview of page 1 of 3 shown below):

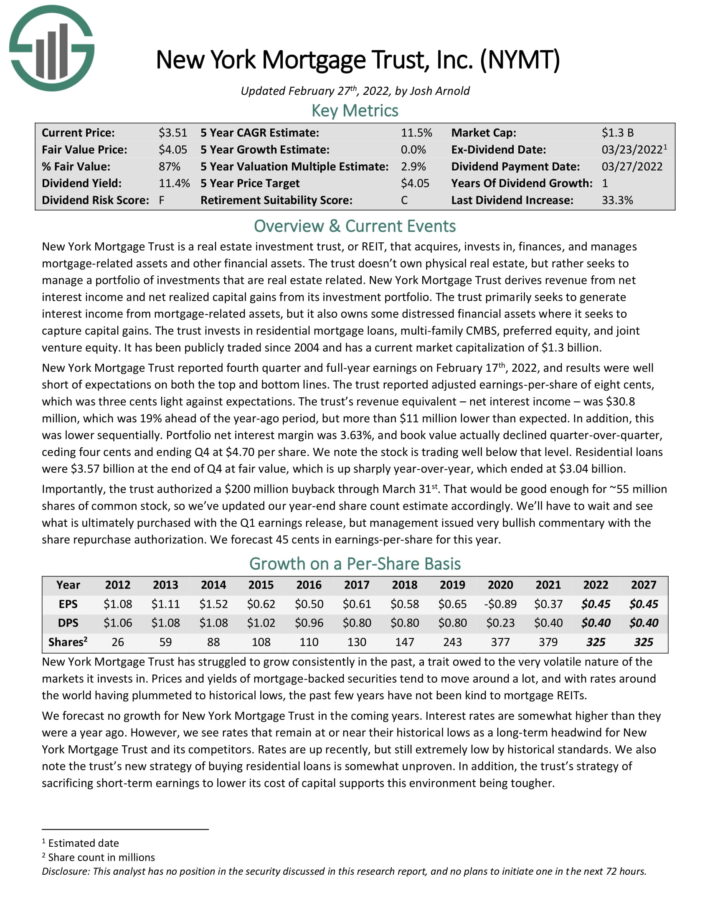

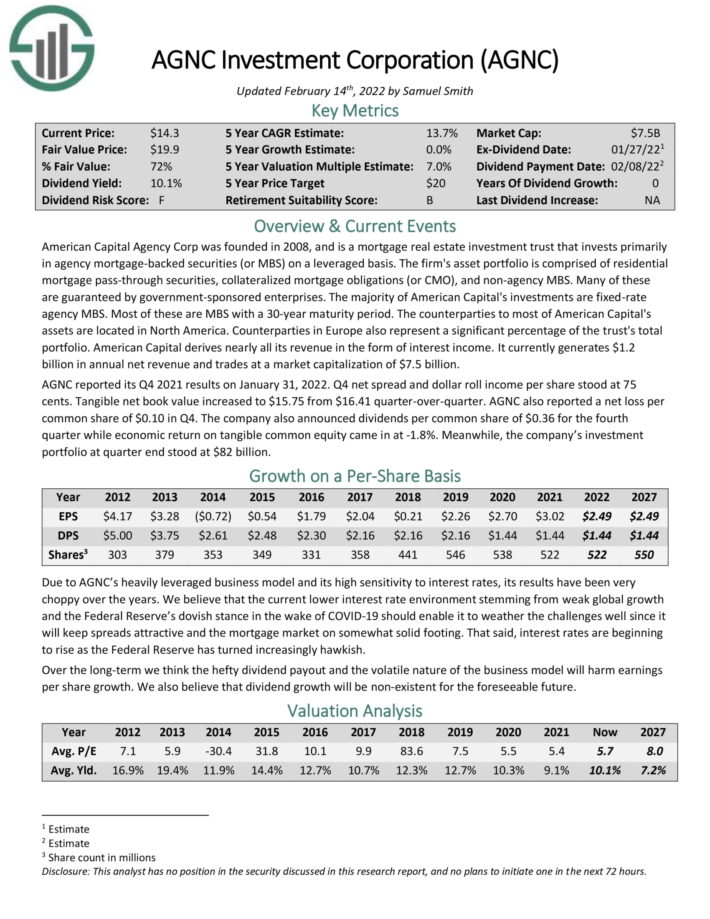

High-Yield REIT No. 8: AGNC Investment Corporation (AGNC)

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

The majority of American Capital’s investments are fixed–rate agency MBS. Most of these are MBS with a 30–year maturity period. American Capital derives nearly all its revenue in the form of interest income.

Source: Investor Presentation

AGNC reported its Q4 2021 results on January 31, 2022. Q4 net spread and dollar roll income per share stood at 75 cents. Tangible net book value increased to $15.75 from $16.41 quarter-over-quarter.

The company also announced dividends per common share of $0.36 for the fourth quarter while economic return on tangible common equity came in at –1.8%. Meanwhile, the company’s investment portfolio at quarter end stood at $82 billion.

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

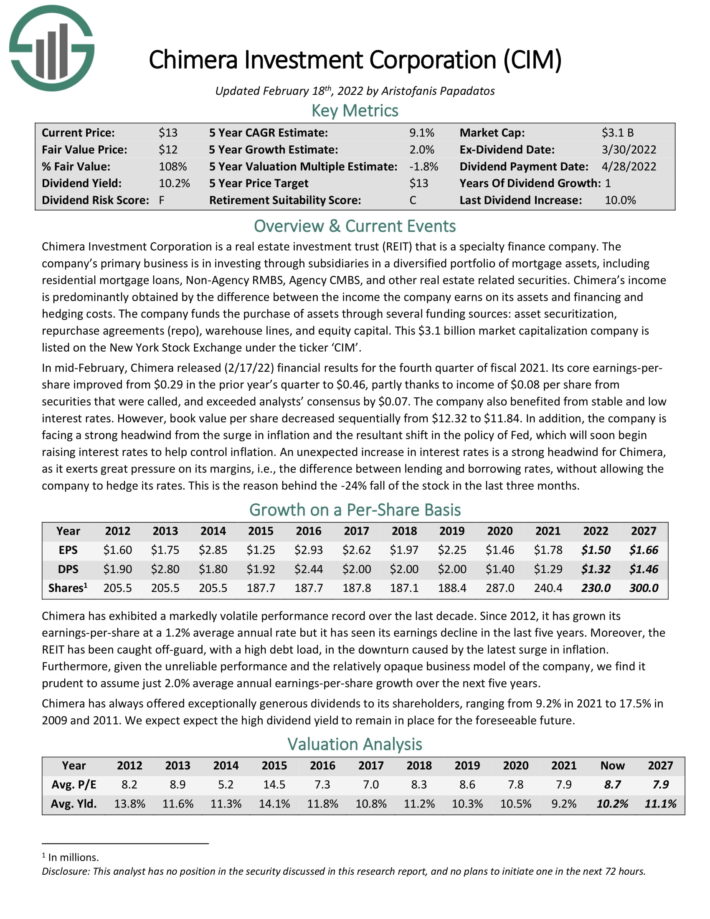

High-Yield REIT No. 7: Chimera Investment Corporation (CIM)

Chimera Investment Corporation is a real estate investment trust (REIT) that is a specialty finance company. The company’s primary business is in investing through subsidiaries in a diversified portfolio of mortgage assets, including residential mortgage loans, Non-Agency RMBS, Agency CMBS, and other real estate related securities.

Chimera’s income is predominantly obtained by the difference between the income the company earns on its assets and financing and hedging costs. The company funds the purchase of assets through several funding sources: asset securitization, repurchase agreements (repo), warehouse lines, and equity capital.

Click here to download our most recent Sure Analysis report on CIM (preview of page 1 of 3 shown below):

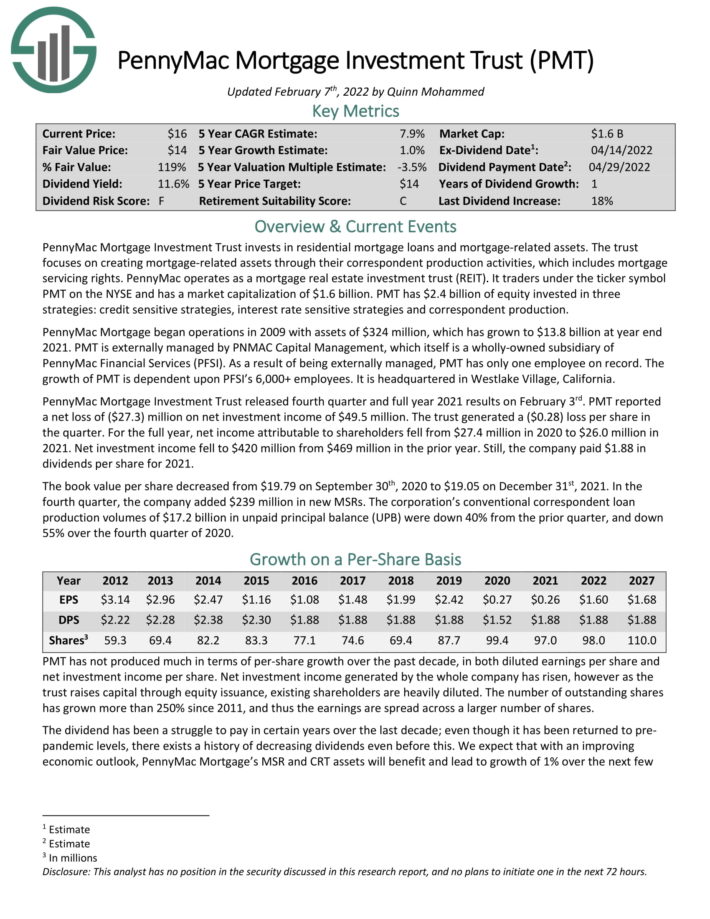

High-Yield REIT No. 6: PennyMac Mortgage Investment Trust (PMT)

PennyMac Mortgage Investment Trust is a specialty REIT that invests in residential mortgage loans and mortgage-related assets. PMT is managed by PNMAC Capital Management, LLC, a subsidiary of PennyMac Financial Services, Inc. (PFSI).

PMT believes it will generate long-term growth alongside a large (and growing) addressable market in its core industry.

Click here to download our most recent Sure Analysis report on PMT (preview of page 1 of 3 shown below):

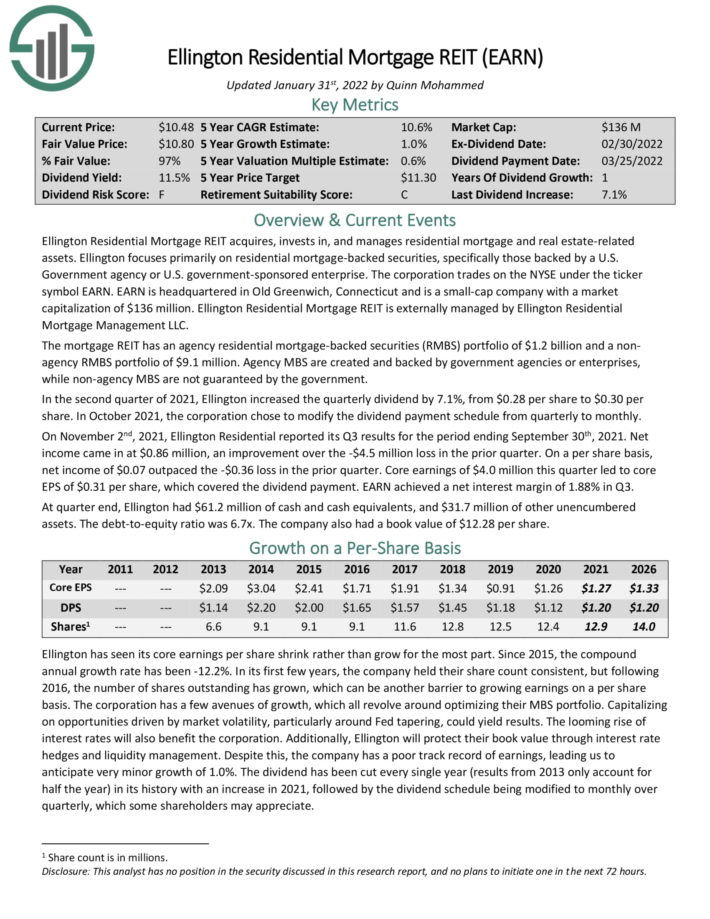

High-Yield REIT No. 5: Ellington Residential Mortgage REIT (EARN)

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Ellington Residential Mortgage REIT is externally managed by Ellington Residential Mortgage Management LLC. The mortgage REIT has an agency residential mortgage–backed securities (RMBS) portfolio of $1.2 billion and a non–agency RMBS portfolio of $9.1 million. Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

High-Yield REIT No. 4: Annally Capital Management (NLY)

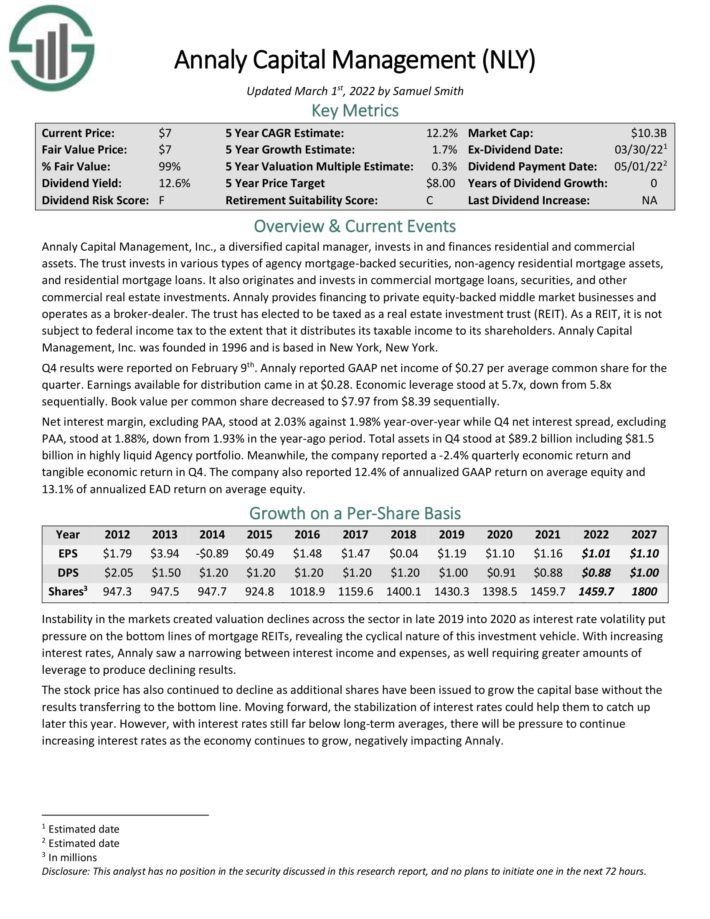

Annaly Capital Management, Inc., a diversified capital manager, invests in and finances residential and commercial assets. The trust invests in various types of agency mortgage–backed securities, non–agency residential mortgage assets, and residential mortgage loans.

It also originates and invests in commercial mortgage loans, securities, and other commercial real estate investments. Annaly provides financing to private equity–backed middle market businesses and operates as a broker–dealer.

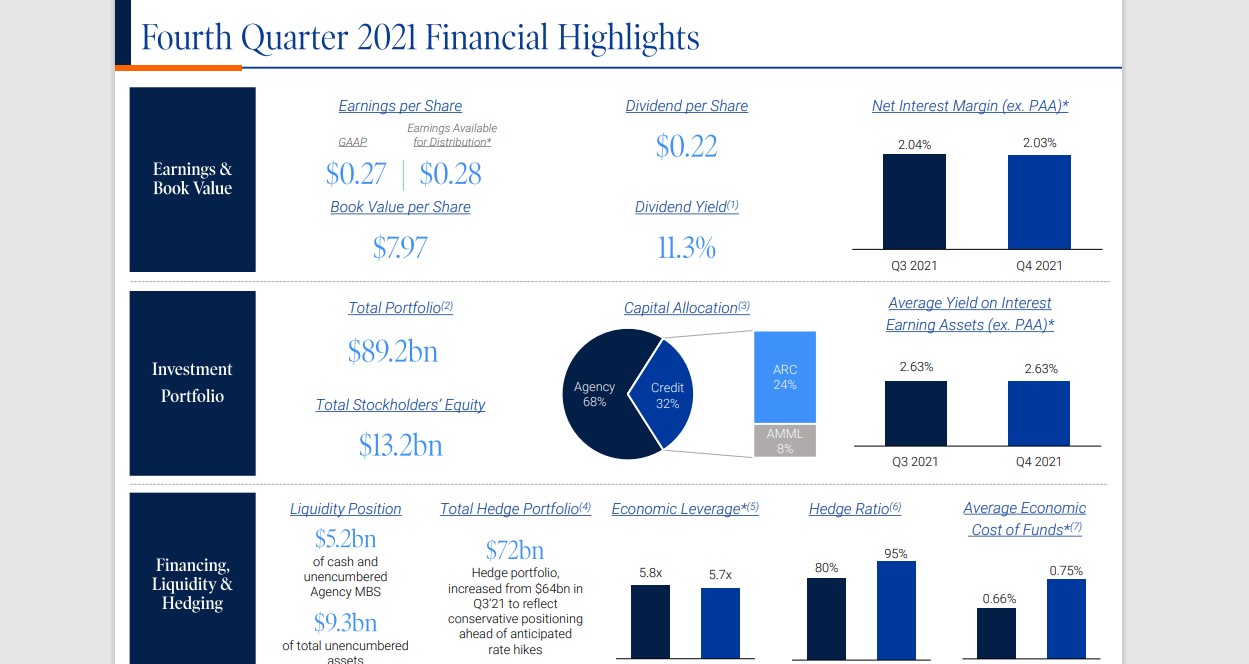

Q4 results were reported on February 9th.

Source: Investor Presentation

Annaly reported GAAP net income of $0.27 per average common share for the quarter. Earnings available for distribution came in at $0.28. Economic leverage stood at 5.7x, down from 5.8x sequentially. Book value per common share decreased to $7.97 from $8.39 sequentially.

Click here to download our most recent Sure Analysis report on NLY (preview of page 1 of 3 shown below):

High-Yield REIT No. 3: Two Harbors Investment Corp. (TWO)

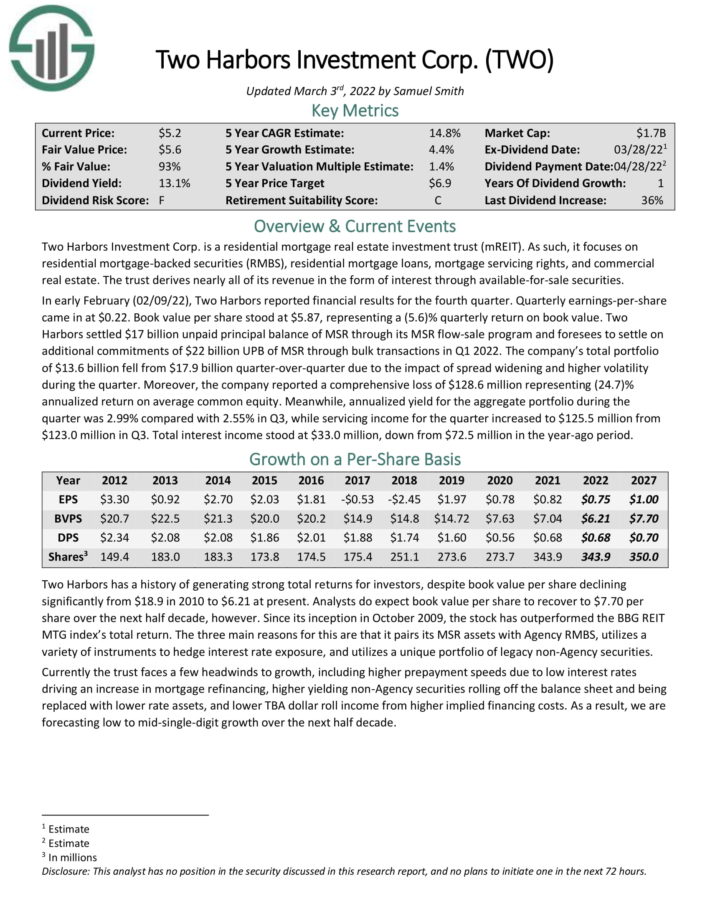

Two Harbors Investment Corp. is a residential mortgage real estate investment trust (mREIT). As such, it focuses on residential mortgage–backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and commercial real estate.

The trust derives nearly all of its revenue in the form of interest through available–for–sale securities.

Source: Investor Presentation

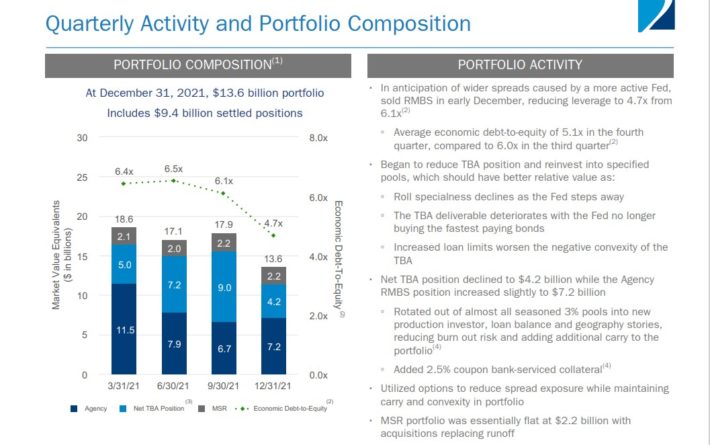

In early February (02/09/22), Two Harbors reported financial results for the fourth quarter. Quarterly earnings-per-share came in at $0.22. Book value per share stood at $5.87, representing a (5.6)% quarterly return on book value.

Two Harbors settled $17 billion unpaid principal balance of MSR through its MSR flow-sale program and foresees to settle on additional commitments of $22 billion UPB of MSR through bulk transactions in Q1 2022.

The company’s total portfolio of $13.6 billion fell from $17.9 billion quarter-over-quarter due to the impact of spread widening and higher volatility during the quarter. Moreover, the company reported a comprehensive loss of $128.6 million representing (24.7)% annualized return on average common equity.

Meanwhile, annualized yield for the aggregate portfolio during the quarter was 2.99% compared with 2.55% in Q3, while servicing income for the quarter increased to $125.5 million from $123.0 million in Q3. Total interest income stood at $33.0 million, down from $72.5 million in the year-ago period.

Click here to download our most recent Sure Analysis report on Two Harbors (TWO) (preview of page 1 of 3 shown below).

High-Yield REIT No. 2: ARMOUR Residential REIT (ARR)

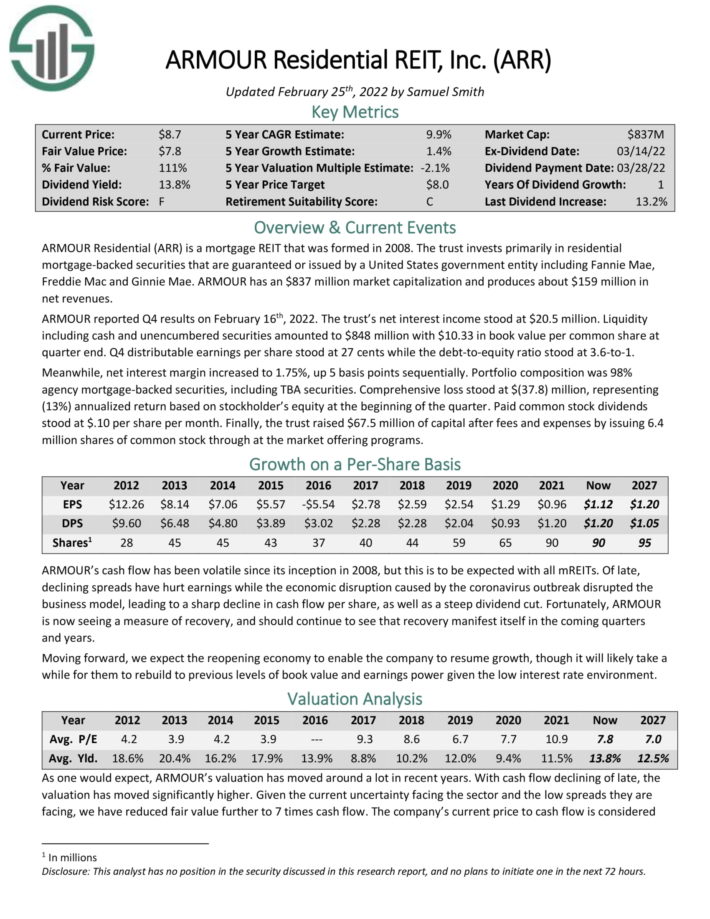

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are guaranteed or issued by a United States government entity including Fannie Mae, Freddie Mac and Ginnie Mae.

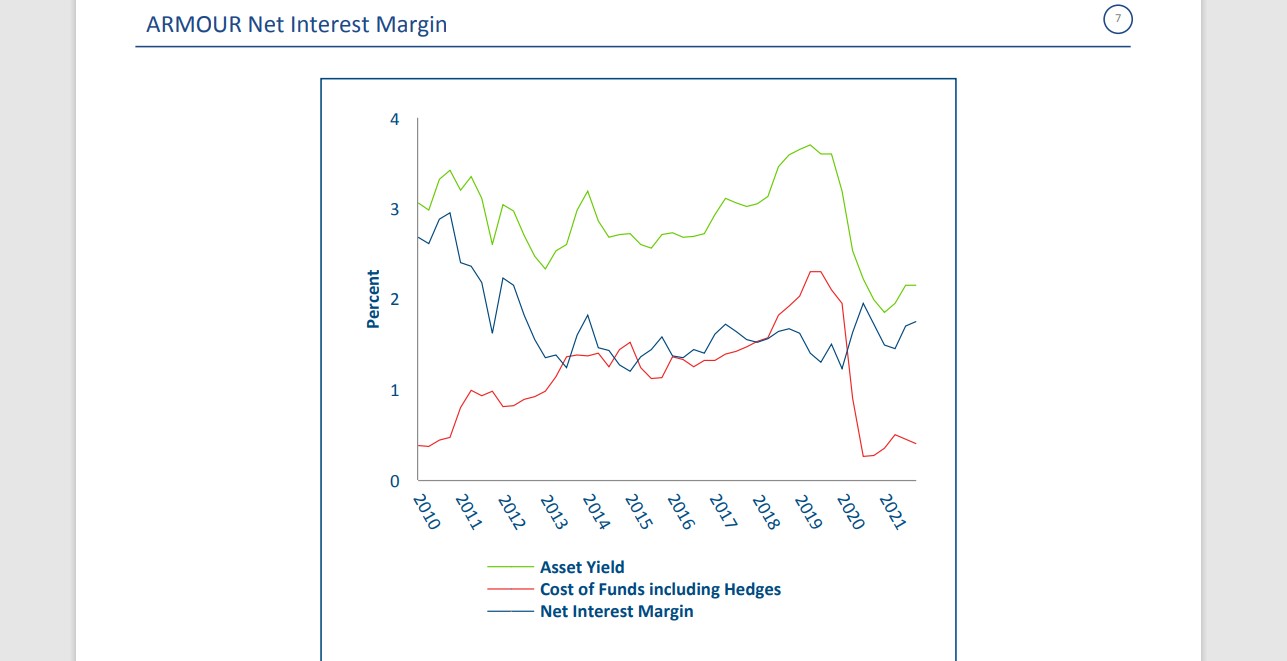

ARMOUR reported Q4 results on February 16th, 2022. The trust’s net interest income stood at $20.5 million. Liquidity including cash and unencumbered securities amounted to $848 million with $10.33 in book value per common share at quarter end. Q4 distributable earnings per share stood at 27 cents while the debt-to-equity ratio stood at 3.6 to 1.

Source: Investor Presentation

Meanwhile, net interest margin increased to 1.75%, up 5 basis points sequentially. Portfolio composition was 98% agency mortgage–backed securities, including TBA securities.

Click here to download our most recent Sure Analysis report on ARR (preview of page 1 of 3 shown below):

High-Yield REIT No. 1: Orchid Island Capital (ORC)

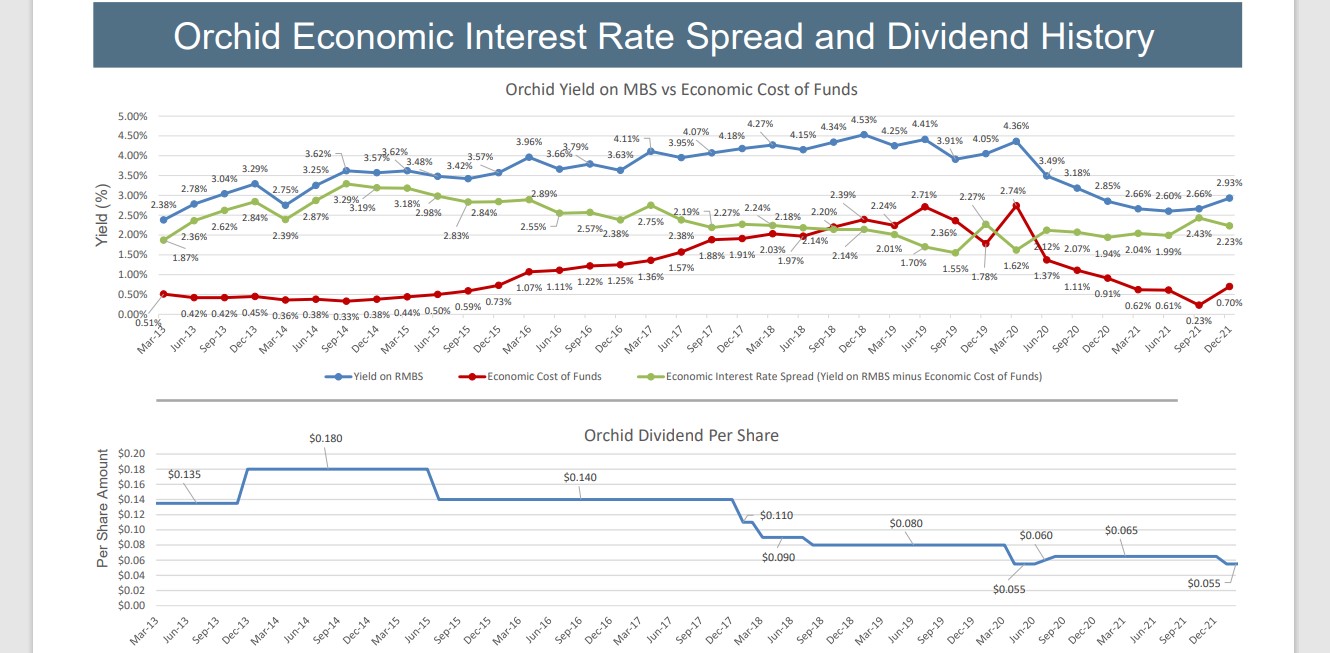

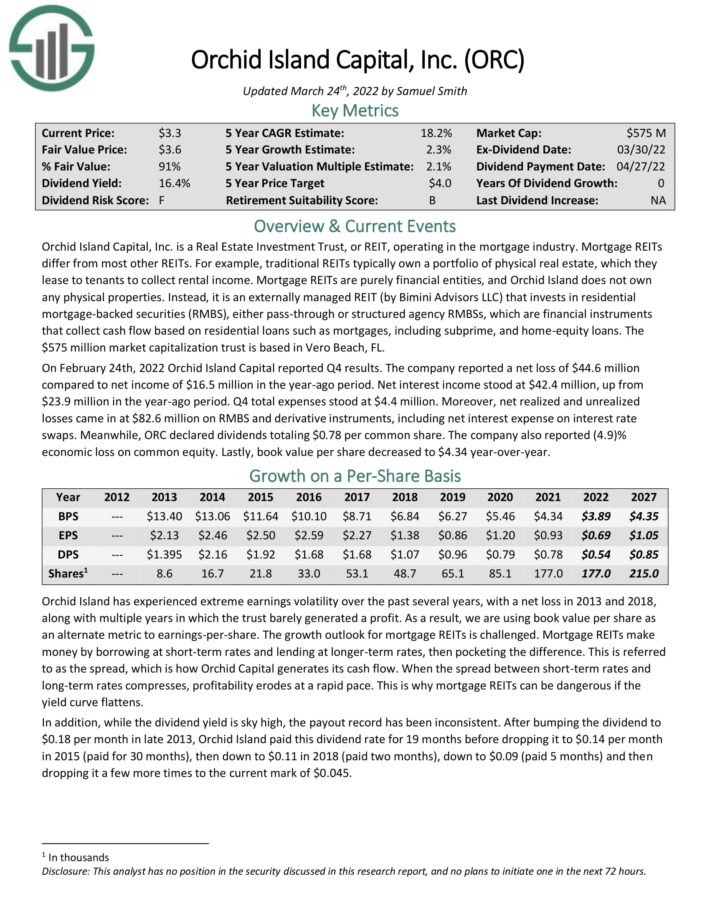

Orchid Island Capital, Inc. is a mortgage REIT. As such, Orchid Island does not own any physical properties.

Instead, it is an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage–backed securities (RMBS), either pass–through or structured agency RMBSs. These are financial instruments that collect cash flow based on residential loans such as mortgages, including subprime, and home–equity loans.

Source: Investor Presentation

On October 28th, 2021 Orchid Island Capital reported Q3 results. Net income came in at $26.0 million and includes a net interest income of $32.6 million. Book value per share stood at $4.77, up by $0.6 sequentially from $4.71.

ORC recently cut its dividend by 18%, although the stock still yields 17.6%.

Click here to download our most recent Sure Analysis report on ORC (preview of page 1 of 3 shown below):

Final Thoughts

REITs have significant appeal for income investors, due to their high yields. These 10 extreme high-yielding REITs are especially attractive on the surface, although investors should be aware that abnormally high yields are often accompanied by elevated risks.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].