Revealed on July eighth, 2025 by Bob Ciura

Excessive dividend shares are shares with a dividend yield nicely in extra of the market common dividend yield of ~1.3%.

We outline a excessive dividend inventory as having a present yield above 5%, which is greater than 4 instances the S&P 500 common.

Excessive-yield shares may be very useful to shore up revenue after retirement.

For instance, a $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

With that in thoughts, now we have created a free listing of over 200 excessive dividend shares with dividend yields above 5%.

You may obtain your copy of the excessive dividend shares listing beneath:

Nonetheless, not all excessive dividend shares are equally protected.

There are various examples of excessive dividend shares decreasing or eliminating their dividends. Total, regardless of the constructive attributes hooked up to excessive dividend shares, their threat profile may be elevated.

On this article, now we have analyzed the ten excessive dividend shares from our Certain Evaluation Analysis Database with the most secure dividends based mostly on our Dividend Threat Rating ranking system.

The ten most secure excessive dividend shares beneath have present yields above 5% and Dividend Threat Scores of ‘C’ or higher.

The shares are listed beneath based on their payout ratio, in ascending order.

Desk of Contents

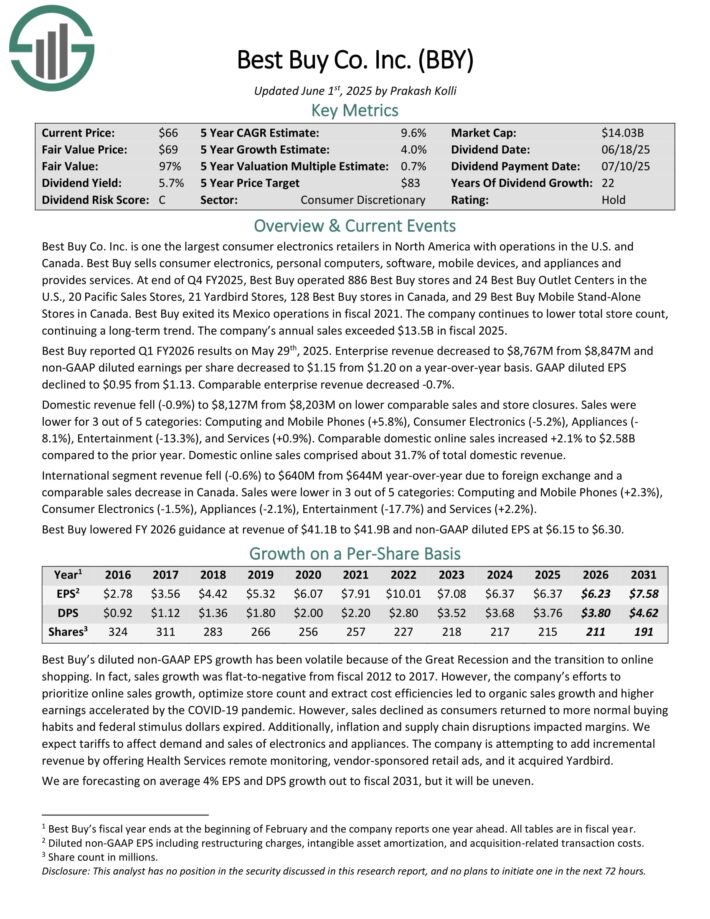

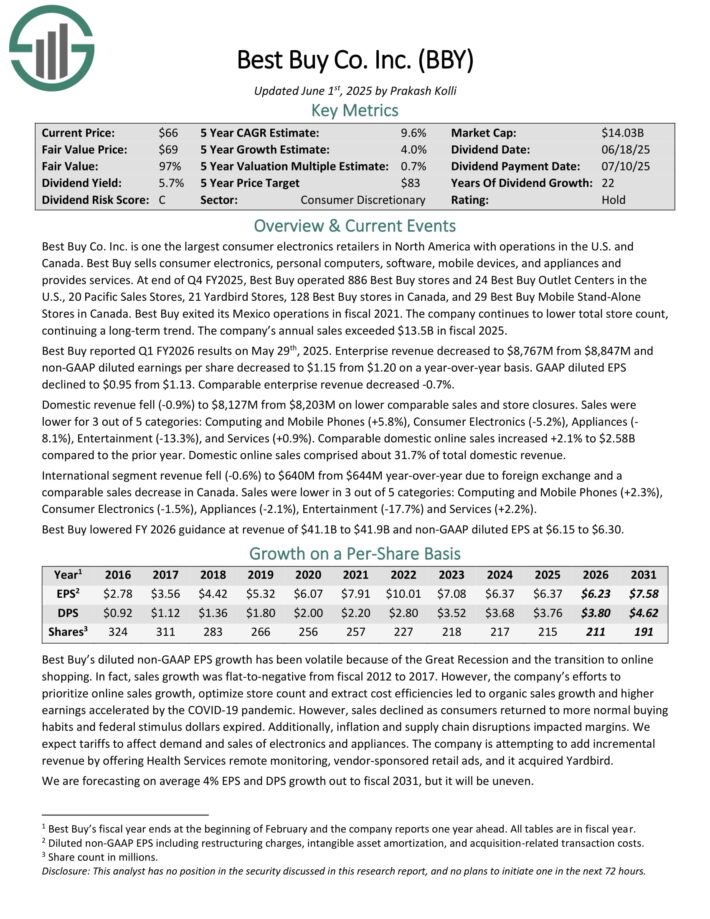

Most secure Excessive Dividend Inventory #10: Finest Purchase Co. (BBY)

- Dividend Yield: 5.4%

- Payout Ratio: 61.0%

Finest Purchase Co. Inc. is one the most important client electronics retailers in North America with operations within the U.S. and Canada. Finest Purchase sells client electronics, private computer systems, software program, cellular gadgets, and home equipment and supplies companies.

At finish of This autumn FY2025, Finest Purchase operated 886 Finest Purchase shops and 24 Finest Purchase Outlet Facilities within the U.S., 20 Pacific Gross sales Shops, 21 Yardbird Shops, 128 Finest Purchase shops in Canada, and 29 Finest Purchase Cellular Stand-Alone Shops in Canada. The corporate’s annual gross sales exceeded $13.5B in fiscal 2025.

Finest Purchase reported Q1 FY2026 outcomes on Might twenty ninth, 2025. Enterprise income decreased to $8,767M from $8,847M and non-GAAP diluted earnings per share decreased to $1.15 from $1.20 on a year-over-year foundation. GAAP diluted EPS declined to $0.95 from $1.13.

Comparable enterprise income decreased -0.7%. Home income fell -0.9% on decrease comparable gross sales and retailer closures. Gross sales have been decrease for 3 out of 5 classes. Comparable home on-line gross sales elevated 2.1% in comparison with the prior yr. Home on-line gross sales comprised about 31.7% of complete home income.

Click on right here to obtain our most up-to-date Certain Evaluation report on BBY (preview of web page 1 of three proven beneath):

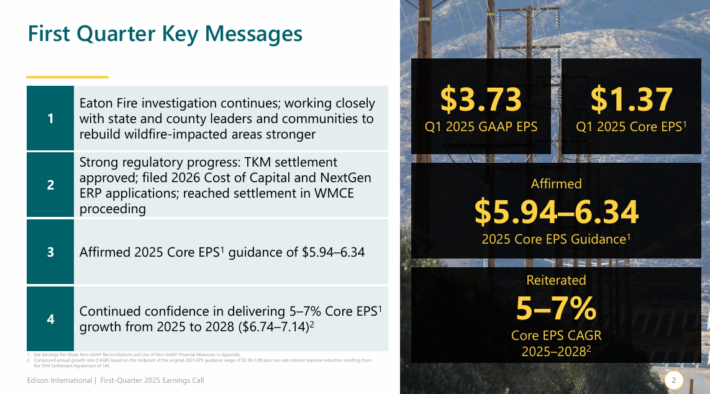

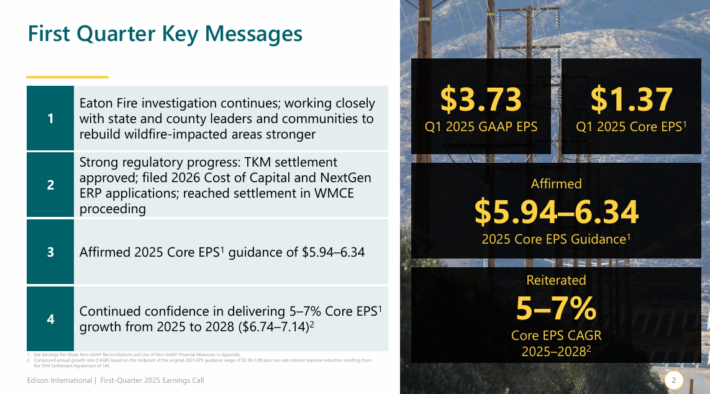

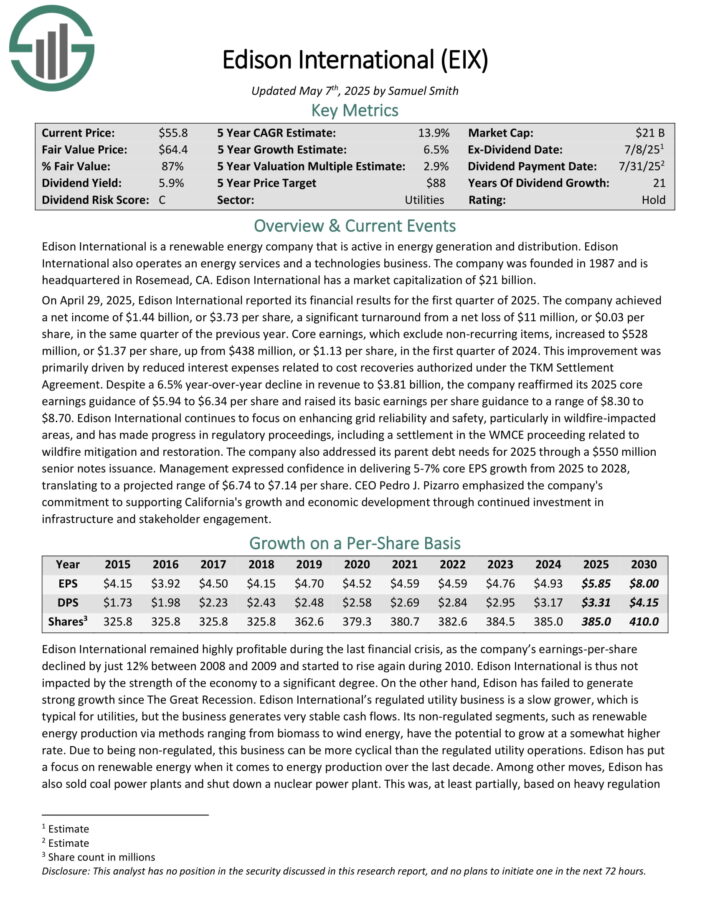

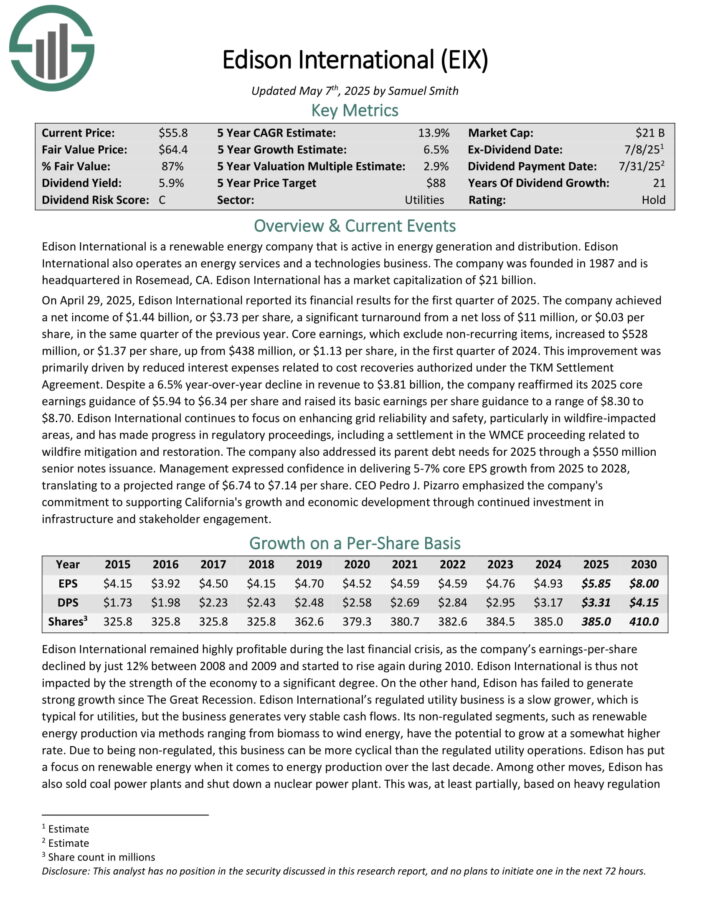

Most secure Excessive Dividend Inventory #9: Edison Worldwide (EIX)

- Dividend Yield: 6.5%

- Payout Ratio: 56.6%

Edison Worldwide is a renewable vitality firm that’s energetic in vitality technology and distribution. Edison Worldwide additionally operates an vitality companies and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison Worldwide reported its monetary outcomes for the primary quarter of 2025. The corporate achieved a internet revenue of $1.44 billion, or $3.73 per share, a big turnaround from a internet lack of $11 million, or $0.03 per share, in the identical quarter of the earlier yr.

Supply: Investor Presentation

Core earnings, which exclude non-recurring objects, elevated to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, within the first quarter of 2024.

This enchancment was primarily pushed by diminished curiosity bills associated to price recoveries licensed beneath the TKM Settlement Settlement. Regardless of a 6.5% year-over-year decline in income to $3.81 billion, the corporate reaffirmed its 2025 core earnings steerage of $5.94 to $6.34 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on EIX (preview of web page 1 of three proven beneath):

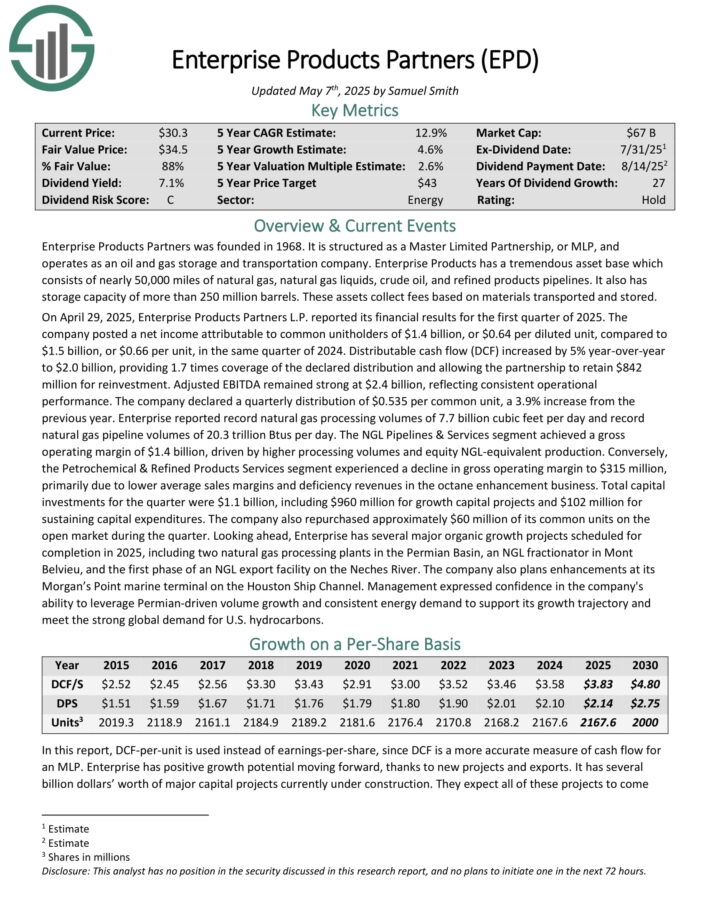

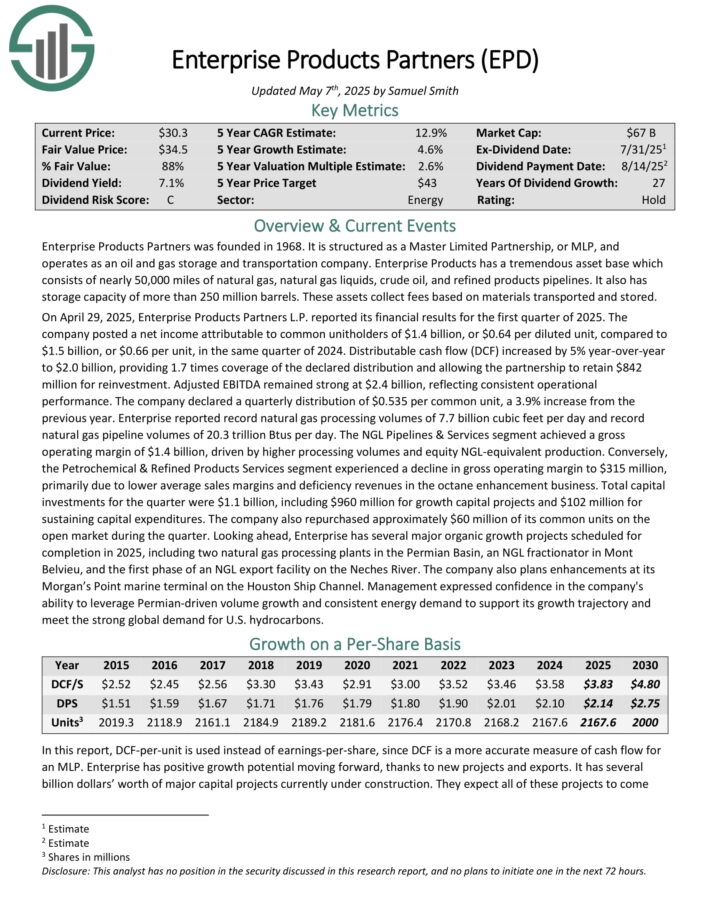

Most secure Excessive Dividend Inventory #8: Enterprise Merchandise Companions LP (EPD)

- Dividend Yield: 6.8%

- Payout Ratio: 55.9%

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property accumulate charges based mostly on volumes of supplies transported and saved.

Supply: Investor Presentation

On April 29, 2025, Enterprise Merchandise Companions L.P. reported its monetary outcomes for the primary quarter of 2025. The corporate posted a internet revenue attributable to frequent unitholders of $1.4 billion, or $0.64 per diluted unit, in comparison with $1.5 billion, or $0.66 per unit, in the identical quarter of 2024.

Distributable money circulation (DCF) elevated by 5% year-over-year to $2.0 billion, offering 1.7 instances protection of the declared distribution and permitting the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained sturdy at $2.4 billion, reflecting constant operational efficiency. The corporate declared a quarterly distribution of $0.535 per frequent unit, a 3.9% enhance from the earlier yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven beneath):

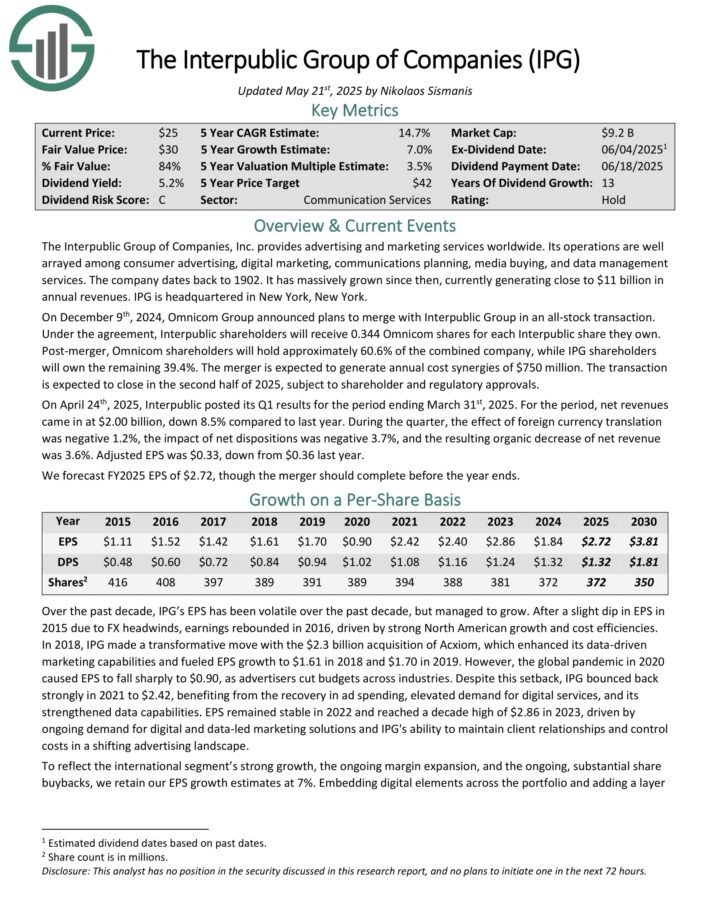

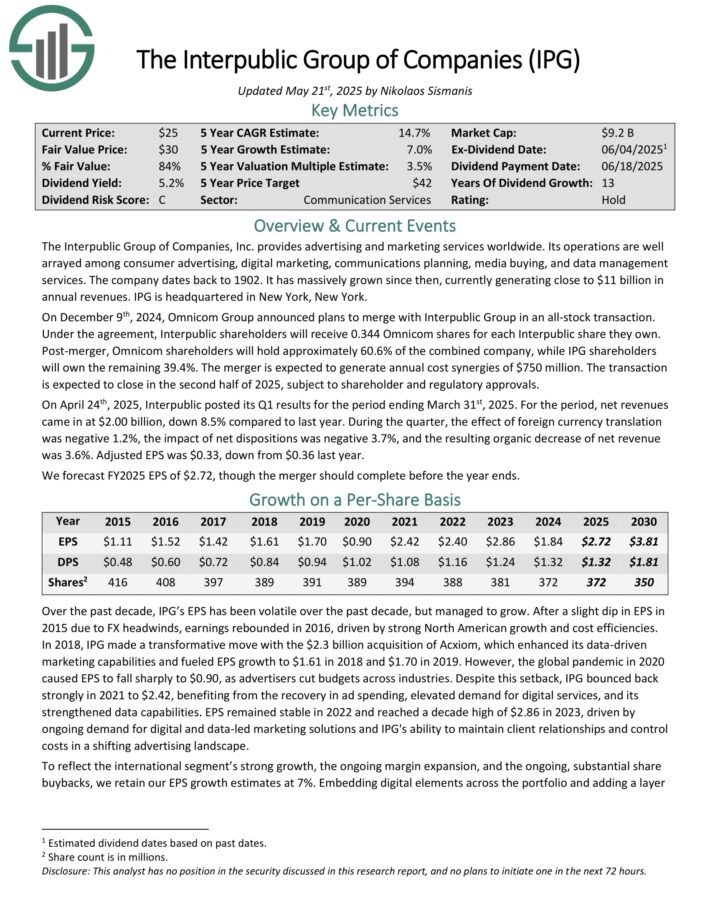

Most secure Excessive Dividend Inventory #7: Interpublic Group of Cos. (IPG)

- Dividend Yield: 5.2%

- Payout Ratio: 48.5%

The Interpublic Group of Corporations, Inc. supplies promoting and advertising companies worldwide. Its operations are nicely arrayed amongst client promoting, digital advertising, communications planning, media shopping for, and knowledge administration companies.

The corporate dates again to 1902. It has massively grown since then, at the moment producing near $11 billion in annual revenues. IPG is headquartered in New York, New York.

On December ninth, 2024, Omnicom Group introduced plans to merge with Interpublic Group in an all-stock transaction. Beneath the settlement, Interpublic shareholders will obtain 0.344 Omnicom shares for every Interpublic share they personal.

Submit-merger, Omnicom shareholders will maintain roughly 60.6% of the mixed firm, whereas IPG shareholders will personal the remaining 39.4%. The merger is predicted to generate annual price synergies of $750 million. The transaction is predicted to shut within the second half of 2025, topic to shareholder and regulatory approvals.

On April twenty fourth, 2025, Interpublic posted its Q1 outcomes for the interval ending March thirty first, 2025. For the interval, internet revenues got here in at $2.00 billion, down 8.5% in comparison with final yr.

Through the quarter, the impact of overseas foreign money translation was adverse 1.2%, the influence of internet tendencies was adverse 3.7%, and the ensuing natural lower of internet income was 3.6%. Adjusted EPS was $0.33, down from $0.36 final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on IPG (preview of web page 1 of three proven beneath):

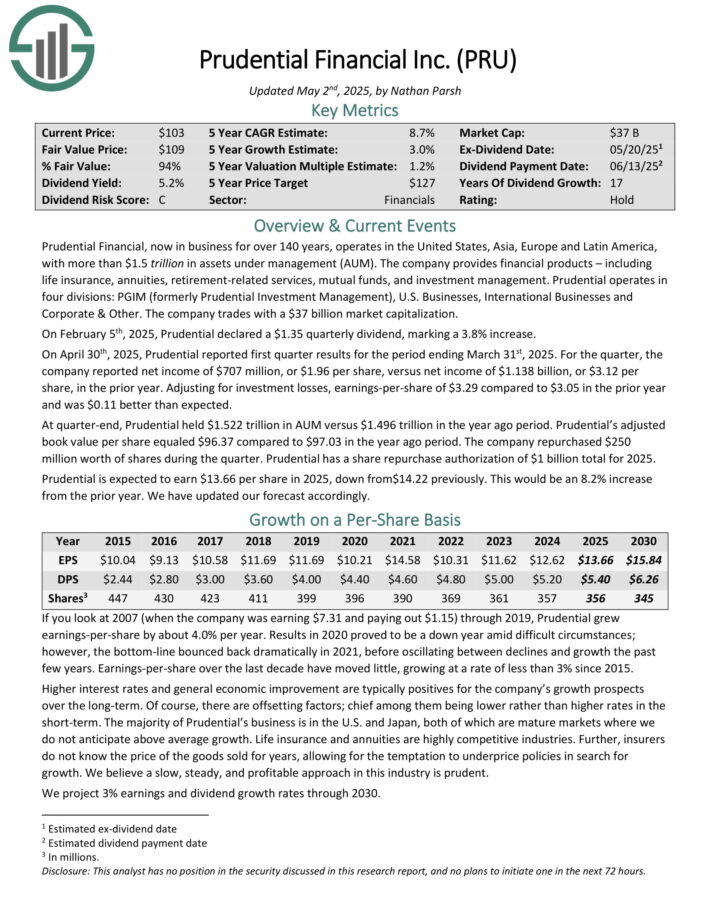

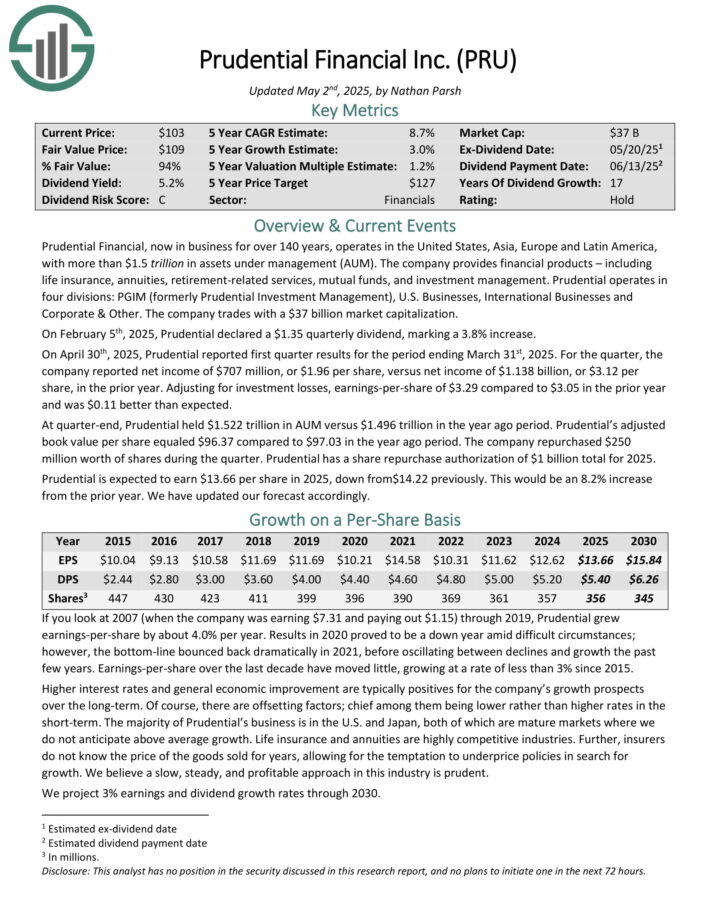

Most secure Excessive Dividend Inventory #6: Prudential Monetary (PRU)

- Dividend Yield: 5.1%

- Payout Ratio: 39.5%

Prudential Monetary, now in enterprise for over 140 years, operates in the US, Asia, Europe and Latin America, with greater than $1.5 trillion in property beneath administration (AUM).

The corporate supplies monetary merchandise – together with life insurance coverage, annuities, retirement-related companies, mutual funds, and funding administration.

Prudential operates in 4 divisions: PGIM (previously Prudential Funding Administration), U.S. Companies, Worldwide Companies and Company & Different.

On April thirtieth, 2025, Prudential reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, the corporate reported internet revenue of $707 million, or $1.96 per share, versus internet revenue of $1.138 billion, or $3.12 per share, within the prior yr.

Adjusting for funding losses, earnings-per-share of $3.29 in comparison with $3.05 within the prior yr and was $0.11 higher than anticipated. At quarter-end, Prudential held $1.522 trillion in AUM versus $1.496 trillion within the yr in the past interval.

Prudential’s adjusted e-book worth per share equaled $96.37 in comparison with $97.03 within the yr in the past interval.

The corporate repurchased $250 million value of shares through the quarter. Prudential has a share repurchase authorization of $1 billion complete for 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRU (preview of web page 1 of three proven beneath):

Most secure Excessive Dividend Inventory #5: Canandaigua Nationwide Company (CNND)

- Dividend Yield: 5.0%

- Payout Ratio: 36.8%

Canandaigua Nationwide Company (CNC) is the mother or father firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF), providing a variety of monetary companies, together with banking, lending, mortgage companies, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is give attention to serving native communities by offering customized monetary options to people, companies, and municipalities.

CNC emphasizes group banking, specializing in reinvesting within the native economic system by a various lending portfolio. As of December thirty first, 2024, CNC reported complete deposits of $4.0 billion.

In early March, Canandaigua Nationwide launched its full-year outcomes for the interval ending December thirty first, 2024. For the yr, complete curiosity revenue grew 13% to $248 million.

Complete curiosity bills grew 29% to $111 million. Internet curiosity revenue grew by 3% to $137 million. Complete different revenue (service fees on deposit accounts and belief and funding companies) elevated 6% to $54 million.

Complete different bills (Inc. salaries, occupancy, and advertising) grew 6% to $125 million. Internet revenue was $45 million, comparatively flat year-over-year. EPS was $24.15.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNND (preview of web page 1 of three proven beneath):

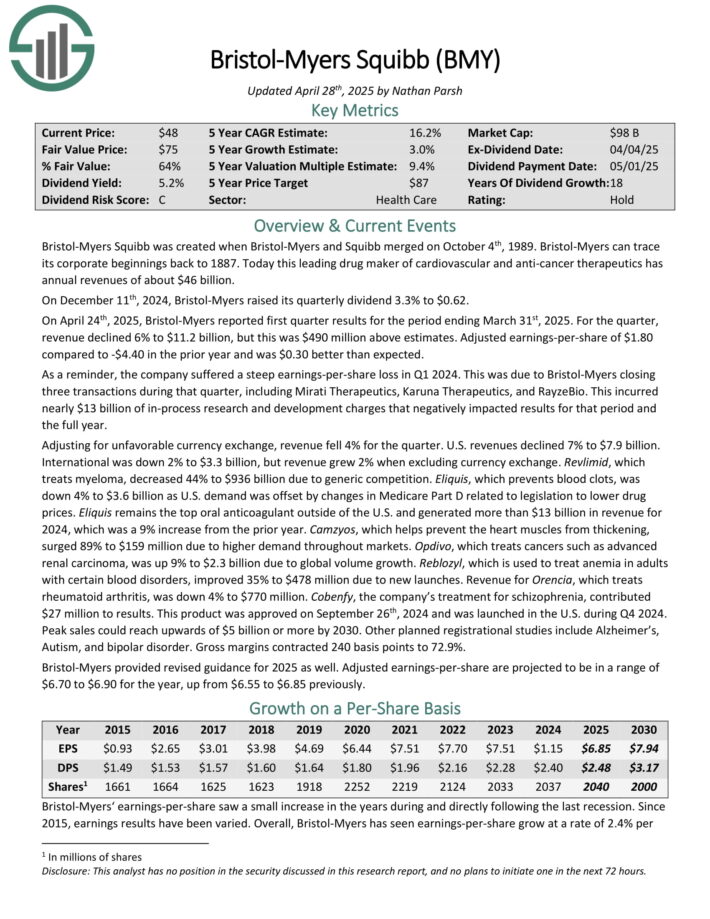

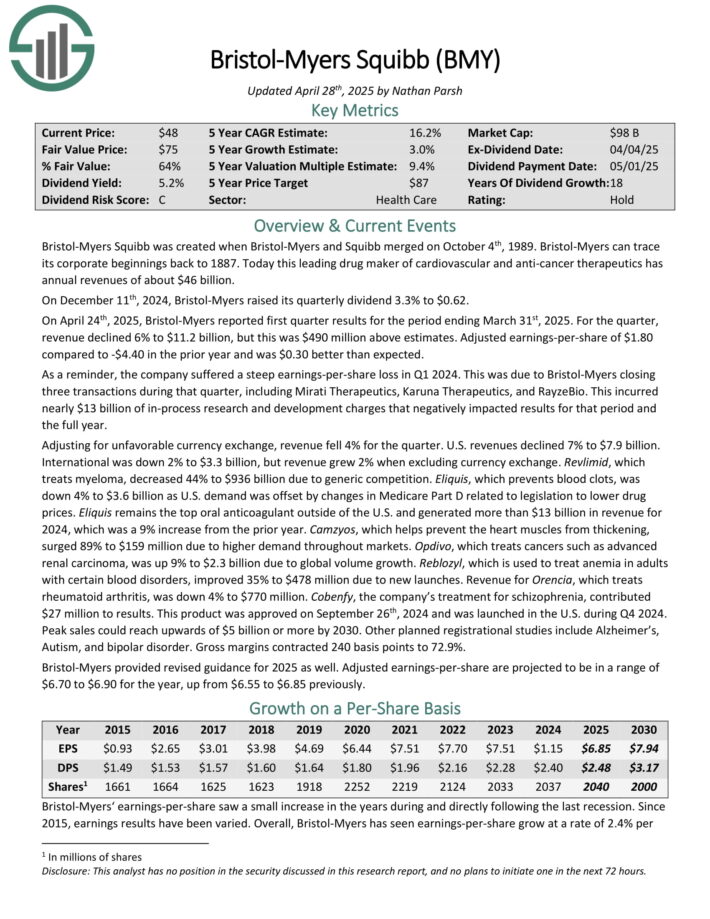

Most secure Excessive Dividend Inventory #4: Bristol-Myers Squibb (BMY)

- Dividend Yield: 5.3%

- Payout Ratio: 36.2%

Bristol-Myers Squibb was created when Bristol-Myers and Squibb merged on October 4th, 1989. This main drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On December eleventh, 2024, Bristol-Myers raised its quarterly dividend 3.3% to $0.62.

On April twenty fourth, 2025, Bristol-Myers reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income declined 6% to $11.2 billion, however this was $490 million above estimates.

Adjusted earnings-per-share of $1.80 in comparison with -$4.40 within the prior yr and was $0.30 higher than anticipated. The corporate suffered a steep earnings-per-share loss in Q1 2024.

Adjusting for unfavorable foreign money trade, income fell 4% for the quarter. U.S. revenues declined 7% to $7.9 billion. Worldwide was down 2% to $3.3 billion, however income grew 2% when excluding foreign money trade.

Revlimid, which treats myeloma, decreased 44% to $936 billion as a result of generic competitors.

Bristol-Myers offered revised steerage for 2025 as nicely. Adjusted earnings-per-share are projected to be in a spread of $6.70 to $6.90 for the yr, up from $6.55 to $6.85 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMY (preview of web page 1 of three proven beneath):

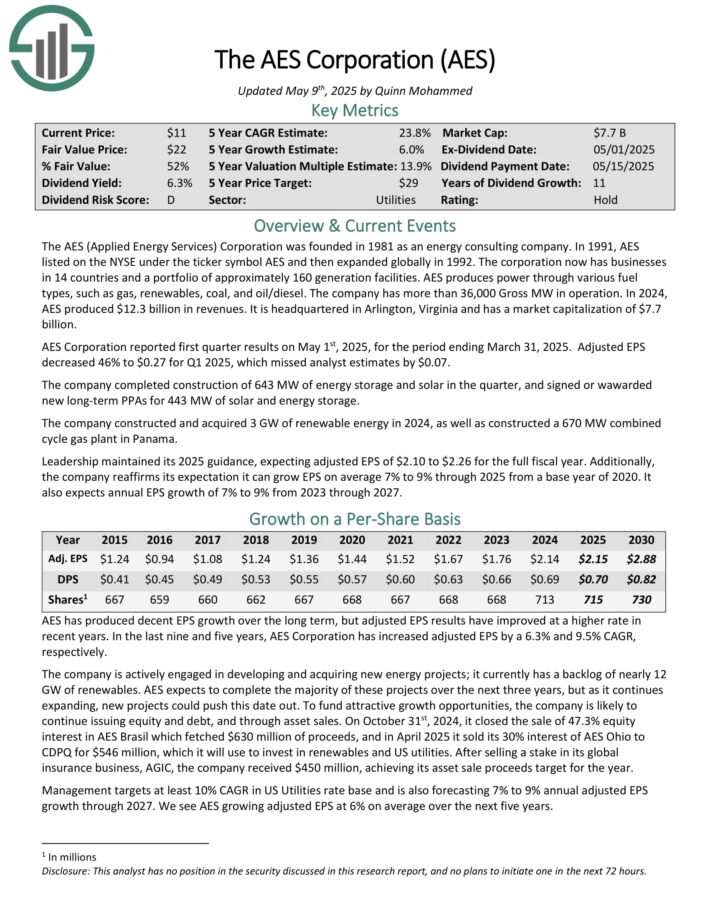

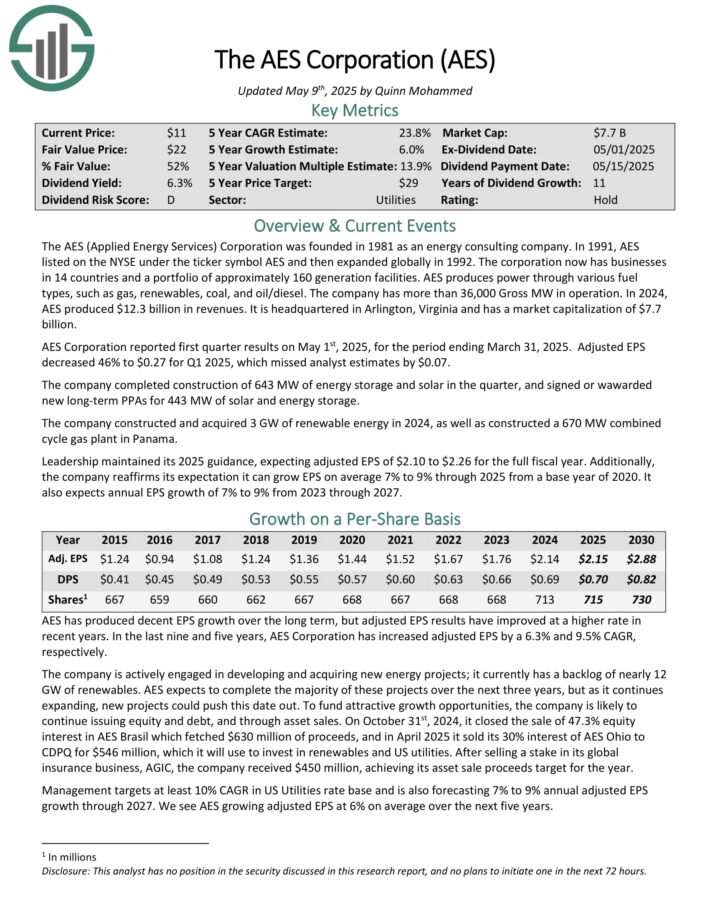

Most secure Excessive Dividend Inventory #3: AES Corp. (AES)

- Dividend Yield: 6.1%

- Payout Ratio: 32.6%

The AES (Utilized Vitality Providers) Company has companies in 14 nations and a portfolio of roughly 160 technology amenities. AES produces energy by varied gas sorts, equivalent to gasoline, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported first quarter outcomes on Might 1st, 2025, for the interval ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The corporate accomplished development of 643 MW of vitality storage and photo voltaic within the quarter, and signed or wawarded new long-term PPAs for 443 MW of photo voltaic and vitality storage.

The corporate constructed and bought 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. Management maintained its 2025 steerage, anticipating adjusted EPS of $2.10 to $2.26 for the total fiscal yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven beneath):

Most secure Excessive Dividend Inventory #2: Shutterstock, Inc. (SSTK)

- Dividend Yield: 6.8%

- Payout Ratio: 30.0%

Shutterstock sells high-quality inventive content material for manufacturers, digital media and advertising firms by its world inventive platform.

Its platform hosts probably the most in depth and various assortment of high-quality 3D fashions, movies, music, pictures, vectors and illustrations for licensing. The corporate reported $935 million in revenues final yr.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Pictures by a merger of equals. The mixed firm will retain the title Getty Pictures Holdings, Inc and commerce on the NYSE beneath ticker GETY.

Getty Pictures shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Pictures plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual price financial savings is forecast by the third yr, with most of this anticipated after 1 to 2 years.

On January twenty seventh, 2025, Shutterstock introduced a $0.33 quarterly dividend, a ten% enhance over the prior yr.

On Might 2nd, 2025, Shutterstock revealed its first quarter outcomes for the interval ending March 31, 2025. Whereas quarterly income grew by a stable 13% year-on-year, it missed analyst estimates by almost $7 million. Adjusted EPS of $1.03 elevated by 12%, and in addition missed analyst estimates by $0.01.

Click on right here to obtain our most up-to-date Certain Evaluation report on SSTK (preview of web page 1 of three proven beneath):

Most secure Excessive Dividend Inventory #1: Lincoln Nationwide (LNC)

- Dividend Yield: 5.3%

- Payout Ratio: 24.6%

Lincoln Nationwide Company provides life insurance coverage, annuities, retirement plan companies and group safety. The company was based in 1905 as The Lincoln Nationwide Life Insurance coverage Firm.

On April 9, 2025, Bain Capital introduced a deal to accumulate a 9.9% stake in Lincoln Monetary for $825 million. The strategic partnership between the 2 could have Bain Capital develop into a strategic asset supervisor companion for sure asset courses, equivalent to non-public credit score, structured property, mortgage loans, and personal fairness.

Lincoln Nationwide reported first quarter 2025 outcomes on Might eighth, 2025, for the interval ending March thirty first, 2025. The corporate generated a internet lack of ($4.41) per share within the quarter, which in contrast unfavorably to internet revenue of $6.93 within the first quarter of 2024.

Adjusted revenue from operations equaled $1.22 per share in comparison with $1.60 in the identical prior yr interval.

Moreover, annuities common account balances rose by 5.4% to $164 billion and group safety insurance coverage premiums grew 6.7% to $1.29 billion. Adjusted e-book worth per share rose 13% in comparison with the prior yr from $65.01 to $73.19.

Click on right here to obtain our most up-to-date Certain Evaluation report on LNC (preview of web page 1 of three proven beneath):

Last Ideas

Excessive dividend shares may be a gorgeous possibility for traders searching for a higher stage of revenue from their funding portfolios.

Whereas no funding comes with out threat, some excessive dividend shares have demonstrated a historical past of monetary stability, constant earnings, and dependable dividend funds.

Excessive dividend shares carry elevated dangers, so traders ought to make sure you conduct thorough analysis earlier than shopping for.

Extra Studying

If you’re focused on discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

And see the sources beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].