[ad_1]

Published on October 28th, 2022, by Quinn Mohammed

Reliable dividend income is often an important factor in investment decision making for retirees.

Dividend Kings and Dividend Aristocrats make great options as an initial screen from which to further narrow down a stock watch list. The companies in these lists have increased their dividends for 50+ and 25+ years, respectively.

To do so, these companies must have remained profitable through multiple economic cycles, and have competitive advantages that set them apart from their peers.

You can see the full downloadable spreadsheet of all 46 Dividend Kings and all 65 Dividend Aristocrats (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

Another important factor in determining whether dividend income is reliable is to analyze the company’s payout ratio. In the below list, all stocks have reasonable payout ratios. These companies should continue to drive earnings growth, and as a result, be capable of raising their dividends every year.

These increasing dividends can help offset the impact of inflation on a retiree’s income. In some cases, companies will increase their dividend even beyond the annual inflation rate. This effectively gives the investor a raise without them having to do anything.

In this article, we will look at 10 retirement stocks that have increased their annual cash dividend paid to shareholders for many years, and that can be relied upon for income.

Table of Contents

Retirement Stock for Income #1: Verizon Communications Inc. (VZ)

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenue, and broadband and cable services account for about a quarter of sales. The company’s network covers about 300 million people and 98% of the U.S.

On October 21st, 2022, the company reported the fiscal year’s third quarter and first nine months results. Revenue was up 4% year-over-year to $34.2 billion for the quarter compared to the third quarter in 2021. Adjusted earnings-per-share equaled $1.32 and compared unfavorably to $1.41 per share in the same prior year period.

Source: Investor Presentation

The company had broadband net additions of 377,000, including 342,000 fixed wireless net additions. This was also the fifth consecutive quarter that business reported more than 150,000 postpaid phone net additions.

The cash flow from operations was down for the year’s first nine months from $31.2 billion to $28.2 billion. Capital expenditures were up $1.9 billion to $15.8 billion in the first nine months. Free cash flow for the quarter was down from $17.3 billion to $12.4 billion for the first nine months of the year.

Verizon expects to generate adjusted earnings per share between $5.10 and $5.25 for fiscal 2022.

Retirement Stock for Income #2: Sonoco Products Co. (SON)

Sonoco Products provides packaging, industrial products, and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction, and food industries.

Sonoco was founded in Hartsville, South Carolina, in 1899 and introduced the first paper textile cone. Sonoco Products is composed of two segments, consumer packaging, and industrial packaging, with all other businesses listed as “all other”.

Source: Investor Presentation

The consumer packaging segment is expected to generate 51% of projected 2022 revenue. Industrial paper packaging is expected to generate 38% of projected 2022 revenue, with all other making up the remaining 11%.

Sonoco Products reported second-quarter earnings on July 21st, 2022. Revenue soared 38% to a record $1.91 billion. Adjusted earnings-per-share also grew considerably, from 84 cents in the prior year to $1.76.

The consumer packaging segment had revenue growth of nearly 66% year-over-year to $990 million, in large part due to the purchase of Ball Metalpack. Increased selling prices also helped the company’s results. The industrial paper packaging segment experienced revenue growth of 20% to $727 million, as a result of increased pricing.

Sonoco Products upgraded its outlook for 2022, and the company now expects adjusted earnings-per-share of $6.20 to $6.30 for the year, which is up from $5.25 to $5.45 previously.

Retirement Stock for Income #3: Leggett & Platt, Inc. (LEG)

Leggett & Platt is a diversified manufacturing company. It was founded in 1883 when an inventor named J.P. Leggett created a bedspring that was superior to the existing products at that time.

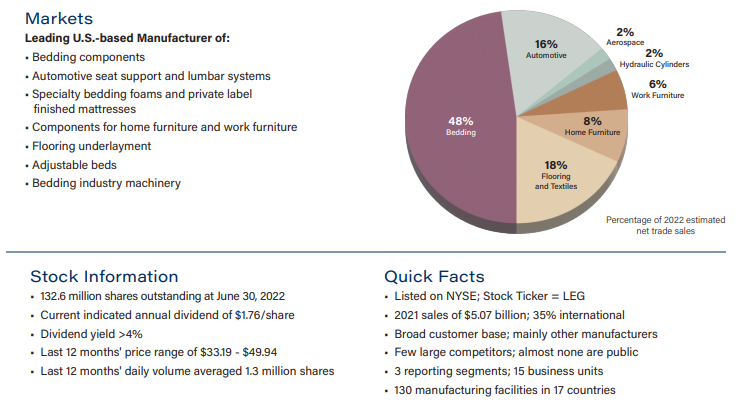

Leggett & Platt is composed of three major segments with a varied product mix and geographic split.

The bedding products segment designs and manufactures bedding components such as bedding industry machinery, steel wire, adjustable beds, and mattress springs.

The specialized products segment revolves around automotive, aerospace, and hydraulic cylinder components. Some product examples would be seat support and lumbar systems, motors and cables, tubing, and hydraulic cylinders. This segment represents 20% of 2022 expected net trade sales.

The furniture, flooring and textile products segment focuses on home furniture, work furniture and flood and textiles.

These three segments account for 50%, 20%, and 30% of 2022 expected net trade sales, respectively.

Source: Investor Presentation

Leggett & Platt reported second quarter 2022 earnings results on August 2nd, 2022. Revenue for the quarter of $1.33 billion rose 5% year-over-year. Earnings-per-share of $0.70 was down 11% from the same prior year period.

Leadership lowered its fiscal 2022 outlook once again, in October, and forecasts sales of $5.1 billion to $5.2 billion, which resulted in a large share price decline. Earnings-per-share is expected to be between $2.30 and $2.45 (compared to $2.65 and $2.80 previously).

Retirement Stock for Income #4: Lowe’s Companies, Inc. (LOW)

Lowe’s Companies is the second-largest home improvement retailer in the U.S. (after Home Depot). Lowe’s operates or services more than 2,200 home improvement and hardware stores in the U.S. and Canada.

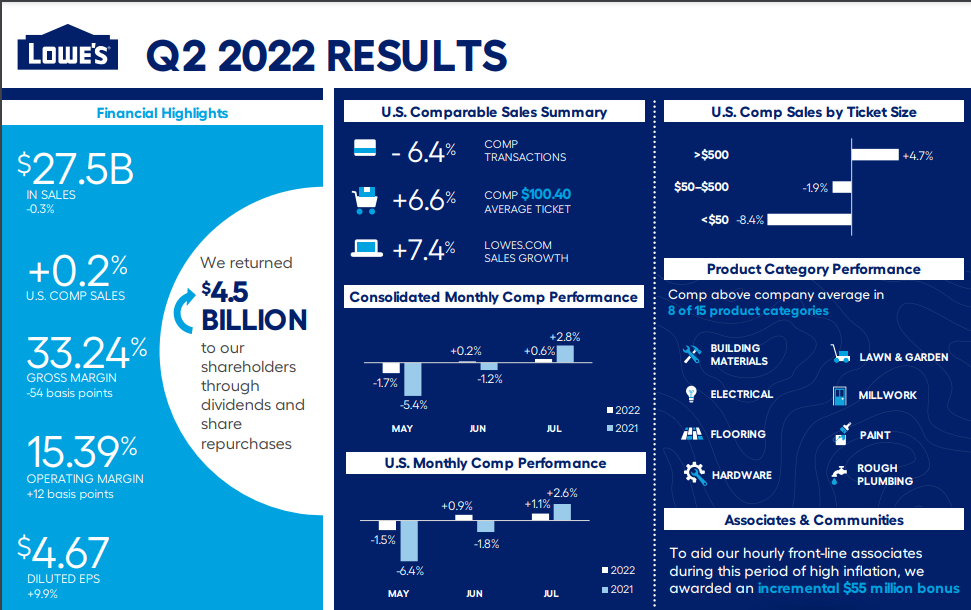

Source: Investor Presentation

Lowe’s reported second-quarter results on August 17th, 2022. Total sales for the second quarter came in at $27.5 billion compared to $27.6 billion in the same quarter a year ago. Comparable sales decreased 0.3%, while U.S. home improvement comparable sales increased 0.2%.

Pro customer sales rose 13% year-over-year. Net earnings of $3.0 billion was in-line with results from Q2 2021. Diluted earnings per share of $4.67 was a 9.9% increase from $4.25 a year earlier.

The company repurchased 21.6 million shares in the second quarter for $4.0 billion. Additionally, it paid out $524 million in dividends. The company remains in a strong liquidity position with $1.5 billion of cash and cash equivalents.

The company reaffirmed its fiscal 2022 outlook and believes it can achieve diluted EPS in the range of $13.10 to $13.60 on total sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion worth of common shares in 2022.

Retirement Stock for Income #5: Walgreens Boots Alliance Inc. (WBA)

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 315,000 people and has more than 13,000 stores.

On October 13th, 2022, Walgreens reported Q4 results for the period ending August 31st, 2022. Sales from continuing operations dipped -5% and adjusted earnings-per-share slumped -32% over the prior year’s quarter, from $1.17 to $0.80, mostly due to high COVID-19 vaccinations in the prior year’s period.

Source: Investor Presentation

Earnings-per-share exceeded analysts’ consensus by $0.03. The company has beaten analysts’ estimates for nine consecutive quarters.

Walgreens is guiding for a roughly 10% decrease in earnings per share for fiscal 2023 to between $4.45 and $4.65 compared to $5.04 in fiscal 2021.

Retirement Stock for Income #6: Realty Income Corp. (O)

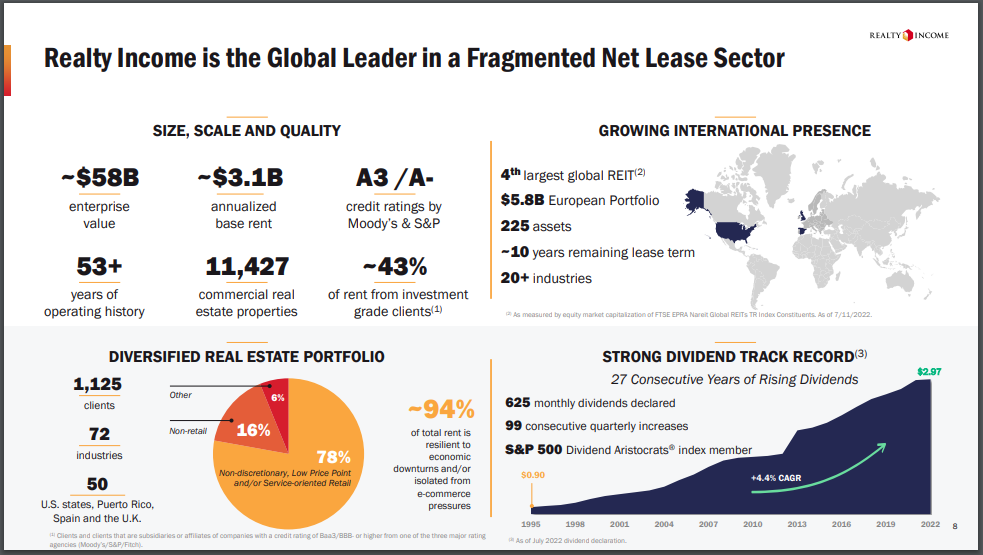

Realty Income is a retail-focused REIT that owns more than 11,000 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Source: Investor Presentation

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Realty Income reported its second-quarter earnings results on August 3rd, 2022. The trust earned revenues of $810 million during the quarter, up 75% year-over-year. Real estate investments into new properties and its acquisition of VEREIT that closed in late 2021 impacted the year-over-year comparison to a significant degree.

Realty Income’s funds-from-operations increased considerably compared to the prior year’s quarter, although AFFO-per-share growth was lower, as a result of a higher share count. Still, the company managed to generate adjusted funds-from operations-per-share of $0.97 during the quarter.

Realty Income is forecasting that funds from operations will come in at about $4 per share for fiscal 2022, which would represent a new record.

Retirement Stock for Income #7: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified health care company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales) and consumer products (~17% of sales). The company is expected to generate at least $95 billion in revenue in 2022.

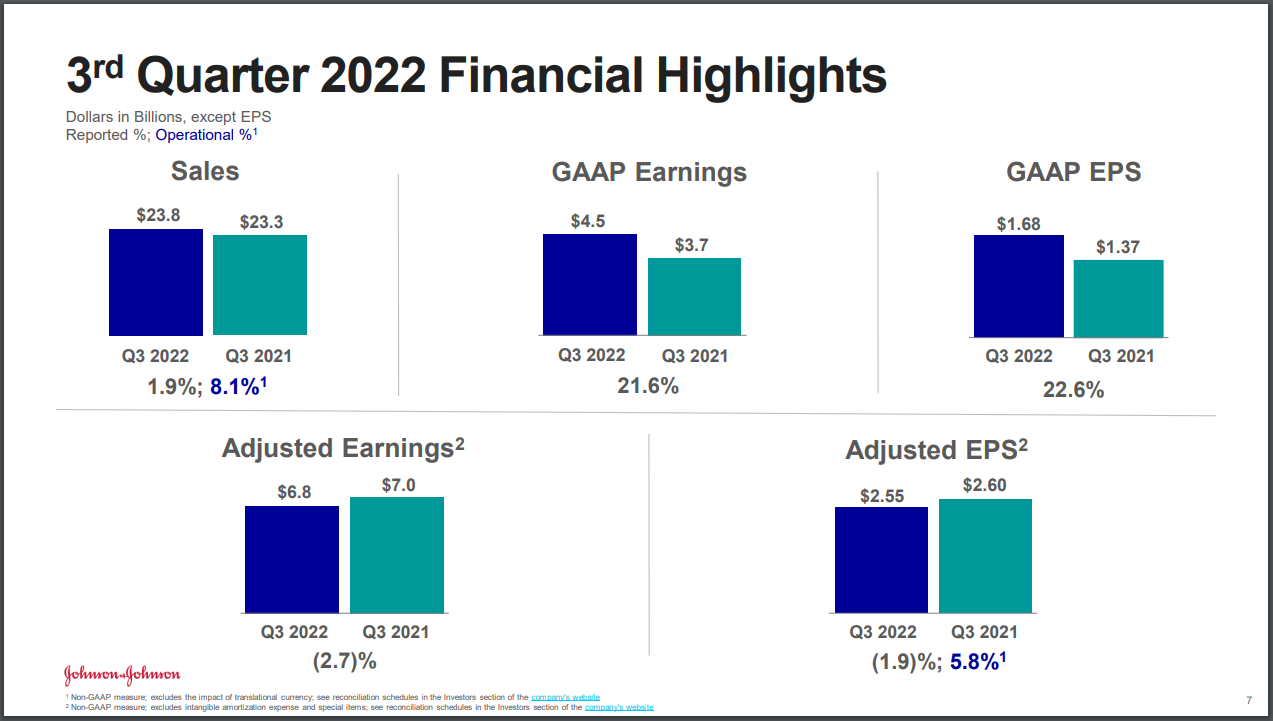

The company’s most recent earnings report was delivered on October 18th, 2022, for the third quarter. Results were better than expected on both revenue and profits.

Source: Investor Presentation

For the third quarter, adjusted earnings-per-share came to $2.55, which was six cents ahead of expectations, but compared unfavorably to $2.60 in the prior year. Revenue was $23.8 billion, up 2% year-over-year and $360 million ahead of estimates.

Johnson & Johnson narrowed its earnings per share guidance to $10.02 to $10.07 (compared to $10.00 to $10.00 previously) and lowered its revenue guidance to be between $93.0 billion and $93.5 billion ($93.3 billion to $94.3 billion previously). The guidance revision was a result of the strengthening U.S. dollar.

Retirement Stock for Income #8: Procter & Gamble (PG)

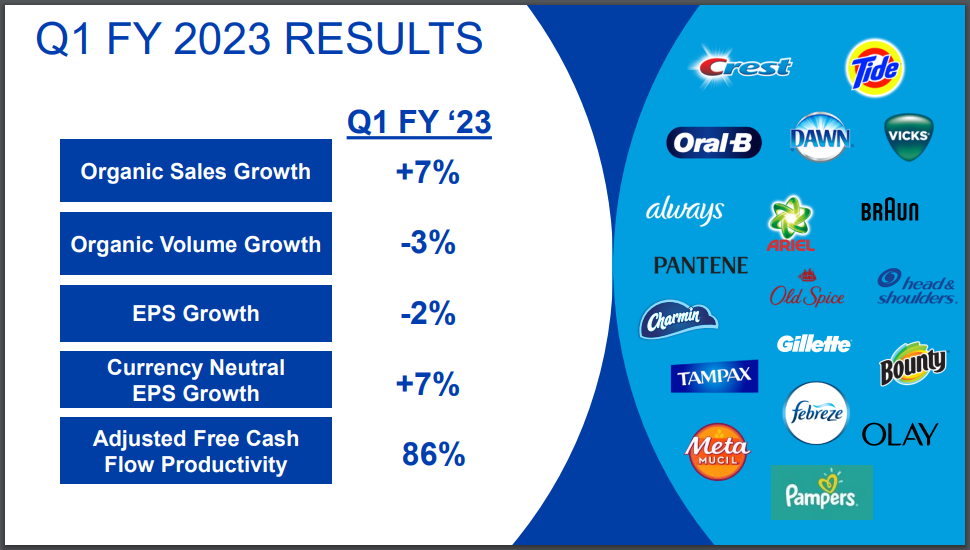

Procter & Gamble is a consumer products giant that sells its products in more than 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and many more. The company generated $80 billion in sales in fiscal 2022.

Procter & Gamble has paid a dividend for 131 years and has grown its dividend for 66 consecutive years – one of the longest active streaks of any company. On April 12th, 2022, Procter & Gamble raised its dividend by 5.0%, from $0.8698 per quarter to $0.9133.

Source: Investor Presentation

Procter & Gamble reported financial results for the first quarter of fiscal 2023 on October 19th, 2022. The company grew its sales and its organic sales by 1% and 7%, respectively, over the prior year’s quarter.

Organic sales growth resulted from 9% price hikes and a 1% increase from positive product mix, which was partly offset by a -3% decrease in volumes. High-cost inflation reduced gross margin by 160 basis points. Core earnings-per-share declined 2% compared to first quarter 2022.

The firm sales amid strong price hikes are a testament to the strength of the brands of Procter & Gamble. The company continues to expect 3% to 5% growth of organic sales in fiscal 2023 and 0% to 4% growth of earnings-per-share.

Retirement Stock for Income #9: AbbVie Inc. (ABBV)

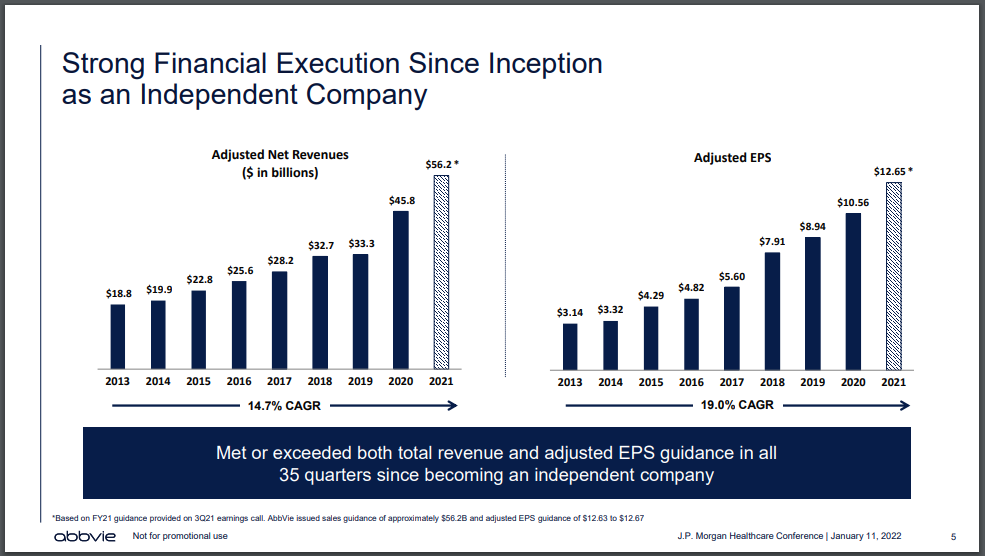

AbbVie Inc. is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. Humira will lose patent protection in the U.S. in 2023.

Still, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

Source: Investor Presentation

AbbVie reported its second quarter earnings results on July 29th, 2022. The company generated revenues of $14.6 billion during the quarter, 4% higher than AbbVie’s revenues during the previous year’s quarter.

AbbVie’s revenue was positively impacted by compelling growth from some of its newer drugs, including Skyrizi and Rinvoq. The impact of the Allergan acquisition has now been fully lapped, which is why it didn’t have a one-time impact on sales growth any longer, unlike in recent previous quarters.

AbbVie earned $3.37 per share during the second quarter, which was up 11% year-over-year. AbbVie’s guidance for 2022’s adjusted earnings-per-share was lowered slightly, and the company now expects to earn $13.78 to $13.98 on a per-share basis this year.

Retirement Stock for Income #10: PepsiCo Inc. (PEP)

PepsiCo is a major consumer staples stock. It has a large portfolio of quality brands, including more than 20 individual brands that generate annual sales of $1 billion or more. Just a few of its core brands include Pepsi, Frito-Lay, Quaker, Gatorade, Naked, and many more.

Source: Investor Presentation

PepsiCo announced earnings results for the third quarter on October 12th, 2022. Revenue rose by 8.8% to nearly $22 billion, which was ahead of expectations by $1.15 billion.

Adjusted earnings-per-share equaled $1.97, a 10% increase from Q3 2021. Year-to-date, revenue increased 7.7% to $58.4 billion while adjusted EPS increased 11% to $5.12.

Unit volumes for food and snack decreased by 1.5%. Beverage volume increased by 3%. Revenue for PepsiCo Beverages North America improved by 13%, with a 7% increase in volumes. Frito-Lay North America’s revenue grew 20% even though volumes were down by 2%. Lastly, Quaker Foods North America’s revenue was up 16%, with a 4% volume decrease.

PepsiCo updated its outlook for 2022, and the company now expects adjusted earnings-per-share of $6.73 for the full year.

Final Thoughts

Companies which have increased their dividends for multiple decades, have reasonable payout ratios, and growing earnings make great candidates for retirement stocks that can be relied upon for income.

A good starting place to find such candidates are the Dividend Kings List, Dividend Aristocrats List, and to a lesser extent, the Blue-Chip Stocks List.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected]

[ad_2]

Source link