[ad_1]

Printed on March fifteenth, 2023 by Aristofanis Papadatos

Just a few days in the past, the inventory of Silicon Valley Financial institution (SVB) collapsed. Attributable to fast-rising rates of interest, the financial institution incurred materials losses within the bonds it had bought when rates of interest have been depressed. With a purpose to cowl its losses, the financial institution issued new shares. Underneath regular circumstances, the financial institution would simply cowl its paper losses and retrieve them upon the maturity of its bonds. Nonetheless, most of its depositors have been enterprise capitalists and know-how startups, who panicked on the information, and thus they withdrew extreme quantities from the financial institution. They primarily triggered a financial institution run, and therefore Silicon Valley Financial institution failed.

The collapse of Silicon Valley Financial institution induced an enormous sell-off of your complete monetary sector, as buyers feared that almost all banks have incurred paper losses as a consequence of rising rates of interest and thus they could comply with the trail of Silicon Valley Financial institution. Regional banks have been notably hit, as they have been thought of extra susceptible to a possible financial institution run.

Nonetheless, the Federal Deposit Insurance coverage Company (FDIC) is not going to permit panic to prevail in your complete monetary system. Which means the shares of banks with strong fundamentals have been punished to the intense by the market. That is the definition of the emergence of uncommon investing alternatives. This text will talk about the prospects of 10 regional banks, which have strong enterprise fundamentals and have change into exceptionally engaging after the current sell-off. We now have ranked the banks so as of anticipated 5-year annual whole return, from lowest to highest.

You may obtain your free copy of the Dividend Champions listing, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

Desk of Contents

You may immediately leap to any particular part of the article by utilizing the hyperlinks under:

Regional Financial institution #10: Cullen/Frost Bankers (CFR)

The roots of Cullen/Frost Bankers return to 1868 when Frost Financial institution was established in San Antonio, Texas, the place T.C. Frost supplied Texans with the provides they wanted to prosper on the frontier. In 1977, Frost merged with Houston-based Cullen Bankers to change into Cullen/Frost Bankers. The corporate operates over 170 branches and 1,700 ATMs in Texas metropolitan areas, the place the community-oriented financial institution serves people and native companies. The Financial institution provides client and industrial loans, funding administration companies, mutual funds, insurance coverage, brokerage, and leasing.

Cullen/Frost has been persistently rising its earnings per share over the past decade, with simply slight declines in 2013, 2015, and 2019. The corporate has grown its earnings per share by 9.8% per yr on common over the past decade. Its earnings per share decreased by 25% in 2020 as a result of pandemic however recovered strongly in 2021.

Cullen/Frost generates most of its income from web curiosity earnings. Depressed rates of interest have supplied a headwind for years, however the Fed has been elevating them aggressively since final yr. We thus count on blowout earnings per share this yr and 1% common annual development past this yr as a consequence of a excessive comparability base.

Because of its disciplined enterprise mannequin, Cullen/Frost has proved resilient to downturns, together with the Nice Recession. The financial institution incurred only a 14% lower in its earnings per share in 2009 and saved rising its dividend, in distinction to most banks.

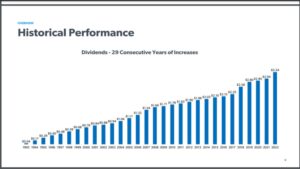

Cullen/Frost has raised its dividend for 29 consecutive years.

Supply: Investor Presentation

The inventory is at present providing a 3.1% dividend yield. Given the wholesome payout ratio of 32% of the inventory and its defensive enterprise mannequin, its dividend has a large margin of security.

Based mostly on anticipated earnings per share of $11.00 this yr, Cullen/Frost is buying and selling at a 10-year low ahead price-to-earnings ratio of 10.1, which is decrease than our assumed truthful earnings a number of of 14.0 of the inventory. If the inventory trades at its common valuation stage in 5 years, it would take pleasure in a 6.7% annualized achieve in its returns. Given additionally the three.1% dividend of the inventory and 1.0% development of earnings per share, Cullen/Frost can provide a ten.3% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cullen/Frost Bankers (CFR) (preview of web page 1 of three proven under):

Regional Financial institution #9: Farmers & Retailers Bancorp (FMCB)

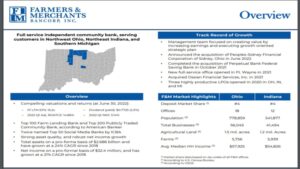

Based in 1916, Farmers & Retailers Bancorp is a domestically owned and operated neighborhood financial institution with 32 areas in California. Attributable to its small market cap ($773 million) and its low buying and selling quantity, it passes below the radar of most buyers. However, F&M Financial institution has paid uninterrupted dividends for 87 consecutive years and has raised its dividend for 58 consecutive years. Because of this, it’s a Dividend King.

The corporate is conservatively managed and, till seven years in the past, had not made an acquisition since 1985. Nonetheless, within the final seven years, it has aggressively pursued development.

Supply: Investor Presentation

It acquired Delta Nationwide Bancorp in 2016 and elevated its areas by 4. Furthermore, in late 2018, it acquired Financial institution of Rio Vista, which has helped F&M Financial institution to additional increase within the San Francisco East Bay Space.

Earlier than 2018, F&M Financial institution grew its earnings per share at a 10-year common annual price of two.2%. Because the Fed has raised rates of interest aggressively since final yr and the financial institution has solely lately begun to pursue development extra aggressively, we count on a 9% development of earnings per share this yr and a 5.0% annual development of earnings per share past this yr. The brand new department in Oakland will likely be a contributor to development, which opened within the fourth quarter of 2021.

F&M Financial institution is a prudently managed financial institution that has at all times focused a conservative capital ratio. The financial institution at present has a complete capital ratio of 13.1%, which ends up in the very best regulatory classification of “effectively capitalized.” Furthermore, its credit score high quality stays exceptionally sturdy, as its portfolio has extraordinarily few non-performing loans and leases.

The deserves of this technique have been on show throughout the Nice Recession. Whereas most banks incurred a collapse of their earnings, F&M Financial institution reported a modest 9% lower in its earnings per share and saved elevating its dividend. The inventory is at present providing a 1.6% dividend yield, with a payout ratio of solely 16%. Thus, its dividend will stay on the rise for a lot of extra years.

Based mostly on anticipated earnings per share of $105.00 this yr, F&M Financial institution is buying and selling at a ahead price-to-earnings ratio of 9.8, which is decrease than our assumed truthful earnings a number of of 12.0 of the inventory. If the inventory trades at its truthful valuation stage in 5 years, it would take pleasure in a 4.2% annualized achieve in its returns. Given additionally the 1.6% dividend of the inventory and 5.0% development of earnings per share, F&M Financial institution can provide a ten.7% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Farmers & Retailers Bancorp (FMCB) (preview of web page 1 of three proven under):

Regional Financial institution #8: Republic Bancorp (RBCAA)

Republic Bancorp is a monetary holding firm headquartered in Louisville, Kentucky, offering conventional and non-traditional banking merchandise to its prospects. It has 42 full-service banking facilities in 5 states, with a lot of the facilities in Kentucky. The financial institution provides financial savings, checking and cash market accounts whereas it additionally originates residential mortgage loans, dwelling fairness loans, industrial actual property loans, credit score strains and provides private and enterprise banking companies.

Republic Bancorp is characterised by conservative administration centered on sustaining pristine credit score high quality metrics. Non-performing loans are solely 0.37% of whole loans, whereas web mortgage charge-offs are solely 0.01% of whole loans. Because of its prudent technique, the corporate has proved resilient to recessions. Within the Nice Recession, Republic Bancorp continued rising its earnings and dividend, in sharp distinction to most banks. The financial institution has proved resilient all through the pandemic as effectively.

The conservative technique of Republic Bancorp leads to slower development throughout increase occasions however rather more dependable efficiency throughout downturns. That is the important thing behind the sturdy dividend development file of Republic Bancorp, which has raised its dividend for 22 consecutive years. The inventory is at present providing a 10-year excessive dividend yield of three.7%. Given its strong payout ratio of 33% and its defensive enterprise mannequin, the financial institution can preserve elevating its dividend for a lot of extra years.

Republic Bancorp has exhibited a strong efficiency file over the past decade. It has grown its earnings per share at a 15.9% common annual price over the past decade and at a 12.9% common annual price over the past 5 years. The financial institution is making an attempt to develop by increasing its attain through digital channels and buying smaller friends, whereas additionally it is doing its finest to cut back its working prices. However, as a consequence of a considerably excessive comparability base fashioned this yr amid high-interest charges, we favor to imagine only a 3.0% development of earnings per share over the subsequent 5 years, so as to be on the secure aspect.

Based mostly on anticipated earnings per share of $5.95 this yr, Republic Bancorp is buying and selling at a virtually 10-year low ahead price-to-earnings ratio of 9.0, which is decrease than the 7-year common earnings a number of of 11.5 of the inventory. If the inventory trades at its common valuation stage in 5 years, it would take pleasure in a 5.0% annualized achieve in its returns. Given additionally the three.7% dividend of the inventory and three.0% development of earnings per share, Republic Bancorp can provide an 11.1% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Republic Bancorp (RBCAA) (preview of web page 1 of three proven under):

Regional Financial institution #7: Group Belief Bancorp (CTBI)

Group Belief Bancorp is a regional financial institution with 84 department areas in 35 counties in Kentucky, Tennessee, and West Virginia. It’s Kentucky’s second-largest financial institution holding firm, with a $5.5 billion steadiness sheet. Attributable to its small market capitalization, it doesn’t belong to the S&P 500 index and therefore it’s not thought of a Dividend Aristocrat although it has raised its dividend for 42 consecutive years.

The important thing aggressive benefit of Group Belief Bancorp is its disciplined and conservative administration. Its enterprise mannequin leads to slower development throughout increase occasions however in resilient efficiency throughout recessions. Within the Nice Recession, Group Belief Bancorp remained worthwhile and saved elevating its dividend.

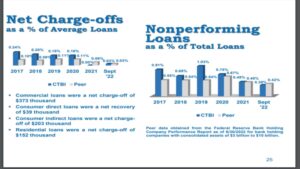

The recession from the pandemic in 2020 induced an 8% lower within the earnings per share of Group Belief Bancorp, however this enterprise efficiency is superior to that of most different banks because of the conservative mortgage portfolio. To supply a perspective, the financial institution has reported common web mortgage charge-offs of solely 0.03% within the final 4 quarters.

Supply: Investor Presentation

Because of the current sell-off, the inventory is providing a virtually 10-year excessive dividend yield of 4.5%. Given its strong payout ratio of 39% and its defensive enterprise mannequin, the corporate is prone to proceed elevating its dividend for a lot of extra years.

Furthermore, Group Belief Bancorp has grown its earnings per share at a 6.4% common annual price over the past decade and at a 9.5% common annual price over the past 5 years. The economic system has recovered from the pandemic, and the Fed has raised rates of interest aggressively in current quarters. Larger rates of interest have enhanced the online curiosity margin of the financial institution, however they’ve induced deceleration of the economic system, as supposed. Furthermore, the non-recurring decreases within the financial institution’s tax price, which fueled an awesome portion of the bottom-line development in 2018 and 2019, will now not be development drivers. Because of this, we count on slower development within the upcoming years. We count on Group Belief Bancorp to develop its earnings per share at a 2.0% common annual price over the subsequent 5 years.

Based mostly on anticipated earnings per share of $4.55 this yr, Group Belief Bancorp is buying and selling at a ahead price-to-earnings ratio of 8.6, which is far decrease than our assumed truthful earnings a number of of 12.0 of the inventory. If the inventory trades at its truthful valuation stage in 5 years, it would take pleasure in a 7.0% annualized achieve in its returns. Given additionally the 4.5% dividend of the inventory and a couple of.0% development of earnings per share, Group Belief Bancorp can provide a 12.5% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Group Belief Bancorp (CTBI) (preview of web page 1 of three proven under):

Regional Financial institution #6: Enterprise Bancorp (EBTC)

Enterprise Bancorp was fashioned in 1996 because the mother or father holding firm of Enterprise Financial institution and Belief Firm, known as Enterprise Financial institution. Enterprise has 27 full-service branches within the North Central area of Massachusetts and Southern New Hampshire. The corporate’s main enterprise operation is gathering deposits from most people and investing in industrial loans and funding securities.

Enterprise has an impressive efficiency file, because it has remained worthwhile for 133 consecutive quarters. This can be a testomony to its prudent administration and its give attention to sustainable long-term development. The financial institution has grown its earnings per share at an 11.1% common annual price over the past decade and has grown its earnings per share in all however two years all through this era.

Enterprise opened a brand new department in North Andover in January 2021 and its 27th department in Londonderry, New Hampshire, in Might 2022. Whereas opening two new branches is just not important for many banks, it can be crucial for Enterprise, because it has elevated its department rely by 8%. Furthermore, the Fed is elevating rates of interest aggressively in an effort to maintain inflation below management. It can thus improve the online curiosity margin of Enterprise. Thanks to those tailwinds, we count on Enterprise to develop its earnings per share by 8% this yr and by 3% per yr past this yr.

Because of its disciplined administration, Enterprise has grown its dividend for 29 consecutive years. Over the last decade, the financial institution has grown its dividend at a 6.6% common annual price. The inventory is at present providing a virtually 10-year excessive dividend yield of two.9%, with a wholesome payout ratio of 24%. It’s thus prone to preserve elevating its dividend for a lot of extra years.

Based mostly on anticipated earnings per share of $3.80 this yr, Enterprise is buying and selling at a ahead price-to-earnings ratio of 8.4, which is far decrease than our assumed truthful earnings a number of of 12.0 of the inventory. If the inventory trades at its truthful valuation stage in 5 years, it would take pleasure in a 7.3% annualized achieve in its returns. Given additionally the two.9% dividend of the inventory and three.0% development of earnings per share, Enterprise can provide a 12.8% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Enterprise Bancorp (EBTC) (preview of web page 1 of three proven under):

Regional Financial institution #5: Prosperity Bancshares (PB)

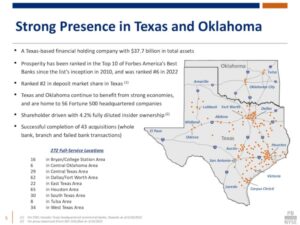

Prosperity Bancshares was fashioned in 1983 to amass the previous Allied Financial institution – chartered in 1949 because the First Nationwide Financial institution of Edna, Texas, now referred to as Prosperity Financial institution. The financial institution’s predominant operation is receiving deposits from most people and utilizing the capital to originate industrial and client loans. Prosperity Bancshares operates 261 branches within the larger Houston space, some neighboring counties in Texas, and 14 extra branches in Oklahoma.

Prosperity Bancshares has grown its earnings per share at a 5.1% common annual price over the past decade, main because of sturdy financial exercise in Texas and Oklahoma. Texas has the fastest-growing inhabitants and one of many highest financial development charges within the nation.

Supply: Investor Presentation

Additionally it is anticipated to outperform most different states in financial development within the upcoming years. Prosperity Bancshares stalled from 2014 to 2017, but it surely has reignited development within the final 5 years.

As well as, the pandemic has not disrupted the financial institution’s development trajectory. Furthermore, the Fed has been elevating rates of interest aggressively since final yr, and thus, it would present a tailwind to the financial institution’s web curiosity earnings. Because of the all-time excessive anticipated earnings this yr, we count on the financial institution to develop its earnings per share by 4.0% per yr on common over the subsequent 5 years.

Prosperity Bancshares initiated a quarterly dividend of $0.025 per share in early 1999 and has grown it at a quick clip to $0.55 per quarter. Within the final 5 years, the financial institution has raised its dividend by 8% per yr on common, and it’s at present providing a 10-year excessive dividend yield of three.5%. Because of its low payout ratio (37%) and its promising development prospects, it ought to be capable to proceed elevating its dividend meaningfully for a lot of extra years.

Based mostly on anticipated earnings per share of $5.95 this yr, Prosperity Bancshares is buying and selling at a 10-year low ahead price-to-earnings ratio of 10.4, which is decrease than the 10-year common earnings a number of of 14.3 of the inventory. If the inventory trades at its historic valuation stage in 5 years, it would take pleasure in a 6.5% annualized achieve in its returns. Given additionally the three.5% dividend of the inventory and 4.0% development of earnings per share, Prosperity Bancshares can provide a 13.5% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Prosperity Bancshares (PB) (preview of web page 1 of three proven under):

Regional Financial institution #4: Financial institution OZK (OZK)

Financial institution OZK, beforehand Financial institution of the Ozarks, is a regional financial institution that gives companies reminiscent of checking, enterprise banking, industrial loans and mortgages to its prospects in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California. Financial institution OZK is the most important financial institution in its dwelling state of Arkansas.

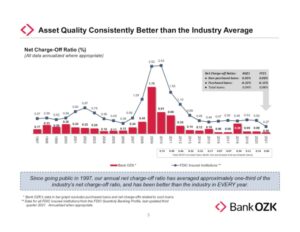

The important thing aggressive benefit of Financial institution OZK is its exemplary administration. The corporate has proved exceptionally resilient to recessions because of its rock-solid enterprise execution, which ends up in superior asset high quality.

Supply: Investor Presentation

Because of its excessive asset high quality and robust enterprise execution, Financial institution OZK has raised its dividend for 27 consecutive years. When most banks incurred extreme losses and lower their dividends within the Nice Recession, Financial institution OZK continued elevating its dividend. Notably, the financial institution has raised its dividend in each single quarter since 2010. Additionally it is providing a 3.6% dividend, with an exceptionally low payout ratio of 25%. Due to this fact, the financial institution is prone to preserve elevating its dividend for a lot of extra years.

Financial institution OZK had grown its earnings per share in nearly yearly for the reason that monetary disaster. Over the last decade, the corporate has grown its common earnings per share by 16% per yr. Financial institution OZK has not solely been rising organically, but it surely has repeatedly carried out high-return acquisitions. However, as a result of excessive comparability base fashioned by its all-time excessive anticipated earnings per share of $5.40 this yr, we count on simply 3.0% development of earnings per share going ahead.

Based mostly on anticipated earnings per share of $5.40 this yr, Financial institution OZK is buying and selling at a ahead price-to-earnings ratio of seven.0, which is far decrease than a typical earnings a number of of 11.0 for a financial institution. If the inventory trades at its truthful valuation stage in 5 years, it would take pleasure in a 9.3% annualized achieve in its returns. Given additionally the three.6% dividend of the inventory and three.0% development of earnings per share, Financial institution OZK can provide a 15.2% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Financial institution OZK (OZK) (preview of web page 1 of three proven under):

Regional Financial institution #3: Huntington Bancshares (HBAN)

Based in 1866 and headquartered in Columbus, Ohio, Huntington Bancshares is a regional financial institution holding firm with $183 billion in belongings. The corporate provides full-service industrial, small enterprise, and client banking companies by means of greater than 1,100 branches in 11 states.

In distinction to a lot of the banks mentioned on this article, Huntington has exhibited a way more unstable efficiency file and has proved extremely susceptible to financial downturns. Within the Nice Recession, Huntington misplaced important cash and needed to take drastic actions. It practically eradicated its dividend and primarily doubled its share rely whereas its inventory value collapsed from $25 to only $1. Earnings per share haven’t but reached the pre-recession peak as a result of hefty issuance of recent shares.

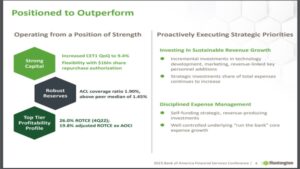

Huntington has grown its earnings per share by 8.5% per yr on common over the past decade, partly because of a catch up from a horrible efficiency throughout the Nice Recession. The financial institution was damage by the fierce recession brought on by the pandemic in 2020, but it surely has absolutely recovered from that downturn.

It has additionally lately improved its credit score metrics.

Supply: Investor Presentation

Because of this, the financial institution is now effectively positioned to make the most of the hikes of rates of interest carried out by the Fed. Total, given the excessive comparability base fashioned by the 10-year excessive earnings anticipated this yr and the vulnerability of Huntington to downturns, we count on the financial institution to develop its earnings per share at a 2.0% common annual price over the subsequent 5 years.

Huntington saved its dividend flat in 2020-2021, so it doesn’t have a dividend development file. Attributable to its current sell-off, the inventory is at present providing a 10-year excessive dividend yield of 5.6%. Huntington has a wholesome payout ratio of 39%, however its enterprise efficiency is considerably unreliable. Because of this, its dividend is just not completely secure. Alternatively, the inventory has change into markedly low cost.

Based mostly on anticipated earnings per share of $1.60 this yr, Huntington is buying and selling at a 10-year low ahead price-to-earnings ratio of 6.9, which is much decrease than our assumed truthful earnings a number of of 11.0 of the inventory. If the inventory trades at its truthful valuation stage in 5 years, it would take pleasure in a 9.9% annualized achieve in its returns. Given additionally the 5.6% dividend of the inventory and a couple of.0% development of earnings per share, Huntington can provide a 15.7% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Huntington Bancshares (HBAN) (preview of web page 1 of three proven under):

Regional Financial institution #2: M&T Financial institution (MTB)

M&T Financial institution is a regional financial institution with branches in New York, Maryland, Pennsylvania, and West Virginia. It has greater than 800 whole branches unfold out amongst these 4 states. Virtually half of the mortgage guide of the financial institution consists of business actual property (47% of portfolio), with the rest of loans consisting of client actual property (8%), industrial loans (29%), and client loans (16%).

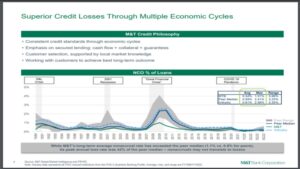

M&T Financial institution incurred a 43% plunge in its earnings per share within the Nice Recession however recovered swiftly within the ensuing years. Since 2009, there have been solely two different years (2014, 2020) by which the corporate didn’t develop its earnings. This constant efficiency is a testomony to the disciplined enterprise mannequin of the financial institution, which can be confirmed by the superior file of the financial institution with respect to credit score losses.

Supply: Investor Presentation

M&T Financial institution has compounded its earnings per share by 7% per yr on common over the past decade. Given the considerably excessive comparability base fashioned this yr, we count on a 6.0% development going ahead.

Attributable to its current sell-off, M&T Financial institution is at present providing a 10-year excessive dividend yield of 4.1%. M&T Financial institution has a wholesome payout ratio of 28% and a reasonably dependable enterprise mannequin. Because of this, its dividend has a large margin of security. As well as, the inventory has change into markedly low cost.

Based mostly on anticipated earnings per share of $18.30 this yr, M&T Financial institution is buying and selling at a 10-year low ahead price-to-earnings ratio of 6.9, which is far decrease than our assumed truthful earnings a number of of 10.0 of the inventory. If the inventory trades at its truthful valuation stage in 5 years, it would take pleasure in a 7.6% annualized achieve in its returns. Given additionally the 4.1% dividend of the inventory and 6.0% development of earnings per share, M&T Financial institution may provide a 16.5% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on M&T Financial institution (MTB) (preview of web page 1 of three proven under):

Regional Financial institution #1: KeyCorp (KEY)

Headquartered in Cleveland, Ohio, KeyCorp has been in enterprise for over 190 years and is now one of many largest bank-based monetary companies firms within the U.S., with $190 billion in belongings. The corporate operates in 15 states with roughly 1,300 ATMs and 1,000 full-service branches.

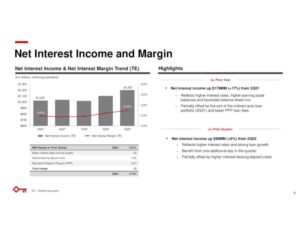

KeyCorp has grown its earnings per share by 8.4% per yr on common over the past decade. Additionally it is prone to profit from the aggressive rate of interest hikes carried out by the Fed, as its web curiosity margin appears to be in a sustained uptrend.

Supply: Investor Presentation

However, as a result of excessive comparability base fashioned this yr, we count on the financial institution to develop its backside line by solely 4.0% per yr on common over the subsequent 5 years.

Additionally it is necessary to notice that KeyCorp has a a lot much less dependable enterprise mannequin than a lot of the banks mentioned on this article. Within the Nice Recession, its shareholders incurred devastating losses as a result of extreme losses of the corporate. This can be a main purpose behind the 33% stoop of the inventory within the current sell-off, in only a few days.

Attributable to its huge sell-off, KeyCorp is at present providing a 10-year excessive dividend yield of 6.8%. KeyCorp has an honest payout ratio of 41%, however its enterprise efficiency is unreliable. Because of this, its dividend is just not secure. Alternatively, the inventory has change into markedly low cost.

Based mostly on anticipated earnings per share of $2.00 this yr, KeyCorp is buying and selling at a 10-year low ahead price-to-earnings ratio of 6.0, which is half the 10-year common earnings a number of of 12.0 of the inventory. If the inventory trades at its common valuation stage in 5 years, it would take pleasure in a 14.9% annualized achieve in its returns. Given additionally the 6.8% dividend of the inventory and 4.0% development of earnings per share, KeyCorp may provide a 23.1% common annual whole return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on KeyCorp (KEY) (preview of web page 1 of three proven under):

Last Ideas

The above 10 regional banks have change into exceptionally low cost as a result of brutal sell-off of your complete monetary sector in the previous few days. KeyCorp has the very best anticipated return, but it surely additionally has elevated threat as a consequence of its inconsistent enterprise efficiency. We thus consider that the 2 most tasty shares are M&T Financial institution and Financial institution OZK. These two high-quality firms have proved resilient to downturns because of their exemplary managements. We now have a robust conviction that these two shares will provide extreme returns to affected person buyers off their present ranges. We additionally count on double-digit whole annual returns with negligible threat from Prosperity Bancshares, Enterprise Bancorp, Group Belief Bancorp, F&M Financial institution, all of which have disciplined managements and a high-quality enterprise mannequin in place.

If you’re concerned with discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases will likely be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link