Revealed on July seventh, 2025 by Bob Ciura

The know-how trade is among the most enjoyable areas of the inventory market, recognized for its excessive development and propensity to create large returns for early buyers.

Till not too long ago, the know-how sector was not recognized for being a supply of high-quality dividend funding concepts.

That is now not the case.

Immediately, a few of the most interesting dividend shares come from the tech sector.

With that in thoughts, we’ve compiled an inventory of 130+ know-how shares full with vital investing metrics, which you’ll be able to obtain by clicking beneath:

It’s not straightforward to search out dividend shares from the tech sector which have greater yields than the S&P 500 common (presently at 1.3%).

Certainly, the Know-how Choose Sector SPDR ETF (XLK) yields simply 0.6% proper now.

Nevertheless, excessive dividend tech shares do exist. This text will talk about the ten highest yielding shares within the Positive Evaluation Analysis Database.

The shares are ranked so as of present dividend yield, in ascending order.

Desk of Contents

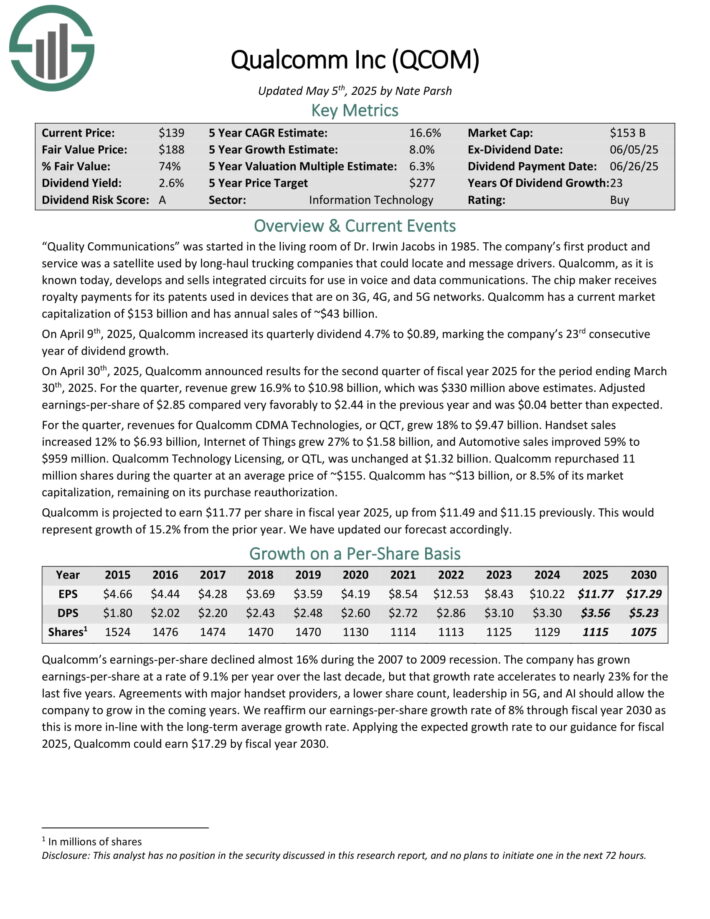

Excessive Dividend Tech Inventory #10: Qualcomm Inc. (QCOM)

Qualcomm develops and sells built-in circuits to be used in voice and information communications. The chip maker receives royalty funds for its patents utilized in gadgets which can be on 3G, 4G, and 5G networks. Qualcomm has annual gross sales of ~$43 billion.

On April ninth, 2025, Qualcomm elevated its quarterly dividend 4.7% to $0.89, marking the corporate’s twenty third consecutive 12 months of dividend development.

On April thirtieth, 2025, Qualcomm introduced outcomes for the second quarter of fiscal 12 months 2025 for the interval ending March thirtieth, 2025. For the quarter, income grew 16.9% to $10.98 billion, which was $330 million above estimates.

Adjusted earnings-per-share of $2.85 in contrast very favorably to $2.44 within the earlier 12 months and was $0.04 higher than anticipated.

For the quarter, revenues for Qualcomm CDMA Applied sciences, or QCT, grew 18% to $9.47 billion. Handset gross sales elevated 12% to $6.93 billion, Web of Issues grew 27% to $1.58 billion, and Automotive gross sales improved 59% to $959 million. Qualcomm Know-how Licensing, or QTL, was unchanged at $1.32 billion.

Qualcomm repurchased 11 million shares throughout the quarter at a mean worth of ~$155. Qualcomm has ~$13 billion, or 8.5% of its market capitalization, remaining on its buy reauthorization.

Qualcomm is projected to earn $11.77 per share in fiscal 12 months 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on QCOM (preview of web page 1 of three proven beneath):

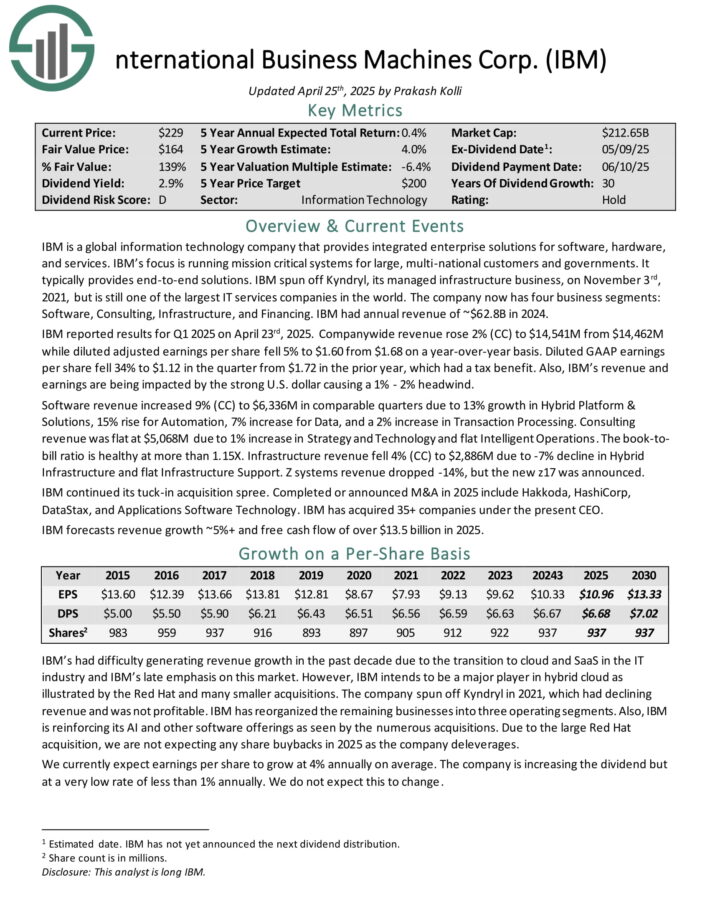

Excessive Dividend Tech Inventory #9: Worldwide Enterprise Machines (IBM)

IBM is a worldwide info know-how firm that gives built-in enterprise options for software program, {hardware}, and providers.

IBM’s focus is working mission crucial methods for giant, multi-national prospects and governments. It sometimes supplies end-to-end options.

The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing. IBM had annual income of ~$62.8B in 2024.

IBM reported outcomes for Q1 2025 on April twenty third, 2025. Firm-wide income rose 2% whereas diluted adjusted earnings per share fell 5% to $1.60 from $1.68 on a year-over-year foundation.

Diluted GAAP earnings per share fell 34% to $1.12 within the quarter from $1.72 within the prior 12 months, which had a tax profit. Additionally, IBM’s income and earnings are being impacted by the robust U.S. greenback inflicting a 1% – 2% headwind.

Software program income elevated 9% in comparable quarters attributable to 13% development in Hybrid Platform & Options, 15% rise for Automation, 7% enhance for Knowledge, and a 2% enhance in Transaction Processing.

Consulting income was flat attributable to 1% enhance in Technique and Know-how and flat Clever Operations. The book-to-bill ratio is wholesome at greater than 1.15X.

Infrastructure income fell 4% (CC) attributable to -7% decline in Hybrid Infrastructure and flat Infrastructure Help. Z methods income dropped -14%, however the brand new z17 was introduced.

Click on right here to obtain our most up-to-date Positive Evaluation report on IBM (preview of web page 1 of three proven beneath):

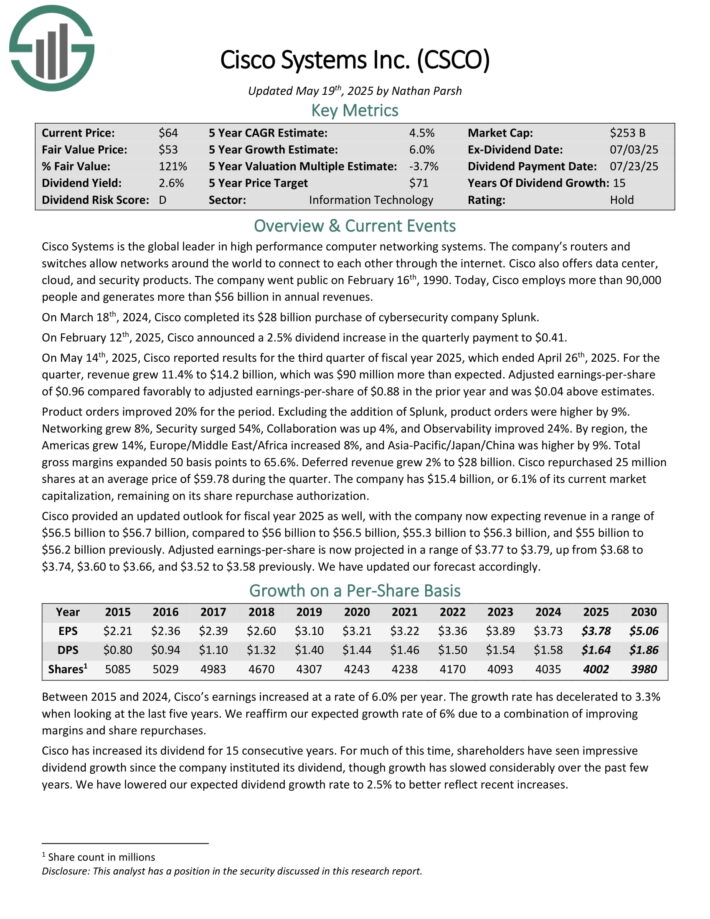

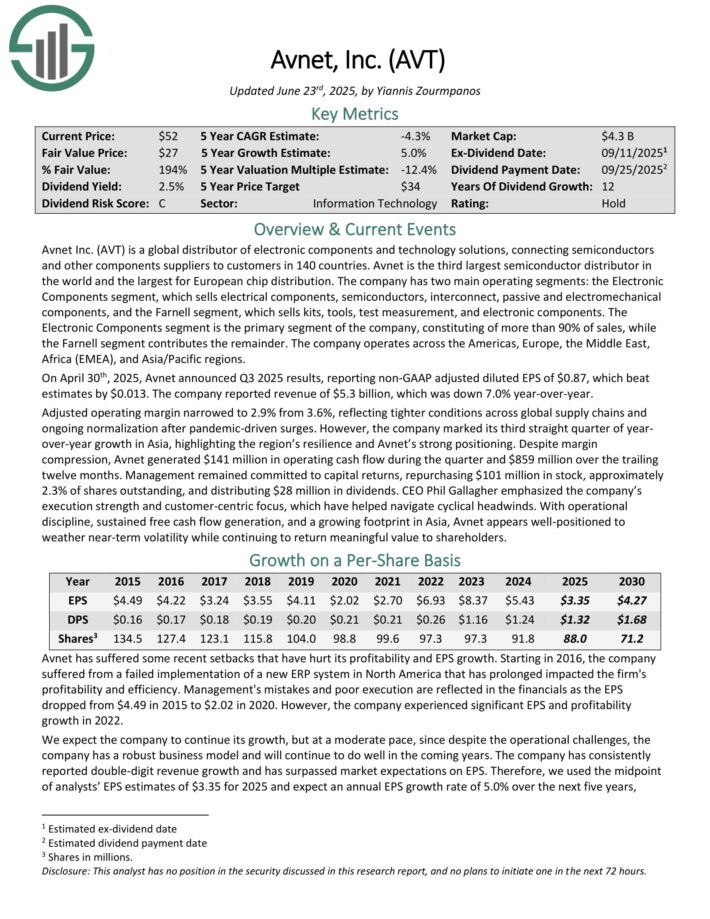

Excessive Dividend Tech Inventory #8: Cisco Techniques (CSCO)

Cisco Techniques is the worldwide chief in excessive efficiency pc networking methods. The corporate’s routers and switches enable networks all over the world to attach to one another by means of the web. Cisco additionally provides information heart, cloud, and safety merchandise.

On Could 14th, 2025, Cisco reported outcomes for the third quarter of fiscal 12 months 2025, which ended April twenty sixth, 2025. For the quarter, income grew 11.4% to $14.2 billion, which was $90 million greater than anticipated. Adjusted earnings-per-share of $0.96 in contrast favorably to adjusted earnings-per-share of $0.88 within the prior 12 months and was $0.04 above estimates.

Product orders improved 20% for the interval. Excluding the addition of Splunk, product orders have been greater by 9%. Networking grew 8%, Safety surged 54%, Collaboration was up 4%, and Observability improved 24%. By area, the Americas grew 14%, Europe/Center East/Africa elevated 8%, and Asia-Pacific/Japan/China was greater by 9%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Cisco Techniques (CSCO) (preview of web page 1 of three proven beneath):

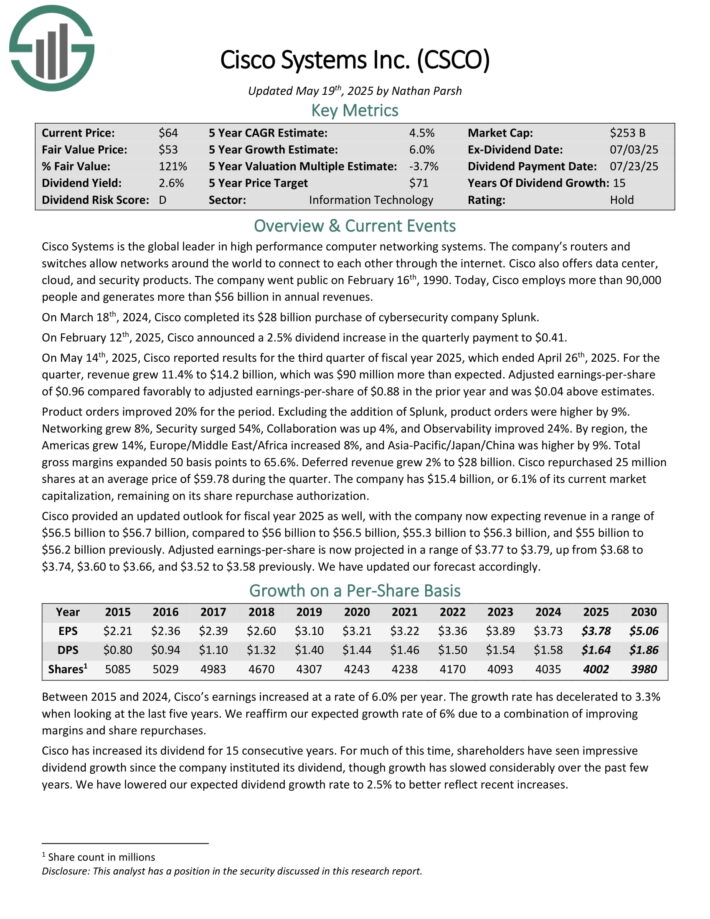

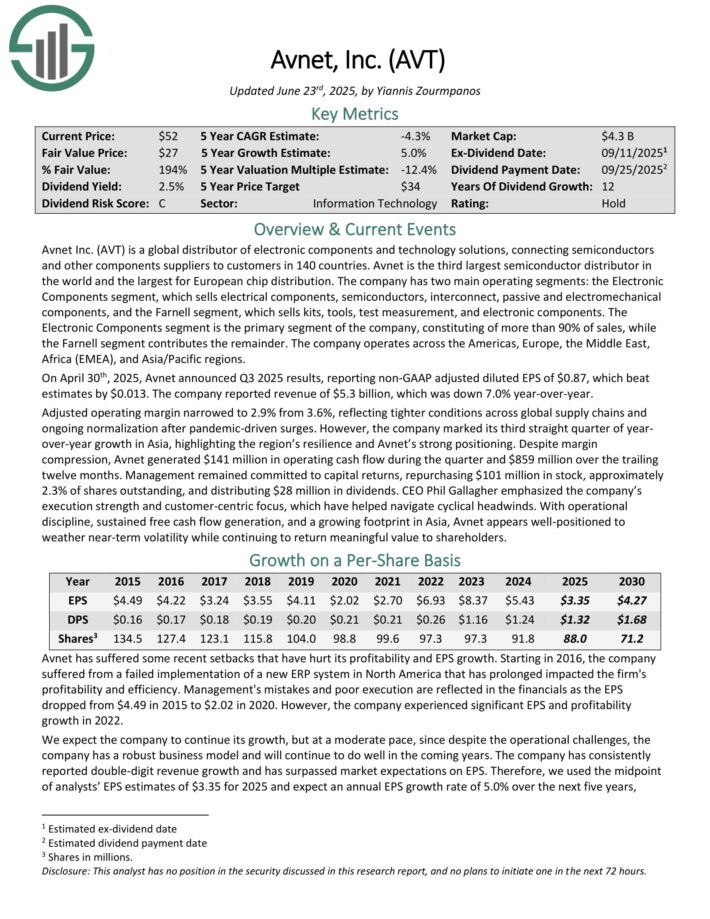

Excessive Dividend Tech Inventory #7: Avnet Inc. (AVT)

Avnet is a worldwide distributor of digital parts and know-how options, connecting semiconductors and different parts suppliers to prospects in 140 international locations. Avnet is the third-largest semiconductor distributor on the earth and the biggest for European chip distribution.

The corporate has two fundamental working segments: the Digital Parts phase, which sells electrical parts, semiconductors, interconnect, passive and electro-mechanical parts, and the Farnell phase, which sells kits, instruments, take a look at measurement, and digital parts.

The Digital Parts phase is the first phase of the corporate, constituting of greater than 90% of gross sales, whereas the Farnell phase contributes the rest. The corporate operates throughout the Americas, Europe, the Center East, Africa (EMEA), and Asia/Pacific areas.

On April thirtieth, 2025, Avnet introduced Q3 2025 outcomes, reporting non-GAAP adjusted diluted EPS of $0.87, which beat estimates by $0.013. The corporate reported income of $5.3 billion, which was down 7.0% year-over-year.

Adjusted working margin narrowed to 2.9% from 3.6%, reflecting tighter circumstances throughout international provide chains and ongoing normalization after pandemic-driven surges.

Regardless of margin compression, Avnet generated $141 million in working money circulation throughout the quarter and $859 million over the trailing twelve months.

Administration remained dedicated to capital returns, repurchasing $101 million in inventory, roughly 2.3% of shares excellent, and distributing $28 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on AVT (preview of web page 1 of three proven beneath):

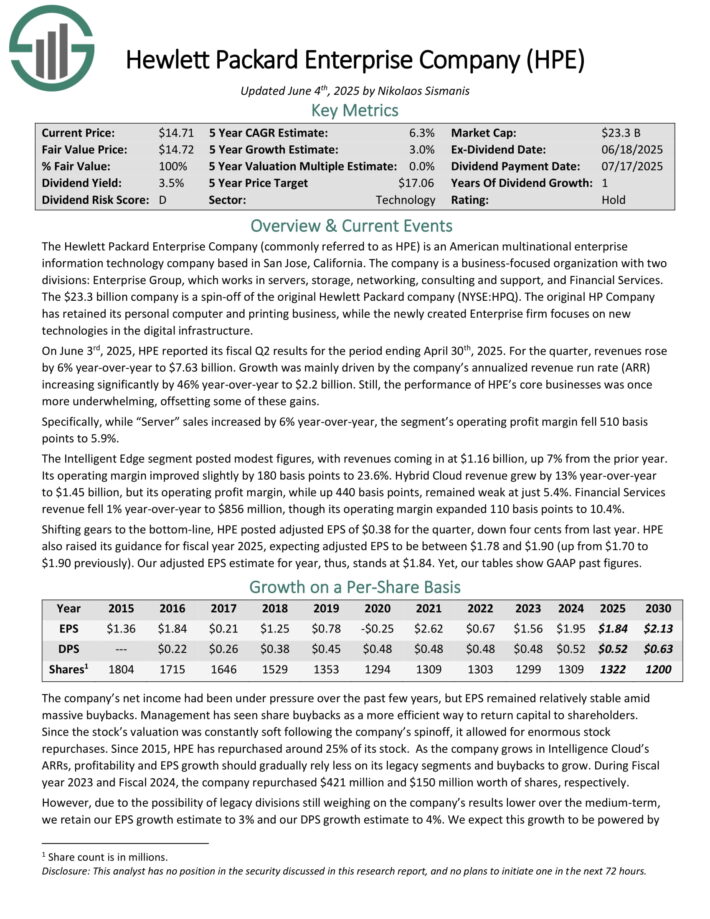

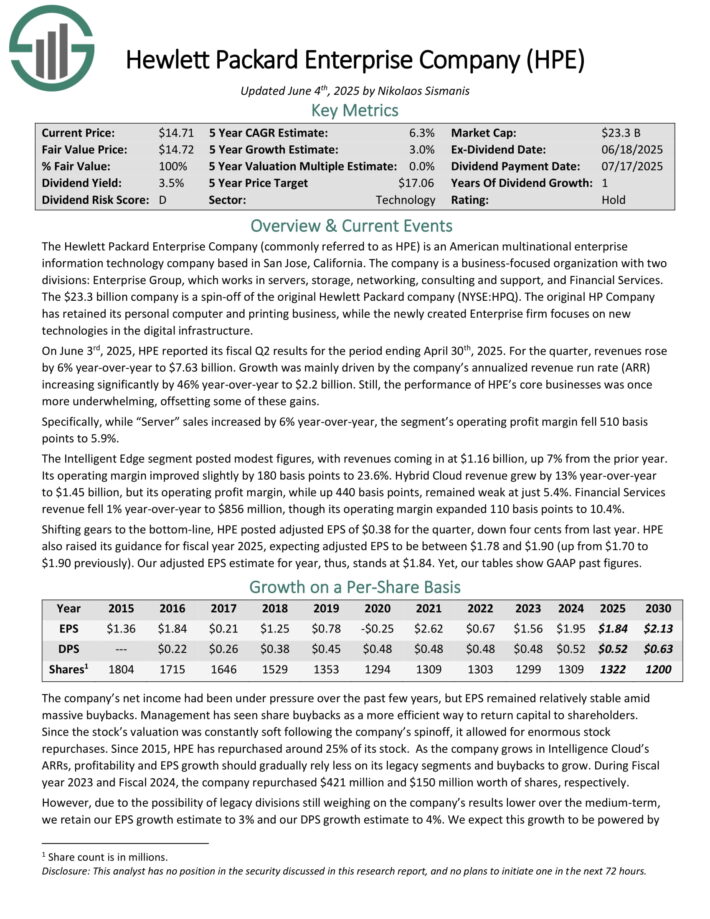

Excessive Dividend Tech Inventory #6: Hewlett Packard Enterprise (HPE)

The Hewlett Packard Enterprise Firm (generally known as HPE) is an American multinational enterprise info know-how firm based mostly in San Jose, California.

The corporate is a business-focused group with two divisions: Enterprise Group, which works in servers, storage, networking, consulting and assist, and Monetary Companies. The Enterprise agency focuses on new applied sciences within the digital infrastructure.

On June third, 2025, HPE reported its fiscal Q2 outcomes for the interval ending April thirtieth, 2025. For the quarter, revenues rose by 6% year-over-year to $7.63 billion.

Development was primarily pushed by the corporate’s annualized income run price (ARR) rising considerably by 46% year-over-year to $2.2 billion. Nonetheless, the efficiency of HPE’s core companies was as soon as extra underwhelming, offsetting a few of these good points.

Particularly, whereas “Server” gross sales elevated by 6% year-over-year, the phase’s working revenue margin fell 510 foundation factors to five.9%. The Clever Edge phase posted modest figures, with revenues coming in at $1.16 billion, up 7% from the prior 12 months.

Its working margin improved barely by 180 foundation factors to 23.6%. Hybrid Cloud income grew by 13% year-over-year to $1.45 billion, however its working revenue margin, whereas up 440 foundation factors, remained weak at simply 5.4%.

Monetary Companies income fell 1% year-over-year to $856 million, although its working margin expanded 110 foundation factors to 10.4%.

HPE posted adjusted EPS of $0.38 for the quarter, down 4 cents from final 12 months. HPE additionally raised its steering for fiscal 12 months 2025, anticipating adjusted EPS to be between $1.78 and $1.90.

Click on right here to obtain our most up-to-date Positive Evaluation report on HPE (preview of web page 1 of three proven beneath):

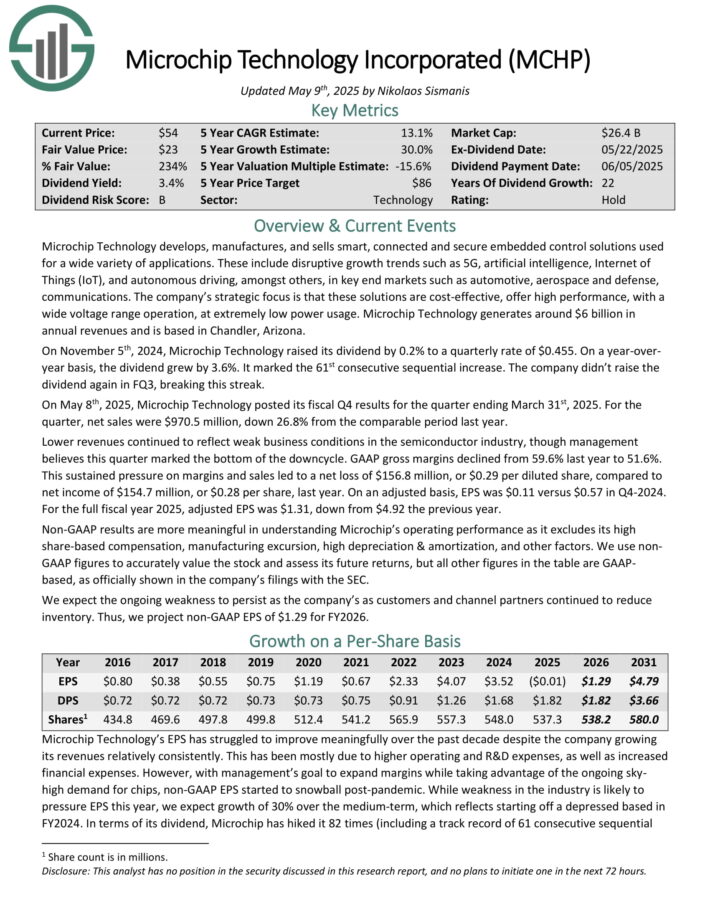

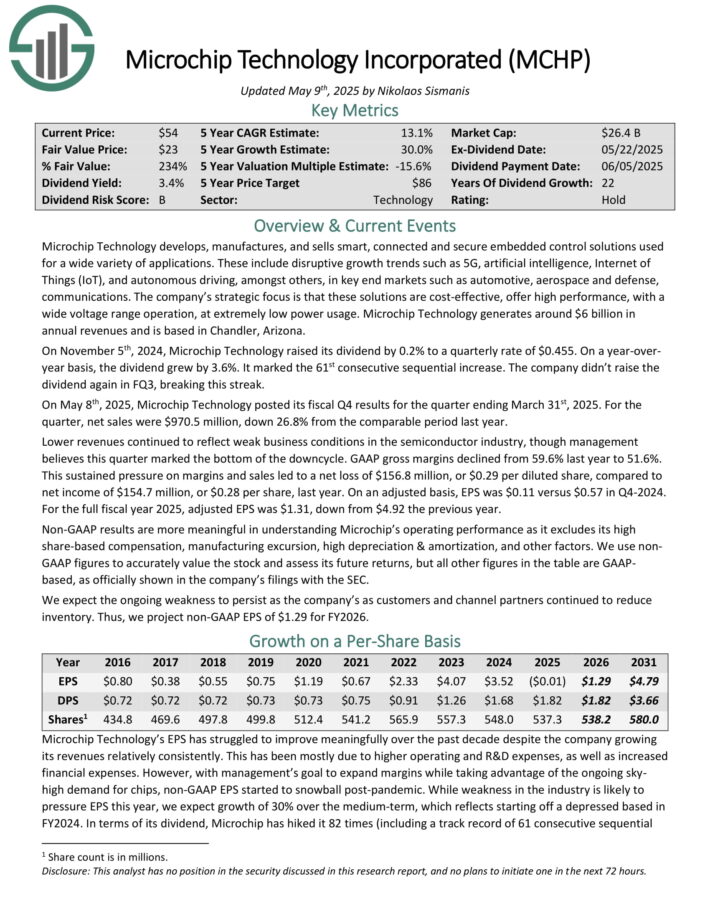

Excessive Dividend Tech Inventory #5: Microchip Know-how (MCHP)

Microchip Know-how develops, manufactures, and sells good, linked and safe embedded management options used for all kinds of purposes.

These embrace disruptive development developments corresponding to 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets corresponding to automotive, aerospace and protection, communications.

Microchip Know-how generates round $6 billion in annual revenues and relies in Chandler, Arizona.

On Could eighth, 2025, Microchip Know-how posted its fiscal This autumn outcomes for the quarter ending March thirty first, 2025. For the quarter, internet gross sales have been $970.5 million, down 26.8% from the comparable interval final 12 months.

Decrease revenues continued to replicate weak enterprise circumstances within the semiconductor trade, although administration believes this quarter marked the underside of the downcycle. GAAP gross margins declined from 59.6% final 12 months to 51.6%.

This sustained stress on margins and gross sales led to a internet lack of $156.8 million, or $0.29 per diluted share, in comparison with internet earnings of $154.7 million, or $0.28 per share, final 12 months.

On an adjusted foundation, EPS was $0.11 versus $0.57 in This autumn-2024. For the total fiscal 12 months 2025, adjusted EPS was $1.31, down from $4.92 the earlier 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCHP (preview of web page 1 of three proven beneath):

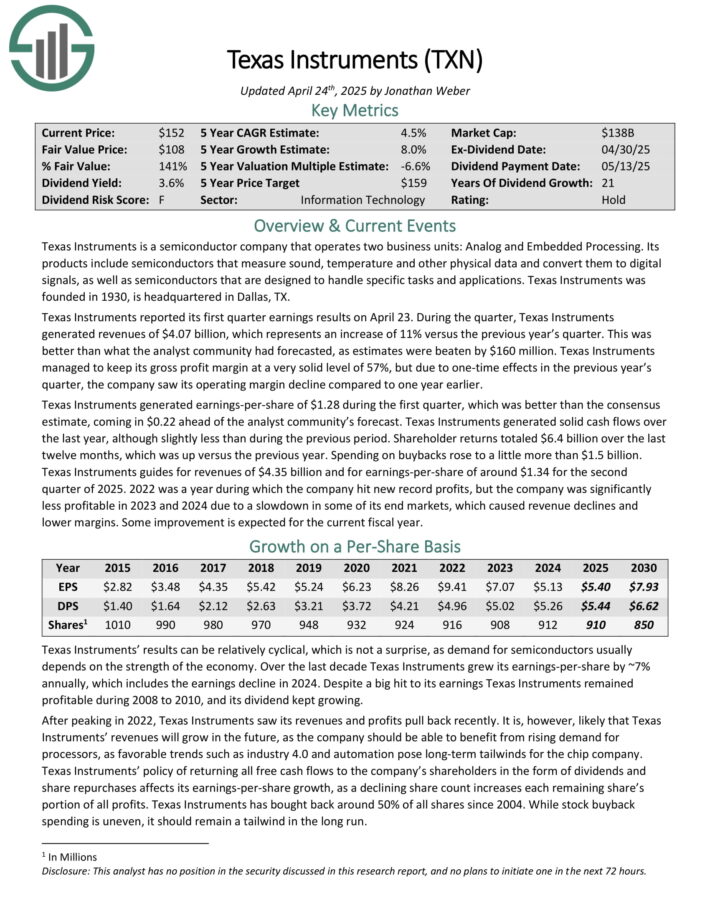

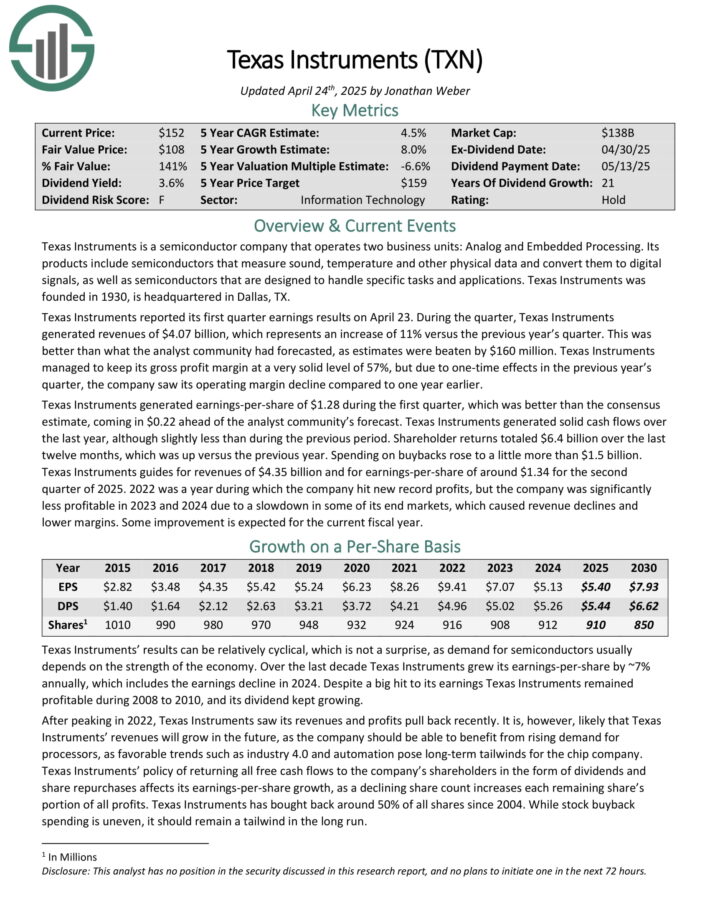

Excessive Dividend Tech Inventory #4: Texas Devices (TXN)

Texas Devices is a semiconductor firm that operates two enterprise models: Analog and Embedded Processing.

Its merchandise embrace semiconductors that measure sound, temperature and different bodily information and convert them to digital alerts, in addition to semiconductors which can be designed to deal with particular duties and purposes.

Texas Devices reported its first quarter earnings outcomes on April 23. Through the quarter, Texas Devices generated revenues of $4.07 billion, which represents a rise of 11% versus the earlier 12 months’s quarter.

This was higher than what the analyst group had forecasted, as estimates have been crushed by $160 million. Texas Devices managed to maintain its gross revenue margin at a really strong stage of 57%.

Texas Devices generated earnings-per-share of $1.28 throughout the first quarter, which was higher than the consensus estimate, coming in $0.22 forward of the analyst group’s forecast. Texas Devices generated strong money flows over the past 12 months, though barely lower than throughout the earlier interval.

Shareholder returns totaled $6.4 billion over the past twelve months, which was up versus the earlier 12 months. Spending on buybacks rose to a little bit greater than $1.5 billion.

Texas Devices guides for revenues of $4.35 billion and for earnings-per-share of round $1.34 for the second quarter of 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on TXN (preview of web page 1 of three proven beneath):

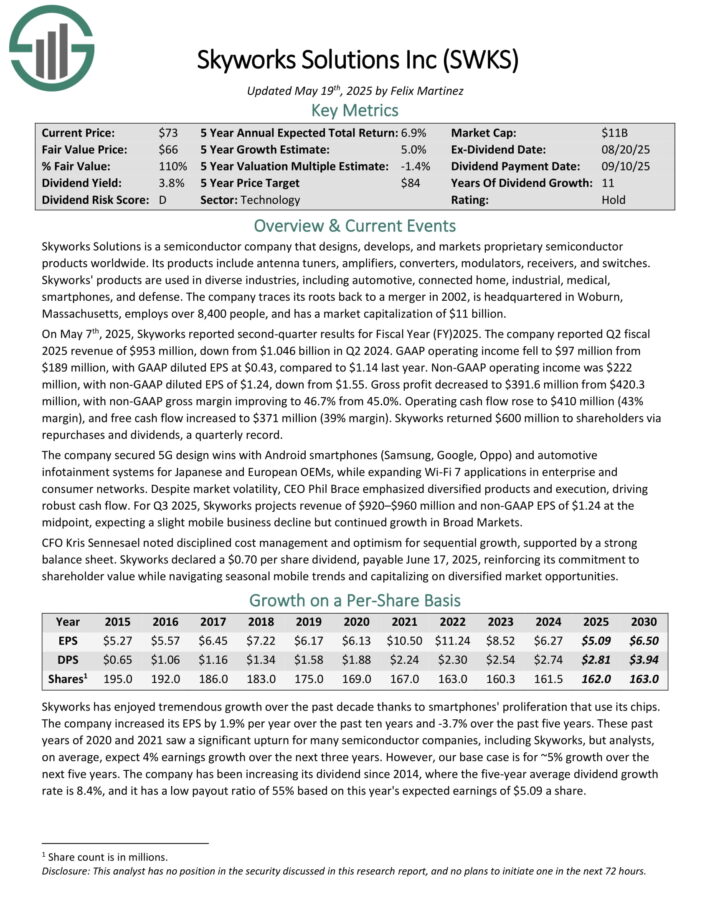

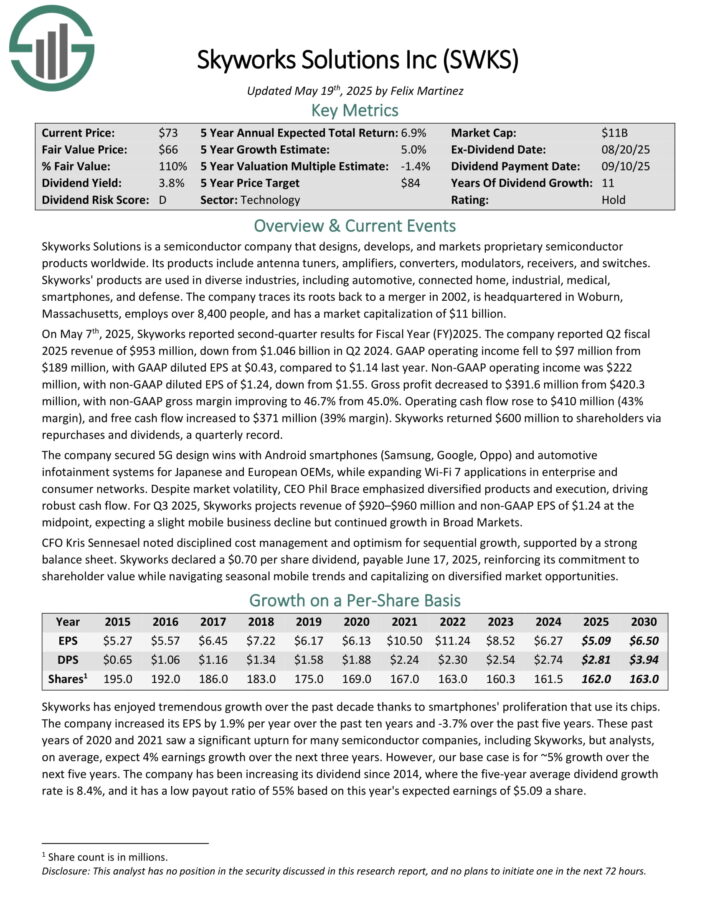

Excessive Dividend Tech Inventory #3: Skyworks Options (SWKS)

Skyworks Options is a semiconductor firm that designs, develops, and markets proprietary semiconductor merchandise worldwide. Its merchandise embrace antenna tuners, amplifiers, converters, modulators, receivers, and switches.

Skyworks’ merchandise are utilized in various industries, together with automotive, linked house, industrial, medical, smartphones, and protection.

On Could seventh, 2025, Skyworks reported second-quarter outcomes for Fiscal Yr (FY)2025. The corporate reported Q2 fiscal 2025 income of $953 million, down from $1.046 billion in Q2 2024.

GAAP working earnings fell to $97 million from $189 million, with GAAP diluted EPS at $0.43, in comparison with $1.14 final 12 months. Non-GAAP working earnings was $222 million, with non-GAAP diluted EPS of $1.24, down from $1.55.

Skyworks returned $600 million to shareholders through repurchases and dividends, a quarterly file.

The corporate secured 5G design wins with Android smartphones (Samsung, Google, Oppo) and automotive infotainment methods for Japanese and European OEMs, whereas increasing Wi-Fi 7 purposes in enterprise and client networks.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWKS (preview of web page 1 of three proven beneath):

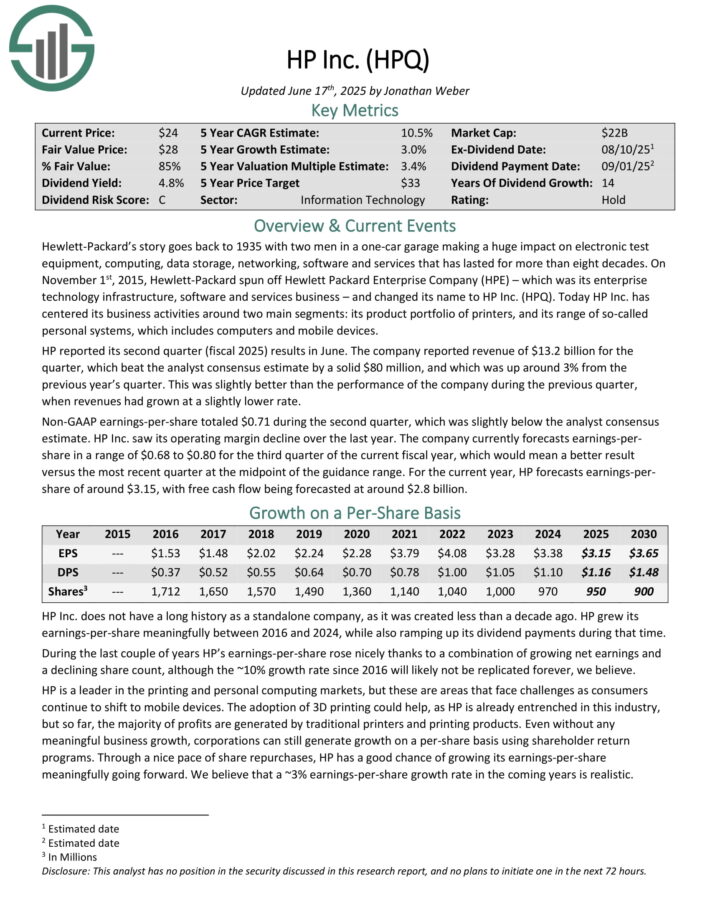

Excessive Dividend Tech Inventory #2: HP Inc. (HPQ)

Hewlett-Packard’s story goes again to 1935 with two males in a one-car storage making a huge effect on digital take a look at tools, computing, information storage, networking, software program and providers that has lasted for greater than eight many years.

HP Inc. has centered its enterprise actions round two fundamental segments: its product portfolio of printers, and its vary of so-called private methods, which incorporates computer systems and cell gadgets.

HP reported its second quarter (fiscal 2025) leads to June. The corporate reported income of $13.2 billion for the quarter, which beat the analyst consensus estimate by a strong $80 million, and which was up round 3% from the earlier 12 months’s quarter.

This was barely higher than the efficiency of the corporate throughout the earlier quarter, when revenues had grown at a barely decrease price.

Non-GAAP earnings-per-share totaled $0.71 throughout the second quarter, which was barely beneath the analyst consensus estimate. HP Inc. noticed its working margin decline over the past 12 months.

The corporate presently forecasts earnings-per-share in a spread of $0.68 to $0.80 for the third quarter of the present fiscal 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on HPQ (preview of web page 1 of three proven beneath):

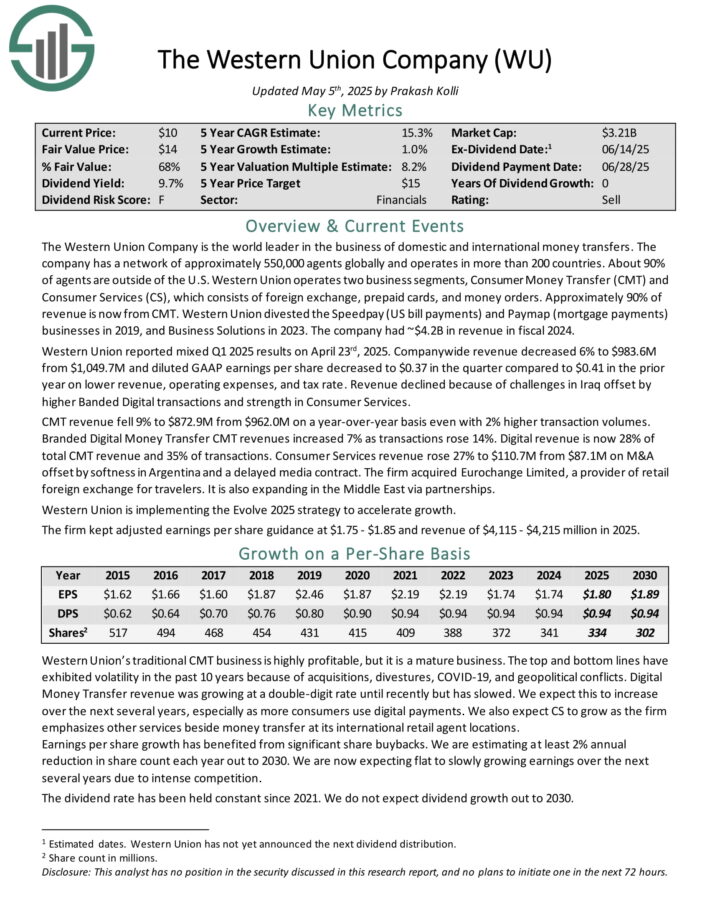

Excessive Dividend Tech Inventory #1: Western Union Firm (WU)

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 international locations.

About 90% of brokers are outdoors of the US. Western Union operates two enterprise segments, Shopper-to-Shopper (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported combined Q1 2025 outcomes on April twenty third, 2025. Firm-wide income decreased 6% to $983.6M from $1,049.7M and diluted GAAP earnings per share decreased to $0.37 within the quarter in comparison with $0.41 within the prior 12 months on decrease income, working bills, and tax price.

Income declined due to challenges in Iraq offset by greater Banded Digital transactions and power in Shopper Companies.

CMT income fell 9% to $872.9M from $962.0M on a year-over-year foundation even with 2% greater transaction volumes. Branded Digital Cash Switch CMT revenues elevated 7% as transactions rose 14%. Digital income is now 28% of complete CMT income and 35% of transactions.

Click on right here to obtain our most up-to-date Positive Evaluation report on WU (preview of web page 1 of three proven beneath):

Closing Ideas

The tech sector has not traditionally been recognized for dividends, however this has modified up to now a number of years.

Many giant, established tech shares now pay dividends to shareholders.

In case you are concerned with discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources might be helpful:

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].