Printed on August sixteenth, 2024 by Bob Ciura

Totally different buyers could have completely different interpretations of the time period “blue chip,” however generally, it refers to corporations which are thought of the leaders of their respective industries.

For us, a inventory earns the title of “blue chip” when it options at the least a decade of constant dividend development. It’s not a small accomplishment, because it demonstrates that the corporate’s enterprise mannequin is prone to stand up to robust financial instances whereas persevering with to ship regular development.

In consequence, we really feel that blue chip shares are among the many most secure dividend shares buyers should buy.

With all this in thoughts, we created an inventory of 400+ blue-chip shares, which you’ll be able to obtain by clicking under:

The tech sector isn’t sometimes recognized for dividend development shares, however these corporations have demonstrated a dedication to rising shareholder money returns.

To spotlight these business leaders, we’ve compiled an inventory of the highest 10 tech sector blue chip shares. Every of those tech shares have raised their dividends for at the least 10 consecutive years.

As well as, the ten tech shares under have Dividend Threat scores of ‘C’ or higher, indicating that their payouts are safe.

The shares are ranked so as of five-year anticipated annual returns, from lowest to highest.

Desk of Contents

Blue Chip Tech Inventory #10: Skyworks Options (SWKS)

- Years of Dividend Development: 11

- 5-Yr Anticipated Annual Returns: 2.0%

Skyworks Options is a semiconductor firm that designs, develops, and markets proprietary semiconductor merchandise worldwide. Its merchandise embody antenna tuners, amplifiers, converters, modulators, receivers, and switches.

Skyworks’ merchandise are utilized in numerous industries, together with automotive, related residence, industrial, medical, smartphones, and protection.

On July thirtieth, 2024, Skyworks reported third-quarter outcomes for Fiscal Yr (FY)2024. The corporate posted income of $906 million. The corporate achieved a GAAP diluted earnings per share (EPS) of $0.75 and a non-GAAP diluted EPS of $1.21.

The year-to-date working money move stands at $1.35 billion, with a free money move of $1.27 billion, reflecting robust money move margins of 43% and 40%, respectively. These outcomes underscore Skyworks’ profitability and constant efficiency according to its steering.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWKS (preview of web page 1 of three proven under):

Blue Chip Tech Inventory #9: HP Inc. (HPQ)

- Years of Dividend Development: 13

- 5-Yr Anticipated Annual Returns: 3.7%

HP Inc. has centered its enterprise actions round two fundamental segments: its product portfolio of printers, and its vary of non-public methods, which incorporates computer systems and cellular units. HP reported its second quarter (fiscal 2024) outcomes on Might 30.

The corporate reported income of $12.8 billion for the quarter, which beat the analyst consensus estimate, and which was down 1% from the earlier yr’s quarter. This was barely higher than the income decline that HP skilled through the earlier quarter, when revenues had been down by 5% on a year-over-year foundation.

Non-GAAP earnings-per-share totaled $0.82 through the second quarter, which was forward of the analyst consensus estimate. HP Inc. noticed its working margin enhance during the last yr.

The corporate at the moment forecasts earnings-per-share in a variety of $0.78 to $0.92 for the third quarter, which might imply a greater end result versus the latest quarter on the midpoint of the steering vary. For the present yr, HP forecasts earnings-per-share of round $3.45.

Click on right here to obtain our most up-to-date Positive Evaluation report on HPQ (preview of web page 1 of three proven under):

Blue Chip Tech Inventory #8: Oracle Company (ORCL)

- Years of Dividend Development: 13

- 5-Yr Anticipated Annual Returns: 5.1%

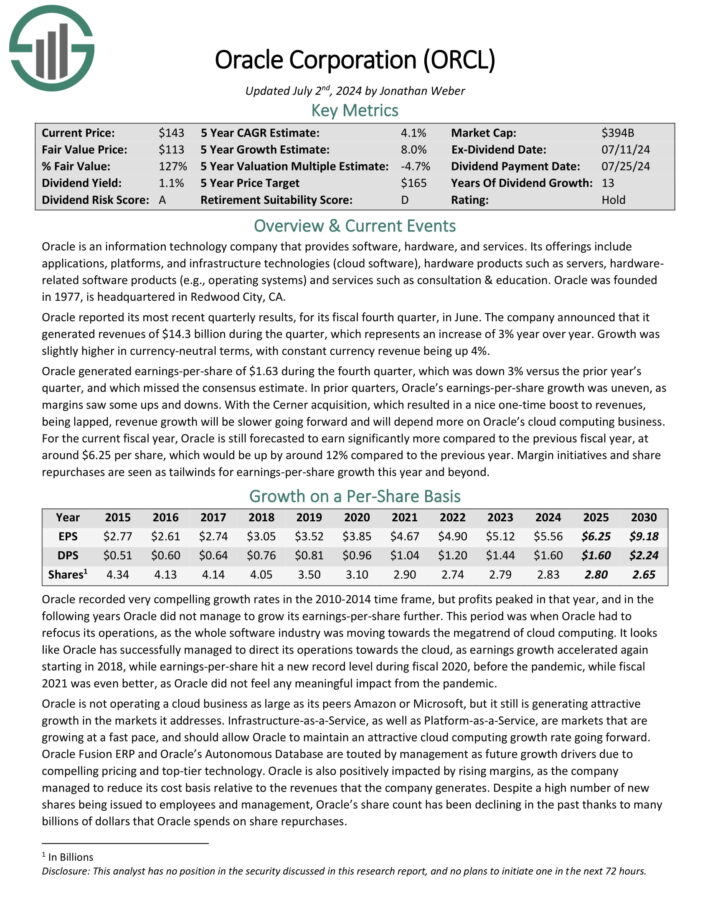

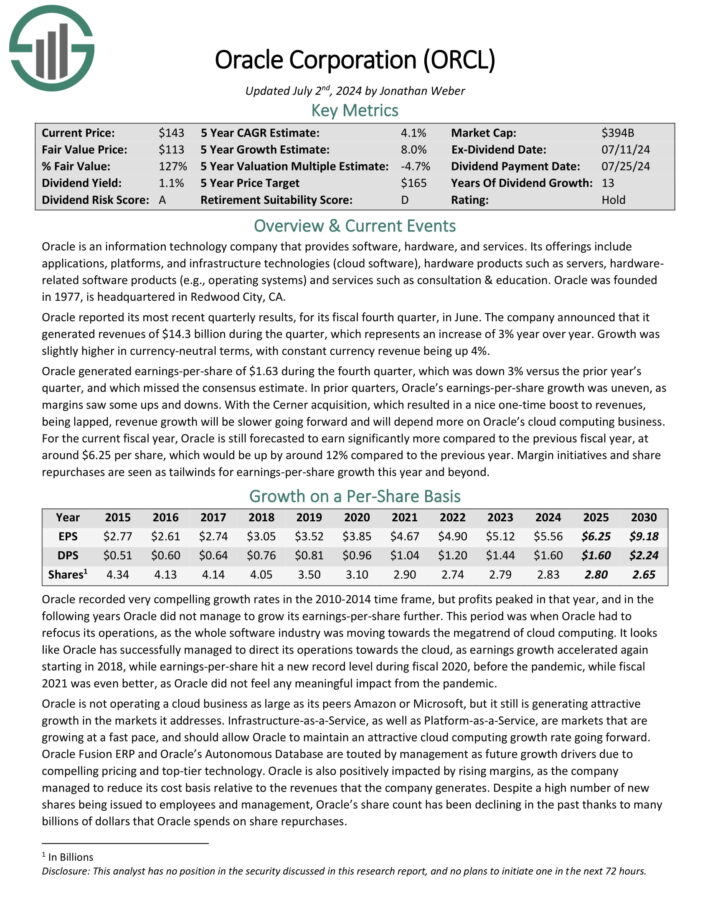

Oracle is an data expertise firm that gives software program, {hardware}, and providers. Its choices embody purposes, platforms, and infrastructure applied sciences (cloud software program), {hardware} merchandise corresponding to servers, hardware-related software program merchandise (e.g., working methods), and providers corresponding to session & schooling.

Oracle reported its most up-to-date quarterly outcomes, for its fiscal fourth quarter, in June. The corporate introduced that it generated revenues of $14.3 billion through the quarter, which represents a rise of three% yr over yr. Development was barely increased in currency-neutral phrases, with fixed foreign money income being up 4%.

Oracle generated earnings-per-share of $1.63 through the fourth quarter, which was down 3% versus the prior yr’s quarter, and which missed the consensus estimate. In prior quarters, Oracle’s earnings-per-share development was uneven as margins noticed some ups and downs.

Click on right here to obtain our most up-to-date Positive Evaluation report on ORCL (preview of web page 1 of three proven under):

Blue Chip Tech Inventory #7: Microsoft Company (MSFT)

- Years of Dividend Development: 22

- 5-Yr Anticipated Annual Returns: 5.5%

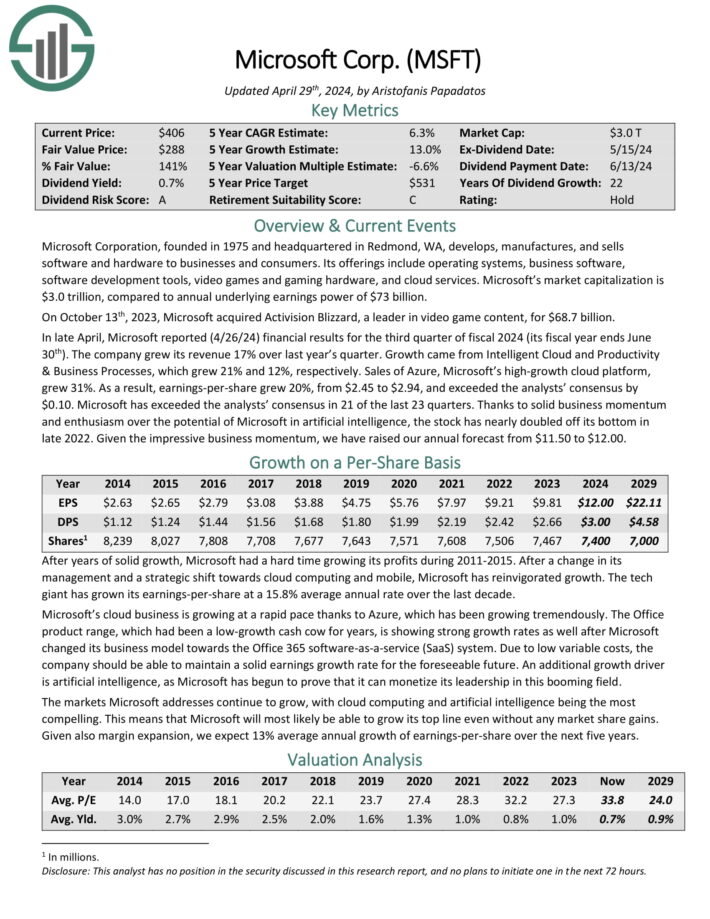

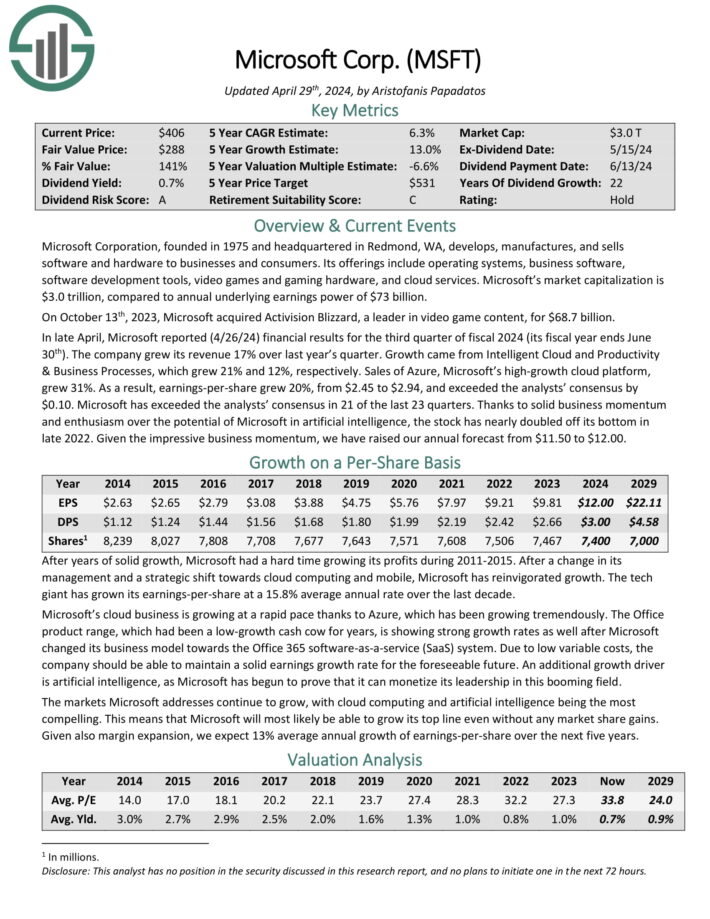

Microsoft Company, based in 1975 and headquartered in Redmond, WA, develops, manufactures, and sells software program and {hardware} to companies and shoppers.

Its choices embody working methods, enterprise software program, software program improvement instruments, video video games and gaming {hardware}, and cloud providers. Microsoft’s market capitalization is ~$3.0 trillion, in comparison with annual underlying earnings energy of $73 billion.

In late April, Microsoft reported (4/26/24) monetary outcomes for the third quarter of fiscal 2024 (its fiscal yr ends June thirtieth). The corporate grew its income 17% over final yr’s quarter.

Development got here from Clever Cloud and Productiveness & Enterprise Processes, which grew 21% and 12%, respectively.

Microsoft’s cloud enterprise is rising at a fast tempo because of Azure. The Workplace product vary, which had been a low-growth money cow for years, is displaying robust development charges as effectively after Microsoft modified its enterprise mannequin in the direction of the Workplace 365 software-as-a-service (SaaS) system.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSFT (preview of web page 1 of three proven under):

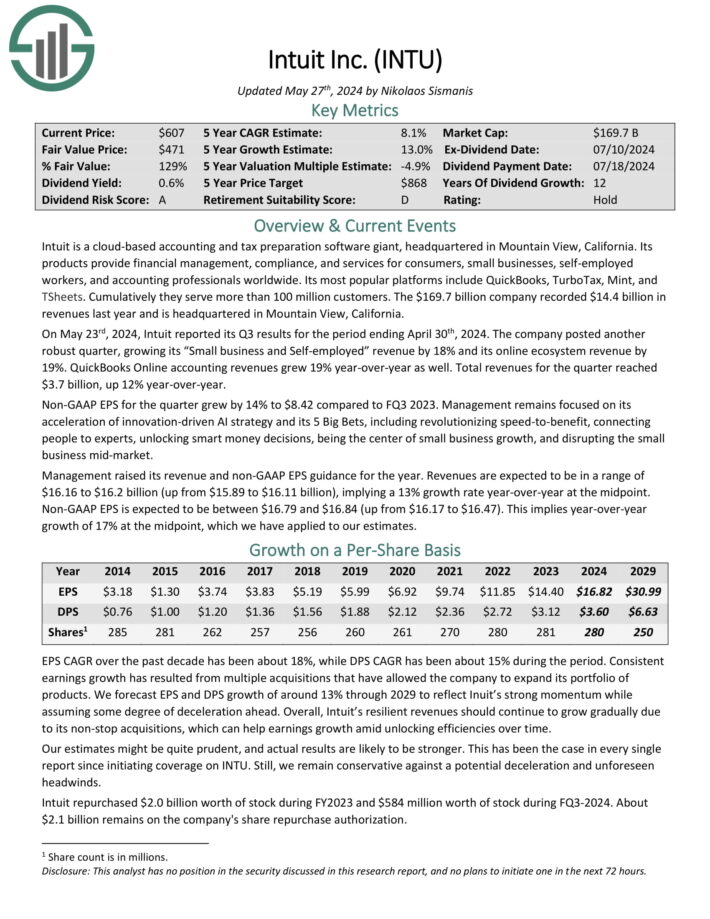

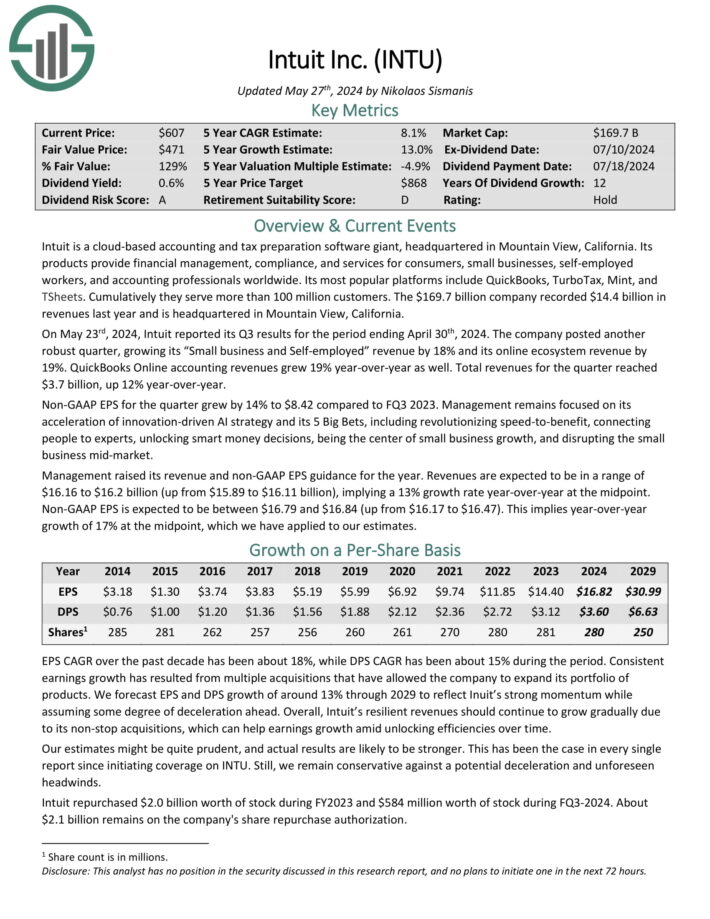

Blue Chip Tech Inventory #6: Intuit Inc. (INTU)

- Years of Dividend Development: 12

- 5-Yr Anticipated Annual Returns: 6.5%

Intuit is a cloud-based accounting and tax preparation software program large. Its merchandise present monetary administration, compliance, and providers for shoppers, small companies, self-employed staff, and accounting professionals worldwide.

Its hottest platforms embody QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve greater than 100 million clients.

On Might twenty third, 2024, Intuit reported its Q3 outcomes for the interval ending April thirtieth, 2024. The corporate posted one other sturdy quarter, rising its “Small enterprise and Self-employed” income by 18% and its on-line ecosystem income by 19%.

QuickBooks On-line accounting revenues grew 19% year-over-year as effectively. Whole revenues for the quarter reached $3.7 billion, up 12% year-over-year. Non-GAAP EPS for the quarter grew by 14% to $8.42 in comparison with FQ3 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on INTU (preview of web page 1 of three proven under):

Blue Chip Tech Inventory #5: Analog Gadgets, Inc. (ADI)

- Years of Dividend Development: 20

- 5-Yr Anticipated Annual Returns: 6.7%

Analog Gadgets makes built-in circuits which are offered to OEMs (authentic gear producers) to be integrated into gear and methods for communications, pc, instrumentation, industrial, navy/aerospace, and client electronics purposes.

The corporate is altering to fulfill the wants of recent markets with its $10 billion funding in Analysis and Improvement over the previous 10 years, and their earlier acquisitions of corporations like Maxim Built-in, Linear Expertise, and Hittite.

On February twentieth, 2024, Analog Gadgets introduced a 7% dividend improve to $0.92 per share quarterly.

On Might twenty second, 2024, Analog Gadgets reported second quarter 2024 outcomes for the interval ending Might 4th, 2024. For the quarter, the corporate reported income of $2.16 billion, down 34% in comparison with the prior yr’s quarter, which beat analysts’ estimates by $50 million. The corporate noticed adjusted earnings-per-share of $1.40, which additionally beat analysts’ estimates by 13 cents however represented a 51% decline in EPS in comparison with the year-ago quarter.

In the course of the quarter, Analog Gadgets repurchased $222 million of its shares, and paid $456 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADI (preview of web page 1 of three proven under):

Blue Chip Tech Inventory #4: QUALCOMM Integrated (QCOM)

- Years of Dividend Development: 22

- 5-Yr Anticipated Annual Returns: 7.3%

Qualcomm has developed into a number one developer and distributor of built-in circuits for each voice and information transmissions. Because of its in depth patent portfolio, Qualcomm receives royalties from units working on cutting-edge 5G networks.

On April twelfth, 2024, Qualcomm elevated its quarterly dividend 6.3% to $0.85, marking the corporate’s twenty second consecutive yr of dividend development.

On July thirty first, 2024, Qualcomm reported for the third quarter of fiscal yr 2024 for the interval ending June twenty third, 2024. For the quarter, income grew 11.3% to $9.39 billion, which was $170 million above estimates. Adjusted earnings-per-share of $2.33 in contrast favorably to $1.87 within the earlier yr and was $0.07 higher than anticipated.

For the quarter, revenues for Qualcomm CDMA Applied sciences, or QCT, improved 12% to $8.07 billion. Handset gross sales elevated 12% to $5.9 billion whereas automotive gross sales surged 87% to $811 million.

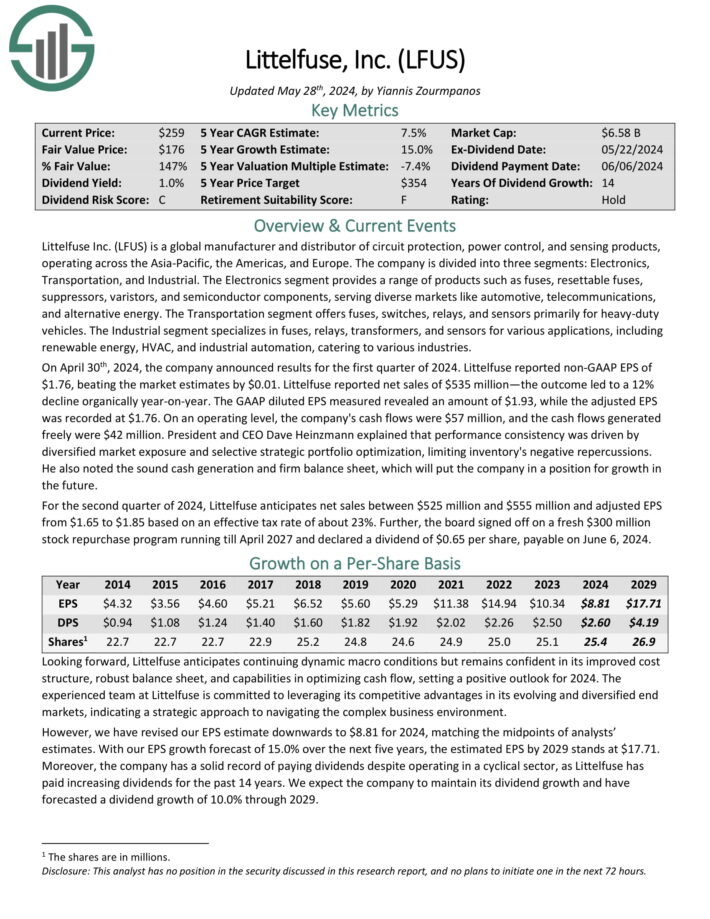

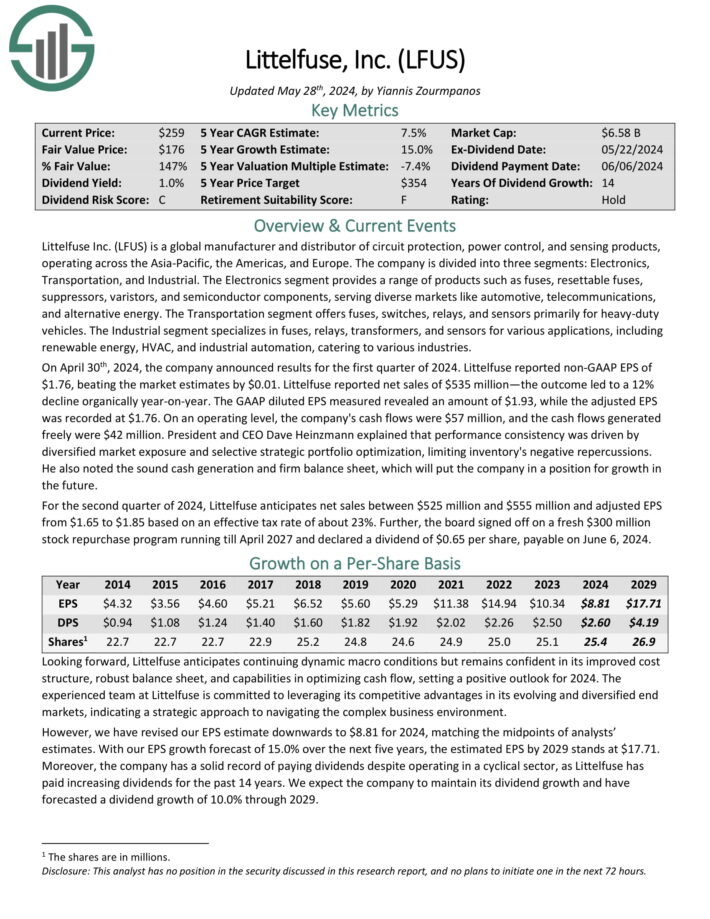

Littelfuse Inc. is a world producer and distributor of circuit safety, energy management, and sensing merchandise, working throughout the Asia-Pacific, the Americas, and Europe.

The corporate is split into three segments: Electronics, Transportation, and Industrial. The Electronics section gives a variety of merchandise corresponding to fuses, resettable fuses, suppressors, varistors, and semiconductor elements, serving numerous markets like automotive, telecommunications, and various power.

The Transportation section presents fuses, switches, relays, and sensors primarily for heavy-duty autos. The Industrial section focuses on fuses, relays, transformers, and sensors for numerous purposes, together with renewable power, HVAC, and industrial automation, catering to numerous industries.

On April thirtieth, 2024, the corporate introduced outcomes for the primary quarter of 2024. Littelfuse reported non-GAAP EPS of $1.76, beating the market estimates by $0.01. Littelfuse reported internet gross sales of $535 million—a 12% decline organically year-on-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on LFUS (preview of web page 1 of three proven under):

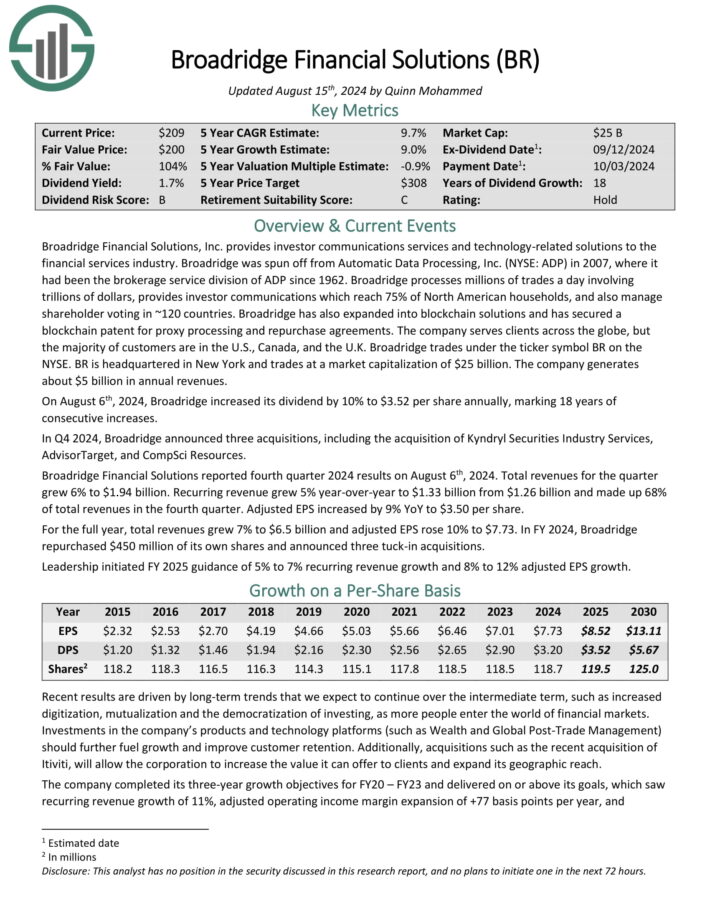

Blue Chip Tech Inventory #2: Broadridge Monetary Options, Inc. (BR)

- Years of Dividend Development: 18

- 5-Yr Anticipated Annual Returns: 9.6%

Broadridge Monetary Options, Inc. gives investor communications providers and technology-related options to the monetary providers business. Broadridge was spun off from Automated Knowledge Processing in 2007, the place it had been the brokerage service division of ADP since 1962.

Broadridge Monetary Options reported fourth quarter 2024 outcomes on August sixth, 2024. Whole revenues for the quarter grew 6% to $1.94 billion. Recurring income grew 5% year-over-year to $1.33 billion from $1.26 billion and made up 68% of complete revenues within the fourth quarter. Adjusted EPS elevated by 9% YoY to $3.50 per share.

For the complete yr, complete revenues grew 7% to $6.5 billion and adjusted EPS rose 10% to $7.73. In FY 2024, Broadridge repurchased $450 million of its personal shares and introduced three tuck-in acquisitions.

Click on right here to obtain our most up-to-date Positive Evaluation report on Broadridge (preview of web page 1 of three proven under):

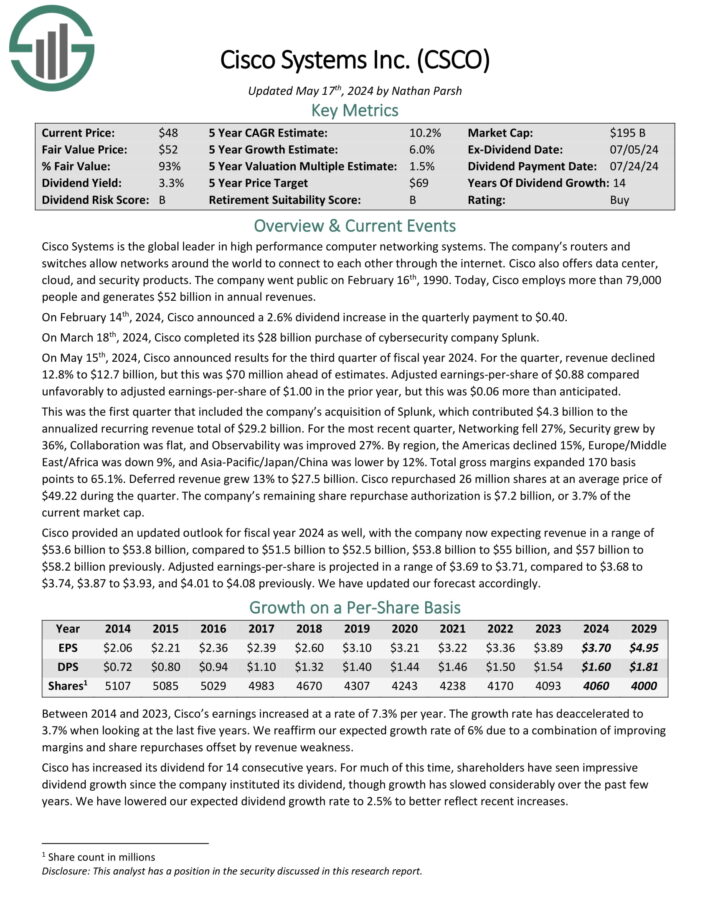

Blue Chip Tech Inventory #1: Cisco Programs, Inc. (CSCO)

- Years of Dividend Development: 14

- 5-Yr Anticipated Annual Returns: 10.0%

Cisco Programs is the worldwide chief in excessive efficiency pc networking methods. The corporate’s routers and switches enable networks around the globe to attach to one another by the web. Cisco additionally presents information heart, cloud, and safety merchandise.

Cisco employs greater than 79,000 folks and generates $52 billion in annual revenues. On February 14th, 2024, Cisco introduced a 2.6% dividend improve within the quarterly fee to $0.40.

On March 18th, 2024, Cisco accomplished its $28 billion buy of cybersecurity firm Splunk. On Might fifteenth, 2024, Cisco introduced outcomes for the third quarter of fiscal yr 2024.

For the quarter, income declined 12.8% to $12.7 billion, however this was $70 million forward of estimates. Adjusted earnings-per-share of $0.88 in contrast unfavorably to adjusted earnings-per-share of $1.00 within the prior yr, however this was $0.06 greater than anticipated.

This was the primary quarter that included the corporate’s acquisition of Splunk, which contributed $4.3 billion to the annualized recurring income complete of $29.2 billion. For the latest quarter, Networking fell 27%, Safety grew by 36%, Collaboration was flat, and Observability was improved 27%.

Click on right here to obtain our most up-to-date Positive Evaluation report on CSCO (preview of web page 1 of three proven under):

Ultimate Ideas

General, buyers can discover many funding alternatives amongst blue chip shares, as these corporations are inclined to function a protracted historical past of monetary stability and a powerful market place.

The tech sector has not traditionally been recognized for dividends, however this has modified previously a number of years. Many giant, established tech shares now pay dividends to shareholders.

In case you are fascinated by discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets will likely be helpful:

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].