Revealed on January sixth, 2026 by Bob Ciura

Month-to-month dividend shares could be a gorgeous funding choice for these looking for steady revenue.

Month-to-month dividends permit traders to obtain extra frequent funds than shares which pay quarterly or semi-annual dividend payouts.

Because of this, month-to-month dividend shares might help to cowl dwelling bills, or complement different sources of revenue.

There are over 80 month-to-month dividend shares that at the moment supply a month-to-month dividend fee.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Nonetheless, not all month-to-month dividend shares are equally protected. There are various examples of month-to-month dividend shares decreasing or eliminating their dividends.

Subsequently, traders with a very long time horizon ought to concentrate on shares with sustainable dividends, not simply these with the very best yields.

The ten month-to-month dividend shares beneath had been discovered based mostly on a qualitative evaluation of their particular person enterprise fashions and future development prospects.

Desk of Contents

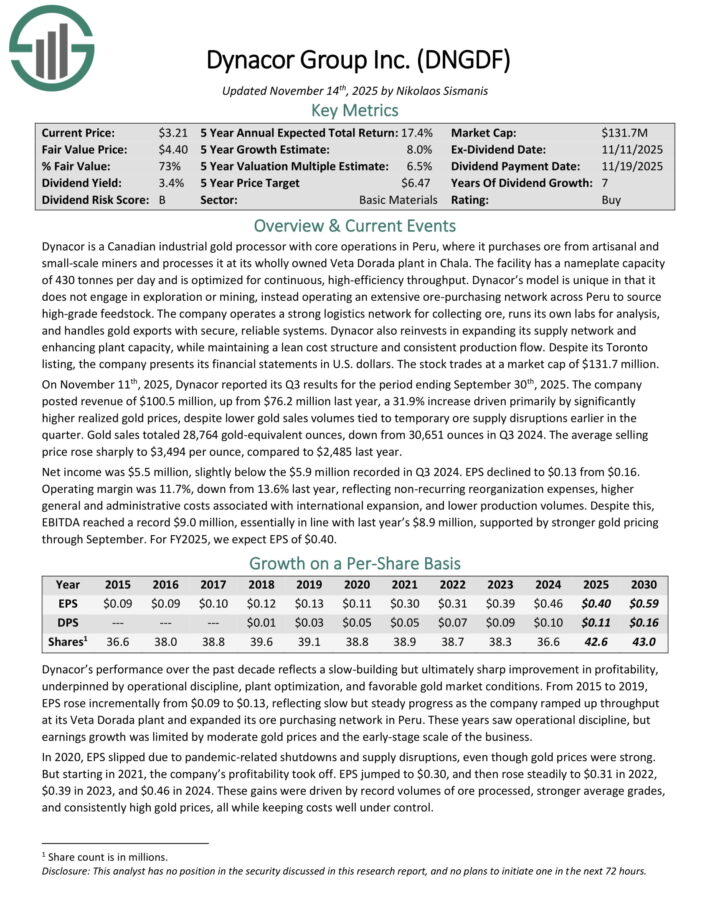

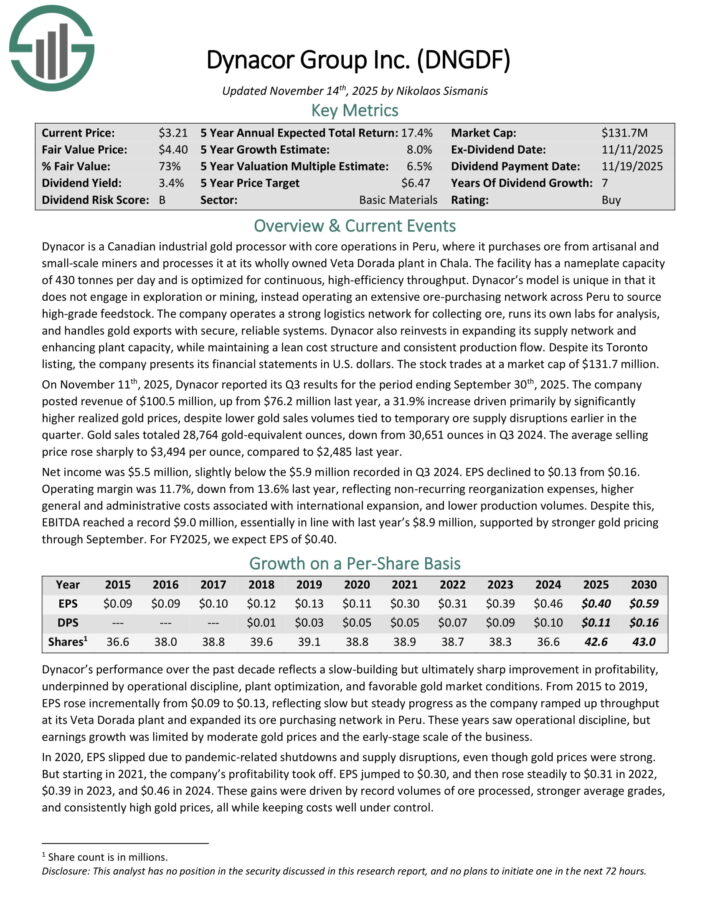

Month-to-month Dividend Inventory For The Lengthy Run #10: Dynacor Group (DNGDF)

Dynacor is a Canadian industrial gold processor with core operations in Peru, the place it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The power has a nameplate capability of 430 tonnes per day and is optimized for steady, high-efficiency throughput.

Dynacor’s mannequin is exclusive in that it doesn’t have interaction in exploration or mining, as a substitute working an in depth ore buying community throughout Peru to supply high-grade feedstock.

The corporate operates a powerful logistics community for gathering ore, runs its personal labs for evaluation, and handles gold exports with safe, dependable programs.

Dynacor additionally reinvests in increasing its provide community and enhancing plant capability, whereas sustaining a lean value construction and constant manufacturing circulate.

On November eleventh, 2025, Dynacor reported its Q3 outcomes. The corporate posted income of $100.5 million, up from $76.2 million final yr, a 31.9% enhance pushed primarily by considerably larger realized gold costs, regardless of decrease gold gross sales volumes tied to momentary ore provide disruptions earlier within the quarter.

Gold gross sales totaled 28,764 gold-equivalent ounces, down from 30,651 ounces in Q3 2024. The common promoting worth rose sharply to $3,494 per ounce, in comparison with $2,485 final yr.

Web revenue was $5.5 million, barely beneath the $5.9 million recorded in Q3 2024. EPS declined to $0.13 from $0.16. Working margin was 11.7%, down from 13.6% final yr, reflecting non-recurring reorganization bills, larger normal and administrative prices related to worldwide growth, and decrease manufacturing volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on DNGDF (preview of web page 1 of three proven beneath):

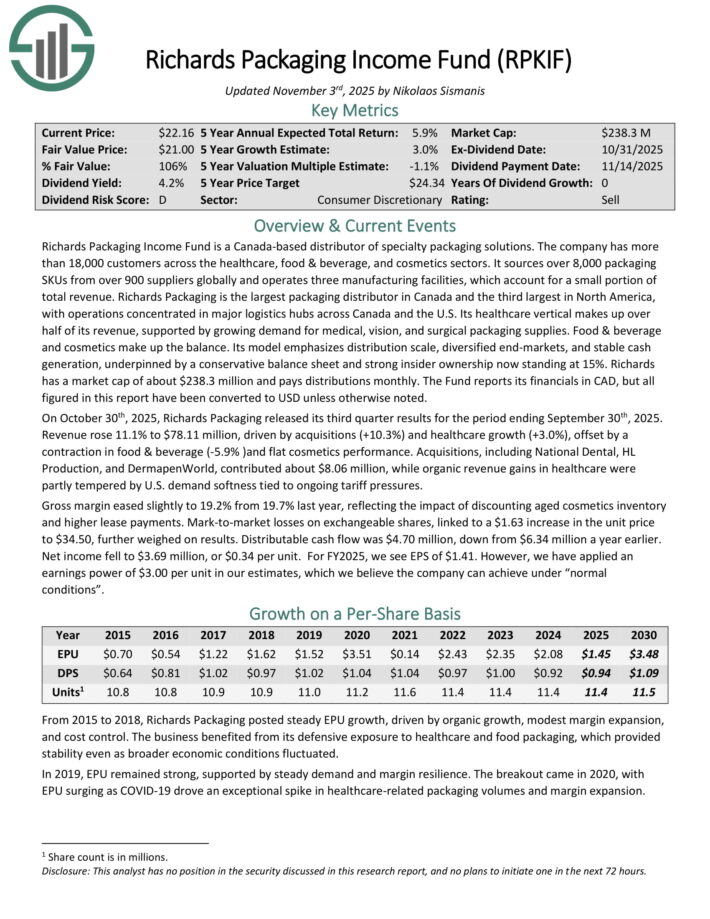

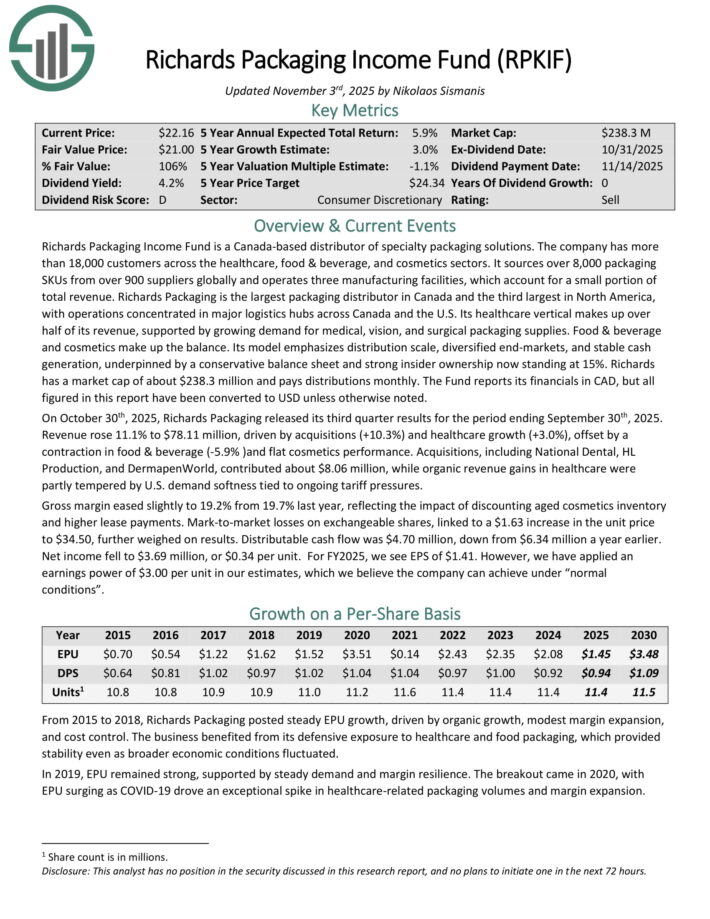

Month-to-month Dividend Inventory For The Lengthy Run #9: Richards Packaging Revenue Fund (RPKIF)

Richards Packaging Revenue Fund is a Canada-based distributor of specialty packaging options. The corporate has greater than 18,000 prospects throughout the healthcare, meals & beverage, and cosmetics sectors.

It sources over 8,000 packaging SKUs from over 900 suppliers globally and operates three manufacturing services, which account for a small portion of complete income.

Richards Packaging is the most important packaging distributor in Canada and the third largest in North America, with operations concentrated in main logistics hubs throughout Canada and the U.S.

Its healthcare vertical makes up over half of its income, supported by rising demand for medical, imaginative and prescient, and surgical packaging provides. Meals & beverage and cosmetics make up the stability.

Its mannequin emphasizes distribution scale, diversified end-markets, and steady money era, underpinned by a conservative stability sheet and powerful insider possession now standing at 15%.

On October thirtieth, 2025, Richards Packaging launched its third quarter outcomes. Income rose 11.1% to $78.11 million, pushed by acquisitions (+10.3%) and healthcare development (+3.0%), offset by a contraction in meals & beverage (-5.9% )and flat cosmetics efficiency.

Distributable money circulate was $4.70 million, down from $6.34 million a yr earlier. Web revenue fell to $3.69 million, or $0.34 per unit.

Click on right here to obtain our most up-to-date Certain Evaluation report on RPKIF (preview of web page 1 of three proven beneath):

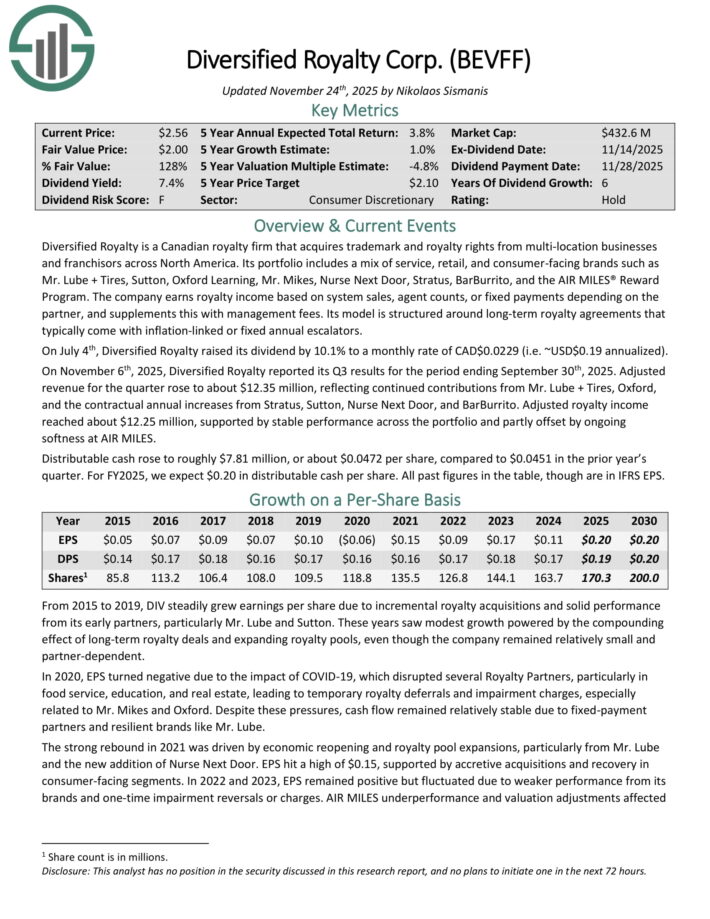

Month-to-month Dividend Inventory For The Lengthy Run #8: Diversified Royalty Corp. (BEVFF)

Diversified Royalty is a Canadian royalty agency that acquires trademark and royalty rights from multi-location companies and franchisors throughout North America.

Its portfolio contains a mixture of service, retail, and consumer-facing manufacturers equivalent to Mr. Lube + Tires, Sutton, Oxford Studying, Mr. Mikes, Nurse Subsequent Door, Stratus, BarBurrito, and the AIR MILES Reward Program.

The corporate earns royalty revenue based mostly on system gross sales, agent counts, or mounted funds relying on the companion, and dietary supplements this with administration charges. Its mannequin is structured round long-term royalty agreements that usually include inflation-linked or mounted annual escalators.

On July 4th, Diversified Royalty raised its dividend by 10.1% to a month-to-month price of CAD$0.0229.

On November sixth, 2025, Diversified Royalty reported its Q3 outcomes for the interval ending September thirtieth, 2025. Adjusted income for the quarter rose to about $12.35 million, reflecting continued contributions from Mr. Lube + Tires, Oxford, and the contractual annual will increase from Stratus, Sutton, Nurse Subsequent Door, and BarBurrito.

Adjusted royalty revenue reached about $12.25 million, supported by steady efficiency throughout the portfolio and partly offset by ongoing softness at AIR MILES.

Distributable money rose to roughly $7.81 million, or about $0.0472 per share, in comparison with $0.0451 within the prior yr’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEVFF (preview of web page 1 of three proven beneath):

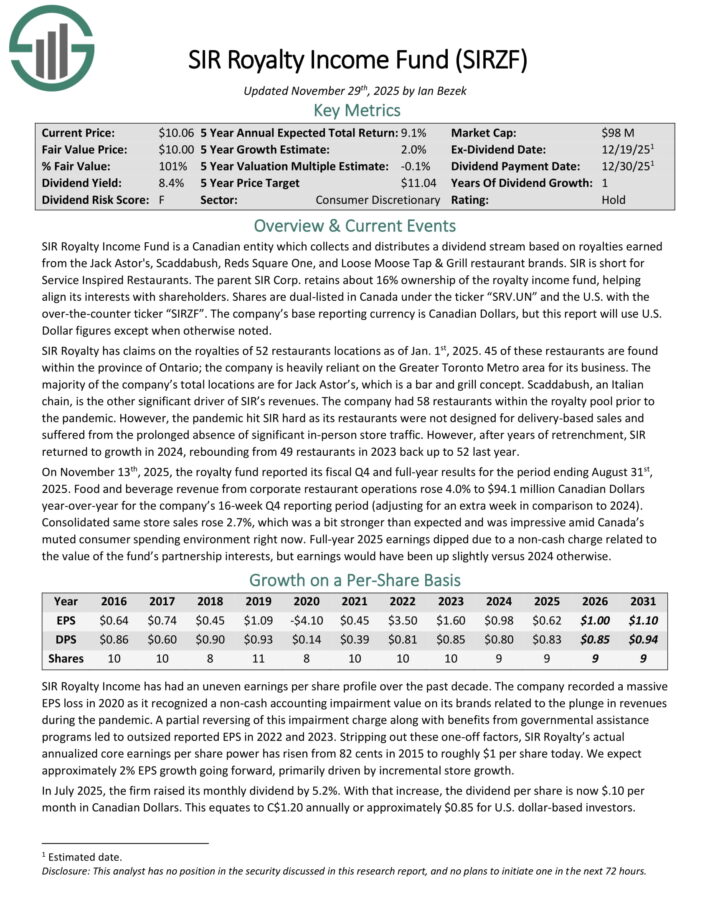

Month-to-month Dividend Inventory For The Lengthy Run #7: SIR Royalty Revenue Fund (SIRZF)

SIR Royalty Revenue Fund is a Canadian entity which collects and distributes a dividend stream based mostly on royalties earned from the Jack Astor’s, Scaddabush, Reds Sq. One, and Unfastened Moose Faucet & Grill restaurant manufacturers.

The guardian SIR Corp. retains about 16% possession of the royalty revenue fund, serving to align its pursuits with shareholders.

SIR Royalty has claims on the royalties of 52 eating places places as of Jan. 1st, 2025. 45 of those eating places are discovered throughout the province of Ontario; the corporate is closely reliant on the Larger Toronto Metro space for its enterprise.

The vast majority of the corporate’s complete places are for Jack Astor’s, which is a bar and grill idea. Scaddabush, an Italian chain, is the opposite vital driver of SIR’s revenues.

On November thirteenth, 2025, the royalty fund reported its fiscal This fall and full-year outcomes. Meals and beverage income from company restaurant operations rose 4.0% to $94.1 million Canadian {Dollars} year-over-year for the corporate’s 16-week This fall reporting interval (adjusting for an additional week compared to 2024).

Consolidated similar retailer gross sales rose 2.7%, which was a bit stronger than anticipated and was spectacular amid Canada’s muted client spending surroundings proper now.

Click on right here to obtain our most up-to-date Certain Evaluation report on SIRZF (preview of web page 1 of three proven beneath):

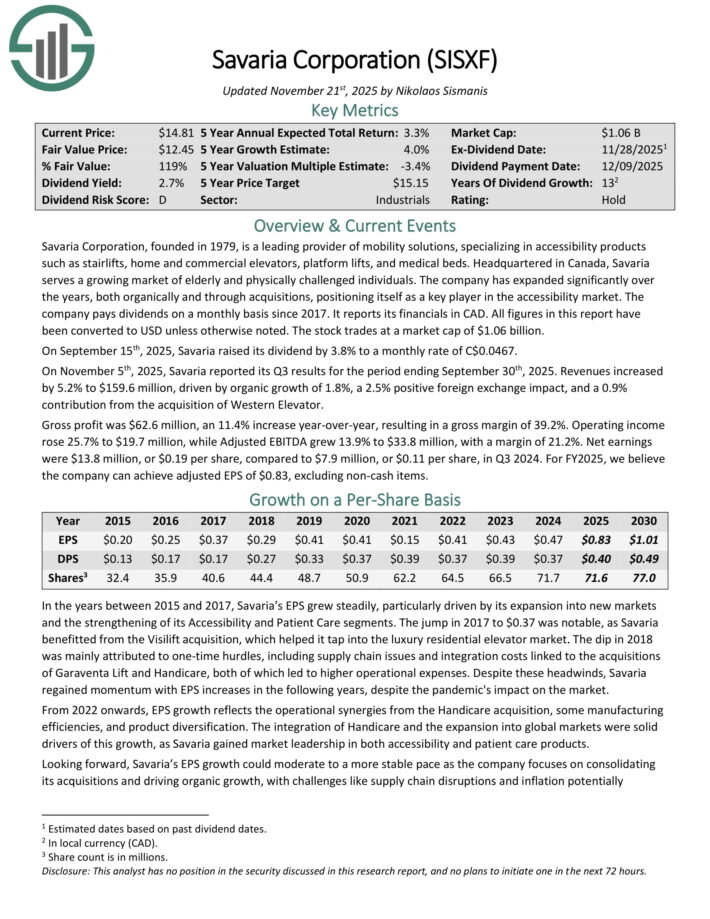

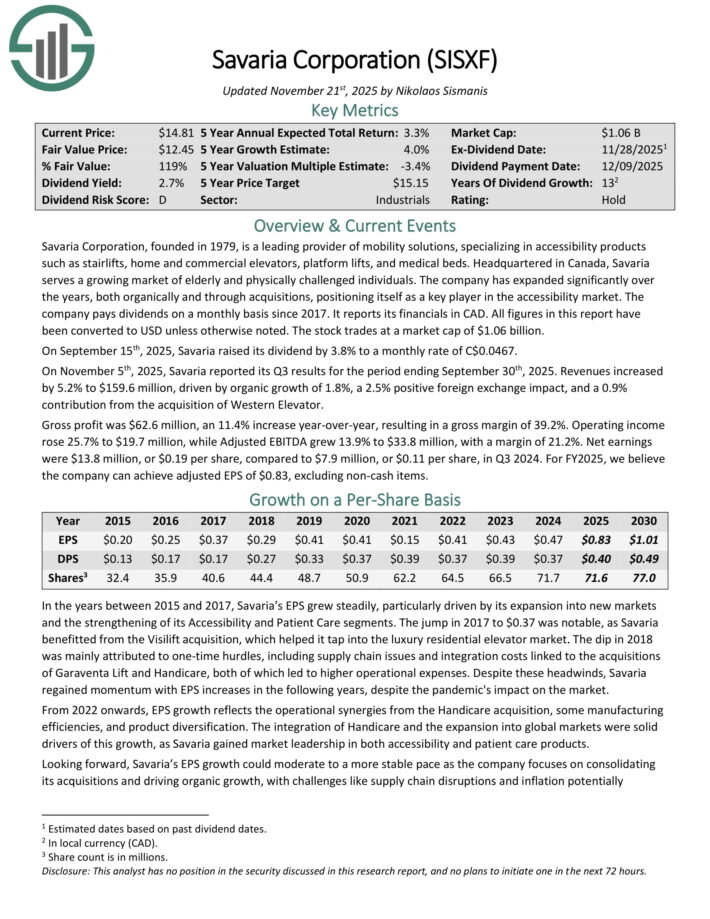

Month-to-month Dividend Inventory For The Lengthy Run #6: Savaria Company (SISXF)

Savaria Company is a number one supplier of mobility options, specializing in accessibility merchandise equivalent to stairlifts, dwelling and business elevators, platform lifts, and medical beds.

Headquartered in Canada, Savaria serves a rising market of aged and bodily challenged people. The corporate has expanded considerably through the years, each organically and thru acquisitions, positioning itself as a key participant within the accessibility market.

On September fifteenth, 2025, Savaria raised its dividend by 3.8% to a month-to-month price of C$0.0467. On November fifth, 2025, Savaria reported its Q3 outcomes for the interval ending September thirtieth, 2025.

Revenues elevated by 5.2% to $159.6 million, pushed by natural development of 1.8%, a 2.5% optimistic international change affect, and a 0.9% contribution from the acquisition of Western Elevator.

Gross revenue was $62.6 million, an 11.4% enhance year-over-year, leading to a gross margin of 39.2%. Working revenue rose 25.7% to $19.7 million, whereas Adjusted EBITDA grew 13.9% to $33.8 million, with a margin of 21.2%. Web earnings had been $13.8 million, or $0.19 per share, in comparison with $7.9 million, or $0.11 per share, in Q3 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on SISXF (preview of web page 1 of three proven beneath):

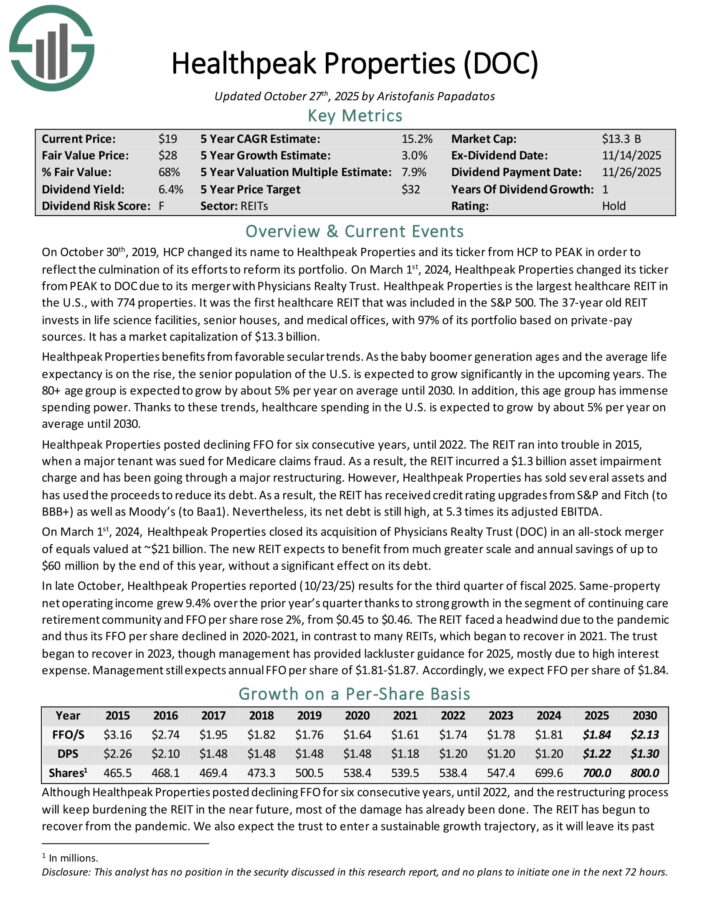

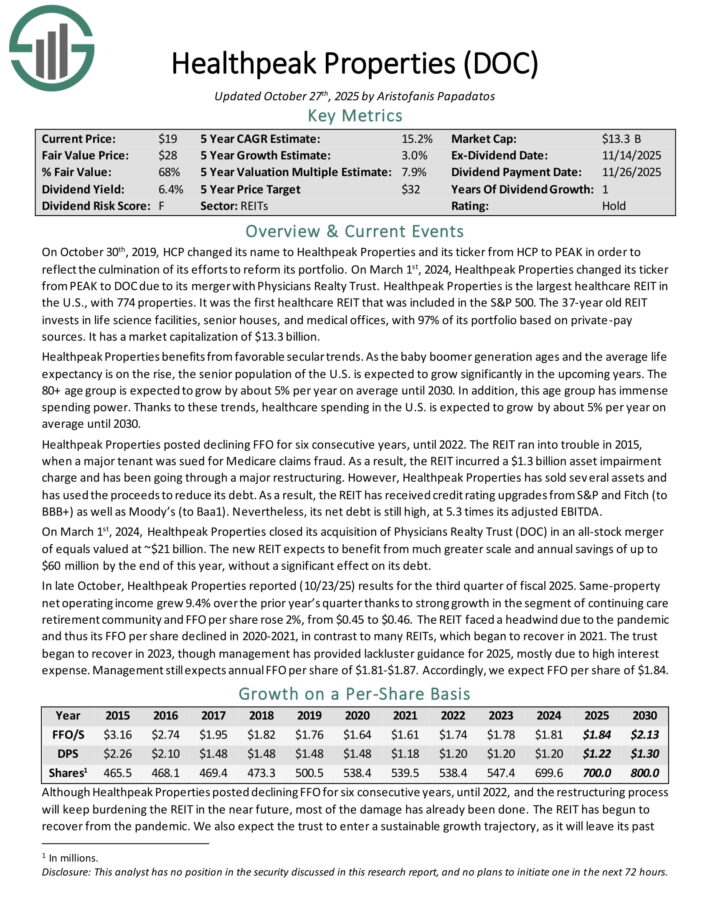

Month-to-month Dividend Inventory For The Lengthy Run #5: Healthpeak Properties (DOC)

Healthpeak Properties is the most important healthcare REIT within the U.S., with 774 properties. It was the primary healthcare REIT that was included within the S&P 500.

The REIT invests in life science services, senior homes, and medical workplaces, with 97% of its portfolio based mostly on private-pay sources.

In late October, Healthpeak Properties reported (10/23/25) outcomes for the third quarter of fiscal 2025. Similar-property internet working revenue grew 9.4% over the prior yr’s quarter because of sturdy development within the section of constant care retirement group and FFO per share rose 2%, from $0.45 to $0.46.

Administration nonetheless expects annual FFO per share of $1.81-$1.87.

The payout ratio is standing at an almost 10-year low whereas the REIT didn’t have any debt maturities in 2025. The REIT has begun to get well from the pandemic. We additionally count on the belief to enter a sustainable development trajectory.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOC (preview of web page 1 of three proven beneath):

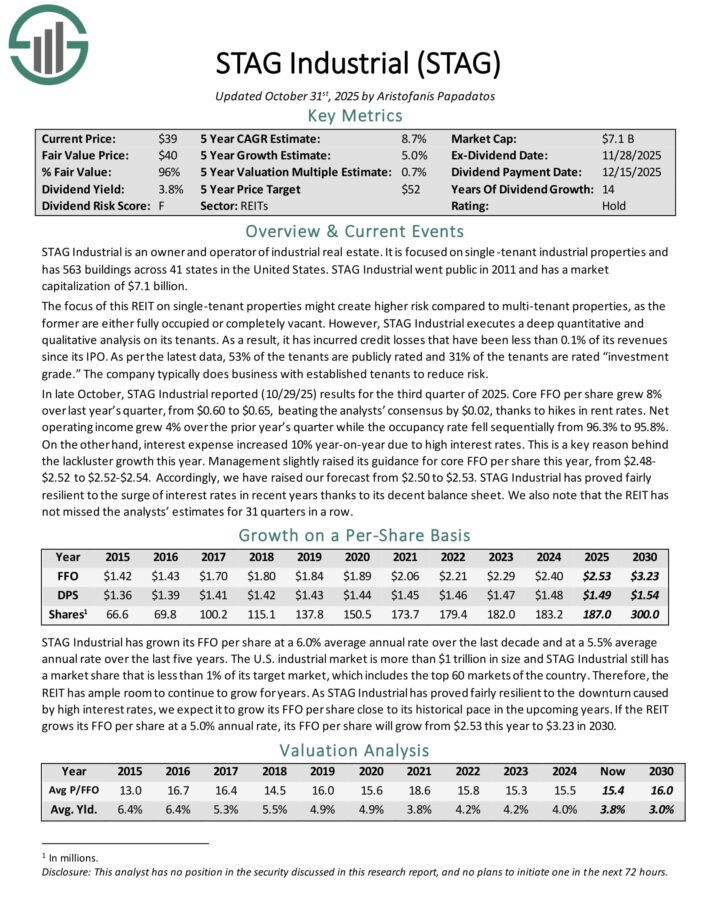

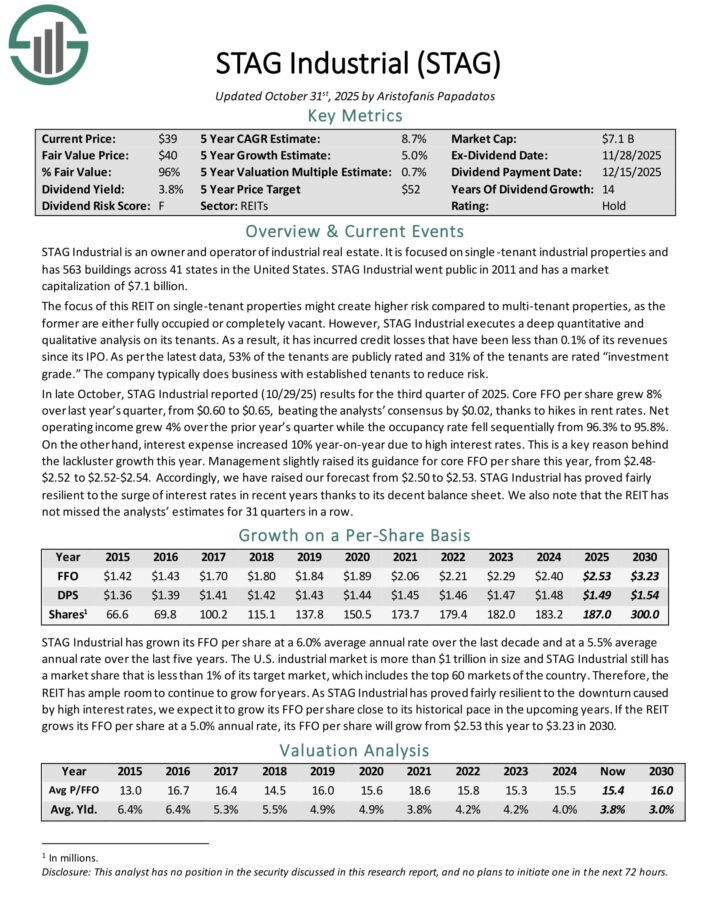

Month-to-month Dividend Inventory For The Lengthy Run #4: STAG Industrial (STAG)

STAG Industrial is an proprietor and operator of commercial actual property. It’s targeted on single-tenant industrial properties and has 563 buildings throughout 41 states in the USA.

The main target of this REIT on single-tenant properties would possibly create larger danger in comparison with multi-tenant properties, as the previous are both totally occupied or fully vacant.

Nonetheless, STAG Industrial executes a deep quantitative and qualitative evaluation on its tenants. Because of this, it has incurred credit score losses which were lower than 0.1% of its revenues since its IPO.

As per the newest knowledge, 53% of the tenants are publicly rated and 31% of the tenants are rated “funding grade.” The corporate usually does enterprise with established tenants to scale back danger.

In late October, STAG Industrial reported (10/29/25) outcomes for the third quarter of 2025. Core FFO per share grew 8% over final yr’s quarter, from $0.60 to $0.65, beating the analysts’ consensus by $0.02, because of hikes in lease charges.

Web working revenue grew 4% over the prior yr’s quarter whereas the occupancy price fell sequentially from 96.3% to 95.8%.

However, curiosity expense elevated 10% year-on-year resulting from excessive rates of interest. This can be a key purpose behind the lackluster development this yr. Administration barely raised its steerage for core FFO per share this yr, from $2.48-$2.52 to $2.52-$2.54.

Click on right here to obtain our most up-to-date Certain Evaluation report on STAG (preview of web page 1 of three proven beneath):

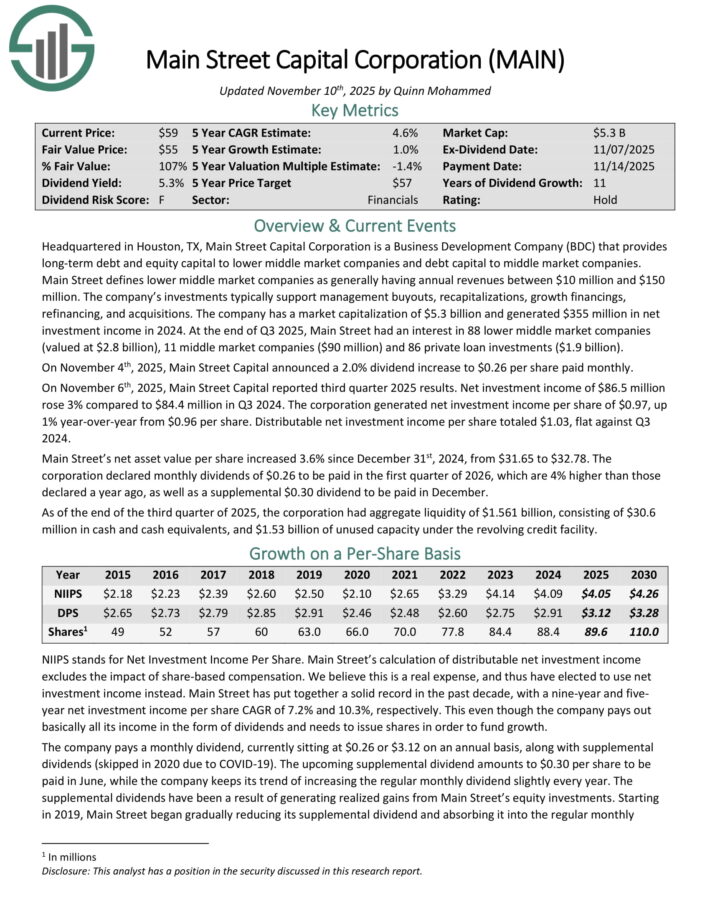

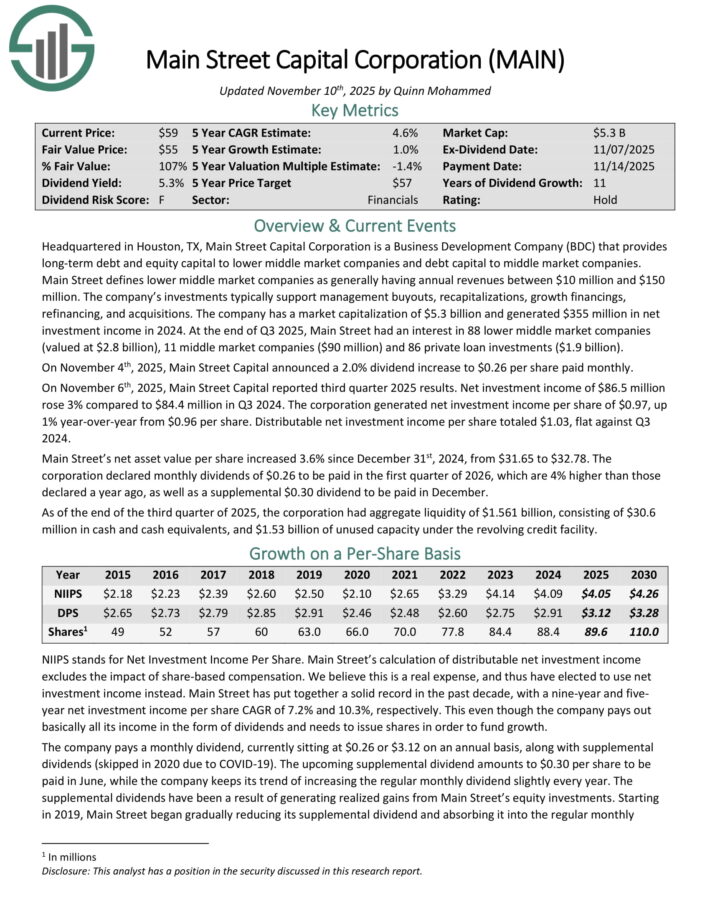

Month-to-month Dividend Inventory For The Lengthy Run #3: Predominant Avenue Capital (MAIN)

Predominant Avenue Capital Company is a Enterprise Growth Firm (BDC) that gives long-term debt and fairness capital to decrease center market corporations and debt capital to center market corporations.

On the finish of Q3 2025, Predominant Avenue had an curiosity in 88 decrease center market corporations (valued at $2.8 billion), 11 center market corporations ($90 million) and 86 non-public mortgage investments ($1.9 billion).

The company had combination liquidity of $1.561 billion, consisting of $30.6 million in money and money equivalents, and $1.53 billion of unused capability below the revolving credit score facility.

On November sixth, 2025, Predominant Avenue Capital reported third quarter 2025 outcomes. Web funding revenue of $86.5 million rose 3% in comparison with $84.4 million in Q3 2024.

The company generated internet funding revenue per share of $0.97, up 1% year-over-year from $0.96 per share. Distributable internet funding revenue per share totaled $1.03, flat in opposition to Q3 2024.

Predominant Avenue’s internet asset worth per share elevated 3.6% since December thirty first, 2024, from $31.65 to $32.78.

The company declared month-to-month dividends of $0.26 to be paid within the first quarter of 2026, that are 4% larger than these declared a yr in the past, in addition to a supplemental $0.30 dividend to be paid in December.

Click on right here to obtain our most up-to-date Certain Evaluation report on MAIN (preview of web page 1 of three proven beneath):

Month-to-month Dividend Inventory For The Lengthy Run #2: Agree Realty (ADC)

Agree Realty is an built-in actual property funding belief (REIT) targeted on possession, acquisition, improvement, and retail property administration.

Agree has developed over 40 group procuring facilities all through the Midwestern and Southeastern United States. On the finish of December 2024, the corporate owned and operated 2,370 properties positioned in 50 states, containing roughly 48.8 million sq. toes of gross leasable house.

The corporate’s enterprise goal is to spend money on and actively handle a diversified portfolio of retail properties internet leased to business tenants.

On October twenty first, 2025, Agree Realty Corp. reported third quarter outcomes for Fiscal Yr (FY)2025. The corporate reported sturdy third-quarter outcomes for 2025, with EPS of $0.47, beating estimates by $0.01, and income of $183.22 million, up 18.7% year-over-year.

Web revenue per share rose 7.9% to $0.45, whereas Core FFO and AFFO per share elevated 8.4% and seven.2% to $1.09 and $1.10, respectively.

The corporate declared a month-to-month dividend of $0.256 per share, representing a 2.4% enhance from the prior yr, and raised full-year 2025 AFFO steerage to $4.31–$4.33 per share.

ADC has elevated its dividend for 13 consecutive years.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADC (preview of web page 1 of three proven beneath):

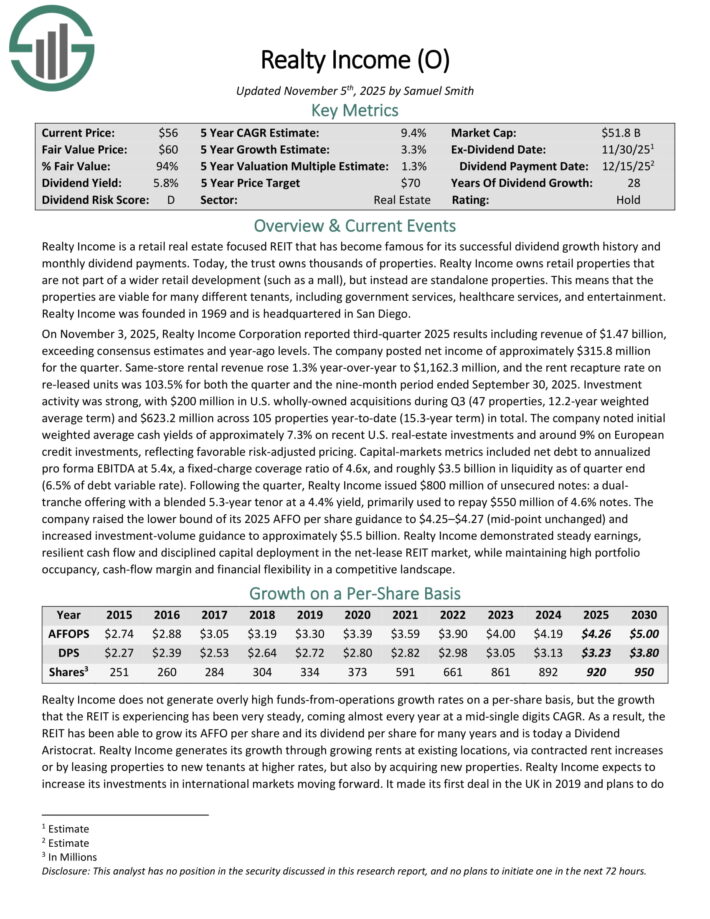

Month-to-month Dividend Inventory For The Lengthy Run #1: Realty Revenue (O)

Realty Revenue is a retail actual property targeted REIT that has grow to be well-known for its profitable dividend development historical past and month-to-month dividend funds.

Realty Revenue owns retail properties that aren’t a part of a wider retail improvement (equivalent to a mall), however as a substitute are standalone properties. Which means the properties are viable for a lot of completely different tenants, together with authorities companies, healthcare companies, and leisure.

On November 3, 2025, Realty Revenue Company reported third-quarter 2025 outcomes together with income of $1.47 billion, exceeding consensus estimates and year-ago ranges.

The corporate posted internet revenue of roughly $315.8 million for the quarter. Similar-store rental income rose 1.3% year-over-year to $1,162.3 million, and the lease recapture price on re-leased models was 103.5% for each the quarter and the nine-month interval ended September 30, 2025.

Funding exercise was sturdy, with $200 million in U.S. wholly-owned acquisitions throughout Q3 (47 properties, 12.2-year weighted common time period) and $623.2 million throughout 105 properties year-to-date (15.3-year time period) in complete.

Realty Revenue’s most essential aggressive benefit is its world-class administration group that has efficiently guided the belief previously.

It has elevated its dividend for 28 consecutive years, and is on the record of Dividend Aristocrats.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Revenue (preview of web page 1 of three proven beneath):

Remaining Ideas

Month-to-month dividend shares could be a gorgeous choice for traders looking for a gradual supply of revenue all year long.

Sadly, many month-to-month dividend shares with extraordinarily excessive yields find yourself chopping or eliminating their dividend payouts.

On the similar time, some month-to-month dividend shares have demonstrated a historical past of monetary stability, constant earnings, and dependable dividend funds.

The ten month-to-month dividend shares on this article might not have the very best dividend yields, however they’ve one of the best likelihood at sustaining (and even rising) their dividend payouts over the subsequent decade.

Further Studying

Don’t miss the assets beneath for extra month-to-month dividend inventory investing analysis.

And see the assets beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].