[ad_1]

- U.S. knowledge, Fed price outlook in focus this week.

- Apple inventory is a purchase forward of extremely anticipated WWDC23 occasion.

- Nio shares set to underperform with downbeat earnings on deck.

- Searching for a serving to hand out there? Members of InvestingPro get unique entry to our analysis instruments and knowledge. Study Extra »

Shares on Wall Avenue ended sharply increased on Friday, with the rallying to its finest degree since August 2022 as traders cheered a robust jobs report and the passage of a debt ceiling invoice that averted a catastrophic default.

For the week, the blue-chip rose 2%, the benchmark S&P 500 tacked on 1.8%, whereas the tech-heavy jumped 2% to notch its sixth-straight week of features.

The week forward is anticipated to be a comparatively quiet one as market gamers proceed to evaluate the outlook for rates of interest, the financial system and inflation.

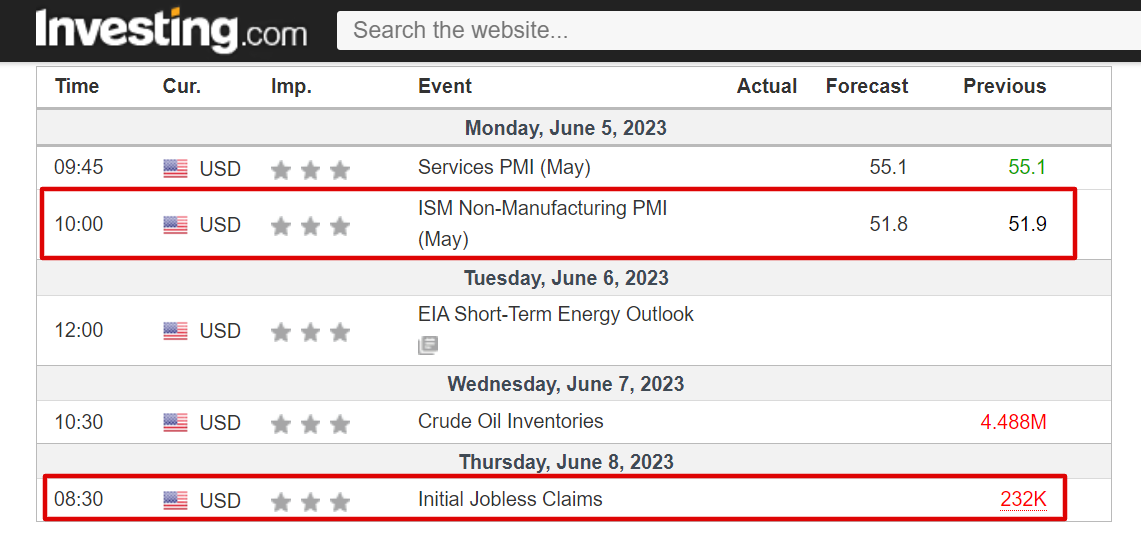

On the financial calendar, most vital would be the Institute for Provide Administration’s (ISM) survey scheduled for Monday, adopted by the most recent report due on Thursday.

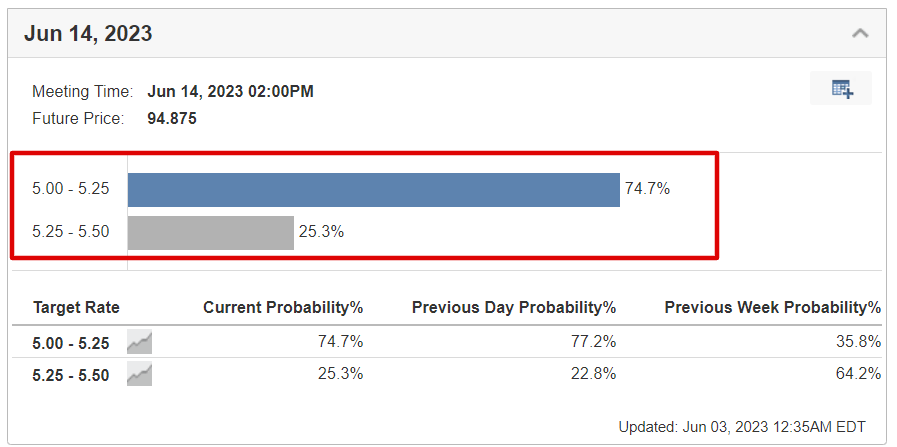

In the meantime, there are not any Fed audio system on the agenda for this week because the U.S. central financial institution goes into its pre-FOMC assembly blackout interval forward of its June 14 coverage choice.

As of Sunday morning, monetary markets are pricing in a roughly 75% likelihood of a pause later this month and a close to 25% likelihood of a 25-basis level price improve, in line with Investing.com’s

Elsewhere, on the earnings docket, there are only a handful of company outcomes due, together with DocuSign (NASDAQ:), Sew Repair (NASDAQ:), Campbell Soup (NYSE:), JM Smucker (NYSE:), GameStop (NYSE:), Signet Jewelers (NYSE:), Vail Resorts (NYSE:), and Ciena (NYSE:).

No matter which route the market goes, under I spotlight one inventory more likely to be in demand and one other which might see additional draw back.

Bear in mind although, my timeframe is simply for the week forward, June 5 to June 9.

Inventory To Purchase: Apple

After ending the week at a recent 52-week excessive, I anticipate Apple’s (NASDAQ:) inventory to increase its uptrend within the days forward because the tech big hosts its Worldwide Builders Convention (WWDC), at which it’s more likely to unveil its long-awaited augmented actuality headset and exhibit its newest {hardware} and software program improvements.

Apple’s WWDC occasion has a historical past of shifting AAPL shares, usually leading to sizable single-day strikes. The inventory has rallied prior to now when new merchandise, options and development initiatives had been introduced on the annual occasion.

The five-day extravaganza will kick off at Apple’s headquarters in Cupertino, California on Monday, June 5, starting with a keynote handle by CEO Tim Prepare dinner that’s set to happen at 1PM ET / 10AM PT.

The patron electronics conglomerate is broadly anticipated to unveil its extremely anticipated blended actuality headset, seemingly known as ‘Actuality Professional’, in what could be the corporate’s first new {hardware} product because the debut of the Apple Watch in 2015.

In addition to this, Apple can also be anticipated to disclose a brand new 15-inch MacBook Air and an Apple Silicon-powered Mac, in addition to the most recent working system updates for the iPhone, iPad, Mac, Apple TV, and Apple Watch.

As well as, Apple might additionally element its AI technique for the primary time. Whereas the tech behemoth has remained comparatively quiet about its AI plans, the corporate’s job listings point out that it’s looking to rent individuals who specialize within the subject.

AAPL inventory ended Friday’s session at $180.95, its highest closing value since Jan. 4, 2022. Shares at the moment stand lower than 2% away from a document excessive of $182.94 reached in January 2022.

At its present valuation, Apple has a market cap of $2.85 trillion, making it probably the most helpful firm buying and selling on the U.S. inventory trade, forward of Microsoft (NASDAQ:), Google-parent Alphabet (NASDAQ:), Amazon (NASDAQ:), and Nvidia (NASDAQ:).

Shares are up 39.2% year-to-date, outperforming the broader market by a large margin over the identical timeframe amid the continued rally in mega-cap tech shares.

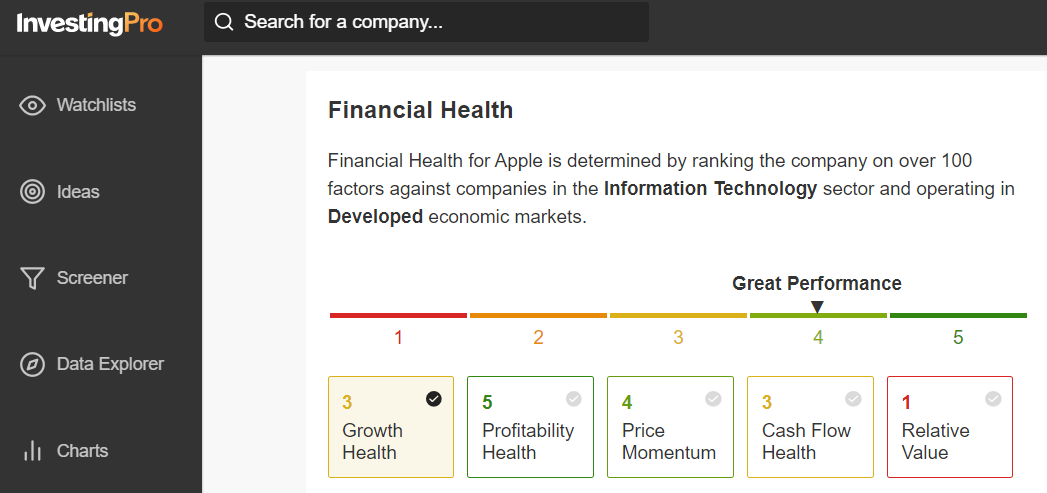

Not surprisingly, Apple at the moment boasts an above-average ‘Monetary Well being’ rating of three.2 out of 5.0 on InvestingPro.

Supply: InvestingPro

That ought to bode effectively for Apple traders as corporations with well being scores better than 2.75 have persistently outpaced the broader market by a large margin over the previous seven years, courting again to 2016.

Inventory To Promote: Nio

I consider shares of Nio (NYSE:) will undergo a difficult week, because the struggling Chinese language electrical automobile maker will ship disappointing earnings for my part and supply a weak outlook as a result of adverse impression of varied headwinds on its enterprise.

Nio’s monetary outcomes for the primary quarter are due forward of the opening bell on Friday, June 9, and are more likely to reveal one other quarterly loss and slowing gross sales development as a result of robust financial local weather.

Market members anticipate a large swing in NIO inventory following the Q1 replace, with a doable implied transfer of roughly 15% in both route, in line with the choices market.

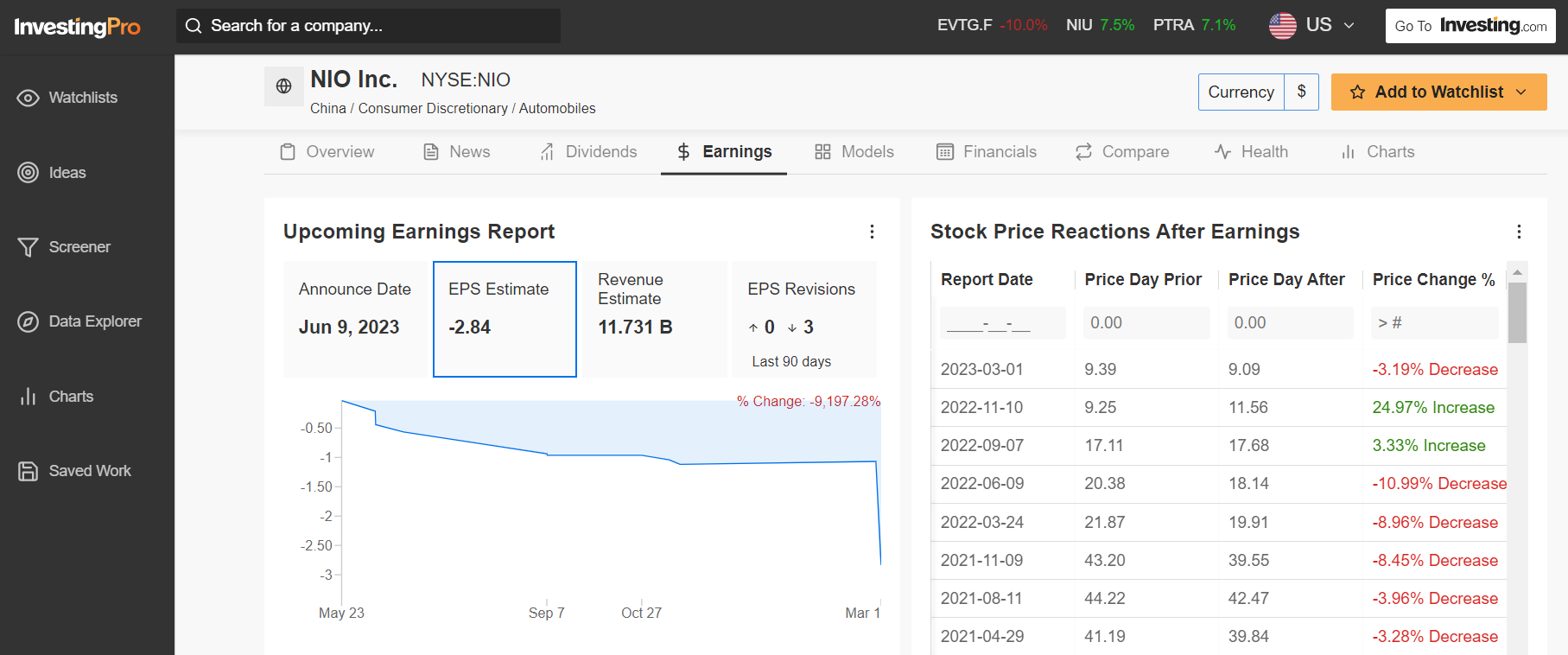

Forward of the report, analysts have slashed their EPS estimates 3 times within the final 90 days, in comparison with zero upward revisions, as per an InvestingPro survey.

Supply: InvestingPro

Wall Avenue sees the EV firm shedding $0.40 a share (¥2.84) within the first quarter, worsening from a internet lack of $0.11 (¥0.79) within the year-ago interval, because it spends closely to fend off competitors from home rivals equivalent to Li Auto (NASDAQ:), Xpeng (NYSE:), and BYD (OTC:), in addition to extra established international automakers, together with Tesla (NASDAQ:), and Volkswagen (ETR:).

In the meantime, income is forecast to extend 18.6% yearly to $1.66 billion (¥11.73 billion), nonetheless, that might mark a pointy slowdown from the gross sales development of 62% seen within the earlier quarter as Nio struggles within the face of weakening demand amid a deteriorating EV market.

That leads me to consider that there’s a rising draw back danger that Nio might minimize its gross sales steerage and supply outlook for the remainder of the 12 months.

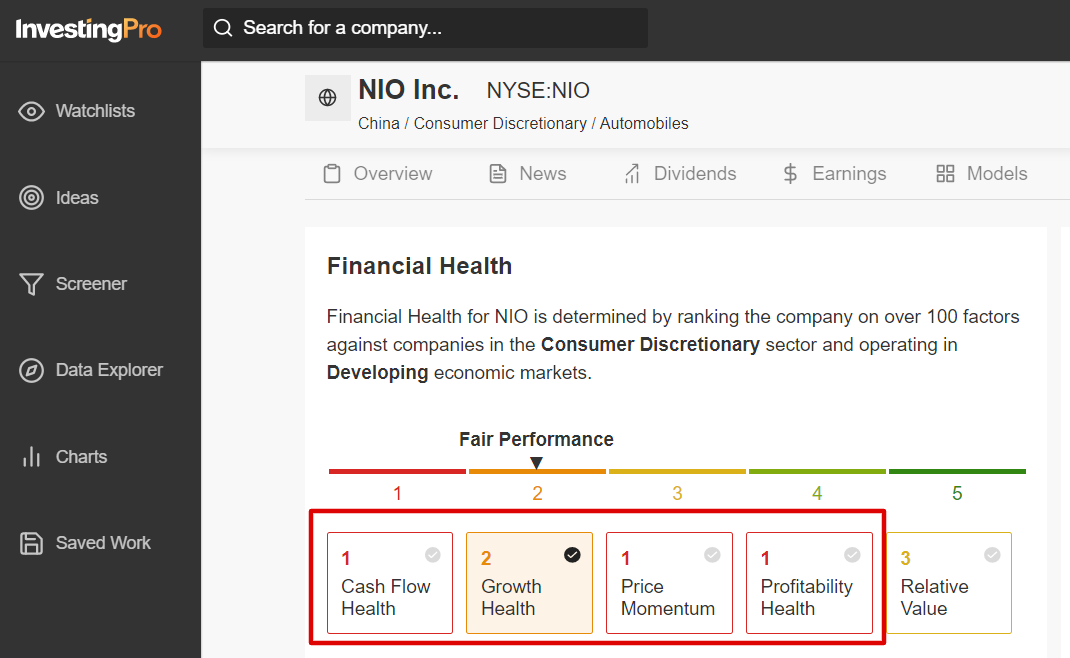

Underscoring the adverse impression of a number of near-term headwinds, Nio at the moment has an especially poor InvestingPro ‘Monetary Well being’ rating of 1.6 out of 5.0 because of considerations about profitability, development, and free money circulation.

Supply: InvestingPro

The Professional well being metric is decided by rating the corporate on over 100 elements in opposition to different corporations within the Client Discretionary sector.

NIO inventory fell to a low of $7.00 on Thursday, a degree not seen since June 2020, earlier than recovering barely to finish at $7.56 on Friday. At present valuations, Shanghai-based Nio has a market cap of $12.6 billion.

Shares are down 22.4% to this point in 2023, trailing the comparable returns of home rivals equivalent to Li Auto, and Xpeng, in addition to different notable international automakers, together with Tesla, Toyota, Honda, Ford, and GM.

Much more alarming, NIO stays practically 90% under its January 2021 all-time excessive of $66.99.

Should you’re searching for extra actionable commerce concepts to navigate the present volatility on Wall St., the InvestingPro software helps you simply determine successful shares at any given time.

Right here is the hyperlink for these of you who wish to subscribe to InvestingPro and begin analyzing shares your self.

Disclosure: On the time of writing, I’m brief on the S&P 500 and Nasdaq 100 by way of the ProShares Quick S&P 500 ETF (SH) and ProShares Quick QQQ ETF (PSQ). I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic atmosphere and firms’ financials. The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

[ad_2]

Source link