CatLane

Because the present rates of interest are comparatively excessive (not less than in comparison with ~ 15 years historical past), earnings investing has turn into extra engaging. This additionally signifies that retirement centered methods that usually contain defensive and yield-bearing belongings have come again in vogue and are in a position to provide stable prospects for tangible earnings streams.

Earlier than the rates of interest ticked increased, traders, who had been tilted in direction of funding a sturdy retirement portfolio, needed to assume an excessive amount of danger relative to the funding goals or put a heavier emphasis on growing the contributions simply to attain the mandatory retirement portfolio earnings ranges sooner or later.

Such devices as REITs and MLPs have been direct beneficiaries of the upper rate of interest surroundings (from the potential and never earlier investor perspective). For instance, as REITs embody danger and return traits which are just like fastened earnings securities, the curiosity price hikes have triggered the multiples to go down in a big vogue. This has, in flip, rendered dividend yields extra engaging and within the case of top quality REITs, conservative retirement traders have now the chance to enter with out assuming speculative danger. For MLPs, the story of engaging earnings consists of two elements: 1) increased rates of interest, which as for the REITs have pushed down the multiples, whereas the basics have remained sound (though for REITs it varies sector by sector), 2) structural tailwinds stemming from elevated demand for vitality, business consolidation and, importantly, notable deleveraging course of that had came about within the speedy years after COVID-19.

With this being mentioned, let me spotlight one REIT and one MLP decide, the place each provide tangible dividends at restricted monetary danger, which, for my part, are the suitable decisions for protected and yield-driven portfolios.

REIT – Realty Earnings Company (NYSE:O)

Realty earnings is likely one of the most well-known REITs on the market, carrying a market capitalization of ~ $54 billion, which is sufficient for being included within the S&P 500. The rationale why it’s so widespread and a typical selection amongst yield-seeking traders isn’t solely its dividend aristocrat standing, but additionally its capability to drive constant earnings progress that finally enable to often enhance the distributions with out exhausting the AFFO payout profile or reducing the interior progress capability.

The present yield of O stands at ~5%, which within the context of the historic common and underlying fundamentals gives a compelling entry level.

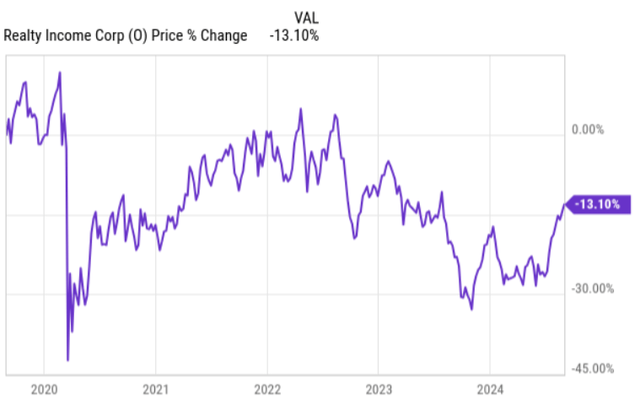

Within the chart under, we will see that over the previous 5-year interval, O’s share worth has dropped by ~13% even if in every of those years the AFFO era per share has gone up. This virtually fully defined by increased rate of interest dynamics, which, as described above, creates a chance.

Ycharts

Talking of the protection, we’ve to take into account that Realty Earnings has an higher funding grade credit standing, which is kind of unusual within the REIT universe. The rationale why O has been in a position to obtain that is associated to its fortress steadiness sheet and, to a big extent, the advantages related to it dimension (e.g., diversification on a tenant, sub-sector and geographic stage). Plus, it has a weighted common lease expiration schedule of near 10 years, which introduces an extra layer of security.

The presence of an higher funding grade credit standing allows O to be aggressive within the M&A recreation by venturing into prime quality properties in an accretive method. In different phrases, since the price of capital for O is comparatively low, it may possibly afford to imagine barely decrease cap charges, whereas nonetheless capturing the mandatory spreads for worth creation.

Due to the deal with the M&A, O has been in a position to register respectable progress dynamics. As an illustration, in Q2, 2024 Realty Earnings achieved AFFO progress per share of 6% in comparison with the identical interval final yr. That is very excessive for any funding grade REIT.

The fantastic thing about O’ dimension and comparatively conservative AFFO payout profile is that it may possibly accommodate new and sizeable transactions via its inside monetary capability (i.e., with out counting on recent fairness issuances). In Q2, O invested ~ $806 million at a blended 7.9% preliminary money yield, which was funded by ~ $200 million of retained AFFO, $106 million of divestiture proceeds and the remaining quantity got here from incremental borrowing. Provided that these new acquisitions generate engaging spreads, the projected enhance in AFFO ought to maintain the capital construction (e.g., debt to EBITDA) in a proper steadiness.

All in all, Realty earnings presents a case of significant dividend earnings that’s underpinned by sturdy fundamentals, which warrant not solely the mandatory protection, but additionally incremental progress that’s so very important for having fun with really sustainable earnings streams.

MLP – MPLX LP (NYSE:MPLX)

MPLX is likely one of the largest midstream partnerships, carrying a market cap of ~ $43 billion, which as within the case of O permits traders to keep away from small-cap dangers and profit from the diversification facet. From the enterprise focus angle, MPLX isn’t that completely different from nearly all of MLPs on the market. It owns and operates midstream vitality infrastructure and logistics belongings, and operates gasoline distribution companies.

The present yield of MPLX stands at 7.9%, which is actually above the sector common if we take a look at prime quality and funding grade names.

There are a number of explanation why MPLX, in my humble opinion, must be severely thought of for being included as a core of top quality income-generating retirement portfolio.

An necessary driver right here is that MPLX’s enterprise focus is essentially biased in direction of the logistics and storage phase, which collectively account for about two thirds of the EBITDA. Each of those enterprise segments are much less delicate to the commodity worth dangers.

But, whereas all of that is inherently defensive, MPLX has managed to register a historic 5-year CAGR of adjusted EBITDA and DCF of ~ 6.5% and eight%, respectively. So, we’ve right here the same scenario to that of Realty Earnings – the place the underlying enterprise is inherently defensive and regardless of that, the expansion dynamics have been robust. One other component to underscore in relation to those two metrics is that the DCF element has elevated greater than adjusted EBITDA, which indicators that MPLX has managed to optimize its capital construction and seize financial savings on debt service value entrance.

The steadiness sheet for MPLX is rock-solid as properly. The present complete debt to adjusted EBITDA stands at 3.4x, which is meaningfully under the 3-year common – as soon as once more confirming the aforementioned nuance of DCF surpassing the EBITDA.

A serious cause why MPLX has been in a position to constantly deleverage (albeit the debt is already at a really wholesome stage) is the truth that it may possibly retain circa $1.8 billion of money every year after servicing each debt and dividend funds. Granted, a part of this goes to CapEx, however on condition that the historic upkeep CapEx has been round $150 million per yr, there may be appreciable capital left to strengthen the capital construction, develop the enterprise or enhance the distributions (together with doing the share buybacks).

For instance, for 2024 the steering from the Administration is that there can be circa $1 billion deployed in incremental progress CapEx initiatives, whereas leaves round $700 million of recent liquidity on the books.

Lastly, in my opinion, having a progress facet in place is crucial to safe a sustainable and not less than according to the inflation issue earnings progress over the long-run.

The underside line

Whereas the rates of interest are nonetheless up, income-seeking retirement traders have the chance to go lengthy and lock in engaging yields in defensive belongings. Actually, at present there are alternatives on the market, the place it’s potential to seize progress facet on prime of top quality and tangible earnings streams.

Realty Earnings and MPLX are two stable picks that fulfill these standards and, in my humble opinion, are positively price contemplating for an inclusion in a retirement portfolio.