unomat/iStock through Getty Pictures

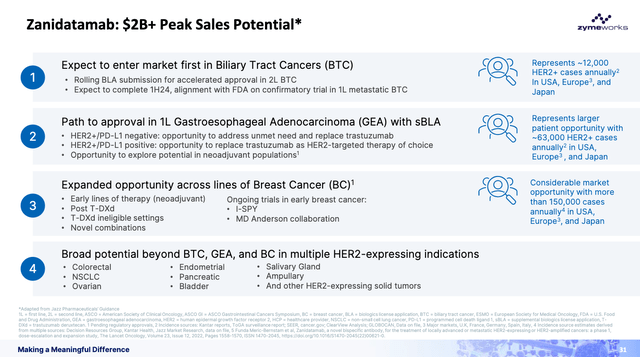

Unveiling Zanidatamab’s Market Potential in Oncology

Zymeworks (NASDAQ:ZYME) is up 67% since my “Sturdy Purchase” advice in September, amidst many developments. Fairly a couple of antibody-drug conjugate [ADC] builders, like Zymeworks, are up huge since AbbVie (ABBV) acquired ImmunoGen again in December for $10.1 billion.

In January, the corporate outlined its methods for the following two years. The main target stays on their lead asset, zanidatamab, a bispecific antibody, for the remedy of first-line HER2-positive gastroesophageal adenocarcinoma (GEA). Zymeworks is growing this asset in collaboration with Jazz Prescribed drugs (JAZZ) and BeiGene (BGNE). Part 3 information in GEA is predicted later this 12 months. In response to Biomarker Analysis, “Roughly 7.3-20.2% of sufferers with superior G/GEJ adenocarcinoma have HER2 overexpression.” Present remedy for 1L HER2-positive GEA at present includes trastuzumab, a monoclonal antibody that targets HER2, together with chemotherapy brokers like fluoropyrimidine (capecitabine or 5-fluorouracil) and a platinum-based drug (cisplatin or oxaliplatin). This advice adopted the ToGA (Trastuzumab for Gastric Most cancers) Part 3 trial, which demonstrated a median general survival of “13.8 months (95% CI 12-16) in these assigned to trastuzumab plus chemotherapy in contrast with 11.1 months (10-13) in these assigned to chemotherapy alone.” In the meantime, in a non-pivotal examine, zanidatamab plus chemotherapy displayed an 18-month general survival fee of 84% (the median general survival shouldn’t be but met). Granted, zanidatamab information is predicated on simply 42 sufferers, in comparison with trastuzumab’s 594. Nevertheless, if the zanidatamab information holds up within the Part 3 trial, it might substitute trastuzumab in HER2-positive GEA first-line remedy. This figures to be a significant marketplace for Zymeworks and its collaborators.

Zymeworks can be evaluating zanidatamab for the remedy of biliary tract cancers and expects regulatory submissions later this 12 months.

Zymeworks

The $2 billion-plus peak gross sales potential is an inexpensive determine given the breadth of alternatives for zanidatamab. Nevertheless, there’s a caveat. Based mostly on their U.S. partnership with Jazz, Zymeworks is entitled to 10-20% in tiered royalty funds. This deal, nevertheless, additionally contains regulatory (as much as $525 million) and commercialization (as much as $862.5 million) milestone funds.

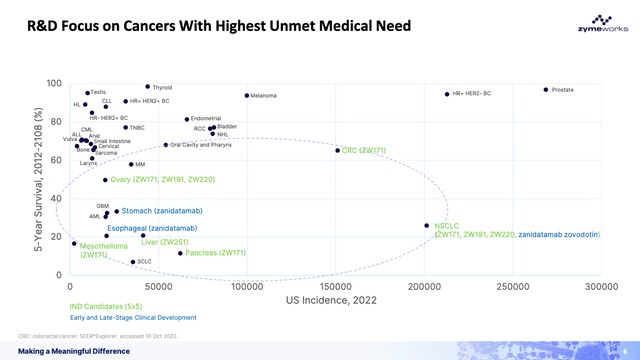

Past zanidatamab, Zymeworks’ pipeline is targeted on indications with the “highest unmet medical wants.”

Zymeworks

This opens Zymeworks as much as accelerated drug growth and pricing energy as soon as their therapeutics attain the market.

So, issues are progressing properly at Zymeworks. Will probably be good to see their efforts bear fruit, assuming some constructive regulatory information within the coming quarters. Surprisingly, Zymeworks’ enterprise worth nonetheless seems low cost at $600 million.

Monetary Well being

Turning to Zymeworks’ stability sheet, after contemplating the newest monetary replace, the mixed worth of money and money equivalents, and marketable securities stands at roughly $455 million (as of December 31). This determine underscores a strong liquidity place in opposition to complete liabilities of $132 million (as of September 30), with a big enhancement within the firm’s capability to cowl its liabilities.

During the last reported 9 months, Zymeworks skilled a internet money burn of $132.3 million in working actions, translating to a month-to-month burn fee of roughly $14.7 million. With the up to date money place, Zymeworks expects its money assets to fund R&D applications and enterprise operations into the second half of 2027. Given the up to date money reserves and the projected money runway, the probability of Zymeworks requiring further financing inside the subsequent twelve months appears low.

Zymeworks formally experiences This fall earnings this Wednesday, March 6, after market shut. Traders ought to monitor for updates concerning the corporate’s money burn, R&D investments, partnerships, and medical developments.

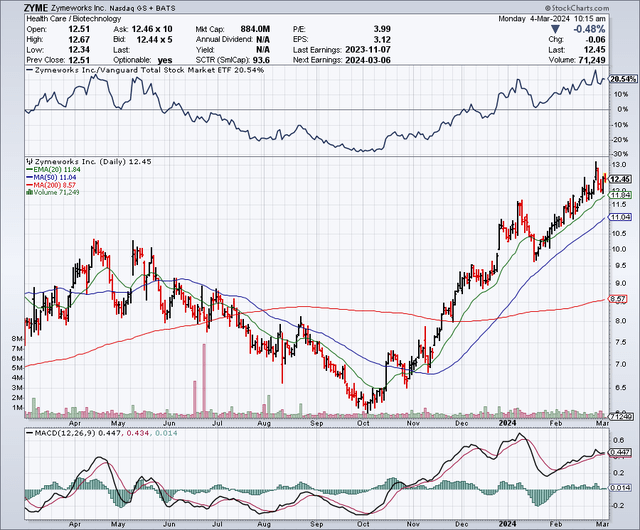

Market Sentiment

In response to Searching for Alpha information, ZYME, with a market capitalization of $875.72 million, reveals promising progress prospects, as analysts forecast a income bounce to $114.04 million in 2024, a 52.48% improve, adopted by a modest 7.36% rise in 2025. Inventory momentum outpaces SPY throughout all noticed timeframes, signaling sturdy market confidence.

StockCharts.com

Per Fintel, brief curiosity stands at 3,256,501 shares, suggesting a average degree of investor skepticism or hedging exercise. Institutional possession is excessive at 93.05%, with important actions noticed: 32 new positions and 15 bought out, highlighting lively institutional engagement. Notable establishments embody Ecor1 Capital and Redmile Group, with Morgan Stanley notably rising its stake. Insider exercise signifies a internet constructive development over the previous 12 months, with internet acquisitions amounting to three,506,440 shares, regardless of a short-term sell-off.

This mixture of excessive institutional possession, constructive progress forecasts, and robust inventory momentum positions ZYME’s market sentiment as “sturdy.”

My Evaluation and Advice

Zymeworks’ latest 67% inventory leap validates my “Sturdy Purchase” stance. This surge highlights the corporate’s sturdy outlook, particularly given zanidatamab’s potential. Strategic alliances, a powerful pipeline, and constructive market views strengthen the funding argument. The agency’s monetary well being, as evidenced by its stable liquidity and ample money runway, suggests it will possibly keep momentum towards profitability.

Traders eyeing Zymeworks should stability progress prospects with inherent dangers. Medical trial uncertainties, regulatory challenges, and biotech sector competitors are notable issues. Danger mitigation includes diversifying inside biotech, monitoring Zymeworks’ medical and regulatory progress, and staying abreast of sector-wide valuation shifts.

Zymeworks stands out for its strategic strikes, monetary stability, and zanidatamab’s disruptive promise. The “Sturdy Purchase” advice stands. But, vigilance is vital. Traders ought to actively gauge inside and exterior shifts affecting Zymeworks’ path.