sorn340/iStock through Getty Photos

In June, I downgraded ZimVie Inc. (NASDAQ:ZIMV) to a maintain, based mostly on the corporate’s elevated valuation and deteriorating fundamentals. For some time, my cautious stance seemed to be the fitting name, as ZimVie struggled to return its companies to progress, and the inventory languished, falling to $7 a share or greater than 40% under my June downgrade (Determine 1).

Determine 1 – ZIMV efficiency since final article (Looking for Alpha)

Nonetheless, since reporting Q3 outcomes on November 1st, ZimVie’s inventory has been on a tear, greater than doubling to virtually $18 / share. What was the reason for this rally and what might be in retailer for ZimVie heading into 2024?

Temporary Firm Overview

First, for these not acquainted, ZimVie was spun out of Zimmer Biomet (ZBH) in March 2022 and included the low-growth dental and backbone medical machine companies of ZBH. Though the mixed companies generated near $1 billion in gross sales, ZimVie was not a market chief in both section and was thus deemed non-core for ZBH.

For extra data on the spinoff, please check with my initiation article.

Q3 Was Higher Than Feared

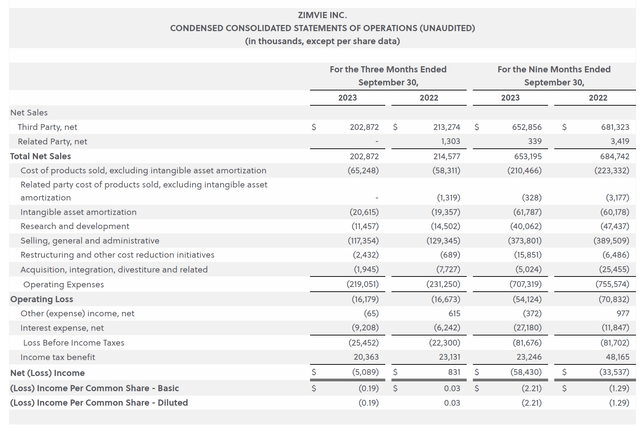

In early November, ZIMV reported Q3/23 earnings, with revenues declining by 5.5% YoY to $203 million. Whereas revenues had declined YoY in each quarter in 2023, the speed of decline was higher than anticipated, as analysts have been on the lookout for $196 million in revenues (Determine 2). For the 9 months to September 30, revenues declined by 4.6% YoY.

Determine 2 – ZIMV monetary abstract (ZIMV Q3/23 press launch)

Regardless of better-than-expected revenues, ZIMV continued to indicate a GAAP web loss, with dil. EPS of -$0.19 / share in Q3/2023 and -$2.21 within the YTD interval.

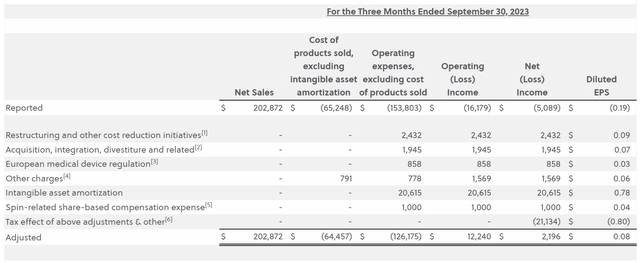

Moreover, ZIMV continued to report closely adjusted earnings, with quarterly adj. EPS of $0.08 in comparison with the -$0.19 GAAP loss. I stay vital of ZIMV’s adjusted earnings observe, as one would usually not anticipate so many ‘changes’ greater than a yr after the spin-off transaction (Determine 3).

Determine 3 – ZIMV reported an ‘adjusted’ web revenue (ZIMV Q3/23 press launch)

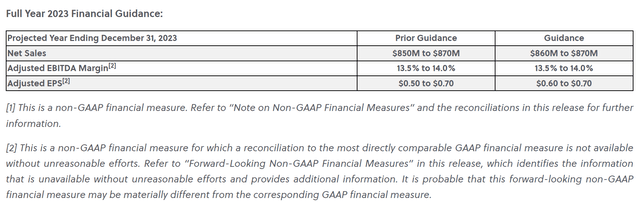

Nonetheless, what probably received buyers excited was the truth that administration raised steerage for fiscal 2023, with slight enhancements to each revenues and adj. EPS (Determine 4). The midpoint of administration’s income steerage was raised by $5 million to $865 million whereas adj. EPS was raised by $0.05 to $0.65.

Determine 4 – Administration raised steerage for 2023 (ZIMV Q3/23 press launch)

Sadly, even when ZimVie hits the highest finish of administration’s steerage and delivers $870 million in revenues and $0.70 in adj. EPS, these outcomes would nonetheless be a YoY decline of 5% and 62% YoY respectively. Nonetheless, buyers cheered the better-than-feared outcomes and propelled the inventory larger.

Divestiture Of Backbone Enterprise Lessens Debt Burden

One other key catalyst prior to now few months was the announcement on December 18th that ZIMV would promote its backbone enterprise to HIG Capital for $375 million ($315 million in money plus a $60 million promissory notice that bears 10% curiosity).

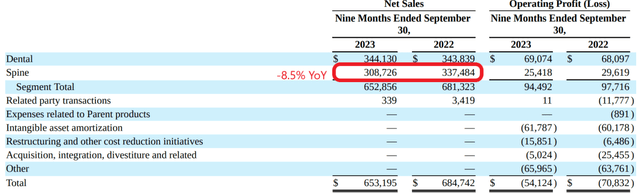

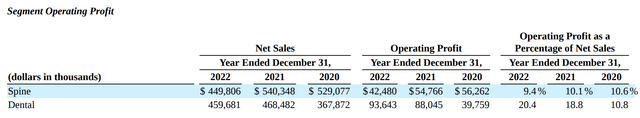

Given the backbone enterprise generated LTM revenues of $421 million and working income of $38.3 million (9.1% working margin), the $375 million price ticket appeared like a gorgeous valuation for the enterprise that was shrinking at a high-single digit (“HSD”) charge when it comes to revenues up to now in 2023 (Determine 5).

Determine 5 – Backbone enterprise was shrinking at HSD charge (ZIMV Q3/23 10Q report)

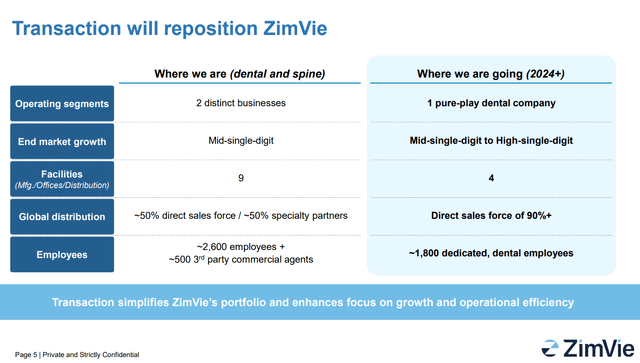

ZimVie commented that the deal proceeds could be used to pay down debt and that the deal will probably be accretive to income progress, EBITDA margin, and money circulation conversion because it permits the corporate to streamline operations and concentrate on being a pure-play dental firm (Determine 6).

Determine 6 – Transaction repositions ZIMV to be a dental pure-play (ZIMV investor presentation)

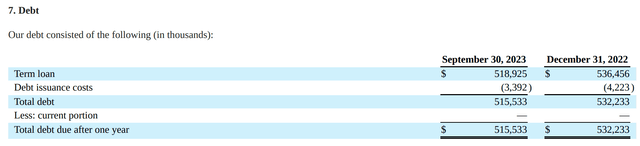

Certainly one of my largest considerations relating to ZimVie has been the onerous debt load that Zimmer Biomet saddled the corporate with, with $516 million nonetheless excellent as of September 30 (Determine 7).

Determine 7 – ZIMV had carried heavy debt load because of spinoff (ZIMV Q3/23 10Q report)

With the proceeds of the sale, ZimVie’s debt load is now projected to be lower than $200 million going ahead.

So ZimVie was capable of resolve one of many firm’s largest challenges by jettisoning the underperforming backbone enterprise for high greenback to a non-public fairness group. Little marvel that ZIMV’s inventory rallied greater than 40% on the deal announcement. Kudos to ZIMV’s CEO for a implausible transaction.

Standalone Dental Enterprise Appears Attractively Valued

As a standalone enterprise, ZimVie’s dental enterprise generated $460 million in revenues in 2022 with $94 million in working revenue (Determine 8).

Determine 8 – 2022 section income and working income (ZIMV 2022 10K report)

These working metrics ought to be pretty constant on a go-forward foundation, as top-line progress charges have hovered round flat in 2023 for the dental section (from Determine 5 above).

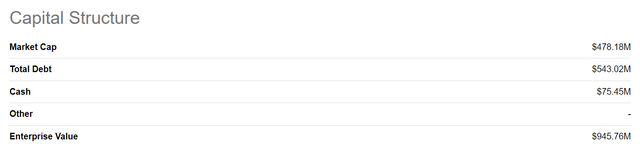

Due to this fact, assuming the complete $375 million is utilized in opposition to debt, ZIMV ought to have a pro-forma enterprise worth (“EV”) of ~$570 million or, a valuation of 6x EV / working revenue (Determine 9).

Determine 9 – ZIMV enterprise worth (Looking for Alpha)

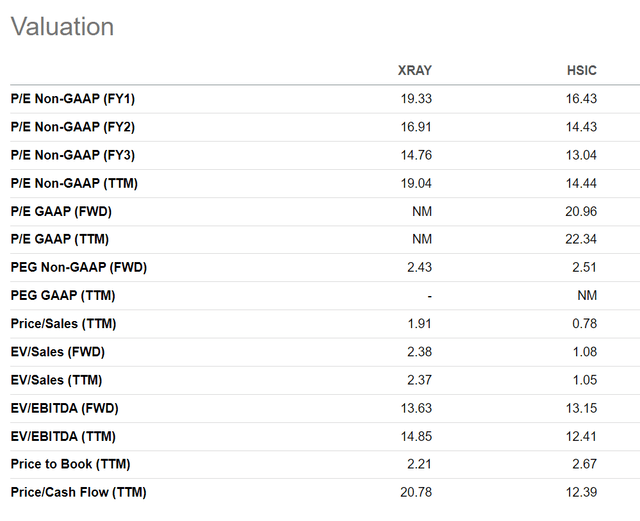

This compares nicely to dental market leaders DENTSPLY (XRAY) and Henry Schein (HSIC), which commerce on the Fwd EV/EBITDA of 13.6x and 13.2x respectively (caveat being ZIMV’s definition of working income and EBITDA will not be the identical).

Determine 10 – ZIMV attractively valued relative to dental market leaders (Looking for Alpha)

If administration can now flip its concentrate on the dental enterprise and return it to progress, then there ought to be vital valuation upside to ZIMV’s shares.

Conclusion

In conclusion, I imagine the market’s constructive response to ZIMV’s deal to promote its backbone enterprise is justified, as the corporate was capable of jettison a shrinking backbone enterprise for high greenback whereas resolving the debt overhang that had been plaguing the corporate.

Wanting ahead, the standalone dental enterprise now appears to be like low cost in comparison with friends, buying and selling at simply ~6x EV / working income. If administration can return the dental enterprise to high and bottom-line progress, I imagine there may be vital upside in ZIMV’s shares, as dental market leaders are buying and selling at >13x Fwd EV/EBITDA. I’m elevating my ranking on ZIMV to a purchase.