Within the wealth administration {industry}, monetary advisors face a essential problem: spending extreme time on administrative duties as a substitute of specializing in shopper relationships and strategic recommendation. The statistics paint a transparent image – whereas 60% of shopper information gathering occurs throughout conferences, lower than 25% of those interactions are correctly documented as a result of time-consuming nature of guide note-taking and follow-up work. Zeplyn, based by former Google engineers with experience in AI and speech recognition, has emerged to deal with this industry-wide drawback. Its AI-powered Assembly Assistant transforms unstructured shopper conversations into extremely correct notes, capturing monetary particulars, targets, and motion objects whereas streamlining the complete assembly course of from prep to follow-up. By automating these administrative burdens whereas sustaining compliance necessities, Zeplyn saves monetary advisors an estimated 10-12 hours per week – time that may be higher used on servicing shopper relationships and enterprise development.

AlleyWatch caught up with Zeplyn CEO and Cofounder Period Jain to study extra concerning the enterprise, the corporate’s strategic plans, current spherical of funding, and far, way more…

Who had been your traders and the way a lot did you increase?

We raised $3M in seed funding, led by Leo Capital. Our traders had been Leo Capital, Converge and numerous angel traders.

Inform us concerning the services or products that Zeplyn provides.

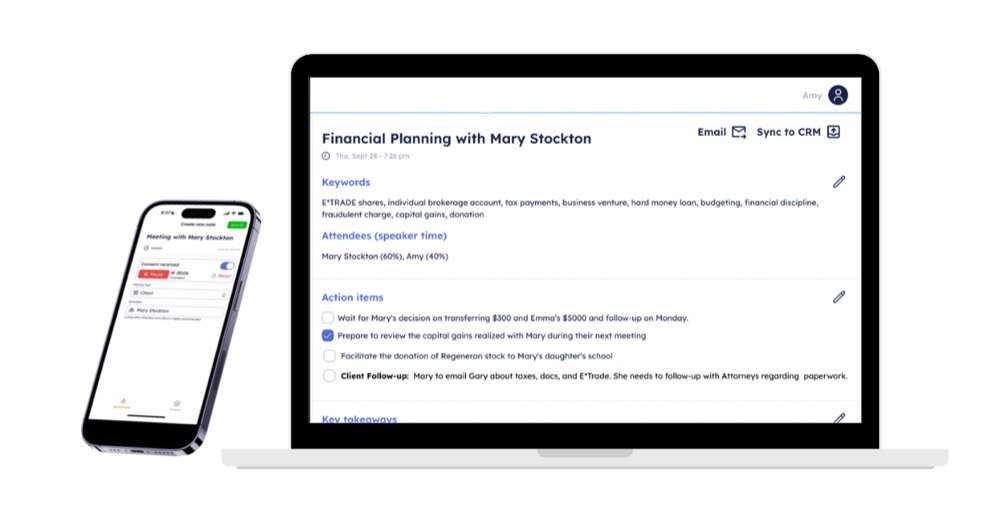

Zeplyn Assembly Assistant, our flagship product, is designed particularly for monetary advisors and wealth administration companies. It takes unstructured shopper conversations and turns them into extremely correct notes, capturing shopper monetary particulars, targets and aims, key dialogue factors, and motion objects. That is one space the place our AI actually shines.

In truth, considered one of our clients, who spent a big period of time testing and coaching different AI options, advised us that no different device understood her agency’s acronyms and will summarize the complexities of their monetary planning conversations. She advised us, “I didn’t assume AI was wherever near with the ability to do it, till we discovered Zeplyn.”

Zepkyn Assembly Assistant additionally streamlines assembly prep, note-taking, and post-meeting workflows whereas fulfilling compliance necessities, saving monetary advisors a mean of 10-12 hours per week.

What impressed the beginning of Zeplyn?

My cofounder Divam Jain and I met at Google, the place we spent years constructing AI for Search, Voice Assistant, and speech recognition merchandise. Enthusiastic about the opportunity of utilizing our experience to reimagine how monetary advisors work, we began Zeplyn.

My introduction to the wealth administration {industry} got here by my classmates at Harvard Enterprise Faculty, who’ve labored at companies resembling Morgan Stanley, and the varsity’s alumni community, lots of whom had been working their very own RIA practices. In digging deeper into the house, I discovered that the shopper assembly course of is likely one of the most costly actions for a wealth administration agency. Advisors spend hours per day documenting shopper conferences and executing post-meeting follow-up duties. We additionally discovered that 60% of shopper information gathering occurs over conferences, but lower than 25% of shopper conferences are correctly documented due to the time-consuming nature of this course of. The antiquated guide processes had been a giant drawback, one we might resolve by introducing AI.

Passionate concerning the potential of AI to rework workflows for monetary advisors, my cofounder and I got down to develop a gathering assistant that will assist automate the tedious however essential sections of the method: assembly admin duties and fulfilling regulatory reporting necessities. In doing so, we freed up wealth administration professionals to concentrate on the human factor and ship higher outcomes for his or her shoppers.

How is Zeplyn totally different?

Zeplyn is a extremely correct end-to-end AI answer that streamlines the complete assembly course of: assembly prep, note-taking, process administration, and follow-ups. Constructed for monetary advisors and skilled to know the wealth administration context, Zeplyn Assembly Assistant delivers extremely correct, post-meeting structured summaries, making it a dependable device for documenting shopper interactions. It additionally meets the distinctive workflow necessities and safety and compliance requirements of the {industry}, and it may be used throughout video assembly platforms, in-person conferences, and dictations. Zeplyn integrates with current infrastructure and the advisor know-how stack with ease.

What market does Zeplyn goal and the way huge is it?

Zeplyn serves the wealth administration market, together with RIAs, brokerages, and household places of work. The market is experiencing important development and transformation, and we’re proud to be supporting it.

What’s your enterprise mannequin?

Zeplyn is out there for any sized RIA and brokerage, with pricing plans for the person advisor, multi-advisor groups, and enterprise deployments. Advisor Assistant licenses are additionally out there. Zeplyn provides seat-based pricing, with the flexibleness to decide on between month-to-month and annual subscriptions.

What are the largest challenges that you just confronted whereas elevating capital?

We had a terrific expertise, truthfully. Once we had been assembly with Leo Capital and Converge, we did our analysis and ready an in depth pitch deck that spoke to our choices, the product-market match, and the way it aligned with their respective portfolios. I do know it’s been a troublesome 12 months for funding in tech, however we imagine in our mission, and it was nice to seek out VCs that imagine in it as properly.

There are just a few key issues to bear in mind when making an attempt to safe funding, no matter exterior financial situations:

- Know your market. What are the ache factors? What are the gaps? How will your organization slot in?

- Collect as a lot validation and as many proof factors as you’ll be able to at your present stage. Speedy buyer acquisition? Main {industry} gamers vouching for the impression of your product? Statistics that again up your product thesis? Be sure to’re presenting these factors succinctly and speaking your worth.

- Know your viewers. In case you are doing VC outreach, be sure you perceive their current portfolio, their funding thesis, and the place you slot in. If you happen to’re planning to pitch a VC that solely invests in a single {industry}, for example, be sure you have a related product that’s sufficiently differentiated from their current investments.

What components about your enterprise led your traders to put in writing the examine?

Early-stage traders care loads concerning the power of the founding staff. At Zeplyn, we’ve constructed a powerful basis. Our product and go-to-market groups carry a mix of experience throughout AI, wealth administration, and enterprise SaaS. Our founding staff contains engineers who carry greater than a decade of foundational AI, machine studying, and software program engineering expertise from main tech giants resembling Google, and seasoned wealth administration professionals with greater than 20 years of expertise constructing advisory platforms at prime brokerage companies resembling Merrill Lynch and LPL Monetary.

This distinctive mixture of technical excellence and {industry} experience equips us with a profound understanding of the wealth administration sector’s complexities and the challenges our customers face. Our staff’s capabilities permit us to design and ship strong, high-performing, and user-centric options that immediately handle these ache factors, inspiring investor confidence in our imaginative and prescient and execution.

What are the milestones you propose to realize within the subsequent six months?

Over the following a number of months, we’re going to be centered on just a few initiatives:

- Consumer acquisition: Zeplyn has obtained a heat response and has grown three-fold within the final three months. We’re onboarding new advisors each week, principally by natural channels. We’re investing in gross sales and advertising, and we’re planning to develop our buyer base whereas persevering with to ship dependable and time-saving AI.

- Technological development: Our aim is to carry an AI-native perspective to wealth administration, rebuilding the {industry} and addressing essential wants. Zeplyn is dedicated to reimagining the monetary advisor expertise, prime to backside. We have now already launched new ranges of effectivity and shopper intelligence with Zeplyn Assembly Assistant, and we’ve got no plans of stopping there. Our imaginative and prescient is to construct a full stack workflow automation answer for monetary advisors that additionally handles refined and sophisticated wealth administration workflows, serving as a single supply of fact.

- Staff growth: We are going to develop our product, engineering, gross sales, and advertising groups.

The place do you see the corporate going within the close to time period?

Zeplyn Assembly Assistant is our first product, and we’re constructing in the direction of a full-stack workflow automation answer that can deeply combine with advisor know-how and instruments to streamline different complicated wealth administration workflows— past shopper conferences.

With Assembly Assistant, we’ve solved for an enormous hole in shopper information gathering in conferences. Now that advisors can seize full and correct shopper information, they will leverage it to reinforce not simply their downstream workflows but in addition the general shopper expertise. We’re actually excited concerning the alternatives the info will unlock for advisors.

What’s your favourite fall vacation spot in and across the metropolis?

It’s touristy, however within the metropolis, Central Park is breathtaking all 12 months spherical. It hosts all types of wonders, from artwork distributors to live shows and performances to hidden gardens. There’s at all times one thing new to do and uncover, or in the event you simply wish to sit and calm down, you are able to do that too.

Farther afield, Beacon is price a visit. It’s a terrific little metropolis with artwork galleries, nature, and historical past. Specifically, the Storm King Artwork Heart hosts artworks that push the boundaries of their medium. It’s an enormous outside artwork museum, and it’s particularly gorgeous in fall.

Within the Catskills, Woodstock is a good retreat in fall. There are mountain climbing trails that can take you into nature, and it’s a enjoyable city to discover, with artwork galleries, retreats, and quirky retailers that hold the spirit of the Sixties Woodstock and “Peace, Love and Music” alive.