1. The Idea – Tips on how to Use Indicator

Developed by Marc Chaikin

This an oscillator Indicator, it measure the Accumulation/distribution of cash that’s flowing into and out of a forex pair. The indicator is predicated on the truth that the nearer the closing worth is to the excessive of the worth, the extra the buildup of the forex pair. Additionally the nearer the closing worth is to the low of the worth, the extra the distribution of the forex pair.

This indicator might be constructive if worth persistently closes above the bar’s midpoint with growing quantity.

Nevertheless, if worth persistently closes beneath the bar’s midpoint with growing quantity the indicator might be detrimental.

Technical Evaluation of Chaikin Oscillator

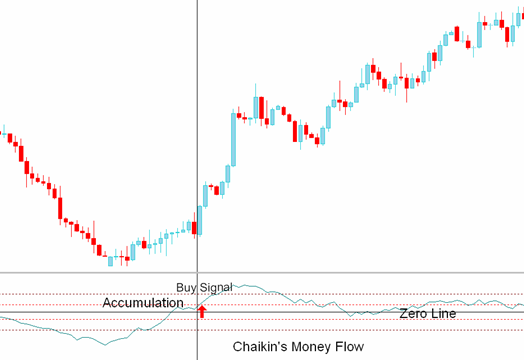

Purchase Sign

A crossover of above zero signifies accumulation of a forex pair. A price of above +10 is a purchase/bullish sign. Values above +20 signify a powerful upward trending market.

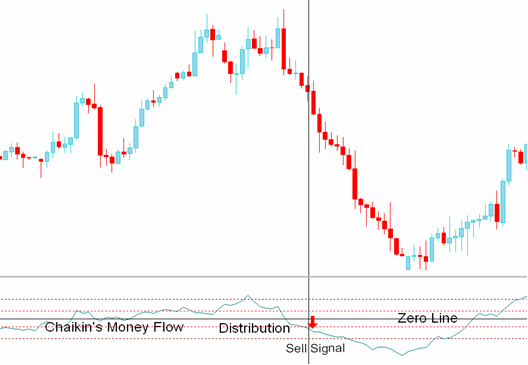

Promote Sign

A Zero line cross of beneath zero signifies distribution of a forex pair. A price of beneath -10 is a brief/promote sign. Values beneath -20 signify a powerful downward trending market.

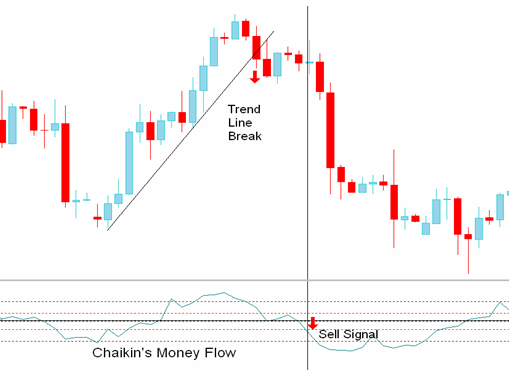

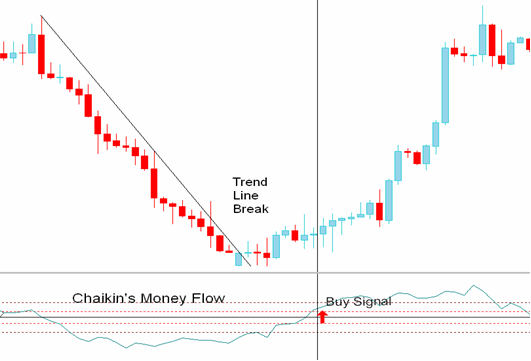

Pattern Line break with Chaikin’s cash stream indicator

The cash stream indicator can be utilized to substantiate development line breaks or assist/resistance degree breaks. If worth breaks an upward development line, foreign exchange merchants ought to then anticipate a affirmation sign from the indicator values of beneath -10.

If worth breaks an downward development line, foreign exchange merchants ought to then anticipate a affirmation sign from indicator values of above +10.

Divergence Buying and selling

A divergence between the Cash Movement indicator and worth typically alerts a pending reversal in market course. Nevertheless as with all divergences its finest to attend for affirmation alerts earlier than buying and selling the divergence. A bullish divergence sign happens when worth makes a decrease low whereas the Chaikin Cash Movement indicator makes a better low. Bearish divergence sign happens when worth makes a better excessive whereas the Chaikin Cash Movement indicator makes a decrease excessive.

2. Sensible Instance

The Chaikin Oscillator or Quantity Accumulation Oscillator consists of the distinction between two exponential shifting averages (often 3 and 10-day) of the Accumulation Distribution Line indicator and is used to substantiate worth motion or divergences in worth motion. The Chaikin Oscillator is extra correct than the On Steadiness Quantity indicator.

- On Steadiness Quantity: provides all quantity for the day if the shut is constructive, even when the inventory closed solely a penny increased or subtracts all quantity for the day if the inventory closes decrease.

- Chaikin Oscillator: elements within the closing worth in relation to the highs, lows, and common worth and determines the suitable ratio of quantity to be attributed to the day.

The primary goal of the Chaikin Oscillator is to substantiate worth tendencies and warn of impending worth reversals. The chart beneath of the Nasdaq 100 ETF QQQQ illustrates these affirmation alerts and divergence alerts:

Excessive #1 to Excessive #2

The Nasdaq 100 ETF QQQQ made increased highs, often a bullish signal. Nevertheless, the Chaikin Oscillator did not mirror the QQQQ’s advance increased and ended up making a decrease low. This bearish divergence forewarned of the upcoming worth reversal.

Excessive #2 to Excessive #3

The QQQQ’s made a considerably decrease excessive. The Chaikin Oscillator confirmed the QQQQ’s downtrend by making a decrease excessive as properly.

Low #1 to Low #2

The Nasdaq 100 made important decrease lows, but the Chaikin Oscillator made increased lows. This bullish divergence signaled that the earlier downtrend could have ended.

The Chaikin Oscillator is a useful quantity primarily based technical indicator that helps verify the present worth motion or foreshadow future worth reversals. Different technical indicators just like the Chaikin Oscillator is the On Steadiness Quantity indicator

Be taught extra about technical indicators and different buying and selling associated matters by subscribing to our channel: https://www.mql5.com/en/channels/indicatoracademy