- Yen will get mauled as merchants lose confidence in BoJ tightening cycle

- Greenback set for fourth week of features, inflation revisions at this time could also be essential

- Oil costs soar, inventory markets take a breather however nonetheless at file highs

Yen meltdown

It’s been a dreadful begin to the 12 months for the Japanese yen, which has already fallen greater than 5% towards the greenback, as a mix of worsening financial knowledge and cautious feedback from the Financial institution of Japan have raised doubts about whether or not a charge enhance cycle lies forward.

Inflation in Tokyo cooled dramatically in January, foreshadowing the same cooldown on a nationwide degree. Equally, wage progress has stalled and family spending is contracting, each indications of even softer inflationary pressures forward.

Reflecting the weaker knowledge “pulse”, a senior BoJ official signaled yesterday that even when the central financial institution exits unfavourable rates of interest, it’s unlikely to maintain elevating them quickly. That dealt a heavy blow to the yen, pushing the foreign money right down to its lowest ranges since November.

More and more, it appears that evidently the Financial institution of Japan gained’t embark on a rate-hike cycle, however is as a substitute a one-and-done enhance out of unfavourable charges as inflation momentum is evaporating. With the specter of FX intervention off the radar for now, this can be a setup that argues for persistent yen weak point.

For the yen to stage a sustainable restoration, the worldwide economic system must weaken sufficient for overseas central banks to slash charges with brute drive, which could take a while.

Greenback eyes annual inflation revisions

In the meantime, the US greenback is on monitor for its fourth consecutive week of advances, using a wave of resilient US financial indicators and fading expectations of speedy Fed charge cuts. This view was echoed by the Fed’s Barkin yesterday, who harassed the central financial institution can maintain off slicing charges given the energy within the labor market and client demand.

All eyes will fall on the annual revisions of US CPI inflation at this time, a launch that Fed Chairman Powell highlighted as one thing he shall be watching intently. Final 12 months’s revisions caught the central financial institution off guard by revealing inflation was hotter than first estimated, finally main the Fed to undertake its ‘larger for longer’ stance on charges.

An identical final result this time may fully shut the door for a March charge minimize and decrease the probabilities of a minimize in Could, serving to the greenback prolong its profitable streak. That stated, there isn’t any clear indication this would be the case. Therefore, there’s an equal threat of a downward revision to inflation readings that triggers the other market results.

Both approach, merchants could have larger fish to fry subsequent week, when the CPI report for January is printed. That launch may have a bigger influence in markets since it’s extra up-to-date, presumably overshadowing at this time’s revisions.

Oil soars, shares hover at file heights

Oil costs got here again with a vengeance this week, recovering chunk of their current losses as hopes for a truce within the Center East pale and the US Power Division projected a pointy slowdown in US oil manufacturing progress this 12 months, calming fears of an oversupplied market.

In the meantime, shares on Wall Avenue are set to shut the week with features of round 1%, with the S&P 500 piercing above the psychological 5,000 area in pre-market buying and selling on Friday to deliver the index to a brand new file excessive.

Large tech has executed the heavy lifting. Cash managers more and more view these shares as bulletproof, beneath the rationale that investments in synthetic intelligence will defend tech earnings even when the broader economic system slows down, justifying their premium valuations.

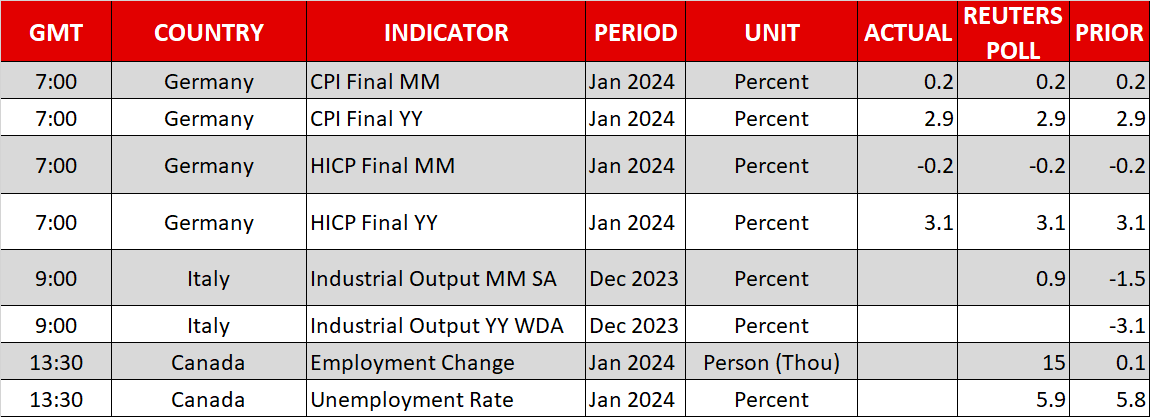

Lastly, the most recent employment stats out of Canada may additionally entice some consideration at this time.