USD/JPY ANALYSIS & TALKING POINTS

- Japan appears to be like to US for steering.

- US inflation might lead to Japanese involvement.

- Bearish divergence suggestive of draw back to return.

Really useful by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen has but to make any actual upside impression on the US greenback this week as USD/JPY stays elevated. Regardless of warnings from the Japanese Finance Minister Shunichi Suzuki that intervention is a chance ought to the JPY deteriorate even additional (across the 150 mark), markets are seemingly unphased till motion is taken. It is very important observe that Japanese exported might be comfy with the weaker forex to stoke demand for native items and providers.

The week forward appears to be like to be US dominated (see financial calendar under) with specific deal with US CPI. Each core and headline inflation has been trending downwards however at a slower place than the Fed would love, and nonetheless removed from the 2% goal degree. An upside shock would actually weigh negatively on the Japanese Yen and improve the strain on the Financial institution of Japan (BOJ) to get entangled.

JPY ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

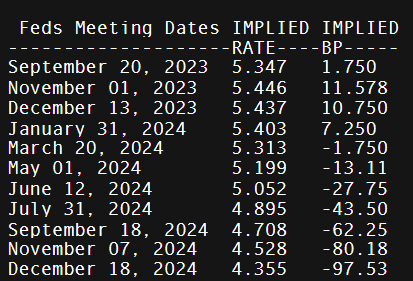

Cash market pricing (consult with desk under) for the Federal Reserve appears to be like to be skewed in direction of a price pause in September thereafter, the potential for one more hike relying on upcoming information which makes subsequent week’s US CPI extraordinarily pertinent.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

IMPLIED FED FUNDS FUTURES

Supply: Refinitiv

USD/JPY TECHNICAL ANALYSIS

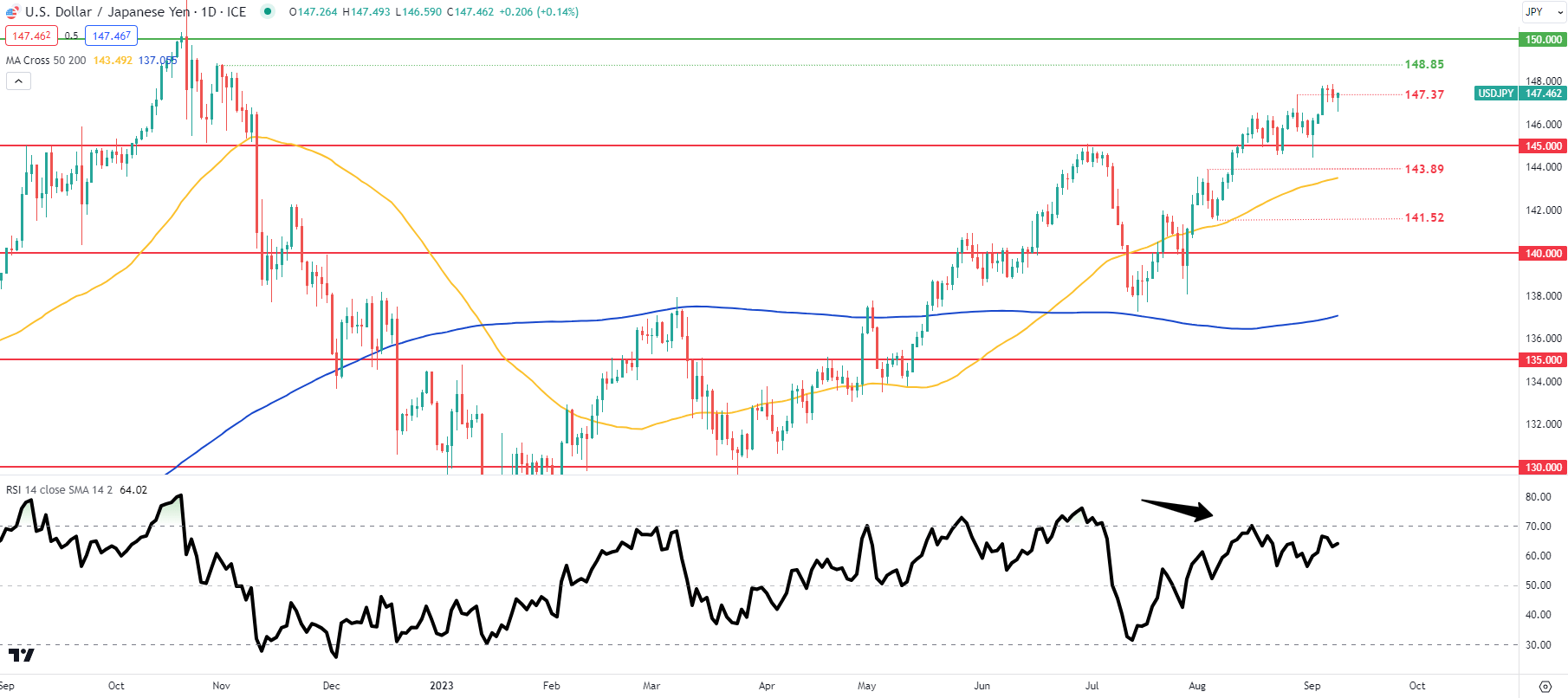

USD/JPY DAILY CHART

Chart ready by Warren Venketas, IG

Day by day USD/JPY value motion alongside its creating bearish/unfavourable divergence sign (black arrow), factors to slowing bullish momentum and the likelihood for a turnaround in favor of JPY energy. Basic components are prone to be the catalysts driving this transfer decrease and the warnings from Japanese officers shouldn’t be taken flippantly.

Key resistance ranges:

Key help ranges:

IG CLIENT SENTIMENT: BEARISH

IGCS exhibits retail merchants are presently web SHORT on USD/JPY, with 75% of merchants presently holding brief positions (as of this writing).

Introduction to Technical Evaluation

Market Sentiment

Really useful by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas