Most Learn: Gold Worth Outlook: Fed Might Shake Up Markets. Pullback or Rally in Retailer?

The Financial institution of Japan is ready to wrap up its March financial coverage assembly on Tuesday (Japan time, nonetheless Monday in NY). After current media leaks, the establishment led by Governor Kazuo Ueda is extensively anticipated to finish adverse borrowing prices, elevating its benchmark price to 0.0% from -0.1%. This could be the primary hike since February 2007, in a turning level for the BOJ’s long-standing ultra-dovish stance.

The central financial institution can be seen terminating its yield curve management scheme, initiated in 2016 and beneath which it has been shopping for huge quantities of presidency bonds to focus on sure charges on the curve. As well as, the BoJ can be anticipated to finish purchases of inventory exchange-traded funds (ETFs) and different threat belongings, which had been initially launched practically 15 years in the past.

The transfer to start out unwinding stimulus comes after wage negotiations between the nation’s massive unions and high companies resulted in bumper pay boosts for Japanese employees in extra of 5.2%, the very best in additional than 30%. Policymakers had repeatedly indicated that sturdy wage progress is important for a virtuous spiral that generates sustainable worth will increase pushed by home demand.

Interested in what lies forward for the Japanese yen? Discover complete solutions in our quarterly buying and selling forecast. Declare your free copy now!

Beneficial by Diego Colman

Get Your Free JPY Forecast

With this resolution now largely discounted, merchants ought to concentrate on steerage to gauge market response. If the central financial institution indicators that it’ll solely withdraw accommodative insurance policies at glacial velocity and that future price hikes can be measured, the yen is more likely to weaken as disenchanted bulls lower lengthy publicity. However even when this state of affairs had been to play out, the Japanese foreign money ought to have higher days forward.

Conversely, if the BoJ unexpectedly adopts a hawkish stance in its outlook, merchants ought to put together for the potential for a strong bullish response within the yen. This might imply a pointy drop in pairs equivalent to USD/JPY, GBP/JPY and EUR/JPY. Nevertheless, the probabilities of this state of affairs materializing are slim, with key central financial institution officers leaning in favor of a really gradual normalization course of.

Eager to grasp how FX retail positioning can present hints concerning the short-term course of USD/JPY? Our sentiment information holds precious insights on this matter. Obtain it at the moment!

| Change in | Longs | Shorts | OI |

| Day by day | 5% | 14% | 12% |

| Weekly | -22% | 37% | 18% |

USD/JPY FORECAST – TECHNICAL ANALYSIS

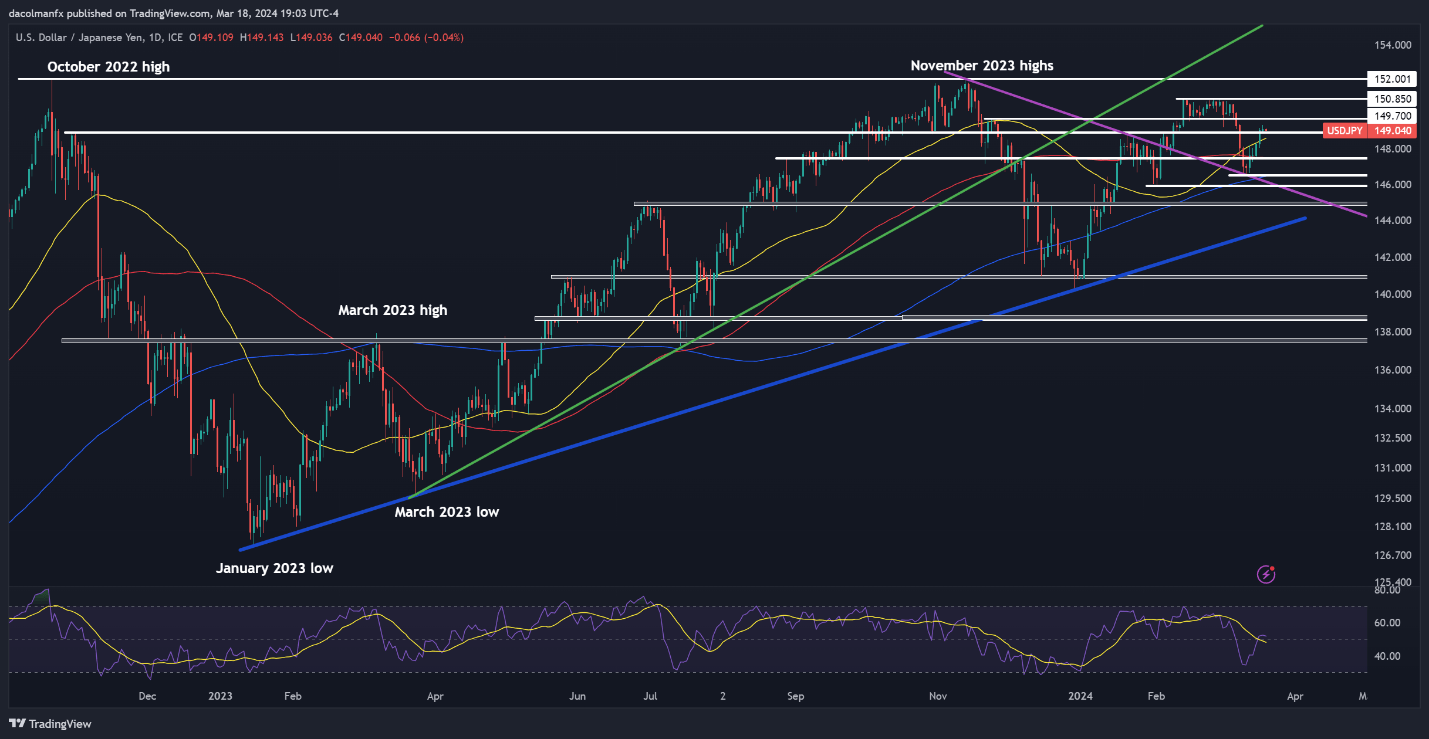

USD/JPY edged larger on Monday, consolidating above the 149.00 deal with. If good points speed up within the coming buying and selling classes, resistance seems at 149.70. On continued power, market’s consideration can be on 150.85, adopted by 152.00.

Then again, if sellers mount a comeback and set off a pullback beneath 149.00/148.90, the main target is more likely to transition in direction of the 50-day easy shifting common. Under this indicator, all eyes can be on 147.50 and 146.50 thereafter, which corresponds to the 200-day easy shifting common.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView