Japanese Yen (USD/JPY, EUR/JPY) Evaluation

Beneficial by Richard Snow

The right way to Commerce EUR/USD

USD/JPY Surrenders Prior Features Forward of the Weekend

USD/JPY is again above the 150.00 marker simply at some point after encouraging feedback from BoJ board member Hajime known as for a change in financial coverage now that the Financial institution’s 2% goal is in sight.

All events (markets and the BoJ) now sit up for essential wage negotiations which are scheduled to wrap up across the thirteenth of March. Labour unions have been lobbying for sizeable wage will increase and companies have appeared largely receptive to the requests given inflation has breached the two% mark for over a 12 months already.

After observing the yen’s restoration from the late 2023 swing low, markets appear to favour the carry commerce, which includes borrowing the cheaper yen in favor of investing in larger yielding currencies, over any notion of persistent yen energy. That is, in fact, till we get an thought of whether or not Japanese corporations comply with the best wage will increase in years.

Wages look like the final piece of the puzzle and BoJ Governor Ueda has usually referred to a ‘virtuous cycle’ between wages and costs as the primary determinant for coverage change.

USD/JPY pulled again yesterday already and as we speak the pair continues the transfer to the upside, above 150. A really slender vary has appeared between 150 and 150.90, with FX markets showing unconvinced about FX intervention and an imminent coverage change from the Financial institution of Japan.

Danger administration is essential in such conditions if the prior intervention from Japanese officers is something to go by. Worth swings round 500 pips have transpired in 2022 so there may be nice threat of an enormous choose up in volatility.

USD/JPY Every day Chart

Supply: TradingView, ready by Richard Snow

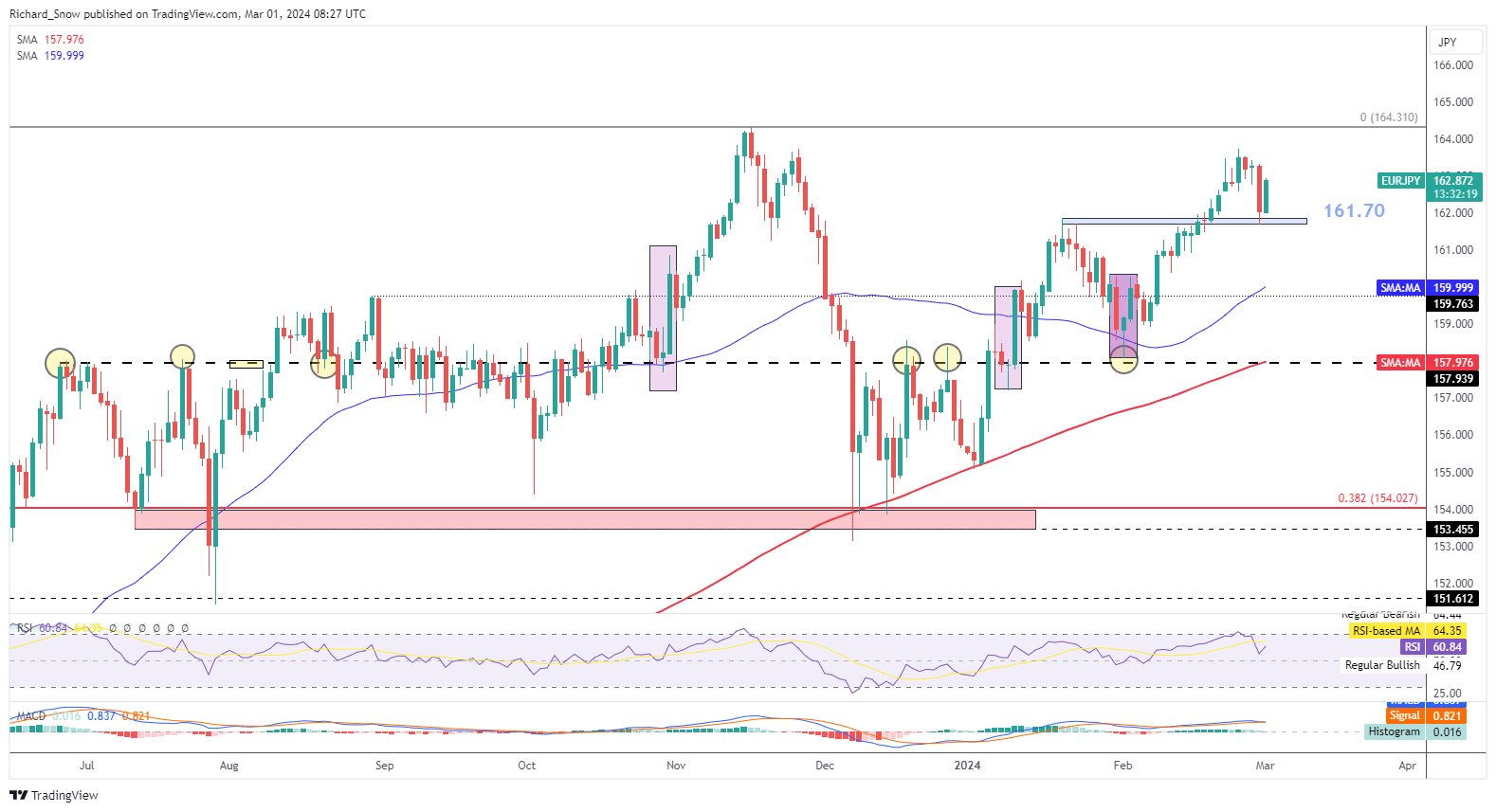

EUR/JPY Finds Help Forward of ECB Assembly Subsequent Week

The ECB is because of meet subsequent week Thursday the place it’s extremely unlikely the governing council will vote to chop rates of interest. ECB officers have been making an attempt to push again towards price cuts as they like to comply with the US in such issues. Nonetheless, Europe’s financial progress is stagnant at greatest, oscillating round 0% and with Germany tipped to already be in a recession.

EUR/JPY appears to be like to have discovered help on the beforehand recognized zone round 161.70. The pair adheres to a longer-term bullish profile with costs above the 50 SMA and the 50 SMA above the 200 SMA. One other take a look at of the 164.31 swing excessive is to not be discounted, notably within the first two weeks of the month (earlier than wage negotiations have concluded).

EUR/JPY Every day Chart

Supply: TradingView, ready by Richard Snow

Keep updated with breaking information and main market themes driving the market. Signal as much as our weekly e-newsletter

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

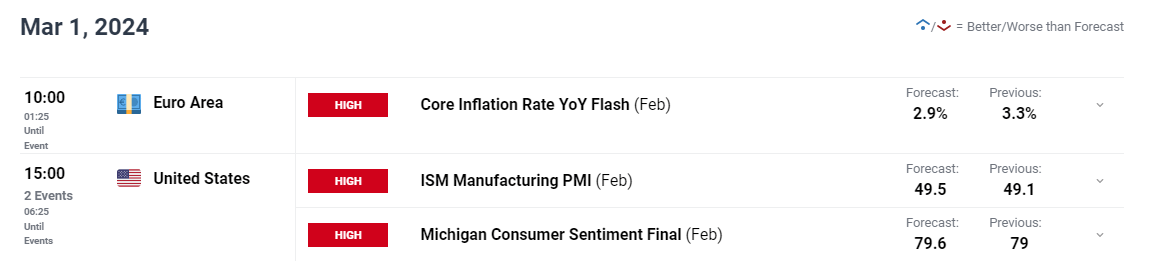

Main Occasion Danger Forward

Later as we speak Euro Space inflation for Feb is anticipated to drop from 3.3% to 2.9% for the core measure and anticipating to see the same decline within the headline measure from 2.8% to 2.5%. A decrease all-round inflation print is probably going to attract the eye to subsequent week’s ECB financial coverage assembly the place there may be little expectation of a price reduce. Markets worth in a powerful likelihood that the primary price reduce will happen in June regardless of Europe’s financial system in want of help proper now. The European Union has witnesses stagnant progress on the entire as quarterly GDP progress figures have oscillated round 0% for the final 5 quarters.

Customise and filter dwell financial information through our DailyFX financial calendar

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX